Deck 14: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 14: Financial Statement Analysis

1

The lower the current ratio,the more liquid the company appears.

False

2

Working capital is the excess of current assets over current liabilities.

True

3

The debt ratio is computed by dividing total liabilities by current assets.

False

4

Comparative financial statements show side-by-side financial data for two or more companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

A company should carry the amount of working capital necessary to conduct operations,not necessarily maximize its working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

The current ratio may be less than,equal to,or greater than the quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

The gross profit rate usually is lowest on fast moving merchandise and highest on specialty and novelty products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

The quick ratio is especially useful in evaluating the liquidity of a company with fast moving inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

When an income statement does not show gross profit or operating income,it is called a consolidated statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

A company's liquidity refers to its ability to remain profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

The quality of earnings tends to be higher for a company that uses accounting principles and methods that lead to a conservative measurement of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

Deducting the cost of goods sold from net income gives us operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

Vertical analysis compares the results of financial information with a business in the same industry for a number of consecutive periods of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

The gross profit rate is gross profit expressed as a percentage of net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

If total current assets are $140,000 at the end of Year 1,increase by $50,000 by the end of Year 2,and increase by $50,000 in Year 3,the percentage increase over the preceding year is less in Year 3 than in Year 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

From a creditor's point of view,the lower the debt ratio;the safer the creditor's position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

Inventory is an example of a quick asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

Current assets are those assets that are expected to be converted into cash within a relatively short period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

In a classified balance sheet,assets are subdivided into current assets,plant and equipment and other assets,while all liabilities are classified as current.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

The owners of a corporation are not personally responsible for the debts of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

The price-earnings ratio is calculated by dividing earnings per share by the current market price of a share of the company's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

The changes in financial statement items from a base year to following years are called:

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

The trend in ratios is usually more useful than looking at a single year's ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

Comparative financial statements compare the company's current statements with:

A)Those of prior periods.

B)Those of other companies in the same industry.

C)Those of the company's principal competitor.

D)The budgeted level of performance for the period.

A)Those of prior periods.

B)Those of other companies in the same industry.

C)Those of the company's principal competitor.

D)The budgeted level of performance for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a single-step income statement,all revenue items are listed,then all expense items are combined and deducted from total revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

The more pessimistic investors' expectations regarding a company's future performance,the lower the price-earnings ratio is likely to be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

A single-step and a multiple-step income statement are different in form and in the amount of net income reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

Net income stated as a percentage of sales is one means of evaluating a company's ability to control its expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

The return on equity ratio may be either higher or lower than the return on assets ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the return on total assets ratio is substantially below the cost of borrowing,common stockholders will benefit from a high debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

One number expressed as a percentage of another is called:

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company cannot be increasing its market share if its net sales are declining.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

The measurement of the relative size of each item included in a total is called:

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

A)Money changes.

B)Trend percentages.

C)Component percentages.

D)Ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

Return on equity (ROE)is measured by dividing net income by average number of shares outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

A comparative financial statement:

A)Places the balance sheet,the income statement,and the statement of cash flows side-by-side in order to compare the results.

B)Places two or more years of a financial statement side-by-side in order to compare results.

C)Places the financial statements of two or more companies side-by-side in order to compare results.

D)Places the dollar amounts next to the percentage amounts of a given year for the income statement.

A)Places the balance sheet,the income statement,and the statement of cash flows side-by-side in order to compare the results.

B)Places two or more years of a financial statement side-by-side in order to compare results.

C)Places the financial statements of two or more companies side-by-side in order to compare results.

D)Places the dollar amounts next to the percentage amounts of a given year for the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company whose sales are growing at less than the rate of inflation may actually be selling less merchandise every year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

37

The inventory turnover rate indicates how quickly inventory sells.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company whose future earnings are expected to rise substantially is likely to have a higher price-earnings ratio than a company whose future earnings are expected to decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

The yield rate on stock is measured by dividing dividends per share by market price per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

The acid test ratio includes marketable securities but does not include accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

The principle factor(s)affecting the quality of working capital is (are):

A)The nature of the current assets.

B)The length of time to convert current assets into cash.

C)Both the nature of the current assets and the length of time to convert current assets into cash.

D)Neither the nature of the current assets nor the length of time to convert current assets into cash.

A)The nature of the current assets.

B)The length of time to convert current assets into cash.

C)Both the nature of the current assets and the length of time to convert current assets into cash.

D)Neither the nature of the current assets nor the length of time to convert current assets into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

On common size income statements,each component in the income statement is represented as a percentage of:

A)Net income.

B)Net sales.

C)Total assets.

D)Profit.

A)Net income.

B)Net sales.

C)Total assets.

D)Profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

The term,classified financial statements,refers to:

A)The financial statements of all companies working on government projects.

B)The financial statements of defense contractors working on secret projects.

C)Financial statements prepared for use by management,but not for distribution outside of the organization.

D)Financial statements in which items with certain characteristics are placed together in a group in an effort to develop useful subtotals.

A)The financial statements of all companies working on government projects.

B)The financial statements of defense contractors working on secret projects.

C)Financial statements prepared for use by management,but not for distribution outside of the organization.

D)Financial statements in which items with certain characteristics are placed together in a group in an effort to develop useful subtotals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

In evaluating the quality of a company's earnings,which of the following factors is least important?

A)The accounting methods used by management

B)The trend of the company's earnings over a period of years

C)The dollar amount of earnings per share

D)The stability and sources of the company's earnings

A)The accounting methods used by management

B)The trend of the company's earnings over a period of years

C)The dollar amount of earnings per share

D)The stability and sources of the company's earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

How would a company's working capital be affected if a substantial amount of accounts payable were paid in cash?

A)It would be unaffected.

B)It would fall.

C)It would increase.

D)The change would depend on the relationship between the payables liquidated and current liabilities.

A)It would be unaffected.

B)It would fall.

C)It would increase.

D)The change would depend on the relationship between the payables liquidated and current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

During the years 2016 through 2018,Powers,Inc. ,reported the following amounts of net income (dollars in thousands):  Relative to the prior year,the percentage change in net income:

Relative to the prior year,the percentage change in net income:

A)Was the same in 2017 and 2018.

B)Was larger in 2018 than in 2017.

C)Was smaller in 2018 than in 2017.

D)Cannot be determined without knowing how many shares of stock were outstanding.

Relative to the prior year,the percentage change in net income:

Relative to the prior year,the percentage change in net income:A)Was the same in 2017 and 2018.

B)Was larger in 2018 than in 2017.

C)Was smaller in 2018 than in 2017.

D)Cannot be determined without knowing how many shares of stock were outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

A high quality of earnings is indicated by:

A)Earnings derived largely from newly introduced products.

B)Declaration of both cash and stock dividends.

C)Use of the FIFO method of inventory during sustained inflation.

D)A history of increasing earnings and conservative accounting methods.

A)Earnings derived largely from newly introduced products.

B)Declaration of both cash and stock dividends.

C)Use of the FIFO method of inventory during sustained inflation.

D)A history of increasing earnings and conservative accounting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

Quick assets include which of the following?

A)Cash,marketable securities,and receivables.

B)Cash,marketable securities,and inventories.

C)Cash,prepaid rent,and receivables.

D)Market securities,receivables,and inventories.

A)Cash,marketable securities,and receivables.

B)Cash,marketable securities,and inventories.

C)Cash,prepaid rent,and receivables.

D)Market securities,receivables,and inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which American industry would tend to have the greatest debt ratio?

A)Automotive

B)Retail clothing

C)Manufacturing

D)Banking

A)Automotive

B)Retail clothing

C)Manufacturing

D)Banking

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

The excess of current assets over current liabilities is called:

A)Current ratio.

B)Working capital.

C)Debt ratio.

D)Quick ratio.

A)Current ratio.

B)Working capital.

C)Debt ratio.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is a measure of short-term liquidity?

A)Quick ratio

B)Return on assets

C)Dividend yield

D)Debt ratio

A)Quick ratio

B)Return on assets

C)Dividend yield

D)Debt ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

The measures most often used in evaluating solvency-the current ratio,quick ratio,and amount of working capital-are developed from amounts appearing in the:

A)Balance sheet.

B)Income statement.

C)Statement of retained earnings.

D)Statement of cash flows.

A)Balance sheet.

B)Income statement.

C)Statement of retained earnings.

D)Statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

Current assets are those assets that can be converted into cash within:

A)One year and never longer.

B)One year or the operating cycle,whichever is longer.

C)One year or the operating cycle,whichever is shorter.

D)Management's discretion.

A)One year and never longer.

B)One year or the operating cycle,whichever is longer.

C)One year or the operating cycle,whichever is shorter.

D)Management's discretion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

The ratio that measures total liabilities as a percentage of total assets is called the:

A)Current ratio.

B)Working capital.

C)Debt ratio.

D)Quick ratio.

A)Current ratio.

B)Working capital.

C)Debt ratio.

D)Quick ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

All of the following are measures of liquidity except:

A)Quick ratio.

B)Debt ratio.

C)Current ratio.

D)Working capital.

A)Quick ratio.

B)Debt ratio.

C)Current ratio.

D)Working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

The operating cycle of a company:

A)Must be less than one year.

B)Is usually greater than one year.

C)Is the time it takes to purchase inventory,sell inventory,and collect cash from the sale.

D)Is the time it takes to acquire a loan,pay the interest,and retire the loan by paying the creditor in full.

A)Must be less than one year.

B)Is usually greater than one year.

C)Is the time it takes to purchase inventory,sell inventory,and collect cash from the sale.

D)Is the time it takes to acquire a loan,pay the interest,and retire the loan by paying the creditor in full.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

Working capital is calculated by:

A)Dividing current assets by total assets.

B)Dividing current assets by total liabilities.

C)Subtracting current liabilities from total assets.

D)Subtracting current liabilities from current assets.

A)Dividing current assets by total assets.

B)Dividing current assets by total liabilities.

C)Subtracting current liabilities from total assets.

D)Subtracting current liabilities from current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

The quick ratio:

A)Is computed by dividing current assets by current liabilities.

B)Is always higher than the current ratio.

C)Cannot be higher than the current ratio.

D)May be higher or lower than the current ratio.

A)Is computed by dividing current assets by current liabilities.

B)Is always higher than the current ratio.

C)Cannot be higher than the current ratio.

D)May be higher or lower than the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

The current ratio:

A)Is computed by dividing current assets by current liabilities.

B)Is computed by subtracting current liabilities from current assets.

C)Remains unchanged throughout the operating cycle.

D)Is a measure of short-term profitability.

A)Is computed by dividing current assets by current liabilities.

B)Is computed by subtracting current liabilities from current assets.

C)Remains unchanged throughout the operating cycle.

D)Is a measure of short-term profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

The current ratio will be ________ the quick ratio.

A)Less than

B)Greater than or equal to

C)The same as

D)Always different than

A)Less than

B)Greater than or equal to

C)The same as

D)Always different than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

200 Working capital equals:

A)$560,000.

B)$530,000.

C)$270,000.

D)$900,000.

A)$560,000.

B)$530,000.

C)$270,000.

D)$900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Piazza Company has working capital of $540,000 and current assets of $810,000.The current ratio is:

A)0.67

B)1.50

C)2.00

D)3.00

A)0.67

B)1.50

C)2.00

D)3.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

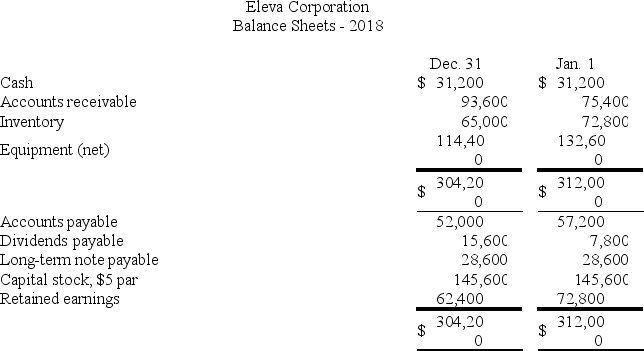

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the amount of working capital?</strong> A)$225 B)$300 C)$150 D)$450](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the amount of working capital?

A)$225

B)$300

C)$150

D)$450

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the amount of working capital?</strong> A)$225 B)$300 C)$150 D)$450](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the amount of working capital?

A)$225

B)$300

C)$150

D)$450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following transactions would cause a change in the amount of a company's working capital?

A)Collection of an account receivable

B)Payment of an account payable

C)Borrowing cash over a 60-day period

D)Selling merchandise at a price above its cost

A)Collection of an account receivable

B)Payment of an account payable

C)Borrowing cash over a 60-day period

D)Selling merchandise at a price above its cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

65

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is Compros' debt ratio?</strong> A)75% B)25% C)60% D)33%](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is Compros' debt ratio?

A)75%

B)25%

C)60%

D)33%

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is Compros' debt ratio?</strong> A)75% B)25% C)60% D)33%](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is Compros' debt ratio?

A)75%

B)25%

C)60%

D)33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the quick ratio?</strong> A)1.5 to 1 B)0.7 to 1 C)0.45 to 1 D)0.8 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the quick ratio?

A)1.5 to 1

B)0.7 to 1

C)0.45 to 1

D)0.8 to 1

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the quick ratio?</strong> A)1.5 to 1 B)0.7 to 1 C)0.45 to 1 D)0.8 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the quick ratio?

A)1.5 to 1

B)0.7 to 1

C)0.45 to 1

D)0.8 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the current ratio?</strong> A)5.0 to 1 B)1.5 to 1 C)0.7 to 1 D)0.8 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the current ratio?

A)5.0 to 1

B)1.5 to 1

C)0.7 to 1

D)0.8 to 1

Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Compros,a small electronics store (dollar amounts are in thousands): 200 What is the current ratio?</strong> A)5.0 to 1 B)1.5 to 1 C)0.7 to 1 D)0.8 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_2e3a_b09f_af4d1766ee38_TB1009_00_TB1009_00_TB1009_00_TB1009_00.jpg)

200 What is the current ratio?

A)5.0 to 1

B)1.5 to 1

C)0.7 to 1

D)0.8 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is considered a quick asset?

A)Accounts receivable.

B)Inventory.

C)Automobiles.

D)Prepaid expenses.

A)Accounts receivable.

B)Inventory.

C)Automobiles.

D)Prepaid expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

Generally speaking,which appears to be a desirable current ratio?

A)20 to 1.

B)1 to 20.

C)2 to 1.

D)1 to 2.

A)20 to 1.

B)1 to 20.

C)2 to 1.

D)1 to 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

When comparing the current ratio to the quick ratio:

A)The current ratio will be greater or equal.

B)The quick ratio will always be greater.

C)The quick ratio is sometimes greater and sometimes less than the current ratio.

D)They always will be the same.

A)The current ratio will be greater or equal.

B)The quick ratio will always be greater.

C)The quick ratio is sometimes greater and sometimes less than the current ratio.

D)They always will be the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

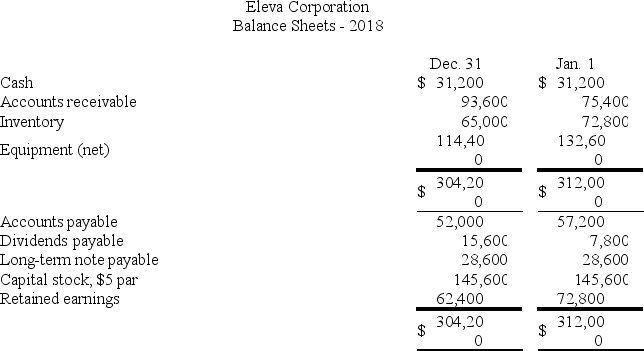

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands): 200 What is the quick ratio? (Round your answer to one decimal place. )</strong> A)5.0% B)1.5 to 1 C)20.0% D)1.1 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_ca7b_b09f_8bfdb007dc52_TB1009_00_TB1009_00.jpg)

200 What is the quick ratio? (Round your answer to one decimal place. )

A)5.0%

B)1.5 to 1

C)20.0%

D)1.1 to 1

Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands): 200 What is the quick ratio? (Round your answer to one decimal place. )</strong> A)5.0% B)1.5 to 1 C)20.0% D)1.1 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_ca7b_b09f_8bfdb007dc52_TB1009_00_TB1009_00.jpg)

200 What is the quick ratio? (Round your answer to one decimal place. )

A)5.0%

B)1.5 to 1

C)20.0%

D)1.1 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

200 Bill's debt ratio is:

A)22%.

B)27%.

C)57%.

D)49%.

A)22%.

B)27%.

C)57%.

D)49%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

73

Short-term creditors are most likely to use the quick ratio instead of the current ratio in evaluating the solvency of a company with large,slow-moving:

A)Plant and equipment.

B)Receivables.

C)Inventories.

D)Employees.

A)Plant and equipment.

B)Receivables.

C)Inventories.

D)Employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Plaza Company has working capital of $540,000 and a current ratio of 3 to 1.The amount of current assets is:

A)$405,000.

B)$540,000.

C)$810,000.

D)$270,000.

A)$405,000.

B)$540,000.

C)$810,000.

D)$270,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a retail store has a current ratio of 2.5 and working capital of $117,000.What are the total of the current assets?

A)$46,800

B)$117,000

C)$195,000

D)$292,500

A)$46,800

B)$117,000

C)$195,000

D)$292,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a company has a current ratio of 2 to 1,and purchases inventory on credit,what will this do to its current ratio?

A)Increase the current ratio.

B)Decrease the current ratio.

C)Does not change the current ratio.

D)Cannot be determined.

A)Increase the current ratio.

B)Decrease the current ratio.

C)Does not change the current ratio.

D)Cannot be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

If a retail store has a current ratio of 2.5 and current assets of $195,000,the amount of working capital is:

A)$ 78,000

B)$380,000

C)$330,000

D)$117,000

A)$ 78,000

B)$380,000

C)$330,000

D)$117,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

The debt ratio is used primarily as a measure of:

A)Short-term liquidity.

B)Creditors' long-term risk.

C)Profitability.

D)Return on Investment.

A)Short-term liquidity.

B)Creditors' long-term risk.

C)Profitability.

D)Return on Investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

The debt ratio indicates the percentage of:

A)Total assets financed by long-term mortgages.

B)Revenue consumed by interest expense.

C)Total assets financed by creditors.

D)Total liabilities classified as current.

A)Total assets financed by long-term mortgages.

B)Revenue consumed by interest expense.

C)Total assets financed by creditors.

D)Total liabilities classified as current.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

[The following information applies to the questions displayed below.]

Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands): 200 What is the current ratio?</strong> A)1.2 to 1 B)Less than 2 to 1,but not 1.2 to 1 C)2.6 to 1 D)More than 2 to 1,but not 2.6 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_ca7b_b09f_8bfdb007dc52_TB1009_00_TB1009_00.jpg)

200 What is the current ratio?

A)1.2 to 1

B)Less than 2 to 1,but not 1.2 to 1

C)2.6 to 1

D)More than 2 to 1,but not 2.6 to 1

Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands):

![<strong>[The following information applies to the questions displayed below.] Shown below are selected data from the balance sheet of Bill's Auto Parts,a retail store (dollar amounts are in thousands): 200 What is the current ratio?</strong> A)1.2 to 1 B)Less than 2 to 1,but not 1.2 to 1 C)2.6 to 1 D)More than 2 to 1,but not 2.6 to 1](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a3a4_ca7b_b09f_8bfdb007dc52_TB1009_00_TB1009_00.jpg)

200 What is the current ratio?

A)1.2 to 1

B)Less than 2 to 1,but not 1.2 to 1

C)2.6 to 1

D)More than 2 to 1,but not 2.6 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck