Deck 1: Introduction to Cost Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/77

العب

ملء الشاشة (f)

Deck 1: Introduction to Cost Accounting

1

The business entity that converts purchased raw materials into finished goods by using labor,technology,and facilities is a:

A)Manufacturer.

B)Merchandiser.

C)Service business.

D)Not-for-profit service agency.

A)Manufacturer.

B)Merchandiser.

C)Service business.

D)Not-for-profit service agency.

A

2

The process of establishing objectives or goals for the firm and determining the means by which they will be met is:

A)controlling.

B)analyzing profitability.

C)planning.

D)assigning responsibility.

A)controlling.

B)analyzing profitability.

C)planning.

D)assigning responsibility.

C

3

Effective control of a company's operations is achieved through all of the following except:

A)periodically measuring and comparing company results.

B)assigning responsibility for costs to employees responsible for those costs.

C)constantly monitoring employees to ensure they do exactly as they are told.

D)taking necessary corrective action when variances suggest it is needed.

A)periodically measuring and comparing company results.

B)assigning responsibility for costs to employees responsible for those costs.

C)constantly monitoring employees to ensure they do exactly as they are told.

D)taking necessary corrective action when variances suggest it is needed.

C

4

Taylor Logan is an accountant with the Tanner Corporation.Taylor's duties include preparing reports that focus on both historical and estimated data needed to conduct ongoing operations and do long-range planning.Taylor is a(n)

A)certified financial planner.

B)management accountant.

C)financial accountant.

D)auditor.

A)certified financial planner.

B)management accountant.

C)financial accountant.

D)auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements characterizes a performance report prepared for use by a production line department head?

A)The costs in the report should include only those controllable by the department head.

B)The report should be stated in dollars rather than in physical units so the department head knows the financial magnitude of any variances.

C)The report should include information on all costs chargeable to the department,regardless of their origin or control.

D)It is more important that the report be precise than timely.

A)The costs in the report should include only those controllable by the department head.

B)The report should be stated in dollars rather than in physical units so the department head knows the financial magnitude of any variances.

C)The report should include information on all costs chargeable to the department,regardless of their origin or control.

D)It is more important that the report be precise than timely.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

6

A budget:

A)is a monthly financial statement issued to a company's shareholders.

B)is management's operating plan expressed in units and dollars.

C)documents the production department's schedule.

D)is the basis for the annual sales forecast.

A)is a monthly financial statement issued to a company's shareholders.

B)is management's operating plan expressed in units and dollars.

C)documents the production department's schedule.

D)is the basis for the annual sales forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

7

Joshua Company prepares monthly performance reports for each department.The budgeted amounts of wages for the Finishing Department for the month of August and for the eight-month period ended August 31 were $12,000 and $100,000,respectively.Actual wages paid through July were $91,500,and wages for the month of August were $11,800.The month and year-to-date variances,respectively,for wages on the August performance report would be:

A)$200 F;$8,500 F

B)$200 F;$3,300 U

C)$200 U;$3,300 U

D)$200 U;$8,500 F

A)$200 F;$8,500 F

B)$200 F;$3,300 U

C)$200 U;$3,300 U

D)$200 U;$8,500 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

8

Examples of service businesses include:

A)Airlines,accountants,and hair stylists.

B)Department stores,poster shops,and wholesalers.

C)Aircraft producers,home builders,and machine tool makers.

D)None of these are correct.

A)Airlines,accountants,and hair stylists.

B)Department stores,poster shops,and wholesalers.

C)Aircraft producers,home builders,and machine tool makers.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following costs would be least likely to appear on a responsibility accounting report for the supervisor of an assembly line in a large manufacturing situation?

A)Direct labor

B)Supervisor's salary

C)Materials

D)Repairs and maintenance

A)Direct labor

B)Supervisor's salary

C)Materials

D)Repairs and maintenance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following costs would be least likely to appear on a responsibility accounting report for the supervisor of an assembly line in a large manufacturing situation?

A)Direct labor

B)Indirect materials

C)Selling expenses

D)Repairs and maintenance

A)Direct labor

B)Indirect materials

C)Selling expenses

D)Repairs and maintenance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

11

Responsibility accounting would most likely hold a manager of a manufacturing unit responsible for:

A)cost of raw materials.

B)quantity of raw materials used.

C)the number of units ordered.

D)amount of taxes incurred.

A)cost of raw materials.

B)quantity of raw materials used.

C)the number of units ordered.

D)amount of taxes incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

12

The business entity that purchases finished goods for resale is a:

A)Manufacturer.

B)Merchandiser.

C)Service business.

D)Wholesaler.

A)Manufacturer.

B)Merchandiser.

C)Service business.

D)Wholesaler.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

13

Unit cost information is important for making all of the following marketing decisions except:

A)Determining the selling price of a product.

B)Bidding on contracts.

C)Determining the amount to spend on social media to promote the product.

D)Determining the amount of profit that each product earns.

A)Determining the selling price of a product.

B)Bidding on contracts.

C)Determining the amount to spend on social media to promote the product.

D)Determining the amount of profit that each product earns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

14

As a result of recent accounting scandals involving companies such as Enron and World Com,the Sarbanes-Oxley Act of 2002 was written to protect shareholders of public companies by improving

A)management accounting.

B)corporate governance.

C)professional competence.

D)the corporate legal process.

A)management accounting.

B)corporate governance.

C)professional competence.

D)the corporate legal process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

15

ISO 9000 is a set of international standards for:

A)determining the selling price of a product.

B)cost control.

C)quality management.

D)delivering product,

A)determining the selling price of a product.

B)cost control.

C)quality management.

D)delivering product,

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not a key element of the Sarbanes Oxley Act?

A)The establishment of the Public Company Accounting Oversight Board

B)Requiring a company's annual report to contain an internal control report that includes management's opinion on the effectiveness of internal control

C)Severe criminal penalties for retaliation against "whistleblowers"

D)Requiring that the company's performance reports are prepared in accordance with generally accepted accounting principles

A)The establishment of the Public Company Accounting Oversight Board

B)Requiring a company's annual report to contain an internal control report that includes management's opinion on the effectiveness of internal control

C)Severe criminal penalties for retaliation against "whistleblowers"

D)Requiring that the company's performance reports are prepared in accordance with generally accepted accounting principles

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

17

Dan Louis is the supervisor of the Assembly Department of Wiggerman Corporation.He has control over and is responsible for manufacturing costs traced to the department.The Assembly Department is an example of a(n):

A)cost center.

B)inventory center.

C)supervised work center.

D)worker's center.

A)cost center.

B)inventory center.

C)supervised work center.

D)worker's center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

18

The type of merchandiser who purchases goods from the producer and sells them to retailers that sell them to the consumer is a:

A)Manufacturer.

B)Retailer.

C)Wholesaler.

D)Service business.

A)Manufacturer.

B)Retailer.

C)Wholesaler.

D)Service business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

19

Cost accounting differs from financial accounting in that financial accounting:

A)Is mostly concerned with external financial reporting.

B)Is mostly concerned with individual departments of the company.

C)Provides the additional information required for special reports to management.

D)Puts more emphasis on future operations.

A)Is mostly concerned with external financial reporting.

B)Is mostly concerned with individual departments of the company.

C)Provides the additional information required for special reports to management.

D)Puts more emphasis on future operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

20

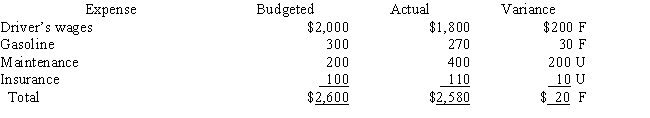

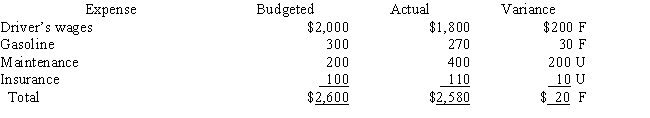

The January performance report for cab no.52 of Teri's Taxi Service was as follows:  Possible reason(s)for the variance in the driver's wages could be:

Possible reason(s)for the variance in the driver's wages could be:

A)A new driver was assigned to cab no.52 on January 5,replacing one who retired after 30 years of service.

B)The cab was in the shop for repairs for a few days.

C)Business was slow so cab no.52 was idled for two days.

D)All of the above are possible reasons.

Possible reason(s)for the variance in the driver's wages could be:

Possible reason(s)for the variance in the driver's wages could be:A)A new driver was assigned to cab no.52 on January 5,replacing one who retired after 30 years of service.

B)The cab was in the shop for repairs for a few days.

C)Business was slow so cab no.52 was idled for two days.

D)All of the above are possible reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

21

In the financial statements,Materials should be categorized as:

A)Revenue.

B)Expenses.

C)Assets.

D)Liabilities.

A)Revenue.

B)Expenses.

C)Assets.

D)Liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

22

The term "prime cost" refers to:

A)The sum of direct labor costs and all factory overhead costs.

B)The sum of direct material costs and direct labor costs.

C)All costs associated with manufacturing other than direct labor costs and direct material costs.

D)Manufacturing costs incurred to produce units of output.

A)The sum of direct labor costs and all factory overhead costs.

B)The sum of direct material costs and direct labor costs.

C)All costs associated with manufacturing other than direct labor costs and direct material costs.

D)Manufacturing costs incurred to produce units of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is most likely to be considered an indirect material in the manufacture of a sofa?

A)Lumber

B)Glue

C)Fabric

D)Foam rubber

A)Lumber

B)Glue

C)Fabric

D)Foam rubber

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

24

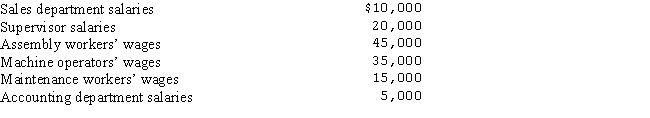

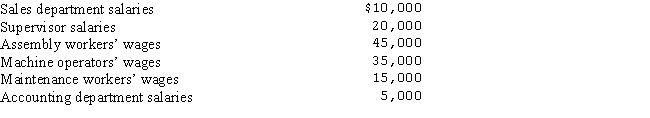

The Lauren Company's payroll summary showed the following in November:  What amount would be included in direct labor in November?

What amount would be included in direct labor in November?

A)$25,000

B)$80,000

C)$45,000

D)$140,000

What amount would be included in direct labor in November?

What amount would be included in direct labor in November?A)$25,000

B)$80,000

C)$45,000

D)$140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

25

A(n)__________ requires estimating inventory balances during the year for interim financial statements and a formal count of all inventory items at the end of the year.

A)periodic inventory system

B)inventory control account

C)perpetual inventory system

D)inventory cost method

A)periodic inventory system

B)inventory control account

C)perpetual inventory system

D)inventory cost method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

26

For a manufacturer,the total cost of manufactured goods completed but still on hand is:

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

27

The wages of which of the following employees would not be included in the product cost for a manufacturer of custom-built home cooking appliances?

A)shipping clerk

B)appliance body welder

C)factory janitor

D)shop floor supervisor

A)shipping clerk

B)appliance body welder

C)factory janitor

D)shop floor supervisor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

28

The balance in Electric Industries' Finished Goods account at December 31 was $325,000.Its December cost of goods manufactured was $1,350,000,its total manufacturing costs were $1,500,000 and its cost of goods sold in December was $1,455,000.What was the balance in Electric's Finished Goods at December 1?

A)$280,000

B)$220,000

C)$370,000

D)$430,000

A)$280,000

B)$220,000

C)$370,000

D)$430,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

29

Factory overhead includes:

A)Indirect labor but not indirect materials.

B)Indirect materials but not indirect labor.

C)All manufacturing costs,except indirect materials and indirect labor.

D)All manufacturing costs,except direct materials and direct labor.

A)Indirect labor but not indirect materials.

B)Indirect materials but not indirect labor.

C)All manufacturing costs,except indirect materials and indirect labor.

D)All manufacturing costs,except direct materials and direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

30

Chen Corp.had finished goods inventory of $60,000 and $70,000 at May 1 and May 31,respectively,and cost of goods manufactured of $175,000.Cost of goods sold in May was:

A)$165,000

B)$175,000

C)$185,000

D)$225,000

A)$165,000

B)$175,000

C)$185,000

D)$225,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

31

Factory overhead includes:

A)Wages of office clerk.

B)Sales manager's salary.

C)Supervisor's salary.

D)Tax accountant's salary.

A)Wages of office clerk.

B)Sales manager's salary.

C)Supervisor's salary.

D)Tax accountant's salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

32

Witt Company maintains a continuous record of purchases,materials issued into production and balances of all goods in stock,so that inventory valuation data is available at any time.This is an example of a(n)

A)perpetual inventory system.

B)inventory control account.

C)periodic inventory system.

D)inventory cost method.

A)perpetual inventory system.

B)inventory control account.

C)periodic inventory system.

D)inventory cost method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

33

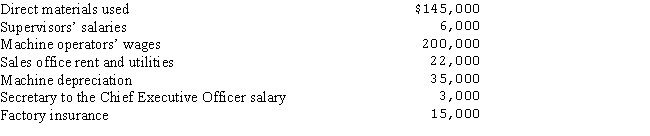

The following data are from Burton Corporation,a manufacturer,for the month of September:  Total prime costs are:

Total prime costs are:

A)$354,000

B)$145,000

C)$345,000

D)$256,000

Total prime costs are:

Total prime costs are:A)$354,000

B)$145,000

C)$345,000

D)$256,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

34

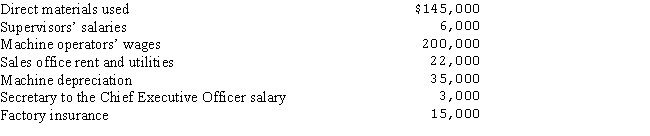

The Shiplett Company's payroll summary showed the following in November:  What is total factory overhead for November?

What is total factory overhead for November?

A)$250,000

B)$200,000

C)$80,000

D)$40,000

What is total factory overhead for November?

What is total factory overhead for November?A)$250,000

B)$200,000

C)$80,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

35

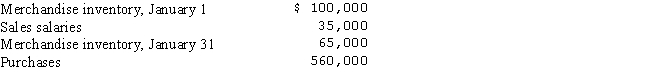

The following data were taken from Mansfield Merchandisers on January 31:  What was the Cost of goods sold in January?

What was the Cost of goods sold in January?

A)$595,000

B)$660,000

C)$630,000

D)$545,000

What was the Cost of goods sold in January?

What was the Cost of goods sold in January?A)$595,000

B)$660,000

C)$630,000

D)$545,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

36

For a manufacturer,manufacturing costs incurred to date for goods in various stages of production,but not yet completed is:

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

37

A typical factory overhead cost is:

A)Freight out.

B)Stationery and printing.

C)Depreciation on machinery and equipment.

D)Postage.

A)Freight out.

B)Stationery and printing.

C)Depreciation on machinery and equipment.

D)Postage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

38

Umberg Merchandise Company's cost of goods sold last month was $1,450,000.Merchandise Inventory at the beginning of the month was $250,000 and $325,000 at the end of the month.Umberg's merchandise purchases were:

A)$1,450,000

B)$1,375,000

C)$1,525,000

D)$1,775,000

A)$1,450,000

B)$1,375,000

C)$1,525,000

D)$1,775,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

39

For a manufacturer,the cost of all materials purchases and on hand to be used in the manufacturing process is:

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

40

Inventory accounts for a manufacturer include all of the following except:

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

A)Merchandise Inventory.

B)Finished Goods.

C)Work in Process.

D)Raw Materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following production operations would be most likely to employ a job order system of cost accounting?

A)Candy manufacturing

B)Crude oil refining

C)Creating custom-made suits

D)Flour milling

A)Candy manufacturing

B)Crude oil refining

C)Creating custom-made suits

D)Flour milling

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

42

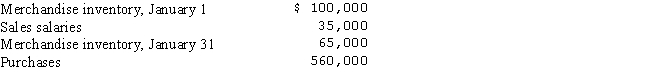

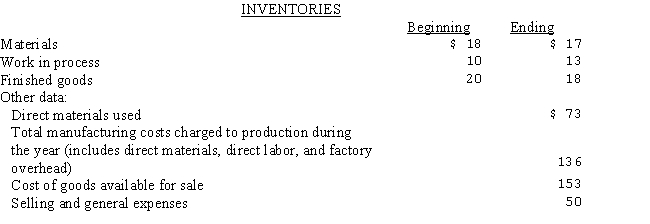

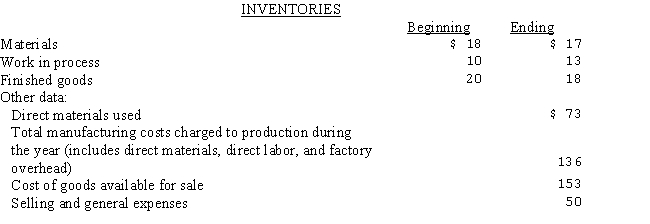

Selected data concerning the past fiscal year's operations (000's omitted)of Hercules Mills are presented below:  The cost of goods sold during the year was:

The cost of goods sold during the year was:

A)$135.

B)$146.

C)$153.

D)$155.

The cost of goods sold during the year was:

The cost of goods sold during the year was:A)$135.

B)$146.

C)$153.

D)$155.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

43

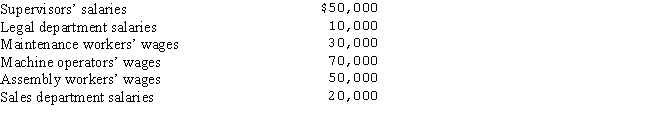

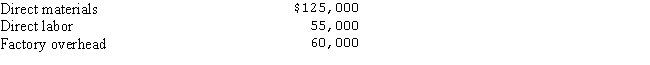

Mountain Company produced 20,000 blankets in June to be sold during the holiday season.The manufacturing costs were:  Management has decided that the mark-on percentage necessary to cover the product's share of selling and administrative expenses and to earn a satisfactory profit is 30%.The selling price per blanket should be:

Management has decided that the mark-on percentage necessary to cover the product's share of selling and administrative expenses and to earn a satisfactory profit is 30%.The selling price per blanket should be:

A)$12.00.

B)$15.60.

C)$23.60.

D)$31.20.

Management has decided that the mark-on percentage necessary to cover the product's share of selling and administrative expenses and to earn a satisfactory profit is 30%.The selling price per blanket should be:

Management has decided that the mark-on percentage necessary to cover the product's share of selling and administrative expenses and to earn a satisfactory profit is 30%.The selling price per blanket should be:A)$12.00.

B)$15.60.

C)$23.60.

D)$31.20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

44

In job order costing,the basic document for accumulating the cost of each job is the:

A)Job cost sheet.

B)Requisition sheet.

C)Purchase order.

D)Invoice.

A)Job cost sheet.

B)Requisition sheet.

C)Purchase order.

D)Invoice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

45

A standard cost system is one:

A)that provides a separate record of cost for each special-order product.

B)that uses predetermined costs to furnish a measurement that helps management make decisions regarding the efficiency of operations.

C)that accumulates costs for each department or process in the factory.

D)where costs are accumulated on a job cost sheet.

A)that provides a separate record of cost for each special-order product.

B)that uses predetermined costs to furnish a measurement that helps management make decisions regarding the efficiency of operations.

C)that accumulates costs for each department or process in the factory.

D)where costs are accumulated on a job cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not a cost that is accumulated in Work in Process?

A)Direct materials

B)Administrative expense

C)Direct labor

D)Factory overhead

A)Direct materials

B)Administrative expense

C)Direct labor

D)Factory overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

47

Selected data concerning the past fiscal year's operations (000's omitted)of the Stanley Manufacturing Company are presented below:  Assuming Stanley does not use indirect materials,the cost of materials purchased during the year amounted to:

Assuming Stanley does not use indirect materials,the cost of materials purchased during the year amounted to:

A)$455.

B)$450.

C)$365.

D)$360.

Assuming Stanley does not use indirect materials,the cost of materials purchased during the year amounted to:

Assuming Stanley does not use indirect materials,the cost of materials purchased during the year amounted to:A)$455.

B)$450.

C)$365.

D)$360.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

48

At a certain level of operations,per unit costs and selling price are as follows: manufacturing costs,$50;selling and administrative expenses,$10;selling price,$80.Given this information,the mark-on percentage to manufacturing cost used to determine selling price must have been:

A)20 percent.

B)60 percent.

C)33 percent.

D)25 percent.

A)20 percent.

B)60 percent.

C)33 percent.

D)25 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

49

Payroll is debited and Wages Payable is credited to:

A)Pay the payroll taxes.

B)Record the payroll.

C)Pay the payroll.

D)Distribute the payroll.

A)Pay the payroll taxes.

B)Record the payroll.

C)Pay the payroll.

D)Distribute the payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

50

A law firm wanting to track the costs of serving different clients may use a:

A)process cost system.

B)job order cost system.

C)cost control system.

D)standard cost system.

A)process cost system.

B)job order cost system.

C)cost control system.

D)standard cost system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

51

When should process costing techniques be used in assigning costs to products?

A)In situations where standard costing techniques should not be used

B)If products manufactured are substantially identical

C)When production is only partially completed during the accounting period

D)If products are manufactured on the basis of each order received

A)In situations where standard costing techniques should not be used

B)If products manufactured are substantially identical

C)When production is only partially completed during the accounting period

D)If products are manufactured on the basis of each order received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

52

The entry to record depreciation of the production equipment would be:

A)Debit - Depreciation Expense - Equipment Credit - Accumulated Depreciation - Equipment

B)Debit - Depreciation Expense - Equipment Credit - Factory Overhead

C)Debit - Factory Overhead Credit - Accumulated Depreciation - Equipment

D)Debit - Work-in-Process Credit - Accumulated Depreciation - Equipment

A)Debit - Depreciation Expense - Equipment Credit - Accumulated Depreciation - Equipment

B)Debit - Depreciation Expense - Equipment Credit - Factory Overhead

C)Debit - Factory Overhead Credit - Accumulated Depreciation - Equipment

D)Debit - Work-in-Process Credit - Accumulated Depreciation - Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

53

The statement of cost of goods manufactured includes:

A)Office supplies used in accounting office.

B)Deprecation of factory building.

C)Salary of sales manager.

D)Rent paid on finished goods warehouse.

A)Office supplies used in accounting office.

B)Deprecation of factory building.

C)Salary of sales manager.

D)Rent paid on finished goods warehouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

54

Selected data concerning the past fiscal year's operations (000's omitted)of Kraig Fabricators are presented below:  The cost of goods manufactured during the year was:

The cost of goods manufactured during the year was:

A)$1,410.

B)$1,330.

C)$1,420.

D)$1,470.

The cost of goods manufactured during the year was:

The cost of goods manufactured during the year was:A)$1,410.

B)$1,330.

C)$1,420.

D)$1,470.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

55

The term "conversion costs" refers to:

A)The sum of direct labor costs and all factory overhead costs.

B)The sum of direct material costs and direct labor costs.

C)All costs associated with manufacturing other than direct labor costs.

D)Direct labor costs incurred to produce units of output.

A)The sum of direct labor costs and all factory overhead costs.

B)The sum of direct material costs and direct labor costs.

C)All costs associated with manufacturing other than direct labor costs.

D)Direct labor costs incurred to produce units of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

56

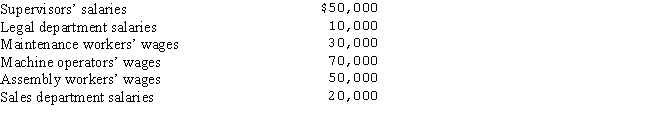

Arnold Furniture Company produced 4,000 chairs in July.The manufacturing costs were:  The cost per tent is:

The cost per tent is:

A)$14.75.

B)$12.00.

C)$9.00.

D)$6.25.

The cost per tent is:

The cost per tent is:A)$14.75.

B)$12.00.

C)$9.00.

D)$6.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following data are from Baker Company,a manufacturer,for the month of October:  Total conversion costs are:

Total conversion costs are:

A)$177,500

B)$114,500

C)$150,500

D)$138,000

Total conversion costs are:

Total conversion costs are:A)$177,500

B)$114,500

C)$150,500

D)$138,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

58

Under a job order system of cost accounting,the dollar amount of the entry to transfer inventory from Work in Process to Finished Goods is the sum of the costs charged to all jobs:

A)In process during the period.

B)Completed and sold during the period.

C)Completed during the period.

D)Started in process during the period.

A)In process during the period.

B)Completed and sold during the period.

C)Completed during the period.

D)Started in process during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

59

Under a job order cost system of accounting,the entry to distribute payroll to the appropriate accounts would be:

A)Debit-Payroll Credit-Wages Payable

B)Debit-Work in Process Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Payroll

C)Debit-Work in Process Debit-Finished Goods

Debit-Cost of Goods Sold

Credit-Payroll

D)Debit-Work in Process Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Wages Payable

A)Debit-Payroll Credit-Wages Payable

B)Debit-Work in Process Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Payroll

C)Debit-Work in Process Debit-Finished Goods

Debit-Cost of Goods Sold

Credit-Payroll

D)Debit-Work in Process Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Wages Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

60

An industry that would most likely use process costing procedures is:

A)Beverage.

B)Home Construction.

C)Printing.

D)Shipbuilding.

A)Beverage.

B)Home Construction.

C)Printing.

D)Shipbuilding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

61

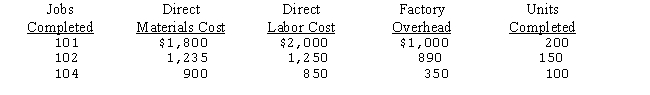

The Shawshank Manufacturing Co.uses a job order cost system of accounting.The following information was taken from the books of the company after all posting had been completed at the end of January:

a.Prepare the journal entries to allocate the costs of materials,labor,and factory overhead to each job and to transfer the costs of jobs completed to Finished Goods.

b.Compute the total production cost of each job.

c.Compute the unit cost of each job.

d.Compute the selling price per unit for each job,assuming a mark-on percentage of 40 percent.

a.Prepare the journal entries to allocate the costs of materials,labor,and factory overhead to each job and to transfer the costs of jobs completed to Finished Goods.

b.Compute the total production cost of each job.

c.Compute the unit cost of each job.

d.Compute the selling price per unit for each job,assuming a mark-on percentage of 40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

62

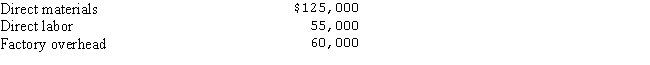

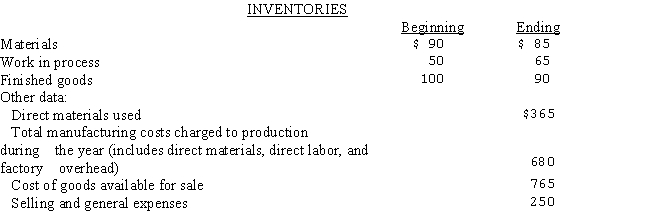

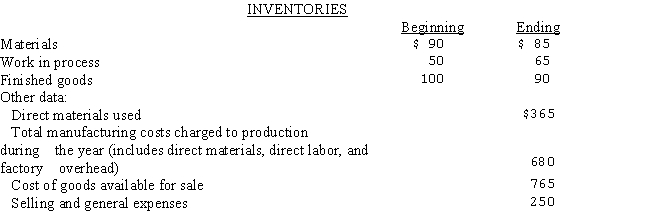

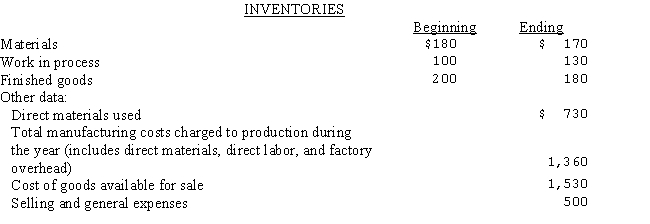

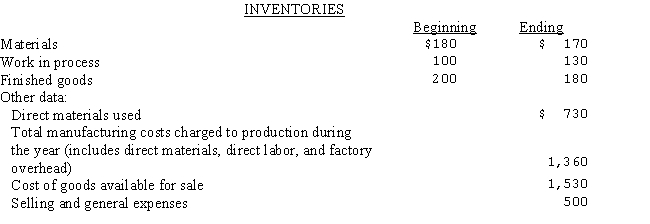

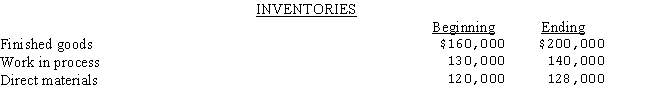

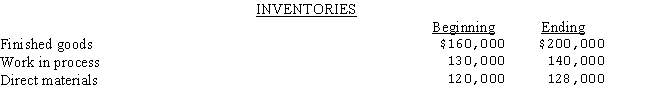

The following inventory data relate to the Reta Company:  Revenues and costs for the period:

Revenues and costs for the period:  Compute the following for the year:

Compute the following for the year:

a.Direct materials purchased

b.Direct labor costs incurred

c.Cost of goods sold

d.Gross profit

Revenues and costs for the period:

Revenues and costs for the period:  Compute the following for the year:

Compute the following for the year: a.Direct materials purchased

b.Direct labor costs incurred

c.Cost of goods sold

d.Gross profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

63

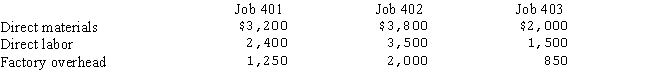

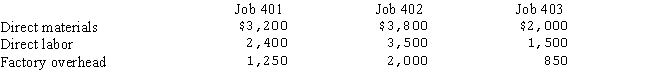

Custom Cabinets Inc.manufactures goods on a job order basis.During the month of November,three jobs were started.(There was no work in process at the beginning of the month. )Jobs 401 and 402 were completed and sold for $14,500 and $19,000,respectively,during the month;Job 403 was still in process at the end of November.

The following data are taken from the job cost sheets for each job.Factory overhead charges include a total of $900 of indirect materials and $600 of indirect labor.One work in process control account is used. Prepare a journal entry to record each of the following:

Prepare a journal entry to record each of the following:

a.Materials used

b.Factory wages and salaries earned

c.Factory Overhead transferred to Work in Process

d.Jobs completed

e.Jobs sold

The following data are taken from the job cost sheets for each job.Factory overhead charges include a total of $900 of indirect materials and $600 of indirect labor.One work in process control account is used.

Prepare a journal entry to record each of the following:

Prepare a journal entry to record each of the following: a.Materials used

b.Factory wages and salaries earned

c.Factory Overhead transferred to Work in Process

d.Jobs completed

e.Jobs sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

64

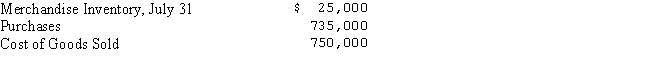

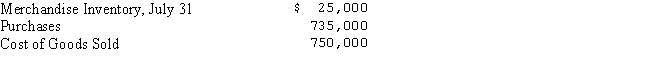

The following data were taken from Middletown Merchandisers on July 31,for the first month of its fiscal year:  Compute the inventory at July 1.

Compute the inventory at July 1.

Compute the inventory at July 1.

Compute the inventory at July 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

65

Joey Bruce is a cost accountant at ABC Industries.Joey told Tanner Scott,his financial advisor,that he was working on a project to determine the feasibility of a merger of ABC Industries with Left Guard Company,a major competitor.Which of the Institute of Management Accountant's (IMA)ethical standards may have been violated?

A)Competence

B)Confidentiality

C)Integrity

D)Credibility

A)Competence

B)Confidentiality

C)Integrity

D)Credibility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under a job order system of cost accounting,Cost of Goods Sold is debited and Finished Goods is credited for a:

A)Transfer of materials to the factory.

B)Shipment of completed goods to the customer.

C)Transfer of completed production to the finished goods storeroom.

D)Purchase of goods on account.

A)Transfer of materials to the factory.

B)Shipment of completed goods to the customer.

C)Transfer of completed production to the finished goods storeroom.

D)Purchase of goods on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

67

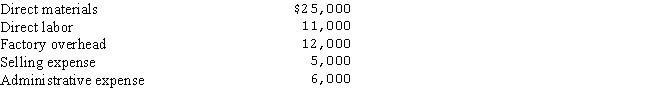

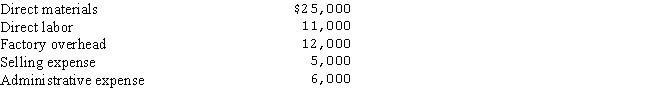

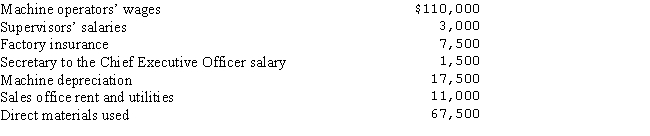

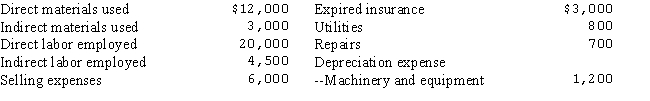

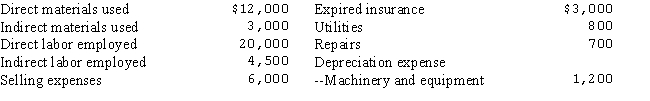

Following is a list of costs incurred by the Sitka Products Co.during the month of June:  Prepare the journal entries necessary to record the issuance of materials,the distribution of labor cost,the recording of factory overhead,and the entry transferring Factory Overhead to Work in Process.

Prepare the journal entries necessary to record the issuance of materials,the distribution of labor cost,the recording of factory overhead,and the entry transferring Factory Overhead to Work in Process.

Prepare the journal entries necessary to record the issuance of materials,the distribution of labor cost,the recording of factory overhead,and the entry transferring Factory Overhead to Work in Process.

Prepare the journal entries necessary to record the issuance of materials,the distribution of labor cost,the recording of factory overhead,and the entry transferring Factory Overhead to Work in Process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

68

Tom Jones,a management accountant,was faced with an ethical conflict at the office.According to the Institute of Management Accountants' (IMA)Statement of Professional Practice,the first action Tom should pursue is to:

A)follow his organization's established policies on the resolution of such conflict.

B)contact the local newspaper.

C)contact the company's audit committee.

D)consult an attorney.

A)follow his organization's established policies on the resolution of such conflict.

B)contact the local newspaper.

C)contact the company's audit committee.

D)consult an attorney.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following data were taken from the general ledger of Data Corp. ,a retailer of computers and accessories:  Compute the cost of goods sold for the month of August.

Compute the cost of goods sold for the month of August.

Compute the cost of goods sold for the month of August.

Compute the cost of goods sold for the month of August.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

70

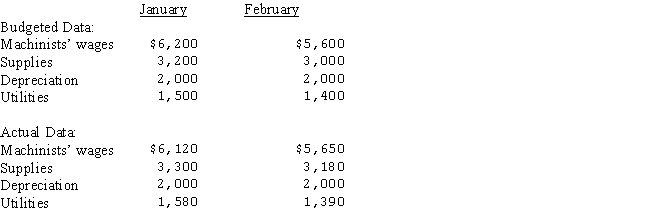

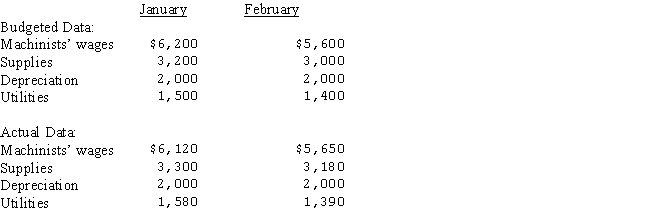

Prepare a performance report showing both month and year-to-date data for Post Manufacturing's Machining Department for February,201X using the following data:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following inventory data relate to the Anaheim Ltd.:  Revenues and costs for the period:

Revenues and costs for the period:  Prepare journal entries for the following,making any necessary computations:

Prepare journal entries for the following,making any necessary computations:

a.Purchase of materials on account

b.Issuance of materials into production

c.Transfer the cost of completed work to Finished Goods

d.Record the sale of the goods on account and the related cost of goods sold.

Revenues and costs for the period:

Revenues and costs for the period:  Prepare journal entries for the following,making any necessary computations:

Prepare journal entries for the following,making any necessary computations: a.Purchase of materials on account

b.Issuance of materials into production

c.Transfer the cost of completed work to Finished Goods

d.Record the sale of the goods on account and the related cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

72

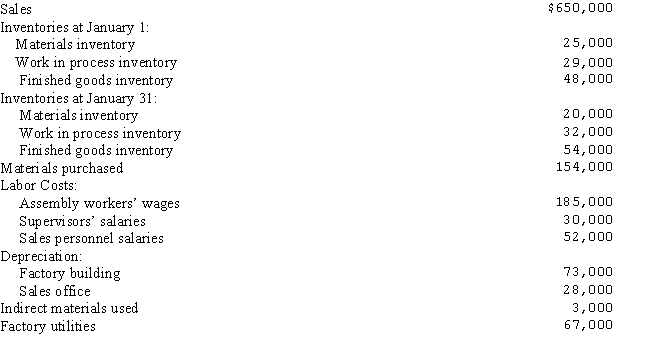

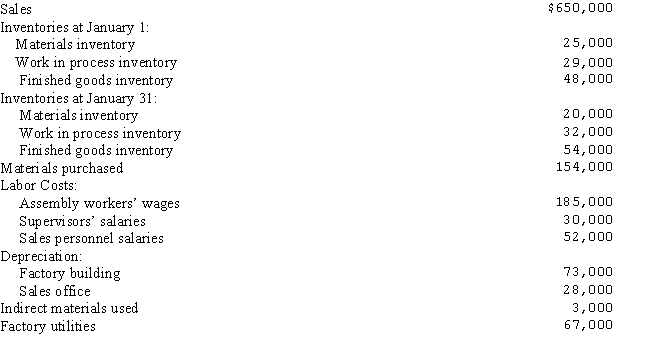

The following data was taken from the general ledger and other records of Marwick Manufacturing Co.at January31,the end of the first month of operations in the current fiscal year:

a.Prepare a statement of cost of goods manufactured.

b.Determine the cost of goods sold for the month.

a.Prepare a statement of cost of goods manufactured.

b.Determine the cost of goods sold for the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

73

According to the Institute of Management Accountants (IMA)Statement of Ethical Professional Practice,under the Integrity Standard,each member has the responsibility to:

A)Communicate information fairly and objectively.

B)Keep information confidential.

C)Mitigate actual conflicts of interest.

D)Maintain an appropriate level of professional competence.

A)Communicate information fairly and objectively.

B)Keep information confidential.

C)Mitigate actual conflicts of interest.

D)Maintain an appropriate level of professional competence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

74

The following data were taken from the general ledger and other data of Price Fabricators on July 31:  Compute the cost of goods sold for Price Fabricators,selecting the appropriate items from the list provided.

Compute the cost of goods sold for Price Fabricators,selecting the appropriate items from the list provided.

Compute the cost of goods sold for Price Fabricators,selecting the appropriate items from the list provided.

Compute the cost of goods sold for Price Fabricators,selecting the appropriate items from the list provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

75

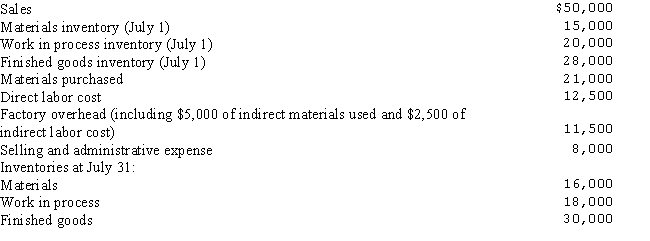

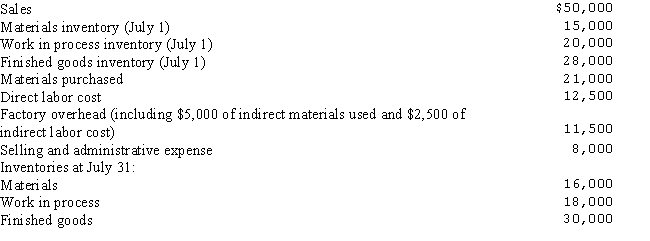

The following data was taken from the general ledger and other records of Martinez Manufacturing Co.at July 31,the end of the first month of operations in the current fiscal year:

a.Prepare a statement of cost of goods manufactured.

b.Determine the cost of goods sold for the month.

a.Prepare a statement of cost of goods manufactured.

b.Determine the cost of goods sold for the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Institute of Management Accountants (IMA)Statement of Professional Practice includes all of the following standards except:

A)Confidentiality.

B)Commitment.

C)Integrity.

D)Competence.

A)Confidentiality.

B)Commitment.

C)Integrity.

D)Competence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck

77

According to the Institute of Management Accountants (IMA)Statement of Ethical Professional Practice,performing professional duties in accordance with relevant laws,regulations and technical standards is a component of which standard?

A)Competence

B)Confidentiality

C)Integrity

D)Credibility

A)Competence

B)Confidentiality

C)Integrity

D)Credibility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 77 في هذه المجموعة.

فتح الحزمة

k this deck