Deck 5: Completing the Accounting Cycle Closing and Reversing Entries

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 5: Completing the Accounting Cycle Closing and Reversing Entries

1

Interim statements are:

A) summary financial statements.

B) only prepared for external users.

C) used by creditors to deal with an emergency.

D) prepared between the annual reports, usually monthly, quarterly or half-yearly.

A) summary financial statements.

B) only prepared for external users.

C) used by creditors to deal with an emergency.

D) prepared between the annual reports, usually monthly, quarterly or half-yearly.

D

2

Closing entries refer to:

A) establishing zero balances in all ledger accounts.

B) establishing a zero balance in the cash at bank account.

C) establishing zero balances in the balance sheet accounts.

D) transferring income and expense account balances to the profit or loss summary account, which is then closed to the equity account.

A) establishing zero balances in all ledger accounts.

B) establishing a zero balance in the cash at bank account.

C) establishing zero balances in the balance sheet accounts.

D) transferring income and expense account balances to the profit or loss summary account, which is then closed to the equity account.

D

3

Balance sheet accounts are known as accounts because their balance at the end of one accounting period becomes their opening balance at the start of the next period.

A) open.

B) long-term.

C) permanent.

D) carry forward.

A) open.

B) long-term.

C) permanent.

D) carry forward.

C

4

Which of the following is a permanent account?

A) Prepaid rent

B) Rent expense

C) Sales revenue

D) Depreciation

A) Prepaid rent

B) Rent expense

C) Sales revenue

D) Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is the correct order for the steps in the closing process?

I Close the drawings account to the owner's capital account

II Balance the owner's capital account

III Transfer the profit or loss to the owner's capital account

IV Close the income and expense accounts to the profit or loss summary account

A) III, IV, II, I

B) IV, III, I, II

C) IV, III, I, II

D) IV, III, II, I

I Close the drawings account to the owner's capital account

II Balance the owner's capital account

III Transfer the profit or loss to the owner's capital account

IV Close the income and expense accounts to the profit or loss summary account

A) III, IV, II, I

B) IV, III, I, II

C) IV, III, I, II

D) IV, III, II, I

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

Adjusting entries prepared for interim financial statements are:

A) often recorded on a worksheet.

B) always recorded in the ledger.

C) always recorded in the journal.

D) none of these options. There are usually no adjusting entries made when interim financial statements are prepared.

A) often recorded on a worksheet.

B) always recorded in the ledger.

C) always recorded in the journal.

D) none of these options. There are usually no adjusting entries made when interim financial statements are prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

Income and expense accounts can be referred to as:

A) normal accounts.

B) permanent accounts.

C) temporary accounts.

D) profit accounts.

A) normal accounts.

B) permanent accounts.

C) temporary accounts.

D) profit accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Income and expenses are accumulated for only one year and are therefore known as:

A) current accounts.

B) short-term accounts.

C) yearly accounts.

D) temporary accounts.

A) current accounts.

B) short-term accounts.

C) yearly accounts.

D) temporary accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

entries are recorded at the end of a financial year to reduce expense and income accounts to zero balances.

A) end of period.

B) adjusting.

C) closing.

D) correcting.

A) end of period.

B) adjusting.

C) closing.

D) correcting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

In which order do these steps in the accounting cycle occur?

I Prepare adjusting entries

II Prepare financial statements

III Record business transactions in the journal

IV Post to the ledger

V Journalise closing entries

A) I, II, III, IV, V

B) III, IV, I, V, II

C) IV, II, I, III, V

D) III, II, IV, V, I

I Prepare adjusting entries

II Prepare financial statements

III Record business transactions in the journal

IV Post to the ledger

V Journalise closing entries

A) I, II, III, IV, V

B) III, IV, I, V, II

C) IV, II, I, III, V

D) III, II, IV, V, I

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Profit or Loss Summary account is what type of account?

A) short-term account

B) asset account

C) temporary account

D) current account

A) short-term account

B) asset account

C) temporary account

D) current account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not a temporary account?

A) Cash at bank

B) Interest revenue

C) Drawings

D) Rent expense

A) Cash at bank

B) Interest revenue

C) Drawings

D) Rent expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Prince Ltd's year-end trial balance includes the following accounts.

I) Cash

II) Sales revenue

III) Accounts receivable

IV) Owner's capital

V) Interest expense

VI) Interest payable

VII) Prepayments

Which of these are temporary accounts?

A) II, V and VII only

B) II, and V only

C) III and VI only

D) III, VI, and VII only

I) Cash

II) Sales revenue

III) Accounts receivable

IV) Owner's capital

V) Interest expense

VI) Interest payable

VII) Prepayments

Which of these are temporary accounts?

A) II, V and VII only

B) II, and V only

C) III and VI only

D) III, VI, and VII only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Closing an account means:

A) reducing the balance to zero.

B) transferring the balance to the trial balance.

C) transferring the balance to the balance sheet.

D) removing the account from the ledger.

A) reducing the balance to zero.

B) transferring the balance to the trial balance.

C) transferring the balance to the balance sheet.

D) removing the account from the ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Before calculating the profit for the period, the totals of the income statement columns on the worksheet are: total debits $70 000 and total credits $60 000. The amount of the profit or loss is:

A) $10 000 loss

B) $10 000 profit

C) $70 000 profit

D) $60 000 profit

A) $10 000 loss

B) $10 000 profit

C) $70 000 profit

D) $60 000 profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

Accounting entries made to reduce the temporary accounts to zero balances are known as:

A) correcting entries.

B) adjusting entries.

C) closing entries.

D) reversing entries.

A) correcting entries.

B) adjusting entries.

C) closing entries.

D) reversing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements about closing entries is correct?

A) The profit or loss summary account is used regularly when processing transactions for sales and expenses.

B) Computerised accounting systems have eliminated the need to close off the income and expense accounts.

C) Closing entries are made at the end of each accounting period whatever its length.

D) Closing entries are only made at the end of the accounting year.

A) The profit or loss summary account is used regularly when processing transactions for sales and expenses.

B) Computerised accounting systems have eliminated the need to close off the income and expense accounts.

C) Closing entries are made at the end of each accounting period whatever its length.

D) Closing entries are only made at the end of the accounting year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which accounts are closed in the closing process?

A) All ledger accounts

B) All balance sheet accounts

C) All unadjusted accounts

D) All income and expense accounts

A) All ledger accounts

B) All balance sheet accounts

C) All unadjusted accounts

D) All income and expense accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

In which order do these steps in the accounting cycle occur?

I Prepare reversing entries

Ii Prepare financial statements

Iii Prepare closing entries

Iv Prepare an adjusted trial balance

V Prepare adjusting entries

A) iii, v, i, iv, ii

B) v, iii, iv, i, ii

C) iv, iv, iii, ii, i

D) v, iii, i, ii, iv

I Prepare reversing entries

Ii Prepare financial statements

Iii Prepare closing entries

Iv Prepare an adjusted trial balance

V Prepare adjusting entries

A) iii, v, i, iv, ii

B) v, iii, iv, i, ii

C) iv, iv, iii, ii, i

D) v, iii, i, ii, iv

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is not recorded on a worksheet?

A) Drawings

B) Closing entries

C) Adjusting entries

D) Profit or loss for the period

A) Drawings

B) Closing entries

C) Adjusting entries

D) Profit or loss for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

The drawings account has a normal balance of $30 000. The correct entry to close this account is:

A) DR Profit or loss summary account $30 000; CR Drawings $30 000

B) DR Owner's capital account $30 000; CR Drawings $30 000

C) DR Drawings $30 000; CR Bank $30 000

D) DR Bank $30 000; CR Drawings $30 000

A) DR Profit or loss summary account $30 000; CR Drawings $30 000

B) DR Owner's capital account $30 000; CR Drawings $30 000

C) DR Drawings $30 000; CR Bank $30 000

D) DR Bank $30 000; CR Drawings $30 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is the correct treatment on the worksheet for the nominated item?

A) GST payable account, credit the income statement and credit the balance sheet.

B) Depreciation account, debit the balance sheet and credit the adjustments.

C) Cash at bank account, credit the adjustments and debit the balance sheet.

D) Profit earned, debit the income statement and credit the balance sheet.

A) GST payable account, credit the income statement and credit the balance sheet.

B) Depreciation account, debit the balance sheet and credit the adjustments.

C) Cash at bank account, credit the adjustments and debit the balance sheet.

D) Profit earned, debit the income statement and credit the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a loss has been incurred for the year, the profit or loss summary account, before it is closed off, has a_________ balance.

A) debit

B) credit

C) positive

D) negative

A) debit

B) credit

C) positive

D) negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

The main reason for preparing a post-closing trial balance is to:

A) determine if any closing entries have been missed.

B) determine if any adjusting entries have been missed.

C) confirm that the ledger is in balance at the start of the new accounting period.

D) prepare the financial reports.

A) determine if any closing entries have been missed.

B) determine if any adjusting entries have been missed.

C) confirm that the ledger is in balance at the start of the new accounting period.

D) prepare the financial reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which statement relating to closing entries is incorrect?

B) Closing entries are made each time interim financial reports are prepared.

B) Closing entries are only made once a year.

C) The need for closing entries arises from the accounting period assumption.

D) The closing process is simple with a computerised accounting system.

B) Closing entries are made each time interim financial reports are prepared.

B) Closing entries are only made once a year.

C) The need for closing entries arises from the accounting period assumption.

D) The closing process is simple with a computerised accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is the correct closing entry for a profit of $78 400?

A) DR Profit or loss summary account $78 400; CR Owner's capital account $78 400

B) DR Owner's capital account $78 400; CR Profit or loss summary account $78 400

C) DR Owner's capital account $78 400; CR Bank $78 400

D) No closing entry is required

A) DR Profit or loss summary account $78 400; CR Owner's capital account $78 400

B) DR Owner's capital account $78 400; CR Profit or loss summary account $78 400

C) DR Owner's capital account $78 400; CR Bank $78 400

D) No closing entry is required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

The correct closing entry for the bank account is:

A) DR Owner's capital account; CR Bank

B) DR Bank; CR Owner's capital account

C) DR Profit or loss summary account; CR Bank

D) No closing entry is required

A) DR Owner's capital account; CR Bank

B) DR Bank; CR Owner's capital account

C) DR Profit or loss summary account; CR Bank

D) No closing entry is required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

The salaries expense account on the worksheet shows an opening balance of $15 000. The worksheet includes a reversing entry for $1800 for salaries prepaid in the previous year and $1400 for salaries accrued in the current year. The balance of the salaries expense account that will be transferred to the income statement column is:

A) $11 800.

B) $14 600.

C) $15 400.

D) $18 200.

A) $11 800.

B) $14 600.

C) $15 400.

D) $18 200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

A trial balance produced after the completion of the closing process is called a:

A) ending trial balance.

B) completed trial balance.

C) post-closing trial balance.

D) closed trial balance.

A) ending trial balance.

B) completed trial balance.

C) post-closing trial balance.

D) closed trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which statement relating to the profit or loss summary account is incorrect?

A) The balance in the profit or loss summary account is transferred to the owner's capital account.

B) The profit or loss summary account is a permanent account.

C) The profit or loss summary account is established to summarise the balances in the income and expense accounts.

D) The balance in each income and expense account is transferred to the profit or loss summary account.

A) The balance in the profit or loss summary account is transferred to the owner's capital account.

B) The profit or loss summary account is a permanent account.

C) The profit or loss summary account is established to summarise the balances in the income and expense accounts.

D) The balance in each income and expense account is transferred to the profit or loss summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

The correct closing entry for sales income of $60 000 is:

A) DR Sales income $60 000; CR Capital $60 000

B) DR Capital $60 000; CR Sales income $60 000

C) DR Sales income $60 000; CR Profit or loss summary account $60 000

D) DR Profit or loss summary account $60 000; CR Sales income $60 000

A) DR Sales income $60 000; CR Capital $60 000

B) DR Capital $60 000; CR Sales income $60 000

C) DR Sales income $60 000; CR Profit or loss summary account $60 000

D) DR Profit or loss summary account $60 000; CR Sales income $60 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which adjustment would never require a reversing entry?

A) Income received in advance (cash received originally recorded in an income account)

B) Accrued wages

C) Prepaid rent

D) Depreciation

A) Income received in advance (cash received originally recorded in an income account)

B) Accrued wages

C) Prepaid rent

D) Depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

Telephone expenses for the year are $13 200. This amount is made up of cash payments of $12 500 and accrued telephone expenses of $700. What is the amount of telephone expenses that is closed to the profit and loss summary account?

A) Nil

B) $700

C) $12 500

D) $13 200

A) Nil

B) $700

C) $12 500

D) $13 200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

Closing which of the following accounts results in a debit entry to the profit or loss summary account?

A) Sales

B) Insurance expense

C) Interest revenue

D) Drawings

A) Sales

B) Insurance expense

C) Interest revenue

D) Drawings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

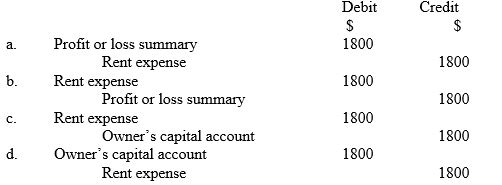

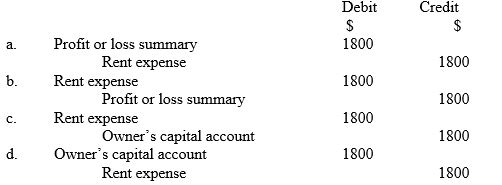

35

The balance of the rent expense account is $1800. The correct closing entry recorded in the general journal is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

Closing entries are recorded:

A) in the ledger only.

B) in the journal only.

C) in the journal and the ledger.

D) on the worksheet.

A) in the ledger only.

B) in the journal only.

C) in the journal and the ledger.

D) on the worksheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

The balance in the profit or loss summary account before it is closed represents:

A) total expenses.

B) profit (or loss) less drawings.

C) total owner's capital.

D) profit (or loss) for the period.

A) total expenses.

B) profit (or loss) less drawings.

C) total owner's capital.

D) profit (or loss) for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following accounts should be closed off to the profit or loss summary account at the end of the financial period?

A) Insurance expense

B) Sales income

C) Depreciation

D) All of these accounts.

A) Insurance expense

B) Sales income

C) Depreciation

D) All of these accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following accounts is closed to the profit or loss summary account?

A) GST receivable

B) Owner's drawings

C) Depreciation expense

D) Accrued wages

A) GST receivable

B) Owner's drawings

C) Depreciation expense

D) Accrued wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

The post-closing trial balance contains only:

A) balance sheet accounts.

B) temporary accounts.

C) income statement accounts.

D) asset and equity accounts.

A) balance sheet accounts.

B) temporary accounts.

C) income statement accounts.

D) asset and equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements is true?

A) reversing entries are compulsory.

B) all accruals must be reversed.

C) reversing entries are optional and are only made to simplify the recording process at the start of the new accounting period.

D) reversing entries are made on the last day of the financial year.

A) reversing entries are compulsory.

B) all accruals must be reversed.

C) reversing entries are optional and are only made to simplify the recording process at the start of the new accounting period.

D) reversing entries are made on the last day of the financial year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

Retained earnings is what type of account?

A) Equity

B) Income

C) Expenses

D) Asset

A) Equity

B) Income

C) Expenses

D) Asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume reversing entries are made by the entity. If wages of $2600 were accrued at the end of the year and the first payment of wages the following year was $33 100 how would this payment be recorded?

A) DR Salaries payable $2600; DR Salaries expense $30 500; CR Cash $33 100

B) DR Salaries expense $35 700; CR Salaries payable $2600; CR Cash $33 100

C) DR Salaries payable $2600; DR Salaries expense $33 100; CR Cash $35 700

D) DR Salaries expense $33 100; CR Cash $33 100

A) DR Salaries payable $2600; DR Salaries expense $30 500; CR Cash $33 100

B) DR Salaries expense $35 700; CR Salaries payable $2600; CR Cash $33 100

C) DR Salaries payable $2600; DR Salaries expense $33 100; CR Cash $35 700

D) DR Salaries expense $33 100; CR Cash $33 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements relating to reversing entries is correct?

A) Reversing entries are rarely used.

B) Reversing entries are never appropriate for accrual type entries.

C) Depreciation is an adjustment that requires reversing in the subsequent period.

D) There are alternative ways of dealing with the effect of accruals in subsequent periods without using reversing entries.

A) Reversing entries are rarely used.

B) Reversing entries are never appropriate for accrual type entries.

C) Depreciation is an adjustment that requires reversing in the subsequent period.

D) There are alternative ways of dealing with the effect of accruals in subsequent periods without using reversing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

Cash distributions authorised by the directors and paid to the owners of a company are called:

A) distributions.

B) bonuses.

C) accumulated profits.

D) dividends.

A) distributions.

B) bonuses.

C) accumulated profits.

D) dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements is correct with regards to closing the accounts of a partnership?

A) Partners are owners; therefore partner's salaries must be treated as drawings.

B) Partnership profit is credited to each partner's capital account according to the profit sharing agreement.

C) Partnership accounts use a retained earnings account instead of a profit or loss summary account.

D) A partnership loss for the period is carried forward and is not transferred to the partner's capital accounts.

A) Partners are owners; therefore partner's salaries must be treated as drawings.

B) Partnership profit is credited to each partner's capital account according to the profit sharing agreement.

C) Partnership accounts use a retained earnings account instead of a profit or loss summary account.

D) A partnership loss for the period is carried forward and is not transferred to the partner's capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

In accounting for a partnership, capital and drawings accounts are:

A) separate for all shareholders.

B) separate for each partner.

C) part of retained earnings.

D) combined for all partners.

A) separate for all shareholders.

B) separate for each partner.

C) part of retained earnings.

D) combined for all partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

The retained earnings balance of The Jackman Company was $50 000 on the first day of the accounting year. Profit during the year was $120 000. At the end of the accounting year a dividend of $15 000 was declared. The dividend will be paid the following year. The year-end balance of retained earnings is:

A) $120 000.

B) $185 000.

C) $105 000.

D) $155 000.

A) $120 000.

B) $185 000.

C) $105 000.

D) $155 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

High Country Ltd issued 50 000 shares for $1 each on 23 May. The correct entry to record this transaction is:

A) DR Bank $50 000; CR Share capital $50 000

B) DR Bank $50 000; CR Shareholder's equity $50 000

C) DR Bank $50 000; CR Retained earnings $50 000

D) DR Share capital $50 000; CR Bank $50 000

A) DR Bank $50 000; CR Share capital $50 000

B) DR Bank $50 000; CR Shareholder's equity $50 000

C) DR Bank $50 000; CR Retained earnings $50 000

D) DR Share capital $50 000; CR Bank $50 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

A post-closing trial balance is prepared so that:

A) the adjusting entries can be completed.

B) the entity can determine if any adjusting entries have been missed.

C) the equality of debits and credits in the general ledger can be tested to ensure the opening position is correct for the next period.

D) all pre-closing account balances can be confirmed as correct.

A) the adjusting entries can be completed.

B) the entity can determine if any adjusting entries have been missed.

C) the equality of debits and credits in the general ledger can be tested to ensure the opening position is correct for the next period.

D) all pre-closing account balances can be confirmed as correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

The two main categories of equity on a company's balance sheet are separated into:

A) Retained earnings and dividends

B) Share capital and dividends

C) Share capital and retained earnings

D) Retained earnings and reserves

A) Retained earnings and dividends

B) Share capital and dividends

C) Share capital and retained earnings

D) Retained earnings and reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

Assume that no reversing entries are made by the entity. How would the entity record the transaction for payment of wages if $5200 was accrued for wages at the end of the year and the first payment of wages in the following year was $63 900?

B) DR Salaries payable $5200; DR Salaries expense $58 700; CR Cash $63 900

C) DR Salaries expense $63 900; CR Salaries payable $5200; CR Cash $58 700

D) DR Salaries expense $63 900; CR Cash $63 900

D) DR Salaries expense $69 100; CR Salaries payable $5200; CR Cash $63 900

B) DR Salaries payable $5200; DR Salaries expense $58 700; CR Cash $63 900

C) DR Salaries expense $63 900; CR Salaries payable $5200; CR Cash $58 700

D) DR Salaries expense $63 900; CR Cash $63 900

D) DR Salaries expense $69 100; CR Salaries payable $5200; CR Cash $63 900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements relating to reversing entries is incorrect?

A) They are recorded on the first day of the new accounting year.

B) They reverse the effects of closing entries.

C) They are made to simplify the recording of regular transactions in the next period.

D) They reverse the effect of certain adjusting entries.

A) They are recorded on the first day of the new accounting year.

B) They reverse the effects of closing entries.

C) They are made to simplify the recording of regular transactions in the next period.

D) They reverse the effect of certain adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

The end of the financial year for Reynolds Ltd is 31 December. At that date, salaries and wages expenses of $580 000 is closed to the profit and loss summary account. This balance includes $550 000 for salaries and wages paid in cash during the year and accrued wages at the end of the year of $30 000. Reynolds Ltd records a reversing entry for the accrued wages on 1 January. The first payment to employees for salaries and wages in the new financial year is $35 000. This payment would be recorded as:

A) DR Salaries and wages expense $35 000; CR Bank $35 000

B) DR Salaries and wages expense $5 000; CR Bank $5 000

C) DR Accrued Salaries and wages $30 000; CR Bank $30 000

D) DR Salaries and wages expense $35 000; DR Accrued salaries and wages $30 000; CR Bank $65 000

A) DR Salaries and wages expense $35 000; CR Bank $35 000

B) DR Salaries and wages expense $5 000; CR Bank $5 000

C) DR Accrued Salaries and wages $30 000; CR Bank $30 000

D) DR Salaries and wages expense $35 000; DR Accrued salaries and wages $30 000; CR Bank $65 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following categories of adjusting entries are always reversed when an entity uses reversing entries in their accounting system?

I) Accrued Expenses

II) Accrued Revenue

III) Depreciation

A) All of these.

B) I and III only.

C) I and II only.

D) III only.

I) Accrued Expenses

II) Accrued Revenue

III) Depreciation

A) All of these.

B) I and III only.

C) I and II only.

D) III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

A post-closing trial balance provides:

A) the starting point for the preparation of the financial reports.

B) a list of out-of-balance accounts.

C) a summary of the adjusting entries yet to be recorded.

D) confirmation that the ledger is in balance at the start of the new accounting period.

A) the starting point for the preparation of the financial reports.

B) a list of out-of-balance accounts.

C) a summary of the adjusting entries yet to be recorded.

D) confirmation that the ledger is in balance at the start of the new accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

The income statement and the balance sheet for sole traders and partnerships are essentially the same except for transactions that directly affect:

A) profit.

B) income.

C) equity.

D) assets.

A) profit.

B) income.

C) equity.

D) assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Entries made at the beginning of the next accounting period to reverse the effect of various adjustments, are called:

A) re-adjusting entries.

B) reversing entries.

C) simplified entries.

D) negative entries.

A) re-adjusting entries.

B) reversing entries.

C) simplified entries.

D) negative entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

Dividends declared near the end of an accounting period require two accounting entries:

1) when the dividend is declared; and

2) when the dividend is paid.

The correct entry to record the declaration of a cash dividend of 10c a share calculated on 200 000 shares is:

A) DR Dividend payable $20 000; CR Bank $20 000

B) DR Bank $20 000; CR Share capital $20 000

C) DR Retained earnings $20 000; CR Dividend payable $20 000

D) DR Dividend payable $20 000; CR Retained earnings $20 000

1) when the dividend is declared; and

2) when the dividend is paid.

The correct entry to record the declaration of a cash dividend of 10c a share calculated on 200 000 shares is:

A) DR Dividend payable $20 000; CR Bank $20 000

B) DR Bank $20 000; CR Share capital $20 000

C) DR Retained earnings $20 000; CR Dividend payable $20 000

D) DR Dividend payable $20 000; CR Retained earnings $20 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of these is not a purpose of a post-closing trial balance?

A) Determining how much profit the entity has made.

B) Testing for the equality of debits and credits in the general ledger.

C) Making sure the ledger is correct as the starting point for the next financial period.

D) Checking that all the revenue and expense accounts have been closed-off.

A) Determining how much profit the entity has made.

B) Testing for the equality of debits and credits in the general ledger.

C) Making sure the ledger is correct as the starting point for the next financial period.

D) Checking that all the revenue and expense accounts have been closed-off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

On 1 November Yasmine Company Pty Ltd issued 100 000 shares for $5 each. The correct entry to record this transaction is:

A) DR Cash $500 000; CR Shareholder's equity $500 000

B) DR Cash $500 000; CR Share capital $500 000

C) DR Cash $500 000; CR Share capital $500 000

D) DR Shareholder's equity $500 000; CR Cash $500 000

A) DR Cash $500 000; CR Shareholder's equity $500 000

B) DR Cash $500 000; CR Share capital $500 000

C) DR Cash $500 000; CR Share capital $500 000

D) DR Shareholder's equity $500 000; CR Cash $500 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Declared dividends are recognised as:

A) a reduction in share capital.

B) a reduction in retained earnings.

C) an expense

D) an asset.

A) a reduction in share capital.

B) a reduction in retained earnings.

C) an expense

D) an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

At the end of the reporting period, a company is required to prepare which additional financial report?

A) Statement of retained profits

B) Statement of equity

C) Statement of changes in equity

D) Statement of liabilities

A) Statement of retained profits

B) Statement of equity

C) Statement of changes in equity

D) Statement of liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck