Deck 5: Money Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 5: Money Markets

1

The largest secondary money market in the United States is the secondary market for T-Bills.

True

2

A short-term unsecured promissory note issued by a company is

A) commercial paper.

B) T-Bills.

C) repurchase agreement.

D) negotiable CD.

E) banker's acceptance.

A) commercial paper.

B) T-Bills.

C) repurchase agreement.

D) negotiable CD.

E) banker's acceptance.

A

3

A time draft payable to a seller of goods, with payment guaranteed by a bank is a

A) commercial paper security.

B) T-Bill.

C) repurchase agreement.

D) negotiable CD.

E) banker's acceptance.

A) commercial paper security.

B) T-Bill.

C) repurchase agreement.

D) negotiable CD.

E) banker's acceptance.

E

4

For the purposes for which they are used, money market securities should have which of the following characteristics?

I) Low trading costs

II) Little price risk

III) High rate of return

IV) Life greater than one year

A) I and III

B) II and IV

C) III and IV

D) I and II

E) I, II, and III

I) Low trading costs

II) Little price risk

III) High rate of return

IV) Life greater than one year

A) I and III

B) II and IV

C) III and IV

D) I and II

E) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the T-Bill secondary market the ask yield will normally be less than the bid yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

The bond equivalent yield times 365/360 is equal to the single payment yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

The U.S. Treasury switched from a discriminating price auction to a single price auction because the latter lowered the average price paid by investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

The majority of money market securities are low denomination, low risk investments designed to appeal to individual investors with excess cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

Commercial paper is a short term obligation of the U.S. government issued to cover government budget deficits and to refinance maturing government debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

A repo is in essence a collateralized

A) banker's acceptance.

B) certificate of deposit.

C) Fed funds loan.

D) commercial paper loan.

E) Eurodollar deposit.

A) banker's acceptance.

B) certificate of deposit.

C) Fed funds loan.

D) commercial paper loan.

E) Eurodollar deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fed funds are short-term unsecured loans while repos are short-term secured loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

Commercial paper, Treasury bills, and banker's acceptance rates are all quoted as discount yields.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

Money markets exist to help reduce the opportunity cost of holding cash balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

Everything else equal, an effective annual rate will be greater than the bond equivalent yield on the same security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

Euro commercial paper is a short-term obligation of the European Central Bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

In the T-Bill auction process, the competitive bidder is guaranteed a ______________ and a noncompetitive bidder is guaranteed a _______________.

A) minimum price; maximum price

B) maximum price; minimum price

C) maximum price; given quantity

D) minimum price; maximum quantity

E) none of the above

A) minimum price; maximum price

B) maximum price; minimum price

C) maximum price; given quantity

D) minimum price; maximum quantity

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

A dealer is quoting a $10,000 face 180-day T-Bill quoted at 2.75 bid, 2.65 ask. You could buy this bill at ______________ or sell it at _______________.

A) $9,869.23; $9864.36

B) $9864.36; $9,869.23

C) $9,867.50; $9862.50

D) $9,862.50; $9,867.50

E) none of the above Buy at 10,000 *[1-(0.0265 *80/360)]; Sell at 10,000 * [1-(0.0275 *180/360)]

A) $9,869.23; $9864.36

B) $9864.36; $9,869.23

C) $9,867.50; $9862.50

D) $9,862.50; $9,867.50

E) none of the above Buy at 10,000 *[1-(0.0265 *80/360)]; Sell at 10,000 * [1-(0.0275 *180/360)]

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

Money market securities exhibit which of the following?

I) Large denomination

II) Maturity greater than one year

III) Low default risk

IV) Contractually determined cash flows

A) I, II, and III

B) I, III, and IV

C) II, III, and IV

D) II and IV

E) I, II, III, and IV

I) Large denomination

II) Maturity greater than one year

III) Low default risk

IV) Contractually determined cash flows

A) I, II, and III

B) I, III, and IV

C) II, III, and IV

D) II and IV

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

Rates on federal funds and repurchase agreements are stated

A) on a bond equivalent basis with a 360 day year.

B) on a bond equivalent basis with a 365 day year.

C) as a discount yield with a 360 day year.

D) as an EAR.

E) as a discount yield with a 365 day year.

A) on a bond equivalent basis with a 360 day year.

B) on a bond equivalent basis with a 365 day year.

C) as a discount yield with a 360 day year.

D) as an EAR.

E) as a discount yield with a 365 day year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

360/h times the difference between the face value and the current value divided by the face value gives you the discount yield on an instrument.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

From 1990 to 2010, which one of the following money market securities actually declined in terms of dollar amount outstanding?

A) Commercial paper

B) Treasury bills

C) Federal funds and repos

D) Negotiable CDs

E) Banker's Acceptances

A) Commercial paper

B) Treasury bills

C) Federal funds and repos

D) Negotiable CDs

E) Banker's Acceptances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

A $2 million jumbo CD is paying a quoted 3.55% interest rate on 180-day maturity CDs. How much money will you have at maturity if you invest in the CD?

A) $2,000,000

B) $2,035,014

C) $2,035,500

D) $2,071,000

E) $2,088,400 2,000,000 * [1 + (0.0355*180/360)]

A) $2,000,000

B) $2,035,014

C) $2,035,500

D) $2,071,000

E) $2,088,400 2,000,000 * [1 + (0.0355*180/360)]

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

A banker's acceptance is

A) a time draft drawn on the exporter's bank.

B) a method to help importers evaluate the creditworthiness of exporters.

C) a liability of the importer and the importer's bank.

D) an add on instrument.

E) for greater than 1 year maturity.

A) a time draft drawn on the exporter's bank.

B) a method to help importers evaluate the creditworthiness of exporters.

C) a liability of the importer and the importer's bank.

D) an add on instrument.

E) for greater than 1 year maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

A 50-day maturity money market security has a bond equivalent yield of 3.60%. The security's EAR is

A) 3.69%.

B) 3.61%.

C) 3.55%.

D) 3.87%.

E) 3.66%. EAR = (1 + (0.0360/(365/50)))365/50 - 1 = 3.66%

A) 3.69%.

B) 3.61%.

C) 3.55%.

D) 3.87%.

E) 3.66%. EAR = (1 + (0.0360/(365/50)))365/50 - 1 = 3.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

A U.S. exporter sells $150,000 of furniture to a Latin American importer. The exporter requires the importer to obtain a letter of credit. When the bank accepts the draft the exporter discounts the 120-day note at a 5.25% discount. What is the exporter's true effective annual financing cost?

A) 5.52%

B) 5.42%

C) 5.34%

D) 5.29%

E) 5.25% 150,000 * [1-(0.0525 * 120/360)] = 147,375; (150,000/147,375)365/120 -1 = 5.52%

A) 5.52%

B) 5.42%

C) 5.34%

D) 5.29%

E) 5.25% 150,000 * [1-(0.0525 * 120/360)] = 147,375; (150,000/147,375)365/120 -1 = 5.52%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a $10,000 par T-Bill has a 3.75% discount quote and a 90-day maturity, what is the price of the T-Bill to the nearest dollar?

A) $9,625

B) $9,906

C) $9,908

D) $9,627

E) None of the above 10,000 * [1-(0.0375 * 90/360)] = 9,906

A) $9,625

B) $9,906

C) $9,908

D) $9,627

E) None of the above 10,000 * [1-(0.0375 * 90/360)] = 9,906

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

A Chinese exporter sells $200,000 of toys to a French importer. The Chinese exporter requires the French importer to obtain a letter of credit. When the bank accepts the draft the exporter discounts the 90-day note at a 4% discount. What is the exporter's true effective annual financing cost?

A) 4.00%

B) 4.04%

C) 4.10%

D) 4.16%

E) 4.22% 200,000 * [1-(0.04 * 90/360)] = 198,000; (200,000/198,000)365/90 -1 = 4.16%

A) 4.00%

B) 4.04%

C) 4.10%

D) 4.16%

E) 4.22% 200,000 * [1-(0.04 * 90/360)] = 198,000; (200,000/198,000)365/90 -1 = 4.16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose that $10 million face value commercial paper with a 270-day maturity is selling for $9.55 million. What is the BEY on the paper?

A) 4.71%

B) 6.42%

C) 6.37%

D) 6.28%

E) 4.50% ((10 million/9.55 million) - 1)* (365/270)

A) 4.71%

B) 6.42%

C) 6.37%

D) 6.28%

E) 4.50% ((10 million/9.55 million) - 1)* (365/270)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

If your firm enters into an overnight reverse repurchase agreement your firm is

A) borrowing Fed funds temporarily.

B) selling a security now while agreeing to buy it back tomorrow.

C) giving an unsecured loan to the counterparty.

D) procuring a banker's acceptance.

E) none of the above.

A) borrowing Fed funds temporarily.

B) selling a security now while agreeing to buy it back tomorrow.

C) giving an unsecured loan to the counterparty.

D) procuring a banker's acceptance.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

In a Treasury auction, preferential bidding status is granted to

A) competitive bidders.

B) noncompetitive bidders.

C) short sale committed bidders.

D) commercial bank bidders.

E) no group of bidders.

A) competitive bidders.

B) noncompetitive bidders.

C) short sale committed bidders.

D) commercial bank bidders.

E) no group of bidders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

In dollars outstanding in 2010 the largest money market security was

A) commercial paper.

B) banker's acceptances.

C) T-Bills.

D) Fed funds & repos.

A) commercial paper.

B) banker's acceptances.

C) T-Bills.

D) Fed funds & repos.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which one of the following statements about commercial paper is NOT true?

Commercial paper issued in the United States

A) is an unsecured short-term promissory note.

B) has a maximum maturity of 270 days.

C) is virtually always rated by at least one ratings agency.

D) has no secondary market.

E) carries an interest rate above the prime rate.

Commercial paper issued in the United States

A) is an unsecured short-term promissory note.

B) has a maximum maturity of 270 days.

C) is virtually always rated by at least one ratings agency.

D) has no secondary market.

E) carries an interest rate above the prime rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

A 180 day $3 million CD has a 4.25% annual rate quote. If you buy the CD, how much will you collect in 180 days?

A) $3,047,439

B) $3,045.678

C) $3,062,877

D) $3,063,750

E) $3,127,500 $3 million * [1 + (0.0425 *180/360)]

A) $3,047,439

B) $3,045.678

C) $3,062,877

D) $3,063,750

E) $3,127,500 $3 million * [1 + (0.0425 *180/360)]

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

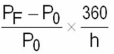

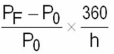

The following formula is used to calculate the _____________ of a money market investment.

A) EAR

B) APR

C) single-payment yield

D) discount yield

E) BEY

A) EAR

B) APR

C) single-payment yield

D) discount yield

E) BEY

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

The most liquid of the money market securities are

A) commercial paper.

B) banker's acceptances.

C) T-Bills.

D) Fed funds.

E) repurchase agreements.

A) commercial paper.

B) banker's acceptances.

C) T-Bills.

D) Fed funds.

E) repurchase agreements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

The discount yield on a T-Bill differs from the T-bill's bond equivalent yield (BEY) because

I) The discount yield is the return per dollar of face value and the BEY is a return per dollar originally invested.

II) A 360-day year is used on the discount yield and the BEY uses 365 days.

III) The discount yield is calculated without compounding, the BEY is calculated with compounding.

A) I only

B) II only

C) I and II only

D) II and III only

E) I, II, and III

I) The discount yield is the return per dollar of face value and the BEY is a return per dollar originally invested.

II) A 360-day year is used on the discount yield and the BEY uses 365 days.

III) The discount yield is calculated without compounding, the BEY is calculated with compounding.

A) I only

B) II only

C) I and II only

D) II and III only

E) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

A negotiable CD

A) is a bank issued transactions deposit.

B) is a registered instrument.

C) is a bank issued time deposit.

D) has denominations ranging from $50,000 to $10 million.

E) pays discount interest.

A) is a bank issued transactions deposit.

B) is a registered instrument.

C) is a bank issued time deposit.

D) has denominations ranging from $50,000 to $10 million.

E) pays discount interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

You buy a $10,000 par Treasury bill at $9,575 and sell it 60 days later for $9,675. What was your EAR?

A) 4.44%

B) 6.29%

C) 6.35%

D) 6.52%

E) 6.67%

A) 4.44%

B) 6.29%

C) 6.35%

D) 6.52%

E) 6.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

LIBOR is generally _______________ the Fed funds rate because foreign bank deposits are generally ________________ than domestic bank deposits.

A) greater than; less risky

B) less than; more risky

C) the same as; equally risk

D) greater than; more risky

E) less than; less risky

A) greater than; less risky

B) less than; more risky

C) the same as; equally risk

D) greater than; more risky

E) less than; less risky

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

A 90-day T-Bill is selling for $9,900. The par is $10,000. The effective annual return on the T-Bill is (watch your rounding)

A) 4.00%.

B) 4.16%.

C) 4.10%.

D) 4.04%.

E) 4.21%. (10,000/9900)(365/90) - 1

A) 4.00%.

B) 4.16%.

C) 4.10%.

D) 4.04%.

E) 4.21%. (10,000/9900)(365/90) - 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

How does a repo differ from a Fed Funds transaction? How do their rates compare?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

One-hundred-eighty-day commercial paper can be bought at a 3.75% discount. What are the bond equivalent yield and the effective annual rate on the commercial paper? Why do these rates differ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

As a corporate treasurer who is unsure how soon funds will be needed, which type of money market investment might you prefer? Explain the trade-offs. Would your answer differ if you had a definite time period during which you would not need the money? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

Given the functions of the money markets, why is it necessary for money market securities to have a maturity of one year or less and low default risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

Why do most money market securities have large denominations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the difference between a discriminating auction and a single-price auction? How is the final price determined in a single-price auction? Why did the Treasury switch to a single-price auction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

A corporate treasurer is looking to invest about $4 million for 60 days. Commercial paper rates are a 3.65% discount and CD rates are 3.66%. Comparing the bond equivalent yields over a 365-day year, which is the best alternative? What is the opportunity cost of leaving the funds idle? (Watch your rounding)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

You are a corporate treasurer for Esso Oil. The quoted rate on dollar denominated euro commercial paper has just blipped down recently. Your firm can issue $10 million of 180-day euro commercial paper in the London markets at 3.45%. You can also invest the proceeds in the United States in comparable maturity negotiable dollar-denominated CDs, which are quoting 3.95%. Ignoring any transactions costs, how much money, if any, can Esso make by borrowing in the euro markets and investing in the United States? Is this a good deal or not? Should you expect it to last? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

How does a banker's acceptance help create more international trade?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

Who are the major participants in money markets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

A government securities dealer needs to make a 7% pre-tax annual return on $10 million of capital employed to make it worthwhile to make a market in T-Bills. If the bid discount on $10,000 face value, ninety day T-Bills is 3.50%, and the dealer can expect to do 5200 round trip deals today what must the ask discount be? Hint: A round trip is a buy and a sell transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck