Deck 10: Income, Deductions, and Credits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/136

العب

ملء الشاشة (f)

Deck 10: Income, Deductions, and Credits

1

Sergio was required by the city to pay $2,000 for the cost of new curbing installed by the city in front of his personal residence. The new curbing was installed throughout Sergio's neighborhood as part of a street upgrade project. Sergio may not deduct $2,000 as a tax, but he may add the $2,000 to the basis of his property.

True

2

Grace's sole source of income is from a restaurant that she owns and operates as a proprietorship. Any state income tax Grace pays on the business net income must be deducted as a business expense rather than as an itemized deduction.

False

3

A taxpayer may not deduct the cost of new curbing (relative to a personal residence), even if the construction is required by the city and the curbing provides an incidental benefit to the public welfare.

True

4

Phyllis, a calendar year cash basis taxpayer who itemized deductions totaling $20,000, overpaid her 2015 state income tax and is entitled to a refund of $400 in 2016. Phyllis chooses to apply the $400 overpayment toward her state income taxes for 2016. She is required to recognize that amount as income in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

5

Upon the recommendation of a physician, Ed has a swimming pool installed at his residence because of a heart condition. If he is allowed to deduct all or part of the cost of the pool, Ed's increase in utility bills due to the operation of the pool qualifies as a medical expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

6

For purposes of computing the deduction for qualified residence interest, a qualified residence includes only the taxpayer's principal residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

7

Matt, a calendar year taxpayer, pays $11,000 in medical expenses in 2016. He expects $5,000 of these expenses to be reimbursed by an insurance company in 2017. In determining his medical expense deduction for 2016, Matt must reduce his 2016 medical expenses by the amount of the reimbursement he expects in 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

8

Georgia contributed $2,000 to a qualifying Health Savings Account in the current year. The entire amount qualifies as an expense deductible for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

9

In 2017, Rhonda received an insurance reimbursement for medical expenses incurred in 2016. She is not required to include the reimbursement in gross income in 2017 if she claimed the standard deduction in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

10

In April 2016, Bertie, a calendar year cash basis taxpayer, had to pay the state of Michigan additional income tax for 2015. Even though it relates to 2015, for Federal income tax purposes the payment qualifies as a tax deduction for tax year 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

11

Adrienne sustained serious facial injuries in a motorcycle accident. To restore her physical appearance, Adrienne had cosmetic surgery. She cannot deduct the cost of this procedure as a medical expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

12

Shirley pays FICA (employer's share) on the wages she pays her maid to clean and maintain Shirley's personal residence. The FICA payment is not deductible as an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

13

Bill paid $2,500 of medical expenses for his daughter, Marie. Marie is married to John and they file a joint return. Bill can include the $2,500 of expenses when calculating his medical expense deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

14

Herbert is the sole proprietor of a furniture store. He can deduct real property taxes on his store building as a business deduction but he cannot deduct state income taxes related to his net income from the furniture store as a business deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

15

The election to itemize is appropriate when total itemized deductions are less than the standard deduction based on the taxpayer's filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

16

Personal expenditures that are deductible as itemized deductions include medical expenses, Federal income taxes, state income taxes, property taxes on a personal residence, mortgage interest, and charitable contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

17

In January 2017, Pam, a calendar year cash basis taxpayer, made an estimated state income tax payment for 2016. The payment is deductible in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

18

Tom, whose MAGI is $40,000, paid $3,500 of interest on a qualified student loan in 2016. Tom is single. He may deduct the $3,500 interest as an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

19

Fees for automobile inspections, automobile titles and registration, bridge and highway tolls, parking meter deposits, and postage are not deductible if incurred for personal reasons, but they are deductible as deductions for AGI if incurred as a business expense by a self-employed taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

20

Chad pays the medical expenses of his son, James. James would qualify as Chad's dependent except that he earns $7,500 during the year. Chad may claim James' medical expenses even if he is not a dependent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

21

Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn. Judy may claim an $80 charitable contribution deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

22

Al contributed a painting to the Metropolitan Art Museum of St. Louis, Missouri. The painting, purchased six years ago, was worth $40,000 when donated, and Al's basis was $25,000. If this painting is immediately sold by the museum and the proceeds are placed in the general fund, Al's charitable contribution deduction is $25,000 (subject to percentage limitations).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

23

Interest paid or accrued during the tax year on aggregate acquisition indebtedness of $2 million or less ($1 million or less for married persons filing separate returns) is deductible as qualified residence interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

24

For all of the current year, Randy (a calendar year taxpayer) allowed the Salvation Army to use a building he owns rent-free. The building normally rents for $24,000 a year. Randy will be allowed a charitable contribution deduction this year of $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sadie mailed a check for $2,200 to a qualified charitable organization on December 31, 2016. The $2,200 contribution is deductible on Sadie's 2016 tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

26

Dan contributed stock worth $16,000 to his college alma mater, a qualified charity. He acquired the stock 11 months ago for $4,000. He may deduct $16,000 as a charitable contribution deduction (subject to percentage limitations).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

27

Employee business expenses for travel qualify as itemized deductions subject to the 2%-of-AGI floor if they are not reimbursed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

28

Excess charitable contributions that come under the 30%-of-AGI ceiling are always subject to the 30%-of-AGI ceiling in the carryover year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

29

Leona borrows $100,000 from First National Bank and uses the proceeds to purchase City of Houston bonds. The interest Leona pays on this loan is deductible as investment interest subject to the investment interest limits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

30

Charitable contributions that exceed the percentage limitations for the current year can be carried over for up to three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

31

In 2016, Allison drove 800 miles to volunteer in a project sponsored by a qualified charitable organization in Utah. In addition, she spent $250 for meals while away from home. In total, Allison may take a charitable contribution deduction of $112 (800 miles × $.14) relating to her transportation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

32

For purposes of computing the deduction for qualified residence interest, a qualified residence includes the taxpayer's principal residence and two other residences of the taxpayer or spouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

33

On December 31, 2016, Lynette used her credit card to make a $500 contribution to the United Way, a qualified charitable organization. She will pay her credit card balance in January 2017. If Lynette itemizes, she can deduct the $500 in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

34

Ronaldo contributed stock worth $12,000 to the Children's Protective Agency, a qualified charity. He acquired the stock 20 months ago for $7,000. He may deduct $7,000 as a charitable contribution deduction (subject to percentage limitations).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

35

Contributions to public charities in excess of 50% of AGI may be carried back 3 years or forward for up to 5 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

36

Points paid by the owner of a personal residence to refinance an existing mortgage must be capitalized and amortized over the life of the new mortgage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

37

A taxpayer pays points to obtain financing to purchase a second residence. At the election of the taxpayer, the points can be deducted as interest expense for the year paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

38

Joe, a cash basis taxpayer, took out a 12-month business loan on December 1, 2016. He prepaid all $3,600 of the interest on the loan on December 1, 2016. Joe can deduct only $300 of the prepaid interest in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

39

Letha incurred a $1,600 prepayment penalty to a lending institution because she paid off the mortgage on her home early. The $1,600 is deductible as interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

40

Capital assets donated to a public charity that would result in long-term capital gain if sold, are subject to the 30%-of-AGI ceiling limitation on charitable contributions for individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

41

Agnes receives a $5,000 scholarship which covers her tuition at Parochial High School. She may not exclude the $5,000 because the exclusion applies only to scholarships to attend college.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

42

Brooke works part-time as a waitress in a restaurant. For groups of 7 or more customers, the customer is charged 15% of the bill for Brooke's services. For parties of less than 7, the tips are voluntary. Brooke received $11,000 from the groups of 7 or more and $7,000 in voluntary tips from all other customers. Using the customary 15% rate, her voluntary tips would have been only $6,000. Brooke must include $18,000 ($11,000 + $7,000) in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

43

George and Erin are divorced, and George is required to pay Erin $20,000 of alimony each year. George earns $75,000 a year. Erin is required to include the alimony payments in gross income although George earned the income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

44

Betty received a graduate teaching assistantship that was awarded on the basis of academic achievement. The payments must be included in her gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

45

After the divorce, Jeff was required to pay $18,000 per year to his former spouse, Darlene, who had custody of their child. Jeff's payments will be reduced to $12,000 per year in the event the child dies or reaches age 21. During the year, Jeff paid the $18,000 required under the divorce agreement. Darlene must include the $12,000 in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

46

A taxpayer's earned income credit is dependent on the number of his or her qualifying children.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

47

Workers' compensation benefits are included in gross income if the employer also pays the employee while the employee is recovering from his or her injury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

48

In December 2016, Emily, a cash basis taxpayer, received a $2,500 cash scholarship for the Spring semester of 2017. However, she did not use the funds to pay the tuition until January 2017. Emily can exclude the $2,500 from her gross income in 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

49

An individual generally may claim a credit for adoption expenses in the year in which the expenses are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

50

In 2016, Theresa was in an automobile accident and suffered physical injuries. The accident was caused by Ramon's negligence. In 2017, Theresa collected from his insurance company. She received $15,000 for loss of income, $10,000 for pain and suffering, $50,000 for punitive damages, and $6,000 for medical expenses which she had deducted on her 2016 tax return (the amount in excess of 10% of adjusted gross income). As a result of the above, Theresa's 2017 gross income is increased by $56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

51

A phaseout of certain itemized deductions applies for all taxpayers who choose to itemize their deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a scholarship does not satisfy the requirements for a gift, the scholarship must be included in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

53

The earned income credit is available only if the taxpayer has at least one qualifying child in the household.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

54

John told his nephew, Steve, "if you maintain my house when I cannot, I will leave the house to you when I die." Steve maintained the house and when John died Steve inherited the house. The value of the residence can be excluded from Steve's gross income as an inheritance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

55

Jacob and Emily were co-owners of a personal residence. As part of their divorce agreement, Emily paid Jacob cash for his interest in the personal residence. This cash payment results in a taxable gain to Jacob if he receives more cash than his share of the cost of the residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

56

Paula transfers stock to her former spouse, Fred. The transfer is pursuant to a divorce agreement. Paula's cost of the stock was $75,000 and its fair market value on the date of the transfer is $95,000. Fred later sells the stock for $100,000. Fred's recognized gain from the sale of the stock is $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ashley received a scholarship to be used as follows: tuition $6,000; room and board $9,000; and books and laboratory supplies $2,000. Ashley is required to include only $9,000 in her gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

58

Ted earned $150,000 during the current year. He paid Alice, his former wife, $75,000 in alimony. Under these facts, the tax is paid by the person who benefits from the income rather than the person who earned the income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

59

The child tax credit is based on the number of the taxpayer's qualifying children under age 17.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

60

Gambling losses may be deducted to the extent of the taxpayer's gambling winnings. Such losses are subject to the 2%-of-AGI floor for miscellaneous itemized deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

61

Barry and Larry, who are brothers, are equal owners in Chickadee Corporation. On July 1, 2016, each loans the corporation $10,000 at an annual interest rate of 10%. Both shareholders are on the cash method of accounting, while Chickadee Corporation is on the accrual method. All parties use the calendar year for tax purposes. On June 30, 2017, Chickadee repays the loans of $20,000 together with the specified interest of $2,000. How much of the interest can Chickadee Corporation deduct in 2016?

A)$0

B)$500

C)$1,000

D)$2,000

E)None of the above

A)$0

B)$500

C)$1,000

D)$2,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

62

Edna had an accident while competing in a rodeo. She sustained facial injuries that required cosmetic surgery. While having the surgery done to restore her appearance, she had additional surgery done to reshape her chin, which was not injured in the accident. The surgery to restore her appearance cost $9,000 and the surgery to reshape her chin cost $6,000. How much of Edna's surgical fees will qualify as a deductible medical expense (before application of the 10%-of-AGI floor)?

A)$0

B)$6,000

C)$9,000

D)$15,000

E)None of the above

A)$0

B)$6,000

C)$9,000

D)$15,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

63

Brad, who uses the cash method of accounting, lives in a state that imposes an income tax (including withholding from wages). On April 14, 2016, he files his state return for 2015, paying an additional $600 in state income taxes. During 2016, his withholdings for state income tax purposes amount to $3,550. On April 13, 2017, he files his state return for 2016 claiming a refund of $800. Brad receives the refund on June 3, 2017. If he itemizes deductions, how much may Brad claim as a deduction for state income taxes on his Federal income tax return for calendar year 2016 (filed in April 2017)?

A)$3,350

B)$3,550

C)$4,150

D)$5,150

E)None of the above

A)$3,350

B)$3,550

C)$4,150

D)$5,150

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

64

For purposes of computing the credit for child and dependent care expenses, the qualifying employment-related expenses are limited to an individual's actual or deemed earned income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

65

Child care payments to a relative are not eligible for the credit for child and dependent care expenses if the relative is a child (under age 19) of the taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

66

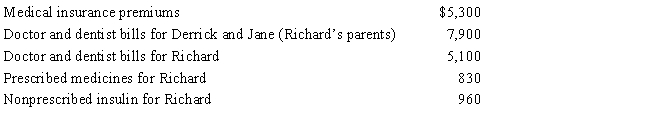

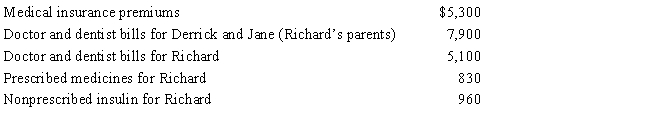

Richard, age 50, is employed as an actuary. For calendar year 2016, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2016 and received the reimbursement in January 2017. What is Richard's maximum allowable medical expense deduction for 2016?

A)$0

B)$7,090

C)$13,000

D)$20,090

E)None of the above

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2016 and received the reimbursement in January 2017. What is Richard's maximum allowable medical expense deduction for 2016?

A)$0

B)$7,090

C)$13,000

D)$20,090

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

67

Both education tax credits are available for qualified tuition expenses, and in certain instances, also may be available for room and board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

68

Fred and Lucy are married, ages 33 and 32, and together have AGI of $120,000 in 2016. They have four dependents and file a joint return. They pay $5,000 for a high deductible health insurance policy and contribute $2,600 to a qualified Health Savings Account. During the year, they paid the following amounts for medical care: $9,200 in doctor and dentist bills and hospital expenses, and $3,000 for prescribed medicine and drugs. In October 2016, they received an insurance reimbursement of $4,400 for the hospitalization. They expect to receive an additional reimbursement of $1,000 in January 2017. Determine the maximum itemized deduction allowable for medical expenses in 2016.

A)$800

B)$3,400

C)$9,200

D)$12,800

E)None of the above

A)$800

B)$3,400

C)$9,200

D)$12,800

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

69

The maximum child tax credit under current law is $1,500 per qualifying child.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

70

Joseph and Sandra, married taxpayers, took out a mortgage on their home for $350,000 15 years ago. In May of this year, when the home had a fair market value of $450,000 and they owed $250,000 on the mortgage, they took out a home equity loan for $220,000. They used the funds to purchase a single engine airplane to be used for recreational travel purposes. What is the maximum amount of debt on which they can deduct home equity interest?

A)$50,000

B)$100,000

C)$220,000

D)$230,000

E)None of the above

A)$50,000

B)$100,000

C)$220,000

D)$230,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

71

In 2016, Boris pays a $3,800 premium for high-deductible medical insurance for himself and his family. In addition, he contributes $3,400 to a Health Savings Account. Which of the following statements is true?

A)If Boris is self-employed, he may deduct $7,200 as a deduction for AGI.

B)If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical expense deduction.

C)If Boris is an employee, he may deduct $7,200 as a deduction for AGI.

D)If Boris is an employee, he may include $7,200 when calculating his itemized medical expense deduction.

E)None of the above.

A)If Boris is self-employed, he may deduct $7,200 as a deduction for AGI.

B)If Boris is self-employed, he may deduct $3,400 as a deduction for AGI and may include the $3,800 premium when calculating his itemized medical expense deduction.

C)If Boris is an employee, he may deduct $7,200 as a deduction for AGI.

D)If Boris is an employee, he may include $7,200 when calculating his itemized medical expense deduction.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

72

The maximum credit for child and dependent care expenses is $2,100 if only one spouse is employed and the other spouse is a full-time student.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

73

A taxpayer may qualify for the credit for child and dependent care expenses if the taxpayer's dependent is under age 17.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

74

Expenses that are reimbursed by a taxpayer's employer under a dependent care assistance program can also qualify for the credit for child and dependent care expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

75

The education tax credits (i.e., the American Opportunity credit and the lifetime learning credit) are available to help defray the cost of higher education regardless of the income level of the taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

76

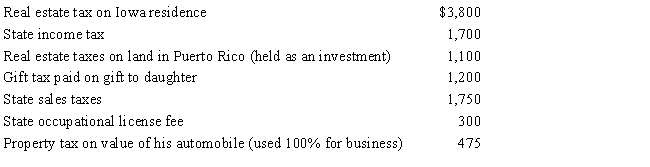

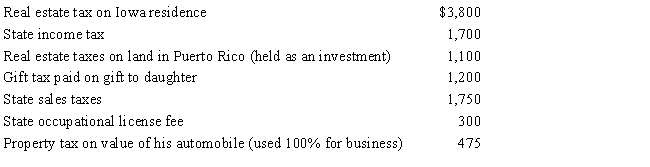

During 2016, Hugh, a self-employed individual, paid the following amounts:

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A)$6,600

B)$6,650

C)$7,850

D)$8,625

E)None of the above

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

A)$6,600

B)$6,650

C)$7,850

D)$8,625

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

77

Qualifying tuition expenses paid from the proceeds of a tax-exempt scholarship do not give rise to an education tax credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

78

Child and dependent care expenses include amounts paid for general household services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

79

Brad, who would otherwise qualify as Faye's dependent, had gross income of $9,000 during the year. Faye, who had AGI of $120,000, paid the following medical expenses in 2016:

Assuming Faye is age 45, she has a medical expense deduction of:

A)$3,150

B)$4,950

C)$10,350

D)$13,350

E)None of the above

Assuming Faye is age 45, she has a medical expense deduction of:

A)$3,150

B)$4,950

C)$10,350

D)$13,350

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

80

Rick and Carol Ryan, married taxpayers, took out a mortgage of $160,000 when purchasing their home ten years ago. In October of the current year, when the home had a fair market value of $200,000 and they owed $125,000 on the mortgage, the Ryans took out a home equity loan for $110,000. They used the funds to purchase a sailboat to be used for recreational purposes. The sailboat does not qualify as a residence. What is the maximum amount of debt on which the Ryans can deduct home equity interest?

A)$75,000

B)$90,000

C)$110,000

D)$125,000

E)None of the above

A)$75,000

B)$90,000

C)$110,000

D)$125,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck