Deck 19: Job Order Cost Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/164

العب

ملء الشاشة (f)

Deck 19: Job Order Cost Accounting

1

A materials requisition is a source document used by production managers to request materials for production and also used to assign materials costs to specific jobs or to overhead.

True

2

Job order production systems would be appropriate for companies that produce compact disks or disposable cameras.

False

3

Job order production systems would be appropriate for companies that produce training films for a specific customer or custom-made furniture to be used in a new five-star resort hotel.

True

4

The cost of all materials issued to production are debited to Goods in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

5

Cost accounting systems accumulate costs and then assign them to products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

6

The direct materials section of a job cost sheet shows the materials costs assigned to a job, but the direct labor section only shows the total hours of labor allocated to the job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

7

When a job is finished, its job cost sheet is completed and moved from the file of jobs in process to the file of finished jobs that are yet to be delivered to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company's file of job cost sheets for finished but unsold jobs equals the balance in the Finished Goods Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

9

Job cost sheets are used to track all of the costs assigned to a job, including direct materials, direct labor, overhead, and all selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company that produces a large number of standardized units would normally use a job order cost accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

11

A job cost sheet is useful for developing financial accounting numbers but does not contain information that is useful for managing the production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

12

There are two basic types of cost accounting systems: job order costing and periodic costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

13

Service firms, unlike manufacturing firms, should only use actual costs when determining a selling price for their services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

14

Job order costing is applicable to manufacturing firms only and not service firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

15

The collection of cost sheets for unfinished jobs makes up a subsidiary ledger controlled by the Goods in Process Inventory account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

16

The file of job cost sheets for completed but undelivered jobs equals the balance in the Goods in Process Inventory account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

17

Cost accounting information is helpful to management in controlling costs but has no effect on pricing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

18

A job order cost accounting system would be appropriate for a manufacturer of automobile tires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

19

Job order production systems would be appropriate for companies that produce custom homes, specialized equipment, and special computer systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company that uses a cost accounting system normally has only two inventory accounts: Finished Goods Inventory and Goods in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

21

A time ticket is a source document an employee uses to record the number of hours at work and that is used each pay period to determine the total labor cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

22

The predetermined overhead allocation rate is used to allocate overhead cost to jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

23

The predetermined overhead allocation rate based on direct labor cost is the ratio of estimated overhead cost for the period to estimated direct labor cost for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

24

A time ticket is a source document used by an employee to record the number of hours worked on a particular job during the work day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

25

A materials requisition is a source document used by materials managers of a manufacturing company to order raw materials from suppliers; it serves the same purpose as a purchase order in a merchandising company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

26

A clock card is a source document used by an employee to record the total number of hours worked and serves as a source document for entries to record labor costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

27

If actual overhead incurred during a period exceeds applied overhead, the difference will be a credit balance in the Factory Overhead account at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a job order cost accounting system, any immaterial underapplied overhead at the end of the period can be charged entirely to Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

29

Any material amount of under- or overapplied factory overhead must always be closed to Cost of Goods Sold at the end of an accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

30

Overapplied overhead is the amount by which actual overhead cost exceeds the overhead applied to products during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Factory Overhead account will have a credit balance at the end of a period if overhead applied during the period is greater than the overhead incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

32

A clock card is a source document that an employee uses to report how much time was spent working on a job or on overhead and that is used to determine the amount of direct labor to charge to the job or to determine the amount of indirect labor to charge to factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

33

Predetermined overhead rates are necessary because cost accountants use periodic inventory systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under a job order cost accounting system, individual jobs are always charged with actual overhead costs when they are transferred to finished goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

35

When time ticket information is entered into the accounting system, the journal entry is a debit to Factory Payroll and a credit to Goods in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

36

Since a predetermined overhead allocation rate is established before a period begins, this rate is revised many times during the period to compensate for inaccurate estimates previously made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

37

In a job order cost accounting system, indirect labor costs are debited to the Factory Overhead account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

38

When materials are used as indirect materials, their cost is debited to the Factory Overhead account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

39

Materials requisitions and time tickets are cost accounting source documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

40

Factory overhead is often collected and summarized in a subsidiary factory overhead ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

41

The two basic types of cost accounting systems are:

A) Job order costing and perpetual costing.

B) Job order costing and customized product costing.

C) Job order costing and customized service costing.

D) Job order costing and process costing.

E) Job order costing and periodic costing.

A) Job order costing and perpetual costing.

B) Job order costing and customized product costing.

C) Job order costing and customized service costing.

D) Job order costing and process costing.

E) Job order costing and periodic costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

42

In comparison to a general accounting system for a manufacturing company, a cost accounting system places an emphasis on:

A) Periodic inventory counts.

B) Total costs.

C) Continually updating costs of materials, goods in process, and finished goods inventories.

D) Products and average costs.

E) Large volume operations involving standardized products.

A) Periodic inventory counts.

B) Total costs.

C) Continually updating costs of materials, goods in process, and finished goods inventories.

D) Products and average costs.

E) Large volume operations involving standardized products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

43

Job order production is also known as:

A) Mass production.

B) Process production.

C) Unit production.

D) Customized production.

E) Standard costing.

A) Mass production.

B) Process production.

C) Unit production.

D) Customized production.

E) Standard costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

44

The production activities for a customized product represent a(n):

A) Operation.

B) Job.

C) Unit.

D) Pool.

E) Process.

A) Operation.

B) Job.

C) Unit.

D) Pool.

E) Process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

45

A job order cost accounting system would best fit the needs of a company that makes:

A) Shoes and apparel.

B) Paint.

C) Cement.

D) Custom machinery.

E) Pencils and erasers.

A) Shoes and apparel.

B) Paint.

C) Cement.

D) Custom machinery.

E) Pencils and erasers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

46

Cost accounting systems used by manufacturing companies are based on the:

A) Periodic inventory system.

B) Perpetual inventory system.

C) Finished goods inventories.

D) Weighted average inventories.

E) LIFO inventory system.

A) Periodic inventory system.

B) Perpetual inventory system.

C) Finished goods inventories.

D) Weighted average inventories.

E) LIFO inventory system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

47

A system of accounting for production operations that uses a periodic inventory system is called a:

A) Manufacturing accounting system.

B) Production accounting system.

C) General accounting system.

D) Cost accounting system.

E) Finished goods accounting system.

A) Manufacturing accounting system.

B) Production accounting system.

C) General accounting system.

D) Cost accounting system.

E) Finished goods accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

48

A document in a job order cost accounting system that is used to record the costs of producing a job is a(n):

A) Job cost sheet.

B) Job lot.

C) Finished goods summary.

D) Process cost system.

E) Units-of-production sheet.

A) Job cost sheet.

B) Job lot.

C) Finished goods summary.

D) Process cost system.

E) Units-of-production sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

49

Underapplied overhead is the amount by which overhead applied to jobs using the predetermined overhead allocation rate exceeds the overhead incurred during a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

50

Target cost is calculated as

A) direct costs + desired profit

B) direct costs - desired profit

C) expected selling price - direct costs

D) expected selling price - desired profit

E) expected selling price + desired profit

A) direct costs + desired profit

B) direct costs - desired profit

C) expected selling price - direct costs

D) expected selling price - desired profit

E) expected selling price + desired profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

51

Job order costing systems normally use:

A) Periodic inventory systems.

B) Perpetual inventory systems.

C) Real inventory systems.

D) General inventory systems.

E) All of these.

A) Periodic inventory systems.

B) Perpetual inventory systems.

C) Real inventory systems.

D) General inventory systems.

E) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

52

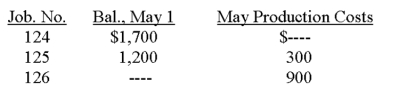

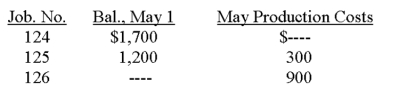

The job order cost sheets used by Garza Company revealed the following:  Job No. 125 was completed during May and Jobs No. 124 and 125 were shipped to customers in May. What was the company's cost of goods sold for May and the goods in process inventory on May 31?

Job No. 125 was completed during May and Jobs No. 124 and 125 were shipped to customers in May. What was the company's cost of goods sold for May and the goods in process inventory on May 31?

A) $3,200; $900.

B) $2,900; $1,200.

C) $1,200; $2,900.

D) $1,700; $1,200.

E) $4,100; $0.

Job No. 125 was completed during May and Jobs No. 124 and 125 were shipped to customers in May. What was the company's cost of goods sold for May and the goods in process inventory on May 31?

Job No. 125 was completed during May and Jobs No. 124 and 125 were shipped to customers in May. What was the company's cost of goods sold for May and the goods in process inventory on May 31?A) $3,200; $900.

B) $2,900; $1,200.

C) $1,200; $2,900.

D) $1,700; $1,200.

E) $4,100; $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

53

A system of accounting for production operations that produces timely information about inventories and manufacturing costs per unit of product is a:

A) Finished goods accounting system.

B) General accounting system.

C) Manufacturing accounting system.

D) Cost accounting system.

E) Production accounting system.

A) Finished goods accounting system.

B) General accounting system.

C) Manufacturing accounting system.

D) Cost accounting system.

E) Production accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

54

Overapplied overhead is the amount by which overhead applied to jobs using the predetermined overhead allocation rate exceeds the overhead incurred during a period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

55

Dell Builders manufactures each house to customer specifications. It most likely would use:

A) Process costing.

B) A periodic inventory system.

C) Unique costing.

D) Job order costing.

E) Activity-based costing.

A) Process costing.

B) A periodic inventory system.

C) Unique costing.

D) Job order costing.

E) Activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

56

A job cost sheet shows information about each of the following items except:

A) The direct labor costs assigned to the job.

B) The name of the customer.

C) The costs incurred by the marketing department in selling the job.

D) The overhead costs assigned to the job.

E) The direct materials costs assigned to the job.

A) The direct labor costs assigned to the job.

B) The name of the customer.

C) The costs incurred by the marketing department in selling the job.

D) The overhead costs assigned to the job.

E) The direct materials costs assigned to the job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

57

Overapplied or underapplied overhead should be removed from the Factory Overhead account at the end of each accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

58

Large aircraft producers such as McDonnell Douglas normally use:

A) Job order costing.

B) Process costing.

C) Mixed costing.

D) Full costing.

E) Simple costing.

A) Job order costing.

B) Process costing.

C) Mixed costing.

D) Full costing.

E) Simple costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

59

A job order production system would be appropriate for a company that produces which one of the following items?

A) A landscaping design for a new hospital.

B) Seedlings for sale in a nursery.

C) Sacks of yard fertilizer.

D) Packets of flower seeds.

E) Small gardening tools, including rakes, shovels, and hoes.

A) A landscaping design for a new hospital.

B) Seedlings for sale in a nursery.

C) Sacks of yard fertilizer.

D) Packets of flower seeds.

E) Small gardening tools, including rakes, shovels, and hoes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

60

A type of production that yields customized products or services for each customer is called:

A) Customer orientation production.

B) Job order production.

C) Just-in-time production.

D) Job lot production.

E) Process production.

A) Customer orientation production.

B) Job order production.

C) Just-in-time production.

D) Job lot production.

E) Process production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

61

A perpetual record of a raw materials item that records data on the quantity and cost of units purchased, units issued for use in production, and units that remain in the raw materials inventory, is called a(n):

A) Materials ledger card.

B) Materials requisition.

C) Purchase order.

D) Materials voucher.

E) Purchase ledger.

A) Materials ledger card.

B) Materials requisition.

C) Purchase order.

D) Materials voucher.

E) Purchase ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

62

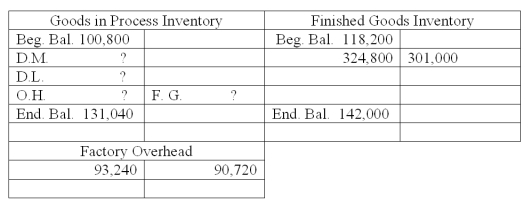

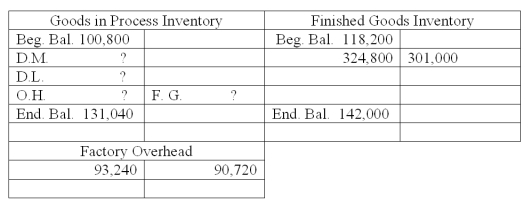

A company's overhead rate is 60% of direct labor cost. Using the following incomplete accounts, determine the cost of direct materials used.

A) $106,400.

B) $113,120.

C) $30,240.

D) $211,680.

E) $324,800.

A) $106,400.

B) $113,120.

C) $30,240.

D) $211,680.

E) $324,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

63

A source document that an employee uses to report how much time was spent working on a job or on overhead activities and that is used to determine the amount of direct labor to charge to the job or to determine the amount of indirect labor to charge to factory overhead is called a:

A) Payroll Register.

B) Factory payroll record.

C) General Ledger.

D) Time ticket.

E) Factory Overhead Ledger.

A) Payroll Register.

B) Factory payroll record.

C) General Ledger.

D) Time ticket.

E) Factory Overhead Ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

64

The overhead cost applied to a job during a period is recorded with a credit to Factory Overhead and a debit to:

A) Jobs Overhead Expense.

B) Cost of Goods Sold.

C) Finished Goods Inventory.

D) Indirect Labor.

E) Goods in Process Inventory.

A) Jobs Overhead Expense.

B) Cost of Goods Sold.

C) Finished Goods Inventory.

D) Indirect Labor.

E) Goods in Process Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

65

A source document that production managers use to request materials for production and that is used to assign materials costs to specific jobs or to overhead is a:

A) Job cost sheet.

B) Production order.

C) Materials requisition.

D) Materials purchase order.

E) Receiving report.

A) Job cost sheet.

B) Production order.

C) Materials requisition.

D) Materials purchase order.

E) Receiving report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

66

BVD Company uses a job order cost accounting system and last period incurred $80,000 of overhead and $100,000 of direct labor. BVD estimates that its overhead next period will be $75,000. It also expects to incur $100,000 of direct labor. If BVD bases applied overhead on direct labor cost, their overhead application rate for the next period should be:

A) 75%.

B) 80%.

C) 107%.

D) 125%.

E) 133%.

A) 75%.

B) 80%.

C) 107%.

D) 125%.

E) 133%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

67

O.K. Company uses a job order cost accounting system and allocates its overhead on the basis of direct labor costs. O.K. expects to incur $800,000 of overhead during the next period, and expects to use 50,000 labor hours at a cost of $10.00 per hour. What is O.K. Company's overhead application rate?

A) 6.25%.

B) 62.5%.

C) 160%.

D) 1600%.

E) 67%.

A) 6.25%.

B) 62.5%.

C) 160%.

D) 1600%.

E) 67%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

68

The Goods in Process Inventory account of a manufacturing company that uses an overhead rate based on direct labor cost has a $4,400 debit balance after all posting is completed. The cost sheet of the one job still in process shows direct material cost of $2,000 and direct labor cost of $800. Therefore, the company's overhead application rate is:

A) 40%.

B) 50%.

C) 80%.

D) 200%.

E) 220%.

A) 40%.

B) 50%.

C) 80%.

D) 200%.

E) 220%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company has an overhead application rate of 125% of direct labor costs. How much overhead would be allocated to a job if it required total labor costing $20,000?

A) $5,000.

B) $16,000.

C) $25,000.

D) $125,000.

E) $250,000.

A) $5,000.

B) $16,000.

C) $25,000.

D) $125,000.

E) $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

70

Canoe Company uses a job order cost accounting system and allocates its overhead on the basis of direct labor costs. Canoe Company's production costs for the year were: direct labor, $30,000; direct materials, $50,000; and factory overhead applied $6,000. The overhead application rate was:

A) 5.0%.

B) 12.0%.

C) 20.0%.

D) 500.0%.

E) 16.7%.

A) 5.0%.

B) 12.0%.

C) 20.0%.

D) 500.0%.

E) 16.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

71

Penn Company uses a job order cost accounting system. In the last month, the system accumulated labor time tickets totaling $24,600 for direct labor and $4,300 for indirect labor. These costs were accumulated in Factory Payroll as they were paid. Which entry should Penn make to assign the Factory Payroll?

A) Debit Payroll Expense $28,900; credit Cash $28,900.

B) Debit Payroll Expense $24,600; debit Factory Overhead $4,300; credit Factory Payroll $28,900.

C) Debit Goods in Process Inventory $24,600; debit Factory Overhead $4,300; credit Factory Payroll $28,900.

D) Debit Goods in Process Inventory $24,600; debit Factory Overhead $4,300; credit Wages Payable $28,900.

E) Debit Goods in Process Inventory $28,900; credit Factory Payroll $28,900.

A) Debit Payroll Expense $28,900; credit Cash $28,900.

B) Debit Payroll Expense $24,600; debit Factory Overhead $4,300; credit Factory Payroll $28,900.

C) Debit Goods in Process Inventory $24,600; debit Factory Overhead $4,300; credit Factory Payroll $28,900.

D) Debit Goods in Process Inventory $24,600; debit Factory Overhead $4,300; credit Wages Payable $28,900.

E) Debit Goods in Process Inventory $28,900; credit Factory Payroll $28,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

72

The rate established prior to the beginning of a period that uses estimated overhead and an allocation factor such as estimated direct labor, and that is used to assign overhead cost to jobs, is the:

A) Predetermined overhead allocation rate.

B) Overhead variance rate.

C) Estimated labor cost rate.

D) Chargeable overhead rate.

E) Miscellaneous overhead rate.

A) Predetermined overhead allocation rate.

B) Overhead variance rate.

C) Estimated labor cost rate.

D) Chargeable overhead rate.

E) Miscellaneous overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

73

A job cost sheet includes:

A) Direct materials, direct labor, operating costs.

B) Direct materials, overhead, administrative costs.

C) Direct labor, overhead, selling costs.

D) Direct material, direct labor, overhead.

E) Direct materials, direct labor, selling costs.

A) Direct materials, direct labor, operating costs.

B) Direct materials, overhead, administrative costs.

C) Direct labor, overhead, selling costs.

D) Direct material, direct labor, overhead.

E) Direct materials, direct labor, selling costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

74

When factory payroll costs for labor are allocated in a job cost accounting system:

A) Factory Payroll is debited and Goods in Process Inventory is credited.

B) Goods in Process Inventory and Factory Overhead are debited and Factory Payroll is credited.

C) Cost of Goods Manufactured is debited and Direct Labor is credited.

D) Direct Labor and Indirect Labor are debited and Factory Payroll is credited.

E) Goods in Process Inventory is debited and Factory Payroll is credited.

A) Factory Payroll is debited and Goods in Process Inventory is credited.

B) Goods in Process Inventory and Factory Overhead are debited and Factory Payroll is credited.

C) Cost of Goods Manufactured is debited and Direct Labor is credited.

D) Direct Labor and Indirect Labor are debited and Factory Payroll is credited.

E) Goods in Process Inventory is debited and Factory Payroll is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

75

The R&R Company's production costs for August are: direct labor, $13,000; indirect labor, $6,500; direct materials, $15,000; property taxes on production equipment, $800; heat, lights and power, $1,000; and insurance on plant and equipment, $200. R&R Company's factory overhead incurred for August is:

A) $2,000.

B) $6,500.

C) $8,500.

D) $21,500.

E) $36,500.

A) $2,000.

B) $6,500.

C) $8,500.

D) $21,500.

E) $36,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

76

Labor costs in production can be:

A) Direct or indirect.

B) Indirect or sunk.

C) Direct or payroll.

D) Indirect or payroll.

E) Direct or sunk.

A) Direct or indirect.

B) Indirect or sunk.

C) Direct or payroll.

D) Indirect or payroll.

E) Direct or sunk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

77

Alton Company has an overhead application rate of 160% and allocates overhead based on direct materials. During the current period, direct labor is $50,000 and direct materials used are $80,000. Determine the amount of overhead Alton Company should record in the current period.

A) $31,250.

B) $50,000.

C) $80,000.

D) $128,000.

E) $208,000.

A) $31,250.

B) $50,000.

C) $80,000.

D) $128,000.

E) $208,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company that uses a job order cost accounting system would make the following entry to record the flow of direct materials into production:

A) debit Goods in Process Inventory, credit Cost of Goods Sold.

B) debit Goods in Process Inventory, credit Raw Materials Inventory.

C) debit Goods in Process Inventory, credit Factory Overhead.

D) debit Factory Overhead, credit Raw Materials Inventory.

E) debit Finished Goods Inventory, credit Raw Materials Inventory.

A) debit Goods in Process Inventory, credit Cost of Goods Sold.

B) debit Goods in Process Inventory, credit Raw Materials Inventory.

C) debit Goods in Process Inventory, credit Factory Overhead.

D) debit Factory Overhead, credit Raw Materials Inventory.

E) debit Finished Goods Inventory, credit Raw Materials Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

79

A source document that an employee uses to record the number of hours at work and that is used to determine the total labor cost for each pay period is a:

A) Job cost sheet.

B) Hours-of-production sheet.

C) Time ticket.

D) Job order ticket.

E) Clock card.

A) Job cost sheet.

B) Hours-of-production sheet.

C) Time ticket.

D) Job order ticket.

E) Clock card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Goods in Process Inventory account for AB Manufacturing follows. Compute the cost of jobs completed and transferred to Finished Goods Inventory.  The cost of units transferred to finished goods is:

The cost of units transferred to finished goods is:

A) $97,000.

B) $105,900.

C) $88,100.

D) $95,200.

E) $92,500.

The cost of units transferred to finished goods is:

The cost of units transferred to finished goods is:A) $97,000.

B) $105,900.

C) $88,100.

D) $95,200.

E) $92,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 164 في هذه المجموعة.

فتح الحزمة

k this deck