Deck 22: Responsibility Accounting and Transfer Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/88

العب

ملء الشاشة (f)

Deck 22: Responsibility Accounting and Transfer Pricing

1

A responsibility income statement shows the revenue and expenses of each cost center within a particular part of a business.

False

2

An accounting system designed to measure the performance of each center within a business is referred to as a profitability accounting system.

False

3

Revenue,less variable costs,less traceable fixed costs,is called the contribution margin.

False

4

In assigning costs to centers,each center is charged with costs attributed to the center and based on company-wide rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

5

Evaluating the performance of cost centers involves subjective judgments as to the value of the services rendered by these centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

6

Performance margin is equal to controllable fixed costs minus the contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

7

In responsibility income statements,revenue is first assigned to the centers responsible for creating that revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

8

Profit centers generate revenues and costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

9

Responsibility margin is useful in evaluating the consequences of short-run marketing strategies,while contribution margin is more useful in evaluating long-term profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

10

The contribution margin approach to preparing reports for managers classifies costs into fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

11

The responsibility margin is the contribution margin less common fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

12

A cost that is directly traceable to a particular center must be a variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

13

If operations at a center are discontinued,all traceable costs attributed to the cost would be discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

14

All costs become traceable at some level of the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

15

Traceable fixed costs usually cannot be eliminated even if the center is closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

16

A common cost may become a traceable cost as it moves up to larger responsibility centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

17

Common fixed costs jointly benefit several parts of the business and would not change significantly even if one of the parts of the business were discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

18

One purpose of a responsibility accounting system is to evaluate the performance of center managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

19

An investment center is a profit center in which management can make related capital investment choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

20

If a business activity qualifies as a profit center,it cannot also qualify as an investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

21

An investment center:

A)Is a profit center for which management is able to objectively measure the cost of the assets used in the center's operations.

B)Is a cost center for which management is able to identify the original amount invested.

C)May be either a cost center or a profit center.

D)Is a subunit of the organization that provides services to other centers within the organization.

A)Is a profit center for which management is able to objectively measure the cost of the assets used in the center's operations.

B)Is a cost center for which management is able to identify the original amount invested.

C)May be either a cost center or a profit center.

D)Is a subunit of the organization that provides services to other centers within the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

22

The bookstore of a university would be considered:

A)A cost center.

B)A profit center.

C)An investment center.

D)A revenue center.

A)A cost center.

B)A profit center.

C)An investment center.

D)A revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

23

Carrier Corporation produces heating and air conditioning equipment at a number of plants throughout the United States including one in Syracuse,New York.Carrier should evaluate its Syracuse plant as:

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)A committed center.

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)A committed center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

24

The transfer price is the dollar amount used in recording sales to primary customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

25

When an external market exists for a transferred product or service,most companies use either negotiated transfer prices or cost-plus transfer prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

26

A responsibility accounting system measures the performance of each of the following centers except:

A)Profit center.

B)Investment center.

C)Control center.

D)Cost center.

A)Profit center.

B)Investment center.

C)Control center.

D)Cost center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

27

The primary difference between profit centers and cost centers is that:

A)Profit centers generate revenue.

B)Cost centers incur costs.

C)Profit centers are evaluated using return on investment criteria.

D)Profit centers provide services to other centers in the organization.

A)Profit centers generate revenue.

B)Cost centers incur costs.

C)Profit centers are evaluated using return on investment criteria.

D)Profit centers provide services to other centers in the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

28

One of the unique services provided by San Francisco's St.Francis Hotel is cleaning and polishing coins (pocket change)for the guests.From the standpoint of hotel management,this "money laundry" should be viewed as:

A)A contribution center.

B)A cost center.

C)An investment center.

D)A profit center (other than an investment center).

A)A contribution center.

B)A cost center.

C)An investment center.

D)A profit center (other than an investment center).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

29

An example of a profit center is:

A)The accounting department in a manufacturing company.

B)The maintenance department of a university.

C)The furniture department of a retail department store.

D)The human resources department in a hospital.

A)The accounting department in a manufacturing company.

B)The maintenance department of a university.

C)The furniture department of a retail department store.

D)The human resources department in a hospital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

30

The part of a business a particular manager is held responsible for is called a:

A)Cost center.

B)Profit center.

C)Investment center.

D)Responsibility center.

A)Cost center.

B)Profit center.

C)Investment center.

D)Responsibility center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

31

John Thomas is the manager of materials movement for the Syracuse plant of Carrier Corporation.Thomas should be evaluated as manager of:

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)Human resources under his supervision.

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)Human resources under his supervision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

32

Disneyland is one of several theme parks owned by The Walt Disney Company.Disneyland should be evaluated as:

A)An investment center.

B)A cost center.

C)An entertainment center.

D)A profit center (other than an investment center).

A)An investment center.

B)A cost center.

C)An entertainment center.

D)A profit center (other than an investment center).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a valid reason for developing responsibility center information?

A)Responsibility center information is useful in deciding how to allocate resources among segments of the business.

B)Separately measuring the revenue and expenses of each responsibility center is a necessary step in developing financial statements for the business entity viewed as a whole.

C)Responsibility center information is useful in evaluating the performance of segment managers.

D)Responsibility center information helps management to quickly identify sections of the business that are performing poorly.

A)Responsibility center information is useful in deciding how to allocate resources among segments of the business.

B)Separately measuring the revenue and expenses of each responsibility center is a necessary step in developing financial statements for the business entity viewed as a whole.

C)Responsibility center information is useful in evaluating the performance of segment managers.

D)Responsibility center information helps management to quickly identify sections of the business that are performing poorly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

34

Disneyland charges visitors for admission to the park but not for individual rides or attractions."Splash Mountain" is one of the rides in Disneyland.The Walt Disney Company should evaluate "Splash Mountain" as:

A)A revenue center.

B)A cost center.

C)An investment center.

D)A profit center (other than an investment center).

A)A revenue center.

B)A cost center.

C)An investment center.

D)A profit center (other than an investment center).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

35

In a responsibility accounting system,the recording of revenue and costs begins with the:

A)Most profitable segments of the business.

B)Least profitable segments of the business.

C)Broadest areas of management responsibility.

D)Smallest areas of management responsibility.

A)Most profitable segments of the business.

B)Least profitable segments of the business.

C)Broadest areas of management responsibility.

D)Smallest areas of management responsibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cost centers are evaluated primarily on the basis of their ability to control costs and:

A)Their return on assets.

B)Residual income.

C)The quantity and quality of the services they provide.

D)Their contribution margin ratio.

A)Their return on assets.

B)Residual income.

C)The quantity and quality of the services they provide.

D)Their contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

37

San Francisco's famous St.Francis Hotel is owned by Westin Hotel and Resort Group.Westin should evaluate the St.Francis as:

A)A cost center.

B)A historical landmark.

C)An investment center.

D)A profit center (other than an investment center).

A)A cost center.

B)A historical landmark.

C)An investment center.

D)A profit center (other than an investment center).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

38

The human resources department of a large company would be considered:

A)A cost center.

B)A profit center.

C)An investment center.

D)A revenue center.

A)A cost center.

B)A profit center.

C)An investment center.

D)A revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

39

Carrier Corporation's Syracuse plant is organized into Air Conditioning and Heating Products divisions.The management of the Syracuse plant should evaluate the Heating Products division as:

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)A revenue center.

A)A cost center.

B)An investment center.

C)A profit center (other than an investment center).

D)A revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

40

The term responsibility center reflects the idea that the "centers" of a business usually are defined in a manner such that each center is:

A)Responsible for earning a specified amount of profit.

B)Responsible for all business operations in a specific region.

C)Under the control of a specified center manager.

D)Approximately the same size.

A)Responsible for earning a specified amount of profit.

B)Responsible for all business operations in a specific region.

C)Under the control of a specified center manager.

D)Approximately the same size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

41

Responsibility margin is equal to revenue,less:

A)Contribution margin and traceable fixed costs.

B)Variable costs.

C)Variable costs and traceable fixed costs.

D)Variable fixed costs,traceable fixed costs,and common costs.

A)Contribution margin and traceable fixed costs.

B)Variable costs.

C)Variable costs and traceable fixed costs.

D)Variable fixed costs,traceable fixed costs,and common costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

42

[The following information applies to the questions displayed below.]

Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year:

![<strong>[The following information applies to the questions displayed below.] Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year: The contribution margin ratio of the local branch is closest to:</strong> A)59%. B)41%. C)49%. D)52%.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a297_a000_b09f_819cf12adb13_TB1009_00_TB1009_00.jpg)

The contribution margin ratio of the local branch is closest to:

A)59%.

B)41%.

C)49%.

D)52%.

Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year:

![<strong>[The following information applies to the questions displayed below.] Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year: The contribution margin ratio of the local branch is closest to:</strong> A)59%. B)41%. C)49%. D)52%.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a297_a000_b09f_819cf12adb13_TB1009_00_TB1009_00.jpg)

The contribution margin ratio of the local branch is closest to:

A)59%.

B)41%.

C)49%.

D)52%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

43

A responsibility income statement generally does not show the:

A)Contribution margin of each responsibility center.

B)Traceable fixed costs allocated to each responsibility center.

C)Segment margin of each responsibility center.

D)Net income of each responsibility center.

A)Contribution margin of each responsibility center.

B)Traceable fixed costs allocated to each responsibility center.

C)Segment margin of each responsibility center.

D)Net income of each responsibility center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

44

The responsibility margin of the local branch is:

A)$5,500,000.

B)$1,926,000.

C)$2,246,000.

D)$2,400,000.

A)$5,500,000.

B)$1,926,000.

C)$2,246,000.

D)$2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

45

In a responsibility income statement,the term common fixed costs describes fixed costs that:

A)Are under the manager's immediate control.

B)Jointly benefit several responsibility centers of the business.

C)Occur in virtually every responsibility center of the business (such as salaries).

D)Are easily traceable to specific profit centers.

A)Are under the manager's immediate control.

B)Jointly benefit several responsibility centers of the business.

C)Occur in virtually every responsibility center of the business (such as salaries).

D)Are easily traceable to specific profit centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

46

Parker's newly hired director of accounting services feels that the property taxes on the Cairo factory should be allocated to the fabricating,assembly,and finishing departments based upon the square footage they occupy.Of the following,which is not a valid reason to reject this recommendation?

A)The property taxes would not change even if one or more of the departments were eliminated.

B)Such an allocation violates GAAP.

C)The property taxes are not under the control of department managers.

D)The allocation may imply changes in efficiency that are unrelated to center performance.

A)The property taxes would not change even if one or more of the departments were eliminated.

B)Such an allocation violates GAAP.

C)The property taxes are not under the control of department managers.

D)The allocation may imply changes in efficiency that are unrelated to center performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

47

In preparing a responsibility income statement that shows contribution margin and responsibility margin,generally two concepts are involved in allocating costs to the various centers.These concepts are:

A)Whether the costs are variable or fixed and whether they are material in dollar amount.

B)Whether the costs are traceable to the responsibility center and whether the responsibility center is organized as a profit center or an investment center.

C)Whether the costs are variable or fixed and whether they are directly traceable to the responsibility center.

D)Whether the costs are traceable to the responsibility center and whether they are material in dollar amount.

A)Whether the costs are variable or fixed and whether they are material in dollar amount.

B)Whether the costs are traceable to the responsibility center and whether the responsibility center is organized as a profit center or an investment center.

C)Whether the costs are variable or fixed and whether they are directly traceable to the responsibility center.

D)Whether the costs are traceable to the responsibility center and whether they are material in dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

48

[The following information applies to the questions displayed below.]

Steel Fabricating,Inc.manufactures furniture at its plants in Akron,Greensboro,and Schenectady.The company prepares monthly income statements segmented by plant.These income statements are organized to disclose contribution margin,performance margin,and responsibility margin for each plant,in addition to operating income for the company as a whole.

Of the following,which should be classified as a common fixed cost?

A)Depreciation on the Schenectady factory.

B)Salaries of the plant managers.

C)Salaries of the company's legal staff.

D)Property taxes on the Akron factory.

Steel Fabricating,Inc.manufactures furniture at its plants in Akron,Greensboro,and Schenectady.The company prepares monthly income statements segmented by plant.These income statements are organized to disclose contribution margin,performance margin,and responsibility margin for each plant,in addition to operating income for the company as a whole.

Of the following,which should be classified as a common fixed cost?

A)Depreciation on the Schenectady factory.

B)Salaries of the plant managers.

C)Salaries of the company's legal staff.

D)Property taxes on the Akron factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

49

After the closing of Profit Center 3,the monthly income from operations for Profit Center 1,as measured by Dalton Co.should be approximately:

A)$25,000.

B)$17,500.

C)$10,000.

D)$15,000.

A)$25,000.

B)$17,500.

C)$10,000.

D)$15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

50

[The following information applies to the questions displayed below.]

Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year:

![<strong>[The following information applies to the questions displayed below.] Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year: The contribution margin of the local branch is:</strong> A)$5,500,000. B)$2,400,000. C)$2,246,000. D)$3,254,000.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a297_a000_b09f_819cf12adb13_TB1009_00_TB1009_00.jpg)

The contribution margin of the local branch is:

A)$5,500,000.

B)$2,400,000.

C)$2,246,000.

D)$3,254,000.

Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year:

![<strong>[The following information applies to the questions displayed below.] Chic Jewelers views each branch location as an investment center.The local branch reported the following results for the current year: The contribution margin of the local branch is:</strong> A)$5,500,000. B)$2,400,000. C)$2,246,000. D)$3,254,000.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a297_a000_b09f_819cf12adb13_TB1009_00_TB1009_00.jpg)

The contribution margin of the local branch is:

A)$5,500,000.

B)$2,400,000.

C)$2,246,000.

D)$3,254,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

51

The responsibility margin is calculated by:

A)Subtracting fixed costs traceable to a center from its contribution margin.

B)Subtracting common fixed costs from the contribution margin.

C)Subtracting variable costs from sales.

D)Subtracting common fixed costs from variable costs.

A)Subtracting fixed costs traceable to a center from its contribution margin.

B)Subtracting common fixed costs from the contribution margin.

C)Subtracting variable costs from sales.

D)Subtracting common fixed costs from variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sloan Sporting Goods has stores in four geographic regions.Each region has at least 20 stores.In the company's responsibility accounting system,sales are recorded separately for each sales department within each store.The total sales for a particular region are determined by:

A)Combining the total sales of all stores in that region.

B)Using a separate revenue account to record the sales transaction for each region.

C)Taking a percentage of the company's total sales that is equal to the percentage of the company's stores located in that region.

D)Adding together the sales tickets for all sales transactions in the region.

A)Combining the total sales of all stores in that region.

B)Using a separate revenue account to record the sales transaction for each region.

C)Taking a percentage of the company's total sales that is equal to the percentage of the company's stores located in that region.

D)Adding together the sales tickets for all sales transactions in the region.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

53

Successful operation of a responsibility accounting system requires all of the following except:

A)Budgets prepared for each responsibility center.

B)The use of a bonus pool based on ROA (return on assets).

C)An accounting system that measures the performance of each responsibility center.

D)The preparation of timely performance reports.

A)Budgets prepared for each responsibility center.

B)The use of a bonus pool based on ROA (return on assets).

C)An accounting system that measures the performance of each responsibility center.

D)The preparation of timely performance reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

54

Responsibility accounting systems should begin with:

A)A budget by center.

B)A performance report by center.

C)A measure of corporate performance.

D)A company-wide income statement.

A)A budget by center.

B)A performance report by center.

C)A measure of corporate performance.

D)A company-wide income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

55

The contribution margin is calculated by:

A)Subtracting fixed costs from sales.

B)Subtracting variable costs from sales.

C)Subtracting fixed and variable costs from sales.

D)Subtracting common costs from sales.

A)Subtracting fixed costs from sales.

B)Subtracting variable costs from sales.

C)Subtracting fixed and variable costs from sales.

D)Subtracting common costs from sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

56

Responsibility accounting systems measures the performance of:

A)The entire company.

B)Each center individually.

C)Both the entire company and each center individually.

D)Neither the entire company nor each center individually.

A)The entire company.

B)Each center individually.

C)Both the entire company and each center individually.

D)Neither the entire company nor each center individually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

57

Traceable fixed costs that the manager of a department cannot change are called:

A)Controllable.

B)Committed.

C)Conditional.

D)Common.

A)Controllable.

B)Committed.

C)Conditional.

D)Common.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

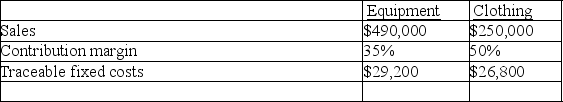

58

[The following information applies to the questions displayed below.]

Dalton Co.follows a policy of allocating all common costs equally among its profit centers.A partial responsibility income statement for a typical month is shown below:

![<strong>[The following information applies to the questions displayed below.] Dalton Co.follows a policy of allocating all common costs equally among its profit centers.A partial responsibility income statement for a typical month is shown below: After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2. Closing Profit Center 3 should cause Dalton's monthly operating income to:</strong> A)Increase by $5,000. B)Decrease by $15,000. C)Decrease by $7,000. D)Decrease by $20,000.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a298_1531_b09f_777c05e4f487_TB1009_00.jpg) After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2.

After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2.

Closing Profit Center 3 should cause Dalton's monthly operating income to:

A)Increase by $5,000.

B)Decrease by $15,000.

C)Decrease by $7,000.

D)Decrease by $20,000.

Dalton Co.follows a policy of allocating all common costs equally among its profit centers.A partial responsibility income statement for a typical month is shown below:

![<strong>[The following information applies to the questions displayed below.] Dalton Co.follows a policy of allocating all common costs equally among its profit centers.A partial responsibility income statement for a typical month is shown below: After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2. Closing Profit Center 3 should cause Dalton's monthly operating income to:</strong> A)Increase by $5,000. B)Decrease by $15,000. C)Decrease by $7,000. D)Decrease by $20,000.](https://d2lvgg3v3hfg70.cloudfront.net/TB1009/11eaae1a_a298_1531_b09f_777c05e4f487_TB1009_00.jpg) After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2.

After evaluating these data,Dalton Co.decides to close Profit Center 3.This action eliminates all revenue,variable costs,and fixed costs traceable to Center 3,but eliminates only $35,000 in common fixed costs.Closing Profit Center 3 has no effect upon the responsibility margins of Centers 1 and 2.Closing Profit Center 3 should cause Dalton's monthly operating income to:

A)Increase by $5,000.

B)Decrease by $15,000.

C)Decrease by $7,000.

D)Decrease by $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

59

The concept of contribution margin applies:

A)Only to investment centers.

B)Only to profit centers.

C)Only to cost centers.

D)To all types of responsibility centers.

A)Only to investment centers.

B)Only to profit centers.

C)Only to cost centers.

D)To all types of responsibility centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

60

Depreciation on the factory would be an example of a:

A)Controllable fixed cost.

B)Period cost.

C)Responsibility cost.

D)Committed fixed cost.

A)Controllable fixed cost.

B)Period cost.

C)Responsibility cost.

D)Committed fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

61

The company's CEO must decide which of the three factories to expand in order to increase productive capacity.She should be most interested in the:

A)Variable costs of each factory.

B)Contribution margin at each factory.

C)Fixed costs traceable to each factory.

D)Responsibility margins of each factory.

A)Variable costs of each factory.

B)Contribution margin at each factory.

C)Fixed costs traceable to each factory.

D)Responsibility margins of each factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

62

[The following information applies to the questions displayed below.]

Patterson's Department Store prepares monthly income statements by sales departments.These income statements are organized to show contribution margin,performance margin,and responsibility margin for each sales department,as well as operating income for the store as a whole.

Depreciation of the fixtures and equipment used exclusively in a particular sales department should be classified as a:

A)Common fixed cost.

B)Variable cost.

C)Controllable fixed cost.

D)Committed fixed cost.

Patterson's Department Store prepares monthly income statements by sales departments.These income statements are organized to show contribution margin,performance margin,and responsibility margin for each sales department,as well as operating income for the store as a whole.

Depreciation of the fixtures and equipment used exclusively in a particular sales department should be classified as a:

A)Common fixed cost.

B)Variable cost.

C)Controllable fixed cost.

D)Committed fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

63

All of the following costs are traceable to specific sales departments except:

A)Cost of goods sold.

B)Depreciation of equipment and fixtures used in the department.

C)Advertising a special sale in a particular department.

D)The salary of the store manager.

A)Cost of goods sold.

B)Depreciation of equipment and fixtures used in the department.

C)Advertising a special sale in a particular department.

D)The salary of the store manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

64

Many companies view performance margin as a more useful tool than responsibility margin for evaluating segment managers.This is because:

A)Managers have no control over traceable fixed costs.

B)Performance margin is not affected by the size of the department.

C)Performance margin indicates the change in operating income that would result from closing the department.

D)Performance margin includes only those revenue and costs under the manager's direct control.

A)Managers have no control over traceable fixed costs.

B)Performance margin is not affected by the size of the department.

C)Performance margin indicates the change in operating income that would result from closing the department.

D)Performance margin includes only those revenue and costs under the manager's direct control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

65

The most common value used for transfer pricing is:

A)Total fixed costs.

B)Total fixed and variable costs.

C)Market value less fixed costs.

D)Market value.

A)Total fixed costs.

B)Total fixed and variable costs.

C)Market value less fixed costs.

D)Market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

66

If a company wanted to evaluate the manager's ability to control costs,the company would probably look at the:

A)Performance margin.

B)Responsibility margin.

C)Contribution margin.

D)Segment margin.

A)Performance margin.

B)Responsibility margin.

C)Contribution margin.

D)Segment margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Akron factory employs two quality control inspectors at an annual salary of $70,000 each.These salaries should be classified as:

A)Common fixed cost.

B)Variable cost.

C)Committed fixed cost.

D)Controllable fixed cost.

A)Common fixed cost.

B)Variable cost.

C)Committed fixed cost.

D)Controllable fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

68

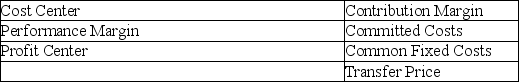

Accounting terminology

Listed below are seven technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

________ (a)Costs that jointly benefit several responsibility centers of the business and that do not vary significantly with changes in sales volume.

________ (b)The amount charged by a responsibility center for the goods it sells to another responsibility center.

________ (c)Used to evaluate the performance of a manager based solely on revenue and costs under the manager's control.

________ (d)A responsibility center of a business that may be evaluated by the return earned on assets.

________ (e)The subtotal in a responsibility income statement that is most useful in evaluating the short-term effects of various marketing strategies on profitability.

Listed below are seven technical accounting terms introduced or emphasized in this chapter:

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.________ (a)Costs that jointly benefit several responsibility centers of the business and that do not vary significantly with changes in sales volume.

________ (b)The amount charged by a responsibility center for the goods it sells to another responsibility center.

________ (c)Used to evaluate the performance of a manager based solely on revenue and costs under the manager's control.

________ (d)A responsibility center of a business that may be evaluated by the return earned on assets.

________ (e)The subtotal in a responsibility income statement that is most useful in evaluating the short-term effects of various marketing strategies on profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

69

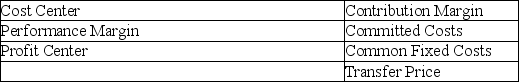

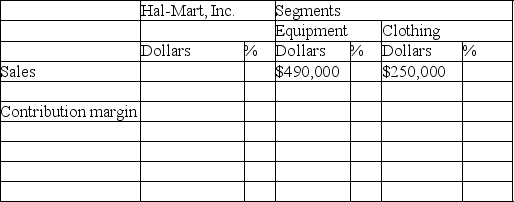

Preparation of responsibility income statements

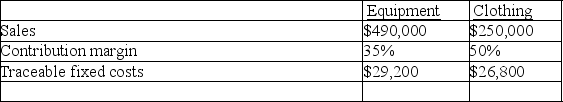

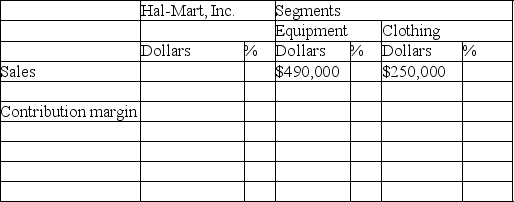

Hal-Marts' Inc.has two sales departments: equipment and clothing.During February,these two departments reported the following operating results:

In addition,fixed costs common to both departments amounted to $54,400.

In addition,fixed costs common to both departments amounted to $54,400.

Complete the following responsibility income statement for Hal-Marts,Inc.Follow the contribution margin approach,and show percentages as well as dollar amounts.Conclude your income statement with the company's income from operations.(Round your percentage computations to nearest whole percent)

HAL-MARTS,INC

Income Statement by Product Lines

For the Month Ended February 28,20__

Hal-Marts' Inc.has two sales departments: equipment and clothing.During February,these two departments reported the following operating results:

In addition,fixed costs common to both departments amounted to $54,400.

In addition,fixed costs common to both departments amounted to $54,400.Complete the following responsibility income statement for Hal-Marts,Inc.Follow the contribution margin approach,and show percentages as well as dollar amounts.Conclude your income statement with the company's income from operations.(Round your percentage computations to nearest whole percent)

HAL-MARTS,INC

Income Statement by Product Lines

For the Month Ended February 28,20__

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

70

Division X supplies partially completed units of product to division Y.The divisions negotiated a price of $30 plus 20% per unit.Assuming Division X completed and transferred 5,000 units to division Y,the total transfer price on this transaction is:

A)$180,000.

B)$120,000.

C)$150,000.

D)$5,000.

A)$180,000.

B)$120,000.

C)$150,000.

D)$5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

71

In deciding how the store will benefit most from increasing the sales of selected departments,the store manager should be most interested in the:

A)Total sales of each department.

B)Contribution margin ratios of each department.

C)Fixed costs traceable to each department.

D)Responsibility margins of each department.

A)Total sales of each department.

B)Contribution margin ratios of each department.

C)Fixed costs traceable to each department.

D)Responsibility margins of each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

72

In the short run,the greatest increase in profitability will result from increasing sales in those profit centers with the:

A)Highest performance margins.

B)Lowest traceable fixed costs.

C)Highest contribution margin ratios.

D)Highest responsibility margins.

A)Highest performance margins.

B)Lowest traceable fixed costs.

C)Highest contribution margin ratios.

D)Highest responsibility margins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

73

Business units

(a)Define what is meant by each of the following: profit center,investment center,and cost center.Your answer should make clear the distinction between each of these types of centers.

(b)Briefly describe the criteria used to evaluate each of the three types of centers listed in part a.

(a)Define what is meant by each of the following: profit center,investment center,and cost center.Your answer should make clear the distinction between each of these types of centers.

(b)Briefly describe the criteria used to evaluate each of the three types of centers listed in part a.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

74

The dollar amount used by one division which supplies a good or a service to another division within a company is called a:

A)Market price.

B)Transfer price.

C)Fair price.

D)Agreed-upon price.

A)Market price.

B)Transfer price.

C)Fair price.

D)Agreed-upon price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

75

[The following information applies to the questions displayed below.]

Patterson's Department Store prepares monthly income statements by sales departments.These income statements are organized to show contribution margin,performance margin,and responsibility margin for each sales department,as well as operating income for the store as a whole.

The monthly salaries of the employees of the store's Accounting Department should be classified as a:

A)Common fixed cost.

B)Traceable fixed cost.

C)Committed fixed cost.

D)Controllable fixed cost.

Patterson's Department Store prepares monthly income statements by sales departments.These income statements are organized to show contribution margin,performance margin,and responsibility margin for each sales department,as well as operating income for the store as a whole.

The monthly salaries of the employees of the store's Accounting Department should be classified as a:

A)Common fixed cost.

B)Traceable fixed cost.

C)Committed fixed cost.

D)Controllable fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

76

Company MHF operates subsidiaries in two countries.One of the subsidiaries consumes the output of the other in the production of a good for sale to the public.The company could increase cash flows by:

A)Using a transfer price based on full cost.

B)Using a transfer price to transfer as much income as possible to the subsidiary located in the lower tax country.

C)Using a transfer price based on market value.

D)Using a transfer price to transfer as much income as possible to the subsidiary located in the higher tax country.

A)Using a transfer price based on full cost.

B)Using a transfer price to transfer as much income as possible to the subsidiary located in the lower tax country.

C)Using a transfer price based on market value.

D)Using a transfer price to transfer as much income as possible to the subsidiary located in the higher tax country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

77

Division managers at Colonial Company are paid a bonus based on the responsibility margin of their respective responsibility centers.Division A sells goods to Division B and to outside customers.The manager of Division B would most likely prefer that transfer prices be based on:

A)The market value of the goods purchased from Division A.

B)The market value of the goods purchased from Division A plus a fixed percentage.

C)The cost of the goods purchased from Division A.

D)The cost of the goods purchased from Division A plus a fixed percentage.

A)The market value of the goods purchased from Division A.

B)The market value of the goods purchased from Division A plus a fixed percentage.

C)The cost of the goods purchased from Division A.

D)The cost of the goods purchased from Division A plus a fixed percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

78

Division X supplies partially completed units of product to division Y.The divisions negotiated a price of $30 per unit.Assuming Division X completed and transferred 3,000 units to division Y,the total transfer price on this transaction is:

A)$30,000.

B)$60,000.

C)$90,000.

D)$3,000.

A)$30,000.

B)$60,000.

C)$90,000.

D)$3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

79

All of the following costs are traceable to a specific factory except:

A)Depreciation on the company's fleet of tractor trailer trucks.

B)Direct materials.

C)Salaries of production supervisors.

D)Wages of production set-up laborers.

A)Depreciation on the company's fleet of tractor trailer trucks.

B)Direct materials.

C)Salaries of production supervisors.

D)Wages of production set-up laborers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

80

The cost of heating and air conditioning the store should be:

A)Allocated among the sales departments based upon relative sales volume.

B)Allocated among the sales departments based upon their relative floor space.

C)Classified as a common fixed cost.

D)Omitted from the company's income statements.

A)Allocated among the sales departments based upon relative sales volume.

B)Allocated among the sales departments based upon their relative floor space.

C)Classified as a common fixed cost.

D)Omitted from the company's income statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck