Deck 13: Activity-Based Costing: a Tool to Aid Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/150

العب

ملء الشاشة (f)

Deck 13: Activity-Based Costing: a Tool to Aid Decision Making

1

The costs of idle capacity should be assigned to products in activity-based costing.

False

2

In activity-based costing, organization-sustaining costs should be included in product costs for internal management reports that are used for decision-making.

False

3

A transaction driver provides a measure of the amount of time required to perform an activity.

True

4

The practice of assigning the costs of idle capacity to products results in more stable unit product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

5

Activity-based costing involves a two-stage allocation in which overhead costs are first assigned to departments and then to jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

6

Direct labor-hours or direct labor cost should not be used as a measure of activity in an activity-based costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

7

Batch-level activities are performed each time a unit is produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

8

Activity-based management seeks to eliminate waste by allocating costs to products that waste resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

9

In activity-based costing, nonmanufacturing costs are not assigned to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

10

Activity-based costing is a costing method that is designed to provide managers with cost information for strategic and other decisions that potentially affect only variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

11

The costs of activities that are classified as unit-level should be fixed respect to the number of units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

12

In activity-based costing, some manufacturing costs can be excluded from product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

13

Activity-based costing uses a number of activity cost pools, each of which may have a different allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

14

In traditional costing, some manufacturing costs may be excluded from product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

15

When a company shifts from a traditional cost system in which manufacturing overhead is applied based on direct labor-hours to an activity-based costing system with batch-level and product-level costs, the unit product costs of low volume products typically decrease whereas the unit product costs of high volume products typically increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

16

The first-stage allocation in activity-based costing is the process by which overhead costs are assigned to activity cost pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

17

Product-level activities relate to how many batches are run or units of product are made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

18

In traditional costing systems, manufacturing costs that are not caused by products are not assigned to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

19

In general, duration drivers are more accurate measures of the consumption of resources than transaction drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

20

Organization-sustaining overhead costs should be allocated to products just like unit-level and product-level activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

21

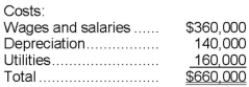

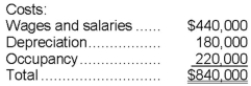

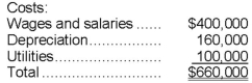

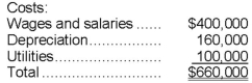

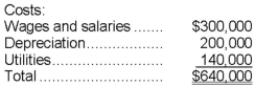

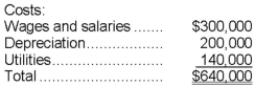

Ginger Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

A)$528,000

B)$454,000

C)$418,000

D)$396,000

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Setting Up activity cost pool?A)$528,000

B)$454,000

C)$418,000

D)$396,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following costs should not be included in product costs for internal management reports that are used for decision-making?

A)Costs of unit-level activities.

B)Costs of batch-level activities.

C)Costs of product-level activities.

D)Costs of organization-sustaining activities.

A)Costs of unit-level activities.

B)Costs of batch-level activities.

C)Costs of product-level activities.

D)Costs of organization-sustaining activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

23

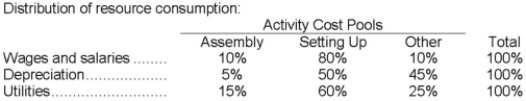

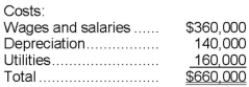

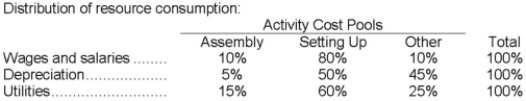

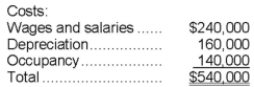

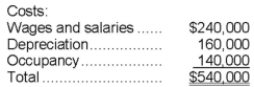

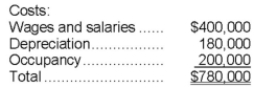

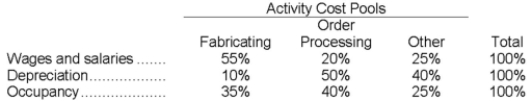

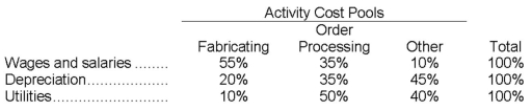

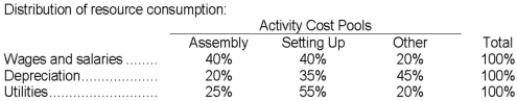

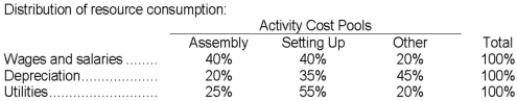

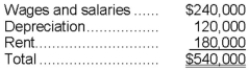

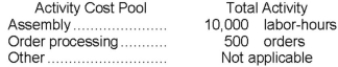

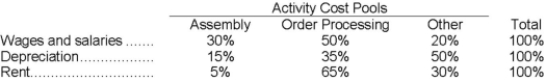

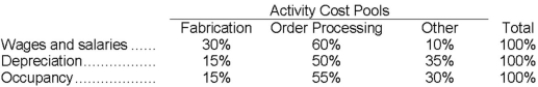

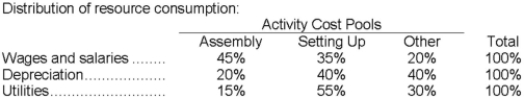

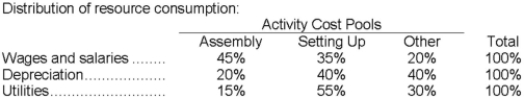

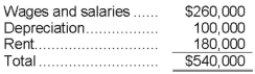

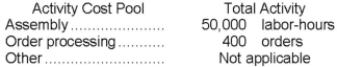

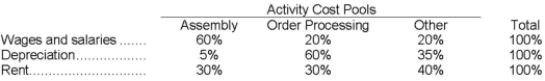

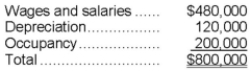

Grammer Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

A)$135,000

B)$174,000

C)$162,000

D)$180,000

The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?A)$135,000

B)$174,000

C)$162,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

24

The plant manager's salary is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

25

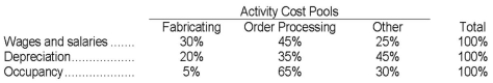

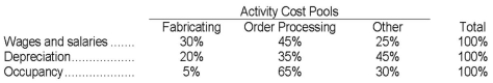

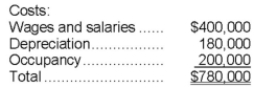

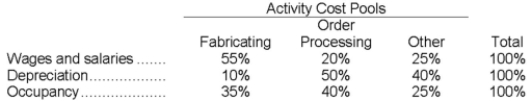

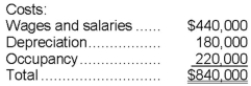

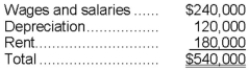

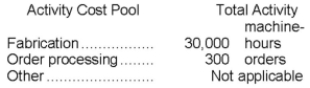

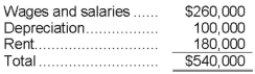

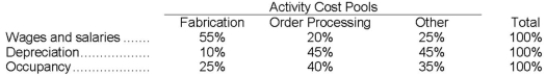

Duerr Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

A)$250,000

B)$286,000

C)$156,000

D)$312,000

The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?A)$250,000

B)$286,000

C)$156,000

D)$312,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

26

Assembling a product is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

27

An activity-based costing system that is designed for internal decision-making will not conform to generally accepted accounting principles because:

A)under activity-based costing the sum of all product costs does not equal the total costs of the company.

B)under activity-based costing manufacturing costs are assigned to products.

C)activity-based costing has not been approved by the United Nation's International Accounting Board.

D)activity-based costing results in less accurate costs than more traditional costing methods based on direct labor-hours or machine-hours.

A)under activity-based costing the sum of all product costs does not equal the total costs of the company.

B)under activity-based costing manufacturing costs are assigned to products.

C)activity-based costing has not been approved by the United Nation's International Accounting Board.

D)activity-based costing results in less accurate costs than more traditional costing methods based on direct labor-hours or machine-hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

28

The labor time required to assemble a product is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

29

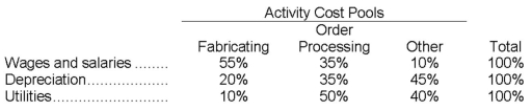

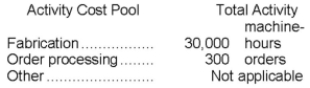

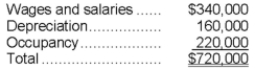

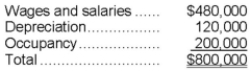

Futter Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

A)$84,000

B)$300,000

C)$238,000

D)$462,000

The distribution of resource consumption across the three activity cost pools is given below:

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Fabricating activity cost pool?A)$84,000

B)$300,000

C)$238,000

D)$462,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

30

If substantial batch-level or product-level costs exist, then overhead allocation based on a measure of volume such as direct labor-hours alone:

A)is a key aspect of the activity-based costing model.

B)will systematically overcost high-volume products and undercost low-volume products.

C)will systematically overcost low-volume products and undercost high-volume products.

D)must be used for external financial reporting since activity-based costing cannot be used for external reporting purposes.

A)is a key aspect of the activity-based costing model.

B)will systematically overcost high-volume products and undercost low-volume products.

C)will systematically overcost low-volume products and undercost high-volume products.

D)must be used for external financial reporting since activity-based costing cannot be used for external reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

31

Setting up a machine to change from producing one product to another is an example of a:

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

A)Unit-level activity.

B)Batch-level activity.

C)Product-level activity.

D)Organization-sustaining activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

32

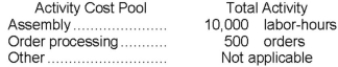

Poskey Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?

A)$187,000

B)$264,000

C)$217,000

D)$165,000

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?A)$187,000

B)$264,000

C)$217,000

D)$165,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

33

Activity rates in activity-based costing are computed by dividing costs from the second-stage allocations by the activity measure for each activity cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

34

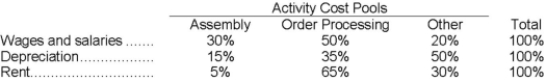

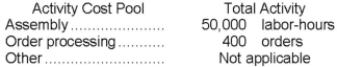

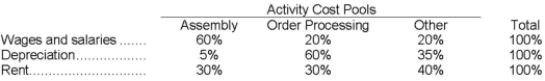

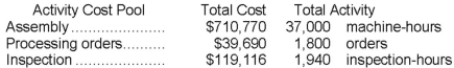

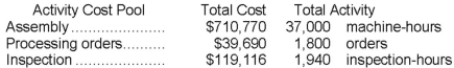

Orzel Corporation has provided the following data concerning its overhead costs for the coming year:  The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:  The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:

The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Assembly activity cost pool is closest to:

The activity rate for the Assembly activity cost pool is closest to:

A)$2.70 per labor-hour

B)$9.00 per labor-hour

C)$9.90 per labor-hour

D)$16.20 per labor-hour

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:  The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:

The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Assembly activity cost pool is closest to:

The activity rate for the Assembly activity cost pool is closest to:A)$2.70 per labor-hour

B)$9.00 per labor-hour

C)$9.90 per labor-hour

D)$16.20 per labor-hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following would probably be the most accurate measure of activity to use for allocating the costs associated with a factory's purchasing department?

A)Machine-hours

B)Direct labor-hours

C)Number of orders processed

D)Cost of materials purchased

A)Machine-hours

B)Direct labor-hours

C)Number of orders processed

D)Cost of materials purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

36

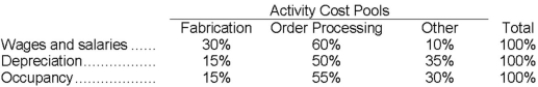

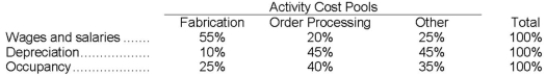

Hochberg Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Fabrication activity cost pool is closest to:

The activity rate for the Fabrication activity cost pool is closest to:

A)$5.30 per machine-hour

B)$3.60 per machine-hour

C)$7.20 per machine-hour

D)$4.80 per machine-hour

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Fabrication activity cost pool is closest to:

The activity rate for the Fabrication activity cost pool is closest to:A)$5.30 per machine-hour

B)$3.60 per machine-hour

C)$7.20 per machine-hour

D)$4.80 per machine-hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following levels of costs should not be allocated to products for decision-making purposes?

A)Unit-level activities.

B)Batch-level activities.

C)Product-level activities.

D)Organization-sustaining activities.

A)Unit-level activities.

B)Batch-level activities.

C)Product-level activities.

D)Organization-sustaining activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which terms would make the following sentence true? Manufacturing companies that benefit the most from activity-based costing are those where overhead costs are a _________ percentage of total product cost and where there is ___________ diversity among the various products that they produce.

A)low; little

B)low; considerable

C)high; little

D)high; considerable

A)low; little

B)low; considerable

C)high; little

D)high; considerable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

39

Activity rates are computed in the second-stage allocation in activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

40

Grandolfo Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

A)$168,000

B)$182,000

C)$128,000

D)$192,000

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Other activity cost pool?A)$168,000

B)$182,000

C)$128,000

D)$192,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

41

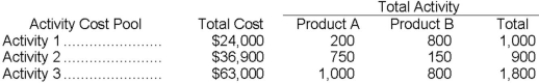

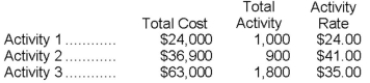

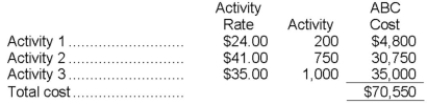

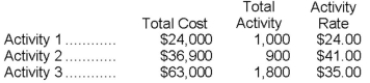

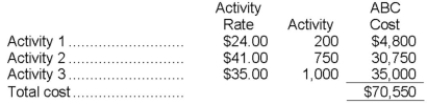

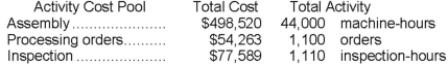

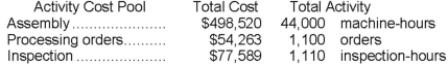

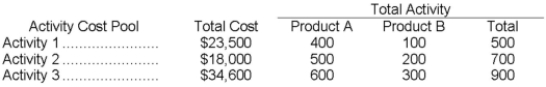

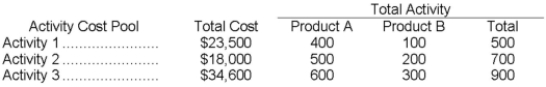

Lindsey Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with total cost and activity as follows:  The activity-based costing cost per unit of Product A is closest to:

The activity-based costing cost per unit of Product A is closest to:

A)$14.11

B)$13.77

C)$7.00

D)$17.70 The activity rates for each activity cost pool are computed as follows:

The overhead cost charged to Product A is:

The overhead cost charged to Product A is:

Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

The activity-based costing cost per unit of Product A is closest to:

The activity-based costing cost per unit of Product A is closest to:A)$14.11

B)$13.77

C)$7.00

D)$17.70 The activity rates for each activity cost pool are computed as follows:

The overhead cost charged to Product A is:

The overhead cost charged to Product A is: Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

42

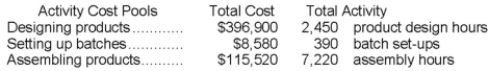

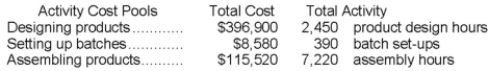

Moyle Corporation has provided the following data from its activity-based costing accounting system:  The activity rate for the "designing products" activity cost pool is closest to:

The activity rate for the "designing products" activity cost pool is closest to:

A)$396,900 per product design hour

B)$62 per product design hour

C)$162 per product design hour

D)$52 per product design hour

The activity rate for the "designing products" activity cost pool is closest to:

The activity rate for the "designing products" activity cost pool is closest to:A)$396,900 per product design hour

B)$62 per product design hour

C)$162 per product design hour

D)$52 per product design hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

43

How much supervisory wages and salaries and factory supplies cost would NOT be assigned to products using the activity-based costing system?

A)$0

B)$102,000

C)$180,000

D)$660,000

A)$0

B)$102,000

C)$180,000

D)$660,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

44

Laguna Corporation has provided the following data concerning its overhead costs for the coming year:  The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:  The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:

The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Order Processing activity cost pool is closest to:

The activity rate for the Order Processing activity cost pool is closest to:

A)$415 per order

B)$405 per order

C)$495 per order

D)$270 per order

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:  The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:

The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs. The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Order Processing activity cost pool is closest to:

The activity rate for the Order Processing activity cost pool is closest to:A)$415 per order

B)$405 per order

C)$495 per order

D)$270 per order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

45

How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

A)$236,000

B)$184,000

C)$230,000

D)$460,000

A)$236,000

B)$184,000

C)$230,000

D)$460,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

46

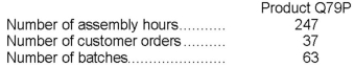

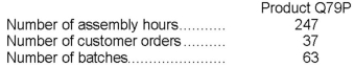

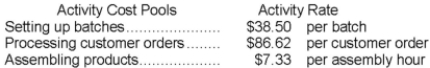

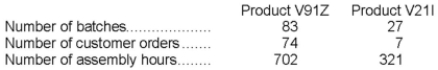

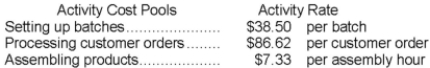

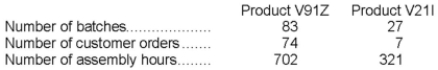

Bera Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

Data for one of the company's products follow:  How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

A)$7,119.92

B)$43,659.54

C)$4,770.99

D)$125.82

Data for one of the company's products follow:

Data for one of the company's products follow:  How much overhead cost would be assigned to Product Q79P using the activity-based costing system?

How much overhead cost would be assigned to Product Q79P using the activity-based costing system?A)$7,119.92

B)$43,659.54

C)$4,770.99

D)$125.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

47

How much factory supervision and indirect factory labor cost would be assigned to the Batch Set-Up activity cost pool?

A)$195,500

B)$230,000

C)$460,000

D)$185,000

A)$195,500

B)$230,000

C)$460,000

D)$185,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

48

How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

A)$56,000

B)$100,000

C)$360,000

D)$0

A)$56,000

B)$100,000

C)$360,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

49

Activity rates from Mcelderry Corporation's activity-based costing system are listed below. The company uses the activity rates to assign overhead costs to products:  Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches. How much overhead cost would be assigned to Product Q06J using the activity-based costing system?

Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches. How much overhead cost would be assigned to Product Q06J using the activity-based costing system?

A)$71.01

B)$219.12

C)$2,388.22

D)$42,748.02

Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches. How much overhead cost would be assigned to Product Q06J using the activity-based costing system?

Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches. How much overhead cost would be assigned to Product Q06J using the activity-based costing system?A)$71.01

B)$219.12

C)$2,388.22

D)$42,748.02

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

50

Senff Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data concerning two products appear below:

Data concerning two products appear below:  How much overhead cost would be assigned to Product V91Z using the activity-based costing system?

How much overhead cost would be assigned to Product V91Z using the activity-based costing system?

A)$113,774.55

B)$132.45

C)$3,195.50

D)$14,751.04

Data concerning two products appear below:

Data concerning two products appear below:  How much overhead cost would be assigned to Product V91Z using the activity-based costing system?

How much overhead cost would be assigned to Product V91Z using the activity-based costing system?A)$113,774.55

B)$132.45

C)$3,195.50

D)$14,751.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

51

How much factory supervision and indirect factory labor cost would NOT be assigned to products using the activity-based costing system?

A)$0

B)$62,000

C)$160,000

D)$300,000

A)$0

B)$62,000

C)$160,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

52

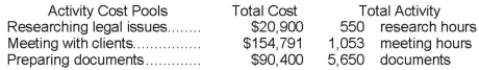

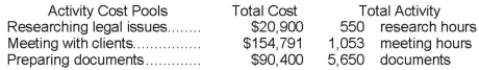

Data concerning three of the activity cost pools of Brevo LLC, a legal firm, have been provided below:  The activity rate for the "meeting with clients" activity cost pool is closest to:

The activity rate for the "meeting with clients" activity cost pool is closest to:

A)$147 per meeting hour

B)$154,791 per meeting hour

C)$37 per meeting hour

D)$68 per meeting hour

The activity rate for the "meeting with clients" activity cost pool is closest to:

The activity rate for the "meeting with clients" activity cost pool is closest to:A)$147 per meeting hour

B)$154,791 per meeting hour

C)$37 per meeting hour

D)$68 per meeting hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

53

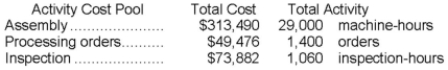

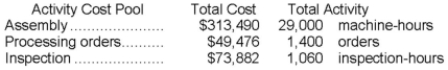

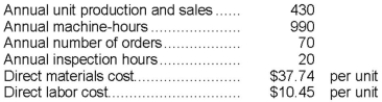

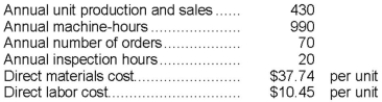

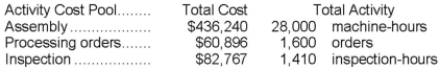

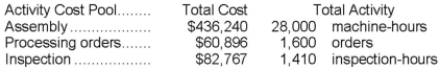

Belsky Corporation has provided the following data from its activity-based costing system:  The company makes 490 units of product Q19S a year, requiring a total of 1,080 machine-hours, 60 orders, and 20 inspection-hours per year. The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:

The company makes 490 units of product Q19S a year, requiring a total of 1,080 machine-hours, 60 orders, and 20 inspection-hours per year. The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:

A)$97.64 per unit

B)$66.64 per unit

C)$93.31 per unit

D)$94.79 per unit

The company makes 490 units of product Q19S a year, requiring a total of 1,080 machine-hours, 60 orders, and 20 inspection-hours per year. The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:

The company makes 490 units of product Q19S a year, requiring a total of 1,080 machine-hours, 60 orders, and 20 inspection-hours per year. The product's direct materials cost is $46.42 per unit and its direct labor cost is $20.22 per unit. According to the activity-based costing system, the average cost of product Q19S is closest to:A)$97.64 per unit

B)$66.64 per unit

C)$93.31 per unit

D)$94.79 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

54

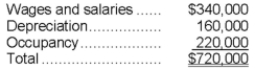

Hettich Corporation uses an activity-based costing system with the following three activity cost pools:  The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Order Processing activity cost pool is closest to:

The activity rate for the Order Processing activity cost pool is closest to:

A)$1,400 per order

B)$1,600 per order

C)$1,150 per order

D)$800 per order

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:

The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The company has provided the following data concerning its costs:  The distribution of resource consumption across activity cost pools is given below:

The distribution of resource consumption across activity cost pools is given below:  The activity rate for the Order Processing activity cost pool is closest to:

The activity rate for the Order Processing activity cost pool is closest to:A)$1,400 per order

B)$1,600 per order

C)$1,150 per order

D)$800 per order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

55

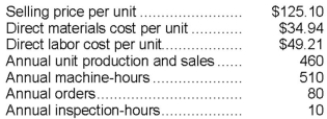

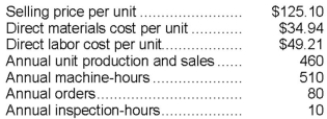

Ravelo Corporation has provided the following data from its activity-based costing system:  Data concerning the company's product L19B appear below:

Data concerning the company's product L19B appear below:  According to the activity-based costing system, the average cost of product L19B is closest to:

According to the activity-based costing system, the average cost of product L19B is closest to:

A)$48.19 per unit

B)$82.31 per unit

C)$85.56 per unit

D)$77.53 per unit

Data concerning the company's product L19B appear below:

Data concerning the company's product L19B appear below:  According to the activity-based costing system, the average cost of product L19B is closest to:

According to the activity-based costing system, the average cost of product L19B is closest to:A)$48.19 per unit

B)$82.31 per unit

C)$85.56 per unit

D)$77.53 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

56

Rosenbrook Corporation has provided the following data from its activity-based costing system:  Data concerning one of the company's products, Product H73N, appear below:

Data concerning one of the company's products, Product H73N, appear below:  According to the activity-based costing system, the product margin for product H73N is:

According to the activity-based costing system, the product margin for product H73N is:

A)$7,275.90

B)$6,661.90

C)$18,837.00

D)$8,425.90

Data concerning one of the company's products, Product H73N, appear below:

Data concerning one of the company's products, Product H73N, appear below:  According to the activity-based costing system, the product margin for product H73N is:

According to the activity-based costing system, the product margin for product H73N is:A)$7,275.90

B)$6,661.90

C)$18,837.00

D)$8,425.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

57

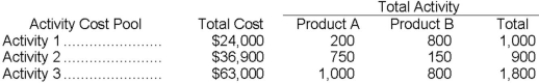

Jennifer Company has two products: A and B. The company uses activity-based costing. The total cost and activity for each of the company's three activity cost pools are as follows:  The activity rate under the activity-based costing system for Activity 3 is closest to:

The activity rate under the activity-based costing system for Activity 3 is closest to:

A)$36.24

B)$38.44

C)$84.56

D)$115.33

The activity rate under the activity-based costing system for Activity 3 is closest to:

The activity rate under the activity-based costing system for Activity 3 is closest to:A)$36.24

B)$38.44

C)$84.56

D)$115.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

58

Radakovich Corporation has provided the following data from its activity-based costing system:  The company makes 230 units of product F60N a year, requiring a total of 480 machine-hours, 50 orders, and 30 inspection-hours per year. The product's direct materials cost is $12.70 per unit and its direct labor cost is $45.93 per unit. The product sells for $126.60 per unit. According to the activity-based costing system, the product margin for product F60N is:

The company makes 230 units of product F60N a year, requiring a total of 480 machine-hours, 50 orders, and 30 inspection-hours per year. The product's direct materials cost is $12.70 per unit and its direct labor cost is $45.93 per unit. The product sells for $126.60 per unit. According to the activity-based costing system, the product margin for product F60N is:

A)$6,251.70

B)$4,490.70

C)$6,393.70

D)$15,633.10

The company makes 230 units of product F60N a year, requiring a total of 480 machine-hours, 50 orders, and 30 inspection-hours per year. The product's direct materials cost is $12.70 per unit and its direct labor cost is $45.93 per unit. The product sells for $126.60 per unit. According to the activity-based costing system, the product margin for product F60N is:

The company makes 230 units of product F60N a year, requiring a total of 480 machine-hours, 50 orders, and 30 inspection-hours per year. The product's direct materials cost is $12.70 per unit and its direct labor cost is $45.93 per unit. The product sells for $126.60 per unit. According to the activity-based costing system, the product margin for product F60N is:A)$6,251.70

B)$4,490.70

C)$6,393.70

D)$15,633.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

59

How much cost, in total, would be allocated in the first-stage allocation to the Order Size activity cost pool?

A)$150,000

B)$360,000

C)$255,000

D)$234,000

A)$150,000

B)$360,000

C)$255,000

D)$234,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

60

How much supervisory wages and salaries and factory supplies cost would be assigned to the Batch Processing activity cost pool?

A)$231,000

B)$420,000

C)$840,000

D)$147,000

A)$231,000

B)$420,000

C)$840,000

D)$147,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the overhead cost assigned to Product S4 under activity-based costing?

A)$18,688

B)$3,570

C)$24,500

D)$22,258

A)$18,688

B)$3,570

C)$24,500

D)$22,258

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the product margin for Product I6 under activity-based costing?

A)$2,000

B)$36,000

C)$11,928

D)$23,688

A)$2,000

B)$36,000

C)$11,928

D)$23,688

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

63

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A)$2.50 per batch

B)$2.63 per batch

C)$9.55 per batch

D)$44.00 per batch

A)$2.50 per batch

B)$2.63 per batch

C)$9.55 per batch

D)$44.00 per batch

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

64

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

A)$300

B)$11,300

C)$24,500

D)$24,800

A)$300

B)$11,300

C)$24,500

D)$24,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

65

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

A)$1.60 per MH

B)$1.62 per MH

C)$0.67 per MH

D)$3.40 per MH

A)$1.60 per MH

B)$1.62 per MH

C)$0.67 per MH

D)$3.40 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

66

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

A)$2.16 per MH

B)$2.10 per MH

C)$4.10 per MH

D)$1.00 per MH

A)$2.16 per MH

B)$2.10 per MH

C)$4.10 per MH

D)$1.00 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

67

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

A)$32,000

B)$16,000

C)$400

D)$32,400

A)$32,000

B)$16,000

C)$400

D)$32,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is the overhead cost assigned to Product R6 under activity-based costing?

A)$44,000

B)$60,900

C)$18,145

D)$42,755

A)$44,000

B)$60,900

C)$18,145

D)$42,755

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

69

What would be the total overhead cost per delivery according to the activity based costing system? In other words, what would be the overall activity rate for the deliveries activity cost pool? (Round to the nearest whole cent.)

A)$6.00

B)$6.60

C)$7.20

D)$6.80

A)$6.00

B)$6.60

C)$7.20

D)$6.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the overhead cost assigned to Product Z5 under activity-based costing?

A)$5,280

B)$6,264

C)$20,500

D)$11,544

A)$5,280

B)$6,264

C)$20,500

D)$11,544

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

71

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

A)$400

B)$4,700

C)$14,700

D)$5,100

A)$400

B)$4,700

C)$14,700

D)$5,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

72

The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

A)$2.86 per order

B)$49.00 per order

C)$5.10 per order

D)$2.00 per order

A)$2.86 per order

B)$49.00 per order

C)$5.10 per order

D)$2.00 per order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

73

What would be the total overhead cost per bouquet according to the activity based costing system? In other words, what would be the overall activity rate for the making bouquets activity cost pool? (Round to the nearest whole cent.)

A)$0.90

B)$1.05

C)$1.20

D)$1.10

A)$0.90

B)$1.05

C)$1.20

D)$1.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

74

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A)$10,600

B)$21,000

C)$21,600

D)$600

A)$10,600

B)$21,000

C)$21,600

D)$600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is the overhead cost assigned to Product A8 under activity-based costing?

A)$3,720

B)$3,975

C)$26,000

D)$7,695

A)$3,720

B)$3,975

C)$26,000

D)$7,695

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

76

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

A)$18,600

B)$16,600

C)$19,100

D)$2,500

A)$18,600

B)$16,600

C)$19,100

D)$2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

77

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

A)$2.60 per MH

B)$1.23 per MH

C)$0.60 per MH

D)$1.24 per MH

A)$2.60 per MH

B)$1.23 per MH

C)$0.60 per MH

D)$1.24 per MH

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the overhead cost assigned to Product I6 under activity-based costing?

A)$11,760

B)$24,072

C)$34,000

D)$12,312

A)$11,760

B)$24,072

C)$34,000

D)$12,312

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

79

How much cost, in total, should NOT be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision-making?

A)$60,000

B)$0

C)$84,000

D)$120,000

A)$60,000

B)$0

C)$84,000

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

80

How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost pool?

A)$255,000

B)$282,000

C)$120,000

D)$390,000

A)$255,000

B)$282,000

C)$120,000

D)$390,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck