Deck 3: Accounting for Merchandising Businesses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/143

العب

ملء الشاشة (f)

Deck 3: Accounting for Merchandising Businesses

1

The gross margin for the year 2012 is:

A) $7,250.

B) $4,250.

C) $8,150.

D) $9,350.

A) $7,250.

B) $4,250.

C) $8,150.

D) $9,350.

B

2

Whitney Company's Cost of Goods Available for Sale for 2012 was $610,000.Which of the following statements is true?

A) If the merchandise inventory at the end of the year was $100,000,the Cost of Goods Sold was $510,000.

B) If the merchandise inventory at the end of the year was $100,000,the Cost of Goods Sold was 710,000.

C) If the beginning inventory was $95,000,the Cost of Goods Sold was $515,000.

D) If the beginning inventory was $95,000,the Cost of Goods sold was $705,000.

A) If the merchandise inventory at the end of the year was $100,000,the Cost of Goods Sold was $510,000.

B) If the merchandise inventory at the end of the year was $100,000,the Cost of Goods Sold was 710,000.

C) If the beginning inventory was $95,000,the Cost of Goods Sold was $515,000.

D) If the beginning inventory was $95,000,the Cost of Goods sold was $705,000.

A

3

Which of the following would be primarily a merchandising business?

A) Williams Consulting

B) Rodriguez Department Store

C) Hester,Attorney at Law

D) Frerotte Accounting Service

A) Williams Consulting

B) Rodriguez Department Store

C) Hester,Attorney at Law

D) Frerotte Accounting Service

B

4

Which of the following is not a period cost?

A) Advertising Expense

B) Sales Commissions

C) Cost of Goods Sold

D) Interest Expense

A) Advertising Expense

B) Sales Commissions

C) Cost of Goods Sold

D) Interest Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

5

Waco Company's Cost of Goods Sold for 2012 was $302,000.Which of the following statements is true?

A) If the ending balance in Merchandise Inventory for 2012 was $100,000,the Cost of Goods Available for Sale was $402,000.

B) If the ending balance in Merchandise Inventory for 2012 was $100,000,the Cost of Goods Available for Sale was $202,000.

C) If the beginning balance in Merchandise Inventory for 2012 was $50,000,the Cost of Goods Available for Sale was $352,000.

D) If the beginning balance in Merchandise Inventory for 2012 was $50,000,the Cost of Goods Available for Sale was $252,000.

A) If the ending balance in Merchandise Inventory for 2012 was $100,000,the Cost of Goods Available for Sale was $402,000.

B) If the ending balance in Merchandise Inventory for 2012 was $100,000,the Cost of Goods Available for Sale was $202,000.

C) If the beginning balance in Merchandise Inventory for 2012 was $50,000,the Cost of Goods Available for Sale was $352,000.

D) If the beginning balance in Merchandise Inventory for 2012 was $50,000,the Cost of Goods Available for Sale was $252,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

6

What was Baxter's Cost of Goods Available for Sale for the year 2012?

A) $391,000

B) $306,000

C) $408,000

D) $289,000

A) $391,000

B) $306,000

C) $408,000

D) $289,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is the relationship between gross margin and net income?

A) Gross Margin - Merchandise Inventory at the end of the period = Net Income

B) Gross Margin - Selling and Administrative Expenses = Net Income

C) Gross Margin + Selling and Administrative Expenses = Net income

D) Sales Revenue x Gross Margin Percentage = Net Income

A) Gross Margin - Merchandise Inventory at the end of the period = Net Income

B) Gross Margin - Selling and Administrative Expenses = Net Income

C) Gross Margin + Selling and Administrative Expenses = Net income

D) Sales Revenue x Gross Margin Percentage = Net Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

8

Gross margin is equal to

A) Sales Revenue divided by the balance in Merchandise Inventory at the end of the period.

B) The balance in Merchandise Inventory at the beginning of the period plus the amount of inventory purchased during the year.

C) Sales Revenue minus Cost of Goods Sold.

D) Sales Revenue minus Cost of Goods Available for Sale.

A) Sales Revenue divided by the balance in Merchandise Inventory at the end of the period.

B) The balance in Merchandise Inventory at the beginning of the period plus the amount of inventory purchased during the year.

C) Sales Revenue minus Cost of Goods Sold.

D) Sales Revenue minus Cost of Goods Available for Sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

9

The amount of Retained Earnings at December 31,2012 is:

A) $4,250.

B) $11,150.

C) $11,650.

D) $4,000.

A) $4,250.

B) $11,150.

C) $11,650.

D) $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

10

A merchandising firm's accounting system must allocate the Cost of Goods Available for Sale between

A) the Merchandise Inventory balance at the start of the period and the balance at the end of the period.

B) Cost of Goods Sold and the ending balance in Merchandise Inventory.

C) the beginning balance in Merchandise Inventory and Cost of Goods Sold.

D) Purchases of inventory and the ending balance in Merchandise Inventory.

A) the Merchandise Inventory balance at the start of the period and the balance at the end of the period.

B) Cost of Goods Sold and the ending balance in Merchandise Inventory.

C) the beginning balance in Merchandise Inventory and Cost of Goods Sold.

D) Purchases of inventory and the ending balance in Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

11

The gross margin for the year 2013 is:

A) $7,650.

B) $4,250.

C) $8,150.

D) $9,350.

A) $7,650.

B) $4,250.

C) $8,150.

D) $9,350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

12

Merchandising businesses

A) generate revenue by selling goods.

B) include wholesale and retail companies.

C) manufacture the goods that they sell.

D) both A and B

A) generate revenue by selling goods.

B) include wholesale and retail companies.

C) manufacture the goods that they sell.

D) both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

13

What was Baxter's Cost of Goods Sold for 2012?

A) $391,000

B) $306,000

C) $408,000

D) $289,000

A) $391,000

B) $306,000

C) $408,000

D) $289,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

14

The balance in the Merchandise Inventory account at December 31,2013 is:

A) $300.

B) $1,500.

C) $800.

D) $11,150.

A) $300.

B) $1,500.

C) $800.

D) $11,150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

15

How is the balance sheet of a merchandising firm different from the balance sheet of a service business?

A) It includes the asset,Accounts Receivable.

B) It reports the cost of goods sold.

C) It includes the asset,Merchandise Inventory.

D) It reports various period costs.

A) It includes the asset,Accounts Receivable.

B) It reports the cost of goods sold.

C) It includes the asset,Merchandise Inventory.

D) It reports various period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

16

Merchandising businesses

A) manufacture the goods they sell.

B) generate revenue primarily by providing services to customers.

C) buy the merchandise they sell from suppliers.

D) include dry cleaning companies and law firms.

A) manufacture the goods they sell.

B) generate revenue primarily by providing services to customers.

C) buy the merchandise they sell from suppliers.

D) include dry cleaning companies and law firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

17

The balance in the Merchandise Inventory account at December 31,2012 is:

A) $300.

B) $1,500.

C) $2,000.

D) $11,150.

A) $300.

B) $1,500.

C) $2,000.

D) $11,150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

18

Product costs are also referred to as

A) period costs.

B) selling and administrative expenses.

C) operating expenses.

D) inventory costs.

A) period costs.

B) selling and administrative expenses.

C) operating expenses.

D) inventory costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

19

What costs should be included in the Merchandise Inventory account of a merchandising firm?

A) the purchase price of merchandise only

B) all costs necessary to acquire inventory and prepare it for sale

C) an allocated portion of period costs

D) the purchase price of the merchandise + selling expenses

A) the purchase price of merchandise only

B) all costs necessary to acquire inventory and prepare it for sale

C) an allocated portion of period costs

D) the purchase price of the merchandise + selling expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

20

The amount of Retained Earnings at December 31,2013 is:

A) $4,250.

B) $11,150.

C) $11,650.

D) $6,500.

A) $4,250.

B) $11,150.

C) $11,650.

D) $6,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

21

Rice Company sold merchandise costing $1,600 for $2,500 cash.All of the merchandise was later returned by the customer.If the perpetual inventory method is used,what effect will the sales return have on the accounting equation?

A) Total assets and total equity increase by $900.

B) Total assets increase by $1,600 and total equity is decreased by $2,500.

C) Total assets and total equity decrease by $2,500.

D) Total assets and total equity decrease by $900.

A) Total assets and total equity increase by $900.

B) Total assets increase by $1,600 and total equity is decreased by $2,500.

C) Total assets and total equity decrease by $2,500.

D) Total assets and total equity decrease by $900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

22

Longoria Company purchased merchandise inventory on account with a list price of $5,000 and credit terms of 1/10,n/30.What was the net or cash cost for the merchandise?

A) $4,900

B) $4,970

C) $4,500

D) $4,950

A) $4,900

B) $4,970

C) $4,500

D) $4,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

23

Strand Company uses the perpetual inventory method.The company purchased an item of inventory for $80 and sold the item to a customer for $120.What effect will the sale have on the company's inventory account?

A) The account balance will decrease by $120

B) The account balance will decrease by $80

C) The account balance will increase by $40

D) No effect

A) The account balance will decrease by $120

B) The account balance will decrease by $80

C) The account balance will increase by $40

D) No effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

24

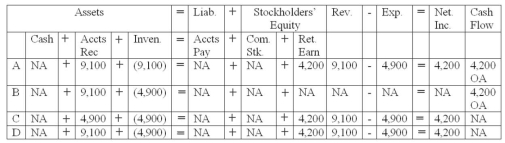

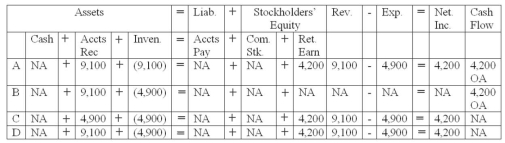

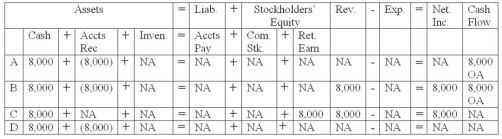

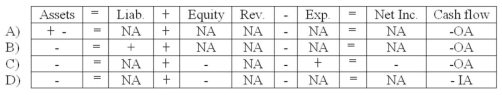

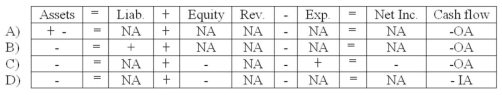

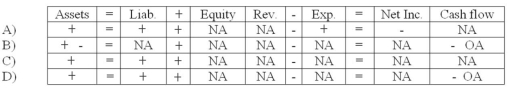

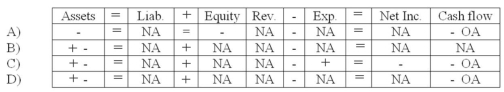

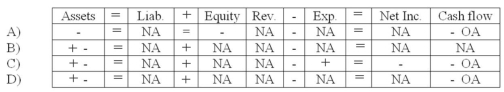

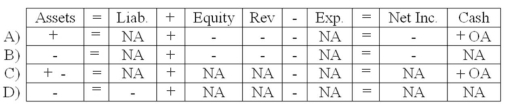

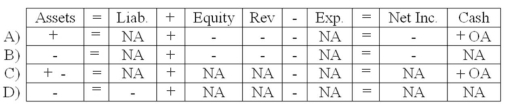

During the month of March,Wang Company sold merchandise on account for $9,100.The merchandise had cost Wang $4,900.Which of the following represents the effects of this transaction on Wang's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

25

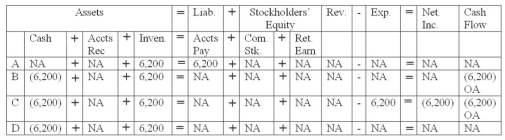

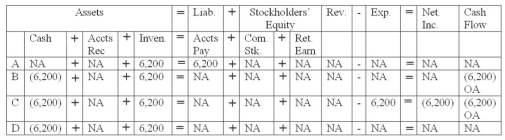

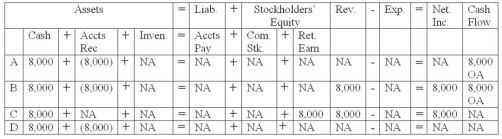

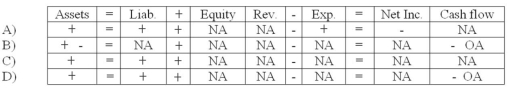

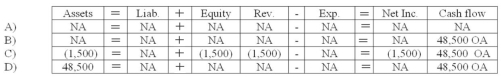

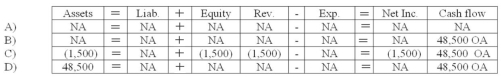

During the month of March,Wang Company purchased merchandise inventory for cash in the amount of $6,200.Which of the following represents the effects of this transaction on Wang's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

26

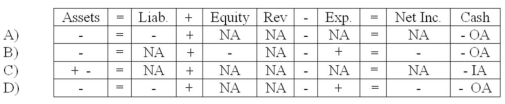

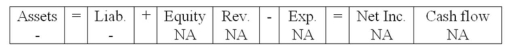

During the month of March,Wang Company collected $8,000 of accounts receivable.Which of the following represents the effects of the collection of the receivables on Wang's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

27

Cost of Goods Sold is reported

A) as an asset on the balance sheet.

B) as a direct reduction of equity on the statement of changes in stockholders' equity.

C) as an addition to Sales Revenue on the income statement.

D) as an expense on the income statement.

A) as an asset on the balance sheet.

B) as a direct reduction of equity on the statement of changes in stockholders' equity.

C) as an addition to Sales Revenue on the income statement.

D) as an expense on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

28

The net cash flow from operating activities as a result of the four transactions is:

A) $1,012.

B) $1,015.

C) $2,100.

D) $2,188.

A) $1,012.

B) $1,015.

C) $2,100.

D) $2,188.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

29

What effect does the return of merchandise to the supplier have on the accounting equation?

A) Assets and equity are reduced by $600.

B) Liabilities and assets are reduced by $600.

C) Assets and liabilities are reduced by $588.

D) Liabilities and equity are reduced by $600.

A) Assets and equity are reduced by $600.

B) Liabilities and assets are reduced by $600.

C) Assets and liabilities are reduced by $588.

D) Liabilities and equity are reduced by $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

30

Faris Company paid the amount due on a purchase of merchandise on account.Faris uses the perpetual inventory system.Which of the following answers reflects the effect of the payment on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

31

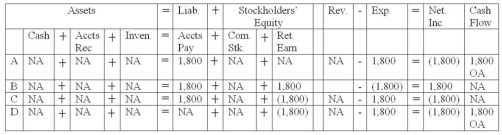

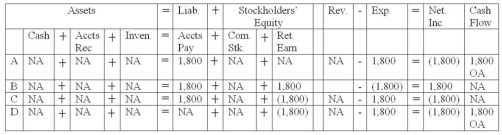

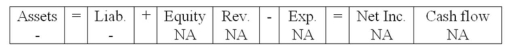

During the month of March,Wang Company incurred selling and administrative expenses on account in the amount of $1,800.Which of the following represents the effects of this transaction on Wang's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company using the perpetual inventory method paid cash to purchase inventory.Which of the following answers reflects the effects of this event on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

33

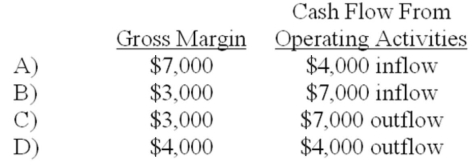

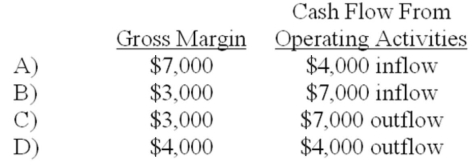

Lynx Company purchased $4,000 of merchandise on account and sold the merchandise to a customer for $7,000 cash.What is Lynx's gross margin and the net change in cash flow from operating activities as a result of these transactions?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

34

Unger Company uses the perpetual inventory method.Unger sold goods that cost $3,500 for $7,200.If the sale was made to a customer on account,the sale will:

A) increase total assets by $3,700.

B) increase total liabilities by $7,200.

C) increase total liabilities by $3,500.

D) increase total assets by $7,200.

A) increase total assets by $3,700.

B) increase total liabilities by $7,200.

C) increase total liabilities by $3,500.

D) increase total assets by $7,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

35

An entry to record the purchase of inventory on account under the perpetual inventory method

A) increases total assets.

B) decreases total liabilities.

C) decreases total assets.

D) increases total equity.

A) increases total assets.

B) decreases total liabilities.

C) decreases total assets.

D) increases total equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

36

Lemon Company paid freight costs to have goods shipped to one of its customers.What effect will these freight costs have on the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

37

Barney Company uses the perpetual inventory system.The company purchased $4,000 of merchandise from Bittiker Company under the terms n/30.Barney also paid $150 freight to obtain the goods under terms FOB shipping point.All of the merchandise purchased was sold for $9,000 cash.The amount of gross margin for this merchandise is:

A) $3,850

B) $4,000

C) $4,070

D) $4,850

A) $3,850

B) $4,000

C) $4,070

D) $4,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company purchased inventory on account.If the perpetual inventory method is used,which of the following choices accurately reflects how the purchase affects the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

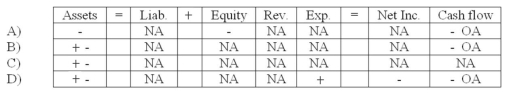

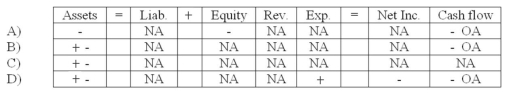

39

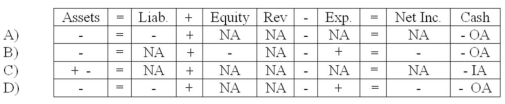

Reno Company experienced a transaction that had the following effect on the financial statements:  Which transaction would have this effect?

Which transaction would have this effect?

A) Freight-in cost incurred; payment to be made in 30 days

B) Return to a supplier of merchandise that was purchased on account

C) Return by a customer of a sale that was made on account

D) A loss on land that was sold for cash

Which transaction would have this effect?

Which transaction would have this effect?A) Freight-in cost incurred; payment to be made in 30 days

B) Return to a supplier of merchandise that was purchased on account

C) Return by a customer of a sale that was made on account

D) A loss on land that was sold for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

40

The amount of gross margin from the four transactions is

A) $1,012.

B) $1,500.

C) $2,188.

D) $2,100.

A) $1,012.

B) $1,500.

C) $2,188.

D) $2,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

41

A discount given to encourage prompt payment on a credit purchase of merchandise is called:

A) a cash discount.

B) a sales discount by the seller.

C) a purchase discount by the buyer.

D) all of these are correct.

A) a cash discount.

B) a sales discount by the seller.

C) a purchase discount by the buyer.

D) all of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

42

The gross margin from these transactions of Marathon Company is

A) $3,060.

B) $4,000.

C) $3,660.

D) $4,160.

A) $3,060.

B) $4,000.

C) $3,660.

D) $4,160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

43

Gruver Company maintains perpetual inventory records.The company's inventory account had a $5,500 balance as of December 31,2012.On that date,a physical count of inventory showed only $5,300 of merchandise in stock.The write-down to recognize the missing inventory will

A) decrease assets.

B) increase expense.

C) decrease equity.

D) all of these.

A) decrease assets.

B) increase expense.

C) decrease equity.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

44

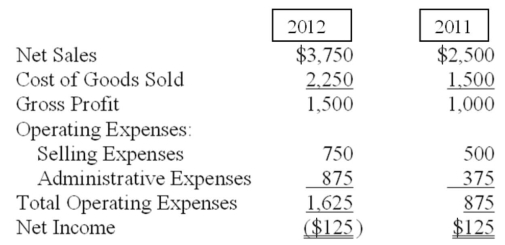

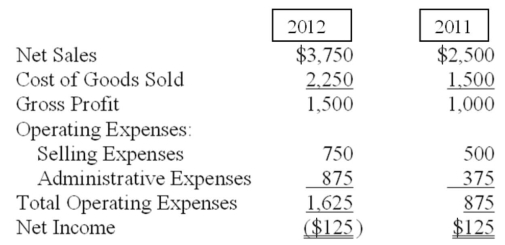

The following are the income statements of the Franz Company for two consecutive years.Which expense(s)increased substantially as a percentage of sales and thus contributed to the net loss in 2012?

A) administrative expenses

B) selling expenses and administrative expenses

C) cost of goods sold

D) cost of goods sold and selling expenses

A) administrative expenses

B) selling expenses and administrative expenses

C) cost of goods sold

D) cost of goods sold and selling expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

45

As a result of Marathon's four transactions above,the net amount of the company's cash flow from operating activities is

A) $8,340 outflow.

B) $12,000 inflow.

C) $8,500 outflow.

D) $3,660 inflow.

A) $8,340 outflow.

B) $12,000 inflow.

C) $8,500 outflow.

D) $3,660 inflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

46

Hanson Company uses a periodic inventory system.For 2012,its beginning inventory was $74,000; purchases of inventory were $328,000; and inventory at the end of the period was $89,000.What was the amount of Hanson's cost of goods sold for 2012?

A) $343,000

B) $328,000

C) $313,000

D) $165,000

A) $343,000

B) $328,000

C) $313,000

D) $165,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

47

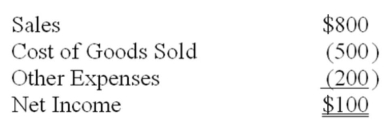

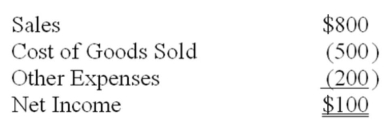

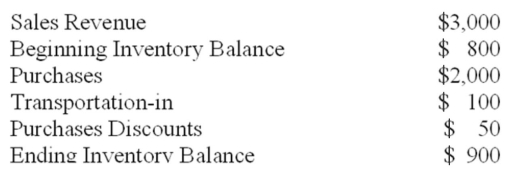

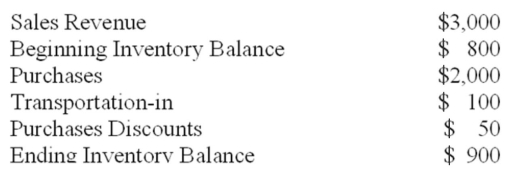

The following data are from the income statement of Rathbun Company:  The company's gross margin percentage is:

The company's gross margin percentage is:

A) 12.5%.

B) 37.5%.

C) 62.5%.

D) 60.0%.

The company's gross margin percentage is:

The company's gross margin percentage is:A) 12.5%.

B) 37.5%.

C) 62.5%.

D) 60.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

48

Refer to the figure above.Based on common size income statements,which of the companies spent,relative to sales,the most on operating expenses?

A) Company A

B) Company B

C) Company C

D) Company D

A) Company A

B) Company B

C) Company C

D) Company D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

49

A company using the perpetual inventory method paid cash for transportation-in.Which of the following choices reflects the effects of this event on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

50

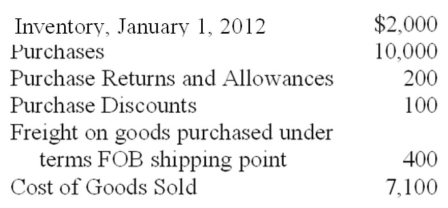

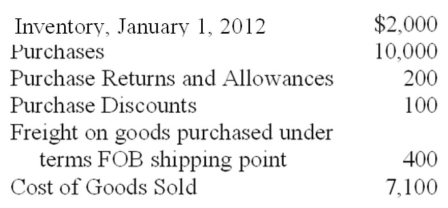

The following information for the year 2012 is taken from the accounts of Thornwood Company.The company uses the periodic inventory method.  Based on this information,the inventory at December 31,2012 is

Based on this information,the inventory at December 31,2012 is

A) $4,600

B) $5,000

C) $4,900

D) $12,100

Based on this information,the inventory at December 31,2012 is

Based on this information,the inventory at December 31,2012 isA) $4,600

B) $5,000

C) $4,900

D) $12,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

51

Fain Company returned merchandise previously purchased on account,which it had not yet paid for.Fain uses the perpetual inventory system.Which of the following answers reflects the effects of the purchase return on the financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

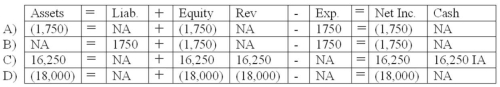

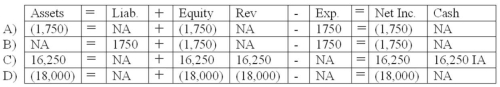

52

The Red Valley Company maintains perpetual inventory records.Although its inventory records indicated $18,000 in the inventory,a physical count showed only $16,250.Which of the following answers indicates the effect of the necessary write-down?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

53

The credit terms,2/10,n/30 indicate that a:

A) ten percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) two percent discount can be deducted for a period up to thirty days following the date of sale.

C) two percent discount can be deducted if the invoice is paid by the tenth day following the date of the sale.

D) two percent discount can be deducted if the invoice is paid after the tenth day following the sale,but before the thirtieth day.

A) ten percent discount can be deducted if the invoice is paid within two days following the date of sale.

B) two percent discount can be deducted for a period up to thirty days following the date of sale.

C) two percent discount can be deducted if the invoice is paid by the tenth day following the date of the sale.

D) two percent discount can be deducted if the invoice is paid after the tenth day following the sale,but before the thirtieth day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

54

Kehoe Co.uses a periodic inventory system.The company had beginning inventory of $400 and ending inventory of $200.Kehoe's cost of goods sold was $1,600.Based on this information,Kehoe must have purchased inventory amounting to:

A) $1,400.

B) $1,600.

C) $1,800.

D) $2,200.

A) $1,400.

B) $1,600.

C) $1,800.

D) $2,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

55

The term "FOB shipping point" means

A) the seller's responsibility ends at the destination.

B) the seller of the merchandise pays the shipping cost.

C) the buyer of the merchandise is responsible for transportation costs.

D) the buyer does not assume ownership until the goods are received.

A) the seller's responsibility ends at the destination.

B) the seller of the merchandise pays the shipping cost.

C) the buyer of the merchandise is responsible for transportation costs.

D) the buyer does not assume ownership until the goods are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

56

The term "FOB destination" means

A) the seller of the merchandise is responsible for transportation costs.

B) the seller relinquishes ownership at the shipping point.

C) the buyer of the merchandise pays the shipping cost.

D) the buyer assumes responsibility at the shipping point.

A) the seller of the merchandise is responsible for transportation costs.

B) the seller relinquishes ownership at the shipping point.

C) the buyer of the merchandise pays the shipping cost.

D) the buyer assumes responsibility at the shipping point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

57

Net income percentage is equal to

A) Net Income divided by Net Sales.

B) Net Income divided by Total Assets.

C) Total Equity divided by Net Sales.

D) Net Sales divided by Retained Earnings.

A) Net Income divided by Net Sales.

B) Net Income divided by Total Assets.

C) Total Equity divided by Net Sales.

D) Net Sales divided by Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

58

On January 1,2012,Shaffer Co.purchased inventory for $1,000 cash with credit terms of 2/10,n/30.If Shaffer does not pay within the discount period,what is the effective annual interest rate?

A) 9.13%

B) 12.17%

C) 18.25%

D) 36.5%

A) 9.13%

B) 12.17%

C) 18.25%

D) 36.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

59

On October 1,Snyder Company made a $50,000 sale giving the customer terms of 3/10,n/30.The receivable was collected from the customer on October 8.What effect will the collection of cash from the receivable have on the company's financial statements?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

A) Choice A

B) Choice B

C) Choice C

D) Choice D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

60

Armstrong Company maintains perpetual inventory records.The company's inventory account had a $6,500 balance as of December 31,2012.On that date,a physical count of inventory showed only $6,100 of merchandise in stock.The write-down to recognize the missing inventory will

A) increase assets.

B) increase expense.

C) increase equity.

D) have no effect on net income.

A) increase assets.

B) increase expense.

C) increase equity.

D) have no effect on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

61

The cash inflow from the sale of a business asset other than inventory is reported in the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under a periodic system,shipping costs paid for goods received from a supplier increases the amount of

A) Merchandise Inventory.

B) Cost of Goods Sold.

C) Transportation-in.

D) Transportation-out.

A) Merchandise Inventory.

B) Cost of Goods Sold.

C) Transportation-in.

D) Transportation-out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

63

The chief advantage of the periodic inventory system,compared to a perpetual system,is

A) better control over inventory.

B) immediate feedback at any time during the period.

C) timely discovery of losses due to theft.

D) efficiency and ease of recording.

A) better control over inventory.

B) immediate feedback at any time during the period.

C) timely discovery of losses due to theft.

D) efficiency and ease of recording.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

64

Gains from sales of assets other than inventory are shown as part of sales revenue on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

65

The Operating Income line appears on a multistep income statement but not on a single-step income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Gross Margin line appears on a single-step income statement but not on a multistep income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

67

Under a periodic inventory system,the buyer does not use which of the following accounts in recording the acquisition of merchandise inventory and related transactions?

A) Purchases

B) Purchase Returns and Allowances

C) Purchase Discounts

D) Merchandise Inventory

A) Purchases

B) Purchase Returns and Allowances

C) Purchase Discounts

D) Merchandise Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

68

Gains and losses are shown separately on the income statement to communicate the expectation that they are nonrecurring.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

69

When Tiffany & Co.discontinued Iridesse,a chain of stores dedicated to pearl-only jewelry,due to losses sustained since its founding,Tiffany & Co.recorded an expense equal to the amount of the cumulative operating losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

70

Maui Company uses the periodic inventory method.The company purchased an item of inventory for $90 and sold the item to a customer for $115.What effect will this sale have on the balance in the company's inventory account at the date of the sale?

A) The account will decrease by $90.

B) The account will decrease by $115.

C) The account will increase by $25.

D) No effect.

A) The account will decrease by $90.

B) The account will decrease by $115.

C) The account will increase by $25.

D) No effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following account titles is normally used in a periodic inventory system?

A) Transportation-in

B) Purchases

C) Purchase Returns and Allowances

D) All of these

A) Transportation-in

B) Purchases

C) Purchase Returns and Allowances

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

72

Royal Company uses the periodic inventory method.The following balances were drawn from the accounts of Royal Company prior to the closing process:  The amount of gross margin appearing on the income statement should be:

The amount of gross margin appearing on the income statement should be:

A) $900.

B) $1,050.

C) $1,950.

D) $2,850.

The amount of gross margin appearing on the income statement should be:

The amount of gross margin appearing on the income statement should be:A) $900.

B) $1,050.

C) $1,950.

D) $2,850.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

73

The term "gain" represents profit resulting from transactions that are not likely to regularly recur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

74

Single-step income statements are more widely used in practice than multistep income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

75

The term "loss" represents the excess of cost over revenue from transactions that occur on a regular basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

76

Income statements that display a single comparison of all revenues minus all expenses are called single-step income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which factor has removed most of the practical limitations associated with use of the perpetual inventory system?

A) a more honest work force

B) recent changes in generally accepted accounting principles

C) advancements in technology

D) recent changes in federal and state laws

A) a more honest work force

B) recent changes in generally accepted accounting principles

C) advancements in technology

D) recent changes in federal and state laws

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

78

The cash inflow from the sale of a business asset other than inventory is reported in the investing activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

79

Gain on Sale of Land is reported in the operating activities section of the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

80

When Tiffany & Co.sells inventory for more than its cost,the difference between the sales revenue and the cost of goods sold is called the gross margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck