Deck 10: Compound Interestfurther Topics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/64

العب

ملء الشاشة (f)

Deck 10: Compound Interestfurther Topics

1

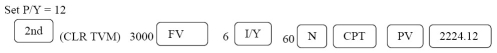

A six-year,$1650.00 note bearing interest at 9.51% compounded annually was discounted at 11.2% compounded semi-annually yielding proceeds of $1916.75.How many months before the due date was the discount date?

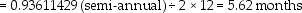

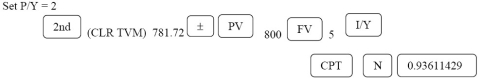

PV = 1650,i = 0.0951,n = 6 Maturity Value = 1650.00(1.0951)6 = 1650.00(1.7247362)= 2845.81 Discount: FV = 2845.81,PV = 1916.75,i = 0.112 ÷ 2 = 0.056 n =  =

=  =

=  = 7.253253 The discount date is 7.253253 × 6 = 43.52 months before the due date.

= 7.253253 The discount date is 7.253253 × 6 = 43.52 months before the due date.

=

=  =

=  = 7.253253 The discount date is 7.253253 × 6 = 43.52 months before the due date.

= 7.253253 The discount date is 7.253253 × 6 = 43.52 months before the due date. 2

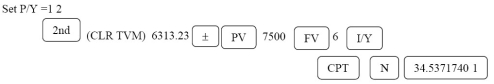

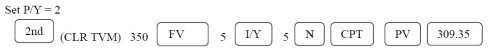

A financial obligation requires payments of $2000.00 today,$2500.00 in three years,and $3000.00 in five years.When can the obligation be discharged by a single payment equal to the sum of the required payments if interest is 6%p.a.compounded monthly?

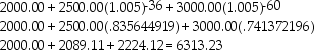

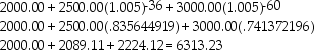

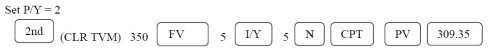

Let the focal date be now; i =  = 0.005; m = 12 For the obligation:

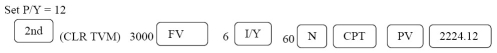

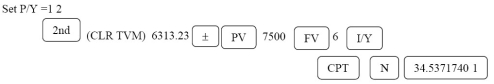

= 0.005; m = 12 For the obligation:  For the payment: (2000 + 2500 + 3000)= 7500 FV = 7500,PV = 6313.23 N =

For the payment: (2000 + 2500 + 3000)= 7500 FV = 7500,PV = 6313.23 N =  =

=  = 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days The obligation can be discharged 2 years 320 days from now. Programmed solution:

= 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days The obligation can be discharged 2 years 320 days from now. Programmed solution:

= 0.005; m = 12 For the obligation:

= 0.005; m = 12 For the obligation:  For the payment: (2000 + 2500 + 3000)= 7500 FV = 7500,PV = 6313.23 N =

For the payment: (2000 + 2500 + 3000)= 7500 FV = 7500,PV = 6313.23 N =  =

=  = 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days The obligation can be discharged 2 years 320 days from now. Programmed solution:

= 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days The obligation can be discharged 2 years 320 days from now. Programmed solution:

3

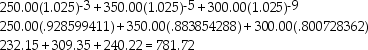

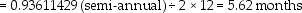

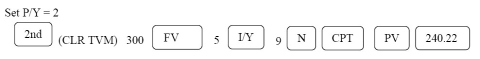

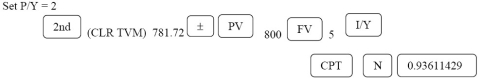

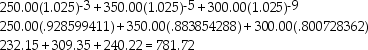

A financial obligation requires the payment of $250.00 in eighteen months,$350.00 in thirty months,and $300.00 in fifty-four months.When can the obligation be discharged by a single payment of $800.00 if interest is 5% compounded semi-annually?

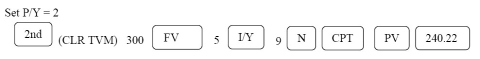

Let the focal date be now; i = 0.05 ÷ 2 = 0.025; m = 2 For the obligation:  For the payment: 800

For the payment: 800  n =

n =  =

=  =

=

Programmed solution:

Programmed solution:

For the payment: 800

For the payment: 800  n =

n =  =

=  =

=

Programmed solution:

Programmed solution:

4

A financial obligation requires the payment of $1500.00 in nine months,$700.00 in twenty-one months,and $1700.00 in 33 months.When can the obligation be discharged by a single payment of $3900.00 if interest is 8.44% compounded quarterly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

5

In how many days will $770.00 grow to $880.00 at 11.5% p.a.compounded monthly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

6

Luciano sold a property and is to receive $14 200.00 in nine months,$14 000.00 in 42 months,and $15 500.00 in 57 months.The deal was renegotiated after six months at which time Luciano received a payment of $17 000.00; he was to receive a further payment of $19 000.00 later.When should Luciano receive the second payment if money is worth 10% compounded quarterly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

7

A financial obligation requires the payment of $1000.00 in nine months,and $500.00 in twelve months.When can the obligation be discharged by a single payment of $1700.00 if interest is 12% compounded quarterly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

8

In how many years will money double at 6.62% compounded semi-annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

9

A five-year,$4500.00 promissory note with interest at 7.5% compounded semi-annually was discounted at 8% compounded quarterly yielding proceeds of $6150.00.How many months before the due date was the discount date?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

10

Janice owes two debt payments-a payment of $6700 due in twelve months and a payment of $8750 due in twenty-one months.If Janice makes a payment of $7000 now,when should she make a second payment of $7900 if money is worth 11.5% compounded semi-annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

11

Find the equated date at which two payments of $1600.00 due six months ago and $1850.00 due today could be settled by a payment of $4300.00 if interest is 9.48% compounded monthly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

12

A 11-year $8000.00 promissory note,with interest at 8.4% compounded monthly,is discounted at 6.5% compounded semi-annually yielding proceeds of $14 631.15.How many months before the due date was the date of discount?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

13

A promissory note for $3600.00 dated May 15,2012,requires an interest payment of $370.00 at maturity.If interest is at 9.6% compounded monthly,determine the due date of the note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

14

In how many years will money triple at 12% compounded semi-annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

15

In how many months will money double at 7.45% compounded semi-annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

16

A loan of $4500.00 was repaid together with interest of $1164.00.If interest was 12 .4% compounded quarterly,for how many months was the loan taken out?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

17

Calculate the number of years for money to triple at 3.6% p.a.compounded monthly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

18

A five-year,$2000.00 note bearing interest at 10% compounded annually was discounted at 12% compounded semi-annually yielding proceeds of $1900.00.How many months before the due date was the discount date?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

19

At what nominal rate of interest compounded semi-annually will $11 800 earn $6 800 interest in six years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

20

A loan of $9000.00 was repaid together with interest of $3728.00.If interest was 9.4% compounded quarterly,how long was the loan taken out? (Give answer in years and months to the nearest tenth)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

21

Calculate the nominal annual rate of interest compounded quarterly that is equivalent to 10% p.a.compounded semi-annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

22

In how many years will money triple at 6.4% compounded monthly?

A)206.53 years

B)17.71 years

C)17.21 years

D)1.48 years

E)2.57 years

A)206.53 years

B)17.71 years

C)17.21 years

D)1.48 years

E)2.57 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

23

At what nominal rate of interest compounded quarterly will $2000.00 earn $400.00 interest in three years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

24

If $1400.00 accumulates to $2350.00 in five years,six months compounded semi-annually,what is the effective rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

25

At what nominal rate of interest compounded semi-annually will $5900 earn $6400 interest in six years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

26

The treasurer of Lynn Lake Credit Union proposes changing the method of compounding interest on premium savings accounts to daily compounding.If the current rate is 4% compounded quarterly,what nominal rate should the treasurer suggest to the Board of Directors to maintain the same effective rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

27

Calculate the nominal rate of interest compounded semi-annually that is equivalent to 8.4% compounded monthly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

28

Calculate the nominal rate of interest compounded semi-annually that will double money in eight years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

29

A principal of $5000.00 compounded monthly amounts to $6000.00 in 7 years.What is the nominal annual rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

30

At what nominal rate of interest compounded monthly will $1700.00 earn $500.00 interest in three years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the effective rate of interest on an investment is 7%,what is the nominal rate of interest compounded quarterly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the effective rate of interest on an investment is 6.52%,what is the nominal rate of interest compounded monthly?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

33

Determine the effective rate of interest corresponding to 6% p.a.compounded monthly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

34

A principal of $4250.00 compounded monthly amounts to $4800.00 in 6.25 years.What is the nominal annual rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the nominal rate of interest at which money will triple itself in eight years and six months if compounded semi-annually?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

36

The accountant of Crystal Credit Union proposes changing the method of compounding interest on premium savings accounts to yearly compounding.If the current rate is 8% compounded quarterly,what nominal rate should the treasurer suggest to the Board of Directors to maintain the same effective rate of interest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the nominal rate of interest compounded semi-annually that is equivalent to an effective rate of 8.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

38

At what nominal rate of interest compounded annually will $5000 earn $2500 interest in seven years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

39

At what nominal rate of interest compounded quarterly will $8100 earn $1700.00 interest in six years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is the nominal rate of interest compounded semi-annually which is equivalent to an effective rate of 5.89%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

41

In how many years will money double at 8% compounded yearly?

A)0.09 years

B)0.9 years

C)9.01 years

D)90.1 years

E)2 years

A)0.09 years

B)0.9 years

C)9.01 years

D)90.1 years

E)2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

42

Calculate the effective annual rate for 5% p.a.compounded semi-annually.

A)0.050625

B)5.0625%

C)0.0255%

D)2.55%

E)15.0625%

A)0.050625

B)5.0625%

C)0.0255%

D)2.55%

E)15.0625%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which is the most attractive of the following interest rates offered on a savings account?

A) 2.7% compounded annually

B)2.68% compounded semiannually

C)2.66% compounded quarterly

D)2.64% compounded monthly

E)All of them offer the same effective rate.

A) 2.7% compounded annually

B)2.68% compounded semiannually

C)2.66% compounded quarterly

D)2.64% compounded monthly

E)All of them offer the same effective rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

44

How long did it take for $1635 to increase to $2310 if the investment earned interest at a rate of 8.08% compounded quarterly (give your final answer in years and months,e.g.,3 years and 7.23 months)?

A)7 years 7.69 months

B)4 years .64 months

C)3 years 4.79 months

D)4 years 3.84 months

E)8 years 1.69 months

A)7 years 7.69 months

B)4 years .64 months

C)3 years 4.79 months

D)4 years 3.84 months

E)8 years 1.69 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

45

According to the World Bank,the population in Georgia is decreasing by 0.83% per year.According to the 2011 consensus,the population of Georgia is 4.5 million.Assuming the population growth rate remains the same; calculate the year in which the population of Georgia will be half the population in 2011?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

46

How long,in compounding periods,will it take for $3327 to increase by $3799 if you are able to earn 6.2% compounded semi-annually?

A)42.95

B)24.95

C)4.56

D)6.45

E)4.95

A)42.95

B)24.95

C)4.56

D)6.45

E)4.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

47

BlackBerry took a loan contract which requires a payment of $40 million plus interest two years after the contract's date of issue.The interest rate on the $40 million face value is 9.6% compounded quarterly.Before the maturity date,the original lender sold the contract to a pension fund for $43 million.The sale price was based on a discount rate of 8.5% compounded semi-annually from the date of sale.How many months before the maturity date did the sale take place?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

48

Calculate the effective rate of interest,if $10 000 grew to $15 000 in 4 years with quarterly compounding.

A)12.28%

B)10.67%

C)4.06%

D)8.45%

E)0.85%

A)12.28%

B)10.67%

C)4.06%

D)8.45%

E)0.85%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

49

What is the quarterly interest rate that you will need to earn in order for an investment of $1635 to grow to be $1748.73 after 2.25 years?

A)12.93%

B)13.93%

C)10.93%

D)8.93%

E)3.00%

A)12.93%

B)13.93%

C)10.93%

D)8.93%

E)3.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the monthly discount rate expressed as an nominal annual rate for a future value of $182 500 to be reduced to $178 663.58 over a period of 4.25 years?

A)4.06%

B)8.04%

C)6.88%

D)4.88%

E)0.50%

A)4.06%

B)8.04%

C)6.88%

D)4.88%

E)0.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

51

Deon has $4000.00 invested at 4.5% compounded semi-annually at her bank.In order to make a comparison with another financial institution she needs to know the effective rate of interest at her bank.What is the effective annual rate of interest?

A)1.12%

B)2.28%

C)9.10%

D)4.55%

E)4.5%

A)1.12%

B)2.28%

C)9.10%

D)4.55%

E)4.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

52

How long will it take an investment to double in value if it earns 6% compounded quarterly? Include accrued interest and round the answer to the nearest month

A)11 years 11 months

B)11 years 9 months

C)11 years 8 months

D)3 years 11 months

E)3 years 10 months

A)11 years 11 months

B)11 years 9 months

C)11 years 8 months

D)3 years 11 months

E)3 years 10 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

53

How many compounding periods does it take for a non-interest bearing bond of $420 150 to be reduced to $199 989 at a discount rate of 5.44% compounded monthly?

A)146.12

B)121.12

C)154.12

D)184.12

E)164.12

A)146.12

B)121.12

C)154.12

D)184.12

E)164.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

54

Calculate the effective annual rate for 10% p.a.compounded quarterly.

A)0.1038%

B)1.038%

C)10.38%

D)10%

E)2.5%

A)0.1038%

B)1.038%

C)10.38%

D)10%

E)2.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

55

How long will it take Whitby's population to grow from 125 000 (in 2013)to 200 000,if the annual growth rate is 3%? Round your answer to the nearest month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Brick store credit card quotes a rate of 1.75% per month on the unpaid balance.Calculate the effective rate of interest being charged.

A)21%

B)9.85%

C)10.97%

D)51.64%

E)23.14%

A)21%

B)9.85%

C)10.97%

D)51.64%

E)23.14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

57

Calculate the nominal rate of interest p.a.compounded semi-annually if $5000.00 accumulates to $7002.64 in 78 months.

A)0.8656%

B)0.02625%

C)2.625%

D)0.0525%

E)5.25%

A)0.8656%

B)0.02625%

C)2.625%

D)0.0525%

E)5.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

58

You have an interest rate of 8.44% compounded quarterly.What is the equivalent effective annual interest rate?

A)7.81%

B)7.71%

C)8.71%

D)8.91%

E)9.71%

A)7.81%

B)7.71%

C)8.71%

D)8.91%

E)9.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

59

What nominal rate of interest-compounded quarterly will have to be earned on a savings account for it to grow from $1525 to $1955 over a period of 21 months?

A)14.45%

B)15.45%

C)12.45%

D)3.61%

E)10.45%

A)14.45%

B)15.45%

C)12.45%

D)3.61%

E)10.45%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

60

At what nominal rate of interest compounded quarterly will $ 13 000.00 earn $8407.27 in interest in six years? (nearest hundredth)

A)1.83%

B)2.10%

C)7.33%

D)8.4%

E)18.4%

A)1.83%

B)2.10%

C)7.33%

D)8.4%

E)18.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

61

Over a 15-year period,Tariq's investment in Cameco stock grew in value from $3000 to $19 847.During the same period,the consumer price index rose from 88.31 to 118.91.What was his real compound annual rate of interest on the stock during this period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Brick store credit card quotes a rate of 1.75% per month on the unpaid balance.When Leons took over Brick's management,they reduced the card's effective rate by 4%.What will be the new periodic rate per month?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

63

For a given interest rate of 10% compounded quarterly,what is the equivalent nominal rate of interest with monthly compounding?

A)10.381%

B)5.0625%

C)10.125%

D)0.8265%

E)9.918%

A)10.381%

B)5.0625%

C)10.125%

D)0.8265%

E)9.918%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck

64

Sajid invested $20 000 in strip bonds earning him $2536.50 in one year.What is the nominal annual rate of interest compounded monthly?

A)12.68%

B)2.05%

C)4.19%

D)12%

E)1%

A)12.68%

B)2.05%

C)4.19%

D)12%

E)1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 64 في هذه المجموعة.

فتح الحزمة

k this deck