Deck 18: Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/143

العب

ملء الشاشة (f)

Deck 18: Fiscal Policy

1

Federal government purchases,as a percentage of GDP,

A)have risen since the early 1950s.

B)have fallen since the early 1950s.

C)have remained roughly the same since the early 1950s.

D)rose from the early 1950s until the mid 1980s,and then fell.

A)have risen since the early 1950s.

B)have fallen since the early 1950s.

C)have remained roughly the same since the early 1950s.

D)rose from the early 1950s until the mid 1980s,and then fell.

have fallen since the early 1950s.

2

The increase in the amount that the government collects in taxes when the economy expands and the decrease in the amount that the government collects in taxes when the economy goes into a recession is an example of

A)automatic stabilizers.

B)discretionary fiscal policy.

C)discretionary monetary policy.

D)automatic monetary policy.

A)automatic stabilizers.

B)discretionary fiscal policy.

C)discretionary monetary policy.

D)automatic monetary policy.

automatic stabilizers.

3

The increase in government spending on unemployment insurance payments to workers who lose their jobs during a recession and the decrease in government spending on unemployment insurance payments to workers during an expansion is an example of

A)automatic stabilizers.

B)discretionary fiscal policy.

C)discretionary monetary policy.

D)automatic monetary policy.

A)automatic stabilizers.

B)discretionary fiscal policy.

C)discretionary monetary policy.

D)automatic monetary policy.

automatic stabilizers.

4

Which of the following would not be considered an automatic stabilizer?

A)legislation increasing funding for job retraining passed during a recession

B)decreasing unemployment insurance payments due to decreased jobless during an expansion

C)rising income tax collections due to rising incomes during an expansion

D)declining food stamp payments due to more persons finding jobs during an expansion

A)legislation increasing funding for job retraining passed during a recession

B)decreasing unemployment insurance payments due to decreased jobless during an expansion

C)rising income tax collections due to rising incomes during an expansion

D)declining food stamp payments due to more persons finding jobs during an expansion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

5

Fiscal policy refers to changes in

A)state and local taxes and purchases that are intended to achieve macroeconomic policy objectives.

B)federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

C)federal taxes and purchases that are intended to fund the war on terrorism.

D)the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

A)state and local taxes and purchases that are intended to achieve macroeconomic policy objectives.

B)federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

C)federal taxes and purchases that are intended to fund the war on terrorism.

D)the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would be classified as fiscal policy?

A)The federal government passes tax cuts to encourage firms to reduce air pollution.

B)The Federal Reserve cuts interest rates to stimulate the economy.

C)A state government cuts taxes to help the economy of the state.

D)The federal government cuts taxes to stimulate the economy.

E)States increase taxes to fund education.

A)The federal government passes tax cuts to encourage firms to reduce air pollution.

B)The Federal Reserve cuts interest rates to stimulate the economy.

C)A state government cuts taxes to help the economy of the state.

D)The federal government cuts taxes to stimulate the economy.

E)States increase taxes to fund education.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

7

Federal government expenditures,as a percentage of GDP,

A)have risen since the early 1950s to the present.

B)have fallen since the early 1950s to the present.

C)rose from 1950 to 1991,fell from 1992 to 2001,and have risen from 2001 to the present.

D)rose from 1950 to 2001 and then fell from 2001 to the present.

E)rose from 1950 to 1980,fell from 1981 to 2001,and have risen from 2001 to the present.

A)have risen since the early 1950s to the present.

B)have fallen since the early 1950s to the present.

C)rose from 1950 to 1991,fell from 1992 to 2001,and have risen from 2001 to the present.

D)rose from 1950 to 2001 and then fell from 2001 to the present.

E)rose from 1950 to 1980,fell from 1981 to 2001,and have risen from 2001 to the present.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

8

Government transfer payments include which of the following?

A)interest on the national debt

B)grants to state and local governments

C)Social Security and Medicare programs

D)national defense

A)interest on the national debt

B)grants to state and local governments

C)Social Security and Medicare programs

D)national defense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

9

Before the Great Depression of the 1930s,the majority of government spending took place at the ________ and after the Great Depression the majority of government spending took place at the ________.

A)state and local levels;federal level

B)local level;federal level

C)federal level;state and local levels

D)federal level;state level

A)state and local levels;federal level

B)local level;federal level

C)federal level;state and local levels

D)federal level;state level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

10

The three categories of federal government expenditures,in addition to government purchases,are

A)interest on the national debt,grants to state and local governments,and transfer payments.

B)interest on the national debt,defense spending,and transfer payments.

C)defense spending,budgets of federal agencies,and transfer payments.

D)defense spending,Social Security,and Medicare.

A)interest on the national debt,grants to state and local governments,and transfer payments.

B)interest on the national debt,defense spending,and transfer payments.

C)defense spending,budgets of federal agencies,and transfer payments.

D)defense spending,Social Security,and Medicare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

11

If Congress passed a one-time tax cut in order to stimulate the economy in 2010,and tax rate levels returned to their pre-2010 level in 2011,how should this tax cut affect the economy?

A)Households on average would save an amount equal to the tax cut.

B)The tax cut would stimulate spending by households.

C)The tax cut would shift the aggregate demand curve to the right.

D)The tax cut would raise the price level in 2010.

A)Households on average would save an amount equal to the tax cut.

B)The tax cut would stimulate spending by households.

C)The tax cut would shift the aggregate demand curve to the right.

D)The tax cut would raise the price level in 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is an objective of fiscal policy?

A)energy independence from Middle East oil

B)health care coverage for all Americans

C)discovering a cure for AIDs

D)high rates of economic growth

E)homeland security

A)energy independence from Middle East oil

B)health care coverage for all Americans

C)discovering a cure for AIDs

D)high rates of economic growth

E)homeland security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

13

Social Security began as a "pay-as-you-go" system,meaning that payments to current retirees were paid

A)from taxes collected from current workers.

B)from taxes collected from retired workers.

C)as long as the government had funds available.

D)as the government collected revenues from tariffs and excise taxes in the years Social Security payments were made.

A)from taxes collected from current workers.

B)from taxes collected from retired workers.

C)as long as the government had funds available.

D)as the government collected revenues from tariffs and excise taxes in the years Social Security payments were made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

14

From the 1960s to 2010,transfer payments

A)have risen from about 25 percent to 46 percent of federal government expenditures.

B)remained the same percentage of total federal government expenditures.

C)have declined by half as a percentage of total federal government expenditures.

D)have grown very slowly as a percentage of total federal government expenditures.

A)have risen from about 25 percent to 46 percent of federal government expenditures.

B)remained the same percentage of total federal government expenditures.

C)have declined by half as a percentage of total federal government expenditures.

D)have grown very slowly as a percentage of total federal government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

15

Since the Social Security system began in 1935,the number of workers per retiree has

A)stayed roughly the same.

B)continually risen.

C)continually declined.

D)risen and declined with different generations.

A)stayed roughly the same.

B)continually risen.

C)continually declined.

D)risen and declined with different generations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

16

The largest and fastest-growing category of federal government expenditures is

A)grants to state and local governments.

B)interest on the national debt.

C)national park spending.

D)transfer payments.

A)grants to state and local governments.

B)interest on the national debt.

C)national park spending.

D)transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

17

The largest source of federal government revenue in 2010 was

A)sales taxes.

B)corporate income taxes.

C)individual income taxes.

D)payroll taxes to fund Social Security and Medicare programs.

A)sales taxes.

B)corporate income taxes.

C)individual income taxes.

D)payroll taxes to fund Social Security and Medicare programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

18

Part of the spending on the Caldecott Tunnel project in northern California came from the American Reinvestment and Recovery Act,which is an example of ________ aimed at increasing real GDP and employment.

A)discretionary fiscal policy

B)an automatic stabilizer

C)contractionary fiscal policy

D)a transfer payment

A)discretionary fiscal policy

B)an automatic stabilizer

C)contractionary fiscal policy

D)a transfer payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

19

Automatic stabilizers refer to

A)the money supply and interest rates that automatically increase or decrease along with the business cycle.

B)government spending and taxes that automatically increase or decrease along with the business cycle.

C)changes in the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

D)changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

A)the money supply and interest rates that automatically increase or decrease along with the business cycle.

B)government spending and taxes that automatically increase or decrease along with the business cycle.

C)changes in the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

D)changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following provides health-care coverage to people age 65 and over?

A)Medicaid

B)Medicare

C)Social Security

D)Health-Aid

A)Medicaid

B)Medicare

C)Social Security

D)Health-Aid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

21

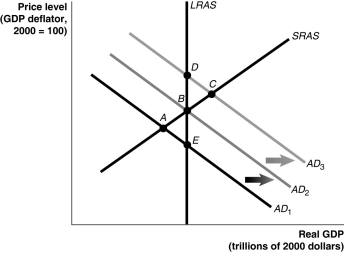

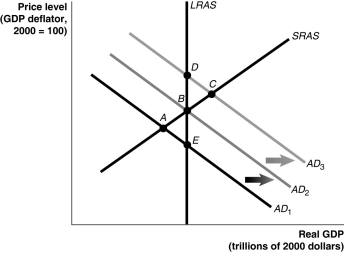

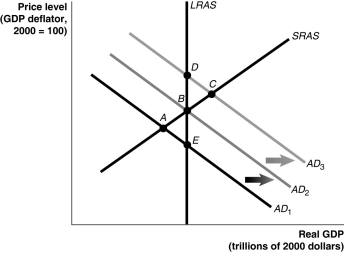

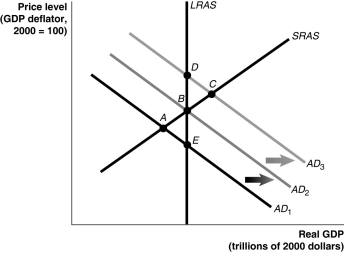

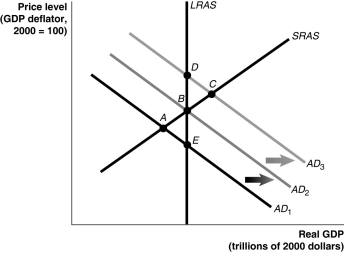

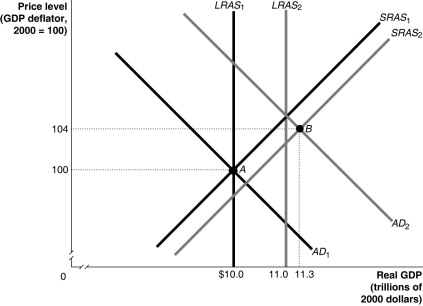

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and no policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)D to C.

B)A to E.

C)C to D.

D)C to B.

E)E to A.

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and no policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)D to C.

B)A to E.

C)C to D.

D)C to B.

E)E to A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

22

Tax cuts on business income ________ aggregate demand.

A)would decrease

B)would increase

C)would not change

D)may increase or decrease

A)would decrease

B)would increase

C)would not change

D)may increase or decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

23

An increase in government purchases will increase aggregate demand because

A)government expenditures are a component of aggregate demand.

B)consumption expenditures are a component of aggregate demand.

C)the decline in the price level will increase demand.

D)the decline in the interest rate will increase demand.

A)government expenditures are a component of aggregate demand.

B)consumption expenditures are a component of aggregate demand.

C)the decline in the price level will increase demand.

D)the decline in the interest rate will increase demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

24

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium below potential GDP and Congress and the president lower taxes to move the economy back to long-run equilibrium.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium below potential GDP and Congress and the president lower taxes to move the economy back to long-run equilibrium.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Social Security and Medicare programs have been a failure in terms of reducing poverty among elderly U.S.citizens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

26

The tax increases necessary to fund future Social Security and Medicare benefit payments would be

A)small,and have little effect on economic growth.

B)small,but could discourage work effort,entrepreneurship and investment,thereby slowing economic growth.

C)large,but would have little effect on economic growth.

D)large,and could discourage work effort,entrepreneurship and investment,thereby slowing economic growth.

A)small,and have little effect on economic growth.

B)small,but could discourage work effort,entrepreneurship and investment,thereby slowing economic growth.

C)large,but would have little effect on economic growth.

D)large,and could discourage work effort,entrepreneurship and investment,thereby slowing economic growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

27

List the five categories of federal government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

28

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and automatic stabilizers move the economy back to long-run equilibrium.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)D to C.

B)A to E.

C)C to B.

D)B to A.

E)E to A.

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and automatic stabilizers move the economy back to long-run equilibrium.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)D to C.

B)A to E.

C)C to B.

D)B to A.

E)E to A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

29

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium below potential GDP and no fiscal or monetary policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium below potential GDP and no fiscal or monetary policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

30

A decrease in the marginal income tax rate is a fiscal policy which will increase aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

31

Fiscal policy is determined by

A)the Federal Reserve.

B)the president and the Federal Reserve.

C)Congress and the Federal Reserve.

D)Congress and the president.

A)the Federal Reserve.

B)the president and the Federal Reserve.

C)Congress and the Federal Reserve.

D)Congress and the president.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

32

Congress and the president carry out fiscal policy through changes in

A)interest rates and the money supply.

B)taxes and the interest rate.

C)government purchases and the money supply.

D)government purchases and taxes.

A)interest rates and the money supply.

B)taxes and the interest rate.

C)government purchases and the money supply.

D)government purchases and taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

33

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in a recession and expansionary fiscal policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

Refer to Figure 18-1.Suppose the economy is in a recession and expansionary fiscal policy is pursued.Using the static AD-AS model in the figure above,this would be depicted as a movement from

A)A to B.

B)B to C.

C)C to B.

D)B to A.

E)A to E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

34

Figure 18-1

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and wages and prices are rising.If contractionary policy is used to move the economy back to long run equilibrium,this would be depicted as a movement from ________ using the static AD-AS model in the figure above.

A)D to C

B)C to B

C)A to E

D)B to A

E)E to A

Refer to Figure 18-1.Suppose the economy is in short-run equilibrium above potential GDP and wages and prices are rising.If contractionary policy is used to move the economy back to long run equilibrium,this would be depicted as a movement from ________ using the static AD-AS model in the figure above.

A)D to C

B)C to B

C)A to E

D)B to A

E)E to A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the difference between fiscal policy and monetary policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

36

Figure 18-1

Refer to Figure 18-1.An increase in taxes would be depicted as a movement from ________,using the static AD-AS model in the figure above.

A)E to B

B)B to C

C)A to B

D)B to A

E)C to D

Refer to Figure 18-1.An increase in taxes would be depicted as a movement from ________,using the static AD-AS model in the figure above.

A)E to B

B)B to C

C)A to B

D)B to A

E)C to D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

37

Expansionary fiscal policy involves

A)increasing government purchases or decreasing taxes.

B)increasing taxes or decreasing government purchases.

C)increasing the money supply and decreasing interest rates.

D)decreasing the money supply and increasing interest rates.

A)increasing government purchases or decreasing taxes.

B)increasing taxes or decreasing government purchases.

C)increasing the money supply and decreasing interest rates.

D)decreasing the money supply and increasing interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

38

An increase in individual income taxes ________ disposable income,which ________ consumption spending.

A)increases;increases

B)increases;decreases

C)decreases;increases

D)decreases;decreases

A)increases;increases

B)increases;decreases

C)decreases;increases

D)decreases;decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

39

Tax cuts on business income increase aggregate demand by increasing

A)business investment spending.

B)consumption spending.

C)government spending.

D)wage rates.

A)business investment spending.

B)consumption spending.

C)government spending.

D)wage rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

40

The income tax system serves as an automatic stabilizer over the course of the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the economy is falling below potential real GDP,which of the following would be an appropriate fiscal policy to bring the economy back to long-run aggregate supply? An increase in

A)the money supply and a decrease in interest rates.

B)government purchases.

C)oil prices.

D)taxes.

A)the money supply and a decrease in interest rates.

B)government purchases.

C)oil prices.

D)taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

42

Lowering the individual income tax will increase household disposable income and consumption spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

43

From an initial long-run equilibrium,if aggregate demand grows more slowly than long-run and short-run aggregate supply,then Congress and the president would most likely

A)increase the required reserve ratio and decrease government spending.

B)decrease government spending.

C)decrease oil prices.

D)decrease taxes.

E)lower interest rates.

A)increase the required reserve ratio and decrease government spending.

B)decrease government spending.

C)decrease oil prices.

D)decrease taxes.

E)lower interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

44

The problem typically during a recession is not that there is too little money,but too little spending.If the problem was too little money,what would be its cause? If the problem was too little spending,what could be its cause?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

45

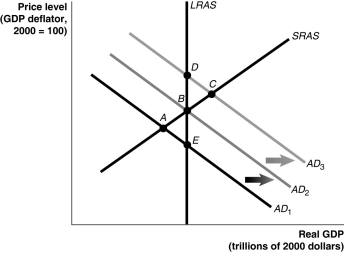

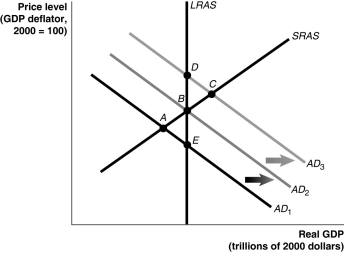

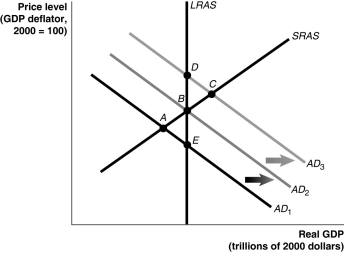

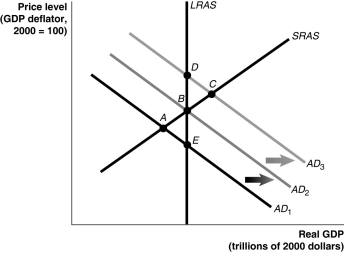

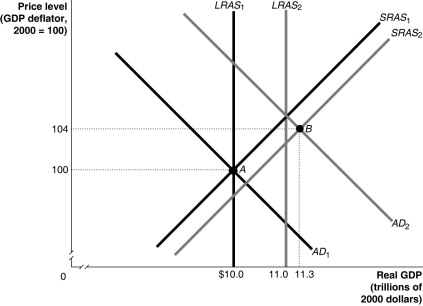

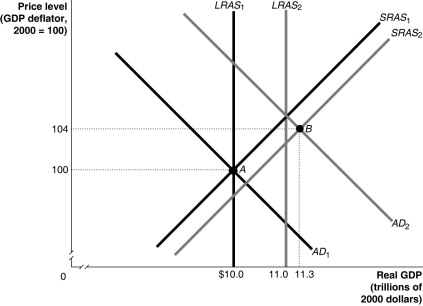

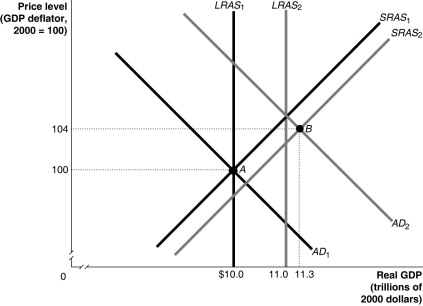

Figure 18-3

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,and no fiscal or monetary policy is pursued,then at point B

A)the unemployment rate is very low.

B)firms are operating at below capacity.

C)the economy is below full employment.

D)income and profits are falling.

E)there is pressure on wages and prices to fall.

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,and no fiscal or monetary policy is pursued,then at point B

A)the unemployment rate is very low.

B)firms are operating at below capacity.

C)the economy is below full employment.

D)income and profits are falling.

E)there is pressure on wages and prices to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

46

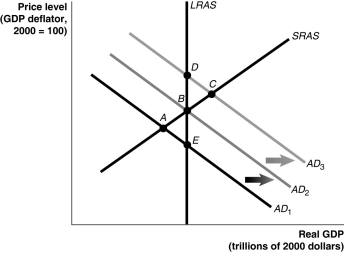

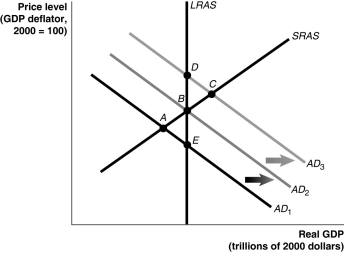

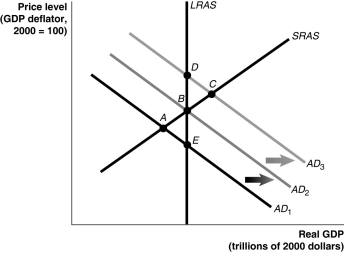

Figure 18-2

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely

A)decrease government spending.

B)increase government spending.

C)increase oil prices.

D)increase taxes.

E)lower interest rates.

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely

A)decrease government spending.

B)increase government spending.

C)increase oil prices.

D)increase taxes.

E)lower interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

47

Contractionary fiscal policy is used to decrease aggregate demand in an attempt to fight rising inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following would be most likely to induce Congress and the president to conduct expansionary fiscal policy? A significant

A)decrease in investment spending.

B)decrease in oil prices.

C)increase in consumption spending.

D)increase in net exports.

A)decrease in investment spending.

B)decrease in oil prices.

C)increase in consumption spending.

D)increase in net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

49

Figure 18-2

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely pursue

A)expansionary fiscal policy.

B)contractionary fiscal policy.

C)expansionary monetary policy.

D)contractionary monetary policy.

E)contractionary automatic stabilizers.

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely pursue

A)expansionary fiscal policy.

B)contractionary fiscal policy.

C)expansionary monetary policy.

D)contractionary monetary policy.

E)contractionary automatic stabilizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

50

Figure 18-3

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely

A)increase the money supply and decrease the interest rate.

B)increase taxes.

C)increase government spending.

D)increase oil prices.

E)raise interest rates.

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely

A)increase the money supply and decrease the interest rate.

B)increase taxes.

C)increase government spending.

D)increase oil prices.

E)raise interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

51

Expansionary fiscal policy involves increasing government purchases or increasing taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

52

Expansionary fiscal policy to prevent real GDP from falling below potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A)higher;higher

B)higher;lower

C)lower;higher

D)lower;lower

A)higher;higher

B)higher;lower

C)lower;higher

D)lower;lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

53

Contractionary fiscal policy to prevent real GDP from rising above potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A)higher;higher

B)higher;lower

C)lower;higher

D)lower;lower

A)higher;higher

B)higher;lower

C)lower;higher

D)lower;lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

54

Figure 18-2

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,and no fiscal or monetary policy is pursued,then at point B

A)the unemployment rate is very low.

B)firms are operating below capacity.

C)the economy is above full employment.

D)income and profits are rising.

E)there is pressure on wages and prices to rise.

Refer to Figure 18-2.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,and no fiscal or monetary policy is pursued,then at point B

A)the unemployment rate is very low.

B)firms are operating below capacity.

C)the economy is above full employment.

D)income and profits are rising.

E)there is pressure on wages and prices to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

55

If real GDP exceeded potential real GDP and inflation was increasing,which of the following would be an appropriate fiscal policy?

A)a decrease in the money supply and an increase in the interest rate

B)an increase in government spending

C)an increase in taxes

D)an increase in oil prices

A)a decrease in the money supply and an increase in the interest rate

B)an increase in government spending

C)an increase in taxes

D)an increase in oil prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is expansionary fiscal policy? What is contractionary fiscal policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is considered contractionary fiscal policy?

A)Congress increases the income tax rate.

B)Congress increases defense spending.

C)Legislation removes a college tuition deduction from federal income taxes.

D)The New Jersey legislature cuts highway spending to balance its budget.

A)Congress increases the income tax rate.

B)Congress increases defense spending.

C)Legislation removes a college tuition deduction from federal income taxes.

D)The New Jersey legislature cuts highway spending to balance its budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

58

Figure 18-3

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely pursue

A)expansionary fiscal policy.

B)contractionary fiscal policy.

C)expansionary monetary policy.

D)contractionary monetary policy.

E)expansionary automatic stabilizers.

Refer to Figure 18-3.In the dynamic model of AD-AS in the figure above,if the economy is at point A in year 1 and is expected to go to point B in year 2,Congress and the president would most likely pursue

A)expansionary fiscal policy.

B)contractionary fiscal policy.

C)expansionary monetary policy.

D)contractionary monetary policy.

E)expansionary automatic stabilizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

59

Does expansionary fiscal policy directly increase the money supply? Isn't it true that the president and Congress fight recessions by spending more money?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

60

From an initial long-run equilibrium,if aggregate demand grows faster than long-run and short-run aggregate supply,then Congress and the president would most likely

A)decrease the required reserve ratio.

B)decrease government spending.

C)decrease oil prices.

D)decrease tax rates.

A)decrease the required reserve ratio.

B)decrease government spending.

C)decrease oil prices.

D)decrease tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

61

Economists refer to the series of induced increases in consumption spending that result from an initial increase in autonomous expenditures as the ________ effect.

A)multiplier

B)expenditure

C)consumption

D)aggregate demand

A)multiplier

B)expenditure

C)consumption

D)aggregate demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

62

If the economy is slipping into a recession,which of the following would be an appropriate fiscal policy?

A)an increase in the money supply and a decrease in interest rates

B)a decrease in government purchases

C)a decrease in taxes

D)a decrease in oil prices

A)an increase in the money supply and a decrease in interest rates

B)a decrease in government purchases

C)a decrease in taxes

D)a decrease in oil prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

63

A change in consumption spending caused by income changes is ________ change in spending,and a change in government spending that occurs to improve roads and bridges is ________ change in spending.

A)an induced;an autonomous

B)an expansionary;a contractionary

C)an autonomous;an induced

D)a contractionary;an expansionary

A)an induced;an autonomous

B)an expansionary;a contractionary

C)an autonomous;an induced

D)a contractionary;an expansionary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

64

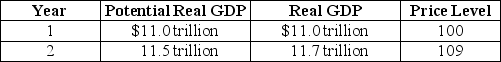

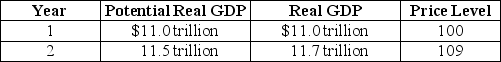

Table 18-1

Refer to Table 18-1.Suppose the economy is in the state described by the table above.What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the appropriate fiscal policy to use in this situation.

Refer to Table 18-1.Suppose the economy is in the state described by the table above.What problem will occur in the economy if no policy is pursued? What fiscal policy tools could be used to combat the problem? Draw a dynamic aggregate demand and aggregate supply diagram to illustrate the appropriate fiscal policy to use in this situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the dynamic aggregate demand and aggregate supply model and start with Year 1 in a long-run macroeconomic equilibrium.For Year 2,graph aggregate demand,long-run aggregate supply,and short-run aggregate supply such that the condition of the economy will induce the president and the Congress to conduct expansionary fiscal policy.Briefly explain the condition of the economy and what the president and the Congress are attempting to do.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

66

An appropriate fiscal policy response when aggregate demand is growing at a slower rate than aggregate supply is to cut taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

67

If real equilibrium GDP is above potential GDP,expansionary fiscal policy should be pursued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

68

The aggregate demand curve will shift to the right ________ the initial decrease in taxes.

A)by less than

B)by more than

C)by the same amount

D)sometimes by more than and other times by less than

A)by less than

B)by more than

C)by the same amount

D)sometimes by more than and other times by less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

69

The aggregate demand curve will shift to the right ________ the initial increase in government purchases.

A)by less than

B)by more than

C)by the same amount as

D)sometimes by more than and other times by less than

A)by less than

B)by more than

C)by the same amount as

D)sometimes by more than and other times by less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

70

The aggregate demand curve will shift to the left ________ the initial decrease in government purchases.

A)by less than

B)by more than

C)by the same amount as

D)sometimes by more than and other times by less than

A)by less than

B)by more than

C)by the same amount as

D)sometimes by more than and other times by less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

71

What are the key differences between how we illustrate an expansionary fiscal policy in the basic aggregate demand and aggregate supply model and in the dynamic aggregate demand and aggregate supply model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

72

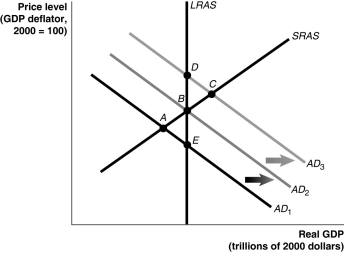

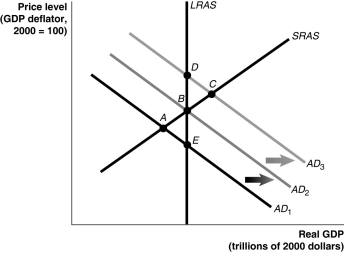

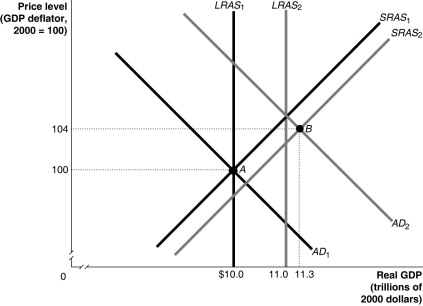

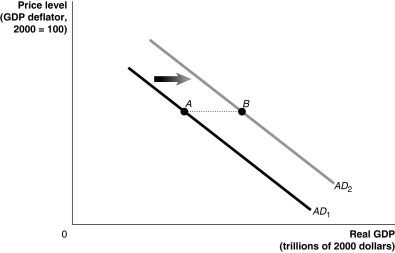

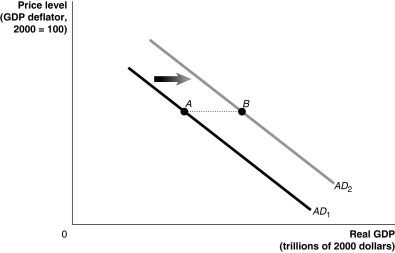

Figure 18-4

Refer to Figure 18-4.In the graph above,the shift from AD1 to AD2 represents the total change in aggregate demand.If government purchases increased by $50 billion,then the distance from point A to point B ________ $50 billion.

A)would be equal to

B)would be greater than

C)would be less than

D)may be greater than or less than

Refer to Figure 18-4.In the graph above,the shift from AD1 to AD2 represents the total change in aggregate demand.If government purchases increased by $50 billion,then the distance from point A to point B ________ $50 billion.

A)would be equal to

B)would be greater than

C)would be less than

D)may be greater than or less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the tax multiplier is -1.5 and a $200 billion tax increase is implemented,what is the change in GDP,holding everything else constant? (Assume the price level stays constant. )

A)a $300 billion decrease in GDP

B)a $300 billion increase in GDP

C)a $30 billion increase in GDP

D)a $133.33 billion decrease in GDP

E)a $133.33 billion increase in GDP

A)a $300 billion decrease in GDP

B)a $300 billion increase in GDP

C)a $30 billion increase in GDP

D)a $133.33 billion decrease in GDP

E)a $133.33 billion increase in GDP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following would increase the size of the government purchases multiplier?

A)an increase in the tax rate

B)an increase in the quantity of imports purchased by households from an increase in income

C)a decrease in the amount of consumption spending by households from an increase in income

D)a decrease in the amount saved by households from an increase in income

A)an increase in the tax rate

B)an increase in the quantity of imports purchased by households from an increase in income

C)a decrease in the amount of consumption spending by households from an increase in income

D)a decrease in the amount saved by households from an increase in income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose the government spending multiplier is 2.The federal government cuts spending by $40 billion.What is the change in GDP if the price level is not held constant?

A)an increase of less than $80 billion

B)an increase equal to $80 billion

C)an increase of greater than $80 billion

D)a decrease of less than $80 billion

E)a decrease of more than $80 billion

A)an increase of less than $80 billion

B)an increase equal to $80 billion

C)an increase of greater than $80 billion

D)a decrease of less than $80 billion

E)a decrease of more than $80 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

76

The government purchases multiplier equals the change in ________ divided by the change in ________.

A)government purchases;equilibrium real GDP

B)equilibrium real GDP;government purchases

C)government purchases;consumption spending

D)consumption spending;government purchases

A)government purchases;equilibrium real GDP

B)equilibrium real GDP;government purchases

C)government purchases;consumption spending

D)consumption spending;government purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

77

The tax multiplier equals the change in ________ divided by the change in ________.

A)taxes;equilibrium real GDP

B)equilibrium real GDP;taxes

C)taxes;consumption spending

D)consumption spending;taxes

A)taxes;equilibrium real GDP

B)equilibrium real GDP;taxes

C)taxes;consumption spending

D)consumption spending;taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

78

The multiplier effect refers to the series of

A)autonomous increases in consumption spending that result from an initial increase in induced expenditures.

B)induced increases in consumption spending that result from an initial increase in autonomous expenditures.

C)autonomous increases in investment spending that result from an initial increase in induced expenditures.

D)induced increases in investment spending that result from an initial increase in autonomous expenditures.

A)autonomous increases in consumption spending that result from an initial increase in induced expenditures.

B)induced increases in consumption spending that result from an initial increase in autonomous expenditures.

C)autonomous increases in investment spending that result from an initial increase in induced expenditures.

D)induced increases in investment spending that result from an initial increase in autonomous expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following would be most likely to induce Congress and the president to conduct contractionary fiscal policy? A significant

A)decrease in oil prices.

B)decrease in real GDP.

C)increase in inflation.

D)increase in labor productivity.

A)decrease in oil prices.

B)decrease in real GDP.

C)increase in inflation.

D)increase in labor productivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

80

The tax multiplier is smaller in absolute value than the government purchases multiplier because some portion of the

A)decrease in taxes will be saved by households and not spent,and some portion will be spent on imported goods.

B)decrease in taxes will be saved by households and not spent,and some portion will be spent on consumer durable goods.

C)increase in government purchases will be saved by households and not spent,and some portion will be spent on imported goods.

D)increase in government purchases will be saved by households and not spent,and some portion will be spent on consumer durable goods.

A)decrease in taxes will be saved by households and not spent,and some portion will be spent on imported goods.

B)decrease in taxes will be saved by households and not spent,and some portion will be spent on consumer durable goods.

C)increase in government purchases will be saved by households and not spent,and some portion will be spent on imported goods.

D)increase in government purchases will be saved by households and not spent,and some portion will be spent on consumer durable goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck