Deck 15: Investments and International Operations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/156

العب

ملء الشاشة (f)

Deck 15: Investments and International Operations

1

Cash equivalents are investments that are readily converted to known amounts of cash and mature within three months.

True

2

The consolidation method is used in accounting for long-term investments in equity securities with controlling influence.

True

3

Investments in held-for-trading securities are accounted for using the consolidation method.

False

4

Comprehensive income refers to all changes in equity during a period except those from owners' investments and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

5

There is fair value adjustment to the portfolio of held-to-maturity debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

6

Equity securities reflect a creditor relationship such as investments in notes and bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

7

Consolidated financial statements show the financial position, results of operations, and cash flows of all entities under the parent's control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bond sinking funds are examples of short-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

9

When an investor company owns more than 25% of the voting shares of an investee company, it has a controlling influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company holds $40,000 of 7% bonds as a held-to-maturity security. Assuming all prior interest entries have been accounted for, the bondholder's journal entry to record receipt of the semiannual interest payment includes a debit to Cash for $2,800 and a credit to Interest Revenue for $2,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

11

Any cash dividends received from equity securities are recorded as Dividend Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

12

Debt securities are recorded at cost when purchased, and interest revenue for investments in debt securities is recorded when earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

13

Long-term investments include investments in land or other assets not used in a company's operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

14

A controlling investor is called the parent, and the investee company is called the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

15

Short-term investments are intended to be converted into cash within the longer of one year or the current operating cycle of the business, and are readily convertible to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

16

Long-term investments are usually held as an investment of cash for use in current operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

17

Accounting for investments in securities depends on, among ther things, the contractual characteristics, e.g. debt or equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

18

Debt securities are recorded at cost when purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

19

Long-term investments can include funds earmarked for special purposes such as bond sinking funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

20

An investor purchased bonds and holds them to maturity. The investor's journal entry to record the interest accrued at the end of the period should include a debit to Interest Receivable and a credit to Interest Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

21

All companies desire a low return on total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company has net income of $130,500. Its net sales were $1,740,000 and its average total assets were $2,750,000. Its total asset turnover equals 4.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company has net income of $130,500. Its net sales were $1,740,000 and its average total assets were $2,750,000. Its profit margin equals 7.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consolidated statements are prepared as if a company is organized as one entity, with the amounts allocated for subsidiaries reported in the investment accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

25

Held-for-trading securities are always reported as current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

26

The price of one currency stated in terms of another currency is called a foreign exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

27

Return on total assets can be separated into the profit margin ratio and total asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

28

Profit margin is net sales divided by net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

29

Equity securities giving an investor significant influence over an investee are always considered short-term investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company should report its portfolio of held-for-trading securities at its fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

31

Held-to-maturity securities are equity securities a company intends and is able to hold until maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

32

Multinational corporations can be U.S. companies with operations in other countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

33

Accounting for long-term investments in held-to-maturity securities requires companies to record interest revenue as it is earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

34

Net profit margin reflects the percent of net income in each dollar of net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

35

Unrealized gains and losses on trading securities are reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

36

Investments in held-to-maturity debt securities are always current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a long-term investment in an equity security gives the investor significant influence over the investee, the investment is classified as available-for-sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the exchange rate for Canadian and U.S. dollars is 0.7382 to 1, this implies that 2 Canadian dollars will buy about1.48 worth of U.S. dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

39

Foreign exchange rates fluctuate due to many factors including changing political and economic conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

40

Held-for-trading securities are securities that are purchased by trading other securities rather than by paying cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

41

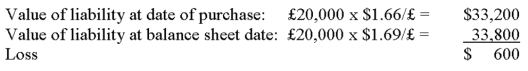

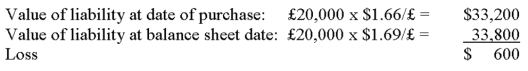

Sanuk purchased on credit 20,000 worth of parts from a British company when the exchange rate was 1.66 per British pound. At the year-end balance sheet date the exchange rate increased to $1.69. Sanuk must record a gain of $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

42

Long-term investments in available-for-sale securities are reported at fair value on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

43

Micron owns 30% of JVT shares. Micron received $6,500 in cash dividends from its investment in JVT. The entry to record receipt of these dividends includes a debit to Cash for $6,500 and a credit to Long-Term Investments for $6,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

44

Long-term investments:

A) Are current assets.

B) Include funds earmarked for a special purpose such as bond sinking funds.

C) Must be readily convertible to cash.

D) Are expected to be converted into cash within one year.

E) Include only equity securities.

A) Are current assets.

B) Include funds earmarked for a special purpose such as bond sinking funds.

C) Must be readily convertible to cash.

D) Are expected to be converted into cash within one year.

E) Include only equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

45

On May 1, Franke Co. purchases 2,000 shares of Computech for $25,000. This investment is considered to be an available-for-sale securities. On July 31 (Franke's year-end), these shares had a market value of $28,000. Franke should record a credit to Gain on Investment for $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

46

To prepare consolidated financial statements when a U. S. parent company has an international subsidiary, the international subsidiary's financial statements must be translated into U.S. dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

47

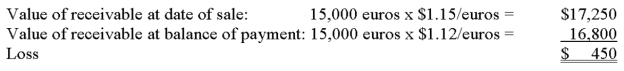

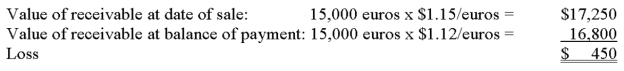

Brown Company sold supplies in the amount of 15,000 euros to a French company when the exchange rate was $1.15 per euro. At the time of payment, the exchange rate decreased to $1.12. Brown must record a loss of $450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

48

Long-term investments in debt securities not classified as trading or held-to-maturity securities are classified as available-for-sale securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

49

A U. S. Company's credit sale to an international customer allowing payment to be made in a foreign currency requires using the same exchange rate for the date of sale and the cash payment date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

50

Any unrealized gain or loss for the portfolio of available-for-sale securities is reported as profit or loss on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

51

On May 15, Briar Company purchased 10,000 shares of Broder Corp. for $80,000. The securities are considered available-for-sale securities. On September 30, the shares had a market value of $85,000. The $5,000 difference must be reported on the income statement as a $5,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

52

Long-term investments are reported in the:

A) Current asset section of the balance sheet.

B) Intangible asset section of the balance sheet.

C) Non-current section of the balance sheet called long-term investments.

D) Plant assets section of the balance sheet.

E) Equity section of the balance sheet.

A) Current asset section of the balance sheet.

B) Intangible asset section of the balance sheet.

C) Non-current section of the balance sheet called long-term investments.

D) Plant assets section of the balance sheet.

E) Equity section of the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

53

If a U. S. company's credit sale to an international customer allows payment to be made in a foreign currency, the transaction is recorded using the exchange rate on the date of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

54

Management's intent determines whether an available-for-sale security is classified as long-term or short-term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

55

Short-term investments:

A) Are securities that management intends to convert to cash within the longer of one year or the current operating cycle, and are readily convertible to cash.

B) Include funds earmarked for a special purpose such as bond sinking funds.

C) Include shares not intended to be converted into cash.

D) Include bonds not intended to be converted into cash.

E) Include sinking funds not intended to be converted into cash.

A) Are securities that management intends to convert to cash within the longer of one year or the current operating cycle, and are readily convertible to cash.

B) Include funds earmarked for a special purpose such as bond sinking funds.

C) Include shares not intended to be converted into cash.

D) Include bonds not intended to be converted into cash.

E) Include sinking funds not intended to be converted into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

56

The cost method is used for long-term investments in equity securities with significant influence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

57

When using the equity method, receipt of cash dividends increases the carrying amount (book value) of an investment in equity securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

58

Long-term investments include:

A) Investments in bonds and shares that are not readily convertible to cash.

B) Investments in marketable shares that are intended to be converted into cash in the short-term.

C) Investments in marketable bonds that are intended to be converted into cash in the short-term.

D) Only investments readily convertible to cash.

E) Investments intended to be converted to cash within one year.

A) Investments in bonds and shares that are not readily convertible to cash.

B) Investments in marketable shares that are intended to be converted into cash in the short-term.

C) Investments in marketable bonds that are intended to be converted into cash in the short-term.

D) Only investments readily convertible to cash.

E) Investments intended to be converted to cash within one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

59

An investor presumed to have significant influence owns as least 20% but not more than 50% of another company's voting shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

60

When using the equity method for investments in equity securities, the investor records the receipt of cash dividends as revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

61

A company had net income of $43,000, net sales of $380,500, and average total assets of $220,000. Its profit margin and total asset turnover were, respectively:

A) 11.3%; 1.73.

B) 11.3%; 19.5.

C) 1.7%; 19.5.

D) 1.7%; 11.3.

E) 19.5%; 11.3.

A) 11.3%; 1.73.

B) 11.3%; 19.5.

C) 1.7%; 19.5.

D) 1.7%; 11.3.

E) 19.5%; 11.3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

62

The price of one currency stated in terms of another currency is called a(n):

A) Foreign exchange rate.

B) Currency transaction.

C) Historical exchange rate.

D) International conversion rate.

E) Currency rate.

A) Foreign exchange rate.

B) Currency transaction.

C) Historical exchange rate.

D) International conversion rate.

E) Currency rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

63

The controlling investor is called the:

A) Owner.

B) Subsidiary.

C) Parent.

D) Investee.

E) Senior entity.

A) Owner.

B) Subsidiary.

C) Parent.

D) Investee.

E) Senior entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the exchange rate for Canadian and U.S. dollars is 0.82777 to 1, this implies that 3 Canadian dollars will buy ____ worth of U.S. dollars.

A) $0.2759

B) $0.82777

C) $1.82777

D) $2.48

E) None of these.

A) $0.2759

B) $0.82777

C) $1.82777

D) $2.48

E) None of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

65

Rosser Company sold supplies in the amount of 25,000 euros to a French company when the exchange rate was $1.21 per euro. At the time of payment, the exchange rate decreased to $0.82. Rosser must record a:

A) gain of $9,750.

B) gain of $20,500.

C) loss of $9,750.

D) loss of $20,500.

E) neither a gain nor loss.

A) gain of $9,750.

B) gain of $20,500.

C) loss of $9,750.

D) loss of $20,500.

E) neither a gain nor loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company had net income of $2,660,000, net sales of $25,000,000, and average total assets of $8,000,000. Its return on total assets equals:

A) 3.01%.

B) 10.64%.

C) 32.00%.

D) 33.25%.

E) 300.75%.

A) 3.01%.

B) 10.64%.

C) 32.00%.

D) 33.25%.

E) 300.75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

67

NSC Corporation has invested in 10% of the outstanding shares of VC Corporation. NSC intends to actively manage this investment for profit. This investment is classified as:

A) an available-for-sale security.

B) a held-to-maturity security.

C) a held-for-trading security.

D) a significant influence security.

E) a controlling influence security.

A) an available-for-sale security.

B) a held-to-maturity security.

C) a held-for-trading security.

D) a significant influence security.

E) a controlling influence security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

68

Foreign exchange rates fluctuate due to changes in:

A) Political conditions.

B) Economic conditions.

C) Supply and demand for currencies.

D) Expectations of future events.

E) All of these.

A) Political conditions.

B) Economic conditions.

C) Supply and demand for currencies.

D) Expectations of future events.

E) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

69

Consolidated financial statements:

A) Show the results of operations, cash flows, and the financial position of all entities under a parent's control.

B) Show the results of operations, cash flows, and the financial position of the parent only.

C) Show the results of operations, cash flows, and the financial position of the subsidiary only.

D) Include the investments account on the balance sheet.

E) Do not include a balance sheet.

A) Show the results of operations, cash flows, and the financial position of all entities under a parent's control.

B) Show the results of operations, cash flows, and the financial position of the parent only.

C) Show the results of operations, cash flows, and the financial position of the subsidiary only.

D) Include the investments account on the balance sheet.

E) Do not include a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

70

The currency in which a company presents its financial statements is known as the:

A) Multinational currency.

B) Price-level-adjusted currency.

C) Specific currency.

D) Reporting currency.

E) Historical cost currency.

A) Multinational currency.

B) Price-level-adjusted currency.

C) Specific currency.

D) Reporting currency.

E) Historical cost currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

71

Comprehensive income includes

A) Revenues and expenses reported in the income statement.

B) Gains and losses reported in the income statement.

C) Unrealized gains and losses on long-term available-for-sale securities.

D) All changes in equity for a period except those due to investments and distributions to owners.

E) All of these.

A) Revenues and expenses reported in the income statement.

B) Gains and losses reported in the income statement.

C) Unrealized gains and losses on long-term available-for-sale securities.

D) All changes in equity for a period except those due to investments and distributions to owners.

E) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

72

Doherty Corporation had net income of $30,000, net sales of $1,000,000, and average total assets of $500,000. Its return on total assets is:

A) 3%

B) 200%

C) 6%

D) 17%

E) 1.5%

A) 3%

B) 200%

C) 6%

D) 17%

E) 1.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

73

Select the correct statement from the following:

A) Profit margin reflects a company's ability to produce net sales from total assets.

B) Total asset turnover reflects the percent of net income in each dollar of net sales.

C) Return on total assets can be separated into gross margin ratio and price-earnings ratio.

D) High returns on total assets are desirable.

E) Return on total assets analysis is beneficial in evaluating a company but is not useful for competitor analysis.

A) Profit margin reflects a company's ability to produce net sales from total assets.

B) Total asset turnover reflects the percent of net income in each dollar of net sales.

C) Return on total assets can be separated into gross margin ratio and price-earnings ratio.

D) High returns on total assets are desirable.

E) Return on total assets analysis is beneficial in evaluating a company but is not useful for competitor analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

74

Breanna Boutique purchased on credit 50,000 worth of clothing from a British company when the exchange rate was $1.97 per British pound. At the year-end balance sheet date the exchange rate increased to $2.76. Breanna Boutique must record a:

A) gain of $39,500.

B) loss of $39,500.

C) gain of $138,000.

D) loss of $138,000.

E) neither a gain nor loss.

A) gain of $39,500.

B) loss of $39,500.

C) gain of $138,000.

D) loss of $138,000.

E) neither a gain nor loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

75

A control over the investee is based on the investor owning voting shares exceeding:

A) 10%.

B) 20%.

C) 30%.

D) 40%.

E) 50%.

A) 10%.

B) 20%.

C) 30%.

D) 40%.

E) 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company has net income of $250,000, net sales of $2,000,000, and average total assets of $1,500,000. Its return on total assets equals:

A) 12.5%.

B) 13.3%.

C) 16.7%.

D) 75.0%.

E) 600.0%.

A) 12.5%.

B) 13.3%.

C) 16.7%.

D) 75.0%.

E) 600.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

77

All of the following statements regarding equity securities are except:

A) Equity securities should be recorded at cost when acquired.

B) Equity securities are valued at fair value if classified as hedl-for-trading securities.

C) Equity securities are valued at fair value if classified as significant influence securities.

D) Equity securities are valued at fair value if classified as available-for-sale securities.

E) Equity securities classified as available-for-sale record the dividend revenue when received.

A) Equity securities should be recorded at cost when acquired.

B) Equity securities are valued at fair value if classified as hedl-for-trading securities.

C) Equity securities are valued at fair value if classified as significant influence securities.

D) Equity securities are valued at fair value if classified as available-for-sale securities.

E) Equity securities classified as available-for-sale record the dividend revenue when received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

78

Long-term investments can include:

A) Held-to-maturity debt securities.

B) Available-for-sale debt securities.

C) Available-for-sale equity securities.

D) Equity securities giving an investor significant influence over an investee.

E) All of these.

A) Held-to-maturity debt securities.

B) Available-for-sale debt securities.

C) Available-for-sale equity securities.

D) Equity securities giving an investor significant influence over an investee.

E) All of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

79

Accounting for long-term investments in equity securities with control uses the:

A) Controlling method.

B) Consolidation method.

C) Investor method.

D) Investment method.

E) Fair value method.

A) Controlling method.

B) Consolidation method.

C) Investor method.

D) Investment method.

E) Fair value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck

80

All of the following statements relating to accounting for international operations are except:

A) Foreign exchange gains or losses can occur when accounting for international sales transactions.

B) Gains and losses from foreign exchange transactions are accumulated in the Fair Value Adjustment Account and are reported on the balance sheet.

C) Gains and losses from foreign exchange transactions are accumulated in the Foreign Exchange Gain (or Loss) account.

D) The balance in the Foreign Exchange Gain (or Loss) account is reported on the income statement.

E) Foreign exchange gains or losses can occur when accounting for international purchases transactions.

A) Foreign exchange gains or losses can occur when accounting for international sales transactions.

B) Gains and losses from foreign exchange transactions are accumulated in the Fair Value Adjustment Account and are reported on the balance sheet.

C) Gains and losses from foreign exchange transactions are accumulated in the Foreign Exchange Gain (or Loss) account.

D) The balance in the Foreign Exchange Gain (or Loss) account is reported on the income statement.

E) Foreign exchange gains or losses can occur when accounting for international purchases transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 156 في هذه المجموعة.

فتح الحزمة

k this deck