Deck 10: Derivative Securities Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 10: Derivative Securities Markets

1

In a futures contract, if funds in the margin account fall below the maintenance margin requirement, a margin call is issued.

True

2

An in the money American call option increases in value as expiration approaches, but an out of the money American call option decreases in value as expiration approaches.

False

3

Which of the following is true?

A) Forward contracts have no default risk.

B) Futures contracts require an initial margin requirement be paid.

C) Forward contracts are marked to market daily.

D) Forward contract buyers and sellers do not know who the counterparty is.

E) Futures contracts are only traded over the counter.

A) Forward contracts have no default risk.

B) Futures contracts require an initial margin requirement be paid.

C) Forward contracts are marked to market daily.

D) Forward contract buyers and sellers do not know who the counterparty is.

E) Futures contracts are only traded over the counter.

B

4

Of the following, the most recent derivative security innovations are

A) foreign currency futures

B) interest rate futures

C) stock index futures

D) stock options

E) credit derivatives

A) foreign currency futures

B) interest rate futures

C) stock index futures

D) stock options

E) credit derivatives

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

You would expect the price quote for a put option to be at least $10 if the put had an exercise price of $40 and the underlying stock was selling for $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

The buyer of a call option on stock benefits if the underlying stock price rises or if the volatility of the stock's price increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

By convention, a swap buyer on an interest rate swap agrees to

A) periodically pay a fixed rate of interest and receive a floating rate of interest.

B) periodically pay a floating rate of interest and receive a fixed rate of interest.

C) swap both principle and interest at contract maturity.

D) back both sides of the swap agreement.

E) act as the dealer in the swap agreement.

A) periodically pay a fixed rate of interest and receive a floating rate of interest.

B) periodically pay a floating rate of interest and receive a fixed rate of interest.

C) swap both principle and interest at contract maturity.

D) back both sides of the swap agreement.

E) act as the dealer in the swap agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

American options can only be exercised at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

Marking to market of futures contracts is the process of realizing gains and losses each day as the futures contract changes in price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

Forward contracts are marked to market daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

A clearinghouse backs the buyer's and seller's position in a forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

Writing a put option results in a potentially limited gain and a potentially unlimited loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

An increase in which of the following would increase the price of a call option on common stock, ceteris paribus?

I) Stock price

II) Stock price volatility

III) Interest rates

IV) Exercise price

A) II only

B) II and IV only

C) I, II, and III only

D) I, III, and IV only

E) I, II, III, and IV

I) Stock price

II) Stock price volatility

III) Interest rates

IV) Exercise price

A) II only

B) II and IV only

C) I, II, and III only

D) I, III, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

Futures or option exchange members who take positions on contracts for only a few moments are called scalpers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

The purchaser of a T-bond futures contract priced at 101-16 at the time of sale agrees to deliver $100,000 face value Treasury bonds in exchange for receiving $101,500 at contract maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

A credit forward is a forward agreement that hedges against an increase in default risk on a loan after the loan has been created by a lender.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

European-style options are options that may only be exercised at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

If you think that interest rates are likely to rise substantially over the next several years, you might sell a T-bond futures contract or buy an interest rate cap to take advantage of your expectations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

A professional futures trader who buys and sells futures for his own account throughout the day but typically closes out his positions at the end of the day is called a

A) floor broker

B) day trader

C) position trader

D) specialist

E) hedger

A) floor broker

B) day trader

C) position trader

D) specialist

E) hedger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

A negotiated non-standardized agreement between a buyer and seller (with no third party involvement) to exchange an asset for cash at some future date, with the price set today is called a forward agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

A speculator may write a put option on stock with an exercise price of $15 and earn a $3 premium only if they thought

A) the stock price would stay above $12.

B) the stock volatility would increase.

C) the stock price would fall below $18.

D) the stock price would stay above $15.

E) the stock price would rise above $18 or fall below $12.

A) the stock price would stay above $12.

B) the stock volatility would increase.

C) the stock price would fall below $18.

D) the stock price would stay above $15.

E) the stock price would rise above $18 or fall below $12.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

A bank with short-term floating-rate assets funded by long-term fixed-rate liabilities could hedge this risk by

I) buying a T-bond futures contract.

II) buying options on a T-bond futures contract.

III) entering into a swap agreement to pay a fixed rate and receive a variable rate.

IV) entering into a swap agreement to pay a variable rate and receive a fixed rate.

A) I and III only

B) I, II, and IV only

C) II and IV only

D) III only

E) IV only

I) buying a T-bond futures contract.

II) buying options on a T-bond futures contract.

III) entering into a swap agreement to pay a fixed rate and receive a variable rate.

IV) entering into a swap agreement to pay a variable rate and receive a fixed rate.

A) I and III only

B) I, II, and IV only

C) II and IV only

D) III only

E) IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

New futures contracts must be approved by

A) the CFTC

B) the SEC

C) the Warren Commission

D) the NYSE

E) the Federal Reserve

A) the CFTC

B) the SEC

C) the Warren Commission

D) the NYSE

E) the Federal Reserve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

A bank with long-term fixed-rate assets funded with short-term rate-sensitive liabilities could do which of the following to limit their interest rate risk?

I) Buy a cap.

II) Buy an interest rate swap.

III) Buy a floor.

IV) Sell an interest rate swap.

A) I and II only

B) III only

C) I and IV only

D) II and III only

E) III and IV only

I) Buy a cap.

II) Buy an interest rate swap.

III) Buy a floor.

IV) Sell an interest rate swap.

A) I and II only

B) III only

C) I and IV only

D) II and III only

E) III and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

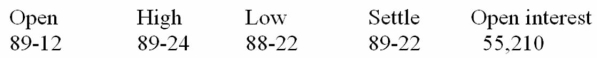

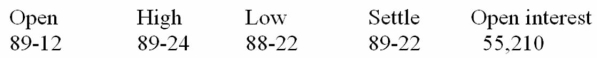

You find the following current quote for the March T-Bond contract: $100,000; Pts 32nd, of 100%  You went long in the contract at the open. Which of the following is/are true?

You went long in the contract at the open. Which of the following is/are true?

I) At the end of the day, your margin account would be increased.

II) 55,210 contracts were traded that day.

III) You agreed to deliver $100,000 face value T-Bonds in March in exchange for $89,120.

IV) You agreed to purchase $100,000 face value T-Bonds in March in exchange for $89,375.

A) I, II, and III only

B) I, II, and IV only

C) I and III only

D) I and IV only

E) IV only

You went long in the contract at the open. Which of the following is/are true?

You went long in the contract at the open. Which of the following is/are true?I) At the end of the day, your margin account would be increased.

II) 55,210 contracts were traded that day.

III) You agreed to deliver $100,000 face value T-Bonds in March in exchange for $89,120.

IV) You agreed to purchase $100,000 face value T-Bonds in March in exchange for $89,375.

A) I, II, and III only

B) I, II, and IV only

C) I and III only

D) I and IV only

E) IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

The higher the exercise price, the ________________ the value of a put and the _______________ the value of a call.

A) higher; higher

B) lower; lower

C) higher; lower

D) lower; higher

A) higher; higher

B) lower; lower

C) higher; lower

D) lower; higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

An interest rate collar is

A) writing a floor and writing a cap.

B) buying a cap and writing a floor.

C) an option on a futures contract.

D) buying a cap and buying a floor.

E) none of the above

A) writing a floor and writing a cap.

B) buying a cap and writing a floor.

C) an option on a futures contract.

D) buying a cap and buying a floor.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a bear market, which option positions make money?

I) Buying a call

II) Writing a call

III) Buying a put

IV) Writing a put

A) I and II

B) I and III

C) II and IV

D) II and III

E) I and IV

I) Buying a call

II) Writing a call

III) Buying a put

IV) Writing a put

A) I and II

B) I and III

C) II and IV

D) II and III

E) I and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

You have taken a stock option position and if the stock's price drops you will get a level gain no matter how far prices fall, but you could go bankrupt if the stock's price rises. You have:

A) bought a call option.

B) bought a put option.

C) written a call option.

D) written a put option.

E) written a straddle.

A) bought a call option.

B) bought a put option.

C) written a call option.

D) written a put option.

E) written a straddle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

You have taken a stock option position and if the stock's price increases you could lose a fixed small amount of money, but if the stock's price decreases your gain increases. You must have ________________________________.

A) bought a call option

B) bought a put option

C) written a call option

D) written a put option

E) purchased a straddle

A) bought a call option

B) bought a put option

C) written a call option

D) written a put option

E) purchased a straddle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

A contract that gives the holder the right to sell a security at a preset price only immediately before contract expiration is a(n)

A) American call option

B) European call option

C) American put option

D) European put option

E) knockout option

A) American call option

B) European call option

C) American put option

D) European put option

E) knockout option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

Measured by the amount outstanding, the largest type of derivative market in the world is the

A) futures market

B) forward market

C) swap market

D) options market

E) credit forward market

A) futures market

B) forward market

C) swap market

D) options market

E) credit forward market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

An agreement between two parties to exchange a series of specified periodic cash flows in the future based on some underlying instrument or price is a(n)

A) forward agreement

B) futures contract

C) interest rate collar

D) option contract

E) swap contract

A) forward agreement

B) futures contract

C) interest rate collar

D) option contract

E) swap contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

The swap market's primary direct government regulator is the

A) SEC

B) CFTC

C) NYSE

D) WTO

E) Nobody

A) SEC

B) CFTC

C) NYSE

D) WTO

E) Nobody

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

A stock has a spot price of $55. Its May options are about to expire. One of its puts is worth $5 and one of its calls is worth $10. The exercise price of the put must be ______________ and the exercise price of the call must be ________________.

A) $50; $45

B) $55; $55

C) $60; $45

D) $60; $50

E) One cannot tell from the information given.

A) $50; $45

B) $55; $55

C) $60; $45

D) $60; $50

E) One cannot tell from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

An interest rate floor is designed to protect an institution from

I) falling interest rates.

II) falling bond prices.

III) increased credit risk on loans.

IV) swap counterparty credit risk.

A) I and IV

B) II and III

C) I and III

D) II and IV

E) I only

I) falling interest rates.

II) falling bond prices.

III) increased credit risk on loans.

IV) swap counterparty credit risk.

A) I and IV

B) II and III

C) I and III

D) II and IV

E) I only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

An investor is committed to purchasing 100 shares of World Port Management stock in six months. She is worried the stock price will rise significantly over the next 6 months. The stock is at $45 and she buys a 6-month call with a strike of $50 for $250. At expiration the stock is at $54. What is the net economic gain or loss on the entire stock/option portfolio?

A) -$500

B) -$750

C) -$900

D) $400

E) $500 [[($45 - $54) * 100] + (($54- $50) * 100)] - $250 = -$750

A) -$500

B) -$750

C) -$900

D) $400

E) $500 [[($45 - $54) * 100] + (($54- $50) * 100)] - $250 = -$750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

You have agreed to deliver the underlying commodity on a futures contract in 90 days. Today the underlying commodity price rises and you get a margin call. You must have

A) a long position in a futures contract.

B) a short position in a futures contract.

C) sold a forward contract.

D) purchased a forward contract.

E) purchased a call option on a futures contract.

A) a long position in a futures contract.

B) a short position in a futures contract.

C) sold a forward contract.

D) purchased a forward contract.

E) purchased a call option on a futures contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

A higher level of which of the following variables would make a put option on common stock more valuable, ceteris paribus?

I) Stock price

II) Stock price volatility

III) Interest rates

IV) Exercise price

A) II only

B) II and IV only

C) I, II, and III only

D) I, III, and IV only

E) I, II, III, and IV

I) Stock price

II) Stock price volatility

III) Interest rates

IV) Exercise price

A) II only

B) II and IV only

C) I, II, and III only

D) I, III, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

An investor has unrealized gains in 100 shares of Amazin stock upon which they do not wish to pay taxes. However, they are now bearish upon the stock for the short term. The stock is at $76 and he buys a put with a strike of $75 for $300. At expiration the stock is at $68. What is the net gain or loss on the entire stock/option portfolio?

A) $700

B) -$800

C) -$400

D) -$200

E) -$100 [[($68 - $76) * 100] + (($75 - $68)*100)] - $300 = -$400

A) $700

B) -$800

C) -$400

D) -$200

E) -$100 [[($68 - $76) * 100] + (($75 - $68)*100)] - $300 = -$400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

How does a futures or option clearinghouse assist traders?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

Buying an at the money call option and writing an at the money put option are two ways to make money when prices rise. When would each be the preferable strategy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

When would an option hedge be better than a futures or forward hedge?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

A bank has made a risky loan to a midsize consumer goods manufacturer. With the weaker economy, the borrower is expected to have trouble repaying the loan. The bank decides to purchase a digital default option. Which one of the following payout patterns does a digital option provide?

A) The option seller pays a stated amount to the option buyer, usually the par on the loan or bond, in the event of a default on the underlying credit.

B) The option seller pays the buyer if the default risk premium or yield spread on a specified benchmark bond of the borrower increases above some exercise spread.

C) If the option buyer makes fixed periodic payments to the option seller, the seller will pay the option buyer if a credit event occurs.

D) If the option buyer makes periodic payments to the seller and delivers the underlying bond or loan, the seller pays the par value of the security.

E) If interest rates change, the option seller will begin making fixed-rate payments to the option buyer.

A) The option seller pays a stated amount to the option buyer, usually the par on the loan or bond, in the event of a default on the underlying credit.

B) The option seller pays the buyer if the default risk premium or yield spread on a specified benchmark bond of the borrower increases above some exercise spread.

C) If the option buyer makes fixed periodic payments to the option seller, the seller will pay the option buyer if a credit event occurs.

D) If the option buyer makes periodic payments to the seller and delivers the underlying bond or loan, the seller pays the par value of the security.

E) If interest rates change, the option seller will begin making fixed-rate payments to the option buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

What kind of interest rate option could FNMA use to limit the interest rate risk? Explain how this would work. Explain how a collar could also be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

A U.S. firm has a European subsidiary that earns euros. The subsidiary has borrowed dollars at a floating rate of interest. What kind of risk does the subsidiary have? What kind of swap could be used to limit the subsidiary's risk? Be specific.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

What determines the success or failure of an exchange-traded derivative contract? Why were currency and interest rate futures introduced in the early and late 1970s, respectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

A bank lender is concerned about the creditworthiness of one of its major borrowers. The bank is considering using a swap to reduce its credit exposure to this customer. Which type of swap would best meet this need?

A) Interest rate swap

B) Currency swap

C) Equity linked swap

D) Credit default swap

E) DIF swap

A) Interest rate swap

B) Currency swap

C) Equity linked swap

D) Credit default swap

E) DIF swap

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

If you buy the March put and don't exercise before contract maturity, you will make a profit if the stock price at maturity _______________________ from today's price.

A) increases by more than 9.65%

B) increases by more than 4.57%

C) decreases by more than 3.94%

D) decreases by more than 11.99%

E) does not decrease by more than 5.64% [(50 - 6.55)/45.23] - 1

A) increases by more than 9.65%

B) increases by more than 4.57%

C) decreases by more than 3.94%

D) decreases by more than 11.99%

E) does not decrease by more than 5.64% [(50 - 6.55)/45.23] - 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

A stock is priced at $27. An American call option on this stock with a $25 strike must be worth at least how much? Numerically show why.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

A contract where the buyer agrees to pay a specified interest rate on a loan where the loan will be originated at some future time is called a(n)

A) forward rate agreement

B) futures loan

C) option on a futures contract

D) interest rate swap contract

E) currency swap contract

A) forward rate agreement

B) futures loan

C) option on a futures contract

D) interest rate swap contract

E) currency swap contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

When would a forward contract be better for hedging than a futures contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

Based on the option quote, the Mar call should cost

A) more than $477

B) more than $102

C) less than $665 but more than $477

D) less than $225

E) $0 The Mar call price must be less than the Jun call price quote * 100

A) more than $477

B) more than $102

C) less than $665 but more than $477

D) less than $225

E) $0 The Mar call price must be less than the Jun call price quote * 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

My bank has a larger number of adjustable-rate mortgage loans outstanding. To protect our interest rate income on these loans the bank could

I) enter into a swap to pay fixed and receive variable.

II) enter into a swap to pay variable and receive fixed.

III) buy an interest rate floor.

IV) buy an interest rate cap.

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

I) enter into a swap to pay fixed and receive variable.

II) enter into a swap to pay variable and receive fixed.

III) buy an interest rate floor.

IV) buy an interest rate cap.

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

Based on the option quote, the June put should cost

I) more than $477

II) more than $665

III) more than the Mar and Jun 60 calls

IV) more than the Mar 60 call but no more than the Jun 60 call

A) I only

B) I, II, and IV only

C) I, II, and III only

D) I and III only

E) IV only The June put price must be greater than the intrinsic value of ($50-$45.23) * 100 and must be worth more than the Mar put price and both the March and Jun 60 calls.

I) more than $477

II) more than $665

III) more than the Mar and Jun 60 calls

IV) more than the Mar 60 call but no more than the Jun 60 call

A) I only

B) I, II, and IV only

C) I, II, and III only

D) I and III only

E) IV only The June put price must be greater than the intrinsic value of ($50-$45.23) * 100 and must be worth more than the Mar put price and both the March and Jun 60 calls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

Your firm enters into a swap agreement with a notional principle of $40 million where the firm pays a fixed-rate of interest of 5.50% and receives a variable-rate of interest equal to LIBOR plus 150 basis points. If LIBOR is currently 3.75%, the NET amount your firm will receive (+) or pay (-) on the next transaction date is

A) -$2,200,000

B) $2,625,000

C) $125,000

D) -$100,000

E) -$875,000 ((3.75% + 1.50%)-5.25%) * $40 million = -$100,000

A) -$2,200,000

B) $2,625,000

C) $125,000

D) -$100,000

E) -$875,000 ((3.75% + 1.50%)-5.25%) * $40 million = -$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

The type of swap most closely linked to the subprime mortgage crisis is the ____________.

A) interest rate swap

B) currency swap

C) equity linked swap

D) credit default swap

E) DIF swap

A) interest rate swap

B) currency swap

C) equity linked swap

D) credit default swap

E) DIF swap

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

Two competing fully electronic derivatives markets in the United States are

A) CME Globex and Eurex

B) Philadelphia Exchange and AMEX

C) NYSE and ABS

D) CME and Pacific Exchange

E) D-Trade and IMM

A) CME Globex and Eurex

B) Philadelphia Exchange and AMEX

C) NYSE and ABS

D) CME and Pacific Exchange

E) D-Trade and IMM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

When might an option on a futures contract be preferable to an option on the underlying instrument?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

What kind of interest rate swap could FNMA use to limit their interest rate risk? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

Suppose a stock is priced at $50. You are bullish on the stock and are considering buying March calls with an exercise price of $45 and $55, respectively. The 45 call is priced at $8.50 and the 55 call is quoted at $2.75. What should you consider in deciding which to purchase if you do not plan on exercising prior to maturity? Be specific.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

A stock is priced at $33.25. The stock has 35 call options that expire in 60 days. The underlying stock price volatility is 39% per year and the annual risk-free rate is 4.5%. According to the Black-Scholes option pricing model, what is the most you should be willing to pay for this call option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck