Deck 13: Analyzing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 13: Analyzing Financial Statements

1

Purchasing treasury stock increases the return on equity ratio.

True

2

The return on assets ratio is influenced significantly by a company's relative debt and equity financing of its assets.

False

3

Return on equity (ROE) by the Du Pont model provides insight with respect to a company's use of its assets.

True

4

Earnings per share (EPS) is affected by treasury stock transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

The earnings quality ratio increases when net income increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

When comparing a fixed asset turnover ratio to a total asset turnover ratio, a company with a high amount of inventory will have a much lower fixed asset turnover ratio than total asset turnover ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

Component percentages are used to express items on financial statements as a percentage of a single base amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company that has a high level of inventory and other assets, in addition to its investment in property, plant, and equipment, should broaden its analysis and calculate the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Finding comparable companies in order to compare performance is often difficult since no two companies have identical products, markets, and operating strategies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

A negative financial leverage percentage occurs when a company has more debt than stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

Finding comparable companies in order to compare performance is important because ratios in isolation are difficult to evaluate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The financial leverage percentage is positive when return on assets is greater than return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

A primary objective of financial statements is to provide information to current and potential investors and creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

Return on equity (ROE) by the DuPont model is a function of three ratios: net profit margin, return on assets, and financial leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

The fixed asset turnover ratio increases when net income increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Financial statement analysis is very precise and does not involve judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

Time series analysis is a comparison of information for a specific company over a period of time to determine changes in operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

The net profit margin ratio considers the asset base utilized to earn income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Some analysts do not use the cash ratio because they see it as too stringent a test of liquidity and the ratio is very sensitive to small events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

A higher current ratio is preferable for companies that do not have predictable cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

The debt-to-equity ratio is a risk measure used by both investors and lenders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

The quick ratio decreases when the adjusting entry to record bad debt expense is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is incorrect?

A)Purchasing fixed assets through equity financing decreases total asset turnover.

B)Accruing an expense increases the financial leverage ratio.

C)The return on equity ratio increases when treasury stock is purchased.

D)The purchase of fixed assets will cause the total asset turnover to decrease.

A)Purchasing fixed assets through equity financing decreases total asset turnover.

B)Accruing an expense increases the financial leverage ratio.

C)The return on equity ratio increases when treasury stock is purchased.

D)The purchase of fixed assets will cause the total asset turnover to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is correct?

A)A ratio calculation is most relevant in isolation.

B)One of the advantages of ratio analysis is that it allows companies of different sizes to be compared.

C)Finding benchmarks for comparison is a straightforward task.

D)It is always preferable to compare a company's performance to industry-wide ratios rather than to use a competitor's ratios.

A)A ratio calculation is most relevant in isolation.

B)One of the advantages of ratio analysis is that it allows companies of different sizes to be compared.

C)Finding benchmarks for comparison is a straightforward task.

D)It is always preferable to compare a company's performance to industry-wide ratios rather than to use a competitor's ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

The dividend yield ratio decreases when earnings per share increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is correct?

A)Selling inventory at its cost does not affect the net profit margin ratio.

B)Accruing sales revenue does not affect the net profit margin ratio.

C)The total asset turnover ratio increases when fixed assets are sold at a loss.

D)The net profit margin ratio decreases when common stock is issueD.Selling fixed assets at a loss reduces average total assets which is the denominator of the total asset turnover ratio.The total asset turnover ratio will therefore increase.

A)Selling inventory at its cost does not affect the net profit margin ratio.

B)Accruing sales revenue does not affect the net profit margin ratio.

C)The total asset turnover ratio increases when fixed assets are sold at a loss.

D)The net profit margin ratio decreases when common stock is issueD.Selling fixed assets at a loss reduces average total assets which is the denominator of the total asset turnover ratio.The total asset turnover ratio will therefore increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

Home Depot's operating strategy is to offer a broad assortment of high-quality merchandise and services at competitive prices using highly knowledgeable service-oriented personnel and aggressive advertising. Which of the following is not as critical to achieving Home Depot's strategy?

A)Cost control

B)Product differentiation

C)High level of customer service

D)High sales volume

A)Cost control

B)Product differentiation

C)High level of customer service

D)High sales volume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

The inventory turnover ratio is significantly affected by the choice of inventory accounting method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

When considering an investment, which of the following is not one of the three critical factors used to evaluate future earnings potential of that investment?

A)Global event factors.

B)Economy-wide factors.

C)Industry factors.

D)Individual company factors.

A)Global event factors.

B)Economy-wide factors.

C)Industry factors.

D)Individual company factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

A very high current ratio and a low quick ratio may indicate the company is not collecting its accounts receivable in a timely manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements is false?

A)When computing the component percentages for the income statement, net income is the base figure.

B)Time series analysis examines a company's performance over time.

C)It is often useful to compare a company's performance with that of a competitor.

D)The North American Industry Classification System assigns industry codes based on business operations.

A)When computing the component percentages for the income statement, net income is the base figure.

B)Time series analysis examines a company's performance over time.

C)It is often useful to compare a company's performance with that of a competitor.

D)The North American Industry Classification System assigns industry codes based on business operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

A high price/earnings ratio usually indicates the market is optimistic about the company's future earnings potential.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements is incorrect about fundamental business strategies?

A)A company implementing a cost differentiation strategy is attempting to increase operating efficiency of assets and improve the total asset turnover ratio.

B)A company implementing a product differentiation strategy is attempting to improve its net profit margin through charging higher prices.

C)A company will be more profitable because it will attract a higher volume of customers and sales revenue when it follows a product differentiation strategy versus a cost differentiation strategy.

D)Financial leverage is how a company finances its assets and can affect total profitability return to stockholders.

A)A company implementing a cost differentiation strategy is attempting to increase operating efficiency of assets and improve the total asset turnover ratio.

B)A company implementing a product differentiation strategy is attempting to improve its net profit margin through charging higher prices.

C)A company will be more profitable because it will attract a higher volume of customers and sales revenue when it follows a product differentiation strategy versus a cost differentiation strategy.

D)Financial leverage is how a company finances its assets and can affect total profitability return to stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

Dividend yield is calculated by dividing dividends per share by earnings per share and measures the current dividend return to investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

Many companies use high levels of debt to finance their assets because financial leverage benefits are provided to investors when return on assets exceeds the after-tax cost of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

The base amount in preparing component percentages for an income statement is usually which of the following?

A)Income from operations.

B)Gross profit.

C)Net income.

D)Net sales.

A)Income from operations.

B)Gross profit.

C)Net income.

D)Net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements is not correct?

A)Purchasing fixed assets through debt financing decreases the financial leverage ratio.

B)Accruing an expense will affect the net profit margin ratio.

C)Return on equity may increase even when the financial leverage ratio decreases.

D)Purchasing treasury stock results in a decrease in total asset turnover.

A)Purchasing fixed assets through debt financing decreases the financial leverage ratio.

B)Accruing an expense will affect the net profit margin ratio.

C)Return on equity may increase even when the financial leverage ratio decreases.

D)Purchasing treasury stock results in a decrease in total asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

The price/earnings ratio is affected by the amount of risk that investors are willing to take.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following ratios is not part of the DuPont model?

A)Total asset turnover.

B)Debt-to-equity.

C)Net profit margin.

D)Return on equity.

A)Total asset turnover.

B)Debt-to-equity.

C)Net profit margin.

D)Return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

The cash coverage ratio measures a firm's ability to pay its current liabilities with its cash flows from operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following transactions decreases earnings per share?

A)Declaring cash dividends payable to the common stockholders.

B)Purchasing treasury stock.

C)The accrual of revenue.

D)Declaring and distributing a 10% common stock dividenD.Issuing additional shares of common stock via a stock dividend increases the number of common shares outstanding and therefore decreases earnings per share.

A)Declaring cash dividends payable to the common stockholders.

B)Purchasing treasury stock.

C)The accrual of revenue.

D)Declaring and distributing a 10% common stock dividenD.Issuing additional shares of common stock via a stock dividend increases the number of common shares outstanding and therefore decreases earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

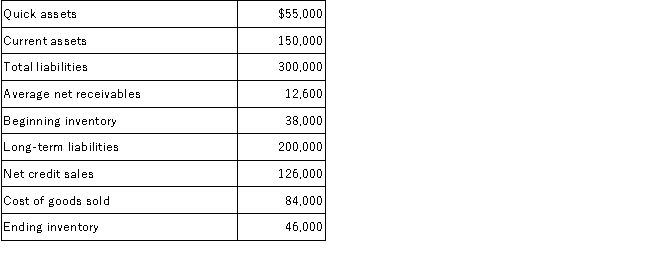

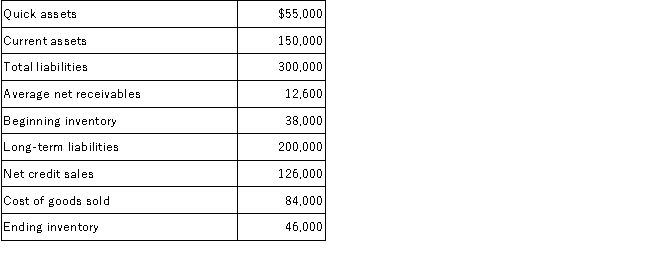

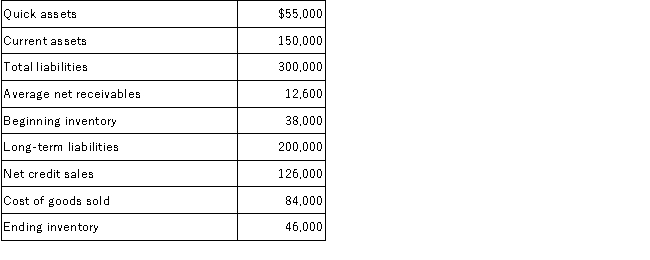

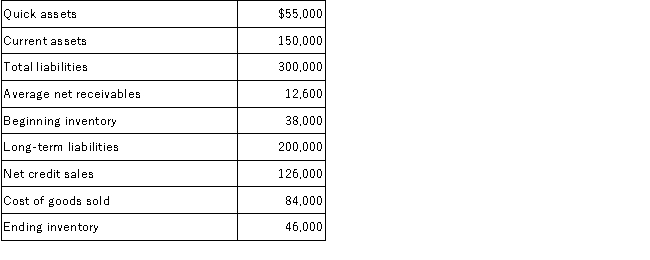

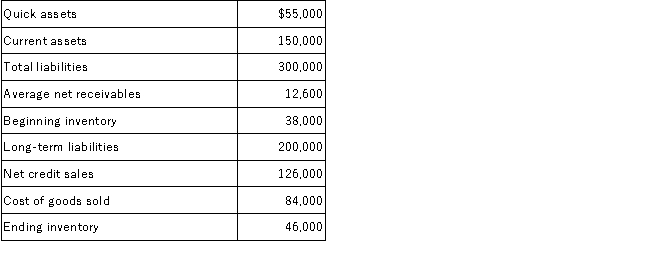

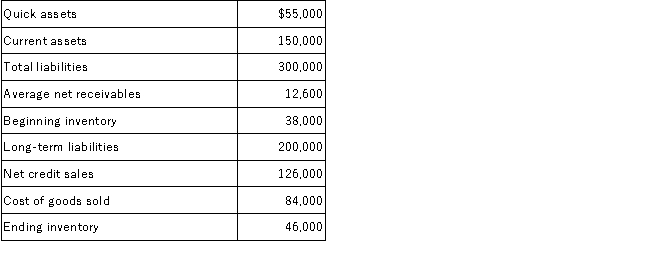

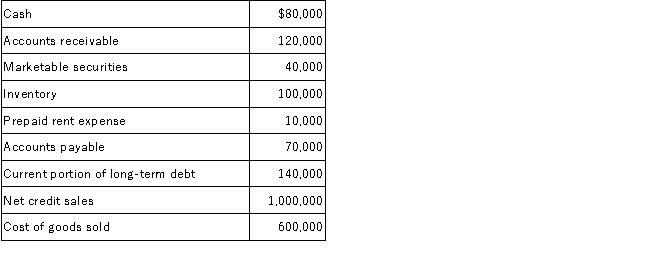

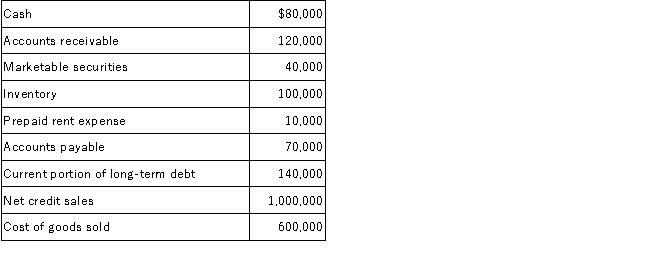

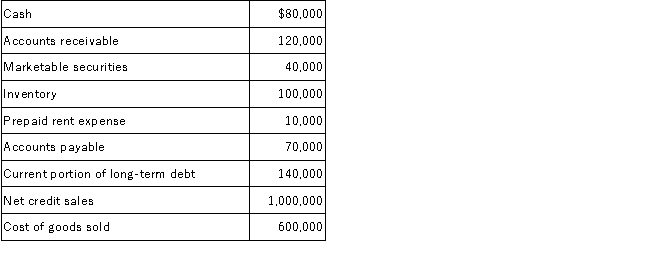

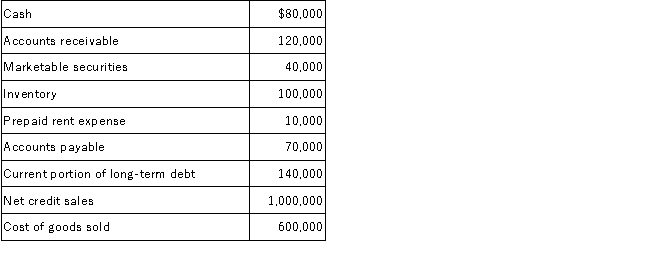

Agnes Company reported the following data:  What was the current ratio?

What was the current ratio?

A)0.5

B)1.5

C)2.5

D)0.75

What was the current ratio?

What was the current ratio?A)0.5

B)1.5

C)2.5

D)0.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

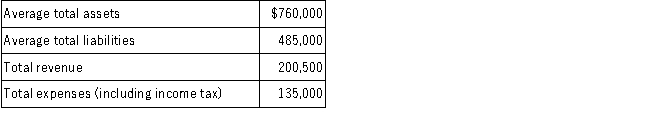

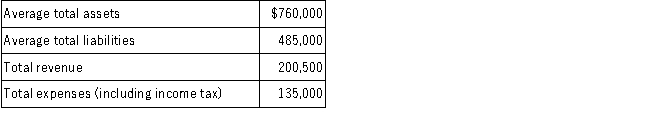

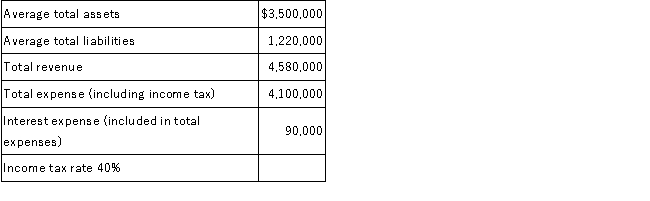

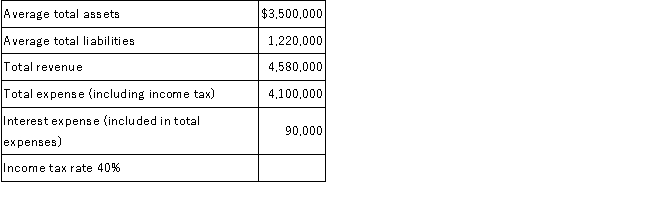

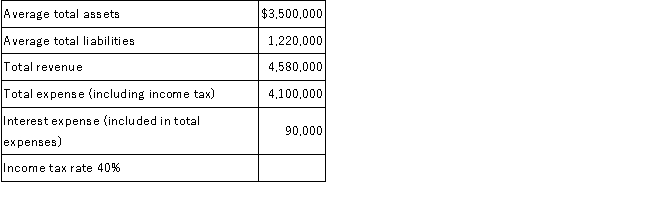

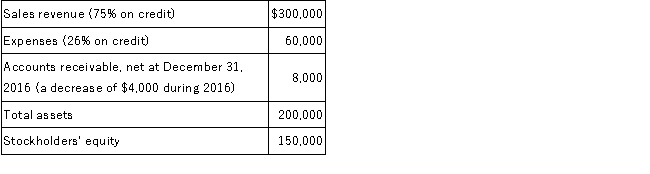

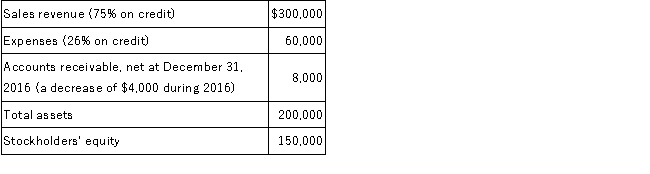

The records of Everyday Electronics Corporation for a particular period include the following:  The return on equity ratio is closest to:

The return on equity ratio is closest to:

A)13.2%

B)23.8%

C)24.0%

D)8.4%

The return on equity ratio is closest to:

The return on equity ratio is closest to:A)13.2%

B)23.8%

C)24.0%

D)8.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is incorrect?

A)If selling and administrative expenses as a percentage of sales increases, then gross profit percentage will decrease.

B)If the cost of goods sold percentage decreases and other expenses do not change, then net profit margin will increase as a percentage of sales.

C)If sales dollars decrease, a company might still report a higher gross profit percentage if cost of goods sold decreases at a faster rate than the decrease in sales.

D)It is possible that when selling and administrative expense in dollars decrease, selling and administrative expenses as a percentage of sales will increase.

A)If selling and administrative expenses as a percentage of sales increases, then gross profit percentage will decrease.

B)If the cost of goods sold percentage decreases and other expenses do not change, then net profit margin will increase as a percentage of sales.

C)If sales dollars decrease, a company might still report a higher gross profit percentage if cost of goods sold decreases at a faster rate than the decrease in sales.

D)It is possible that when selling and administrative expense in dollars decrease, selling and administrative expenses as a percentage of sales will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

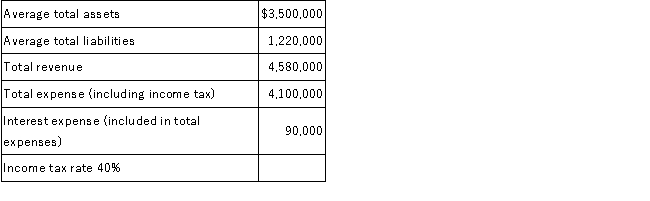

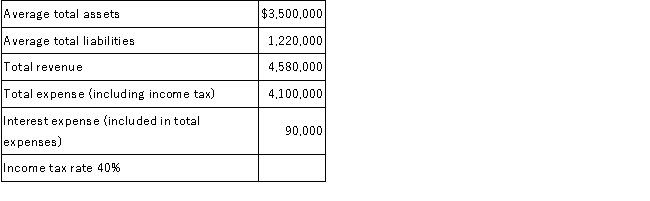

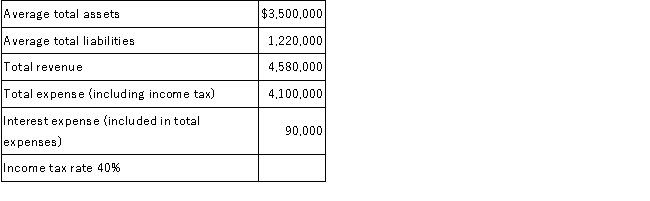

The records of Marshall Company include the following:  The return on assets is closest to:

The return on assets is closest to:

A)14.9%.

B)18.3%.

C)15.3%.

D)14.7%.

The return on assets is closest to:

The return on assets is closest to:A)14.9%.

B)18.3%.

C)15.3%.

D)14.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

The records of Marshall Company include the following:  The return on equity is closest to:

The return on equity is closest to:

A)21.1%

B)10.2%

C)16.4%

D)17.1%

The return on equity is closest to:

The return on equity is closest to:A)21.1%

B)10.2%

C)16.4%

D)17.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

Teague Company's working capital was $40,000 and total current liabilities were one-fourth of that amount. What was the current ratio?

A)1.00

B)1.25

C)3.00

D)5.00

A)1.00

B)1.25

C)3.00

D)5.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cecilia Company reported net income of $1,200,000. The average total liabilities were $4,300,000 and average total stockholders' equity was $5,200,000. Interest expense was $100,000 and the tax rate was 40%. Cecilia's return on assets ratio is closest to: What is Trenton's price/earnings ratio?

A)13.7%

B)12.6%

C)11.6%

D)13.3%

A)13.7%

B)12.6%

C)11.6%

D)13.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Trenton Company has provided the following information: • Net income, $240,000

• Preferred shares issued, 6,000

• Weighted average number of shares of common stock issued, 24,000

• Cash dividends declared and paid on common stock, $30,000

• Market price per share, $36

• Weighted average number of treasury shares of common stock, 4,000

What is Trenton's price/earnings ratio?

A)3.0

B)5.1

C)3.4

D)4.5

• Preferred shares issued, 6,000

• Weighted average number of shares of common stock issued, 24,000

• Cash dividends declared and paid on common stock, $30,000

• Market price per share, $36

• Weighted average number of treasury shares of common stock, 4,000

What is Trenton's price/earnings ratio?

A)3.0

B)5.1

C)3.4

D)4.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following ratios is not considered to be a test of profitability?

A)Current ratio.

B)Net profit margin.

C)Return on assets.

D)Earnings per share.

A)Current ratio.

B)Net profit margin.

C)Return on assets.

D)Earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

During 2016, Home Style's cost of goods sold percentage was 68.2%, and selling and store operating costs were 19.3% of sales. During 2015, Home Style's cost of goods sold percentage was 70.1% while selling and store operating costs were 19.0% of sales. What effect would the change in these percentages have on 2016's gross profit percentage and net profit margin percentage?

A)The decrease in the cost of goods sold percentage would increase both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would decrease both the gross profit and net profit margin percentages.

B)The decrease in the cost of goods sold percentage would decrease both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would increase both the gross profit and net profit margin percentages.

C)The decrease in the cost of goods sold percentage would increase both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would decrease only the net profit margin percentage.

D)The decrease in the cost of goods sold percentage would decrease both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would increase only the net profit margin percentage.

A)The decrease in the cost of goods sold percentage would increase both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would decrease both the gross profit and net profit margin percentages.

B)The decrease in the cost of goods sold percentage would decrease both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would increase both the gross profit and net profit margin percentages.

C)The decrease in the cost of goods sold percentage would increase both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would decrease only the net profit margin percentage.

D)The decrease in the cost of goods sold percentage would decrease both the gross profit and net profit margin percentages, but the increase in the selling and store operating costs percentage would increase only the net profit margin percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following transactions will increase the earnings quality ratio?

A)Paying cash to suppliers.

B)Accruing sales revenue.

C)Selling treasury stock for more than its cost.

D)Collecting an account receivable.

A)Paying cash to suppliers.

B)Accruing sales revenue.

C)Selling treasury stock for more than its cost.

D)Collecting an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following transactions will increase a current ratio, which is currently 2.5?

A)Receiving cash from signing a 6-month note payable.

B)Accruing an expense.

C)Using cash to pay an account payable.

D)Collecting an account receivable.

A)Receiving cash from signing a 6-month note payable.

B)Accruing an expense.

C)Using cash to pay an account payable.

D)Collecting an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

Trenton Company has provided the following information: • Net income, $240,000

• Preferred shares issued, 6,000

• Weighted average number of shares of common stock issued, 24,000

• Cash dividends declared and paid on common stock, $30,000

• Market price per share, $36

• Weighted average number of treasury shares of common stock, 4,000

What is Trenton's earnings per share?

A)$8.00.

B)$7.00.

C)$10.50.

D)$12.00.

• Preferred shares issued, 6,000

• Weighted average number of shares of common stock issued, 24,000

• Cash dividends declared and paid on common stock, $30,000

• Market price per share, $36

• Weighted average number of treasury shares of common stock, 4,000

What is Trenton's earnings per share?

A)$8.00.

B)$7.00.

C)$10.50.

D)$12.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following ratios is not an indicator of a company's short-term financial strength?

A)Earnings quality.

B)Current ratio.

C)Cash ratio.

D)Quick ratio.

A)Earnings quality.

B)Current ratio.

C)Cash ratio.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following transactions decreases earnings per share?

A)Collection of an account receivable.

B)Selling treasury stock for an amount less than its cost.

C)A decrease in the market value per share.

D)Paying cash in advance for rent.

A)Collection of an account receivable.

B)Selling treasury stock for an amount less than its cost.

C)A decrease in the market value per share.

D)Paying cash in advance for rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following transactions will not increase the cash ratio?

A)Receiving cash from a common stock issue.

B)Refinancing a current liability with long-term debt.

C)Using cash to purchase a two-month treasury bill.

D)Collecting an account receivable.

A)Receiving cash from a common stock issue.

B)Refinancing a current liability with long-term debt.

C)Using cash to purchase a two-month treasury bill.

D)Collecting an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements is correct?

A)When cost of goods sold as a percentage of sales increases, the gross profit percentage will increase.

B)It is possible that when cost of goods sold in dollars increases, cost of goods sold as a percentage of sales decreases.

C)If gross profit percentage is the same for the current and past year, then sales and cost of goods sold in dollars did not change.

D)If gross profit percentage increases from one year to the next, then the net income percentage will also increase from one year to the next.

A)When cost of goods sold as a percentage of sales increases, the gross profit percentage will increase.

B)It is possible that when cost of goods sold in dollars increases, cost of goods sold as a percentage of sales decreases.

C)If gross profit percentage is the same for the current and past year, then sales and cost of goods sold in dollars did not change.

D)If gross profit percentage increases from one year to the next, then the net income percentage will also increase from one year to the next.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

Negative financial leverage occurs when the:

A)Average net (after tax) interest rate on borrowed funds is less than the company's earnings rate on its assets.

B)Return on assets is more than return on equity.

C)Return on equity is more than return on assets.

D)Operating expenses exceed gross profit.

A)Average net (after tax) interest rate on borrowed funds is less than the company's earnings rate on its assets.

B)Return on assets is more than return on equity.

C)Return on equity is more than return on assets.

D)Operating expenses exceed gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

The records of Marshall Company include the following:  The financial leverage percentage is closest to:

The financial leverage percentage is closest to:

A)1.8%

B)2.8%

C)5.8%

D)6.4%

The financial leverage percentage is closest to:

The financial leverage percentage is closest to:A)1.8%

B)2.8%

C)5.8%

D)6.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

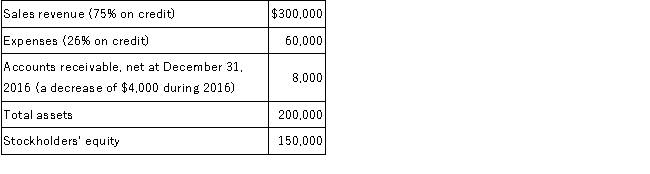

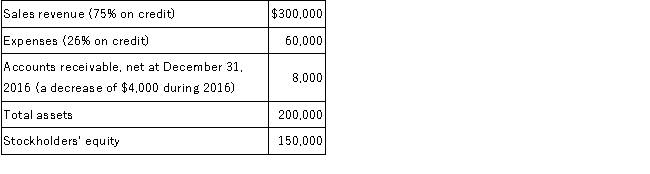

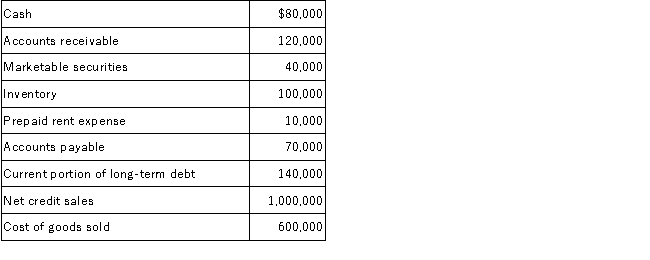

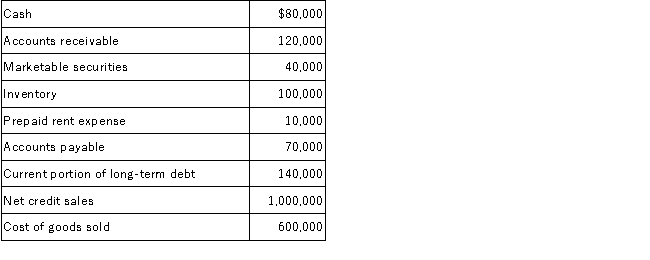

Potaw Company reported the following data at the end of 2016:  What was the accounts receivable turnover ratio?

What was the accounts receivable turnover ratio?

A)30.0

B)37.5

C)36.5

D)22.5

What was the accounts receivable turnover ratio?

What was the accounts receivable turnover ratio?A)30.0

B)37.5

C)36.5

D)22.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following transactions would increase the current ratio of a company if the ratio is currently greater than 1?

A)Paid the principal on a long-term note payable.

B)Borrowed cash on a short-term note.

C)Sold inventory for more than cost.

D)Purchased supplies with cash.

A)Paid the principal on a long-term note payable.

B)Borrowed cash on a short-term note.

C)Sold inventory for more than cost.

D)Purchased supplies with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is not a measure of solvency?

A)Debt-to-equity ratio.

B)Cash coverage ratio.

C)Times interest earned ratio.

D)Earnings per share.

A)Debt-to-equity ratio.

B)Cash coverage ratio.

C)Times interest earned ratio.

D)Earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Cromwell Company began the year with a balance in inventory of $110,000 and ended the year with a balance of $102,000. The net sales for the year were $983,000 with a gross profit on sales of $295,000. The inventory turnover ratio is closest to:

A)2.78

B)9.27

C)6.49

D)2.89

A)2.78

B)9.27

C)6.49

D)2.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is false?

A)The major difference between the quick and current ratios is inventory.

B)Current liabilities are the denominator in the cash, quick, and current ratios.

C)Companies that sell expensive merchandise tend to have high inventory turnover ratios.

D)Some analysts do not use the cash ratio because it is very sensitive to individual events.

A)The major difference between the quick and current ratios is inventory.

B)Current liabilities are the denominator in the cash, quick, and current ratios.

C)Companies that sell expensive merchandise tend to have high inventory turnover ratios.

D)Some analysts do not use the cash ratio because it is very sensitive to individual events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

Wildlife Co. reported net income of $8.3 million, interest expense of $0.5 million and is in a 30% tax rate bracket. Wildlife's average total assets are $65.8 million and average stockholders' equity is $48.6 million. Wildlife's financial leverage percentage is closest to:

A)3.7%

B)4.5%

C)4.0%

D)4.7%

A)3.7%

B)4.5%

C)4.0%

D)4.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Agnes Company reported the following data:  What was the inventory turnover ratio?

What was the inventory turnover ratio?

A)2.2

B)1.8

C)2.0

D)3.0

What was the inventory turnover ratio?

What was the inventory turnover ratio?A)2.2

B)1.8

C)2.0

D)3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the current ratio is 2, what will be the effect of the payment of a cash dividend, which was recorded as a liability on the date of declaration?

A)An increase in the current ratio.

B)A decrease in the current ratio.

C)No effect on the current ratio.

D)A decrease in the cash coverage ratio.

A)An increase in the current ratio.

B)A decrease in the current ratio.

C)No effect on the current ratio.

D)A decrease in the cash coverage ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

The debt-to-equity ratio measures which of the following?

A)Liquidity.

B)Solvency.

C)Profitability.

D)Market strength.

A)Liquidity.

B)Solvency.

C)Profitability.

D)Market strength.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

Liquidity ratios concentrate on:

A)The operating cycle.

B)Profitability.

C)Short-term financial strength.

D)Ability to pay interest on loans.

A)The operating cycle.

B)Profitability.

C)Short-term financial strength.

D)Ability to pay interest on loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is false?

A)The cash ratio is the least stringent but most reliable test of liquidity.

B)A company with a high level of inventory will have a quick ratio significantly lower than its current ratio.

C)A current ratio that is too high could indicate funds tied up in inventory and other working capital assets.

D)Analysts consider a current ratio of 2 to be financially conservative.

A)The cash ratio is the least stringent but most reliable test of liquidity.

B)A company with a high level of inventory will have a quick ratio significantly lower than its current ratio.

C)A current ratio that is too high could indicate funds tied up in inventory and other working capital assets.

D)Analysts consider a current ratio of 2 to be financially conservative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

Agnes Company reported the following data:  What was the average number of days to sell inventory?

What was the average number of days to sell inventory?

A)165.9

B)202.7

C)182.5

D)121.7

What was the average number of days to sell inventory?

What was the average number of days to sell inventory?A)165.9

B)202.7

C)182.5

D)121.7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Potaw Company reported the following data at the end of 2016:  The average number of days to collect receivables during 2016 is closest to:

The average number of days to collect receivables during 2016 is closest to:

A)16.2.

B)14.3.

C)36.5.

D)21.9.

The average number of days to collect receivables during 2016 is closest to:

The average number of days to collect receivables during 2016 is closest to:A)16.2.

B)14.3.

C)36.5.

D)21.9.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

Thomas Company had income before interest and taxes of $120,000. Interest expense for the period was $17,000 and income taxes amounted to $28,500. The average stockholders' equity was $680,000. Thomas' return on equity (ROE) is closest to:

A)17.65%

B)15.15%

C)13.46%

D)10.96%

A)17.65%

B)15.15%

C)13.46%

D)10.96%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is not a ratio included in analysis of the operating cycle?

A)Days to collect receivables.

B)Days to buy inventory.

C)Days to pay payables.

D)Days sales in inventory.

A)Days to collect receivables.

B)Days to buy inventory.

C)Days to pay payables.

D)Days sales in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Baron Company reported the following data:  The quick ratio is closest to:

The quick ratio is closest to:

A)3.57

B)1.67

C)1.19

D)1.14

The quick ratio is closest to:

The quick ratio is closest to:A)3.57

B)1.67

C)1.19

D)1.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

The operating cycle includes the number of days it takes to:

A)Purchase goods, sell goods, pay cash to suppliers.

B)Purchase goods, pay cash, collect cash from customers.

C)Borrow money, collect cash from customers, repay cash borrowed.

D)Pay cash for goods, sell goods, collect cash from customers.

A)Purchase goods, sell goods, pay cash to suppliers.

B)Purchase goods, pay cash, collect cash from customers.

C)Borrow money, collect cash from customers, repay cash borrowed.

D)Pay cash for goods, sell goods, collect cash from customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

Baron Company reported the following data:  The cash ratio is closest to:

The cash ratio is closest to:

A)1.14

B)0.95

C)0.38

D)0.36

The cash ratio is closest to:

The cash ratio is closest to:A)1.14

B)0.95

C)0.38

D)0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

Bailey Corporation reported the following information for 2016:  What is Bailey's debt-to-equity ratio?

What is Bailey's debt-to-equity ratio?

A)2

B)1.25

C)1.0

D)3.0

What is Bailey's debt-to-equity ratio?

What is Bailey's debt-to-equity ratio?A)2

B)1.25

C)1.0

D)3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Baron Company reported the following data:  The current ratio is closest to:

The current ratio is closest to:

A)5.0

B)4.92

C)4.86

D)1.67

The current ratio is closest to:

The current ratio is closest to:A)5.0

B)4.92

C)4.86

D)1.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck