Deck 20: Audit of the Payroll and Personnel Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

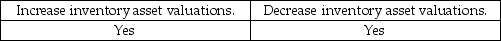

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

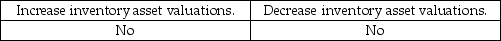

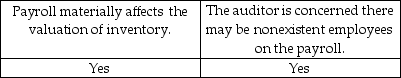

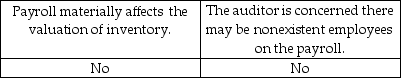

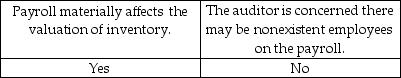

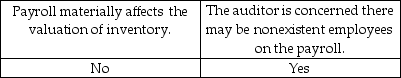

سؤال

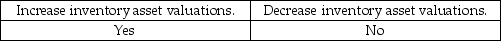

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

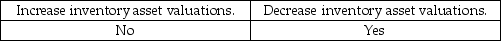

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/113

العب

ملء الشاشة (f)

Deck 20: Audit of the Payroll and Personnel Cycle

1

Because of the cycle's pervasive nature, audit tests of the payroll cycle are usually extensive.

False

2

The file for recording each payroll transaction for each employee and maintaining total employee wages paid for the year to date is the:

A) payroll master file.

B) summary payroll report.

C) payroll journal.

D) job time ticket.

A) payroll master file.

B) summary payroll report.

C) payroll journal.

D) job time ticket.

A

3

What events initiate and terminate the payroll and personnel cycle?

The hiring of an employee initiates the cycle and the payments to employees, governments, and other organizations terminate the cycle.

4

Discuss each of the following primary documents and records used in the (1) payment of payroll function, and (2) preparation of payroll tax returns and payment of taxes function in the payroll and personnel cycle: payroll check, W-2 form, and payroll tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

5

Match seven of the terms for documents and records (a-k) used in the payroll and personnel cycle with the descriptions provided below (1-7):

a. Human resource records

b. Deduction authorization form

c. Rate authorization form

d. Time card

e. Job time ticket

f. Summary payroll report

g. Payroll check

h. W-2 form

i. Payroll tax returns

j. Payroll journal

k. Payroll master file

________ 1. A file used for recording payroll transactions for each employee and maintaining total employee wages paid for the year to date.

________ 2. A document indicating the time the hourly employee started and stopped working.

________ 3. A document written in exchange for services received from an employee.

________ 4. Forms submitted to local, state, and federal units of government for the payment of withheld taxes and the employer's tax.

________ 5. A form authorizing payroll deductions, including the number of exemptions for withholding of income taxes, U.S. savings bonds, and union dues.

________ 6. A form used to authorize the amount of pay.

________ 7. Records including date of employment, personnel investigations, rates of pay, etc.

a. Human resource records

b. Deduction authorization form

c. Rate authorization form

d. Time card

e. Job time ticket

f. Summary payroll report

g. Payroll check

h. W-2 form

i. Payroll tax returns

j. Payroll journal

k. Payroll master file

________ 1. A file used for recording payroll transactions for each employee and maintaining total employee wages paid for the year to date.

________ 2. A document indicating the time the hourly employee started and stopped working.

________ 3. A document written in exchange for services received from an employee.

________ 4. Forms submitted to local, state, and federal units of government for the payment of withheld taxes and the employer's tax.

________ 5. A form authorizing payroll deductions, including the number of exemptions for withholding of income taxes, U.S. savings bonds, and union dues.

________ 6. A form used to authorize the amount of pay.

________ 7. Records including date of employment, personnel investigations, rates of pay, etc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following includes all payroll transactions processed by the accounting system for a given period of time?

A) payroll journal

B) payroll transaction file

C) time report

D) payroll summary

A) payroll journal

B) payroll transaction file

C) time report

D) payroll summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

7

Discuss each of the following primary documents and records used in the personnel and employment function in the payroll and personnel cycle: personnel records, deduction authorization form, and the rate authorization form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

8

Most companies, with the exception of small ones, have effective controls over the payroll cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

9

Discuss three important differences between the payroll and personnel cycle and other cycles in a typical audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

10

An imprest payroll account that has a significant balance may indicate the presence of:

A) employees have not yet deposited or cashed payroll checks.

B) fraudulent transfer of funds by the company.

C) lack of controls over payroll distribution.

D) the company is overpaying its employees.

A) employees have not yet deposited or cashed payroll checks.

B) fraudulent transfer of funds by the company.

C) lack of controls over payroll distribution.

D) the company is overpaying its employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

11

The total of the individual employee earnings in the payroll master file should equal the total:

A) balance of gross payroll in general ledger accounts.

B) of the checks drawn to employees for payroll.

C) gross payroll plus the total contributed by the employer for payroll taxes.

D) gross pay for the current week's payroll.

A) balance of gross payroll in general ledger accounts.

B) of the checks drawn to employees for payroll.

C) gross payroll plus the total contributed by the employer for payroll taxes.

D) gross pay for the current week's payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

12

The computer file used for recording payroll transactions for each employee and maintaining total wages paid for the year to date is the:

A) payroll transaction file.

B) payroll master file.

C) payroll bank account reconciliation.

D) payroll tax returns.

A) payroll transaction file.

B) payroll master file.

C) payroll bank account reconciliation.

D) payroll tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

13

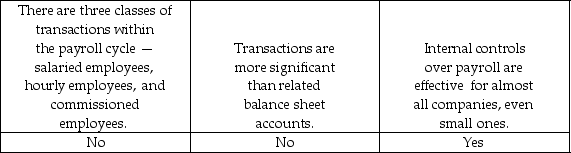

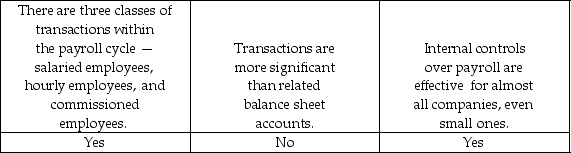

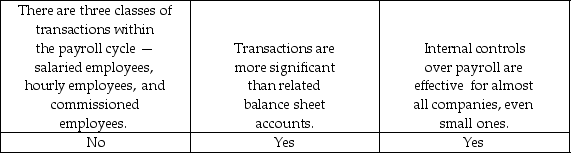

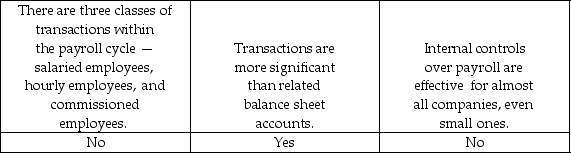

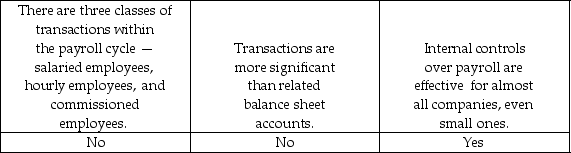

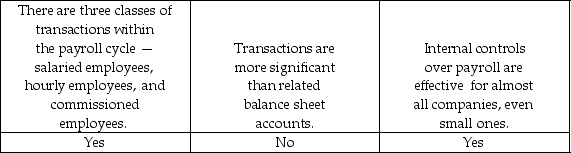

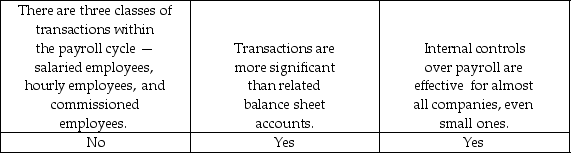

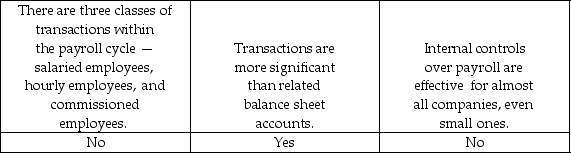

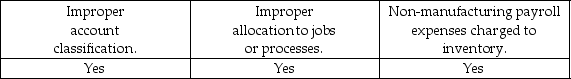

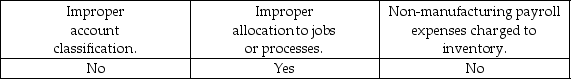

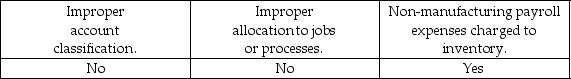

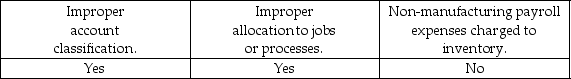

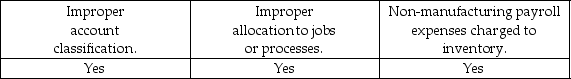

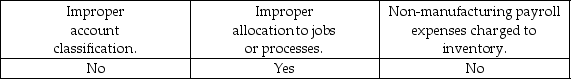

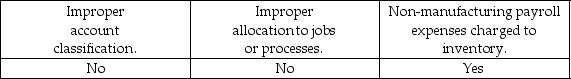

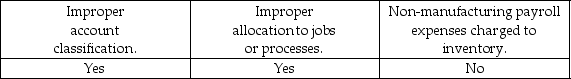

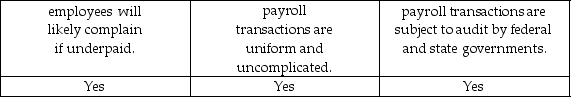

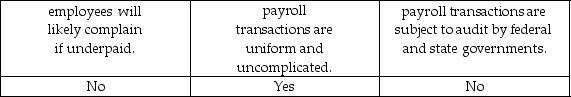

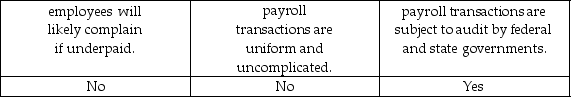

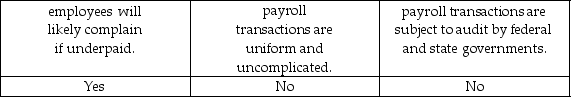

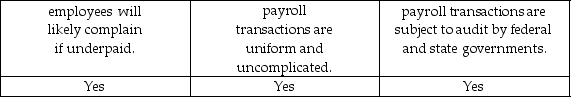

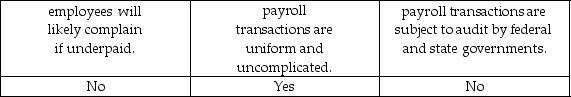

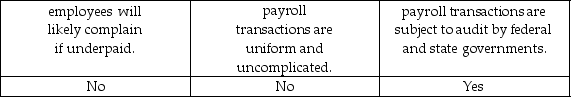

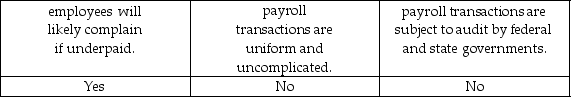

Which of the following statements about the payroll and personnel cycle is correct?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following departments is most likely responsible for pay rate changes and changes in deductible amounts for employees?

A) General Accounting

B) Human Resources

C) Treasury

D) Controller

A) General Accounting

B) Human Resources

C) Treasury

D) Controller

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which department should be authorized to add and delete employees from the payroll or change pay rates and deductions?

A) the supervising department

B) the accounting department

C) the human resources department

D) the treasurer's department

A) the supervising department

B) the accounting department

C) the human resources department

D) the treasurer's department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

16

While most cycles include at least two classes of transactions, the payroll and personnel cycle includes only one class of transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

17

Discuss each of the following documents and records used in the timekeeping and payroll preparation function in the payroll and personnel cycle: time card, job time ticket, summary payroll report, payroll journal and payroll master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

18

The auditor, in auditing payroll, wants to determine that the individuals included in her sample were employees of the company for the period under review. What is the auditor's best source of evidence?

A) Examination of Human Resource Records

B) Examination of the Payroll Master File

C) Examination of the Payroll Transaction File

D) Examination of the Payroll Tax Records

A) Examination of Human Resource Records

B) Examination of the Payroll Master File

C) Examination of the Payroll Transaction File

D) Examination of the Payroll Tax Records

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

19

The payroll and personnel cycle ends with which of the following events?

A) interviewing job candidates

B) hiring a new employee

C) existing employees submitting requests for payment for work performed

D) issuance of paychecks

A) interviewing job candidates

B) hiring a new employee

C) existing employees submitting requests for payment for work performed

D) issuance of paychecks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

20

Records that include data about employees such as employment date, performance ratings and pay rates are the:

A) human resource records.

B) employee screening forms.

C) summary payroll reports.

D) employee folders.

A) human resource records.

B) employee screening forms.

C) summary payroll reports.

D) employee folders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

21

The deduction authorization form authorizes the rate of pay and the deductions for taxes, dues, etc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

22

An auditor is vouching a sample of hourly employees from the payroll master file to approved time clock or time sheet data in order to provide evidence that:

A) employees work the number of hours for which they are paid.

B) payments are made at the contractual rate.

C) product cost information is accurate.

D) segregation of duties is present between the payroll function and the payment function for cash disbursements.

A) employees work the number of hours for which they are paid.

B) payments are made at the contractual rate.

C) product cost information is accurate.

D) segregation of duties is present between the payroll function and the payment function for cash disbursements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

23

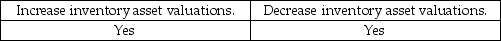

In audits of companies in which payroll is a significant portion of inventory, the improper account classification of payroll can:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

24

When examining payroll transactions, an auditor is primarily concerned with the possibility of:

A) incorrect summaries of employee time records.

B) overpayments and unauthorized payments.

C) under withholding of amounts required to be withheld.

D) posting of gross payroll amounts to incorrect salary expense accounts.

A) incorrect summaries of employee time records.

B) overpayments and unauthorized payments.

C) under withholding of amounts required to be withheld.

D) posting of gross payroll amounts to incorrect salary expense accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

25

For which of the following functions is the use of prenumbered documents least important?

A) Use of prenumbered time cards in the payroll function.

B) Use of prenumbered sales invoices in the sales function.

C) Use of prenumbered receiving reports in the acquisitions function.

D) Use of prenumbered deposit slips in the cash receipts function.

A) Use of prenumbered time cards in the payroll function.

B) Use of prenumbered sales invoices in the sales function.

C) Use of prenumbered receiving reports in the acquisitions function.

D) Use of prenumbered deposit slips in the cash receipts function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

26

The payroll and personnel cycle begins with which of the following events?

A) interviewing job candidates

B) hiring a new employee

C) existing employees submitting requests for payment for work performed

D) issuance of paychecks

A) interviewing job candidates

B) hiring a new employee

C) existing employees submitting requests for payment for work performed

D) issuance of paychecks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following audit procedures would be the most effective in testing for nonexistent employees?

A) Trace transactions recorded in the payroll journal to the HR department to determine employment status.

B) Examine cancelled checks for proper endorsement.

C) Recalculate net pay .

D) Reconcile the disbursements in the payroll journal with the disbursements on the payroll bank statements.

A) Trace transactions recorded in the payroll journal to the HR department to determine employment status.

B) Examine cancelled checks for proper endorsement.

C) Recalculate net pay .

D) Reconcile the disbursements in the payroll journal with the disbursements on the payroll bank statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following types of audit procedures is ordinarily emphasized the least when auditing payroll?

A) Tests of controls

B) Tests of transactions

C) Analytical procedures

D) Tests of details of balances

A) Tests of controls

B) Tests of transactions

C) Analytical procedures

D) Tests of details of balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following audit procedures would be most useful in testing the cut-off audit objective for payroll-related liabilities?

A) Review documentation for proper classification between long and short term liabilities.

B) Compare the clients accrual of payroll liabilities with the payroll tax return.

C) Examine payment tax returns to determine that the expense was recorded in the correct period.

D) Examine subsequent cash disbursements to determine when the liabilities for payroll were paid.

A) Review documentation for proper classification between long and short term liabilities.

B) Compare the clients accrual of payroll liabilities with the payroll tax return.

C) Examine payment tax returns to determine that the expense was recorded in the correct period.

D) Examine subsequent cash disbursements to determine when the liabilities for payroll were paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is false?

A) The payroll cycle consists of one class of transactions.

B) Balance sheet accounts related to payroll are generally more significant than related transactions.

C) Internal controls over payroll are effective for most companies.

D) Small companies usually have effective controls over payroll.

A) The payroll cycle consists of one class of transactions.

B) Balance sheet accounts related to payroll are generally more significant than related transactions.

C) Internal controls over payroll are effective for most companies.

D) Small companies usually have effective controls over payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

31

Firing personnel terminates the payroll and personnel cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following internal control objectives is likely to be the most important in the audit of the payroll cycle?

A) Payroll transactions are properly disclosed and presented in the notes to the financial statements.

B) Payroll transactions are processed by an outside service provider.

C) Recorded transactions represent valid payments.

D) Recorded transactions are recorded in the proper accounting period.

A) Payroll transactions are properly disclosed and presented in the notes to the financial statements.

B) Payroll transactions are processed by an outside service provider.

C) Recorded transactions represent valid payments.

D) Recorded transactions are recorded in the proper accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following best describes the systems of internal control for payroll for large companies ?

A) loosely structured but well controlled

B) loosely structured and loosely controlled

C) highly structured and well controlled

D) highly structured but loosely controlled

A) loosely structured but well controlled

B) loosely structured and loosely controlled

C) highly structured and well controlled

D) highly structured but loosely controlled

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

34

Hiring personnel initiates the payroll and personnel cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

35

Paying employees for their services ends the payroll and personnel cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following would have the least amount of importance regarding controls over the processing of payroll?

A) The person authorized to sign paychecks should not be otherwise involved in the preparation of the payroll.

B) A check-signing machine should not be used to replace a manual signature.

C) Distribution of pay checks should be performed by someone who is not involved in the other payroll functions.

D) Unclaimed paychecks should be immediately returned for redeposit.

A) The person authorized to sign paychecks should not be otherwise involved in the preparation of the payroll.

B) A check-signing machine should not be used to replace a manual signature.

C) Distribution of pay checks should be performed by someone who is not involved in the other payroll functions.

D) Unclaimed paychecks should be immediately returned for redeposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

37

Imprest accounts usually carry a significant balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

38

The use of an imprest payroll account prevents losses from payment of unauthorized payroll to no more than the balance in the imprest account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

39

The job time ticket indicates the starting and stopping times of work during the pay period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

40

To minimize the opportunity for fraud, unclaimed salary checks should be:

A) deposited in a special bank account.

B) kept in the payroll department.

C) left with the employee's supervisor.

D) held for the employee in the personnel department.

A) deposited in a special bank account.

B) kept in the payroll department.

C) left with the employee's supervisor.

D) held for the employee in the personnel department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

41

When labor is a material factor in inventory valuation, the auditor should place special emphasis on testing the internal controls concerning:

A) fictitious employees.

B) authorization of wage rates.

C) proper valuation and allocation of balances.

D) completeness of recorded transactions.

A) fictitious employees.

B) authorization of wage rates.

C) proper valuation and allocation of balances.

D) completeness of recorded transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

42

No individual with access to time cards, payroll records, or checks should also be permitted access to:

A) the computer.

B) job time tickets.

C) personnel records.

D) the canceled check file.

A) the computer.

B) job time tickets.

C) personnel records.

D) the canceled check file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

43

The most important means of verifying account balances in the payroll and personnel cycle are:

A) tests of controls and substantive tests of transactions.

B) analytical procedures and tests of controls.

C) analytical procedures and substantive tests of transactions.

D) tests of controls and tests of details of balances.

A) tests of controls and substantive tests of transactions.

B) analytical procedures and tests of controls.

C) analytical procedures and substantive tests of transactions.

D) tests of controls and tests of details of balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

44

As a part of the auditor's responsibility for ________, the auditor should review the preparation of at least one of each type of payroll tax form the client is responsible for filing.

A) doing tests of controls

B) doing tests of balances

C) doing tests of transactions

D) understanding the client's internal controls

A) doing tests of controls

B) doing tests of balances

C) doing tests of transactions

D) understanding the client's internal controls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following best describes inherent risk for balance-related audit objectives as they relate to payroll?

A) not considered

B) low

C) moderate

D) high

A) not considered

B) low

C) moderate

D) high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

46

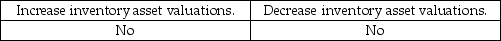

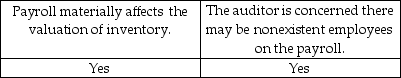

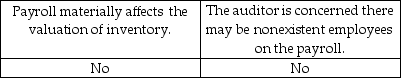

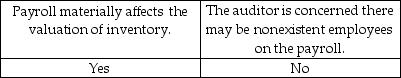

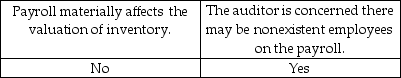

Auditors may extend their tests of payroll in which of the following circumstances?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

47

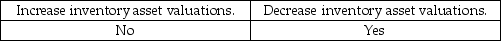

What potential problems may arise when an auditor considers the relationship between payroll and inventory valuation?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following errors gives the auditor the least concern in auditing payroll transactions?

A) An error that indicates possible fraud.

B) Computational errors in formulas when a computerized system is used.

C) Classification errors in charging labor to inventory and job cost accounts.

D) Each of the above gives the auditor significant concern.

A) An error that indicates possible fraud.

B) Computational errors in formulas when a computerized system is used.

C) Classification errors in charging labor to inventory and job cost accounts.

D) Each of the above gives the auditor significant concern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

49

The careful and timely preparation of all payroll tax returns is necessary to avoid penalties and criminal charges. The most important control in the timely preparation of these returns is:

A) computerized preparation of tax returns.

B) a well-defined set of policies that indicate when each form must be filed.

C) independent verification of computer output by a competent individual.

D) a Gaant chart.

A) computerized preparation of tax returns.

B) a well-defined set of policies that indicate when each form must be filed.

C) independent verification of computer output by a competent individual.

D) a Gaant chart.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is the best way for an auditor to determine that every name on a company's payroll for the Rodgers factory is that of a bona fide employee presently on the job?

A) Examine personnel records for accuracy and completeness.

B) Examine employees' names listed on payroll tax returns for agreement with payroll accounting records.

C) Make a surprise observation of the company's regular distribution of paychecks.

D) Visit the working areas and confirm with employees their badge or identification numbers.

A) Examine personnel records for accuracy and completeness.

B) Examine employees' names listed on payroll tax returns for agreement with payroll accounting records.

C) Make a surprise observation of the company's regular distribution of paychecks.

D) Visit the working areas and confirm with employees their badge or identification numbers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

51

To check the accuracy of hours worked, an auditor would ordinarily compare clock cards with:

A) personnel records.

B) job time tickets.

C) labor variance reports.

D) time recorded in the payroll register.

A) personnel records.

B) job time tickets.

C) labor variance reports.

D) time recorded in the payroll register.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

52

If an auditor wishes to test the completeness transaction-related audit objective in the payroll and personnel cycle, which of the following would be a reasonable test of control?

A) Account for a sequence of payroll checks.

B) Examine procedures manual and observe the recording of transactions.

C) Examine payroll records for indication of pay rate approval.

D) Reconcile the payroll bank account.

A) Account for a sequence of payroll checks.

B) Examine procedures manual and observe the recording of transactions.

C) Examine payroll records for indication of pay rate approval.

D) Reconcile the payroll bank account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is a substantive test of transactions?

A) Review personnel policies.

B) Account for a sequence of payroll checks.

C) Reconcile the disbursements in the payroll journal with the disbursements on the payroll bank statement.

D) Examine printouts of transactions rejected by the computer as having invalid employee IDs.

A) Review personnel policies.

B) Account for a sequence of payroll checks.

C) Reconcile the disbursements in the payroll journal with the disbursements on the payroll bank statement.

D) Examine printouts of transactions rejected by the computer as having invalid employee IDs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following types of audit tests is usually emphasized due to a lack of independent third-party evidence related to payroll transactions?

A) Analytical procedures

B) Tests of details of balances

C) Tests of controls

D) Each of the above is emphasized.

A) Analytical procedures

B) Tests of details of balances

C) Tests of controls

D) Each of the above is emphasized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

55

Many companies use outside payroll services to process payroll. Which of the following regarding the auditors responsibilities is most correct regarding their reliance on the internal controls of these outside payroll services?

A) must

B) cannot

C) rarely

D) can often

A) must

B) cannot

C) rarely

D) can often

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not an assertion related to the classes of transactions underlying the payroll cycle?

A) Classification

B) Accuracy

C) Existence

D) Occurrence

A) Classification

B) Accuracy

C) Existence

D) Occurrence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

57

A surprise payroll payoff in which employees must pick-up and sign for their pay check is one means of:

A) identifying employees who do not have proper work credentials.

B) establishing a tightly controlled, fraud-free work environment.

C) testing for nonexistent employees.

D) identifying employees who have not submitted proper W-2 forms.

A) identifying employees who do not have proper work credentials.

B) establishing a tightly controlled, fraud-free work environment.

C) testing for nonexistent employees.

D) identifying employees who have not submitted proper W-2 forms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

58

You are responsible for the audit of payroll. You have assessed control risk as low for the payroll transactions. Substantive tests of payroll would most likely be limited to analytical procedures and:

A) tracing employee time records to the payroll transaction file.

B) recomputing an entire payroll period and compare to the client's records.

C) tracing amounts in the payroll transaction file to the payroll master file.

D) recalculating payroll accruals.

A) tracing employee time records to the payroll transaction file.

B) recomputing an entire payroll period and compare to the client's records.

C) tracing amounts in the payroll transaction file to the payroll master file.

D) recalculating payroll accruals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is not a procedure that can be performed on canceled checks in an effort to detect defalcations?

A) Compare the endorsements on checks with authorized signatures.

B) Scan endorsements for unusual or recurring second endorsements.

C) Examine voided checks to be sure they haven't been used.

D) Examine the payroll records in subsequent periods to determine that terminated employees are no longer being paid.

A) Compare the endorsements on checks with authorized signatures.

B) Scan endorsements for unusual or recurring second endorsements.

C) Examine voided checks to be sure they haven't been used.

D) Examine the payroll records in subsequent periods to determine that terminated employees are no longer being paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

60

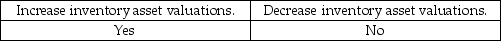

Audit tests of payroll are usually not extensive because:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

61

A weak internal control system allows a department supervisor to "clock in" for a fictitious employee and then approve the employee's time card at the end of the pay period. This fraud would be detected if other controls were in place, such as having an independent party:

A) distribute paychecks.

B) recompute hours worked from time cards.

C) foot the payroll journal and trace postings to the general ledger and the payroll master file.

D) compare the date of the recorded check in the payroll journal with the date on the canceled checks and time cards.

A) distribute paychecks.

B) recompute hours worked from time cards.

C) foot the payroll journal and trace postings to the general ledger and the payroll master file.

D) compare the date of the recorded check in the payroll journal with the date on the canceled checks and time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

62

What types of audit procedures are typically emphasized during the audit of the payroll cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

63

The periodic payment from the general cash account to the payroll account for net payroll should be tested for at least one payroll period. The primary audit procedure is a(n):

A) analytical review procedure that net pay is reasonable.

B) test of controls that an imprest account is being used for payroll.

C) substantive test that the correct amount was transferred for this test period.

D) test of transactions that the check is prepared for the proper amount and transmitted to an imprest bank account before payroll checks are handed out.

A) analytical review procedure that net pay is reasonable.

B) test of controls that an imprest account is being used for payroll.

C) substantive test that the correct amount was transferred for this test period.

D) test of transactions that the check is prepared for the proper amount and transmitted to an imprest bank account before payroll checks are handed out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

64

Payroll checks should be distributed by someone independent of the payroll and timekeeping functions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

65

What key separation of duties should the auditor expect to find within the payroll and personnel cycle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

66

In auditing payroll, which of the following procedures will normally require the least amount of auditor time under normal circumstances?

A) Tests of controls

B) Substantive tests of transactions

C) Analytical procedures

D) Tests of details of balances

A) Tests of controls

B) Substantive tests of transactions

C) Analytical procedures

D) Tests of details of balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

67

Auditors seldom expect to find misstatements when testing payroll transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

68

An auditor traces a sample of electronic time cards before and after the bi-weekly payroll report and then traces to the payroll master file to determine that payroll transactions are reported in the correct period is gathering evidence for which audit objective?

A) Completeness

B) Existence

C) Cut-off

D) Accuracy

A) Completeness

B) Existence

C) Cut-off

D) Accuracy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

69

It would be appropriate for the payroll department to be responsible for which of the following functions?

A) Approval of employee time records.

B) Maintain records of employment, firings, and raises.

C) Temporary retention of unclaimed employee paychecks.

D) Preparation of governmental reports as to employees' earnings and withholding taxes.

A) Approval of employee time records.

B) Maintain records of employment, firings, and raises.

C) Temporary retention of unclaimed employee paychecks.

D) Preparation of governmental reports as to employees' earnings and withholding taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is one audit procedure that may be used to test for proper handling of terminated employees?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

71

There are several key internal controls over the payment of payroll function that should be present. For example, the payroll should be distributed by someone who is not involved in the other payroll functions. Discuss other key internal controls over the payment of payroll function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

72

There are several key internal controls over the timekeeping and payroll preparation function that should be present. For example, adequate control over the time on employees' time cards includes the use of a time clock or other method of making certain that employees are paid for the number of hours they worked. Discuss other key internal controls over the timekeeping and payroll preparation function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is an effective internal accounting control used to prove that production department employees are properly validating payroll time cards at a time-recording station?

A) Internal auditors should make observations of distribution of paychecks on a surprise basis.

B) Time cards should be carefully inspected by those persons who distribute pay envelopes to the employees.

C) One person should be responsible for maintaining records of employee time for which salary payment is not to be made.

D) Daily reports showing time charged to jobs should be approved by the supervisor and compared to the total hours worked on the employee time cards.

A) Internal auditors should make observations of distribution of paychecks on a surprise basis.

B) Time cards should be carefully inspected by those persons who distribute pay envelopes to the employees.

C) One person should be responsible for maintaining records of employee time for which salary payment is not to be made.

D) Daily reports showing time charged to jobs should be approved by the supervisor and compared to the total hours worked on the employee time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following best describes effective internal control over payroll?

A) The preparation of the payroll must be under the control of the personnel department.

B) The confidentiality of employee payroll data should be carefully protected to prevent fraud.

C) The duties of hiring, payroll computation, and payment to employees should be segregated.

D) The payment of cash to employees should be replaced with payment by checks.

A) The preparation of the payroll must be under the control of the personnel department.

B) The confidentiality of employee payroll data should be carefully protected to prevent fraud.

C) The duties of hiring, payroll computation, and payment to employees should be segregated.

D) The payment of cash to employees should be replaced with payment by checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

75

Discuss the two circumstances under which auditors would extend their procedures considerably in the audit of payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

76

Generally, is the inherent risk level for the audit of the payroll and personnel set at low, moderate, or high? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

77

Discuss the procedures involved in, and the purpose of, a surprise payroll payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

78

Effective internal accounting control over unclaimed payroll checks that are kept by the company would include accounting department procedures that require:

A) effective cancellation and stop payment orders for checks representing unclaimed wages.

B) preparation of a list of unclaimed wages on a periodic basis.

C) accounting for all unclaimed wages in a current liability account.

D) periodic accounting for the actual checks representing unclaimed wages.

A) effective cancellation and stop payment orders for checks representing unclaimed wages.

B) preparation of a list of unclaimed wages on a periodic basis.

C) accounting for all unclaimed wages in a current liability account.

D) periodic accounting for the actual checks representing unclaimed wages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is correct?

A) The overhead charged to inventory at the balance sheet date can be understated if the salaries of administrative personnel are inadvertently or intentionally charged to indirect manufacturing overhead.

B) When jobs are billed on a cost-plus basis, revenue and total expenses are both affected by charging labor to incorrect jobs.

C) Payroll is a significant portion of inventory for retail and service industry companies.

D) The valuation of inventory is affected if the direct labor cost of individual employees is improperly charged to the wrong job or process.

A) The overhead charged to inventory at the balance sheet date can be understated if the salaries of administrative personnel are inadvertently or intentionally charged to indirect manufacturing overhead.

B) When jobs are billed on a cost-plus basis, revenue and total expenses are both affected by charging labor to incorrect jobs.

C) Payroll is a significant portion of inventory for retail and service industry companies.

D) The valuation of inventory is affected if the direct labor cost of individual employees is improperly charged to the wrong job or process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

80

There are several internal controls in the personnel and employment function that are important from an audit perspective. For example, there should be an adequate investigation of the competence and trustworthiness of new employees. Discuss other internal controls in the personnel and employment function that are important from an audit perspective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck