Deck 23: Corporate Restructuring

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/75

العب

ملء الشاشة (f)

Deck 23: Corporate Restructuring

1

Which of the following terms are not associated with mergers and acquisitions?

A) white knight

B) tender offers

C) greenmail

D) declaration of bankruptcy

A) white knight

B) tender offers

C) greenmail

D) declaration of bankruptcy

D

2

What is a form of business combination in which a company purchases all or a controlling block of another company's common shares and the two companies become affiliated?

A) horizontal merger

B) vertical merger

C) conglomerate

D) holding company

A) horizontal merger

B) vertical merger

C) conglomerate

D) holding company

D

3

The basic methods used in combining financial accounts in a merger include all of the following except the

A) goodwill consolidation method

B) purchase method

C) pooling of interests method

D) book value method

A) goodwill consolidation method

B) purchase method

C) pooling of interests method

D) book value method

A

4

In a ____ form of business combination, a parent-subsidiary relationship exists between the acquiring and acquired companies.

A) leveraged buyout

B) holding company

C) consolidation

D) leveraged buyout or consolidation

A) leveraged buyout

B) holding company

C) consolidation

D) leveraged buyout or consolidation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

5

The reasons why a company may choose external growth by merger over internal growth include

A) economies of scale

B) more rapid growth

C) tax considerations and rapid growth

D) economies of scale, tax considerations, and more rapid growth

A) economies of scale

B) more rapid growth

C) tax considerations and rapid growth

D) economies of scale, tax considerations, and more rapid growth

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

6

A combination of two or more companies in which neither competes directly with the other and no buyer-seller relationship exists is known as a

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

7

A form of business combination in which two (unaffiliated) companies contribute financial and/or physical assets, as well as personnel, to a new company to engage in some economic activity is known as a ____.

A) joint venture

B) conglomerate merger

C) merger

D) consolidation

A) joint venture

B) conglomerate merger

C) merger

D) consolidation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

8

The acquisition of a company in which the buyer borrows a large amount of the purchase price, using the purchased assets as collateral for a large portion of the borrowings, is known as a ____.

A) pooling of interests

B) leveraged buyout

C) conglomerate merger

D) tender offer

A) pooling of interests

B) leveraged buyout

C) conglomerate merger

D) tender offer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

9

A combination of two or more companies that compete directly with each other is known as a

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

10

In the ____ method of combining financial accounts in a merger, the acquired company's assets are recorded on the acquiring company's books at their cost (net of depreciation) when originally acquired.

A) goodwill consolidation

B) purchase

C) pooling of interests

D) EVA

A) goodwill consolidation

B) purchase

C) pooling of interests

D) EVA

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

11

Forms of business combinations include:

A) mergers

B) consolidations

C) holding companies and consolidations

D) mergers, consolidations, and holding companies

A) mergers

B) consolidations

C) holding companies and consolidations

D) mergers, consolidations, and holding companies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the market value of a company's common stock is below the replacement value of the firm's net assets, this company is frequently referred to as a possible ____.

A) white knight

B) leveraged buyout

C) takeover candidate

D) conglomerate

A) white knight

B) leveraged buyout

C) takeover candidate

D) conglomerate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

13

Employee Stock Ownership Plans (ESOPs) are useful instruments for financing leveraged buyouts because in an ESOP transaction

A) employees have a greater voice in the final decision

B) lenders can offer below market interest rates

C) ESOPs can be used only when employees take over management functions

D) ESOPs attract greater external equity investments

A) employees have a greater voice in the final decision

B) lenders can offer below market interest rates

C) ESOPs can be used only when employees take over management functions

D) ESOPs attract greater external equity investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

14

In general, the greatest economies of scale are possible with ____ mergers.

A) conglomerate

B) vertical

C) horizontal

D) integrated

A) conglomerate

B) vertical

C) horizontal

D) integrated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

15

The major methods typically used to value merger candidates include all the following except

A) comparative price-earnings ratio method

B) adjusted book value method

C) discounted cash flow method

D) bottom line comparison method

A) comparative price-earnings ratio method

B) adjusted book value method

C) discounted cash flow method

D) bottom line comparison method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a(n) ____ common stock in a division or subsidiary is distributed to shareholders of the parent company on a pro rata basis.

A) spin-off

B) reverse LBO

C) equity carve-out

D) tender offer

A) spin-off

B) reverse LBO

C) equity carve-out

D) tender offer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the ____ method for combining financial accounts in a merger, the total value paid or exchanged for the acquired company's assets is recorded on the acquiring company's books.

A) pooling of interests

B) goodwill consolidation

C) purchase

D) book value

A) pooling of interests

B) goodwill consolidation

C) purchase

D) book value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

18

When the net income of the combined companies after merger exceeds the sum of the net incomes prior to the merger, ____ is said to exist.

A) goodwill

B) synergy

C) leverage

D) greenmail

A) goodwill

B) synergy

C) leverage

D) greenmail

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the ____ method of accounting for mergers, the total value paid or exchanged for the acquired firm's assets is recorded on the acquiring company's books.

A) purchase

B) goodwill

C) pooling of interests

D) stockholder's equity

A) purchase

B) goodwill

C) pooling of interests

D) stockholder's equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

20

A combination of two or more companies that have a buyer-seller relationship with each other is known as a

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

A) conglomerate merger

B) vertical merger

C) horizontal merger

D) takeover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

21

Chapter 11 bankruptcy proceedings may be initiated by ____ or more of its unsecured creditors who have aggregate claims of at least ____.

A) 2, $1,000

B) 2, $5,000

C) 3, $ 500

D) 3, $5,000

A) 2, $1,000

B) 2, $5,000

C) 3, $ 500

D) 3, $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

22

Legal insolvency occurs when

A) the firm is unable to meet its current obligations as they come due, even though the value of its assets exceeds its liabilities

B) the recorded value of the firm's assets is less than the recorded value of its liabilities

C) the firm files a bankruptcy petition in accordance with the Federal bankruptcy laws

D) the owners of the businesses lack experience

A) the firm is unable to meet its current obligations as they come due, even though the value of its assets exceeds its liabilities

B) the recorded value of the firm's assets is less than the recorded value of its liabilities

C) the firm files a bankruptcy petition in accordance with the Federal bankruptcy laws

D) the owners of the businesses lack experience

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

23

A(n) ____ is a situation in which a failing business is permitted to lengthen the amount of time it has to meet its obligations with creditors.

A) assignment

B) composition

C) extension

D) insolvency

A) assignment

B) composition

C) extension

D) insolvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under Chapter(s) ____ of the bankruptcy laws, a company's assets are sold off and the proceeds are distributed to the creditors.

A) 11

B) 7

C) 4

D) 7 and 11

A) 11

B) 7

C) 4

D) 7 and 11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

25

All of the following are anti-takeover measures except:

A) black knight

B) staggered board

C) super major voting rules

D) golden parachute

A) black knight

B) staggered board

C) super major voting rules

D) golden parachute

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

26

In analyzing a merger the ____ is the number of the acquiring company shares received per share of acquired company stock owned.

A) assignment

B) composition

C) price-purchase ratio

D) exchange ratio

A) assignment

B) composition

C) price-purchase ratio

D) exchange ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a ____, the acquiring company effectively announces that it will pay a certain price above the current existing price for a merger candidate's shares.

A) leveraged buyout

B) tender offer

C) equity carve-out

D) divestiture

A) leveraged buyout

B) tender offer

C) equity carve-out

D) divestiture

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

28

____ equals the proceeds that would be received from the sale of the firm's assets minus its liabilities.

A) Market value

B) Equity value

C) Going-concern value

D) Liquidation value

A) Market value

B) Equity value

C) Going-concern value

D) Liquidation value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

29

A(n) ____ is a situation in which a failing business is permitted to discharge its debt obligations by paying less than the full amounts owed to creditors.

A) assignment

B) composition

C) extension

D) insolvency

A) assignment

B) composition

C) extension

D) insolvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

30

A bond that contains a put option that can be exercised only if an unfriendly takeover occurs, is an example of a ____ .

A) pacman defense

B) liability restructuring

C) poison pill

D) standstill option

A) pacman defense

B) liability restructuring

C) poison pill

D) standstill option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under Chapter(s) ____ of the bankruptcy laws, a company continues to operate while it attempts to work out a reorganization plan.

A) 11

B) 7

C) 4

D) 4 and 11

A) 11

B) 7

C) 4

D) 4 and 11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

32

A combination in which all of the combining companies are dissolved and a new firm is formed is known as a ____.

A) holding company

B) leveraged buyout

C) consolidation

D) composition

A) holding company

B) leveraged buyout

C) consolidation

D) composition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

33

Bankruptcy occurs when the firm

A) is unable to pay its debts

B) files a bankruptcy petition in accordance with the Federal bankruptcy laws

C) is more than 6 months overdue to its creditors

D) is unable to pay its debts and files a bankruptcy petition in accordance with the Federal bankruptcy laws

A) is unable to pay its debts

B) files a bankruptcy petition in accordance with the Federal bankruptcy laws

C) is more than 6 months overdue to its creditors

D) is unable to pay its debts and files a bankruptcy petition in accordance with the Federal bankruptcy laws

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

34

The process of liquidating a business outside of the jurisdiction of the bankruptcy courts is called a(n)

A) assignment

B) composition

C) extension

D) voluntary insolvency

A) assignment

B) composition

C) extension

D) voluntary insolvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

35

One anti-takeover measure is the ____, where the target company makes a takeover bid for the stock of the bidder.

A) poison put

B) black knight defense

C) pacman defense

D) shark repellent

A) poison put

B) black knight defense

C) pacman defense

D) shark repellent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

36

Technical insolvency occurs when

A) the firm is unable to meet its current obligations as they come due, even though the value of its assets exceeds its liabilities

B) the recorded value of the firm's assets is less than the recorded value of its liabilities

C) the firm files a bankruptcy petition in accordance with the Federal bankruptcy laws

D) the owners of the businesses lack experience

A) the firm is unable to meet its current obligations as they come due, even though the value of its assets exceeds its liabilities

B) the recorded value of the firm's assets is less than the recorded value of its liabilities

C) the firm files a bankruptcy petition in accordance with the Federal bankruptcy laws

D) the owners of the businesses lack experience

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

37

The accounting method used in most mergers is the ____ method.

A) pooling of interests

B) purchase

C) consolidation

D) merger

A) pooling of interests

B) purchase

C) consolidation

D) merger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

38

A reorganization plan is reviewed by the ____ for fairness and feasibility.

A) bankruptcy court

B) Securities and Exchange Commission

C) Federal Trade Commission

D) bankruptcy court and the SEC

A) bankruptcy court

B) Securities and Exchange Commission

C) Federal Trade Commission

D) bankruptcy court and the SEC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

39

Legal bankruptcy proceedings focus on the decision of whether or not the firm's value as a going concern is greater than its

A) liquidation value

B) market value

C) equity value

D) historical value

A) liquidation value

B) market value

C) equity value

D) historical value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

40

____ equals the capitalized value of the company's operating earnings minus its liabilities.

A) Market value

B) Equity value

C) Going-concern value

D) Liquidation value

A) Market value

B) Equity value

C) Going-concern value

D) Liquidation value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

41

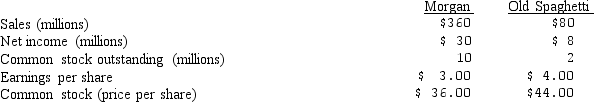

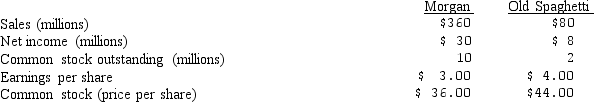

Morgan Foods is considering the acquisition of Old Spaghetti Warehouse Inc. in a stock-for-stock exchange. Selected financial data for the two companies is shown below. An immediate synergistic earnings benefit of $1.5 million is expected in this merger, due to cost savings.

Calculate the postmerger EPS if the Old Spaghetti shareholders accept an offer of $54 per share in a stock-for-stock exchange.

A) $3.04

B) $2.92

C) $3.29

D) $3.17

Calculate the postmerger EPS if the Old Spaghetti shareholders accept an offer of $54 per share in a stock-for-stock exchange.

A) $3.04

B) $2.92

C) $3.29

D) $3.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

42

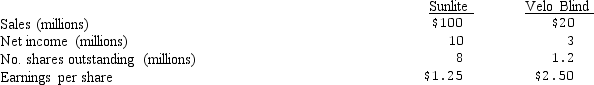

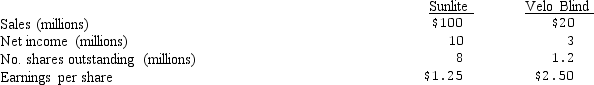

Sunlite is considering a merger with Velo Blind by offering the equivalent of $21 a share in a stock-for-stock transaction. Sunlite's current common stock price is $30 a share and Velo's is $17. Other financial data on the two firms is as follows:

Assuming no economies of scale or synergistic benefits, what will be the post-merger earnings per share?

A) $1.47

B) $1.41

C) $1.50

D) $1.25

Assuming no economies of scale or synergistic benefits, what will be the post-merger earnings per share?

A) $1.47

B) $1.41

C) $1.50

D) $1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

43

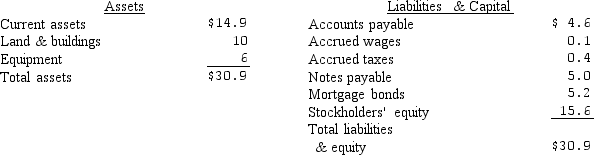

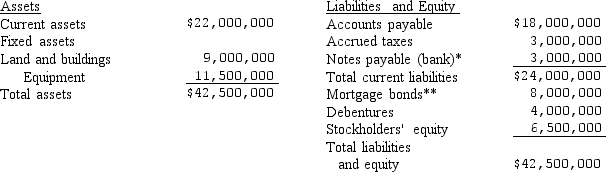

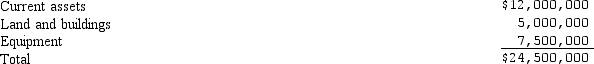

Quarter Staff is being liquidated under Chapter 7 of the bankruptcy code. When it filed for bankruptcy, its balance sheet (in millions) was as follows:

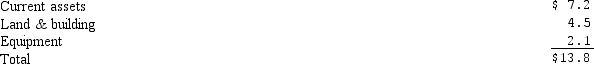

The notes payable are an unsecured bank loan and the mortgage bond is secured by the land and building. The proceeds from the liquidation of the company's assets are as follows:

If the bankruptcy administration charges were $500,000, what dollar amount will the trade creditors (accounts payable) receive in the liquidation?

A) $1.65 million

B) $3.71 million

C) $4.60 million

D) $2.55 million

The notes payable are an unsecured bank loan and the mortgage bond is secured by the land and building. The proceeds from the liquidation of the company's assets are as follows:

If the bankruptcy administration charges were $500,000, what dollar amount will the trade creditors (accounts payable) receive in the liquidation?

A) $1.65 million

B) $3.71 million

C) $4.60 million

D) $2.55 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

44

After a merger with Velo Blind, Sunlite's earnings per share are $1.50. If Sunlite had a P/E ratio of 14 times before the merger and a price of $28 a share after the merger, what is Sunlite's post-merger P/E?

A) 16.8

B) 14.3

C) 20.2

D) 18.7

A) 16.8

B) 14.3

C) 20.2

D) 18.7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

45

The annual after-tax free cash flow from the acquisition by Pacific Care of Universal Health is projected to be $12 million. These flows are expected to continue for 20 years. No value is placed on cash flows beyond 20 years. If the appropriate risk-adjusted discount rate for the merged firm is 15 percent, what is the maximum amount Pacific Care should pay to acquire Universal Health?

A) $79,476,000

B) $70,164,000

C) $75,108,000

D) can not be determined from the information provided

A) $79,476,000

B) $70,164,000

C) $75,108,000

D) can not be determined from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

46

The ____ is the number of acquiring company shares received per share of acquiring company stock owned.

A) stock equity ratio

B) exchange ratio

C) dividend exchange ratio

D) interest parity ratio

A) stock equity ratio

B) exchange ratio

C) dividend exchange ratio

D) interest parity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

47

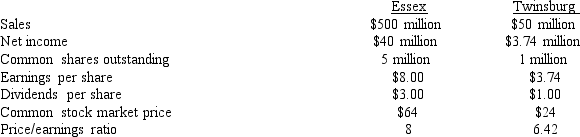

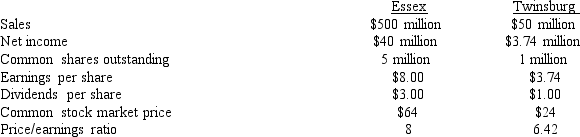

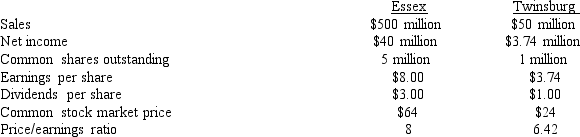

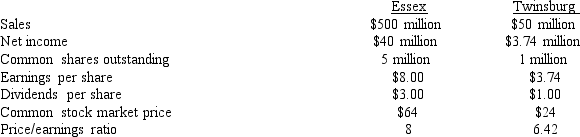

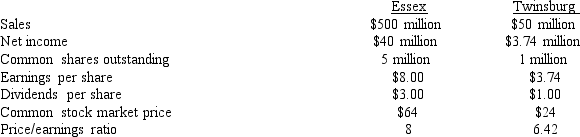

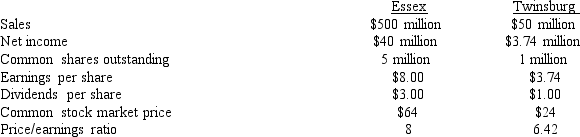

Essex Industries is considering the acquisition of the Twinsburg Company in a stock-for-stock exchange. The following financial data are available on both companies. (Assume no synergy is expected with this merger.) Calculate answers to nearest 0.001.

Calculate the post-merger earnings per share if the exchange ratio is 0.4 shares of Essex for each share of Twinsburg. (Assume total post-merger earnings are $43,740,000).

A) $8.10

B) $7.33

C) $7.29

D) $7.42

Calculate the post-merger earnings per share if the exchange ratio is 0.4 shares of Essex for each share of Twinsburg. (Assume total post-merger earnings are $43,740,000).

A) $8.10

B) $7.33

C) $7.29

D) $7.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

48

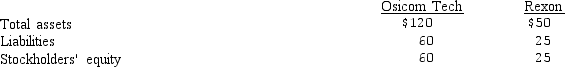

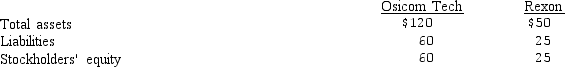

Osicom Tech is acquiring Rexon's outstanding common stock for $32 million. Before acquisition financial information on these two firms is given as follows (in $ millions):

What are the total assets and stockholders' equity (in $ millions) if the purchase method is used as the accounting method for this merger?

A) $170, $85

B) $177, $92

C) $170, $92

D) $85, $92

What are the total assets and stockholders' equity (in $ millions) if the purchase method is used as the accounting method for this merger?

A) $170, $85

B) $177, $92

C) $170, $92

D) $85, $92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

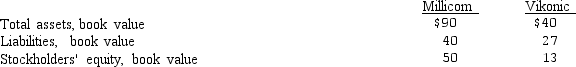

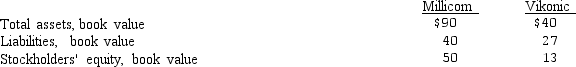

49

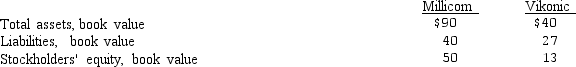

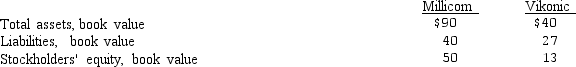

Millicom is acquiring Vikonic's outstanding common stock for $15 million. Financial information (in $ millions) on these two firms prior to the acquisition is as follows:

What are the total assets and stockholders' equity (in $ millions) if the purchase method is used as the accounting method for this merger?

A) $130, $63

B) $130, $67

C) $132, $65

D) $132, $67

What are the total assets and stockholders' equity (in $ millions) if the purchase method is used as the accounting method for this merger?

A) $130, $63

B) $130, $67

C) $132, $65

D) $132, $67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

50

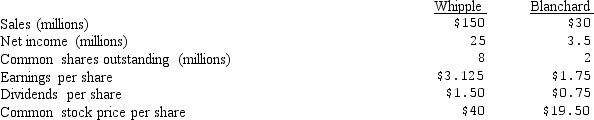

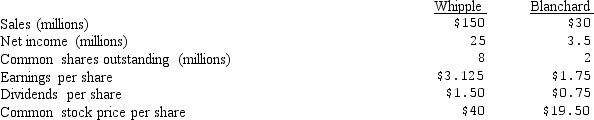

Whipple Industries is considering the acquisition of the Blanchard Company in a stock-for stock exchange. Selected financial data for the two companies is shown below. No synergy is expected in this merger.

Determine the post-merger earnings per share if the Blanchard company shareholders accept an offer of $22 per share in a stock-for-stock exchange.

A) $2.85

B) $3.175

C) $3.13

D) $1.75

Determine the post-merger earnings per share if the Blanchard company shareholders accept an offer of $22 per share in a stock-for-stock exchange.

A) $2.85

B) $3.175

C) $3.13

D) $1.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

51

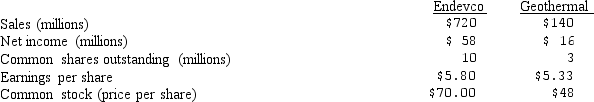

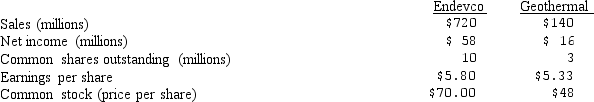

Endevco is considering the acquisition of Geothermal Resources in a stock-for-stock exchange. Assume no immediate synergistic benefits are expected. Selected financial data on the two companies are shown below:

If Endevco is not willing to incur an initial dilution in its EPS, and if Endevco also feels that it will have to offer Geothermal shareholders a minimum of 20% over Geothermal's current market price, what is the maximum price per share that Endevco will have to pay for Geothermal's stock?

A) $57.60

B) $64.33

C) $52.23

D) $60.00

If Endevco is not willing to incur an initial dilution in its EPS, and if Endevco also feels that it will have to offer Geothermal shareholders a minimum of 20% over Geothermal's current market price, what is the maximum price per share that Endevco will have to pay for Geothermal's stock?

A) $57.60

B) $64.33

C) $52.23

D) $60.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

52

Essex Industries is considering the acquisition of the Twinsburg Company in a stock-for-stock exchange. The following financial data are available on both companies. (Assume no synergy is expected with this merger.) Calculate answers to nearest 0.001.

Calculate the exchange ratio if Essex offers the Twinsburg stockholders a 20% premium over Twinsburg's current market price.

A) 0.375

B) 2.22

C) 0.45

D) 0.288

Calculate the exchange ratio if Essex offers the Twinsburg stockholders a 20% premium over Twinsburg's current market price.

A) 0.375

B) 2.22

C) 0.45

D) 0.288

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

53

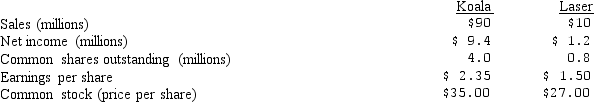

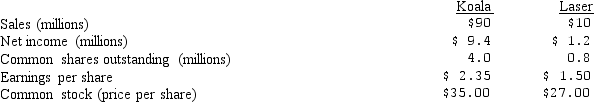

Koala Technologies is considering the acquisition of Laser Industries in a stock-for-stock exchange. Selected financial data for the two companies is shown below. An immediate synergistic earnings benefit of $2.5 million is expected in this merger.

Calculate the postmerger EPS if the Laser shareholders accept an offer of $33.25 a share in a stock-for-stock exchange.

A) $2.21

B) $2.25

C) $2.75

D) $2.23

Calculate the postmerger EPS if the Laser shareholders accept an offer of $33.25 a share in a stock-for-stock exchange.

A) $2.21

B) $2.25

C) $2.75

D) $2.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

54

Essex Industries is considering the acquisition of the Twinsburg Company in a stock-for-stock exchange. The following financial data are available on both companies. (Assume no synergy is expected with this merger.) Calculate answers to nearest 0.001.

What is Essex's post-merger share price if the post-merger price/earnings ratio is 7.5, and the exchange ratio is 0.4. Assume total post-merger earnings are $43,740,000.

A) $60.75

B) $54.98

C) $64.80

D) $30.42

What is Essex's post-merger share price if the post-merger price/earnings ratio is 7.5, and the exchange ratio is 0.4. Assume total post-merger earnings are $43,740,000.

A) $60.75

B) $54.98

C) $64.80

D) $30.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

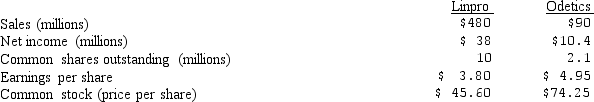

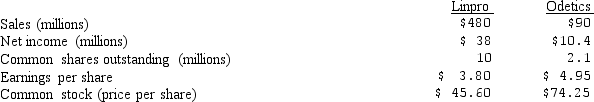

55

Linpro Industries is considering the acquisition of Odetics, Inc. in a stock-for-stock exchange. Assume no immediate synergistic benefits are expected. Selected financial data on the two companies are shown below:

Calculate Linpro's postmerger EPS if the Odetics shareholders accept an offer of $90 a share in a stock-for-stock exchange.

A) $4.38

B) $4.29

C) $3.42

D) $3.81

Calculate Linpro's postmerger EPS if the Odetics shareholders accept an offer of $90 a share in a stock-for-stock exchange.

A) $4.38

B) $4.29

C) $3.42

D) $3.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

56

A plan of reorganization must be all of the following EXCEPT:

A) feasible

B) fair

C) a plan that allows the firm a chance to reestablish successful business operations

D) a plan whereby the creditors that are due the most money are paid first.

A) feasible

B) fair

C) a plan that allows the firm a chance to reestablish successful business operations

D) a plan whereby the creditors that are due the most money are paid first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

57

Millicom is acquiring Vikonic's outstanding common stock for $15 million. Financial information (in $ millions) on these two firms prior to the acquisition is as follows:

What are the total assets and stockholders' equity (in $ millions) if the pooling of interests method had been used as the accounting method for this merger?

A) $130, $63

B) $130, $67

C) $132, $65

D) $132, $67

What are the total assets and stockholders' equity (in $ millions) if the pooling of interests method had been used as the accounting method for this merger?

A) $130, $63

B) $130, $67

C) $132, $65

D) $132, $67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

58

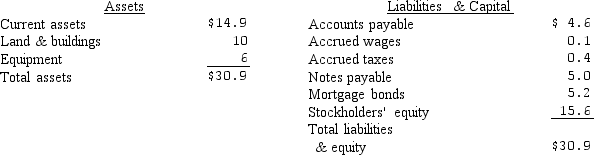

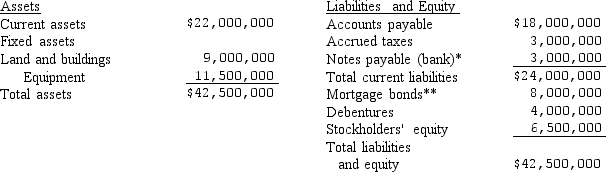

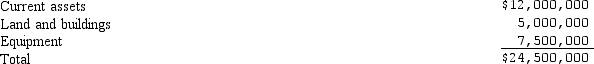

Buggy Whip Industries is being liquidated under Chapter 7 of the bankruptcy code. When it filed for bankruptcy, its balance sheet was a follows:

*Bank loan is unsecured

**Mortgage bonds are secured by land and buildings

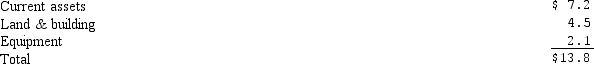

Assume that the liquidation is a voluntary petition, that no unpaid contributions to employee benefit plans exist, and that no customer layaway deposits are involved. The proceeds from the liquidation of the company's assets are as follows:

Bankruptcy administration charges are $2,500,000. Determine the amount that the mortgage bondholders will receive in this liquidation.

A) $5,000,000

B) $6,500,000

C) $8,000,000

D) $10,500,000

*Bank loan is unsecured

**Mortgage bonds are secured by land and buildings

Assume that the liquidation is a voluntary petition, that no unpaid contributions to employee benefit plans exist, and that no customer layaway deposits are involved. The proceeds from the liquidation of the company's assets are as follows:

Bankruptcy administration charges are $2,500,000. Determine the amount that the mortgage bondholders will receive in this liquidation.

A) $5,000,000

B) $6,500,000

C) $8,000,000

D) $10,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

59

The most correct method of valuing a merger candidate is:

A) adjusted book value method

B) discounted cash flow method

C) pooling of interests method

D) comparative price-earnings ratio method

A) adjusted book value method

B) discounted cash flow method

C) pooling of interests method

D) comparative price-earnings ratio method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

60

A firm is technically insolvent when: it is unable to meet it current obligations and:

A) the value of its assets exceeds the value of its liabilities.

B) the value of its assets is less than the value of its liabilities.

C) it files a bankruptcy petition.

D) it merges with another firm.

A) the value of its assets exceeds the value of its liabilities.

B) the value of its assets is less than the value of its liabilities.

C) it files a bankruptcy petition.

D) it merges with another firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

61

An antitakeover measure where a company attempts to buy back its shares of stock at a premium from the company or investor who initiated the unfriendly takeover is:

A) pacman defense

B) boardmail

C) white squire

D) greenmail

A) pacman defense

B) boardmail

C) white squire

D) greenmail

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

62

How does a joint venture differ from a holding company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain the motivation for a company to divest through a spin-off or equity carve-out.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

64

An anti-takeover measure that is inserted in the corporate charter stating that 80% of the stock shares must approve the takeover proposal is a(n):

A) Golden parachute

B) Supermajority voting rules

C) Poison puts

D) Standstill agreement

A) Golden parachute

B) Supermajority voting rules

C) Poison puts

D) Standstill agreement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following about an asset purchase merger transaction is/are correct?

I) Only the assets are purchased.

II) The buying firm receives 100% of the assets and incurs only 50% of the liabilities.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) Only the assets are purchased.

II) The buying firm receives 100% of the assets and incurs only 50% of the liabilities.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following would be considered a reason for corporate restructuring?

I) Availability of credit

II) Low cost of credit

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) Availability of credit

II) Low cost of credit

A) I only

B) II only

C) Both I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

67

What are some informal alternatives for salvaging a failing business?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

68

Explain the difference between a stock purchase and an asset purchase in a merger transaction. Which is preferred and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

69

Explain a form of business combination called a holding company and how the combination is achieved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

70

One reason for a company to spin-off a division is to:

A) consolidate expenses.

B) remove an underperforming unit.

C) create a better distribution unit.

D) achieve synergy.

A) consolidate expenses.

B) remove an underperforming unit.

C) create a better distribution unit.

D) achieve synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

71

A new takeover defense is boardmail. How does it work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

72

An alternative to a spin-off is a(n)_______________which allows a large company to capture the value of a high-growth business buried within the organization.

A) equity carve out

B) holding company

C) tracking stock

D) stock synergy

A) equity carve out

B) holding company

C) tracking stock

D) stock synergy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

73

An example of a passive institutional investor is a:

A) pension fund

B) private equity investor

C) parent company

D) third party administrator

A) pension fund

B) private equity investor

C) parent company

D) third party administrator

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

74

An antitakeover measure that is employed after the takeover has been initiated is:

A) Golden parachute

B) Staggered board

C) White knight

D) Poison put

A) Golden parachute

B) Staggered board

C) White knight

D) Poison put

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

75

There are three methods for valuing merger candidates. Briefly explain each of them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck