Deck 22: Liabilities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 22: Liabilities

1

Under the Conceptual Framework 'probable' in the recognition criteria means:

A) a higher than 60% probability.

B) a higher than 75% probability.

C) a higher than 50% probability.

D) 100% probability.

A) a higher than 60% probability.

B) a higher than 75% probability.

C) a higher than 50% probability.

D) 100% probability.

C

2

The key characteristic of contingent liabilities is:

A) a legal dispute must exist at balance date.

B) the liability does not exist beyond a reasonable doubt.

C) the liability will be confirmed only by the occurrence or non-occurrence of a future event not completely within the control of an entity.

D) the timing of the future sacrifice of economic benefits is uncertain.

A) a legal dispute must exist at balance date.

B) the liability does not exist beyond a reasonable doubt.

C) the liability will be confirmed only by the occurrence or non-occurrence of a future event not completely within the control of an entity.

D) the timing of the future sacrifice of economic benefits is uncertain.

C

3

The key difference between provisions and liabilities is:

A) the party that the obligation is owed to.

B) whether the obligation is current or non-current.

C) the uncertainty regarding the amount or timing of the future sacrifice of economic resources.

D) whether there is an obligation.

A) the party that the obligation is owed to.

B) whether the obligation is current or non-current.

C) the uncertainty regarding the amount or timing of the future sacrifice of economic resources.

D) whether there is an obligation.

C

4

Which of these are contingent liabilities?

I) A loan from a financial institution

II) An unresolved lawsuit brought against a newspaper for defamation

III) An agreement to act as guarantor for borrowings

A) II, III

B) I, II, III

C) I, III

D) I, II

I) A loan from a financial institution

II) An unresolved lawsuit brought against a newspaper for defamation

III) An agreement to act as guarantor for borrowings

A) II, III

B) I, II, III

C) I, III

D) I, II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

The requirement of IAS 37/AASB 137 that a provision must satisfy the definition of a liability means which of these is not regarded as a liability?

A) Provision for onerous contracts

B) Provision for doubtful debts

C) Provision for warrantee expenses

D) Provision for long-service leave

A) Provision for onerous contracts

B) Provision for doubtful debts

C) Provision for warrantee expenses

D) Provision for long-service leave

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

What are the essential characteristics of a liability under the definition in the Conceptual Framework?

I) Settlement requiring an outflow of resources embodying economic benefits.

Ii) A present obligation to an external party.

Iii) A legal debt.

Iv) The obligation must have resulted from past events.

A) i, , iv

B) i, ii, ,iv

C) i, ii, iii

D) ii, iii, iv

I) Settlement requiring an outflow of resources embodying economic benefits.

Ii) A present obligation to an external party.

Iii) A legal debt.

Iv) The obligation must have resulted from past events.

A) i, , iv

B) i, ii, ,iv

C) i, ii, iii

D) ii, iii, iv

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of these is not normally regarded as a current liability?

A) Accounts payable

B) GST collected

C) Mortgage

D) Bank overdraft

A) Accounts payable

B) GST collected

C) Mortgage

D) Bank overdraft

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

A bank loan for $100 000, taken out on 1 July 2015, is repayable in equal instalments, plus interest, over 5 years. The annual repayments are due on the second last day of the financial year. How would the loan be classified in a balance sheet prepared at 30 June 2016, the end of the entities financial year?

A) Non-current liability $80 000

B) Current liability $20 000; non-current liability $80 000

C) Current liability $40 000; non-current liability $40 000

D) Current liability $20 000; non-current liability $60 000

A) Non-current liability $80 000

B) Current liability $20 000; non-current liability $80 000

C) Current liability $40 000; non-current liability $40 000

D) Current liability $20 000; non-current liability $60 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

A current liability is:

A) a liability expected to be paid beyond one year of the reporting date.

B) a liability expected to be paid within one year of the reporting date.

C) a liability expected to be paid within six months of the reporting date.

D) a liability arising from past events that will be confirmed by the occurrence of future events.

A) a liability expected to be paid beyond one year of the reporting date.

B) a liability expected to be paid within one year of the reporting date.

C) a liability expected to be paid within six months of the reporting date.

D) a liability arising from past events that will be confirmed by the occurrence of future events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of these is not an essential characteristic of a liability under the Conceptual

Framework?

A) A legal debt.

B) A present obligation to an external party.

C) An outflow of resources embodying economic benefits.

D) A past transaction or event.

Framework?

A) A legal debt.

B) A present obligation to an external party.

C) An outflow of resources embodying economic benefits.

D) A past transaction or event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Contingent liabilities are disclosed in financial reports:

A) in footnotes to the reports.

B) in the liability section of the balance sheet.

C) as deductions from the asset accounts they relate to.

D) in the financial expense section of the income statement.

A) in footnotes to the reports.

B) in the liability section of the balance sheet.

C) as deductions from the asset accounts they relate to.

D) in the financial expense section of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of these would not be defined as a liability under the Conceptual Framework?

A) A loan from a financial institution.

B) Money owing to a supplier for goods purchased.

C) Wages owing to employees.

D) An arrangement to pay a bonus commission to salespersons for achieving sales over a certain level.

A) A loan from a financial institution.

B) Money owing to a supplier for goods purchased.

C) Wages owing to employees.

D) An arrangement to pay a bonus commission to salespersons for achieving sales over a certain level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of these would be defined as contingent liabilities?

I) A loan from a financial institution

II) An unresolved lawsuit brought against the entity for breach of health and safety regulations

III) An agreement to act as guarantor for another firm's borrowings

IV) A bank overdraft

A) I, II, IV

B) II, III

C) I, II

D) I, III

I) A loan from a financial institution

II) An unresolved lawsuit brought against the entity for breach of health and safety regulations

III) An agreement to act as guarantor for another firm's borrowings

IV) A bank overdraft

A) I, II, IV

B) II, III

C) I, II

D) I, III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of these criteria specified in the Conceptual Framework must be met before a liability can be recognised in the accounting records?

I) It is probable that the future sacrifices associated with the item will occur.

Ii) The liability is beyond a reasonable doubt.

Iii) The liability has a cost or value that can be measured with reliability.

A) i, ii, iii

B) i, iii

C) ii, iii

D) i, ii

I) It is probable that the future sacrifices associated with the item will occur.

Ii) The liability is beyond a reasonable doubt.

Iii) The liability has a cost or value that can be measured with reliability.

A) i, ii, iii

B) i, iii

C) ii, iii

D) i, ii

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

How many of these are a possible basis for classifying liabilities?

Timing of settlement

Whether secured or unsecured

Source

Liquidity

A) 1

B) 2

C) 3

D) 4

Timing of settlement

Whether secured or unsecured

Source

Liquidity

A) 1

B) 2

C) 3

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

The classification of liabilities on the basis of timing of settlement, i.e. current and non-current, is useful as it helps decision-makers assess the firm's ability to meet all of the following except:

A) dividends.

B) profitability.

C) commitments which are part of the operating cycle.

D) capital repayments.

A) dividends.

B) profitability.

C) commitments which are part of the operating cycle.

D) capital repayments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of these is not typically a non-current liability?

A) Unsecured notes

B) Mortgage payable

C) Provision for long service leave

D) Accounts payable

A) Unsecured notes

B) Mortgage payable

C) Provision for long service leave

D) Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of these does not fit the IAS 37/AASB 137 definition of a provision as a liability of uncertain timing or amount?

A) Provision for warranties

B) Provision for environmental damage

C) Provision for long-service leave

D) Provision for depreciation

A) Provision for warranties

B) Provision for environmental damage

C) Provision for long-service leave

D) Provision for depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

What are the two criteria, specified in the Conceptual Framework, that must be met before a liability can be recognised in the accounting records?

A) It must be probable that any future sacrifices associated with the item will flow from the entity and the liability must have a cost or value that can be measured with reliability.

B) It must be probable that a future sacrifice of economic resources will be required and the liability must be beyond a reasonable doubt.

C) The liability must be beyond a reasonable doubt and the amount of the liability must be able to be recognised reliably.

D) There must have been a past event and there must be a present obligation

A) It must be probable that any future sacrifices associated with the item will flow from the entity and the liability must have a cost or value that can be measured with reliability.

B) It must be probable that a future sacrifice of economic resources will be required and the liability must be beyond a reasonable doubt.

C) The liability must be beyond a reasonable doubt and the amount of the liability must be able to be recognised reliably.

D) There must have been a past event and there must be a present obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

A contingent liability is reported:

A) in a footnote to the financial reports.

B) on the balance sheet.

C) in the income statement.

D) as a negative figure on the statement of changes in equity.

A) in a footnote to the financial reports.

B) on the balance sheet.

C) in the income statement.

D) as a negative figure on the statement of changes in equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

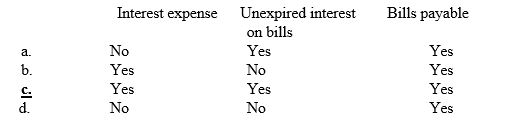

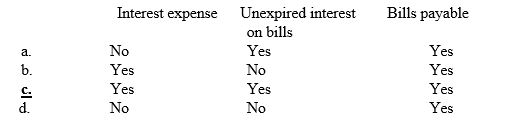

On 1 December 2015 Morgan Smith Ltd issued a three-month, $50 000 bills payable to Northport Savings & Loan in order to borrow $48 500. If the bills payable is still outstanding at 31 December 2015, which of the following will be reported on Morgan Smith's financial statements concerning the bill?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which statement relating to workers' compensation insurance is not true?

A) It is compulsory for all employers to take out workers' compensation insurance.

B) The percentage rate of premium is the same rate for all employers.

C) The premium is based on a percentage of the wages and salaries bill for the coming year.

D) When workers' compensation insurance is paid in advance, prepaid workers' compensation insurance is debited and bank is credited.

A) It is compulsory for all employers to take out workers' compensation insurance.

B) The percentage rate of premium is the same rate for all employers.

C) The premium is based on a percentage of the wages and salaries bill for the coming year.

D) When workers' compensation insurance is paid in advance, prepaid workers' compensation insurance is debited and bank is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

BB had previously purchased inventory from L Wong for $15 000. On 1 October BB gave Wong a 60-day, bill of exchange to cover the amount of the account payable plus interest at 9% p.a. What is the correct accounting entry in BB's books to record the issue of the bill?

A) Debit accounts payable $15 000; debit unexpired interest $222; credit bills payable $15 222

B) Debit accounts payable $15 000; credit bills payable $15 000

C) Debit bills payable $15 222; credit accounts payable $15 222

D) Debit bills payable $15 000; debit unexpired interest $222; credit accounts payable $15 222

A) Debit accounts payable $15 000; debit unexpired interest $222; credit bills payable $15 222

B) Debit accounts payable $15 000; credit bills payable $15 000

C) Debit bills payable $15 222; credit accounts payable $15 222

D) Debit bills payable $15 000; debit unexpired interest $222; credit accounts payable $15 222

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

A) $72 000.

B) $78 500.

C) $95 500.

D) $97 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Jill Wybrow's regular and overtime pay for the week ending 30 September was $1480. Amounts were deducted for income tax $109.50, union fees $6 and loan repayments of $20. Jill's employer contributes 9% of her gross pay to a superannuation fund on her behalf. What is Jill's net take home pay for the week?

A) $1308.50

B) $1 326.50

C) $1 344.50

D) $1337.00

A) $1308.50

B) $1 326.50

C) $1 344.50

D) $1337.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Star Mobile Phone company estimates that the amount of monthly salaries on which four weeks annual leave is payable is $208 000. What is the correct accounting entry to accrue annual leave at the end of the month?

A) Debit annual leave payable $16 000; credit bank $16 000

B) Debit annual leave payable $16 000; credit annual leave expense $16 000

C) Debit annual leave expense $16 000; credit annual leave payable $16 000

D) No accounting entry is required

A) Debit annual leave payable $16 000; credit bank $16 000

B) Debit annual leave payable $16 000; credit annual leave expense $16 000

C) Debit annual leave expense $16 000; credit annual leave payable $16 000

D) No accounting entry is required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

(I) Warranty expense and (II) provision for warranties are what type of accounts?

A) (I) Expense, (II) equity

B) (I) Expense, (II) asset

C) (I) Expense, (II) liability

D) (I) Liability, (II) expense

A) (I) Expense, (II) equity

B) (I) Expense, (II) asset

C) (I) Expense, (II) liability

D) (I) Liability, (II) expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

The payment of net wages involves a:

A) debit to bank and a credit to wages and salaries payable.

B) debit to wages and salaries payable and a credit to bank.

C) debit to wages and salaries and a credit to provision for wages and salaries.

D) debit to gross pay and a credit to net pay.

A) debit to bank and a credit to wages and salaries payable.

B) debit to wages and salaries payable and a credit to bank.

C) debit to wages and salaries and a credit to provision for wages and salaries.

D) debit to gross pay and a credit to net pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

Kartik's regular and overtime gross pay combined, for the week ending 30 September, was $1480. Amounts were deducted for income tax $339.50, union fees $6 and donations to charity $50. Kartik contributes 10% of his gross pay to a superannuation fund as a personal contribution. What is his net pay for the week?

A) $1084.50

B) $936.50

C) $1140.50

D) $1134.50

A) $1084.50

B) $936.50

C) $1140.50

D) $1134.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

One of these items is not normally a payroll ancillary cost for an employer in Australia?

A) Annual leave

B) Workers' compensation insurance

C) Medical and hospital insurance

D) Long-service leave

A) Annual leave

B) Workers' compensation insurance

C) Medical and hospital insurance

D) Long-service leave

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

'No Rust' car sales provides a one-year labour and parts warranty with every car sold. It is expected that 1000 cars will be sold for the year. Past records show that about 8% of cars require warranty repairs at an average cost of $200 per car. What is the accounting entry to record the expected warranty expense for the year?

A) Debit warranty expense $16 000; credit provision for warranties $16 000

B) Debit provision for warranties $16 000; credit bank $16 000

C) Debit provision for warranties $16 000; credit warranty expense $16 000

D) No entry is required

A) Debit warranty expense $16 000; credit provision for warranties $16 000

B) Debit provision for warranties $16 000; credit bank $16 000

C) Debit provision for warranties $16 000; credit warranty expense $16 000

D) No entry is required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of these is not a deduction by employers from their employees' gross pay?

A) Income tax instalments owing to the taxation office

B) Superannuation contributions

C) Union fees

D) Payroll tax

A) Income tax instalments owing to the taxation office

B) Superannuation contributions

C) Union fees

D) Payroll tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of these is not part of the net pay calculation?

A) Workers compensation insurance

B) Clothing allowance

C) Bonus

D) Overtime pay

A) Workers compensation insurance

B) Clothing allowance

C) Bonus

D) Overtime pay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

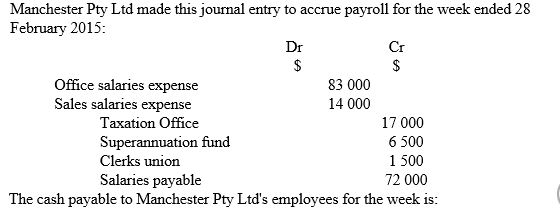

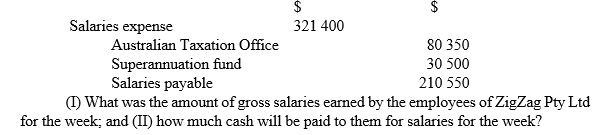

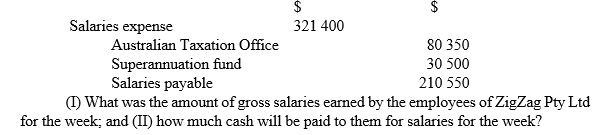

ZigZag Pty Ltd made the following journal entry to accrue payroll for the week ended 28 February.

Dr) Cr.

A) (I) $321 400, (II) $321 400

B) (I) $210 550, (II) $210 550

C) (I) $321 400, (II) $210 550

D) (I) $210 550, (II) $321 400

Dr) Cr.

A) (I) $321 400, (II) $321 400

B) (I) $210 550, (II) $210 550

C) (I) $321 400, (II) $210 550

D) (I) $210 550, (II) $321 400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which statement relating to sick leave is true?

A) Accounting for sick leave is largely determined by the conditions attached to the leave.

B) Employees are generally entitled to be paid pro-rata for sick leave not taken if they terminate their employment.

C) When sick leave is actually taken by employees an entry is made to debit sick leave expense and credit the Australian Tax Office.

D) When sick leave is paid it is at the lowest award rate rather than the normal salary rate.

A) Accounting for sick leave is largely determined by the conditions attached to the leave.

B) Employees are generally entitled to be paid pro-rata for sick leave not taken if they terminate their employment.

C) When sick leave is actually taken by employees an entry is made to debit sick leave expense and credit the Australian Tax Office.

D) When sick leave is paid it is at the lowest award rate rather than the normal salary rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which statement in relation to payroll ancillary costs is untrue?

A) Payroll ancillary costs are employee benefits set down in various awards and contracts in addition to benefits relating directly to hours worked.

B) Examples of payroll ancillary costs are annual leave, sick leave and long-service leave.

C) Payroll ancillary costs equal gross wages less deductions.

D) Workers compensation insurance is a payroll ancillary cost not actually paid to employees but paid on their behalf.

A) Payroll ancillary costs are employee benefits set down in various awards and contracts in addition to benefits relating directly to hours worked.

B) Examples of payroll ancillary costs are annual leave, sick leave and long-service leave.

C) Payroll ancillary costs equal gross wages less deductions.

D) Workers compensation insurance is a payroll ancillary cost not actually paid to employees but paid on their behalf.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

It is not true in relation to IAS 19/AASB 119 Employee Benefits that:

A) employee benefits include wages and salaries, non-monetary fringe benefits, annual leave and superannuation.

B) the principles for recognition of employee benefits as expenses or liabilities are consistent with those in the Conceptual Framework.

C) wages and salaries, annual leave and sick leave are to be reported at their nominal amounts.

D) the controls that need to be provided when operating a payroll system are outlined.

A) employee benefits include wages and salaries, non-monetary fringe benefits, annual leave and superannuation.

B) the principles for recognition of employee benefits as expenses or liabilities are consistent with those in the Conceptual Framework.

C) wages and salaries, annual leave and sick leave are to be reported at their nominal amounts.

D) the controls that need to be provided when operating a payroll system are outlined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which statement relating to annual leave under Australian awards is untrue?

A) Employees are normally entitled to four weeks paid annual leave per annum.

B) The entitlement to annual leave accrues to an employee on a day-to-day basis throughout the year.

C) The entry to recognise annual leave each month is a debit to annual leave expense and a credit to bank.

D) Employees are entitled to be paid pro-rata for annual leave not taken on termination of employment.

A) Employees are normally entitled to four weeks paid annual leave per annum.

B) The entitlement to annual leave accrues to an employee on a day-to-day basis throughout the year.

C) The entry to recognise annual leave each month is a debit to annual leave expense and a credit to bank.

D) Employees are entitled to be paid pro-rata for annual leave not taken on termination of employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which statement relating to employee benefits is incorrect?

A) Employee benefits are defined as all forms of consideration given by an entity in exchange for services rendered by employees.

B) If an employee benefit meets the Conceptual Framework's definition of a liability, it is recognised as a liability, if it meets the definition of an expense it is recognised as an expense.

C) Wages and salaries, annual leave and sick leave are recorded at their nominal amounts.

D) Long-term employee benefits are recorded at their recoverable amount.

A) Employee benefits are defined as all forms of consideration given by an entity in exchange for services rendered by employees.

B) If an employee benefit meets the Conceptual Framework's definition of a liability, it is recognised as a liability, if it meets the definition of an expense it is recognised as an expense.

C) Wages and salaries, annual leave and sick leave are recorded at their nominal amounts.

D) Long-term employee benefits are recorded at their recoverable amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of these is not an employee benefit?

A) Wages and salaries

B) Non-monetary fringe benefits

C) Employer's contribution to superannuation

D) GST paid

A) Wages and salaries

B) Non-monetary fringe benefits

C) Employer's contribution to superannuation

D) GST paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which statement relating to workers' compensation insurance is not true?

A) It relates to an insurance scheme, imposed by law, whereby the employer purchases insurance which may be used to compensate employees for job related injuries and loss of wages.

B) It is compulsory for all employers to obtain this cover.

C) The premium is deducted from employees' salaries and wages.

D) The premium is based on a percentage of the total wages and salaries bill for the coming year.

A) It relates to an insurance scheme, imposed by law, whereby the employer purchases insurance which may be used to compensate employees for job related injuries and loss of wages.

B) It is compulsory for all employers to obtain this cover.

C) The premium is deducted from employees' salaries and wages.

D) The premium is based on a percentage of the total wages and salaries bill for the coming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of these is a disadvantage to shareholders of using long-term debt rather than equity?

A) Interest is tax deductible

B) Interest payments must be made on time regardless of a reduction in profitability

C) Lenders do not share in excess profits

D) Lenders do not have voting rights

A) Interest is tax deductible

B) Interest payments must be made on time regardless of a reduction in profitability

C) Lenders do not share in excess profits

D) Lenders do not have voting rights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which statement concerning long-service leave is correct?

A) Long-service leave does not have to be paid to an employee until the required period of employment has been completed,e.g. 10 years, 15 years.

B) Long-service leave is paid at the employees' average rate of pay over the period for which the leave has accrued.

C) Long-service leave relates to an insurance scheme whereby employees are compensated for injuries, loss of limbs and loss of life while at work.

D) Long-service leave entitlements were recently abolished by the government.

A) Long-service leave does not have to be paid to an employee until the required period of employment has been completed,e.g. 10 years, 15 years.

B) Long-service leave is paid at the employees' average rate of pay over the period for which the leave has accrued.

C) Long-service leave relates to an insurance scheme whereby employees are compensated for injuries, loss of limbs and loss of life while at work.

D) Long-service leave entitlements were recently abolished by the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the debt ratio is 40% the equity ratio is:

A) 40%.

B) 2:1.

C) 60%.

D) unable to be calculated.

A) 40%.

B) 2:1.

C) 60%.

D) unable to be calculated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

A capitalisation ratio of 4:1 means:

A) debt is 75% equity is 25%.

B) debt is one fifth of equity.

C) equity is one fifth of debt.

D) debt is 25% equity is 75%.

A) debt is 75% equity is 25%.

B) debt is one fifth of equity.

C) equity is one fifth of debt.

D) debt is 25% equity is 75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

An arrangement whereby the terms and conditions of a debt are avoided or defeated is known as:

A) defeasance.

B) discounting.

C) obligating.

D) collateralising.

A) defeasance.

B) discounting.

C) obligating.

D) collateralising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

In relation to long-service leave how many of these statements are untrue?

The entry to accrue long-service leave is a debit to long-service leave expense and a credit to provision for long-service leave.

The leave is paid at the rate of pay applicable when the leave is taken.

Employees only starts to accrue long service leave after being employed for a predetermined length of time (often 10 years).

A) 0

B) 1

C) 2

D) 3

The entry to accrue long-service leave is a debit to long-service leave expense and a credit to provision for long-service leave.

The leave is paid at the rate of pay applicable when the leave is taken.

Employees only starts to accrue long service leave after being employed for a predetermined length of time (often 10 years).

A) 0

B) 1

C) 2

D) 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

A $100 debenture quoted at 104 is said to:

A) sell at a discount.

B) sell at a premium.

C) sell at $4 above its market value.

D) sell at par.

A) sell at a discount.

B) sell at a premium.

C) sell at $4 above its market value.

D) sell at par.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under Australian awards, which statement relating to annual leave is true?

A) Annual leave is generally accounted for on a cash rather than an accrual basis.

B) An employee is not entitled to annual leave until he/she has worked for a year with the same employer.

C) Employees are generally entitled to two weeks paid annual leave a year.

D) Employees are entitled to be paid pro-rata for annual leave not taken if their employment terminates.

A) Annual leave is generally accounted for on a cash rather than an accrual basis.

B) An employee is not entitled to annual leave until he/she has worked for a year with the same employer.

C) Employees are generally entitled to two weeks paid annual leave a year.

D) Employees are entitled to be paid pro-rata for annual leave not taken if their employment terminates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

From the point of view of the business, which of these is an advantage of using long-term debt rather than equity in financing?

I) It does not dilute the control of existing owners.

II) Creditors do not share in any excess profits of the entity.

III) Interest payments are a fixed commitment regardless of profits.

IV Interest is tax deductible.

A) I, II, III, IV

B) I, IV

C) I, II, IV

D) I

I) It does not dilute the control of existing owners.

II) Creditors do not share in any excess profits of the entity.

III) Interest payments are a fixed commitment regardless of profits.

IV Interest is tax deductible.

A) I, II, III, IV

B) I, IV

C) I, II, IV

D) I

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

A capitalisation ratio of 2:1 compared to 2.5:1 means:

A) a lesser dependency on debt.

B) a lower level of gearing.

C) a greater dependency on debt.

D) a higher level of equity.

A) a lesser dependency on debt.

B) a lower level of gearing.

C) a greater dependency on debt.

D) a higher level of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

Debentures may be:

I) secured by a specific charge over particular assets.

Ii) secured by a floating charge over assets.

Iii) unsecured.

A) i

B) i, ii

C) i, ii, iii

D) ii, iii

I) secured by a specific charge over particular assets.

Ii) secured by a floating charge over assets.

Iii) unsecured.

A) i

B) i, ii

C) i, ii, iii

D) ii, iii

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

A liability where the borrowings are from many investors, representing a written promise to pay a principal amount at a specific time, as well as interest on the principal at a specific rate per period, is known as:

A) a debenture.

B) a lease.

C) defeasance.

D) collateral.

A) a debenture.

B) a lease.

C) defeasance.

D) collateral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

How many of these ratios are used to evaluate long-term financial stability?

Debt ratio

Current ratio

Equity ratio

Profit margin

Quick ratio

A) 2

B) 3

C) 4

D) 5

Debt ratio

Current ratio

Equity ratio

Profit margin

Quick ratio

A) 2

B) 3

C) 4

D) 5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

On 1 October 2015 Rugworld purchased a building for $800 000, paying $300 000 as a deposit and giving the seller a 12% mortgage for the balance. The monthly repayment was $6000. What is the entry to record the payment on 1 November 2015?

A) Dr interest expense $5000; Dr mortgage payable $1000; Cr bank $6000

B) Dr mortgage payable $6000; Cr bank $6000

C) Dr interest expense $5000; Dr bank $1000; Cr mortgage payable $6000

D) Dr interest expense $6000; Cr bank $6000

A) Dr interest expense $5000; Dr mortgage payable $1000; Cr bank $6000

B) Dr mortgage payable $6000; Cr bank $6000

C) Dr interest expense $5000; Dr bank $1000; Cr mortgage payable $6000

D) Dr interest expense $6000; Cr bank $6000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

'No Rust' car sales provides a one year labour and parts warranty with every car sold and at the start of 2012 had a provision of $16 000 to cover warranty claims. On 30 March 2012 $2700 was paid out for repairs for vehicles under warranty. What is the correct accounting entry to record the payment of the claims?

A) Debit warranty expense $2700; credit provision for warranties $2700

B) Debit provision for warranties $2700; credit bank $2700

C) Debit provision for warranties $2700; credit warranty expense $2700

D) Debit warranty expense $2700; credit bank $2700

A) Debit warranty expense $2700; credit provision for warranties $2700

B) Debit provision for warranties $2700; credit bank $2700

C) Debit provision for warranties $2700; credit warranty expense $2700

D) Debit warranty expense $2700; credit bank $2700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which statement concerning debentures is incorrect?

A) A trustee, such as a bank or an insurance company, must be appointed to protect the rights of the debenture holders.

B) An issue of debentures to the public must be accompanied by a prospectus.

C) The division of debenture borrowings into $100 or $50 units allows many small investors to participate in the issue.

D) The market value of debentures is always the same as their face value.

A) A trustee, such as a bank or an insurance company, must be appointed to protect the rights of the debenture holders.

B) An issue of debentures to the public must be accompanied by a prospectus.

C) The division of debenture borrowings into $100 or $50 units allows many small investors to participate in the issue.

D) The market value of debentures is always the same as their face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Indigo had previously purchased inventory from Larry for $40 000. On 1 October Indigo gave Larry a 90-day, bill of exchange to cover the amount of the account payable plus interest at 10% p.a. The correct accounting entry in Indigo's books to record the settlement of the bill at maturity is:

A) Debit bills payable $40 986; debit interest expense $986; credit bank $40 986; credit unexpired interest $986

B) Debit bills payable $40 986; credit interest expense $986; credit bank $40 000.

C) Debit bills payable $40 000; credit bank $40 000

D) Debit bills payable $39 014; debit interest expense $986; credit bank $40 000

A) Debit bills payable $40 986; debit interest expense $986; credit bank $40 986; credit unexpired interest $986

B) Debit bills payable $40 986; credit interest expense $986; credit bank $40 000.

C) Debit bills payable $40 000; credit bank $40 000

D) Debit bills payable $39 014; debit interest expense $986; credit bank $40 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the formula for the debt ratio?

A) Total equity divided by total assets

B) Non-current liabilities divided by current liabilities

C) Total liabilities divided by net assets

D) Total liabilities divided by total assets

A) Total equity divided by total assets

B) Non-current liabilities divided by current liabilities

C) Total liabilities divided by net assets

D) Total liabilities divided by total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

What types of accounts are (I) GST collections and (II) GST outlays?

A) (I) Liability, (II) asset

B) (I) Negative liability, (II) liability,

C) (I) Asset, (II) liability

D) (I) Liability, (II) negative liability

A) (I) Liability, (II) asset

B) (I) Negative liability, (II) liability,

C) (I) Asset, (II) liability

D) (I) Liability, (II) negative liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

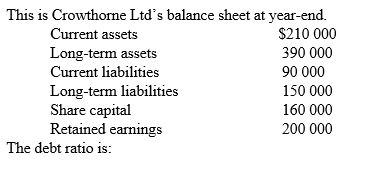

A) 37.5%.

B) 40%.

C) 60%.

D) 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which statement concerning liabilities is untrue?

A) Borrowing to finance assets provides the potential for greater returns for owners but also means greater risk.

B) The absolute value of liquidity ratios is usually more important than their trend over time.

C) A difference between an accounts payable and a bills payable is that the liability created with a bills payable is evidenced by a bills payable or a promissory note.

D) Leverage is the use of borrowed funds in an attempt to earn a return greater than the interest paid on the borrowings.

A) Borrowing to finance assets provides the potential for greater returns for owners but also means greater risk.

B) The absolute value of liquidity ratios is usually more important than their trend over time.

C) A difference between an accounts payable and a bills payable is that the liability created with a bills payable is evidenced by a bills payable or a promissory note.

D) Leverage is the use of borrowed funds in an attempt to earn a return greater than the interest paid on the borrowings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

Souvenirs Pty Ltd has a current ratio of 3:1 and current liabilities of $15 000. If Souvenirs Ltd has $10 000 of inventory, what is the quick ratio?

A) 2.25 to 1

B) 2.00 to 1

C) 2.33 to 1

D) 1.50 to 1

A) 2.25 to 1

B) 2.00 to 1

C) 2.33 to 1

D) 1.50 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck