Deck 7: Multifactor Models of Risk and Return

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 7: Multifactor Models of Risk and Return

1

Refer to the information in the previous question. If you know that the actual prices one year from now are stock X €55, stock Y €52, and stock Z €57, then

A) stock X is undervalued, stock Y is undervalued, stock Z is undervalued.

B) stock X is undervalued, stock Y is overvalued, stock Z is overvalued.

C) stock X is overvalued, stock Y is undervalued, stock Z is undervalued.

D) stock X is undervalued, stock Y is overvalued, stock Z is undervalued.

E) stock X is overvalued, stock Y is overvalued, stock Z is undervalued.

A) stock X is undervalued, stock Y is undervalued, stock Z is undervalued.

B) stock X is undervalued, stock Y is overvalued, stock Z is overvalued.

C) stock X is overvalued, stock Y is undervalued, stock Z is undervalued.

D) stock X is undervalued, stock Y is overvalued, stock Z is undervalued.

E) stock X is overvalued, stock Y is overvalued, stock Z is undervalued.

D

2

The equation for the single-index market model is

A) RFRit = ai + bRmt + et

B) Rit = ai + bRmt + et

C) Rit = ai + bRFRt + et

D) Rmt = ai + bRit + et

E) Rit = ai + b(Rmt − RFRt) + et

A) RFRit = ai + bRmt + et

B) Rit = ai + bRmt + et

C) Rit = ai + bRFRt + et

D) Rmt = ai + bRit + et

E) Rit = ai + b(Rmt − RFRt) + et

B

3

Consider the following list of risk factors: (1) monthly growth in industrial production

(2) return on high book to market value portfolio minus return on low book to market value portfolio

(3) change in inflation

(4) excess return on stock market portfolio

(5) return on small cap portfolio minus return on big cap portfolio

(6) unanticipated change in bond credit spread

Which of the factors would you use to develop a microeconomic-based risk factor model?

A) (1), (2), and (3)

B) (1), (3), and (5)

C) (2), (4), and (5)

D) (1), (3), and (6)

E) (4), (5), and (6)

(2) return on high book to market value portfolio minus return on low book to market value portfolio

(3) change in inflation

(4) excess return on stock market portfolio

(5) return on small cap portfolio minus return on big cap portfolio

(6) unanticipated change in bond credit spread

Which of the factors would you use to develop a microeconomic-based risk factor model?

A) (1), (2), and (3)

B) (1), (3), and (5)

C) (2), (4), and (5)

D) (1), (3), and (6)

E) (4), (5), and (6)

C

4

One approach for using multifactor models is to use factors that capture systematic risk. Which of the following is not a common factor used in this approach?

A) Unexpected changes in inflation

B) Consumer confidence

C) Yield curve shifts

D) Unexpected changes in real GDP

E) All of the above are common factors used to measure systematic risk

A) Unexpected changes in inflation

B) Consumer confidence

C) Yield curve shifts

D) Unexpected changes in real GDP

E) All of the above are common factors used to measure systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

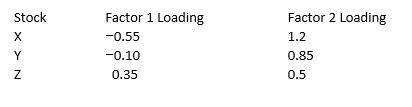

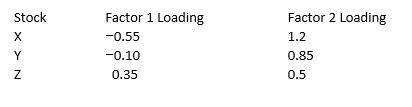

Refer to the following information. Consider the three stocks, stock X, stock Y and stock Z, that have the following factor loadings (or factor betas).

The expected prices one year from now for stocks X, Y, and Z are

The expected prices one year from now for stocks X, Y, and Z are

A) €53.55, €54.4, €55.25

B) €45.35, €54.4, €55.25

C) €55.55, €56.35, €57.15

D) €50, €50, €50

E) €51.35, €47.79, €51.58.

The expected prices one year from now for stocks X, Y, and Z are

The expected prices one year from now for stocks X, Y, and Z areA) €53.55, €54.4, €55.25

B) €45.35, €54.4, €55.25

C) €55.55, €56.35, €57.15

D) €50, €50, €50

E) €51.35, €47.79, €51.58.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

In one of their empirical tests of the APT, Roll and Ross examined the relationship between a security's returns and its own standard deviation. A finding of a statistically significant relationship would indicate that

A) APT is valid because a security's unsystematic component would be eliminated by diversification.

B) APT is valid because non-diversifiable components should be explained by factor sensitivities.

C) APT is invalid because a security's unsystematic component would be eliminated by diversification.

D) APT is invalid because standard deviation is not an appropriate factor.

E) None of the above.

A) APT is valid because a security's unsystematic component would be eliminated by diversification.

B) APT is valid because non-diversifiable components should be explained by factor sensitivities.

C) APT is invalid because a security's unsystematic component would be eliminated by diversification.

D) APT is invalid because standard deviation is not an appropriate factor.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a microeconomic (or characteristic) based risk factor model the following factor would be one of many appropriate factors:

A) confidence risk.

B) maturity risk.

C) expected inflation risk.

D) call risk.

E) return difference between small capitalisation and large capitalisation stocks.

A) confidence risk.

B) maturity risk.

C) expected inflation risk.

D) call risk.

E) return difference between small capitalisation and large capitalisation stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume that you are embarking on a test of the small-firm effect using APT. You form 10 size-based portfolios. The following finding would suggest there is evidence supporting APT:

A) the top five size-based portfolios should have excess returns that exceed the bottom five size-based portfolios.

B) the bottom five size-based portfolios should have excess returns that exceed the top five size-based portfolios.

C) the ten portfolios must have excess returns not significantly different from zero.

D) the ten portfolios must have excess returns significantly different from zero.

E) none of the above.

A) the top five size-based portfolios should have excess returns that exceed the bottom five size-based portfolios.

B) the bottom five size-based portfolios should have excess returns that exceed the top five size-based portfolios.

C) the ten portfolios must have excess returns not significantly different from zero.

D) the ten portfolios must have excess returns significantly different from zero.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

To date, the results of empirical tests of the Arbitrage Pricing Model have been

A) clearly favourable.

B) clearly unfavourable.

C) mixed.

D) unavailable.

E) biased.

A) clearly favourable.

B) clearly unfavourable.

C) mixed.

D) unavailable.

E) biased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

Consider a two-factor APT model where the first factor is changes in the 30-year T-bond rate, and the second factor is the per cent growth in GNP. Based on historical estimates you determine that the risk premium for the interest rate factor is 0.02, and the risk premium on the GNP factor is 0.03. For a particular asset, the response coefficient for the interest rate factor is −1.2, and the response coefficient for the GNP factor is 0.80. The rate of return on the zero-beta asset is 0.03. Calculate the expected return for the asset.

A) 5.0%

B) 2.4%

C) −3.0%

D) −2.4%

E) 3.0%

A) 5.0%

B) 2.4%

C) −3.0%

D) −2.4%

E) 3.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the APT model the idea of riskless arbitrage is to assemble a portfolio that

A) requires some initial wealth, will bear no risk, and still earn a profit.

B) requires no initial wealth, will bear no risk, and still earn a profit.

C) requires no initial wealth, will bear no systematic risk, and still earn a profit.

D) requires no initial wealth, will bear no unsystematic risk, and still earn a profit.

E) requires some initial wealth, will bear no systematic risk, and still earn a profit.

A) requires some initial wealth, will bear no risk, and still earn a profit.

B) requires no initial wealth, will bear no risk, and still earn a profit.

C) requires no initial wealth, will bear no systematic risk, and still earn a profit.

D) requires no initial wealth, will bear no unsystematic risk, and still earn a profit.

E) requires some initial wealth, will bear no systematic risk, and still earn a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

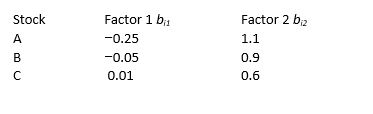

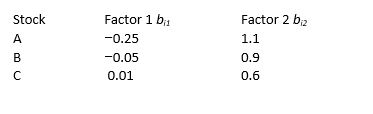

Refer to the following information. Stocks A, B, and C have two risk factors with the following beta coefficients. The zero-beta return (λ0) = 0.025 and the risk premiums for the two factors are (λ1) = 0.12 and (λ0) = 0.10.

Stock Factor 1 bi1 Factor 2 bi2

Calculate the expected returns for stocks A, B, C.

Calculate the expected returns for stocks A, B, C.

A B C

A) 0.082 0.091 0.033

B) 0.105 0.109 0.032

C) 0.132 0.128 0.033

D) 0.165 0.121 0.032

E) 0.850 0.850 0.610

Stock Factor 1 bi1 Factor 2 bi2

Calculate the expected returns for stocks A, B, C.

Calculate the expected returns for stocks A, B, C.A B C

A) 0.082 0.091 0.033

B) 0.105 0.109 0.032

C) 0.132 0.128 0.033

D) 0.165 0.121 0.032

E) 0.850 0.850 0.610

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

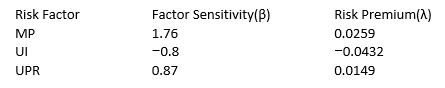

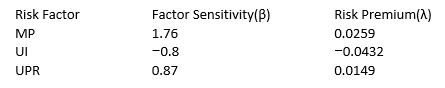

The table below provides factor risk sensitivities and factor risk premia for a three factor model for a particular asset where factor 1 is MP the growth rate in US industrial production, factor 2 is UI the difference between actual and expected inflation, and factor 3 is UPR the unanticipated change in bond credit spread.  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

A) 12.32%

B) 9.32%

C) 4.56%

D) 6.32%

E) 8.02%

Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.A) 12.32%

B) 9.32%

C) 4.56%

D) 6.32%

E) 8.02%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Refer to the following list. Which are not assumptions of the Arbitrage Pricing model? (1) Capital markets are perfectly competitive.

(2) Quadratic utility function.

(3) Investors prefer more wealth to less wealth with certainty.

(4) Normally distributed security returns.

(5) Representation as a K factor model.

(6) A market portfolio that is mean-variance efficient.

A) (1) and (3)

B) (1), (2), and (3)

C) (1), (2), and (5)

D) (2), (4), and (6)

E) All six are assumptions

(2) Quadratic utility function.

(3) Investors prefer more wealth to less wealth with certainty.

(4) Normally distributed security returns.

(5) Representation as a K factor model.

(6) A market portfolio that is mean-variance efficient.

A) (1) and (3)

B) (1), (2), and (3)

C) (1), (2), and (5)

D) (2), (4), and (6)

E) All six are assumptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a multifactor model, confidence risk represents

A) unanticipated changes in the level of overall business activity.

B) unanticipated changes in investors' desired time to receive payouts.

C) unanticipated changes in short term and long term inflation rates.

D) unanticipated changes in the willingness of investors to take on investment risk.

E) none of the above.

A) unanticipated changes in the level of overall business activity.

B) unanticipated changes in investors' desired time to receive payouts.

C) unanticipated changes in short term and long term inflation rates.

D) unanticipated changes in the willingness of investors to take on investment risk.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck