Deck 23: Interest Rate Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 23: Interest Rate Risk Management

1

'The duration of a portfolio of bonds is the portfolio-weighted average of the durations of the respective bonds in the portfolio.' Which of the following is an assumption for the above statement to hold true?

A)The term structure of interest rates is flat.

B)There are no arbitraging opportunities.

C)The market is frictionless.

D)The firm can lend and borrow at the risk free rate of interest.

A)The term structure of interest rates is flat.

B)There are no arbitraging opportunities.

C)The market is frictionless.

D)The firm can lend and borrow at the risk free rate of interest.

A

2

The current yield to maturity is 7% compounded annually for bonds of all maturities.A bond portfolio consists of €25 million (market value)of fixed-income securities.What amount will the portfolio manager be able to lock in five years from now?

A)€35.93 million

B)€35.26 million

C)€35.07 million

D)€34.86 million

A)€35.93 million

B)€35.26 million

C)€35.07 million

D)€34.86 million

C

3

PV01 is a measure:

A)of how much a bond's price will decrease in response to a one-basis-point decline in a bond's duration.

B)that determines how secure an investor should feel about a perfectly hedged portfolio.

C)of the rate of change of price with respect to yield or the percentage change in price for a parallel shift in yields.

D)of how much a bond's price will increase in response to a one-basis-point decline in a bond's yield to maturity.

A)of how much a bond's price will decrease in response to a one-basis-point decline in a bond's duration.

B)that determines how secure an investor should feel about a perfectly hedged portfolio.

C)of the rate of change of price with respect to yield or the percentage change in price for a parallel shift in yields.

D)of how much a bond's price will increase in response to a one-basis-point decline in a bond's yield to maturity.

D

4

Which of the following is true of immunization using PV01?

A)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price equal to that of the portfolio,then the PV01 of a short position in the portfolio and a long position in the bond is less than zero.

B)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price equal to that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

C)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price greater than that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

D)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity greater than the horizon date and a price equal to that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

A)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price equal to that of the portfolio,then the PV01 of a short position in the portfolio and a long position in the bond is less than zero.

B)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price equal to that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

C)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity equal to the horizon date and a price greater than that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

D)If the duration of the portfolio matches the duration of a zero-coupon bond with a maturity greater than the horizon date and a price equal to that of the portfolio,then the PV01 of a long position in the portfolio and a short position in the bond is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

_____ is a technique for locking in the value of a portfolio at the end of a planning horizon.

A)Convexity

B)Immunization

C)Duration

D)Modified duration

A)Convexity

B)Immunization

C)Duration

D)Modified duration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is duration?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is the correct algebraic expression of modified duration? (PV01 is based on interest rate(r)that are compounded m times a year instead of continuously)

A)Modified duration=[DUR/(1+ r/m)] 0.0001 P

B)Modified duration=[DUR/(1- r/m)] 0.0001 P

C)Modified duration= DUR/(1+ r/m)

D)Modified duration= DUR/(1- r/m)

A)Modified duration=[DUR/(1+ r/m)] 0.0001 P

B)Modified duration=[DUR/(1- r/m)] 0.0001 P

C)Modified duration= DUR/(1+ r/m)

D)Modified duration= DUR/(1- r/m)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

_____ is defined as the sensitivity of the hedge portfolio's yield to maturity to movements in the yield to maturity of the portfolio one is trying to hedge.

A)Contingent immunization

B)Modified duration

C)Yield beta

D)Convexity

A)Contingent immunization

B)Modified duration

C)Yield beta

D)Convexity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

_____ sets a target value for the bond portfolio at the horizon date that is smaller than the face value of a zero-coupon bond with the same market value as the portfolio.

A)Modified duration

B)Convexity

C)MacAuley duration

D)Contingent immunization

A)Modified duration

B)Convexity

C)MacAuley duration

D)Contingent immunization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is true of PV01?

A)In a corporate setting,firms that have low PV01s are more exposed to interest rate risk.

B)High-PV01 bonds are more sensitive to interest rate movements than low-PV01 bonds.

C)Low-PV01 bonds are more volatile to interest rate movements than high-PV01 bonds.

D)If a corporation has a stock that has a positive PV01,then acquiring a bond with a positive PV01 will increase the interest rate exposure.

A)In a corporate setting,firms that have low PV01s are more exposed to interest rate risk.

B)High-PV01 bonds are more sensitive to interest rate movements than low-PV01 bonds.

C)Low-PV01 bonds are more volatile to interest rate movements than high-PV01 bonds.

D)If a corporation has a stock that has a positive PV01,then acquiring a bond with a positive PV01 will increase the interest rate exposure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

A bond position has a PV01 of €50.Its yield is currently 11%.Calculate the change in the value of the bond position if the yield drops to 10.5%.

A)€250

B)€2,000

C)€2,500

D)€200

A)€250

B)€2,000

C)€2,500

D)€200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is contingent immunization?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

The duration of a bond:

A)is a weighted average of the waiting times for receiving its promised future cash flows.

B)is a measure of how much a bond's price will increase in response to a one-basis-point decline in a bond's yield to maturity.

C)is defined as the maturity period of the bon

D)measures how much PV01 changes as the yield of a bond or bond portfolio changes.

A)is a weighted average of the waiting times for receiving its promised future cash flows.

B)is a measure of how much a bond's price will increase in response to a one-basis-point decline in a bond's yield to maturity.

C)is defined as the maturity period of the bon

D)measures how much PV01 changes as the yield of a bond or bond portfolio changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

Assuming market value and PV01 constant,which of the following is true of convexity?

A)Higher the convexity of a bond portfolio,the larger the value of the portfolio for both an increase and a decrease in its yield to maturity.

B)Other things being equal,investments with a little convexity or negative convexity are in some sense better than investments with a large amount of convexity.

C)Higher the convexity of a bond portfolio,the smaller the value of the portfolio for an increase in its yield to maturity.

D)Convexity depends on the scale of investment and the maturity of bonds.

A)Higher the convexity of a bond portfolio,the larger the value of the portfolio for both an increase and a decrease in its yield to maturity.

B)Other things being equal,investments with a little convexity or negative convexity are in some sense better than investments with a large amount of convexity.

C)Higher the convexity of a bond portfolio,the smaller the value of the portfolio for an increase in its yield to maturity.

D)Convexity depends on the scale of investment and the maturity of bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

Convexity is:

A)a measure that determines how secure an investor should feel about a 'perfectly hedged' portfolio.

B)a technique for locking in the value of a portfolio at the end of a planning horizon.

C)a measure of the rate of change of price with respect to yield or the percentage change in price for a parallel shift in yields.

D)the sensitivity of the hedge portfolio's yield to maturity to movements in the yield to maturity of the portfolio one is trying to hedge.

A)a measure that determines how secure an investor should feel about a 'perfectly hedged' portfolio.

B)a technique for locking in the value of a portfolio at the end of a planning horizon.

C)a measure of the rate of change of price with respect to yield or the percentage change in price for a parallel shift in yields.

D)the sensitivity of the hedge portfolio's yield to maturity to movements in the yield to maturity of the portfolio one is trying to hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

Explain effective duration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

Explain the practical issues to be considered in using immunization techniques.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is an assumption related to the MacAuley Duration?

A)Investors are indifferent to capital structure.

B)Investors prefer investing in bonds to equities.

C)No two bonds will have the same credit rating.

D)The yields for bonds of all maturities are identical.

A)Investors are indifferent to capital structure.

B)Investors prefer investing in bonds to equities.

C)No two bonds will have the same credit rating.

D)The yields for bonds of all maturities are identical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

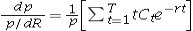

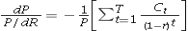

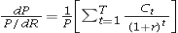

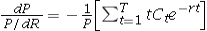

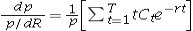

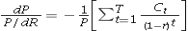

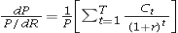

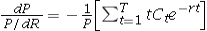

The percentage change in price (P)with respect to the continuously compounded yield of a bond maturing in T years,with cash flows of Ct at date t,t = 1,...,T is _____.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck