Deck 7: Mortgage Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 7: Mortgage Markets

1

A subprime mortgage is a mortgage made to a borrower who has a below normal credit rating.

True

2

GNMA role is to provide insurance to pass through mortgage securities.

True

3

Federally insured mortgages are called conventional mortgages.

False

4

In synthetic securitization,the transfer of risk on a pool of assets is achieved by the use of credit derivatives or guarantees to a third party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a borrower makes a 20 percent down payment on a conventional mortgage,she will be required to obtain

A)FHA insurance.

B)VA insurance.

C)private mortgage insurance.

D)GNMA payment guarantees

E)None of these choices are correct.

A)FHA insurance.

B)VA insurance.

C)private mortgage insurance.

D)GNMA payment guarantees

E)None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

Rank the following types of mortgages by amount outstanding from largest to smallest.

I. Home mortgages

II. Multifamily mortgages

III. Farm mortgages

IV. Commercial mortgages

A)I,II,III,IV

B)I,II,IV,III

C)II,I,IV,III

D)IV,II,III,I

E)I,IV,II,III

I. Home mortgages

II. Multifamily mortgages

III. Farm mortgages

IV. Commercial mortgages

A)I,II,III,IV

B)I,II,IV,III

C)II,I,IV,III

D)IV,II,III,I

E)I,IV,II,III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

The largest category of mortgages by dollar volume is commercial mortgages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

A borrower using a conventional mortgage will have to put up at least a 20 percent down payment or purchase private mortgage insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

The process of packaging and/or selling mortgages that are then used to back publicly traded debt securities is called

A)collateralization.

B)securitization.

C)market capitalization.

D)stock diversification.

E)mortgage globalization.

A)collateralization.

B)securitization.

C)market capitalization.

D)stock diversification.

E)mortgage globalization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

A ________ placed against mortgaged property ensures that the property cannot be sold (except by the lender)until the mortgage is paid off.

A)collateral

B)lien

C)writ of habeas corpus

D)down payment

E)writ of certiorari

A)collateral

B)lien

C)writ of habeas corpus

D)down payment

E)writ of certiorari

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

For CMOs,prepayment risk is the risk that a borrower may prepay the mortgage before maturity when interest rates decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

A large portion of the mortgage payment goes towards the principal,during the early life of a mortgage loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

Risk attributes of collateralized mortgage obligations differ based on tranches.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

On a fixed-rate mortgage the dollars of interest the homeowner pays falls each year the mortgage is outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

Subprime mortgage borrowers usually have poorer credit ratings or lower income levels compared to conventional mortgage borrowers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

The process of mortgage securitization results in a separation between mortgage origination and mortgage financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

Pass through mortgage securities are for primary market investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

Discount points are paid to reduce the down payment required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

Private mortgage insurance (and hence,that part of the homeowner's monthly payment)is automatically removed from a mortgage when the loan-to-value ratio on the mortgage falls below 80 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

Mortgage payments are ________ on a 15-year fixed-rate mortgage than on a 30-year fixed-rate mortgage,and ________ is paid on a 15-year mortgage than on a 30-year mortgage; ceteris paribus.

A)lower; less interest

B)lower; less principal

C)higher; less interest

D)higher; more principal

E)higher; more interest

A)lower; less interest

B)lower; less principal

C)higher; less interest

D)higher; more principal

E)higher; more interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

The FHA charges the homeowner ________ to insure an FHA mortgage.

A)nothing

B)0.5 percent of the loan amount

C)$500

D)1 percent of the loan amount

E)$1,500

A)nothing

B)0.5 percent of the loan amount

C)$500

D)1 percent of the loan amount

E)$1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

A borrower took out a 30-year fixed-rate mortgage of $2,250,000 at a 7.2 percent annual rate. After five years,he wishes to pay off the remaining balance. Interest rates have by then fallen to 7 percent. How much must he pay to retire the mortgage (to the nearest dollar)?

A)$2,122,426

B)$2,225,330

C)$2,015,678

D)$2,212,041

E)$1,999,998

A)$2,122,426

B)$2,225,330

C)$2,015,678

D)$2,212,041

E)$1,999,998

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

You want to buy a $250,000 house and you will use a conventional mortgage. What is the minimum down payment you have to make to avoid having to purchase mortgage insurance?

A)$10,000

B)$20,000

C)$30,000

D)$40,000

E)$50,000

A)$10,000

B)$20,000

C)$30,000

D)$40,000

E)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

A(n)________ is used to help retired people receive monthly income in exchange for the equity in their home.

A)SAM

B)Equity Participation Mortgage

C)RAM

D)PLAM

E)GEM

A)SAM

B)Equity Participation Mortgage

C)RAM

D)PLAM

E)GEM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

An MBB differs from a CMO or a pass-through in that

I. the MBB does not result in the removal of mortgages from the balance sheet.

II. a MBB holder has no prepayment risk.

III. cash flows on a MBB are not directly passed through from mortgages.

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)I only

I. the MBB does not result in the removal of mortgages from the balance sheet.

II. a MBB holder has no prepayment risk.

III. cash flows on a MBB are not directly passed through from mortgages.

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)I only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements about mortgage markets is/are true?

I. Mortgage companies service more mortgages than they originate.

II. Servicing fees typically range from 2 percent to 4 percent.

III. Most mortgage sales are with recourse.

IV. The government is involved in the residential mortgage markets.

A)I,III,and IV only

B)II,III,and IV only

C)I,II,and IV only

D)II and III only

E)I and IV only

I. Mortgage companies service more mortgages than they originate.

II. Servicing fees typically range from 2 percent to 4 percent.

III. Most mortgage sales are with recourse.

IV. The government is involved in the residential mortgage markets.

A)I,III,and IV only

B)II,III,and IV only

C)I,II,and IV only

D)II and III only

E)I and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

Mortgage fees paid by the homeowner at,or prior to,closing upon the purchase of a house typically include all but which one of the following?

A)Application fee

B)Title search fee

C)Title insurance fee

D)Appraisal fee

E)Prepayment penalty

A)Application fee

B)Title search fee

C)Title insurance fee

D)Appraisal fee

E)Prepayment penalty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

A $25,000 face value GNMA pass-through quote sheet lists a spread to average life of 103,PSA of 220,and a price of 101-09. This means that

I. the pass-through yield is 103 basis points above the comparable maturity Treasury bond.

II. the pass-through is being prepaid more quickly than standard PSA.

III. the pass-through is priced at $25,272.50.

A)I,II,and III are correct.

B)I and II only

C)I and III only

D)II and III only

E)III only

I. the pass-through yield is 103 basis points above the comparable maturity Treasury bond.

II. the pass-through is being prepaid more quickly than standard PSA.

III. the pass-through is priced at $25,272.50.

A)I,II,and III are correct.

B)I and II only

C)I and III only

D)II and III only

E)III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

A homeowner can obtain a $250,000,30-year fixed-rate mortgage at a rate of 6.0 percent with zero points or at a rate of 5.5 percent with 2.25 points.

How long must the owner stay in the house to make it worthwhile to pay the points if the payment saving is invested monthly?

A)7.15 years

B)3.33 years

C)6.04 years

D)5.90 years

E)More than 30 years

How long must the owner stay in the house to make it worthwhile to pay the points if the payment saving is invested monthly?

A)7.15 years

B)3.33 years

C)6.04 years

D)5.90 years

E)More than 30 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

With a fixed-rate mortgage,the ________ bears the interest rate risk and with an ARM the ________ bears the interest rate risk.

A)borrower; lender

B)borrower; borrower

C)lender; lender

D)lender; borrower

E)federal government; pool organizer

A)borrower; lender

B)borrower; borrower

C)lender; lender

D)lender; borrower

E)federal government; pool organizer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

You obtain a $265,000,15-year fixed-rate mortgage. The annual interest rate is 6.25 percent. In addition to the principal and interest paid,you must pay $275 a month into an escrow account for insurance and taxes. What is the total monthly payment (to the nearest dollar)?

A)$2,272

B)$1,632

C)$2,547

D)$1,907

E)$2,311

A)$2,272

B)$1,632

C)$2,547

D)$1,907

E)$2,311

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

A homeowner could take out a 15-year mortgage at a 5.5 percent annual rate on a $195,000 mortgage amount,or she could finance the purchase with a 30-year mortgage at a 6.1 percent annual rate. How much total interest over the entire mortgage period could she save by financing her home with the 15-year mortgage (to the nearest dollar)?

A)$230,408

B)$190,105

C)$155,612

D)$144,325

E)$138,612

A)$230,408

B)$190,105

C)$155,612

D)$144,325

E)$138,612

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

You purchase a $255,000 house and you pay 20 percent down. You obtain a fixed-rate mortgage where the annual interest rate is 5.85 percent and there are 360 monthly payments. What is the monthly payment?

A)$1,215.27

B)$1,203.48

C)$1,194.45

D)$1,367.22

E)$1,504.35

A)$1,215.27

B)$1,203.48

C)$1,194.45

D)$1,367.22

E)$1,504.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

The least used form of mortgage securitization is the ________.

A)second mortgage

B)mortgage-backed bond

C)mortgage pass-through

D)CMO

E)home equity loan

A)second mortgage

B)mortgage-backed bond

C)mortgage pass-through

D)CMO

E)home equity loan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

A homeowner can obtain a $250,000,30-year fixed-rate mortgage at a rate of 6.0 percent with zero points or at a rate of 5.5 percent with 2.25 points.

How long must the owner stay in the house to make it worthwhile to pay the points if the payment saving is not invested?

A)7.15 years

B)3.33 years

C)6.04 years

D)5.90 years

E)More than 30 years

How long must the owner stay in the house to make it worthwhile to pay the points if the payment saving is not invested?

A)7.15 years

B)3.33 years

C)6.04 years

D)5.90 years

E)More than 30 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements about GNMA is/are true?

I. GNMA provides timing insurance.

II. GNMA creates pools of mortgages and issues securities.

III. GNMA insures only FHA,VA,HUD's Office of Indian and Public Housing,and USDA Rural Development loans.

IV. GNMA requires that all mortgages in the pool have the same interest rate.

A)I,II,III,and IV are true.

B)I,III,and IV only

C)I,II,and III only

D)II,III,and IV only

E)III and IV only

I. GNMA provides timing insurance.

II. GNMA creates pools of mortgages and issues securities.

III. GNMA insures only FHA,VA,HUD's Office of Indian and Public Housing,and USDA Rural Development loans.

IV. GNMA requires that all mortgages in the pool have the same interest rate.

A)I,II,III,and IV are true.

B)I,III,and IV only

C)I,II,and III only

D)II,III,and IV only

E)III and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

A homeowner can obtain a $250,000,30-year fixed-rate mortgage at a rate of 6.0 percent with zero points or at a rate of 5.5 percent with 2.25 points.

If you will keep the mortgage for 30 years,what is the net present value of paying the points (to the nearest dollar)?

A)$9,475

B)$8,360

C)$7,564

D)$7,222

E)$6,578

If you will keep the mortgage for 30 years,what is the net present value of paying the points (to the nearest dollar)?

A)$9,475

B)$8,360

C)$7,564

D)$7,222

E)$6,578

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

You purchase a $325,000 town home and you pay 25 percent down. You obtain a 30-year fixed-rate mortgage with an annual interest rate of 5.75 percent. After five years you refinance the mortgage for 25 years at a 5.1 percent annual interest rate. After you refinance,what is the new monthly payment (to the nearest dollar)?

A)$1,422

B)$1,401

C)$1,366

D)$1,335

E)$1,296

A)$1,422

B)$1,401

C)$1,366

D)$1,335

E)$1,296

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

A home buyer bought a house for $245,000. The buyer paid 20 percent down but decided to finance closing costs of 3 percent of the mortgage amount. If the borrower took out a 30-year fixed-rate mortgage at a 5 percent annual interest rate,how much interest will the borrower pay over the life of the mortgage?

A)$224,655

B)$180,622

C)$228,477

D)$188,265

E)$248,575

A)$224,655

B)$180,622

C)$228,477

D)$188,265

E)$248,575

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

The schedule showing how monthly mortgage payments are split into principal and interest is called a(n)

A)securitization schedule.

B)balloon payment schedule.

C)graduated payment schedule.

D)amortization schedule.

E)growing equity schedule.

A)securitization schedule.

B)balloon payment schedule.

C)graduated payment schedule.

D)amortization schedule.

E)growing equity schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

Why were CMOs created?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

A homeowner is looking to buy a home in Marvin Gardens. The most he can afford to pay in total is $1,800 per month. Yearly property taxes will be about $3,000 (escrowed monthly)and insurance is $110 per month. There are no other costs.

If mortgage rates are 6.25 percent for a 30-year fixed-rate mortgage,how large can his mortgage be?

If mortgage rates are 6.25 percent for a 30-year fixed-rate mortgage,how large can his mortgage be?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

As compared to fixed-rate mortgages,ARMs result in which of the following for the lender?

I. Higher interest rate risk

II. Lower default risk

III. Greater prepayment penalty fees

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)None of these choices are correct.

I. Higher interest rate risk

II. Lower default risk

III. Greater prepayment penalty fees

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

A homeowner is looking to buy a home in Marvin Gardens. The most he can afford to pay in total is $1,800 per month. Yearly property taxes will be about $3,000 (escrowed monthly)and insurance is $110 per month. There are no other costs.

If his parents give him $20,000 for a down payment,what is the most he can pay for a house with a 15-year mortgage if the interest rate is 5.50 percent?

If his parents give him $20,000 for a down payment,what is the most he can pay for a house with a 15-year mortgage if the interest rate is 5.50 percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

A Collateralized mortgage obligation (CMO)has:

A)no interest rate risk.

B)no default risk.

C)no prepayment risk.

D)high degree of interest rate risk.

E)no default,no prepayment and no interest rate risks.

A)no interest rate risk.

B)no default risk.

C)no prepayment risk.

D)high degree of interest rate risk.

E)no default,no prepayment and no interest rate risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which one of the following entities is an actual government-owned enterprise dealing with mortgages?

A)GNMA

B)FNMA

C)FHLMC

D)PIP

E)CMO

A)GNMA

B)FNMA

C)FHLMC

D)PIP

E)CMO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

Why have FNMA and Freddie Mac,considered government-sponsored enterprises (GSEs),been in the news lately? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which one of the following types of mortgages is likely to become more popular as the average age of the U.S. population increases?

A)GEM

B)GPM

C)SAM

D)PLA

E)RAM

A)GEM

B)GPM

C)SAM

D)PLA

E)RAM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

You bought your house five years ago and you believe you will be in the house only about five more years before it gets too small for your family. Your original home value when you bought it was $250,000,you paid 20 percent down,and you financed closing costs equal to 3 percent of the mortgage amount. The mortgage was a 30-year fixed-rate mortgage with a 6.5 percent annual interest rate. Rates on 30-year mortgages are now at 5 percent if you pay 2 points. Your refinancing costs will be 1.5 percent of the new mortgage amount (excluding points). You won't finance the points and closing costs this time. A new down payment is not required. Should you refinance? Ignore all taxes and show your work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

What three major ways has the federal government assisted the mortgage markets? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

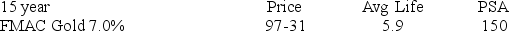

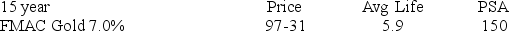

Explain each term of the following pass-through quote:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the current interest environment is low,lenders tend to prefer ________ ; while borrowers tend to prefer ________.

A)ARM; fixed-rate mortgage

B)ARM; ARM

C)fixed-rate mortgage; fixed-rate mortgage

D)fixed-rate mortgage; ARM

E)None of these choices are correct.

A)ARM; fixed-rate mortgage

B)ARM; ARM

C)fixed-rate mortgage; fixed-rate mortgage

D)fixed-rate mortgage; ARM

E)None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

A fixed-rate mortgage originator is adversely affected by ________ interest rates while the borrower is adversely affected by ________ interest rates.

A)increasing; decreasing

B)increasing; increasing

C)decreasing; decreasing

D)decreasing; increasing

E)stable; decreasing

A)increasing; decreasing

B)increasing; increasing

C)decreasing; decreasing

D)decreasing; increasing

E)stable; decreasing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

An adjustable rate mortgage originator is adversely affected by ________ interest rates while the borrower is adversely affected by ________ interest rates.

A)increasing; decreasing

B)increasing; increasing

C)decreasing; decreasing

D)decreasing; increasing

E)stable; decreasing

A)increasing; decreasing

B)increasing; increasing

C)decreasing; decreasing

D)decreasing; increasing

E)stable; decreasing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

The borrower of an amortized mortgage makes most of the payment during the early life of the mortgage:

A)towards the principal.

B)towards the interest.

C)equally towards the principal and interest.

D)mostly towards the principal rather than interest.

E)None of these choices are correct.

A)towards the principal.

B)towards the interest.

C)equally towards the principal and interest.

D)mostly towards the principal rather than interest.

E)None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Who are the major buyers of mortgages after they have been originated? What is the difference between selling with recourse or without recourse? Which is most common?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

One fixed-rate mortgage pool has a 750 PSA and a second fixed-rate pool has 150 PSA. The pool with the higher PSA ________ than the pool with the lower PSA.

I. probably has a higher coupon

II. probably has lower default risk

III. will mature more quickly

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)I only

I. probably has a higher coupon

II. probably has lower default risk

III. will mature more quickly

A)I,II,and III

B)I and II only

C)II and III only

D)I and III only

E)I only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

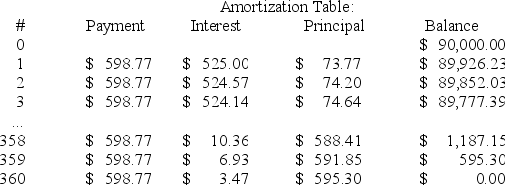

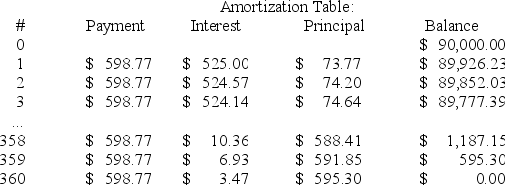

Construct an amortization schedule for the first three months and the final three months of payments for a 30-year,7 percent mortgage in the amount of $90,000. What percentage of the third payment is principal? What percentage of the final payment is principal? What do these differences imply? (Hint: The balance after the 357th payment is $1,775.56.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

How does GNMA improve mortgage marketability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why do mortgage lenders prefer ARMs while many borrowers prefer fixed-rate mortgages,ceteris paribus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck