Deck 18: Forward and Futures Contracts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 18: Forward and Futures Contracts

1

The bond that maximises the difference between the invoice price and the delivery price is referred to as the

A) cheapest-to-deliver.

B) conversion bond.

C) delivery bond.

D) cheapest to substitute.

E) cost-of-carry.

A) cheapest-to-deliver.

B) conversion bond.

C) delivery bond.

D) cheapest to substitute.

E) cost-of-carry.

A

2

As a relationship officer for a money-centre commercial bank, one of your corporate accounts has just approached you about a one-year loan for £3 000 000. The customer would pay a quarterly interest expense based on the prevailing level of LIBOR at the beginning of each quarter. As is the bank's convention on all such loans, the amount of the interest payment would then be paid at the end of the quarterly cycle when the new rate for the next cycle is determined. You observe the following LIBOR yield curve in the cash market: 90-day LIBOR 4.70%

180-day LIBOR 4.85%

270-day LIBOR 5.10%

360-day LIBOR 5.40%

If 90-day LIBOR rises to the levels 'predicted' by the implied forward rates, what will the pound level of the bank's interest receipt be at the end of the first quarter?

A) £35 250.00

B) £36 375.00

C) £38 250.00

D) £40 500.00

E) None of the above

180-day LIBOR 4.85%

270-day LIBOR 5.10%

360-day LIBOR 5.40%

If 90-day LIBOR rises to the levels 'predicted' by the implied forward rates, what will the pound level of the bank's interest receipt be at the end of the first quarter?

A) £35 250.00

B) £36 375.00

C) £38 250.00

D) £40 500.00

E) None of the above

A

3

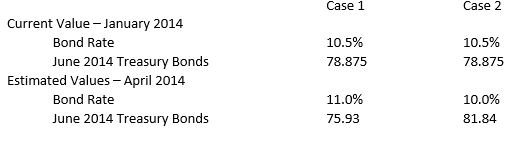

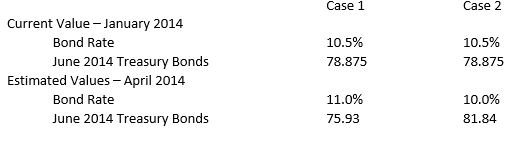

In late January 2014, The Union Cosmos Company is considering the sale of €100 million in 10-year debentures that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 per cent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing €100,000.  Explain how you would go about hedging the bond issue?

Explain how you would go about hedging the bond issue?

A) Sell 1000 contracts

B) Buy 1000 contracts

C) Sell 100 contracts

D) Sell 10 000 contracts

E) None of the above

Explain how you would go about hedging the bond issue?

Explain how you would go about hedging the bond issue?A) Sell 1000 contracts

B) Buy 1000 contracts

C) Sell 100 contracts

D) Sell 10 000 contracts

E) None of the above

A

4

Refer to the previous question. What is the euro gain or loss assuming that future conditions described in Case 1 actually occur? (Ignore commissions and margin costs, and assume a naive hedge ratio.)

A) €2 945 000.00 gain

B) €65 500.00 gain

C) €2 945 000.00 loss

D) €65 500.00 loss

E) None of the above

A) €2 945 000.00 gain

B) €65 500.00 gain

C) €2 945 000.00 loss

D) €65 500.00 loss

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

The process by which invest on margin accounts are credited or debited to reflect daily trading gains or losses is referred to as the ____ process.

A) marked-to-market

B) hedge rationing

C) daily settlement

D) book-to-market

E) account realisation

A) marked-to-market

B) hedge rationing

C) daily settlement

D) book-to-market

E) account realisation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

According to the cost of carry model the relationship between the spot (S0) and futures price (F0,T) is

A) S0 = F0,T/(1 + rf)T

B) S0 = F0,T(1 + rf)T

C) S0 + F0,T = (1 + rf)T

D) S0 = F0,T + (1 + rf)T

E) S0 − F0,T = (1 + rf)T

A) S0 = F0,T/(1 + rf)T

B) S0 = F0,T(1 + rf)T

C) S0 + F0,T = (1 + rf)T

D) S0 = F0,T + (1 + rf)T

E) S0 − F0,T = (1 + rf)T

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

In your portfolio you have €1 million of 20 year, 8 5/8 per cent bonds which are selling at 83.15 (or 83 15/32) against this position. Because you feel interest rates will rise you sell 10 bond futures at 81.15 (or 81 15/32) against this position. Two months later you decide to close your position. The bonds have fallen to 78 and the futures contracts are at 75.16 (75 16/32). Disregarding margin and transaction costs, what is your gain or loss?

A) €5000 loss

B) €500 loss

C) Breakeven

D) €500 gain

E) €5000 gain

A) €5000 loss

B) €500 loss

C) Breakeven

D) €500 gain

E) €5000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

The major difference between valuing futures versus forward contracts stems from the fact that future contracts are

A) traded on exchange.

B) backed by a clearinghouse.

C) marked-to-market daily.

D) less risky.

E) relatively inflexible.

A) traded on exchange.

B) backed by a clearinghouse.

C) marked-to-market daily.

D) less risky.

E) relatively inflexible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

Refer to the previous question. What is the implied 90-day forward rate at the beginning of the second quarter?

A) 4.70%

B) 4.85%

C) 4.60%

D) 4.94%

E) None of the above

A) 4.70%

B) 4.85%

C) 4.60%

D) 4.94%

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is true when F0,T < E(ST)?

A) Occurs when long hedgers outnumber short hedgers.

B) Occurs when short hedgers outnumber long hedgers.

C) The market is said to be in contango.

D) The market is said to be in normal contango.

E) The pure expectations hypothesis holds.

A) Occurs when long hedgers outnumber short hedgers.

B) Occurs when short hedgers outnumber long hedgers.

C) The market is said to be in contango.

D) The market is said to be in normal contango.

E) The pure expectations hypothesis holds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Refer to the previous two questions. What is the euro gain or loss assuming that future conditions described in Case 2 actually occur? (Ignore commissions and margin costs, and assume a naive hedge ratio.)

A) €2 965 000.00 gain

B) €45 500.00 gain

C) €2 965 000.00 loss

D) €45 500.00 loss

E) None of the above

A) €2 965 000.00 gain

B) €45 500.00 gain

C) €2 965 000.00 loss

D) €45 500.00 loss

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

The main tradeoff between forward and future contracts is

A) design flexibility.

B) credit risk.

C) liquidity risk.

D) all of the above.

E) choices a and b only

A) design flexibility.

B) credit risk.

C) liquidity risk.

D) all of the above.

E) choices a and b only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

An investor who wants a long position in a ____ must first place the order with a broker, who then passes it on to the trading pit or electronic network. Details of the order are then passed on to the exchange clearinghouse.

A) call option

B) put option

C) forward contract

D) futures contract

E) none of the above

A) call option

B) put option

C) forward contract

D) futures contract

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Refer to the previous two questions. If 90-day LIBOR rises to the levels 'predicted' by the implied forward rates, what will the dollar level of the bank's interest receipt be at the end of the third quarter?

A) £35 250.00

B) £36 375.00

C) £38 250.00

D) £41 005.50

E) None of the above

A) £35 250.00

B) £36 375.00

C) £38 250.00

D) £41 005.50

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the absence of arbitrage opportunities, the forward contract price should be equal to the current price plus

A) contract price.

B) the cost of carry.

C) margin requirement.

D) the price discovery rate.

E) the convenience return.

A) contract price.

B) the cost of carry.

C) margin requirement.

D) the price discovery rate.

E) the convenience return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck