Deck 9: Measuring and Managing Translation and Transaction Exposure

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 9: Measuring and Managing Translation and Transaction Exposure

1

If the functional currency is the U.S. dollar, the net result under FASB?52 would be a

A) transaction loss of $40,000 for the U.S. parent

B) transaction gain of $56,383 for the U.S. parent

C) transaction loss of $32,876 for the Swiss subsidiary

D) transaction gain of $3176 for the U.S. parent

E) no transaction gain or loss for either the subsidiary or parent

A) transaction loss of $40,000 for the U.S. parent

B) transaction gain of $56,383 for the U.S. parent

C) transaction loss of $32,876 for the Swiss subsidiary

D) transaction gain of $3176 for the U.S. parent

E) no transaction gain or loss for either the subsidiary or parent

E

2

Under the current rate method, what is Ajax's translation gain (loss).?

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

A

3

Under the temporal method, what is Ajax's translation gain (loss).?

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

D

4

The major difference between the temporal method and the monetary/nonmonetary method is that

A) under the monetary/nonmonetary method, long?term debt is translated at the historical rate, whereas under the temporal method, long?term debt is translated at the current rate

B) under the monetary/nonmonetary method, inventory is always translated at the historical rate, whereas under the temporal method, inventory may be translated at the current rate if the inventory is shown on the balance sheet at market values

C) under the monetary/nonmonetary method, fixed assets are translated at the historical rate, whereas under the temporal method, fixed assets may be translated at the current rate

D) under the monetary/nonmonetary method, accounts receivable are always translated at the historical rate, whereas under the temporal method, receivables may be translated at the current rate

A) under the monetary/nonmonetary method, long?term debt is translated at the historical rate, whereas under the temporal method, long?term debt is translated at the current rate

B) under the monetary/nonmonetary method, inventory is always translated at the historical rate, whereas under the temporal method, inventory may be translated at the current rate if the inventory is shown on the balance sheet at market values

C) under the monetary/nonmonetary method, fixed assets are translated at the historical rate, whereas under the temporal method, fixed assets may be translated at the current rate

D) under the monetary/nonmonetary method, accounts receivable are always translated at the historical rate, whereas under the temporal method, receivables may be translated at the current rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

The functional currency of a Colombian manufacturing subsidiary selling exclusively to the U.S.

A) depends on where it sources its raw materials

B) depends on where it sells the completed product

C) will be the Colombian peso

D) will be the U.S. dollar

A) depends on where it sources its raw materials

B) depends on where it sells the completed product

C) will be the Colombian peso

D) will be the U.S. dollar

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

Under FASB 52, most financial statements must be translated using the

A) monetary/nonmonetary method

B) current/noncurrent method

C) current rate method

D) temporal method

A) monetary/nonmonetary method

B) current/noncurrent method

C) current rate method

D) temporal method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose the English subsidiary of a U.S. firm had current assets of £1 million, fixed assets of £2 million and current liabilities of 1 million pounds both at the start and at the end of the year. There are no long?term liabilities. If the pound depreciated during that year from $1.50 to $1.30, the translation gain (loss) to be included in the parent company's equity account according to FASB #52 is

A) 0 since the current assets and current liabilities cancel

B) +$200,000

C) ?$250,000

D) ?$400,000

A) 0 since the current assets and current liabilities cancel

B) +$200,000

C) ?$250,000

D) ?$400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

Transaction gains and losses that result from adjusting assets and liabilities denominated in a currency other than the functional currency must appear on the foreign unit's income statement unless the gains or losses are attributable to

A) foreign currency transactions that are designated as an economic hedge of a net investment in a foreign entity

B) intercompany foreign?currency transactions that are of a short? term nature

C) foreign?currency transactions that involve currency speculation

D) all of the above

A) foreign currency transactions that are designated as an economic hedge of a net investment in a foreign entity

B) intercompany foreign?currency transactions that are of a short? term nature

C) foreign?currency transactions that involve currency speculation

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

The functional currency of a German subsidiary that both manufactures and sells in Germany and competes primarily against Japanese firms

A) will be the U.S. dollar

B) will be the Deutsche mark

C) may be the Japanese yen

D) will be the U.S. dollar unless German inflation is high

A) will be the U.S. dollar

B) will be the Deutsche mark

C) may be the Japanese yen

D) will be the U.S. dollar unless German inflation is high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under a historical cost accounting system, as the United States now has, most accounting theoreticians would probably argue that the appropriate method for translation is the

A) monetary/nonmonetary method

B) current/noncurrent method

C) current rate method

D) temporal method

A) monetary/nonmonetary method

B) current/noncurrent method

C) current rate method

D) temporal method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

The most important aspect of the FASB?52 is that

A) it is consistent with generally accepted accounting practice that requires balance?sheet items to be valued according to their underlying measurement basis

B) it disallows all reserves for currency losses

C) it mandates a uniform translation standard for all firms

D) most translation gains and losses bypass the income statement and are accumulated in a separate equity account on the parent's balance sheet

A) it is consistent with generally accepted accounting practice that requires balance?sheet items to be valued according to their underlying measurement basis

B) it disallows all reserves for currency losses

C) it mandates a uniform translation standard for all firms

D) most translation gains and losses bypass the income statement and are accumulated in a separate equity account on the parent's balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

The functional currency of a Mexican subsidiary that both manufactures and sells most of its output in Mexico will

A) always be the U.S. dollar

B) always be the Mexican peso

C) be the U.S. dollar unless Mexico has a high rate of inflation

D) be the Mexican peso unless Mexico has a high rate of inflation

A) always be the U.S. dollar

B) always be the Mexican peso

C) be the U.S. dollar unless Mexico has a high rate of inflation

D) be the Mexican peso unless Mexico has a high rate of inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

Suppose the German subsidiary of a U.S. firm had current assets of DM3 million, fixed assets of DM6 million and current liabilities of DM3 million both at the start and at the end of the year. There are no long?term liabilities. If the DM depreciated during that year from $.48 to $.38, the FASB?52 translation gain (loss. to be included in the parent company's equity account is

A) 0, since the current assets and current liabilities cancel

B) +$300,000

C) ?$350,000

D) ?$600,000

A) 0, since the current assets and current liabilities cancel

B) +$300,000

C) ?$350,000

D) ?$600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

The functional currency of a Malaysian subsidiary that assembles computers using U.S.?made parts, which it then sells in the United States, would most likely be the

A) Malaysian ringgit

A) U.S. dollar

B) The supplier's currency

C) The lender's currency

A) Malaysian ringgit

A) U.S. dollar

B) The supplier's currency

C) The lender's currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the current/noncurrent method, what is Ajax's translation gain (loss).?

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under FASB 52, foreign exchange gains and losses

A) flow into a special reserve account

B) are usually determined according to the current rate method

C) both a and b

D) flow directly into the income statement

A) flow into a special reserve account

B) are usually determined according to the current rate method

C) both a and b

D) flow directly into the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the monetary/non-monetary method, what is Ajax's translation gain (loss).?

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

A) a gain of $294,000

B) a gain of $192,000

C) a loss of $174,000

D) a loss of $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the functional currency is the Swiss franc, the net result under FASB?52 would be a

A) transaction loss of $40,000 for the U.S. parent

B) transaction gain of $56,383 for the U.S. parent

C) transaction loss of $32,876 for the Swiss subsidiary

D) transaction gain of $3176 for the U.S. parent

A) transaction loss of $40,000 for the U.S. parent

B) transaction gain of $56,383 for the U.S. parent

C) transaction loss of $32,876 for the Swiss subsidiary

D) transaction gain of $3176 for the U.S. parent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

The current standard for measuring translation exposure is

A) the current/noncurrent method

B) the monetary/nonmonetary method

C) FASB 8

D) FASB 52

A) the current/noncurrent method

B) the monetary/nonmonetary method

C) FASB 8

D) FASB 52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

Translation exposure reflects the exposure of a company's

A) foreign operations to currency movements

B) foreign sales to currency movements

C) financial statements to currency movements

D) cash flows to currency movements

A) foreign operations to currency movements

B) foreign sales to currency movements

C) financial statements to currency movements

D) cash flows to currency movements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

American Airlines hedges a £2.5 million receivable by selling pounds forward. If the spot rate is £1 = $1.73 and the 90?day forward rate is $1.7158, what is American's cost of hedging?

A) $142,000

B) $35,500

C) $8,875

D) it is unknown at the time American enters into its hedge

A) $142,000

B) $35,500

C) $8,875

D) it is unknown at the time American enters into its hedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

Firms that attempt to reduce risk and beat the market simultaneously may end up with

A) more risk, not less

B) less risk

C) a profit as well as reduced risk

D) a loss as well as reduced risk

A) more risk, not less

B) less risk

C) a profit as well as reduced risk

D) a loss as well as reduced risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

If you fear the dollar will rise against the French franc, with a resulting adverse change in the dollar value of the equity of your French subsidiary, you can hedge by

A) selling francs forward in the amount of net assets

B) buying francs forward in the amount of net assets

C) reducing the liabilities of the subsidiary

D) selling francs forward in the amount of total assets

A) selling francs forward in the amount of net assets

B) buying francs forward in the amount of net assets

C) reducing the liabilities of the subsidiary

D) selling francs forward in the amount of total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose General Motors uses a money market hedge to protect an Lit 200 million payable due in one year. The U.S. interest rate at the time of the hedge was 9% and the lira interest rate was 14%. If the spot rate moved from Lit 1293 at the start of the year to Lit 1349 at the end of the year, what was GM's cost of the money market hedge?

A) $3,647

B) $414

C) GM gained $1,069

D) GM gained $5,631

A) $3,647

B) $414

C) GM gained $1,069

D) GM gained $5,631

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

One argument that favors centralization of foreign risk management is the ability to take advantage of the portfolio effect through ________.

A) risk shifting

B) risk sharing

C) offshore banking

D) exposure netting

A) risk shifting

B) risk sharing

C) offshore banking

D) exposure netting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

A Japanese firm sells TV sets to an American importer for one billion yen payable in 90 days. To protect against exchange risk, the importer could

A) borrow yen, convert to dollars, and lend dollars for the interim period

B) sell yen on the forward market

C) sell a call option on yen

D) buy a futures contract for yen on the IMM

A) borrow yen, convert to dollars, and lend dollars for the interim period

B) sell yen on the forward market

C) sell a call option on yen

D) buy a futures contract for yen on the IMM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose that the spot rate and the 90?day forward rate on the pound sterling are $1.35 and $1.30, respectively. Your company, wishing to avoid foreign exchange risk, sells £500,000 forward 90 days. Assuming that the spot rate remains the same 90 days hence, your company would

A) receive £500,000 90 days hence

B) receive more than £500,000 in 90 days

C) have been better off not to have sold pounds forward

D) receive nothing

A) receive £500,000 90 days hence

B) receive more than £500,000 in 90 days

C) have been better off not to have sold pounds forward

D) receive nothing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose PepsiCo hedges a ¥1 billion dividend it expects to receive from its Japanese subsidiary in 90 days with a forward contract. The current spot rate is ¥150/$1 and the 90?day forward rate is ¥149/$1. If the spot rate in 90 days is ¥154/$, how much has this forward market hedge cost PepsiCo?

A) $173,160

B) $44,743

C) Pepsi gains $173,160 from the forward contract

D) Pepsi gains $217,903 from the forward contract

A) $173,160

B) $44,743

C) Pepsi gains $173,160 from the forward contract

D) Pepsi gains $217,903 from the forward contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a forward market hedge, a company that is long a foreign currency will ____ the foreign currency forward.

A) buy

B) sell

C) borrow

D) lend

A) buy

B) sell

C) borrow

D) lend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is NOT a basic hedging technique during a currency depreciation?

A) buy local currency forward

B) sell a local currency put option

C) reduce levels of local currency cash and marketable securities

D) loosen credit (increase local currency receivables)

A) buy local currency forward

B) sell a local currency put option

C) reduce levels of local currency cash and marketable securities

D) loosen credit (increase local currency receivables)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

Compaq Computer has a £1 million receivable that it expects to collect in one year. Suppose the interest rate on pounds is 15%. How could Compaq protect this receivable using a money market hedge?

A) borrow £1 million pounds today

B) lend £1 million pounds today

C) borrow £869,565 pounds today

D) lend £986,754 pounds today

A) borrow £1 million pounds today

B) lend £1 million pounds today

C) borrow £869,565 pounds today

D) lend £986,754 pounds today

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

On March 1, Bechtel submits a franc?denominated bid on a project in France. Bechtel will not learn until June 1 whether it has won the contract. What is the most appropriate way for Bechtel to manage the exchange risk on this contract?

A) sell the franc amount of the bid forward for U.S. dollars

B) buy French francs forward in the amount of the contract

C) buy a put option on francs in the amount of the franc exposure

D) sell a call option on francs in the amount of franc exposure

A) sell the franc amount of the bid forward for U.S. dollars

B) buy French francs forward in the amount of the contract

C) buy a put option on francs in the amount of the franc exposure

D) sell a call option on francs in the amount of franc exposure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ford simultaneously borrows Spanish pesetas at 13% and invests dollars at 10%, both for one year. At the time Ford enters into these transactions, the spot rate for the peseta is $0.095. If the spot rate is Ptas. 1 = $0.087 in one year, what is the cost to Ford of this money market hedge?

A) 2.0%

B) 3.8%

C) 1.3%

D) Ford has a 6.5% gain, not a cost

A) 2.0%

B) 3.8%

C) 1.3%

D) Ford has a 6.5% gain, not a cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

A ________ involves simultaneously borrowing and lending activities in two different currencies to lock in the currency's value of a future foreign currency cash flow.

A) forward contract

B) currency collar

C) money-market hedge

D) currency option

A) forward contract

B) currency collar

C) money-market hedge

D) currency option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

Hedging cannot provide protection against ________ exchange rate changes.

A) expected

A) nominal

B) real

C) pegged

A) expected

A) nominal

B) real

C) pegged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

If you fear the dollar will rise against the Spanish peseta, with a resulting adverse change in the dollar value of the equity of your Spanish subsidiary, you can hedge by

A) selling pesetas forward in the amount of net assets

B) buying pesetas forward in the amount of net assets

C) reducing the liabilities of the subsidiary

D) selling pesetas forward in the amount of total assets

A) selling pesetas forward in the amount of net assets

B) buying pesetas forward in the amount of net assets

C) reducing the liabilities of the subsidiary

D) selling pesetas forward in the amount of total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

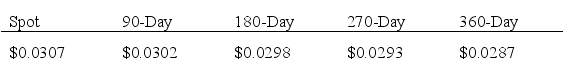

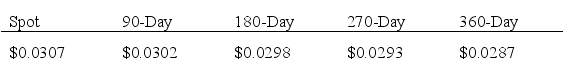

DEC is asked to quote a price in Belgian francs for computer sales to a Belgian company. The computers will be paid for in four equal, quarterly installments, beginning 90 days from now. DEC requires a minimum price of $2.5 million to accept this contract. Suppose the spot and forward rates for the Belgian franc are as follows:  What is the minimum Belgian franc price that DEC should quote for this order?

What is the minimum Belgian franc price that DEC should quote for this order?

A) BF 82,781,457

B) BF 87,108,014

C) BF 81,433,225

D) BF 84,745,763

What is the minimum Belgian franc price that DEC should quote for this order?

What is the minimum Belgian franc price that DEC should quote for this order?A) BF 82,781,457

B) BF 87,108,014

C) BF 81,433,225

D) BF 84,745,763

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose PPP holds, markets are efficient, there are no taxes, and relative prices remain constant. In such a world,

A) hedging can not still be of value

B) exchange risk management remains of vital concern

C) markets are always free of inflation

D) exchange risk is nonexistent

A) hedging can not still be of value

B) exchange risk management remains of vital concern

C) markets are always free of inflation

D) exchange risk is nonexistent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

A __________ involves offsetting exposures in one currency with exposures in the same or another currency, where exchange rates are expected to move in such a way that losses on the first exposed position should be offset by gains on the second currency exposure and vice versa.

A) forward contract

A) money-market hedge

B) currency collar

D) currency option

A) forward contract

A) money-market hedge

B) currency collar

D) currency option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

The basic hedging strategy involves

A) reducing hard currency assets and soft currency liabilities

A) reducing soft currency assets and hard currency liabilities

B) converting soft currencies to hard currencies and lending hard currencies

B) increasing hard currency liabilities and soft currency assets

A) reducing hard currency assets and soft currency liabilities

A) reducing soft currency assets and hard currency liabilities

B) converting soft currencies to hard currencies and lending hard currencies

B) increasing hard currency liabilities and soft currency assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

What value can Alcoa lock in for its FF 3 million receivable if it executes a forward contract today?

A) $518,700

B) $524,100

C) $528,900

D) $532,410

A) $518,700

B) $524,100

C) $528,900

D) $532,410

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose Alcoa has a payable of FF 1 million due in one year. Alcoa's cost of the payable using a money market hedge is ????? and its cost using a forward market hedge is ?????.

A) $173,900; $177,470

B) $174,925; $176,300

C) $176,671; $172,900

D) $178,937; $174,700

A) $173,900; $177,470

B) $174,925; $176,300

C) $176,671; $172,900

D) $178,937; $174,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

What value can Alcoa lock in for a receivable of FF 3 million due in one year if it executes a money market hedge today?

A) $525,540

B) $516,545

C) $530,012

D) $520,940

A) $525,540

B) $516,545

C) $530,012

D) $520,940

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

Goodyear has operations in both Germany and the Netherlands. Because of their membership in the European monetary system, the Dutch guilder and Deutsche mark are highly correlated in their movements against the U.S. dollar. If the Dutch unit has net inflows of guilders and the German unit has net inflows of DM, then Goodyear's combined transaction exposure

A) approximately equals the sum of its guilder and DM exposures

B) is less than the sum of its guilder and DM exposures because the currencies are highly correlated

C) is less than the sum of its guilder and DM exposures because of diversification

D) b and c

A) approximately equals the sum of its guilder and DM exposures

B) is less than the sum of its guilder and DM exposures because the currencies are highly correlated

C) is less than the sum of its guilder and DM exposures because of diversification

D) b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

DEC hedges a FF 3.2 million receivable due in 180 days. The current spot rate is FF 1 = $0.18834 and the 180?day forward rate is FF 1 = $0.18625. If the spot rate at the end of 180 days is $0.18728, how much has the forward market hedge cost DEC?

A) $6,688

B) $3,392

C) $3,296

D) DEC gains $6,688 on the hedge

A) $6,688

B) $3,392

C) $3,296

D) DEC gains $6,688 on the hedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

Du Pont has entered into a currency risk sharing arrangement with British Gas. Under the contract, Du Pont agrees to pay British Gas a base price of $10 million for gas purchases, but the parties would share the currency risk equally beyond a neutral zone, specified as a band of exchange rates: $1.67?1.73:£1. Within the neutral zone, Du Pont must pay BG the pound equivalent of $10 million at the base rate of $1.70. Suppose the spot rate at the time of payment is £1 = $1.63. How much will Du Pont owe British Gas?

A) $10 million

B) $9,702,381

C) $9,588,235

D) $9,819,277

A) $10 million

B) $9,702,381

C) $9,588,235

D) $9,819,277

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck