Deck 8: Risk and Returncapital Market Theory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 8: Risk and Returncapital Market Theory

1

The expected return on ZV next year is 12% with a standard deviation of 20%.The expected return on TNA next year is 24% with a standard deviation of 30%.The correlation between the two shares is -.6.If Hannah makes equal investments in ZV and TNA, what is the standard deviation of her portfolio?

A)22.47%

B)12.04%

C)1.45%

D)16.00%

A)22.47%

B)12.04%

C)1.45%

D)16.00%

B

2

You are considering investing in a portfolio consisting of 40% Melbourne Sports and 60% Buckstar.If the expected rate of return on Melbourne Sports is 16% and the expected return on Buckstar is 9%, what is the expected return on the portfolio?

A)12.50%

B)13.20%

C)11.80%

D)10.00%

A)12.50%

B)13.20%

C)11.80%

D)10.00%

C

3

The standard deviation of a portfolio is always just the weighted average of the standard deviations of assets in the portfolio.

False

4

The expected return on MSFT next year is 12% with a standard deviation of 20%.The expected return on AAPL next year is 24% with a standard deviation of 30%.If James makes equal investments in MSFT and AAPL, what is the expected return on his portfolio?

A)20%

B)16%

C)18%%

D)25%

A)20%

B)16%

C)18%%

D)25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

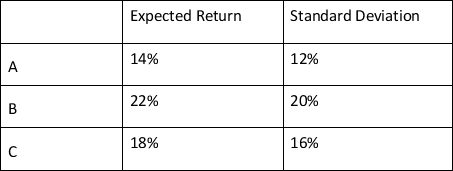

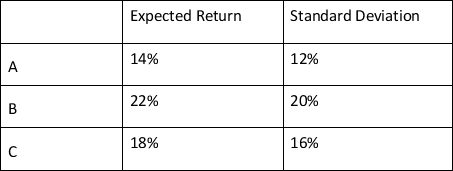

Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s).

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). An investor will get maximum risk reduction by combining assets that are [blank].</strong> A)negatively correlated B)positively correlated C)uncorrelated D)perfectly, positively correlated](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

An investor will get maximum risk reduction by combining assets that are [blank].

A)negatively correlated

B)positively correlated

C)uncorrelated

D)perfectly, positively correlated

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). An investor will get maximum risk reduction by combining assets that are [blank].</strong> A)negatively correlated B)positively correlated C)uncorrelated D)perfectly, positively correlated](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

An investor will get maximum risk reduction by combining assets that are [blank].

A)negatively correlated

B)positively correlated

C)uncorrelated

D)perfectly, positively correlated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

In most cases, combining investments in a portfolio leads to [blank].

A)high risk

B)a large standard deviation

C)risk reduction

D)a low correlation coefficient

A)high risk

B)a large standard deviation

C)risk reduction

D)a low correlation coefficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

You are considering buying shares in Queensland Grain.Which of the following is an example of non-diversifiable risk?

A)Risk resulting from a general decline in the shares market

B)Risk resulting from a news release that several of Queensland Grain's grain silos were tainted

C)Risk resulting from an explosion in a grain elevator owned by Queensland Grain

D)Risk resulting from an impending lawsuit against Queensland Grain

A)Risk resulting from a general decline in the shares market

B)Risk resulting from a news release that several of Queensland Grain's grain silos were tainted

C)Risk resulting from an explosion in a grain elevator owned by Queensland Grain

D)Risk resulting from an impending lawsuit against Queensland Grain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

A portfolio will always have less risk than the riskiest asset in it if the correlation of assets is less than perfectly positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s).

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). If an investor must choose between investing in either portfolio X or portfolio Y, then [blank].</strong> A)she will always choose portfolio X over portfolio Y B)she will always choose portfolio Y over portfolio X C)she will be indifferent between investing in portfolio X and portfolio Y D)she will always ask for more information before making a decision](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

If an investor must choose between investing in either portfolio X or portfolio Y, then [blank].

A)she will always choose portfolio X over portfolio Y

B)she will always choose portfolio Y over portfolio X

C)she will be indifferent between investing in portfolio X and portfolio Y

D)she will always ask for more information before making a decision

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). If an investor must choose between investing in either portfolio X or portfolio Y, then [blank].</strong> A)she will always choose portfolio X over portfolio Y B)she will always choose portfolio Y over portfolio X C)she will be indifferent between investing in portfolio X and portfolio Y D)she will always ask for more information before making a decision](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

If an investor must choose between investing in either portfolio X or portfolio Y, then [blank].

A)she will always choose portfolio X over portfolio Y

B)she will always choose portfolio Y over portfolio X

C)she will be indifferent between investing in portfolio X and portfolio Y

D)she will always ask for more information before making a decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

Your portfolio consists of $3000 in ABC shares, $4500 of DEF shares and $2500 of GHI shares.Expected rates of return are ABC 5%, DEF 12% and GHI 16%.What is the portfolio expected rate of return?

A)10.9%

B)12.0%

C)11.4%

D)16.0%

A)10.9%

B)12.0%

C)11.4%

D)16.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

Adequate portfolio diversification can be achieved by investing in several companies in the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

The portfolio standard deviation will always be less than the standard deviation of any asset in the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

The expected return on VZ next year is 12% with a standard deviation of 20%.The expected return on ANT next year is 24% with a standard deviation of 30%.The correlation between the two shares is .6.If Arya makes equal investments in VZ and ANT, what is the standard deviation of her portfolio?

A)22.47%

B)25.00%

C)5.05%

D)15.00%

A)22.47%

B)25.00%

C)5.05%

D)15.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

When assets are positively correlated, they tend to rise or fall together.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following portfolios is clearly preferred to the others?

A)Investment A

B)Investment B

C)Investment C

D)Cannot be determined

A)Investment A

B)Investment B

C)Investment C

D)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

If your portfolio consists of 20% RJH (expected return 16% ), 30% PAV (expected return -2%)and 50% MB (expected return 8%), what is the expected rate of return on the portfolio?

A)7.8%

B)7.3%

C)6.6%

D)8.7%

A)7.8%

B)7.3%

C)6.6%

D)8.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

A correlation coefficient of +1 indicates that returns on one asset can be exactly predicted from the returns on another asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

What is the expected rate of return on a portfolio 18% of which is invested in an S&P 500 Index fund, 65% in a technology fund, and 17% in Treasury notes.The expected rate of return is 11% on the S&P Index fund, 14% on the technology fund and 2% on the Treasury notes.

A)10.25%

B)8.33%

C)11.42%

D)9.00%

A)10.25%

B)8.33%

C)11.42%

D)9.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the expected dollar return on a portfolio which consists of $9000 invested in an S&P 500 Index fund, $32500 in a technology fund, and $8,500 in Treasury notes.The expected rate of return is 11% on the S&P Index fund, 14% on the technology fund and 2% on the Treasury notes.

A)$13640

B)$571

C)$4500

D)$5710

A)$13640

B)$571

C)$4500

D)$5710

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s).

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). A negative coefficient of correlation implies that [blank].</strong> A)on average, returns to such assets are negative B)asset returns tend to move in opposite directions C)asset returns tend to move in the same directions D)there is a perfect relationship between returns earned](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

A negative coefficient of correlation implies that [blank].

A)on average, returns to such assets are negative

B)asset returns tend to move in opposite directions

C)asset returns tend to move in the same directions

D)there is a perfect relationship between returns earned

![<strong>Use the following information, which describes the expected return and standard deviation for three different assets, to answer the following question(s). A negative coefficient of correlation implies that [blank].</strong> A)on average, returns to such assets are negative B)asset returns tend to move in opposite directions C)asset returns tend to move in the same directions D)there is a perfect relationship between returns earned](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_933a_88e0_9109_dbb2de69d94d_TB6913_00_TB6913_00_TB6913_00.jpg)

A negative coefficient of correlation implies that [blank].

A)on average, returns to such assets are negative

B)asset returns tend to move in opposite directions

C)asset returns tend to move in the same directions

D)there is a perfect relationship between returns earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

When constructing a portfolio, it is a good idea to put all your eggs in one basket, then watch the basket closely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

A share's beta is a measure of its [blank].

A)systematic risk

B)unsystematic risk

C)company-specific risk

D)diversifiable risk

A)systematic risk

B)unsystematic risk

C)company-specific risk

D)diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

Most financial assets have correlation coefficients between 0 and 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Negatively correlated assets are quite hard to find.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

Reuters and Commonwealth Securities are both sources of [blank].

A)unsystematic risk

B)expected returns

C)high-risk assets

D)beta estimates

A)unsystematic risk

B)expected returns

C)high-risk assets

D)beta estimates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

A portfolio containing a mix of shares, bonds and real estate is likely to be more diversified than a portfolio made up of only one asset class.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

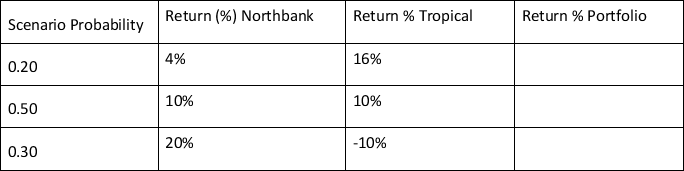

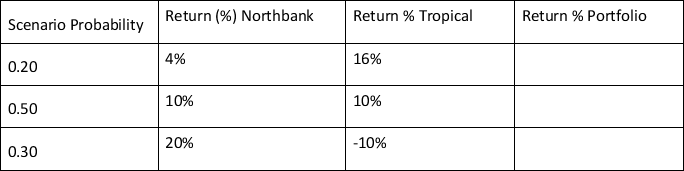

You are considering a portfolio consisting of equal investments in the shares Northbank Ltd and Tropical Escapes Inc.Returns on the two shares under various conditions are shown below.

Calculate the expected rate of and the standard deviation return of the portfolio.

Calculate the expected rate of and the standard deviation return of the portfolio.

Calculate the expected rate of and the standard deviation return of the portfolio.

Calculate the expected rate of and the standard deviation return of the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

The capital asset pricing model [blank].

A)provides a risk-return trade-off in which risk is measured in terms of the market returns

B)provides a risk-return trade-off in which risk is measured in terms of beta

C)measures risk as the correlation coefficient between a security and market rates of return

D)depicts the total risk of a security

A)provides a risk-return trade-off in which risk is measured in terms of the market returns

B)provides a risk-return trade-off in which risk is measured in terms of beta

C)measures risk as the correlation coefficient between a security and market rates of return

D)depicts the total risk of a security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following has a beta of 1?

A)The 10-year T-Bond

B)The one-year T-Bill

C)Telstra Corporation

D)The market

A)The 10-year T-Bond

B)The one-year T-Bill

C)Telstra Corporation

D)The market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

The appropriate measure for risk according to the capital asset pricing model is [blank].

A)the standard deviation of a firm's cash flows

B)alpha

C)beta

D)probability of correlation

A)the standard deviation of a firm's cash flows

B)alpha

C)beta

D)probability of correlation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

The benefit from diversification is far greater when the diversification occurs across asset types.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

The effect of reducing risks by including a large number of investments in a portfolio is known as [blank].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

You are considering investing Woolworths Ltd.Which of the following is an example of diversifiable risk?

A)Risk resulting from the possibility of shares market crash

B)Risk resulting from uncertainty regarding a possible strike against Ford

C)Risk resulting from an expected recession

D)Risk resulting from interest rates decreasing

A)Risk resulting from the possibility of shares market crash

B)Risk resulting from uncertainty regarding a possible strike against Ford

C)Risk resulting from an expected recession

D)Risk resulting from interest rates decreasing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

For the most part, there has been a positive relation between risk and return historically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

An asset with a large standard deviation of returns can lower portfolio risk if its returns are uncorrelated with the returns on the other assets in the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Changes in the general economy, such as changes in interest rates, represent what type of risk?

A)Firm-specific risk

B)Market risk

C)Unsystematic risk

D)Diversifiable risk

A)Firm-specific risk

B)Market risk

C)Unsystematic risk

D)Diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Portfolio returns can be calculated as the geometric mean of the returns on the individual assets in the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

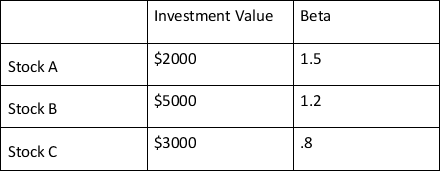

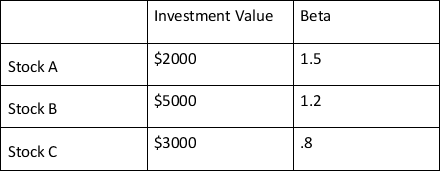

If you hold a portfolio made up of the following shares:  What is the beta of the portfolio?

What is the beta of the portfolio?

A)1.17

B)1.14

C)1.32

D)1.44

What is the beta of the portfolio?

What is the beta of the portfolio?A)1.17

B)1.14

C)1.32

D)1.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

The standard deviation of returns on Warchester shares is 20% and on Shoesbury shares it is 16%.The coefficient of correlation between the shares is .75.The standard deviation of any portfolio combining the two shares will be less than 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

On average, when the overall market changes by 10%, the shares of Veracity Communications changes 12%.Veracity's beta is

A)1.2

B)8.33%

C)12%

D)15%

A)1.2

B)8.33%

C)12%

D)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements is true?

A)Systematic, or market, risk can be reduced through diversification.

B)Both systematic and unsystematic risk can be reduced through diversification.

C)Unsystematic, or company, risk can be reduced through diversification.

D)Neither systematic nor unsystematic risk can be reduced through diversification.

A)Systematic, or market, risk can be reduced through diversification.

B)Both systematic and unsystematic risk can be reduced through diversification.

C)Unsystematic, or company, risk can be reduced through diversification.

D)Neither systematic nor unsystematic risk can be reduced through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements is true?

A)A shares with a beta less than zero has no exposure to systematic risk.

B)A shares with a beta greater than 1.0 has lower non-diversifiable risk than shares with a beta of 1.0.

C)A shares with a beta less than 1.0 has lower non-diversifiable risk than shares with a beta of 1.0.

D)A shares with a beta less than 1.0 has higher non-diversifiable risk than shares with a beta of 1.0.

A)A shares with a beta less than zero has no exposure to systematic risk.

B)A shares with a beta greater than 1.0 has lower non-diversifiable risk than shares with a beta of 1.0.

C)A shares with a beta less than 1.0 has lower non-diversifiable risk than shares with a beta of 1.0.

D)A shares with a beta less than 1.0 has higher non-diversifiable risk than shares with a beta of 1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

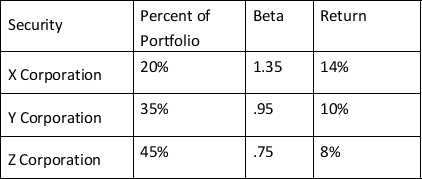

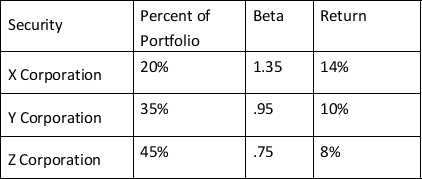

You hold a portfolio with the following securities:  Calculate the expected return and beta for the portfolio.

Calculate the expected return and beta for the portfolio.

A)10.67%, 1.02

B)9.9%, 1.02

C)34.4%, .94

D)9.9%, .94

Calculate the expected return and beta for the portfolio.

Calculate the expected return and beta for the portfolio.A)10.67%, 1.02

B)9.9%, 1.02

C)34.4%, .94

D)9.9%, .94

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Shares with higher betas are usually more stable than shares with lower betas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

Total risk equals unsystematic risk times systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

The beta of ABC Co.shares is the slope of [blank].

A)the security market line

B)the characteristic line for a plot of returns on the S&P 500 versus returns on short-term Treasury notes

C)the arbitrage pricing line

D)the line of best fit for a plot of ABC Co.returns against the returns of the market portfolio for the same period

A)the security market line

B)the characteristic line for a plot of returns on the S&P 500 versus returns on short-term Treasury notes

C)the arbitrage pricing line

D)the line of best fit for a plot of ABC Co.returns against the returns of the market portfolio for the same period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

The CAPM designates the risk-return tradeoff existing in the market, where risk is defined in terms of beta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is a good measure of the relationship between an investment's returns and the market's returns?

A)The beta coefficient

B)The standard variation

C)The CPI

D)The S&P 500 Index

A)The beta coefficient

B)The standard variation

C)The CPI

D)The S&P 500 Index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Beta is a measurement of the relationship between a security's returns and the general market's returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

Currently, the expected return on the market is 12.5% and the required rate of return for Alpha, Inc.is 12.5%.Therefore, Alpha's beta must be

A)less than 1.0.

B)greater than 1.0.

C)equal to 1.0.

D)between 0 and .5.

A)less than 1.0.

B)greater than 1.0.

C)equal to 1.0.

D)between 0 and .5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

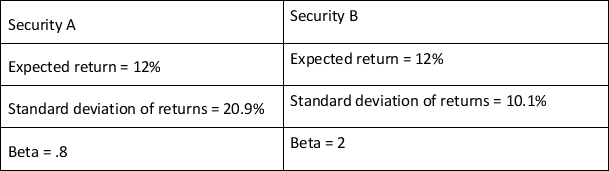

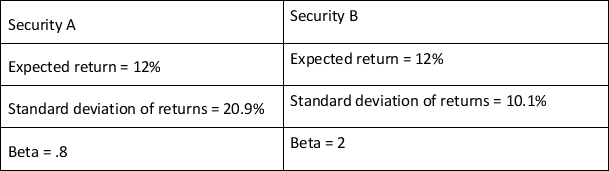

You are thinking of adding one of two investments to an already well-diversified portfolio.  If you are a risk-averse investor

If you are a risk-averse investor

A)security A is the better choice

B)security B is the better choice

C)either security would be acceptable

D)cannot be determined with information given

If you are a risk-averse investor

If you are a risk-averse investorA)security A is the better choice

B)security B is the better choice

C)either security would be acceptable

D)cannot be determined with information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

You are considering a portfolio of three shares with 30% of your money invested in company X, 45% of your money invested in company Y and 25% of your money invested in company Z.If the betas for each shares are 1.22 for company X, 1.46 for company Y and 1.03 for company Z, what is the portfolio beta?

A)1.24

B)1.00

C)1.28

D)1.33

A)1.24

B)1.00

C)1.28

D)1.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

What type of risk can investors reduce through diversification?

A)All risk

B)Systematic risk only

C)Unsystematic risk only

D)Uncertainty

A)All risk

B)Systematic risk only

C)Unsystematic risk only

D)Uncertainty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

It is impossible to eliminate all risk through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

Shares with a beta greater than 1.0 have returns that are [blank] volatile than the market, and shares with a beta of less than 1.0 exhibits returns which are [blank] volatile than those of the market portfolio.

A)more, more

B)more, less

C)less, more

D)less, less

A)more, more

B)more, less

C)less, more

D)less, less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

Investment risk is [blank].

A)the probability of achieving a return that is greater than what was expected

B)the probability of achieving a beta coefficient that is less than what was expected

C)the probability of achieving a return that is less than what was expected

D)the probability of achieving a standard deviation that is less than what was expected

A)the probability of achieving a return that is greater than what was expected

B)the probability of achieving a beta coefficient that is less than what was expected

C)the probability of achieving a return that is less than what was expected

D)the probability of achieving a standard deviation that is less than what was expected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

All of the following are examples of systematic risk except [blank].

A)Inflation

B)Recession

C)Management risk

D)Interest rate risk

A)Inflation

B)Recession

C)Management risk

D)Interest rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

Beta is the slope of a straight line that best fits the returns on an asset plotted against the return on [blank].

A)inflation

B)a portfolio of companies in the same industry

C)a broad market index

D)Treasury notes

A)inflation

B)a portfolio of companies in the same industry

C)a broad market index

D)Treasury notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

Your broker mailed you your year-end statement.You have $25000 invested in Telstra, $18000 tied up in Boeing, $36,000 in RedBalloon shares, and $11000 in Woolworths.The betas for each of your shares are 1.43 for Telstra, .79 for Boeing, 1.37 for RedBalloon and 1.71 for Woolworths.What is the beta of your portfolio?

A)1.33

B)1.31

C)1.00

D)5.30

A)1.33

B)1.31

C)1.00

D)5.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is generally used to measure the market when calculating betas?

A)The Dow Jones Industrial Average

B)The Standard & Poors 500 Index

C)The Value Line Quantam Index

D)The Case Schiller Housing Index

A)The Dow Jones Industrial Average

B)The Standard & Poors 500 Index

C)The Value Line Quantam Index

D)The Case Schiller Housing Index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

The SML relates risk to return, for a given set of market conditions.If risk aversion increases, which of the following would most likely occur?

A)The market risk premium would increase

B)Beta would increase

C)The slope of the SML would increase

D)The SML line would shift up

A)The market risk premium would increase

B)Beta would increase

C)The slope of the SML would increase

D)The SML line would shift up

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

Provide an intuitive discussion of beta and its importance for measuring risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

Shares with a beta of 1.0 would on average earn the risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

Given the capital asset pricing model, a security with a beta of 1.5 should return [blank], if the risk-free rate is 3% and the market return is 11%.

A)16.5%

B)14.0%

C)14.5%

D)15.0%

A)16.5%

B)14.0%

C)14.5%

D)15.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

In 1990, Harry Markowitz and William Sharpe won the Nobel Memorial Prize in Economics for their [blank] model of measuring risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

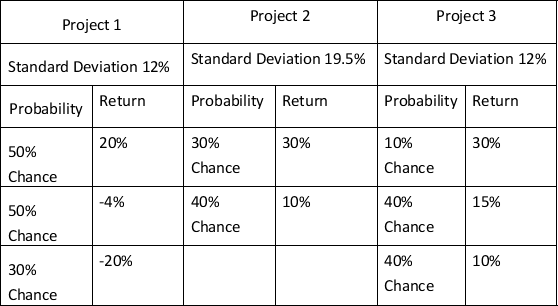

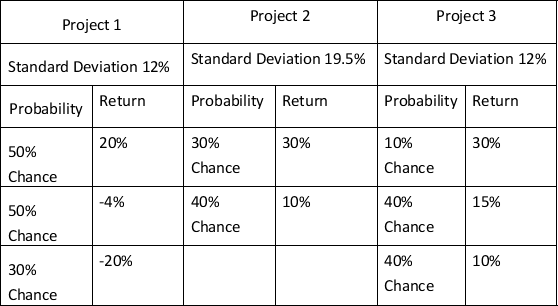

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:  If you are a risk-averse investor, which one should you choose?

If you are a risk-averse investor, which one should you choose?

A)Project 1

B)Project 2

C)Project 3

D)A risk-averse investor would not choose any of these projects

If you are a risk-averse investor, which one should you choose?

If you are a risk-averse investor, which one should you choose?A)Project 1

B)Project 2

C)Project 3

D)A risk-averse investor would not choose any of these projects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

The market rewards assuming additional unsystematic risk with additional returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Betas for individual shares tend to be stable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

The security market line (SML)relates risk to return, for a given set of market conditions.If expected inflation increases, which of the following would most likely occur?

A)The market risk premium would increase

B)Beta would increase

C)The slope of the SML would increase

D)The SML line would shift up

A)The market risk premium would increase

B)Beta would increase

C)The slope of the SML would increase

D)The SML line would shift up

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Unsystematic risk can be eliminated through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

The risk-return relationship for each financial asset is shown on [blank].

A)the capital market line

B)the New York Stock Exchange market line

C)the security market line

D)the Australian banking line

A)the capital market line

B)the New York Stock Exchange market line

C)the security market line

D)the Australian banking line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Treize Industries' common shares has an expected return of 13% and a beta of 1.3.If the expected risk-free return is 3%, what is the expected return for the market (round your answer to the nearest .1%)?

A)7.7%

B)9.6%

C)10.0%

D)10.7%

A)7.7%

B)9.6%

C)10.0%

D)10.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Briefly discuss why there is no reason to believe that the market will reward investors with additional returns for assuming unsystematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

Siebling Manufacturing Company's common shares has a beta of .8.If the expected risk-free return is 2% and the market offers a premium of 8% over the risk-free rate, what is the expected return on Siebling's common shares?

A)7.8%

B)13.4%

C)14.4%

D)8.4%

A)7.8%

B)13.4%

C)14.4%

D)8.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

On average, the market rewards assuming additional systematic risk with additional returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Tanzlin Manufacturing's common shares has a beta of 1.5.If the expected risk-free return is 2% and the expected return on the market is 14%, what is the expected return on the shares?

A)13.5%

B)21.0%

C)16.8%

D)20.0%

A)13.5%

B)21.0%

C)16.8%

D)20.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

In an efficient market there is no reward for accepting risk that can be eliminated through diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Bell Weather Ltd has a beta of 1.25.The return on the market portfolio is 12.5%, and the risk-free rate is 5%.According to CAPM, what is the required return on this shares?

A)20.62%

B)9.37%

C)14.38%

D)15.62%

A)20.62%

B)9.37%

C)14.38%

D)15.62%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

HealthEngine, has a beta of 2.35.The return on the market portfolio is 12%, and the risk-free rate is 2.5%.According to CAPM, what is the risk premium on shares with a beta of 1.0?

A)12.00%

B)22.33%

C)9.5%

D)14.5%

A)12.00%

B)22.33%

C)9.5%

D)14.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

The rate on six-month T-bills is currently 5%.Andvark Company shares has a beta of 1.69 and a required rate of return of 15.4%.According to CAPM, determine the return on the market portfolio.

A)11.15%

B)6.15%

C)17.07%

D)14.11%

A)11.15%

B)6.15%

C)17.07%

D)14.11%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck