Deck 7: Risk and Returnan Introduction: History of Financial Market Returns

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/56

العب

ملء الشاشة (f)

Deck 7: Risk and Returnan Introduction: History of Financial Market Returns

1

Investments that have earned the highest rates of return over 1995-2015 also have [blank].

A)the lowest risk.

B)the highest standard deviation of returns.

C)the largest market capitalization.

D)the least sensitivity to inflation.

A)the lowest risk.

B)the highest standard deviation of returns.

C)the largest market capitalization.

D)the least sensitivity to inflation.

B

2

The higher the standard deviation, the less risk the investment has.

False

3

Spartan Furniture Pty Ltd is selling for $50.00 per share today.In one year, Spartan will be selling for $48.00 per share, and the dividend for the year will be $3.00.What is the cash return on Spartan shares?

A)$51.00

B)$1.00

C)$2.00

D)$3.00

A)$51.00

B)$1.00

C)$2.00

D)$3.00

B

4

Over the period 1995-2015, which pair of investments does not perfectly fit the 'higher risk, higher return' pattern?

A)Government bonds, Treasury bills

B)US equities, corporate bonds

C)US equities, international equities

D)Corporate bonds, international equities

A)Government bonds, Treasury bills

B)US equities, corporate bonds

C)US equities, international equities

D)Corporate bonds, international equities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

5

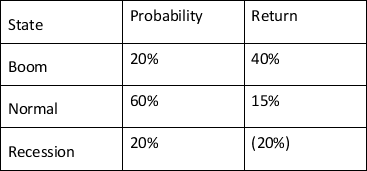

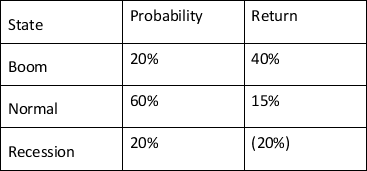

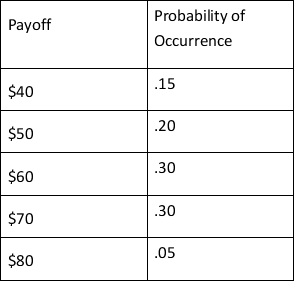

Using the following information for Graphics Ltd shares, calculate their expected return and standard deviation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the standard deviation of an investment that has the following expected scenario? 18% probability of a recession, 2.0% return; 65% probability of a moderate economy, 9.5% return; 17% probability of a strong economy, 14.2% return.

A)3.68%

B)1.23%

C)8.47%

D)6.66%

A)3.68%

B)1.23%

C)8.47%

D)6.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

7

Over the period 1995-2015, the risk-return relationship appears to be [blank].

A)A)negative.

B)B)perfectly positive.

C)C)random.

D)D)generally positive, but not perfect.

A)A)negative.

B)B)perfectly positive.

C)C)random.

D)D)generally positive, but not perfect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

8

Investment variances may be either positive or negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

9

You purchased shares of Global Security at a price of $75.75 one-year ago today.If you sell the shares today for $89.00, what is your rate of return?

A)35.00%

B)12.50%

C)17.50%

D)25.00%

A)35.00%

B)12.50%

C)17.50%

D)25.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

10

Because returns are more certain for the least risky investments, the required return on these investments should be higher than the required returns on more risky investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

11

If there is a 20% chance we will get a 16% return, a 30% chance of getting a 14% return, a 40% chance of getting a 12% return and a 10% chance of getting an 8% return, what is the expected rate of return?

A)12%

B)13%

C)14%

D)15%

A)12%

B)13%

C)14%

D)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

12

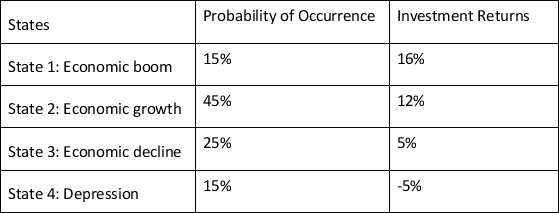

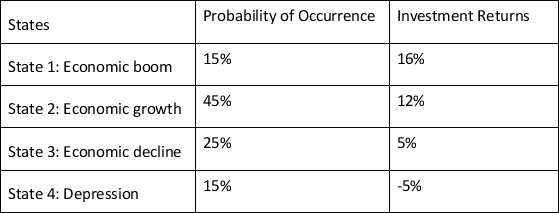

You are considering investing in a project with the following possible outcomes:  Calculate the expected rate of return for this investment.

Calculate the expected rate of return for this investment.

A)9.8%

B)7.0%

C)8.3%

D)6.3%

Calculate the expected rate of return for this investment.

Calculate the expected rate of return for this investment.A)9.8%

B)7.0%

C)8.3%

D)6.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following best measures an asset's risk?

A)Expected return

B)The standard deviation

C)The probability distribution

D)The cash return

A)Expected return

B)The standard deviation

C)The probability distribution

D)The cash return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

14

You are considering investing in a firm that has the following possible outcomes: Economic boom: probability of 25%; return of 25%

Economic growth: probability of 60%; return of 15%

Economic decline: probability of 15%; return of -5%

What is the expected rate of return on the investment?

A)15.0%

B)11.7%

C)14.5%

D)25.0%

Economic growth: probability of 60%; return of 15%

Economic decline: probability of 15%; return of -5%

What is the expected rate of return on the investment?

A)15.0%

B)11.7%

C)14.5%

D)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

15

The cash return on an investment is calculated as purchase price-selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

16

The difference between returns on shares and government bonds is known as [blank].

A)the equity risk premium.

B)the risk and return trade-off.

C)the maturity premium.

D)the risk/reward paradox.

A)the equity risk premium.

B)the risk and return trade-off.

C)the maturity premium.

D)the risk/reward paradox.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

17

Even though an investor expects a positive rate of return, it is possible that the actual return will be negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

18

The expected rate of return is the weighted average of the possible returns for an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

19

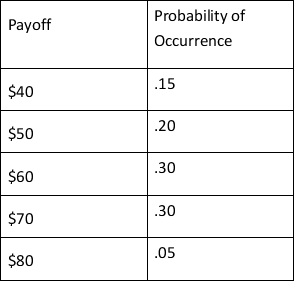

You have invested in a project that has the following payoff schedule:  What is the expected value of the investment's payoff? (Round to the nearest $1.)

What is the expected value of the investment's payoff? (Round to the nearest $1.)

A)$60

B)$65

C)$58

D)$70

What is the expected value of the investment's payoff? (Round to the nearest $1.)

What is the expected value of the investment's payoff? (Round to the nearest $1.)A)$60

B)$65

C)$58

D)$70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which sequence is arranged in the correct order, from highest expected long-term returns to lowest?

A.Small shares, government bonds, large shares

B.Large shares, Treasury notes, small shares

C.Small shares, large shares, Treasury notes

D.Government bonds, large shares, Treasury notes

A.Small shares, government bonds, large shares

B.Large shares, Treasury notes, small shares

C.Small shares, large shares, Treasury notes

D.Government bonds, large shares, Treasury notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the arithmetic average return of Kamal's investment?

A)2.42%

B)3.96%

C)5.18%

D)15.1%

A)2.42%

B)3.96%

C)5.18%

D)15.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

22

Risky investments have the potential for higher returns, but also larger losses. True

A)False

A)False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

23

The arithmetic average rate of return takes compounding into effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

24

Riskier investments have traditionally had lower returns than less risky investments have had.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

25

The risk-return trade-off tells us that expected returns should be higher on investments that have higher risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

26

Historically, including international shares in one's portfolio increases the portfolio's risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the geometric average return on Susan's shares if she sells it five years from today?

A)-2.33%

B).59%

C)3.67%

D)4.88%

A)-2.33%

B).59%

C)3.67%

D)4.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

28

Investments in emerging markets have higher volatility than do Australian shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

29

Treasury notes have less default risk than do government bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

30

An investor who wishes to hold a share for five years will be most interested in the geometric average rather than in the arithmetic average return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

31

Less risky investments have lower standard deviations than do more risky investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

32

An emerging market is [blank].

A)a market for small, but rapidly growing companies.

B)market for companies coming out from bankruptcy proceedings.

C)market for promising, but untested technologies

D)a market located in an economy with low-to-middle per capita income.

A)a market for small, but rapidly growing companies.

B)market for companies coming out from bankruptcy proceedings.

C)market for promising, but untested technologies

D)a market located in an economy with low-to-middle per capita income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

33

Michael Lynch invested $10 000 in the Rearguard Fund four years ago.All earnings were reinvested in the fund.If his compound annual rate of return was 7%, what is his investment worth today (round to the nearest dollar)?

A)$13,108

B)$10,700

C)$12,800

D)$763

A)$13,108

B)$10,700

C)$12,800

D)$763

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

34

Investors are always rewarded for taking higher risk with higher realized returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

35

The variation in rates of return earned over a period of time is known as the investment's [blank].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

36

How much will Susan's shares be worth if she sells it five years from today?

A)$71,423.85

B)$73,419.66

C)$75,628.75

D)$80,333.40

A)$71,423.85

B)$73,419.66

C)$75,628.75

D)$80,333.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the arithmetic average return on Susan's shares if she sells it five years from today?

A)1.92%

B)3.98%

C)6.47%

D)7.11%

A)1.92%

B)3.98%

C)6.47%

D)7.11%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

38

Marcus Berger invested $9842.33 in Hawkeye Hats Ltd four years ago.He sold the shares today for $11 396.22.What is his geometric average return?

A)2.98%

B)3.73%

C)3.95%

D)There is insufficient information to derive an answer.

A)2.98%

B)3.73%

C)3.95%

D)There is insufficient information to derive an answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

39

How much money did Kamal receive when he sold his shares of Oceanic Electric?

A)$12 014.88

B)$12 398.42

C)$13 663.47

D)$14 184.73

A)$12 014.88

B)$12 398.42

C)$13 663.47

D)$14 184.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is the geometric average return of Kamal's investment?

A)3.38%

B)4.63%

C)6.96%

D)8.78%

A)3.38%

B)4.63%

C)6.96%

D)8.78%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the efficient market hypothesis, would securities be properly priced?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

42

If markets are efficient, share prices go up when there is positive information about a company, and go down when there is negative information about the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

43

Are markets moving towards being more efficient or towards being less efficient?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

44

Work by the behavioural economists Robert Shiller and Daniel Kahnemann strongly supports the weak and semi-strong forms of the Efficient Market Hypothesis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

45

If an individual with inside information can make higher than expected profits, the market is no more than semi-strong form efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

46

If an investor holds shares for three years, the value at the end of three years will always be the initial cost of the shares times (1 + arithmetic average return)to the third power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

47

Madison's sister, Amanda, works at a large pharmaceutical company.While visiting Amanda at work, Madison glanced at a report indicating that a new drug had just been approved by the Therapeutic Goods Administration.She immediately bought some of the company's shares, which doubled in price over the following week.This outcome is inconsistent with the [blank] market hypothesis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

48

Why do the arithmetic average return and the geometric return differ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

49

Identify the three anomalies to the efficient markets hypothesis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is consistent with the semi-strong form efficient market hypothesis?

A)So-called value shares outperform growth shares.

B)Shares that have performed well over the past year continue to perform well for several more months.

C)A company announces higher than expected sales and earnings.The share price immediately increases by 10%.

D)A company announces higher than expected sales and earnings.The share price remains unchanged.

A)So-called value shares outperform growth shares.

B)Shares that have performed well over the past year continue to perform well for several more months.

C)A company announces higher than expected sales and earnings.The share price immediately increases by 10%.

D)A company announces higher than expected sales and earnings.The share price remains unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

51

The traditional view of markets assumes that investors are [blank].

A)overconfident

B)rational

C)unreasonable

D)sensitive

A)overconfident

B)rational

C)unreasonable

D)sensitive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

52

Each of the following would tend to weaken the semi-strong form Efficient Market Hypothesis except

A)There is publicly available information that Boeing Aircraft has procured a contract to build 25 planes for the US Government and the price of Boeing quickly goes up.

B)ACG, Inc.performed well for the past six months, but they just lost a major distribution contract, but the price of ACG shares continues to go up.

C)Woolworth announces higher sales turnover this quarter, and the share price remains stable.

D)Muguet Company consistently underperforms the market in October, but outperforms the market in May.

A)There is publicly available information that Boeing Aircraft has procured a contract to build 25 planes for the US Government and the price of Boeing quickly goes up.

B)ACG, Inc.performed well for the past six months, but they just lost a major distribution contract, but the price of ACG shares continues to go up.

C)Woolworth announces higher sales turnover this quarter, and the share price remains stable.

D)Muguet Company consistently underperforms the market in October, but outperforms the market in May.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

53

If a market is weak form efficient, an investor can make higher than expected profits by studying the past price patterns of shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

54

Strategies that exploit market inefficiencies tend to lose their effectiveness when they become widely known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

55

If an investor earns 10% on her investment in the first year and loses 10% the next year, she will have neither a gain nor a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

56

The favourable returns of shares in Australia over the past 100 years is partly explained by the concept that share prices [blank] when there is [blank] news about future profits.

A)stagnate; good

B)rapidly decrease; good

C)slightly increase; bad

D)go up; good

A)stagnate; good

B)rapidly decrease; good

C)slightly increase; bad

D)go up; good

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck