Deck 16: Multijurisdictional Taxation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/129

العب

ملء الشاشة (f)

Deck 16: Multijurisdictional Taxation

1

Jaime received gross foreign-source dividend income of $250,000. Foreign taxes withheld on the dividend were $25,000. Jaime's total U.S. tax liability is $800,000 (the 35% marginal tax rate applies). Jaime's current year FTC is $87,500.

False

2

Winnie, Inc., a U.S. corporation, receives a dividend of $400,000 from a non-CFC foreign corporation. Deemed-paid foreign taxes attributable to the dividend are $120,000. If Winnie elects the FTC, its gross income attributable to this dividend is $400,000.

False

3

Subpart F income includes portfolio income like dividends and interest.

True

4

ForCo, a non-U.S. corporation based in Aldonza, purchases widgets from USCo, Inc., its U.S. parent corporation. The widgets are sold by ForCo to an unrelated foreign corporation in Aldonza. The income from sale of the widgets by ForCo is Subpart F foreign base company sales income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

5

In allocating interest expense between U.S. and foreign sources, a taxpayer elects to use either the tax basis of the income-producing assets or their fair market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

6

The sourcing rules of Federal income taxation apply to deductions as well as to income items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

7

Waltz, Inc., a U.S. taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000. Waltz's worldwide taxable income is $450,000, on which it owes U.S. taxes of $157,500 before FTC. Waltz's FTC is $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

8

U.S. individuals who receive dividends from foreign corporations may claim the deemed-paid foreign tax credit related to such dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

9

The "residence of seller" rule is used in determining the sourcing of all gross income and deductions of a U.S. multinational business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

10

Unused foreign tax credits are carried back two years and then forward 20 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

11

Kipp, a U.S. shareholder under the CFC provisions, owns 40% of a CFC. If the CFC's Subpart F income for the taxable year is $200,000, Kipp is taxed on receipt of a constructive dividend of $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

12

Income tax treaties provide for either higher or lower withholding tax rates on interest income than the rate provided under U.S. statutory law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

13

Twenty unrelated U.S. persons equally own all of the stock of Quigley, a foreign corporation. Quigley is a CFC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

14

ForCo, a subsidiary of a U.S. corporation incorporated in Belgium, manufactures widgets in Belgium and sells the widgets to its 100%-owned subsidiary in Germany. The income from the sale of widgets is not Subpart F foreign base company sales income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

15

A "U.S. shareholder" for purposes of CFC classification is any U.S. person who owns directly, indirectly, and constructively at least 50% of the voting power of a foreign corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

16

The United States has in force income tax treaties with about 70 countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

17

Jokerz, a CFC of a U.S. parent, generated $80,000 Subpart F foreign base company services income in its first year of operations. The next year, Jokerz distributes $50,000 cash to the parent, from those service profits. The parent is taxed on $0 in the first year (tax deferral rules apply) and $50,000 in the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

18

The IRS can use § 482 reallocations to assure that transactions between related parties are properly reflected in a tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

19

Hendricks Corporation, a domestic corporation, owns 40 percent of Shane Corporation and 55 percent of Ferrell Corporation, both foreign corporations. Ferrell owns the other 60 percent of Shane Corporation. Both Shane and Ferrell are CFCs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

20

A U.S. taxpayer may take a current FTC equal to the greater of the FTC limit or the actual foreign taxes (direct or indirect) paid or accrued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

21

If a state follows Federal income tax rules, the state's tax compliance and enforcement become easier to accomplish.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

22

In most states, a taxpayer's income is apportioned on the basis of a formula measuring the extent of business contact, and allocated according to the location of property owned or used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

23

The U.S. system for taxing income earned outside its borders by U.S. persons is referred to as the territorial approach, because only income earned within the U.S. border is subject to taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

24

The U.S. system for taxing income earned inside its borders by non-U.S. persons is referred to as inbound taxation because such foreign persons are earning income by coming into the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

25

Nico lives in California. She was born in Peru but holds a green card. Nico is a nonresident alien (NRA).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

26

All of the U.S. states use an apportionment formula based on the sales, property, and payroll factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

27

Most states begin the computation of corporate taxable income with an amount from the Federal income tax return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

28

Typically, sales/use taxes constitute about 20 percent of a state's annual tax collections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

29

Carol, a citizen and resident of Adagio, reports gross income that is effectively connected with a U.S. business. No deductions are allowed against this income, and Carol's U.S. tax rate is a flat 30 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

30

All of the U.S. states have adopted a tax based on the net taxable income of corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

31

The purpose of the transfer pricing rules is to ensure that taxpayers have ultimate flexibility in shifting profits between related entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

32

Politicians frequently use tax credits and exemptions to create economic development incentives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

33

A domestic corporation is one whose assets are primarily located in the U.S. For this purpose, the primarily located test (>50%) applies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

34

A typical state taxable income subtraction modification is the interest income earned from another state's bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

35

Freda was born and continues to live in Uruguay. She exports widgets to U.S. customers. The U.S. does not have in force an income tax treaty with Uruguay. Freda's net U.S. income from the widgets is subject to a flat 30% Federal income tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

36

A state can levy an income tax on a business only if the business was incorporated in the state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

37

A typical state taxable income addition modification is for the Federal income tax paid for the tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

38

Nonbusiness income receives tax-exempt treatment under all state corporate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

39

Under P.L. 86-272, the taxpayer is exempt from state taxes on income resulting from the mere solicitation of orders for the sale of stocks and bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

40

Typical indicators of income-tax nexus include the presence of customers in the state.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

41

The property factor includes land and buildings used for business purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

42

Wellington, Inc., a U.S. corporation, owns 30% of a CFC that has $50 million of earnings and profits for the current year. Included in that amount is $20 million of Subpart F income. Wellington has been a CFC for the entire year and makes no distributions in the current year. Wellington must include in gross income (before any § 78 gross-up):

A)$0.

B)$6 million.

C)$20 million.

D)$50 million.

A)$0.

B)$6 million.

C)$20 million.

D)$50 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

43

In which of the following independent situations would Slane, a foreign corporation, be classified as a controlled foreign corporation? The Slane stock is directly owned 12% by Jen, 10% by Kathy, 12% by Leslie, 10% by David, 8% by Ben, and 48% by Mike.

A)Jen, Kathy, Leslie, David, Ben, and Mike are all U.S. citizens.

B)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. David is married to Kathy. Mike is a foreign resident and citizen.

C)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. Ben is Mike's son. Mike is a foreign resident and citizen.

D)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. Mike is a foreign resident and citizen.

A)Jen, Kathy, Leslie, David, Ben, and Mike are all U.S. citizens.

B)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. David is married to Kathy. Mike is a foreign resident and citizen.

C)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. Ben is Mike's son. Mike is a foreign resident and citizen.

D)Jen, Kathy, Leslie, David, and Ben are all U.S. citizens. Mike is a foreign resident and citizen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is false in regard to the U.S. income tax treaty program?

A)There are about 70 bilateral income tax treaties between the U.S. and other countries.

B)Tax treaties generally provide for primary taxing rights that require the other treaty partner to allow a credit for the taxes paid on the twice-taxed income.

C)U.S. income tax treaties are written to set up a "network" of up to five foreign countries that are covered by the treaty language.

D)None of the above statements is false.

A)There are about 70 bilateral income tax treaties between the U.S. and other countries.

B)Tax treaties generally provide for primary taxing rights that require the other treaty partner to allow a credit for the taxes paid on the twice-taxed income.

C)U.S. income tax treaties are written to set up a "network" of up to five foreign countries that are covered by the treaty language.

D)None of the above statements is false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

45

Double weighting the sales factor effectively decreases the corporate income tax burden on taxpayers based in the state, such as entities with in-state headquarters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

46

USCo, a U.S. corporation, purchases inventory from distributors within the U.S. and resells this inventory to customers outside the U.S., with title passing outside the U.S. Profit on the sale is $10,000. What is the source of the USCo's inventory sales income?

A)$5,000 U.S. source and $5,000 foreign source.

B)$5,000 U.S. source and $5,000 sourced based on location of the pertinent manufacturing assets.

C)$10,000 U.S. source.

D)$10,000 foreign source.

A)$5,000 U.S. source and $5,000 foreign source.

B)$5,000 U.S. source and $5,000 sourced based on location of the pertinent manufacturing assets.

C)$10,000 U.S. source.

D)$10,000 foreign source.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following income items does not represent Subpart F income if it is earned by a controlled foreign corporation in Fredonia? Purchase of inventory from the U.S. parent, followed by:

A)Sale to anyone outside Fredonia.

B)Sale to anyone inside Fredonia.

C)Sale to a related party outside Fredonia.

D)Sale to a non-related party outside Fredonia.

A)Sale to anyone outside Fredonia.

B)Sale to anyone inside Fredonia.

C)Sale to a related party outside Fredonia.

D)Sale to a non-related party outside Fredonia.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

48

A tax haven often is:

A)A country with high internal income taxes.

B)A country with no or low internal income taxes.

C)A country without income tax treaties.

D)A country that prohibits "treaty shopping."

A)A country with high internal income taxes.

B)A country with no or low internal income taxes.

C)A country without income tax treaties.

D)A country that prohibits "treaty shopping."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

49

The property factor includes business assets that the taxpayer owns, but also those merely used under a lease agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

50

A controlled foreign corporation (CFC) realizes Subpart F income from:

A)Purchase of inventory from unrelated U.S. person and sale outside the CFC country.

B)Purchase of inventory from a related U.S. person and sale outside the CFC country.

C)Services performed for the U.S. parent in a country in which the CFC was organized.

D)Services performed on behalf of an unrelated party in a country outside the country in which the CFC was organized.

A)Purchase of inventory from unrelated U.S. person and sale outside the CFC country.

B)Purchase of inventory from a related U.S. person and sale outside the CFC country.

C)Services performed for the U.S. parent in a country in which the CFC was organized.

D)Services performed on behalf of an unrelated party in a country outside the country in which the CFC was organized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

51

Without the foreign tax credit, double taxation would result when:

A)The United States taxes the U.S.-source income of a U.S. resident.

B)A foreign country taxes the foreign-source income of a nonresident alien.

C)The United States and a foreign country both tax the foreign-source income of a U.S. resident.

D)Terms of a tax treaty assign income taxing rights to the U.S.

A)The United States taxes the U.S.-source income of a U.S. resident.

B)A foreign country taxes the foreign-source income of a nonresident alien.

C)The United States and a foreign country both tax the foreign-source income of a U.S. resident.

D)Terms of a tax treaty assign income taxing rights to the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

52

U.S. income tax treaties typically:

A)Provide for taxation exclusively by the source country.

B)Provide for taxation exclusively by the country of residence.

C)Provide rules by which multinational taxpayers avoid double taxation.

D)Provide that the country with the highest tax rate will be allowed exclusive tax collection rights.

A)Provide for taxation exclusively by the source country.

B)Provide for taxation exclusively by the country of residence.

C)Provide rules by which multinational taxpayers avoid double taxation.

D)Provide that the country with the highest tax rate will be allowed exclusive tax collection rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

53

A unitary group of entities files a combined return that includes all of the affiliates' income and apportionment data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

54

Dividends received from a domestic corporation are totally U.S. source:

A)If the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

B)If the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

C)Unless the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

D)Unless the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

E)In all of the above cases.

A)If the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

B)If the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a U.S. trade or business.

C)Unless the corporation earns at least 80% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

D)Unless the corporation earns at least 25% of its gross income over the immediately preceding three tax years from the active conduct of a foreign trade or business.

E)In all of the above cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

55

An assembly worker earns a $50,000 salary and receives a fringe benefit package worth $15,000. The payroll factor assigns $65,000 for this employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

56

Section 482 is used by the Treasury to:

A)Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B)Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C)Increase information that is reported about U.S. corporations with non-U.S. owners.

D)All of the above.

E)None of the above.

A)Force taxpayers to use arms-length transfer pricing on transactions between related parties.

B)Reallocate income, deductions, etc., to a related taxpayer to minimize tax liability.

C)Increase information that is reported about U.S. corporations with non-U.S. owners.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

57

OutCo, a controlled foreign corporation in Meena (located outside the U.S.), earns $600,000 in net interest and dividend income from investments in the bonds and stock of unrelated companies. All of the dividend payors are located in Meena. OutCo's Subpart F income for the year is:

A)$0.

B)$0 only if OutCo is engaged in a trade or business in Meena.

C)$600,000.

D)$600,000 only if OutCo is engaged in a trade or business in Meena.

A)$0.

B)$0 only if OutCo is engaged in a trade or business in Meena.

C)$600,000.

D)$600,000 only if OutCo is engaged in a trade or business in Meena.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

58

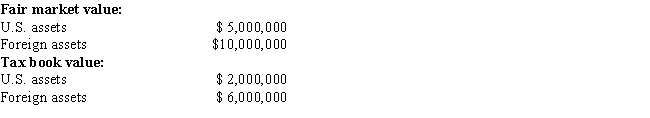

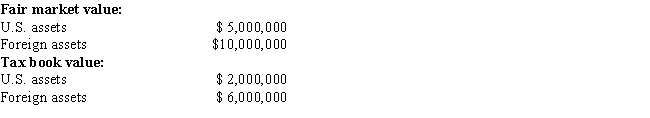

Qwan, a U.S. corporation, reports $250,000 interest expense for the tax year. None of the interest relates to nonrecourse debt or loans from affiliated corporations. Qwan's U.S. and foreign assets are reported as follows.

How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

A)Using tax book values.

B)Using tax book value for U.S. source and fair market value for foreign source.

C)Using fair market values.

D)Using fair market value for U.S. source and tax book value for foreign source.

How should Qwan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

A)Using tax book values.

B)Using tax book value for U.S. source and fair market value for foreign source.

C)Using fair market values.

D)Using fair market value for U.S. source and tax book value for foreign source.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

59

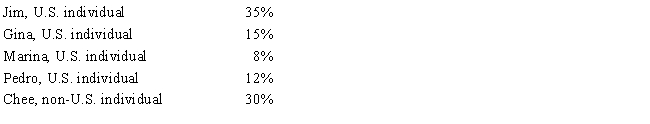

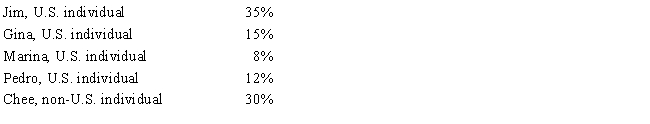

The following persons own Schlecht Corporation, a foreign corporation.

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A)Schlecht is not a CFC.

B)Chee includes $90,000 in gross income.

C)Marina is not a U.S. shareholder for purposes of determining whether Schlecht is a CFC.

D)Marina includes $24,000 in gross income.

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A)Schlecht is not a CFC.

B)Chee includes $90,000 in gross income.

C)Marina is not a U.S. shareholder for purposes of determining whether Schlecht is a CFC.

D)Marina includes $24,000 in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

60

A unitary business applies a combined apportionment formula, including data from operations of all of the affiliates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following statements regarding a non-U.S. person's U.S. tax consequences is true?

A)Non-U.S. persons may be subject to withholding tax on U.S.-source investment income even if not engaged in a U.S. trade or business.

B)Non-U.S. persons are subject to U.S. income or withholding tax only if they are engaged in a U.S. trade or business.

C)Non-U.S. persons are not taxed on gains from U.S. real property as long as such property is not used in a U.S. trade or business.

D)Once a non-U.S. person is engaged in a U.S. trade or business, the non-U.S. person's worldwide income is subject to U.S. taxation.

A)Non-U.S. persons may be subject to withholding tax on U.S.-source investment income even if not engaged in a U.S. trade or business.

B)Non-U.S. persons are subject to U.S. income or withholding tax only if they are engaged in a U.S. trade or business.

C)Non-U.S. persons are not taxed on gains from U.S. real property as long as such property is not used in a U.S. trade or business.

D)Once a non-U.S. person is engaged in a U.S. trade or business, the non-U.S. person's worldwide income is subject to U.S. taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kilps, a U.S. corporation, receives a $200,000 dividend from a 20% owned foreign corporation. The deemed-paid taxes attributable to this dividend are $40,000 and foreign taxes withheld on remittance of the dividend are $30,000. Kilps's U.S. tax liability before the FTC is $350,000, the gross dividend income is $240,000, and Kilps's worldwide taxable income is $1 million. Kilps's foreign tax credit for the taxable year is:

A)$84,000.

B)$70,000.

C)$40,000.

D)$30,000.

A)$84,000.

B)$70,000.

C)$40,000.

D)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

63

Peanut, Inc., a U.S. corporation, receives $500,000 of foreign-source interest income, on which foreign taxes of $5,000 are withheld. Peanut's worldwide taxable income is $900,000, and its U.S. Federal income tax liability before FTC is $270,000. What is Peanut's foreign tax credit?

A)$500,000

B)$275,000

C)$150,000

D)$5,000

A)$500,000

B)$275,000

C)$150,000

D)$5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

64

Dark, Inc., a U.S. corporation, operates Dunkel, an unincorporated branch manufacturing operation in Germany. Dark reports $100,000 of taxable income from Dunkel on its U.S. tax return, along with $400,000 of taxable income from its U.S. operations. Dark paid $40,000 in German income taxes related to the $100,000 of Dunkel income. Assuming a U.S. tax rate of 35%, what is Dark's U.S. tax liability after any allowable foreign tax credits?

A)$35,000

B)$135,000

C)$140,000

D)$175,000

A)$35,000

B)$135,000

C)$140,000

D)$175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

65

Columbia, Inc., a U.S. corporation, receives a $150,000 cash dividend from Starke, Ltd. Columbia owns 15% of Starke. Starke's E & P is $2 million and it has paid foreign taxes of $750,000 attributable to that E & P. What is Columbia's foreign tax credit related to the Starke dividend?

A)$22,500

B)$56,250

C)$150,000

D)$750,000

A)$22,500

B)$56,250

C)$150,000

D)$750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is a principle used in applying the income-sourcing rules under U.S. tax law?

A)The rules should be acceptable to both countries.

B)The rules should favor the U.S. Treasury.

C)The rules should favor the treasury of the non-U.S. country.

D)The rules should apply to income items only; deductions need not be sourced in this way.

A)The rules should be acceptable to both countries.

B)The rules should favor the U.S. Treasury.

C)The rules should favor the treasury of the non-U.S. country.

D)The rules should apply to income items only; deductions need not be sourced in this way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

67

Waldo, Inc., a U.S. corporation, owns 100% of Orion, Ltd., a foreign corporation. Orion earns only general basket income. During the current year, Orion paid Waldo a $5,000 dividend. The foreign tax credit associated with this dividend is $3,000. The foreign jurisdiction requires a withholding tax of 10%, so Waldo received only $4,500 in cash as a result of the dividend. What is Waldo's total U.S. gross income reported as a result of the $4,500 cash received?

A)$8,000

B)$5,000

C)$4,500

D)$3,000

A)$8,000

B)$5,000

C)$4,500

D)$3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following persons typically is not concerned with the U.S.-sourcing rules for gross income?

A)Foreign persons with U.S. activities.

B)Foreign persons with only foreign activities.

C)U.S. employees working abroad.

D)U.S. persons with foreign activities.

A)Foreign persons with U.S. activities.

B)Foreign persons with only foreign activities.

C)U.S. employees working abroad.

D)U.S. persons with foreign activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

69

Performance, Inc., a U.S. corporation, owns 100% of Krumb, Ltd., a foreign corporation. Krumb earns only general basket income. During the current year, Krumb paid Performance a $200,000 dividend. The foreign tax credit associated with this dividend is $30,000. The foreign jurisdiction requires a withholding tax of 30%, so Performance received only $140,000 in cash as a result of the dividend. What is Performance's total U.S. gross income reported as a result of the $140,000 cash received?

A)$30,000

B)$140,000

C)$200,000

D)$230,000

A)$30,000

B)$140,000

C)$200,000

D)$230,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not a U.S. person?

A)Domestic corporation.

B)Citizen of Turkey with U.S. permanent residence status (i.e., green card).

C)U.S. corporation 100% owned by a foreign corporation.

D)Foreign corporation 100% owned by a domestic corporation.

A)Domestic corporation.

B)Citizen of Turkey with U.S. permanent residence status (i.e., green card).

C)U.S. corporation 100% owned by a foreign corporation.

D)Foreign corporation 100% owned by a domestic corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

71

Maxim, Inc., a U.S. corporation, reports worldwide taxable income of $8 million, including a $900,000 dividend from ForCo, a wholly-owned foreign corporation. ForCo's undistributed E & P are $15 million and it has paid $6 million of foreign income taxes attributable to these earnings. What is Maxim's deemed paid foreign tax credit related to the dividend received (before consideration of any limitation)?

A)$0

B)$360,000

C)$900,000

D)$6 million

A)$0

B)$360,000

C)$900,000

D)$6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements regarding the U.S. taxation of non-U.S. persons is true?

A)A non-U.S. person's effectively connected U.S. business income is taxed by the U.S. only if it is portfolio income.

B)A non-U.S. person's effectively connected U.S. business income is subject to U.S. income taxation.

C)A non-U.S. person may earn income from selling U.S. real property without incurring any U.S. income tax.

D)A non-U.S. person must spend at least 183 days in the United States before any effectively connected income is subject to U.S. taxation.

A)A non-U.S. person's effectively connected U.S. business income is taxed by the U.S. only if it is portfolio income.

B)A non-U.S. person's effectively connected U.S. business income is subject to U.S. income taxation.

C)A non-U.S. person may earn income from selling U.S. real property without incurring any U.S. income tax.

D)A non-U.S. person must spend at least 183 days in the United States before any effectively connected income is subject to U.S. taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following persons typically is concerned with the U.S.-sourcing rules for gross income?

A)U.S. persons with only U.S. activities.

B)U.S. persons that earn only tax-exempt income.

C)U.S. persons with U.S. and non-U.S. activities.

D)Non-U.S. persons with only non-U.S. activities.

A)U.S. persons with only U.S. activities.

B)U.S. persons that earn only tax-exempt income.

C)U.S. persons with U.S. and non-U.S. activities.

D)Non-U.S. persons with only non-U.S. activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following determinations requires knowing the amount of one's foreign-source gross income?

A)Itemized deductions.

B)Foreign tax credit.

C)Calculation of a U.S. person's total taxable income.

D)Calculation of a U.S. person's deductible interest expense.

A)Itemized deductions.

B)Foreign tax credit.

C)Calculation of a U.S. person's total taxable income.

D)Calculation of a U.S. person's deductible interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following determinations does not require knowing the amounts of one's U.S.- versus foreign-source income?

A)Calculation of a U.S. person's total taxable income.

B)Calculation of U.S. withholding tax on the FDAP income of foreign persons.

C)Calculation of the foreign earned income exclusion.

D)Calculation of a foreign person's income effectively connected with carrying on a U.S. trade or business.

A)Calculation of a U.S. person's total taxable income.

B)Calculation of U.S. withholding tax on the FDAP income of foreign persons.

C)Calculation of the foreign earned income exclusion.

D)Calculation of a foreign person's income effectively connected with carrying on a U.S. trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements regarding the U.S. taxation of non-U.S. persons is true?

A)Non-U.S. persons never are subject to U.S. income tax.

B)Non-U.S. persons are subject to U.S. income tax only on gains from U.S. real property.

C)Non-U.S. persons can be subject to a withholding tax on U.S.-source portfolio income.

D)Non-U.S. persons can be subject to a withholding tax on foreign-source portfolio income.

A)Non-U.S. persons never are subject to U.S. income tax.

B)Non-U.S. persons are subject to U.S. income tax only on gains from U.S. real property.

C)Non-U.S. persons can be subject to a withholding tax on U.S.-source portfolio income.

D)Non-U.S. persons can be subject to a withholding tax on foreign-source portfolio income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

77

Chipper, Inc., a U.S. corporation, reports worldwide taxable income of $1 million, including a $300,000 dividend from Emma, Inc., a foreign corporation. Chipper's U.S. tax liability before FTC is $340,000. Chipper owns 20% of Emma. Emma's E & P after taxes is $8 million and it has paid foreign taxes of $2 million attributable to that E & P. If Chipper elects the FTC, its U.S. gross income with regard to the dividend from Emma is:

A)$300,000.

B)$340,000.

C)$375,000.

D)$400,000.

A)$300,000.

B)$340,000.

C)$375,000.

D)$400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

78

Krebs, Inc., a U.S. corporation, operates an unincorporated branch manufacturing operation in the U.K. Krebs, Inc., reports $900,000 of taxable income from the U.K. branch on its U.S. tax return, along with $1,600,000 of taxable income from its U.S. operations. The U.K. branch income is all general limitation basket income. Krebs paid $270,000 in U.K. income taxes related to the $900,000 in branch income. Assuming a U.S. tax rate of 35%, what is Krebs' U.S. tax liability after any allowable foreign tax credits?

A)$0

B)$270,000

C)$605,000

D)$875,000

A)$0

B)$270,000

C)$605,000

D)$875,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

79

Kunst, a U.S. corporation, generates $100,000 of foreign-source income in the general income basket and $40,000 of foreign-source income in the passive income basket. Kunst's worldwide taxable income is $1,200,000, and its U.S. tax liability before FTC is $420,000. Foreign taxes attributable to the general income basket are $60,000 and to the passive income are $4,000. What is Kunst's foreign tax credit for the tax year?

A)$64,000

B)$39,000

C)$35,000

D)$4,000

A)$64,000

B)$39,000

C)$35,000

D)$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck

80

Columbia, Inc., a U.S. corporation, receives a $150,000 cash dividend from Starke, Ltd. Columbia owns 15% of Starke. Starke's E & P is $2 million and it has paid foreign taxes of $750,000 attributable to that E & P. What is Columbia's gross income related to the Starke dividend?

A)$206,250

B)$150,000

C)$56,250

D)$22,500

A)$206,250

B)$150,000

C)$56,250

D)$22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 129 في هذه المجموعة.

فتح الحزمة

k this deck