Deck 4: Completing the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/170

العب

ملء الشاشة (f)

Deck 4: Completing the Accounting Cycle

1

Nominal account balances are reduced to zero by closing entries.

True

2

Accounts Receivable is closed to Income Summary as part of the closing process.

False

3

An expense account is closed with a credit to the expense account and a debit to Income Summary.

True

4

Depreciation Expense-Buildings is a nominal account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

5

During the closing process,expenses are transferred to the debit side of the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

6

The only accounts that are closed are income statement accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

7

An adjusted trial balance provides all the data needed to record the closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the accounting cycle,closing entries are prepared before adjusting entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

9

Permanent accounts are also known as nominal accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

10

Closing entries deal primarily with the balances of real accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Income Summary account appears in the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

12

A revenue account is closed with a debit to the revenue account and a credit to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

13

Closing entries result in the transfer of net income or net loss into the owner's Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cash is a nominal account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

15

Supplies Expense is a temporary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Withdrawals account bypasses the Income Summary account when it is being closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

17

During the closing process,revenues are transferred to the debit side of the Income Summary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

18

Income Summary is closed with a debit to Income Summary and a credit to the Withdrawals account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

19

After all closing entries have been entered and posted,the balance of the Income Summary account will be zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

20

A temporary account is also known as a nominal account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

21

Despite the many uses of laptop computers,they cannot be used to prepare work sheets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

22

Reversing entries are made to correct errors in the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Adjusted Trial Balance columns of the work sheet are prepared by combining the Trial Balance and Adjustments columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

24

Working papers provide a written record of the work performed by the accountant or auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

25

There is sufficient information on a post-closing trial balance to prepare an income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

26

The adjusting entries involving Rent Receivable and Salaries Payable could be reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

27

Owner's Capital is closed by transferring the balance to Income Summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

28

The adjusting entries involving Depreciation Expense-Buildings and Supplies Expense could be reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

29

Reversing entries can be made for accruals,but not for deferrals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

30

The amount for the Withdrawals account will appear in the Income Statement columns of a work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

31

Reversing entries are never required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

32

When a company has net income,the Income Summary account appears as a credit on the post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

33

The post-closing trial balance will contain only nominal accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

34

A reversing entry will include either a debit to a revenue account or a credit to an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

35

The work sheet is a type of accountant's working paper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

36

The post-closing trial balance will typically have more accounts than the adjusted trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

37

The work sheet is published in the annual report along with the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

38

There is sufficient information on a post-closing trial balance to prepare a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

39

The balances of all the real (permanent)accounts are the same on the adjusted trial balance as they are on a post-closing trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

40

The purpose of reversing entries is to simplify the bookkeeping process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

41

An important use of the work sheet is as a replacement for the annual financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Income Statement columns of the work sheet show all the accounts that need to be closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

43

The amount of the Withdrawals account can be found on the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

44

Preparing the worksheet and closing entries provide a mechanism for applying the concept of periodicity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

45

The adjusting entries entered onto a work sheet must still be recorded in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

46

The amount placed opposite the owner's Capital account in the Balance Sheet columns of the work sheet is the amount to be reflected for owner's Capital on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

47

When the Balance Sheet columns of the work sheet are initially footed,they should be in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Income Statement columns of the work sheet show all the accounts that need to be closed,except for the Withdrawals account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

49

The information needed to record the adjusting entries can be copied from the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

50

Reversing entries are all dated as of the first day of the new accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

51

Preparing the work sheet and recording closing entries are important steps that save money and prevent mistakes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

52

Reversing entries,like any other entries,are posted to the ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

53

The work sheet should be prepared after the formal financial statements have been prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

54

Since the balance of the Accumulated Depreciation account will appear on the asset side of the balance sheet,it is placed on the debit side of the work sheet's Balance Sheet columns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

55

The heading of a work sheet might contain the line "As of February 28,20x5."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

56

Closing entries can be prepared by referring solely to the Income Statement columns of the work sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

57

When the Income Statement columns of the work sheet are initially footed,they should be in balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

58

The work sheet is prepared after the formal adjusting and closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

59

The amount placed opposite the Land account in the Balance Sheet columns of the work sheet is the amount to be reflected for Land on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

60

On a work sheet,the balance of the owner's Capital account is its ending amount for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following accounts is not closed during the closing process?

A)Owner's Capital

B)Commissions Earned

C)Income Summary.

D)Withdrawals

A)Owner's Capital

B)Commissions Earned

C)Income Summary.

D)Withdrawals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

62

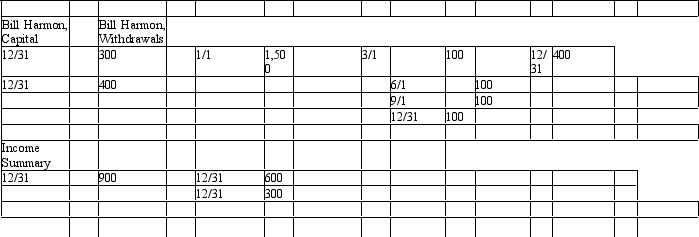

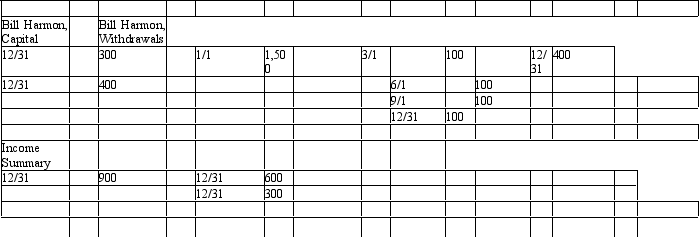

The owner's Capital,Withdrawals,and Income Summary accounts for Harmon Repair Company for the accounting period are presented below in T account form after the recording and posting of closing entries:  The total amount of revenue earned for the period is

The total amount of revenue earned for the period is

A)$300.

B)$600.

C)$700.

D)$900.

The total amount of revenue earned for the period is

The total amount of revenue earned for the period isA)$300.

B)$600.

C)$700.

D)$900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is a nominal account?

A)Interest Payable

B)Property Taxes Expense

C)Owner's Capital

D)Cash

A)Interest Payable

B)Property Taxes Expense

C)Owner's Capital

D)Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

64

Failure to prepare closing entries will produce a misstated

A)total liabilities figure on the balance sheet.

B)total assets figure on the balance sheet.

C)owner's Capital account balance.

D)Income Summary account balance.

A)total liabilities figure on the balance sheet.

B)total assets figure on the balance sheet.

C)owner's Capital account balance.

D)Income Summary account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

65

Preparation of closing entries

A)is an optional step in the accounting cycle.

B)is the first step after posting to the general ledger.

C)assist in achieving periodicity and accrual accounting.

D)All of these choices.

A)is an optional step in the accounting cycle.

B)is the first step after posting to the general ledger.

C)assist in achieving periodicity and accrual accounting.

D)All of these choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

66

Closing entries are made

A)to clear revenue and expense accounts of their balances.

B)to clear withdrawals of its balance.

C)to summarize a period's revenues and expenses.

D)All of these choices.

A)to clear revenue and expense accounts of their balances.

B)to clear withdrawals of its balance.

C)to summarize a period's revenues and expenses.

D)All of these choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Income Summary account

A)appears on the balance sheet.

B)appears on the income statement.

C)is closed to the cash account to properly state cash at the end of the period.

D)does not appear in the financial statements.

A)appears on the balance sheet.

B)appears on the income statement.

C)is closed to the cash account to properly state cash at the end of the period.

D)does not appear in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

68

After all closing entries have been posted,which of the following accounts is most likely to have a nonzero balance?

A)Interest Expense

B)Unearned Revenue

C)Service Revenue

D)Income Summary

A)Interest Expense

B)Unearned Revenue

C)Service Revenue

D)Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

69

Under which circumstance would one less closing entry than usual be made?

A)When a net loss has been suffered

B)When withdrawals by the owner are equal to net income for the period

C)When net income is zero

D)When the owner's Capital account is zero prior to posting of closing entries

A)When a net loss has been suffered

B)When withdrawals by the owner are equal to net income for the period

C)When net income is zero

D)When the owner's Capital account is zero prior to posting of closing entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following accounts is not found in closing entries?

A)Accumulated Depreciation-Equipment

B)Owner's Capital

C)Income Summary

D)Withdrawals

A)Accumulated Depreciation-Equipment

B)Owner's Capital

C)Income Summary

D)Withdrawals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Income Summary account is credited in the entry that closes

A)the Withdrawals account.

B)expense accounts.

C)net income.

D)revenue accounts.

A)the Withdrawals account.

B)expense accounts.

C)net income.

D)revenue accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

72

Closing entries ultimately will affect

A)total liabilities.

B)the Cash account.

C)the owner's Capital account.

D)total assets.

A)total liabilities.

B)the Cash account.

C)the owner's Capital account.

D)total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is not a permanent account?

A)Supplies

B)Accounts Receivable

C)Withdrawals

D)Unearned Revenue

A)Supplies

B)Accounts Receivable

C)Withdrawals

D)Unearned Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

74

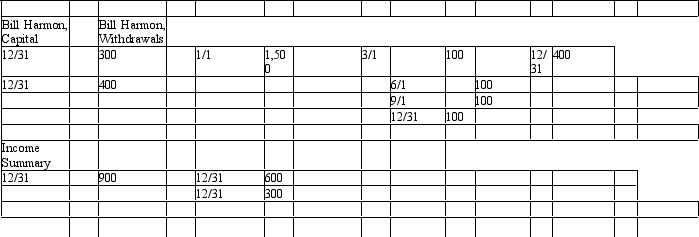

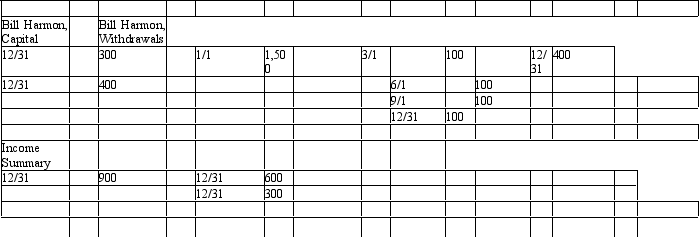

The owner's Capital,Withdrawals,and Income Summary accounts for Harmon Repair Company for the accounting period are presented below in T account form after the recording and posting of closing entries:  The amount of net income (or net loss)for the period is

The amount of net income (or net loss)for the period is

A)$300 net income.

B)$900 net income.

C)$600 net income.

D)$300 net loss.

The amount of net income (or net loss)for the period is

The amount of net income (or net loss)for the period isA)$300 net income.

B)$900 net income.

C)$600 net income.

D)$300 net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following accounts is a real account?

A)Building

B)Depreciation Expense-Buildings

C)Interest Expense

D)Service Revenue

A)Building

B)Depreciation Expense-Buildings

C)Interest Expense

D)Service Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Balance Sheet columns of the work sheet show one account that needs to be closed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following could not possibly be a closing entry?

A)Debit Income Summary and credit owner's Capital

B)Debit Income Summary and credit Withdrawals

C)Debit owner's Capital and credit Withdrawals

D)Debit owner's Capital and credit Income Summary

A)Debit Income Summary and credit owner's Capital

B)Debit Income Summary and credit Withdrawals

C)Debit owner's Capital and credit Withdrawals

D)Debit owner's Capital and credit Income Summary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

78

An important purpose of closing entries is to

A)set nominal account balances to zero to begin the next period.

B)adjust the accounts in the ledger.

C)help in preparing financial statements.

D)set real account balances to zero to begin the next period.

A)set nominal account balances to zero to begin the next period.

B)adjust the accounts in the ledger.

C)help in preparing financial statements.

D)set real account balances to zero to begin the next period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is not a temporary account?

A)Depreciation Expense-Vehicles

B)Service Revenue

C)Unearned Revenue

D)Interest Income

A)Depreciation Expense-Vehicles

B)Service Revenue

C)Unearned Revenue

D)Interest Income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

80

An important purpose of closing entries is to

A)help achieve the goals of the matching principle.

B)set permanent account balances to zero to begin the next period.

C)update the nominal accounts at year end.

D)transfer net income or net loss to the owner's Capital account.

A)help achieve the goals of the matching principle.

B)set permanent account balances to zero to begin the next period.

C)update the nominal accounts at year end.

D)transfer net income or net loss to the owner's Capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck