Deck 4: Adjusting the Accounts and Preparing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 4: Adjusting the Accounts and Preparing Financial Statements

1

The office supplies inventory account is a/an:

A) liability.

B) income.

C) expense.

D) asset.

A) liability.

B) income.

C) expense.

D) asset.

D

2

Adjustments where income is earned or expenses incurred before the cash is received or paid are called:

A) accruals.

B) deferrals.

C) depreciation.

D) prepayments.

A) accruals.

B) deferrals.

C) depreciation.

D) prepayments.

A

3

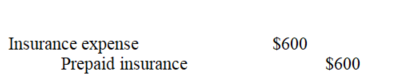

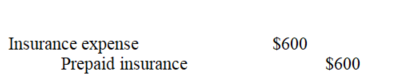

On 1 July 2014 Tan Traders paid $600, representing a two-year insurance premium. The $600 was initially recorded in the insurance expense account. The correct adjusting entry on 31 December 2014, the close of the annual accounting period, is which of the following?

A) Debit prepaid insurance $450; credit insurance expense $450

B) Debit prepaid insurance $150; credit insurance expense $150

C) Debit prepaid insurance $300; credit insurance expense $300

D) Debit insurance expense $150; credit prepaid insurance $150

A) Debit prepaid insurance $450; credit insurance expense $450

B) Debit prepaid insurance $150; credit insurance expense $150

C) Debit prepaid insurance $300; credit insurance expense $300

D) Debit insurance expense $150; credit prepaid insurance $150

A

4

The cash approach to profit measurement will not give a reliable profit figure for an entity that conducts a significant portion of its business:

A) overseas.

B) with subsidiaries.

C) with borrowed money.

D) on credit.

A) overseas.

B) with subsidiaries.

C) with borrowed money.

D) on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

X Co's employees carry out work to the value of $7500. They are paid $4500 immediately with the balance to be settled in the next accounting period. Under the cash approach to profit measurement the amount of wages expense that will be recorded in the current period is:

A) nil.

B) $4500.

C) $3000.

D) $7500.

A) nil.

B) $4500.

C) $3000.

D) $7500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

On the first day of the year Tan Traders purchased a forklift truck for $12 000 which is to be depreciated by 25% a year. At the end of the first year the adjusting entry to record depreciation is which of the following?

A) Debit depreciation of forklift $3000; credit forklift $3000

B) Debit depreciation of forklift $3000; credit accumulated depreciation of forklift $3000

C) Debit depreciation of forklift $12 000; credit accumulated depreciation of forklift $12 000

D) Debit accumulated depreciation of forklift $3000; credit depreciation of forklift $3000

A) Debit depreciation of forklift $3000; credit forklift $3000

B) Debit depreciation of forklift $3000; credit accumulated depreciation of forklift $3000

C) Debit depreciation of forklift $12 000; credit accumulated depreciation of forklift $12 000

D) Debit accumulated depreciation of forklift $3000; credit depreciation of forklift $3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

Adjustments which are necessary because cash for expenses is paid in advance or cash from income is pre-collected are called:

A) accruals.

B) deferrals/prepayments.

C) contras.

D) unrecorded adjustments.

A) accruals.

B) deferrals/prepayments.

C) contras.

D) unrecorded adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under the cash approach to profit measurement income is recorded in the accounting period when:

A) the services are performed.

B) the cash is deposited into the entities bank account.

C) cash is received.

D) an order is placed.

A) the services are performed.

B) the cash is deposited into the entities bank account.

C) cash is received.

D) an order is placed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

What type of account is prepaid insurance?

A) Liability

B) Income

C) Expense

D) Asset

A) Liability

B) Income

C) Expense

D) Asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

What type of account is unearned income?

A) Liability

B) Income

C) Expense

D) Asset

A) Liability

B) Income

C) Expense

D) Asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

The two main accounting assumptions that underpin the accrual approach to profit measurement are:

A) going concern and accounting period.

B) historical cost and accounting period.

C) entity and accounting period.

D) going concern and historical cost.

A) going concern and accounting period.

B) historical cost and accounting period.

C) entity and accounting period.

D) going concern and historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

Harry Company uses cleaning supplies on a daily basis. Under the accrual basis of accounting these supplies would be an expense of the period in which they are:

A) ordered.

B) received.

C) paid for.

D) used.

A) ordered.

B) received.

C) paid for.

D) used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

The last step in the manual accounting cycle before financial statements are prepared is which of the following?

A) Post the journals to the ledger

B) Determine adjusting entries

C) Prepare an adjusted trial balance

D) Prepare a closing trial balance

A) Post the journals to the ledger

B) Determine adjusting entries

C) Prepare an adjusted trial balance

D) Prepare a closing trial balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of these is not a name for the original cost of an asset less its accumulated depreciation (if any)?

A) Carrying amount

B) Book value

C) Written down value

D) Depreciable amount

A) Carrying amount

B) Book value

C) Written down value

D) Depreciable amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

It is correct that each balance day adjustment:

A) affects either the income statement or the balance sheet.

B) has at least one effect on the income statement and one effect on the balance sheet.

C) only affects the income statement.

D) always has an effect on the bank account.

A) affects either the income statement or the balance sheet.

B) has at least one effect on the income statement and one effect on the balance sheet.

C) only affects the income statement.

D) always has an effect on the bank account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

The reason it is necessary to prepare adjusting entries at the end of the financial year is:

A) to correct errors made during the year.

B) to provide as accurate a profit measurement as possible.

C) to prepare the ledger for the next accounting period.

D) to close the accounts.

A) to correct errors made during the year.

B) to provide as accurate a profit measurement as possible.

C) to prepare the ledger for the next accounting period.

D) to close the accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which statement concerning accrual accounting is true?

A) Profit is the excess of cash inflows from income over cash outflows for expenses.

B) Income from sales is recognised in the period when the cheque is cashed.

C) For most businesses the cash approach gives a better measure of economic performance than does the accrual approach.

D) Income is recognised in the period when the flow of economic benefits can be reliably measured.

A) Profit is the excess of cash inflows from income over cash outflows for expenses.

B) Income from sales is recognised in the period when the cheque is cashed.

C) For most businesses the cash approach gives a better measure of economic performance than does the accrual approach.

D) Income is recognised in the period when the flow of economic benefits can be reliably measured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

Rather than using the cash method accountants prefer to calculate profitability using the:

A) adjusted approach.

B) accrual approach.

C) permanent approach.

D) non-current approach.

A) adjusted approach.

B) accrual approach.

C) permanent approach.

D) non-current approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

Profit is measured as:

A) income - expenses.

B) assets - liabilities.

C) current assets - current liabilities.

D) debits - credits.

A) income - expenses.

B) assets - liabilities.

C) current assets - current liabilities.

D) debits - credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

What is the correct order in which the steps in the manual recording process occur?

I Record transactions in the journal

Ii Record adjusting entries

Iii Prepare financial statements

Iv Post transactions to the ledger

A) i, ii, iii, iv

B) iv, ii, i, iii

C) i, iv, iii, ii

D) i, iv, ii, iii

I Record transactions in the journal

Ii Record adjusting entries

Iii Prepare financial statements

Iv Post transactions to the ledger

A) i, ii, iii, iv

B) iv, ii, i, iii

C) i, iv, iii, ii

D) i, iv, ii, iii

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

Right Style received a $1000 advance payment from a customer for work to be carried out in the next accounting period. Which of the following is the correct accounting entry to initially record the $1000?

A) Debit bank $1000; credit unearned income $1000

B) Debit unearned income $1000; credit bank $1000

C) Debit bank $1000; credit accounts payable $1000

D) Debit income earned $1000; credit bank $1000

A) Debit bank $1000; credit unearned income $1000

B) Debit unearned income $1000; credit bank $1000

C) Debit bank $1000; credit accounts payable $1000

D) Debit income earned $1000; credit bank $1000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

If an adjustment for accrued income is omitted from the financial reports the effect is:

A) assets are understated; profit is understated.

B) assets are overstated; profit is understated.

C) assets are understated; profit is overstated.

D) assets are overstated; profit is overstated.

A) assets are understated; profit is understated.

B) assets are overstated; profit is understated.

C) assets are understated; profit is overstated.

D) assets are overstated; profit is overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which statement relating to the accumulated depreciation account is correct?

A) It normally has a debit balance.

B) It reflects the portion of the cost of the asset that has been assigned as an expense since purchase.

C) It provides information on the market value of the asset.

D) It is classified as a liability in the balance sheet.

A) It normally has a debit balance.

B) It reflects the portion of the cost of the asset that has been assigned as an expense since purchase.

C) It provides information on the market value of the asset.

D) It is classified as a liability in the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Accrued salaries is a:

A) contra asset account.

B) equity account.

C) asset account.

D) liability account.

A) contra asset account.

B) equity account.

C) asset account.

D) liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

Tan Traders is owed $350 interest on an investment which has not been received by 3l December 2014, the last day of the accounting year. The adjusting entry is which of the following?

A) Debit bank $350; credit interest income $350

B) Debit accounts receivable $350; credit interest income $350

C) Debit interest income $350; credit accounts receivable $350

D) Debit interest income $350; credit accrued interest $350

A) Debit bank $350; credit interest income $350

B) Debit accounts receivable $350; credit interest income $350

C) Debit interest income $350; credit accounts receivable $350

D) Debit interest income $350; credit accrued interest $350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

The publishers of 'Guide to the Stock Market', a magazine published monthly, received $121 in advance, including $11 GST on 1 March, for a 1 year's subscription (11 issues) beginning with the March issue. On receipt of the subscription which entry will the company make?

A) DR Cash $121; CR Subscriptions income $121

B) DR Cash $121; CR GST collections $11, CR Unearned subscriptions (liability) $110

C) DR Cash $121; CR GST collections $11, CR Subscriptions received in advance (asset) $110

D) DR Cash $110; CR Subscriptions income $110

A) DR Cash $121; CR Subscriptions income $121

B) DR Cash $121; CR GST collections $11, CR Unearned subscriptions (liability) $110

C) DR Cash $121; CR GST collections $11, CR Subscriptions received in advance (asset) $110

D) DR Cash $110; CR Subscriptions income $110

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

An account that is always deducted from a related account is known as a:

A) carrying account.

B) temporary account.

C) contra account.

D) negative account.

A) carrying account.

B) temporary account.

C) contra account.

D) negative account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

Michael purchased two vehicles for his business on 1 January 2014. These vehicles cost $70 000 each and have a useful life of 5 years with an expected residual of $20 000 each. The adjusting entry for depreciation on 31 December 2014, using the straight-line method, is which of the following?

A) DR Accumulated depreciation $10 000; CR Depreciation expense $10 000

B) DR Depreciation expense $10 000; CR Accumulated depreciation $10 000

C) DR Accumulated depreciation $20 000; CR Depreciation expense $20 000

D) DR Depreciation expense $20 000 CR Accumulated depreciation $20 000

A) DR Accumulated depreciation $10 000; CR Depreciation expense $10 000

B) DR Depreciation expense $10 000; CR Accumulated depreciation $10 000

C) DR Accumulated depreciation $20 000; CR Depreciation expense $20 000

D) DR Depreciation expense $20 000 CR Accumulated depreciation $20 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

The publishers of 'Guide to the Stock Market', a magazine published monthly, received $121 in advance, including $11 GST on 1 March, for a 1 year's subscription (11 issues) beginning with the March issue. At the end of the financial year on 30 June what entry will the company make?

A) DR Unearned subscriptions (liability) $40; CR Subscriptions income $40

B) DR Cash $40; CR Subscriptions income $40

C) DR Cash $121; CR GST collections $11; CR Unearned subscriptions (liability) $110

D) DR Unearned subscriptions (liability) $40; CR Subscriptions income $36; CR GST collections $4

A) DR Unearned subscriptions (liability) $40; CR Subscriptions income $40

B) DR Cash $40; CR Subscriptions income $40

C) DR Cash $121; CR GST collections $11; CR Unearned subscriptions (liability) $110

D) DR Unearned subscriptions (liability) $40; CR Subscriptions income $36; CR GST collections $4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

During 2014 The Style Hairdressing Salon paid out $41 000 in wages from its bank account. At year-end 2014 wages owing but unpaid were $1600. The salon uses accrual accounting. How much would be reported as wages expense for 2014?

A) $39 400

B) $41 000

C) $43 400

D) $42 600

A) $39 400

B) $41 000

C) $43 400

D) $42 600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

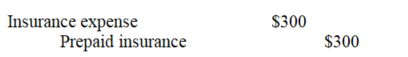

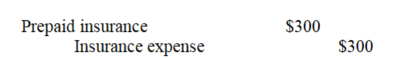

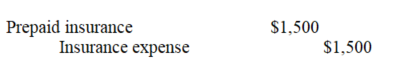

31

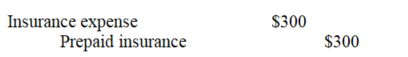

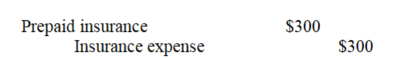

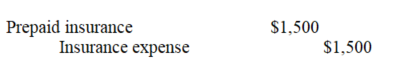

The prepaid insurance account of Megaton Ltd shows a balance of $1800 (net of GST) representing a payment on 1 July 2014 of a three-year insurance premium. Which of the following is the correct adjusting entry on 31 December 2014, the close of the annual accounting period?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

The office supplies inventory account of Tan Traders shows a balance of $1600 on 31 December 2014. The adjusting entry to record office supplies of $550 issued to staff in the 12 months up to 31 December 2014 is which of the following?

A) Debit office supplies inventory $550; credit office supplies expense $550

B) Debit office supplies inventory $1050; credit office supplies expense $1050

C) Debit office supplies expense $550; credit office supplies inventory $550

D) Debit office supplies expense $1600; credit office supplies inventory $1600

A) Debit office supplies inventory $550; credit office supplies expense $550

B) Debit office supplies inventory $1050; credit office supplies expense $1050

C) Debit office supplies expense $550; credit office supplies inventory $550

D) Debit office supplies expense $1600; credit office supplies inventory $1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

On July 1 2014 the Indigo Ltd rented out part of its property and collected $9000 in advance for a nine-month period. The receipt was credited to a liability account. At 31 December 2014, Indigo Ltd's year-end, which of the following adjusting journal entries should be made?

A) DR Cash $6000; CR Rent income $6000

B) DR Rent income $3000; CR Unearned rent income $3000

C) DR Unearned rent income $6000; CR Rent income $6000

D) DR Rent receivable $6000; CR Rent income $6 000

A) DR Cash $6000; CR Rent income $6000

B) DR Rent income $3000; CR Unearned rent income $3000

C) DR Unearned rent income $6000; CR Rent income $6000

D) DR Rent receivable $6000; CR Rent income $6 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

The office supplies inventory account of Tan Traders shows a balance of $1600 on 31 December 2014. Office supplies of $550 were issued to staff in the 12 months up to 31 December 2014. After adjustment on 31 December 2014, the close of the annual accounting period:

A) office supplies expense in the income statement is $550 and office supplies inventory in the balance sheet is $1050.

B) office supplies expense in the income statement is $1600 and office supplies inventory in the balance sheet is $0.

C) office supplies expense in the income statement is $0 and office supplies inventory in the balance sheet is $1600.

D) office supplies expense in the income statement is $1050 and office supplies inventory in the balance sheet is $550.

A) office supplies expense in the income statement is $550 and office supplies inventory in the balance sheet is $1050.

B) office supplies expense in the income statement is $1600 and office supplies inventory in the balance sheet is $0.

C) office supplies expense in the income statement is $0 and office supplies inventory in the balance sheet is $1600.

D) office supplies expense in the income statement is $1050 and office supplies inventory in the balance sheet is $550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

The prepaid insurance account of Tan Traders shows a balance of $600, representing a payment on 1 July 2014 of a two-year insurance premium. After adjustment at 31 December 2014, the close of the annual accounting period:

A) insurance expense in the income statement is $600 and prepaid insurance in the balance sheet is $0.

B) insurance expense in the income statement is $150 and prepaid insurance in the balance sheet is $450.

C) insurance expense in the income statement is $0 and prepaid insurance in the balance sheet is $600.

D) insurance expense in the income statement is $300 and prepaid insurance in the balance sheet is $300.

A) insurance expense in the income statement is $600 and prepaid insurance in the balance sheet is $0.

B) insurance expense in the income statement is $150 and prepaid insurance in the balance sheet is $450.

C) insurance expense in the income statement is $0 and prepaid insurance in the balance sheet is $600.

D) insurance expense in the income statement is $300 and prepaid insurance in the balance sheet is $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

Deferral type adjustments occur when cash for expenses is paid in advance or cash from incomes is pre-collected. How many of the following will require a deferral type adjustment?

Rent paid for in advance

Buildings to be depreciated

Rent collected in advance from tenants

Interest is owed to the bank

A) 1

B) 2

C) 3

D) 4

Rent paid for in advance

Buildings to be depreciated

Rent collected in advance from tenants

Interest is owed to the bank

A) 1

B) 2

C) 3

D) 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

Newark Company purchased a machine for $35 000 on 1 January 2012 with an estimated life of 5 years and a residual value of $5000. The straight-line method of depreciation is used. What is the carrying value of the machine on the 31 December 2014 in the balance sheet of Newark Company?

A) $30 000

B) $17 000

C) $18 000

D) $12 000

A) $30 000

B) $17 000

C) $18 000

D) $12 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

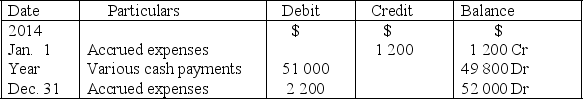

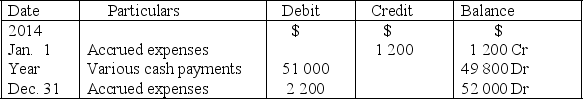

The wages expense account for Gerry Mander, political consultants, showed the following entries for 2014. What was the portion of wages that was treated as an expense in 2013 but was not paid until 2014?

Wages expense

A) $49 800

B) $51 000

C) $1200

D) $2200

Wages expense

A) $49 800

B) $51 000

C) $1200

D) $2200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

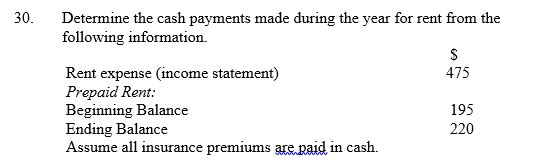

39

A) $475

B) $500

C) $695

D) $450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a company has earned income which has not been received in cash at the end of the accounting period an adjustment should be made which will:

A) debit an asset account and credit an income account.

B) debit an expense account and credit cash.

C) debit an income account and credit an asset account.

D) debit an asset account and credit an expense account.

A) debit an asset account and credit an income account.

B) debit an expense account and credit cash.

C) debit an income account and credit an asset account.

D) debit an asset account and credit an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

Obligations of the entity that do not require payment within one year of the balance sheet date are classified as:

A) current liabilities.

B) non-current assets.

C) current obligations.

D) non-current liabilities.

A) current liabilities.

B) non-current assets.

C) current obligations.

D) non-current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

On 1 July 2014 Tan Traders paid $600, representing a two-year insurance premium. The $600 was initially recorded in the Insurance expense account. After adjustment at 31 December 2015, the close of the annual accounting period:

A) insurance expense in the income statement is $600 and prepaid insurance in the balance sheet is $0.

B) insurance expense in the income statement is $150 and prepaid insurance in the balance sheet is $450.

C) insurance expense in the income statement is $450 and prepaid insurance in the balance sheet is $0.

D) insurance expense in the income statement is $300 and prepaid insurance in the balance sheet is $150.

A) insurance expense in the income statement is $600 and prepaid insurance in the balance sheet is $0.

B) insurance expense in the income statement is $150 and prepaid insurance in the balance sheet is $450.

C) insurance expense in the income statement is $450 and prepaid insurance in the balance sheet is $0.

D) insurance expense in the income statement is $300 and prepaid insurance in the balance sheet is $150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

In preparing its 2014 adjusting entries, the ZigZag Ltd forgot to adjust the Office Supplies (asset) account for the amount of supplies used up during the year. As a result of this error:

A) 2014 profit is understated, the balance of equity is understated, and assets are understated.

B) 2014 profit is overstated, the balance of equity is correct, and assets are overstated.

C) 2014 profit is overstated, the balance of equity is overstated, and assets are overstated.

D) 2014 profit is overstated, the balance of equity is overstated, and assets are ly stated.

A) 2014 profit is understated, the balance of equity is understated, and assets are understated.

B) 2014 profit is overstated, the balance of equity is correct, and assets are overstated.

C) 2014 profit is overstated, the balance of equity is overstated, and assets are overstated.

D) 2014 profit is overstated, the balance of equity is overstated, and assets are ly stated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

The period of time over which a non-current asset, such as a motor vehicle, is expected to be used by the entity is known as its:

A) carrying period.

B) useful life.

C) accumulated depreciation.

D) working life.

A) carrying period.

B) useful life.

C) accumulated depreciation.

D) working life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

When using a worksheet to prepare accounting reports in a manual accounting system, what is the correct set of column headings?

A) Unadjusted trial balance, adjustments, adjusted trial balance, income statement, balance sheet.

B) Opening balances at the start of the period, adjustments and adjusted trial balance.

C) Unadjusted trial balance, adjustments, income statement, balance sheet and statement of changes in equity.

D) Adjusted trial balance, income statement and balance sheet.

A) Unadjusted trial balance, adjustments, adjusted trial balance, income statement, balance sheet.

B) Opening balances at the start of the period, adjustments and adjusted trial balance.

C) Unadjusted trial balance, adjustments, income statement, balance sheet and statement of changes in equity.

D) Adjusted trial balance, income statement and balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

The capital account of a sole trader was credited with $5000. Which of these items would not give rise to such a credit?

A) The business earned a profit of $5000.

B) The owner brought in a private car valued at $5000 for business use.

C) The owner introduced $5000 new capital.

D) The owner paid an outstanding private gambling debt of $5000 from the business bank account.

A) The business earned a profit of $5000.

B) The owner brought in a private car valued at $5000 for business use.

C) The owner introduced $5000 new capital.

D) The owner paid an outstanding private gambling debt of $5000 from the business bank account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

To facilitate the evaluation of an entity's liquidity assets and liabilities are classified as:

A) tangible and intangible.

B) current and non-current.

C) operating and non-operating.

D) temporary and permanent.

A) tangible and intangible.

B) current and non-current.

C) operating and non-operating.

D) temporary and permanent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

Purple Co's employees carry out work to the value of $7500. They are paid $4500 immediately with the balance to be settled in the next accounting period. Under the accrual approach to profit measurement the amount of wages expense that will be recorded in the current period is:

A) $7500.

B) $4500.

C) $3000.

D) nil.

A) $7500.

B) $4500.

C) $3000.

D) nil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

The portion of a non-current asset, such as plant and equipment, which is transferred to an expense account during an accounting period, is known as:

A) carrying amount.

B) accumulated depreciation.

C) depreciation.

D) contra asset.

A) carrying amount.

B) accumulated depreciation.

C) depreciation.

D) contra asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

Current assets may be listed in the balance sheet in the order of their liquidity. Liquidity is:

A) another name for the operating cycle.

B) a measure of how many buyers there are for the asset.

C) whether the asset is secured over a liability.

D) the average length of time it takes to convert an asset into cash.

A) another name for the operating cycle.

B) a measure of how many buyers there are for the asset.

C) whether the asset is secured over a liability.

D) the average length of time it takes to convert an asset into cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of these is not an intangible asset?

A) Patents

B) Goodwill

C) Stock of books

D) Brand names

A) Patents

B) Goodwill

C) Stock of books

D) Brand names

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

The current liability is:

A) accrued delivery expenses.

B) accounts receivable.

C) electricity expense.

D) long-term loan.

A) accrued delivery expenses.

B) accounts receivable.

C) electricity expense.

D) long-term loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

The excess of current assets over current liabilities is known as:

A) tangible assets.

B) net assets.

C) intangible assets.

D) working capital.

A) tangible assets.

B) net assets.

C) intangible assets.

D) working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

On the first day of the year Mayo Resources purchased a forklift truck for $12 000 which is to be depreciated by 25% a year. At the end of the first year:

A) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $12 000.

B) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $15 000.

C) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $9000.

D) depreciation in the income statement is $0 and the carrying value of the forklift in the balance sheet is $12 000.

A) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $12 000.

B) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $15 000.

C) depreciation in the income statement is $3000 and the carrying value of the forklift in the balance sheet is $9000.

D) depreciation in the income statement is $0 and the carrying value of the forklift in the balance sheet is $12 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

The primary basis for the classification of assets and liabilities in the balance sheet is:

A) profitability.

B) liquidity.

C) age.

D) value.

A) profitability.

B) liquidity.

C) age.

D) value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assets that do not have a physical subsistence but which are expected to provide future benefits are known as:

A) non-current assets.

B) tangible assets.

C) intangible assets.

D) cash at bank.

A) non-current assets.

B) tangible assets.

C) intangible assets.

D) cash at bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

ABC collects rents from several properties. Prior to recording adjusting entries, assume the rent income account has a credit balance of $8000. Two adjustments are to be made at the end of the financial year (1) an accrual for accrued rent income of $600 (2) the unearned rent income account is to be decreased by $200. After processing these adjusting entries the amount of rent income to be shown in the income statement is:

A) $8800.

B) $8400.

C) $7600.

D) $7200.

A) $8800.

B) $8400.

C) $7600.

D) $7200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Indicate the order that the following current assets should be listed in the balance sheet.

I Accounts receivable

II Bank

III Stock of stationery

IV Prepaid expenses

A) I, II, III, IV

B) II, III, I, IV

C) II, I, III, IV

D) III, II, I, IV

I Accounts receivable

II Bank

III Stock of stationery

IV Prepaid expenses

A) I, II, III, IV

B) II, III, I, IV

C) II, I, III, IV

D) III, II, I, IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

Michael Myers & Co paid salaries of $150 000 during the year and owes $2200 for three days work carried out before the 31 December 2014 which will not be paid until January 3 2015. After the adjusting entry for the year ended 31 December 2014:

A) salaries in the income statement are $152 200 and accrued salaries in the balance sheet are $2200.

B) salaries in the income statement are $150 000 and accrued salaries in the balance sheet are $2200.

C) salaries in the income statement are $147 800 and accrued salaries in the balance sheet are $2200.

D) salaries in the income statement are $152 200 and accrued salaries in the balance sheet are zero.

A) salaries in the income statement are $152 200 and accrued salaries in the balance sheet are $2200.

B) salaries in the income statement are $150 000 and accrued salaries in the balance sheet are $2200.

C) salaries in the income statement are $147 800 and accrued salaries in the balance sheet are $2200.

D) salaries in the income statement are $152 200 and accrued salaries in the balance sheet are zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not an advantage of preparing an adjusted trial balance?

A) It verifies that the debits equal the credits in the ledger after the preparation of the adjusting entries.

B) It reduces the possibility of errors being carried forward from the ledger into the accounting reports.

C) It is a shortcut which means that the adjusting entries do not have to be entered into the ledger.

D) It assists in the preparation of the financial statements.

A) It verifies that the debits equal the credits in the ledger after the preparation of the adjusting entries.

B) It reduces the possibility of errors being carried forward from the ledger into the accounting reports.

C) It is a shortcut which means that the adjusting entries do not have to be entered into the ledger.

D) It assists in the preparation of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

The income statement columns on the worksheet are not equal because:

A) a mistake has been made in the adjustments section.

B) the columns have not been added up correctly.

C) the unadjusted trial balance was incorrect.

D) the difference is the profit or loss for the period.

A) a mistake has been made in the adjustments section.

B) the columns have not been added up correctly.

C) the unadjusted trial balance was incorrect.

D) the difference is the profit or loss for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

On a worksheet used in a manual accounting system to prepare the financial statements:

A) profit is shown as a debit to the income statement column and a credit to the balance sheet column.

B) profit is not shown.

C) profit is shown as a credit to the capital account and a debit to the bank account.

D) profit is shown as a debit to the adjustments column and a credit to the balance sheet column.

A) profit is shown as a debit to the income statement column and a credit to the balance sheet column.

B) profit is not shown.

C) profit is shown as a credit to the capital account and a debit to the bank account.

D) profit is shown as a debit to the adjustments column and a credit to the balance sheet column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of these is correct in matching decisions with information in financial reports?

A) Profitability - balance sheet

B) Solvency - income statement

C) Return on investment - income statement and balance sheet

D) Long-term borrowing - statement of changes in equity

A) Profitability - balance sheet

B) Solvency - income statement

C) Return on investment - income statement and balance sheet

D) Long-term borrowing - statement of changes in equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

At year-end it was forgotten to accrue an income item. This will result in an:

A) understatement of assets and an overstatement of profit and equity.

B) overstatement of liabilities and an understatement of profit and equity.

C) overstatement of assets, profit, and equity.

D) understatement of assets, profit, and equity.

A) understatement of assets and an overstatement of profit and equity.

B) overstatement of liabilities and an understatement of profit and equity.

C) overstatement of assets, profit, and equity.

D) understatement of assets, profit, and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

If an adjustment for depreciation is omitted from the financial reports, the effect is which of the following?

A) Assets are understated; profit is understated

B) Assets are overstated; profit is overstated

C) Assets are understated; profit is overstated

D) Assets are overstated; profit is understated

A) Assets are understated; profit is understated

B) Assets are overstated; profit is overstated

C) Assets are understated; profit is overstated

D) Assets are overstated; profit is understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck