Deck 10: Variance Analysis A Tool for Cost Control and Performance Evaluation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

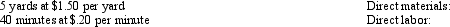

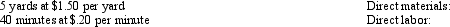

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

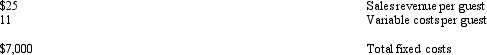

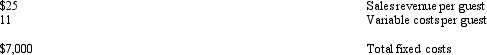

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/106

العب

ملء الشاشة (f)

Deck 10: Variance Analysis A Tool for Cost Control and Performance Evaluation

1

The difference between operating income on a flexible budget and actual operating income is called the:

A) sales price variance.

B) efficiency variance.

C) standard variance.

D) flexible budget variance.

A) sales price variance.

B) efficiency variance.

C) standard variance.

D) flexible budget variance.

D

2

Variance analysis compares:

A) practical standards and ideal standards.

B) static budgets and flexible budgets.

C) standard costs and actual costs.

D) product costs and period costs.

A) practical standards and ideal standards.

B) static budgets and flexible budgets.

C) standard costs and actual costs.

D) product costs and period costs.

C

3

The type of budget that consider standard costs for the actual volume of production is a:

A) standard budget.

B) static budget.

C) flexible budget.

D) fixed budget.

A) standard budget.

B) static budget.

C) flexible budget.

D) fixed budget.

C

4

A(n) ____ is attainable only when near-perfect conditions exist.

A) practical standard

B) ideal standard

C) static budget

D) flexible budget

A) practical standard

B) ideal standard

C) static budget

D) flexible budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

5

Differences in sales revenue between the flexible budget and actual results can be attributed to:

A) the sales volume variance.

B) the flexible budget variance.

C) the sales price variance.

D) the variable overhead efficiency variance.

A) the sales volume variance.

B) the flexible budget variance.

C) the sales price variance.

D) the variable overhead efficiency variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is true regarding the budgeted cost for direct materials?

A) It would be used on a static budget but not a flexible budget.

B) It would consist of two components - a standard quantity and a standard price.

C) It must be determined after materials are purchased for the year.

D) It can not be determined if a company uses a just-in-time inventory system.

A) It would be used on a static budget but not a flexible budget.

B) It would consist of two components - a standard quantity and a standard price.

C) It must be determined after materials are purchased for the year.

D) It can not be determined if a company uses a just-in-time inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

7

Rogers Rods & Reels Ltd. Rogers Rods & Reels Ltd. manufactures and sells various types of fishing equipment. At the end of 2011, Rogers had estimated for the production and sale of 15,000 bass fishing rods. Each rod has a standard calling for 1.5 pounds of direct material at a standard rate of $8.00 per pound and 15 minutes of direct labor time at a standard rate of $.18 per minute. During 2012, Rogers actually produced and sold 16,000 rods. These 16,000 rods had an actual direct materials cost of $179,200 (25,600 pounds at $7.00 per pound) and an actual direct labor cost of $44,800 (224,000 minutes at $.20 per minute). Each rod sells for $50.

Refer to the Rogers Rods & Reels Ltd. information above. What is Rogers' net operating income based on a flexible budget?

A) $579,500

B) $564,800

C) $576,000

D) $590,000

Refer to the Rogers Rods & Reels Ltd. information above. What is Rogers' net operating income based on a flexible budget?

A) $579,500

B) $564,800

C) $576,000

D) $590,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

8

Rogers Rods & Reels Ltd. Rogers Rods & Reels Ltd. manufactures and sells various types of fishing equipment. At the end of 2011, Rogers had estimated for the production and sale of 15,000 bass fishing rods. Each rod has a standard calling for 1.5 pounds of direct material at a standard rate of $8.00 per pound and 15 minutes of direct labor time at a standard rate of $.18 per minute. During 2012, Rogers actually produced and sold 16,000 rods. These 16,000 rods had an actual direct materials cost of $179,200 (25,600 pounds at $7.00 per pound) and an actual direct labor cost of $44,800 (224,000 minutes at $.20 per minute). Each rod sells for $50.

Refer to the Rogers Rods & Reels Ltd. information above. What is Rogers' flexible budget variance?

A) $11,200 F

B) $11,200 U

C) $ 3,500 F

D) $ 3,500 U

Refer to the Rogers Rods & Reels Ltd. information above. What is Rogers' flexible budget variance?

A) $11,200 F

B) $11,200 U

C) $ 3,500 F

D) $ 3,500 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

9

Holt Products manufactures desktop computers. Management has determined that each computer has a standard labor cost of $75.00 when 5 hours of labor at a cost of $15.00 per hour are used. The static budget for the month of April showed an estimated production of 4,200 computers. During April, 4,500 computers were actually produced. The actual direct labor cost for each computer was $85.80 when 5.5 hours of labor at a cost of $15.60 per hour was used. What should be the total direct labor cost according to Holt's flexible budget for April?

A) $360,360

B) $315,000

C) $337,500

D) $386,100

A) $360,360

B) $315,000

C) $337,500

D) $386,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is false regarding task analysis?

A) It examines the production process in detail.

B) It may involve the use of engineers.

C) It emphasizes what it should cost to produce a product rather than historical costs.

D) It uses actual historical data in the determination of standard costs.

A) It examines the production process in detail.

B) It may involve the use of engineers.

C) It emphasizes what it should cost to produce a product rather than historical costs.

D) It uses actual historical data in the determination of standard costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

11

Hoppe Inc. manufactures widgets. Management has determined that each widget has a standard materials cost of $3.50 when 2.5 ounces of raw material at a cost of $1.40 per ounce are used. The static budget for the month of December showed an estimated production of 4,000 widgets in December. During December, 4,300 widgets were actually produced. The actual cost for each widget was $3.60 when 2.25 ounces of raw material at a cost of $1.60 per ounce were purchased and used. What should be the total direct materials cost according to Hoppe's flexible budget for December?

A) $14,400

B) $15,050

C) $14,000

D) $15,480

A) $14,400

B) $15,050

C) $14,000

D) $15,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

12

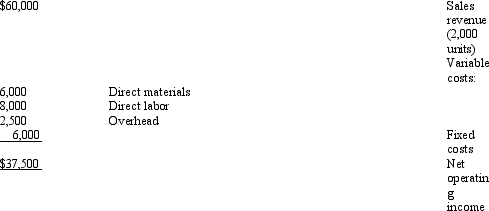

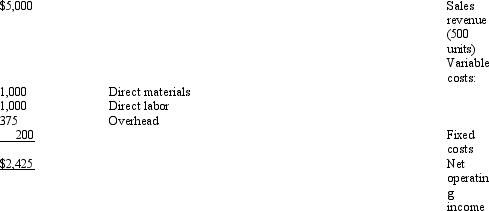

Hathaway Inc. produces and sells golf umbrellas to local resorts. Hathaway anticipates April to be a busy month with the sale of 2,000 umbrellas. The company has prepared the following static budget for April:  During April, Hathaway actually produced and sold 2,300 umbrellas. What should be Hathaway's net operating income in April based on a flexible budget?

During April, Hathaway actually produced and sold 2,300 umbrellas. What should be Hathaway's net operating income in April based on a flexible budget?

A) $44,025

B) $43,125

C) $37,500

D) $35,025

During April, Hathaway actually produced and sold 2,300 umbrellas. What should be Hathaway's net operating income in April based on a flexible budget?

During April, Hathaway actually produced and sold 2,300 umbrellas. What should be Hathaway's net operating income in April based on a flexible budget?A) $44,025

B) $43,125

C) $37,500

D) $35,025

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

13

Violetta Inc. manufactures plastic storage boxes. Management has determined that each medium-sized box has a standard materials cost of $1.20 when 4 pounds of raw material at a cost of $.30 per pound are used. The static budget for the month of March showed an estimated production of 15,000 boxes in March. During March, 17,000 boxes were actually produced. The actual cost for each box was $1.56 when 3.9 pounds of raw material at a cost of $.40 per pound were purchased and used. What should be the total direct materials cost according to Violetta's flexible budget for March?

A) $20,400

B) $26,520

C) $18,000

D) $23,400

A) $20,400

B) $26,520

C) $18,000

D) $23,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

14

Task analysis:

A) is used to determine the tasks that production employees should complete on a daily basis.

B) is used to evaluate employee performance.

C) is used to set standard costs.

D) emphasizes the historical costs of a product.

A) is used to determine the tasks that production employees should complete on a daily basis.

B) is used to evaluate employee performance.

C) is used to set standard costs.

D) emphasizes the historical costs of a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

15

A budget for a single unit of a product or service is called as a:

A) fixed cost.

B) real cost.

C) standard cost.

D) total cost.

A) fixed cost.

B) real cost.

C) standard cost.

D) total cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

16

Martin Corporation had an unfavorable sales price variance of $4,800 for 2012. Martin had budgeted for sales of 10,000 units at a sales price of $5 each. Actual sales in 2012 totaled 12,000 units. What was the actual sales price per unit?

A) $5.40

B) $4.60

C) $4.52

D) $5.48

A) $5.40

B) $4.60

C) $4.52

D) $5.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

17

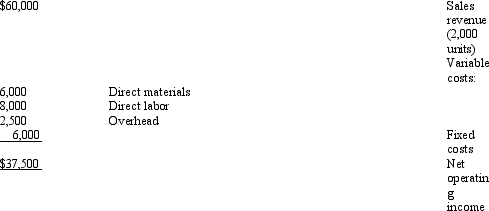

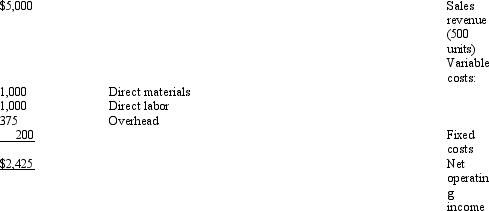

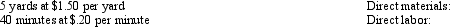

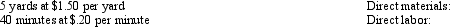

Trina makes handmade leis in Hawaii which she sells to local tourists. She anticipates August to be a busy month with the sale of 500 leis. She has prepared the following static budget for August:  During August, Trina actually produced and sold 400 leis. What should be Trina's net operating income in August based on a flexible budget?

During August, Trina actually produced and sold 400 leis. What should be Trina's net operating income in August based on a flexible budget?

A) $1,940

B) $1,825

C) $1,425

D) $1,900

During August, Trina actually produced and sold 400 leis. What should be Trina's net operating income in August based on a flexible budget?

During August, Trina actually produced and sold 400 leis. What should be Trina's net operating income in August based on a flexible budget?A) $1,940

B) $1,825

C) $1,425

D) $1,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

18

Summerlin Law Offices applies overhead to clients based on direct labor hours. The office manager determined that overhead will be applied at a rate of $25 per direct labor hour. The static budget for the month of November showed an estimated 2,500 direct labor hours would be incurred. During November, 2,800 direct labor hours were actually incurred and actual overhead costs were $58,800. What should be the total overhead cost according to the firm's flexible budget for November?

A) $70,000

B) $58,800

C) $62,500

D) $52,500

A) $70,000

B) $58,800

C) $62,500

D) $52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

19

In most companies, machines break down occasionally and employees are often less than perfect. Which type of standard acknowledges these characteristics when determining the standard cost of a product?

A) Efficiency standard

B) Ideal standard

C) Practical standard

D) Budgeted standard

A) Efficiency standard

B) Ideal standard

C) Practical standard

D) Budgeted standard

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

20

The flexible budget variance:

A) directs management's attention to specific reasons for why budgeted income differed from actual operating income.

B) compares the static budget to the flexible budget.

C) removes any differences between budgeted operating income and actual operating income that are attributable to differences in budgeted and actual volume.

D) is most often used to determine whether or not there is sufficient demand for a company's product.

A) directs management's attention to specific reasons for why budgeted income differed from actual operating income.

B) compares the static budget to the flexible budget.

C) removes any differences between budgeted operating income and actual operating income that are attributable to differences in budgeted and actual volume.

D) is most often used to determine whether or not there is sufficient demand for a company's product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

21

Fox Manufacturing At the beginning of the year, Fox Manufacturing had budgeted for the production and sale of 24,000 units. The standard sales price and variable costs per unit were budgeted to be $20.00 and $8.00, respectively. Actual sales for the year totaled 21,000 units, and the actual sales price and variable costs per unit were $19.50 and $8.00, respectively. Both budgeted and actual fixed costs were $20,000.

Refer to the Fox Manufacturing information above. What was Fox's sales price variance for the year?

A) $10,500 F

B) $10,500 U

C) $12,000 F

D) $12,000 U

Refer to the Fox Manufacturing information above. What was Fox's sales price variance for the year?

A) $10,500 F

B) $10,500 U

C) $12,000 F

D) $12,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

22

Mystic Falls Inc. Mystic Falls Inc. bottles and sells a popular soft drink. In 2011, the company had expected to sell 1,000,000 bottles but actually bottled and sold 900,000 bottles. The standard direct materials cost for each bottle is $.40 comprised of 10 ounces at a cost of $.04 per ounce. During 2011, 10,000,000 ounces of material were purchased out of which 9,200,000 ounces were used at a cost of $.05 per ounce.

Refer to the Mystic Falls Inc. information above. The direct materials price variance for 2011 was:

A) $ 92,000 U.

B) $ 92,000 F.

C) $100,000 U.

D) $100,000 F.

Refer to the Mystic Falls Inc. information above. The direct materials price variance for 2011 was:

A) $ 92,000 U.

B) $ 92,000 F.

C) $100,000 U.

D) $100,000 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

23

Miller Company has an unfavorable materials price variance. Which of the following would be the least likely reason for this variance?

A) The company purchased a higher quality material than was budgeted.

B) The company could not take advantage of quantity discounts.

C) The company used more material than was budgeted for in each unit.

D) The company under budgeted the standard price for materials.

A) The company purchased a higher quality material than was budgeted.

B) The company could not take advantage of quantity discounts.

C) The company used more material than was budgeted for in each unit.

D) The company under budgeted the standard price for materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

24

When the quantity of materials purchased and materials used is different, which of the following is more relevant for the purpose of calculating the direct materials price variance?

A) Standard quantity allowed

B) Actual quantity purchased

C) Actual quantity used

D) The lower of the standard quantity allowed and the actual quantity purchased

A) Standard quantity allowed

B) Actual quantity purchased

C) Actual quantity used

D) The lower of the standard quantity allowed and the actual quantity purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

25

Lukey Products has an unfavorable materials usage variance. Which of the following would be the most likely reason for this variance?

A) The company under budgeted the quantity of material to be used for each unit.

B) The company purchased material at a price for less than what was expected.

C) The company budgeted for a lower sales volume than what actually occurred.

D) The company did not use up all the material that had been purchased.

A) The company under budgeted the quantity of material to be used for each unit.

B) The company purchased material at a price for less than what was expected.

C) The company budgeted for a lower sales volume than what actually occurred.

D) The company did not use up all the material that had been purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

26

Dabney Inc. has a favorable direct labor efficiency variance. Which of the following would be the most likely reason for this variance?

A) The company used lower-paid workers in the production process more than they had expected.

B) Employees took a shorter amount of time to produce the product than expected.

C) The company used a standard direct labor rate that was too low.

D) Employees used less direct materials in the production process than expected.

A) The company used lower-paid workers in the production process more than they had expected.

B) Employees took a shorter amount of time to produce the product than expected.

C) The company used a standard direct labor rate that was too low.

D) Employees used less direct materials in the production process than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

27

Coppelli Inc. In early 2012, Coppelli Inc. had budgeted for the production and sale of 24,000 units. The standard sales price and variable costs per unit were budgeted to be $6.00 and $2.00, respectively. Actual sales for 2012 totaled 25,300 units, and the actual sales price and variable costs per unit were $6.50 and $2.10, respectively. Both budgeted and actual fixed costs were $30,000.

Refer to the Coppelli Inc. information above. What was Coppelli's sales price variance for 2012?

A) $12,650 F

B) $12,650 U

C) $12,000 F

D) $12,000 U

Refer to the Coppelli Inc. information above. What was Coppelli's sales price variance for 2012?

A) $12,650 F

B) $12,650 U

C) $12,000 F

D) $12,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tulley Manufacturing has an unfavorable direct labor rate variance. Which of the following would be the most likely reason for this variance?

A) The company used lower-paid workers in the production process than they had expected.

B) Employees took a longer amount of time to produce the product than expected.

C) The company gave employees an unexpected raise due to union negotiations.

D) Employees used more direct materials in the production process than expected.

A) The company used lower-paid workers in the production process than they had expected.

B) Employees took a longer amount of time to produce the product than expected.

C) The company gave employees an unexpected raise due to union negotiations.

D) Employees used more direct materials in the production process than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

29

Taylor Products Inc. has an $5,000 unfavorable flexible budget variance for October. Which of the following statements is true, if October's flexible budget net operating income was $175,000?

A) Taylor's static budget must have showed a net operating income of $180,000.

B) Taylor's static budget must have showed a net operating income of $170,000.

C) Taylor's actual net operating income must have been $180,000.

D) Taylor's actual net operating income must have been $170,000.

A) Taylor's static budget must have showed a net operating income of $180,000.

B) Taylor's static budget must have showed a net operating income of $170,000.

C) Taylor's actual net operating income must have been $180,000.

D) Taylor's actual net operating income must have been $170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

30

Bukowitz Inc. has a favorable direct labor rate variance. Which of the following would be the most likely reason for this variance?

A) The company used lower-paid workers in the production process more than they had expected.

B) Employees took a shorter amount of time to produce the product than expected.

C) The company used a standard direct labor rate that was too low.

D) Employees used less direct materials in the production process than expected.

A) The company used lower-paid workers in the production process more than they had expected.

B) Employees took a shorter amount of time to produce the product than expected.

C) The company used a standard direct labor rate that was too low.

D) Employees used less direct materials in the production process than expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

31

Chilé Products Ltd. Chilé Products Ltd. bottles and sells hot pepper sauce. In 2012, the company had expected to sell 65,000 bottles but actually bottled and sold 80,000 bottles. The standard direct materials cost for each bottle is $.24 comprised of .60 ounces at a cost of $.40 per ounce. During 2012, 52,000 ounces of material were purchased out of which 46,000 ounces were used at a cost of $.37 per ounce.

Refer to the Chilé Products Ltd. information above. The direct materials price variance for 2012 was:

A) $1,560 F.

B) $1,560 U.

C) $1,380 F.

D) $1,380 U.

Refer to the Chilé Products Ltd. information above. The direct materials price variance for 2012 was:

A) $1,560 F.

B) $1,560 U.

C) $1,380 F.

D) $1,380 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

32

Smith Corporation has a $6,000 favorable flexible budget variance for January. Which of the following statements is true, if January's flexible budget net operating income was $100,000?

A) Smith's static budget must have showed a net operating income of $106,000.

B) Smith's static budget must have showed a net operating income of $94,000.

C) Smith's actual net operating income must have been $106,000.

D) Smith's actual net operating income must have been $94,000.

A) Smith's static budget must have showed a net operating income of $106,000.

B) Smith's static budget must have showed a net operating income of $94,000.

C) Smith's actual net operating income must have been $106,000.

D) Smith's actual net operating income must have been $94,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

33

When the quantity of materials purchased and materials used is different, which of the following is more relevant for the purpose of calculating the direct materials usage variance?

A) Actual quantity purchased

B) Actual quantity used

C) The lower of standard quantity allowed and actual quantity purchased

D) The lower of actual quantity used and actual quantity purchased

A) Actual quantity purchased

B) Actual quantity used

C) The lower of standard quantity allowed and actual quantity purchased

D) The lower of actual quantity used and actual quantity purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

34

Chapman Products has a favorable materials usage variance. Which of the following would be the most likely reason for this variance?

A) The company under budgeted the quantity of material to be used for each unit.

B) The company purchased material at a price for less than what was expected.

C) The company's employees were less trained than expected.

D) The company's machines were better maintained resulting in lower wastage of materials.

A) The company under budgeted the quantity of material to be used for each unit.

B) The company purchased material at a price for less than what was expected.

C) The company's employees were less trained than expected.

D) The company's machines were better maintained resulting in lower wastage of materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

35

Dorffman Inc. has a $18,000 favorable flexible budget variance for May. Which of the following statements is true, if May's actual net operating income was $72,000?

A) Dorffman's static budget must have showed a net operating income of $54,000.

B) Dorffman's static budget must have showed a net operating income of $90,000.

C) Dorffman's flexible budget must have showed a net operating income of $54,000.

D) Dorffman's flexible budget must have showed a net operating income of $90,000.

A) Dorffman's static budget must have showed a net operating income of $54,000.

B) Dorffman's static budget must have showed a net operating income of $90,000.

C) Dorffman's flexible budget must have showed a net operating income of $54,000.

D) Dorffman's flexible budget must have showed a net operating income of $90,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

36

Prevo Products Inc. has a $15,000 unfavorable flexible budget variance for July. Which of the following statements is true, if July's actual net operating income was $300,000?

A) Prevo's static budget must have showed a net operating income of $315,000.

B) Prevo's static budget must have showed a net operating income of $285,000.

C) Prevo's flexible budget must have showed a net operating income of $315,000.

D) Prevo's flexible budget must have showed a net operating income of $285,000.

A) Prevo's static budget must have showed a net operating income of $315,000.

B) Prevo's static budget must have showed a net operating income of $285,000.

C) Prevo's flexible budget must have showed a net operating income of $315,000.

D) Prevo's flexible budget must have showed a net operating income of $285,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

37

Mystic Falls Inc. Mystic Falls Inc. bottles and sells a popular soft drink. In 2011, the company had expected to sell 1,000,000 bottles but actually bottled and sold 900,000 bottles. The standard direct materials cost for each bottle is $.40 comprised of 10 ounces at a cost of $.04 per ounce. During 2011, 10,000,000 ounces of material were purchased out of which 9,200,000 ounces were used at a cost of $.05 per ounce.

Refer to the Mystic Falls Inc. information above. The direct materials usage variance for 2011 was:

A) $ 8,000 U.

B) $ 8,000 F.

C) $40,000 U.

D) $40,000 F.

Refer to the Mystic Falls Inc. information above. The direct materials usage variance for 2011 was:

A) $ 8,000 U.

B) $ 8,000 F.

C) $40,000 U.

D) $40,000 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

38

Peterson Inc. uses direct labor hours as the cost driver for variable overhead. Which of the following items does not need to be known, in order to calculate the variable overhead spending variance?

A) Actual overhead costs

B) Actual direct labor hours

C) Standard variable overhead rate per direct labor hour

D) Standard direct labor hours allowed

A) Actual overhead costs

B) Actual direct labor hours

C) Standard variable overhead rate per direct labor hour

D) Standard direct labor hours allowed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

39

Byron Products has a favorable materials price variance. Which of the following would be the least likely reason for this variance?

A) The company over budgeted the standard price for materials.

B) The company took advantage of quantity discounts from its suppliers.

C) The company's employees were more efficient with the use of their production time.

D) The company purchased a substandard material at a cheaper price.

A) The company over budgeted the standard price for materials.

B) The company took advantage of quantity discounts from its suppliers.

C) The company's employees were more efficient with the use of their production time.

D) The company purchased a substandard material at a cheaper price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

40

Chilé Products Ltd. Chilé Products Ltd. bottles and sells hot pepper sauce. In 2012, the company had expected to sell 65,000 bottles but actually bottled and sold 80,000 bottles. The standard direct materials cost for each bottle is $.24 comprised of .60 ounces at a cost of $.40 per ounce. During 2012, 52,000 ounces of material were purchased out of which 46,000 ounces were used at a cost of $.37 per ounce.

Refer to the Chilé Products Ltd. information above. The direct materials usage variance for 2012 was:

A) $ 800 F.

B) $ 800 U.

C) $1,600 F.

D) $1,600 U.

Refer to the Chilé Products Ltd. information above. The direct materials usage variance for 2012 was:

A) $ 800 F.

B) $ 800 U.

C) $1,600 F.

D) $1,600 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

41

When managers apply the process of "management by exception":

A) they take action when there is a significant variance between planned and actual results.

B) they take action when there is a variance of any size or amount between planned and actual results.

C) they are allowed to use standard costs rather than actual costs on financial statements issued to decision makers.

D) they are not required to compute the standard cost of making a product.

A) they take action when there is a significant variance between planned and actual results.

B) they take action when there is a variance of any size or amount between planned and actual results.

C) they are allowed to use standard costs rather than actual costs on financial statements issued to decision makers.

D) they are not required to compute the standard cost of making a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

42

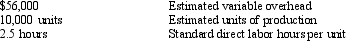

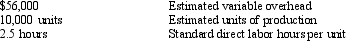

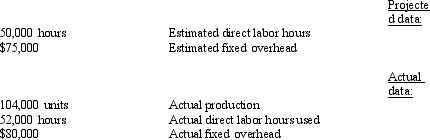

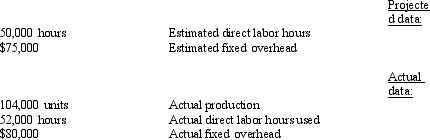

Atkinson Landscaping Atkinson Landscaping applies variable overhead based on direct labor hours. At the beginning of the current year, Atkinson had estimated the following:

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

Refer to the Atkinson Landscaping information above. Atkinson's variable overhead spending variance for the year is:

A) $ 672 F.

B) $ 928 F.

C) $4,000 U.

D) $ 145 U.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.Refer to the Atkinson Landscaping information above. Atkinson's variable overhead spending variance for the year is:

A) $ 672 F.

B) $ 928 F.

C) $4,000 U.

D) $ 145 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements is false regarding variance analysis in the modern manufacturing environment?

A) It is often not timely enough to be useful to managers.

B) It is often too detailed to be of much use to managers.

C) Not all variances are required to be investigated.

D) It can influence employee behavior.

A) It is often not timely enough to be useful to managers.

B) It is often too detailed to be of much use to managers.

C) Not all variances are required to be investigated.

D) It can influence employee behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

44

Armstrong Products Armstrong Products applies fixed overhead at a rate of $3 per direct labor hour. Each unit produced is expected to take 2 direct labor hours. Armstrong expected production in the current year to be 10,000 units but 9,000 units were actually produced. Actual direct labor hours were 19,000 and actual fixed overhead costs were $62,000.

Refer to the Armstrong Products information above. Armstrong's fixed overhead volume variance is:

A) $2,000.

B) $6,000.

C) $8,000.

D) $ 0.

Refer to the Armstrong Products information above. Armstrong's fixed overhead volume variance is:

A) $2,000.

B) $6,000.

C) $8,000.

D) $ 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

45

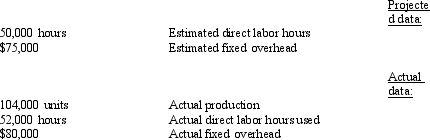

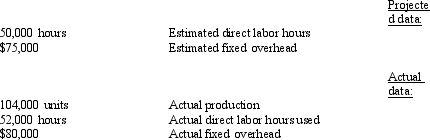

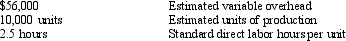

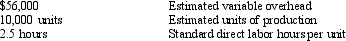

Hayward Inc. Hayward Inc. produces a unique item. Hayward's management team wishes to perform a variance analysis on its fixed overhead. Fixed overhead is applied to units produced using direct labor hours as its cost driver. The company's managerial accountant has compiled the following information:

Refer to the Hayward Inc. information above. Hayward's fixed overhead volume variance is:

Refer to the Hayward Inc. information above. Hayward's fixed overhead volume variance is:

A) $5,000.

B) $2,000.

C) $3,000.

D) $2,500.

Refer to the Hayward Inc. information above. Hayward's fixed overhead volume variance is:

Refer to the Hayward Inc. information above. Hayward's fixed overhead volume variance is:A) $5,000.

B) $2,000.

C) $3,000.

D) $2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sampson Apparel Inc. Sampson Apparel Inc. incurred actual variable overhead expenses of $20,000 in the current year for the production of 5,000 units. Variable overhead was applied at a rate of $1.50 per direct labor hour and 2 direct labor hours were budgeted for each unit. The company used 9,000 direct labor hours for production.

Refer to the Sampson Apparel Inc. information above. What was Sampson's variable overhead efficiency variance?

A) $6,500 U

B) $6,500 F

C) $1,500 U

D) $1,500 F

Refer to the Sampson Apparel Inc. information above. What was Sampson's variable overhead efficiency variance?

A) $6,500 U

B) $6,500 F

C) $1,500 U

D) $1,500 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

47

The variable overhead efficiency variance:

A) is interpreted in the same manner as the direct labor efficiency variance.

B) measures the efficient use of factory utilities, factory maintenance, and factory supplies.

C) measures the efficient use of the cost driver used in the flexible budget.

D) measures the efficient use of direct materials.

A) is interpreted in the same manner as the direct labor efficiency variance.

B) measures the efficient use of factory utilities, factory maintenance, and factory supplies.

C) measures the efficient use of the cost driver used in the flexible budget.

D) measures the efficient use of direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

48

Latimer Textiles Inc. Latimer Textiles Inc. incurred actual variable overhead expenses of $27,000 in the current year for the production of 8,000 units. Variable overhead was applied at a rate of $1.75 per direct labor hour and 2 direct labor hours were budgeted for each unit. The company used 17,400 direct labor hours for production.

Refer to the Latimer Textiles Inc. information above. What was Latimer's variable overhead efficiency variance?

A) $3,450 U

B) $3,450 F

C) $2,450 U

D) $2,450 F

Refer to the Latimer Textiles Inc. information above. What was Latimer's variable overhead efficiency variance?

A) $3,450 U

B) $3,450 F

C) $2,450 U

D) $2,450 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

49

Managers who properly apply the concept of "management by exception" will:

A) investigate only unfavorable variances.

B) investigate only favorable variances.

C) always investigate unfavorable and favorable variances regardless of size.

D) investigate only variances of a certain size or scope.

A) investigate only unfavorable variances.

B) investigate only favorable variances.

C) always investigate unfavorable and favorable variances regardless of size.

D) investigate only variances of a certain size or scope.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

50

Washington Inc. has an unfavorable fixed overhead spending variance. Which of the following would be the most likely reason for this variance?

A) More units were actually produced than predicted.

B) Fewer units were actually produced than predicted.

C) Actual fixed overhead was more than predicted.

D) Actual fixed overhead was less than predicted.

A) More units were actually produced than predicted.

B) Fewer units were actually produced than predicted.

C) Actual fixed overhead was more than predicted.

D) Actual fixed overhead was less than predicted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

51

Latimer Textiles Inc. Latimer Textiles Inc. incurred actual variable overhead expenses of $27,000 in the current year for the production of 8,000 units. Variable overhead was applied at a rate of $1.75 per direct labor hour and 2 direct labor hours were budgeted for each unit. The company used 17,400 direct labor hours for production.

Refer to the Latimer Textiles Inc. information above. What was Latimer's variable overhead spending variance?

A) $3,450 U

B) $3,450 F

C) $2,450 U

D) $2,450 F

Refer to the Latimer Textiles Inc. information above. What was Latimer's variable overhead spending variance?

A) $3,450 U

B) $3,450 F

C) $2,450 U

D) $2,450 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

52

Armstrong Products Armstrong Products applies fixed overhead at a rate of $3 per direct labor hour. Each unit produced is expected to take 2 direct labor hours. Armstrong expected production in the current year to be 10,000 units but 9,000 units were actually produced. Actual direct labor hours were 19,000 and actual fixed overhead costs were $62,000.

Refer to the Armstrong Products information above. Armstrong's fixed overhead spending variance is:

A) $8,000 F.

B) $8,000 U.

C) $2,000 F.

D) $2,000 U.

Refer to the Armstrong Products information above. Armstrong's fixed overhead spending variance is:

A) $8,000 F.

B) $8,000 U.

C) $2,000 F.

D) $2,000 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

53

Bellow Ltd. uses direct labor hours as the cost driver for variable overhead. Which of the following items does not need to be known, in order to calculate the variable overhead efficiency variance?

A) Actual overhead costs

B) Actual direct labor hours

C) Standard variable overhead rate per direct labor hour

D) Standard direct labor hours allowed

A) Actual overhead costs

B) Actual direct labor hours

C) Standard variable overhead rate per direct labor hour

D) Standard direct labor hours allowed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

54

New Hampshire Products has a favorable fixed overhead spending variance. Which of the following would be the most likely reason for this variance?

A) More units were actually produced than predicted.

B) Fewer units were actually produced than predicted.

C) Actual fixed overhead was more than predicted.

D) Actual fixed overhead was less than predicted.

A) More units were actually produced than predicted.

B) Fewer units were actually produced than predicted.

C) Actual fixed overhead was more than predicted.

D) Actual fixed overhead was less than predicted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following types of companies would not have a need to calculate a fixed overhead volume variance?

A) A company that uses variable costing.

B) A company that uses absorption costing.

C) A company that applies fixed overhead based on direct labor hours.

D) A company that uses activity-based costing (ABC).

A) A company that uses variable costing.

B) A company that uses absorption costing.

C) A company that applies fixed overhead based on direct labor hours.

D) A company that uses activity-based costing (ABC).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

56

Sampson Apparel Inc. Sampson Apparel Inc. incurred actual variable overhead expenses of $20,000 in the current year for the production of 5,000 units. Variable overhead was applied at a rate of $1.50 per direct labor hour and 2 direct labor hours were budgeted for each unit. The company used 9,000 direct labor hours for production.

Refer to the Sampson Apparel Inc. information above. What was Sampson's variable overhead spending variance?

A) $6,500 U

B) $6,500 F

C) $1,500 U

D) $1,500 F

Refer to the Sampson Apparel Inc. information above. What was Sampson's variable overhead spending variance?

A) $6,500 U

B) $6,500 F

C) $1,500 U

D) $1,500 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

57

Hayward Inc. Hayward Inc. produces a unique item. Hayward's management team wishes to perform a variance analysis on its fixed overhead. Fixed overhead is applied to units produced using direct labor hours as its cost driver. The company's managerial accountant has compiled the following information:

Refer to the Hayward Inc. information above. Hayward's fixed overhead spending variance is:

Refer to the Hayward Inc. information above. Hayward's fixed overhead spending variance is:

A) $2,000 F.

B) $2,000 U.

C) $5,000 F.

D) $5,000 U.

Refer to the Hayward Inc. information above. Hayward's fixed overhead spending variance is:

Refer to the Hayward Inc. information above. Hayward's fixed overhead spending variance is:A) $2,000 F.

B) $2,000 U.

C) $5,000 F.

D) $5,000 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

58

Atkinson Landscaping Atkinson Landscaping applies variable overhead based on direct labor hours. At the beginning of the current year, Atkinson had estimated the following:

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

Refer to the Atkinson Landscaping information above. Atkinson's variable overhead efficiency variance for the year is:

A) $ 672 F.

B) $ 928 F.

C) $4,000 U.

D) $ 145 U.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.

During the year, 11,000 units were produced using a total of 27,200 direct labor hours and actual overhead costs were $60,000.Refer to the Atkinson Landscaping information above. Atkinson's variable overhead efficiency variance for the year is:

A) $ 672 F.

B) $ 928 F.

C) $4,000 U.

D) $ 145 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

59

The fixed overhead volume variance is calculated by taking the difference between:

A) actual fixed overhead and budgeted fixed overhead.

B) budgeted fixed overhead and budgeted variable overhead.

C) budgeted fixed overhead and applied fixed overhead.

D) actual fixed overhead and applied fixed overhead.

A) actual fixed overhead and budgeted fixed overhead.

B) budgeted fixed overhead and budgeted variable overhead.

C) budgeted fixed overhead and applied fixed overhead.

D) actual fixed overhead and applied fixed overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following variances is generally not reported as being favorable or unfavorable?

A) Variable overhead efficiency variance

B) Direct labor rate variance

C) Fixed overhead volume variance

D) Direct materials usage variance

A) Variable overhead efficiency variance

B) Direct labor rate variance

C) Fixed overhead volume variance

D) Direct materials usage variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

61

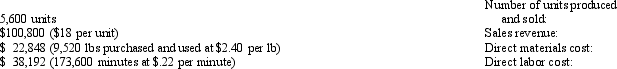

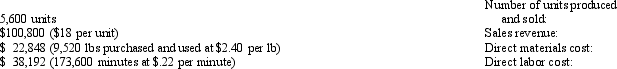

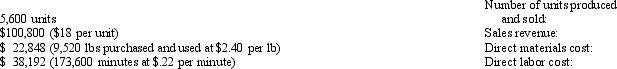

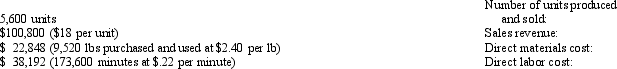

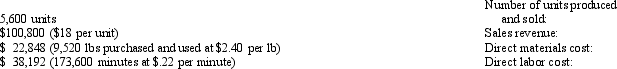

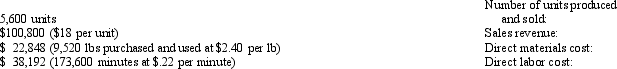

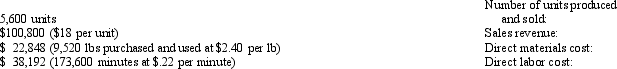

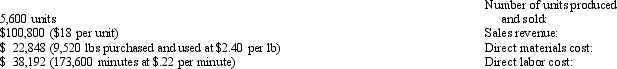

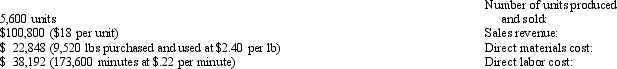

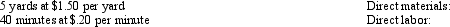

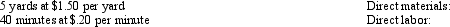

JAX Inc. In early 2012, JAX Inc. had budgeted for the production and sales of 5,000 units at a sales price of $15 per unit. The following information is available regarding the standard cost for each unit:

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows:

Refer to the JAX Inc. information above. What was JAX Inc.'s sales price variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s sales price variance for 2012?

A) $15,000 F

B) $15,000 U

C) $16,800 F

D) $16,800 U

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows: Refer to the JAX Inc. information above. What was JAX Inc.'s sales price variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s sales price variance for 2012?A) $15,000 F

B) $15,000 U

C) $16,800 F

D) $16,800 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

62

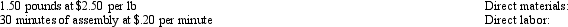

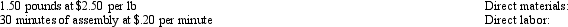

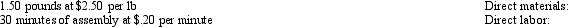

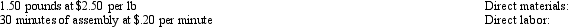

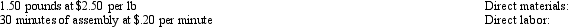

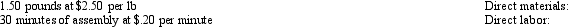

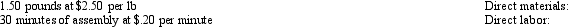

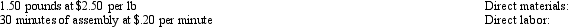

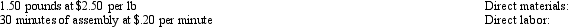

Moreland Manufacturing Inc. Moreland Manufacturing Inc. produces and sells stainless steel faucets. In the current year, the company had budgeted for the production and sale of 6,000 faucets but, due to unexpected demand, 7,000 faucets were actually produced and sold. Each faucet has a standard requiring 15 ounces of direct material at a cost of $.40 per ounce and 15 minutes of assembly time at a cost of $.20 per minute. Actual costs for the production of 7,000 faucets were $41,359.50 for materials (106,050 ounces purchased and used @ $.39 per ounce) and $21,560 for labor (98,000 minutes @ $.22 per minute).

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct materials usage variance is:

A) $ 420 U.

B) $ 420 F.

C) $6,420 U.

D) $6,420 F.

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct materials usage variance is:

A) $ 420 U.

B) $ 420 F.

C) $6,420 U.

D) $6,420 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

63

Meow Products Ltd. Meow Products Ltd. produces and sells scratching posts for cats. In the current year, the company had expected to sell 12,000 posts but actually produced and sold 10,000 posts. The following information is available regarding the standard cost to produce a single post:

In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.

In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.

Refer to the Meow Products Ltd. information above. The company's direct materials price variance for the current year is:

A) $2,350 F.

B) $7,600 F.

C) $7,000 U.

D) $4,100 U.

In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.

In the current year, 38,000 feet of material were purchased out of which 35,000 feet were used at a cost of $1.55 per foot, and 160,000 direct labor minutes were incurred at a cost of $.32 per minute.Refer to the Meow Products Ltd. information above. The company's direct materials price variance for the current year is:

A) $2,350 F.

B) $7,600 F.

C) $7,000 U.

D) $4,100 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

64

JAX Inc. In early 2012, JAX Inc. had budgeted for the production and sales of 5,000 units at a sales price of $15 per unit. The following information is available regarding the standard cost for each unit:

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows:

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials usage variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials usage variance for 2012?

A) $2,800 F

B) $2,800 U

C) $2,688 F

D) $2,688 U

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows: Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials usage variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials usage variance for 2012?A) $2,800 F

B) $2,800 U

C) $2,688 F

D) $2,688 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

65

Paw-Paw Products Paw-Paw Products produces and sells flannel covered dogbeds. In the current year, Paw-Paw had expected to sell 8,000 beds but actually produced and sold 8,500 beds. The following information is available regarding the standard cost to produce a single dogbed:

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

Refer to the Paw-Paw Products information above. The company's direct labor rate variance for the current year is:

A) $ 2,550 F.

B) $10,200 F.

C) $10,965 U.

D) $16,065 U.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.Refer to the Paw-Paw Products information above. The company's direct labor rate variance for the current year is:

A) $ 2,550 F.

B) $10,200 F.

C) $10,965 U.

D) $16,065 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

66

Moreland Manufacturing Inc. Moreland Manufacturing Inc. produces and sells stainless steel faucets. In the current year, the company had budgeted for the production and sale of 6,000 faucets but, due to unexpected demand, 7,000 faucets were actually produced and sold. Each faucet has a standard requiring 15 ounces of direct material at a cost of $.40 per ounce and 15 minutes of assembly time at a cost of $.20 per minute. Actual costs for the production of 7,000 faucets were $41,359.50 for materials (106,050 ounces purchased and used @ $.39 per ounce) and $21,560 for labor (98,000 minutes @ $.22 per minute).

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct labor rate variance is:

A) $2,100 F.

B) $1,800 F.

C) $1,960 U.

D) $ 560 U.

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct labor rate variance is:

A) $2,100 F.

B) $1,800 F.

C) $1,960 U.

D) $ 560 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

67

Mary's Fine Fashions Mary's Fine Fashions manufactures and sells various types of women's clothing. At the end of 2011, Mary had estimated for the production and sale of 25,000 short-sleeve shirts. Each shirt has a standard calling for 2.5 yards of direct material at a standard rate of $1.25 per yard and 12 minutes of direct labor time at a standard rate of $.20 per minute. During 2012, the company actually produced and sold 23,000 shirts. These 23,000 shirts had an actual direct materials cost of $77,142 (59,340 yards at $1.30 per yard) and an actual direct labor cost of $63,250 (253,000 minutes at $.25 per minute). Each shirt sells for $20.

Refer to the Mary's Fine Fashions information above. What is Mary's flexible budget variance?

A) $14,475 F

B) $28,950 U

C) $42,267 F

D) $13,317 U

Refer to the Mary's Fine Fashions information above. What is Mary's flexible budget variance?

A) $14,475 F

B) $28,950 U

C) $42,267 F

D) $13,317 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following statements is true regarding "management by exception"?

A) It is rarely used in variance analysis.

B) It forces managers to investigate all variances, regardless of size.

C) It requires managers to investigate variances that are material in amount.

D) It requires managers to calculate standard costs but not actual costs.

A) It is rarely used in variance analysis.

B) It forces managers to investigate all variances, regardless of size.

C) It requires managers to investigate variances that are material in amount.

D) It requires managers to calculate standard costs but not actual costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is true regarding variance analysis in the modern manufacturing environment?

A) It requires all variances, regardless of size, to be investigated by managers.

B) The use of ideal standards over practical standards will always be the best motivator to employees.

C) An "unfavorable" variance should always be interpreted as "bad".

D) It is often not available in a timely enough manner to be useful to employees.

A) It requires all variances, regardless of size, to be investigated by managers.

B) The use of ideal standards over practical standards will always be the best motivator to employees.

C) An "unfavorable" variance should always be interpreted as "bad".

D) It is often not available in a timely enough manner to be useful to employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

70

JAX Inc. In early 2012, JAX Inc. had budgeted for the production and sales of 5,000 units at a sales price of $15 per unit. The following information is available regarding the standard cost for each unit:

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows:

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor efficiency variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor efficiency variance for 2012?

A) $1,120 F

B) $1,120 U

C) $1,232 F

D) $1,232 U

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows: Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor efficiency variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor efficiency variance for 2012?A) $1,120 F

B) $1,120 U

C) $1,232 F

D) $1,232 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

71

Paw-Paw Products Paw-Paw Products produces and sells flannel covered dogbeds. In the current year, Paw-Paw had expected to sell 8,000 beds but actually produced and sold 8,500 beds. The following information is available regarding the standard cost to produce a single dogbed:

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

Refer to the Paw-Paw Products information above. The company's direct material price variance for the current year is:

A) $4,250 F.

B) $6,650 U.

C) $4,400 U.

D) $3,750 F.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.Refer to the Paw-Paw Products information above. The company's direct material price variance for the current year is:

A) $4,250 F.

B) $6,650 U.

C) $4,400 U.

D) $3,750 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

72

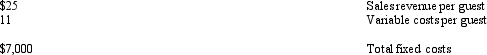

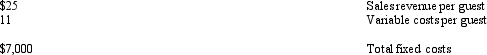

Supreme Catering At the end of January, Supreme Catering prepared the following budget for the upcoming month of February estimating that they would serve 5,000 people:

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

Refer to the Supreme Catering information above. Supreme Catering's flexible budget variance for February would show a variance of:

A) $15,400 U.

B) $15,400 F.

C) $18,200 U.

D) $18,200 F.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.Refer to the Supreme Catering information above. Supreme Catering's flexible budget variance for February would show a variance of:

A) $15,400 U.

B) $15,400 F.

C) $18,200 U.

D) $18,200 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

73

Moreland Manufacturing Inc. Moreland Manufacturing Inc. produces and sells stainless steel faucets. In the current year, the company had budgeted for the production and sale of 6,000 faucets but, due to unexpected demand, 7,000 faucets were actually produced and sold. Each faucet has a standard requiring 15 ounces of direct material at a cost of $.40 per ounce and 15 minutes of assembly time at a cost of $.20 per minute. Actual costs for the production of 7,000 faucets were $41,359.50 for materials (106,050 ounces purchased and used @ $.39 per ounce) and $21,560 for labor (98,000 minutes @ $.22 per minute).

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct labor efficiency variance is:

A) $1,600 U.

B) $1,400 F.

C) $2,100 U.

D) $2,100 F.

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct labor efficiency variance is:

A) $1,600 U.

B) $1,400 F.

C) $2,100 U.

D) $2,100 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

74

JAX Inc. In early 2012, JAX Inc. had budgeted for the production and sales of 5,000 units at a sales price of $15 per unit. The following information is available regarding the standard cost for each unit:

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows:

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials price variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials price variance for 2012?

A) $952 F

B) $952 U

C) $1,120 F

D) $1,120 U

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows: Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials price variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct materials price variance for 2012?A) $952 F

B) $952 U

C) $1,120 F

D) $1,120 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

75

Supreme Catering At the end of January, Supreme Catering prepared the following budget for the upcoming month of February estimating that they would serve 5,000 people:

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

Refer to the Supreme Catering information above. Supreme Catering's flexible budget for February would show net operating income of:

A) $63,000.

B) $60,200.

C) $59,200.

D) $45,800.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.

During February, there were 4,800 guests actually served. Actual costs incurred were $67,200 for variable costs and $8,000 for fixed costs. Each guest was charged $25.Refer to the Supreme Catering information above. Supreme Catering's flexible budget for February would show net operating income of:

A) $63,000.

B) $60,200.

C) $59,200.

D) $45,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

76

Paw-Paw Products Paw-Paw Products produces and sells flannel covered dogbeds. In the current year, Paw-Paw had expected to sell 8,000 beds but actually produced and sold 8,500 beds. The following information is available regarding the standard cost to produce a single dogbed:

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

Refer to the Paw-Paw Products information above. The company's direct labor efficiency variance for the current year is:

A) $ 5,100 U.

B) $ 9,100 U.

C) $ 5,865 F.

D) $20,065 F.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.Refer to the Paw-Paw Products information above. The company's direct labor efficiency variance for the current year is:

A) $ 5,100 U.

B) $ 9,100 U.

C) $ 5,865 F.

D) $20,065 F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

77

JAX Inc. In early 2012, JAX Inc. had budgeted for the production and sales of 5,000 units at a sales price of $15 per unit. The following information is available regarding the standard cost for each unit:

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows:

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor rate variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor rate variance for 2012?

A) $3,360 F

B) $3,360 U

C) $3,472 F

D) $3,472 U

Actual results for 2012 were determined to be as follows:

Actual results for 2012 were determined to be as follows: Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor rate variance for 2012?

Refer to the JAX Inc. information above. What was JAX Inc.'s direct labor rate variance for 2012?A) $3,360 F

B) $3,360 U

C) $3,472 F

D) $3,472 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

78

Mary's Fine Fashions Mary's Fine Fashions manufactures and sells various types of women's clothing. At the end of 2011, Mary had estimated for the production and sale of 25,000 short-sleeve shirts. Each shirt has a standard calling for 2.5 yards of direct material at a standard rate of $1.25 per yard and 12 minutes of direct labor time at a standard rate of $.20 per minute. During 2012, the company actually produced and sold 23,000 shirts. These 23,000 shirts had an actual direct materials cost of $77,142 (59,340 yards at $1.30 per yard) and an actual direct labor cost of $63,250 (253,000 minutes at $.25 per minute). Each shirt sells for $20.

Refer to the Mary's Fine Fashions information above. What is Mary's net operating income based on a flexible budget?

A) $332,925

B) $361,875

C) $347,400

D) $307,400

Refer to the Mary's Fine Fashions information above. What is Mary's net operating income based on a flexible budget?

A) $332,925

B) $361,875

C) $347,400

D) $307,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

79

Paw-Paw Products Paw-Paw Products produces and sells flannel covered dogbeds. In the current year, Paw-Paw had expected to sell 8,000 beds but actually produced and sold 8,500 beds. The following information is available regarding the standard cost to produce a single dogbed:

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

Refer to the Paw-Paw Products information above. The company's direct material usage variance for the current year is:

A) $3,750 U.

B) $2,250 U.

C) $6,000 U.

D) $6,650 U.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.

In the current year, 44,000 yards of material were purchased and used at a cost of $1.60 per yard and 365,500 direct labor minutes were incurred at a cost of $.23 per minute.Refer to the Paw-Paw Products information above. The company's direct material usage variance for the current year is:

A) $3,750 U.

B) $2,250 U.

C) $6,000 U.

D) $6,650 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck

80

Moreland Manufacturing Inc. Moreland Manufacturing Inc. produces and sells stainless steel faucets. In the current year, the company had budgeted for the production and sale of 6,000 faucets but, due to unexpected demand, 7,000 faucets were actually produced and sold. Each faucet has a standard requiring 15 ounces of direct material at a cost of $.40 per ounce and 15 minutes of assembly time at a cost of $.20 per minute. Actual costs for the production of 7,000 faucets were $41,359.50 for materials (106,050 ounces purchased and used @ $.39 per ounce) and $21,560 for labor (98,000 minutes @ $.22 per minute).

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct materials price variance is:

A) $1,050.00 F.

B) $1,050.00 U.

C) $1,060.50 F.

D) $1,060.50 U.

Refer to the Moreland Manufacturing Inc. information above. Moreland's direct materials price variance is:

A) $1,050.00 F.

B) $1,050.00 U.

C) $1,060.50 F.

D) $1,060.50 U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 106 في هذه المجموعة.

فتح الحزمة

k this deck