Deck 13: Capital Budgeting Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

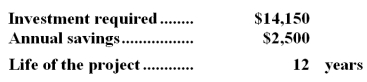

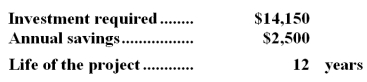

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

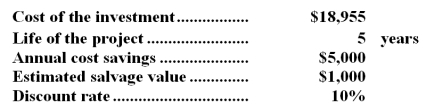

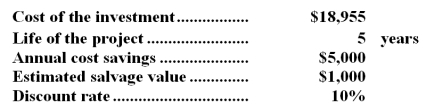

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/137

العب

ملء الشاشة (f)

Deck 13: Capital Budgeting Decisions

1

The net present value method assumes that the project's cash flows are reinvested at the:

A)internal rate of return.

B)the simple rate of return.

C)the discount rate used in the net present value calculation.

D)the payback rate of return.

A)internal rate of return.

B)the simple rate of return.

C)the discount rate used in the net present value calculation.

D)the payback rate of return.

C

2

An investment project with a project profitability index of less than zero should ordinarily be rejected.

True

3

The payback method of making capital budgeting decisions gives full consideration to the time value of money.

False

4

In preference decision situations,a project with a high net present value will always be preferable to a project with a lower net present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

5

An investment project that requires a present investment of $210,000 will have cash inflows of "R" dollars each year for the next five years.The project will terminate in five years.Consider the following statements (ignore income tax considerations): I.If "R" is less than $42,000,the payback period exceeds the life of the project.

II)If "R" is greater than $42,000,the payback period exceeds the life of the project.

III)If "R" equals $42,000,the payback period equals the life of the project.

Which statement(s) is (are) true?

A)Only I and II.

B)Only I and III.

C)Only II and III.

D)I,II,and III.

II)If "R" is greater than $42,000,the payback period exceeds the life of the project.

III)If "R" equals $42,000,the payback period equals the life of the project.

Which statement(s) is (are) true?

A)Only I and II.

B)Only I and III.

C)Only II and III.

D)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

6

When the net present value method is used,the internal rate of return is the discount rate used to compute the net present value of a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

7

When using internal rate of return to evaluate investment projects,if the internal rate of return is less than the required rate of return,the project would be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

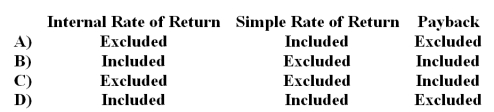

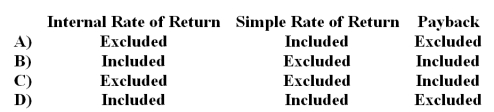

8

(Ignore income taxes in this problem. ) How is depreciation handled by the following capital budgeting techniques?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

9

The net present value method assumes that cash flows from a project are immediately reinvested at a rate of return equal to the discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

10

The payback method measures:

A)how quickly investment dollars may be recovered.

B)the cash flow from an investment.

C)the economic life of an investment.

D)the project profitability of an investment.

A)how quickly investment dollars may be recovered.

B)the cash flow from an investment.

C)the economic life of an investment.

D)the project profitability of an investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

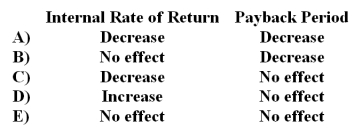

11

Rennin Dairy Corporation is considering a plant expansion decision that has an estimated useful life of 20 years.This project has an internal rate of return of 15% and a payback period of 9.6 years.How would a decrease in the expected salvage value from this project in 20 years affect the following for this project?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

12

Screening decisions follow preference decisions and seek to rank investment proposals in order of their desirability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

13

Cresol Corporation has a large number of potential investment opportunities that are acceptable.However,Cresol does not have enough investment funds to invest in all of them.Which calculation would be the best one for Cresol to use to determine which projects to choose?

A)payback period

B)simple rate of return

C)net present value

D)project profitability index

A)payback period

B)simple rate of return

C)net present value

D)project profitability index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

14

In capital budgeting decisions,a $10,000 decrease in annual cash outflows can be treated as if it is a $10,000 increase in annual cash inflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

15

The payback period is the length of time it takes for an investment to recoup its initial cost out of the cash receipts it generates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

16

A weakness of the internal rate of return method for screening investment projects is that it:

A)does not consider the time value of money.

B)implicitly assumes that the company is able to reinvest cash flows from the project at the company's discount rate.

C)implicitly assumes that the company is able to reinvest cash flows from the project at the internal rate of return.

D)does not take into account all of the cash flows from a project.

A)does not consider the time value of money.

B)implicitly assumes that the company is able to reinvest cash flows from the project at the company's discount rate.

C)implicitly assumes that the company is able to reinvest cash flows from the project at the internal rate of return.

D)does not take into account all of the cash flows from a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

17

The total-cost approach and the incremental-cost approach to evaluating two competing investment opportunities:

A)are dissimilar in that one deals with net present value and the other deals with internal rate of return.

B)are similar in that they will recommend the same alternative as the best.

C)are dissimilar in that one uses the cost of capital as a discount rate and the other does not.

D)are similar in that neither considers the time value of money.

A)are dissimilar in that one deals with net present value and the other deals with internal rate of return.

B)are similar in that they will recommend the same alternative as the best.

C)are dissimilar in that one uses the cost of capital as a discount rate and the other does not.

D)are similar in that neither considers the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

18

A project profitability index greater than zero for a project indicates that:

A)the discount rate is less than the internal rate of return.

B)there has been a calculation error.

C)the project is unattractive and should not be pursued.

D)the company should reevaluate its discount rate.

A)the discount rate is less than the internal rate of return.

B)there has been a calculation error.

C)the project is unattractive and should not be pursued.

D)the company should reevaluate its discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

19

One strength of the simple rate of return method is that it takes into account the time value of money in computing the return on an investment project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

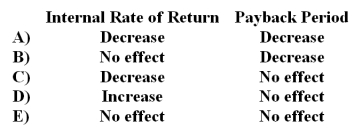

20

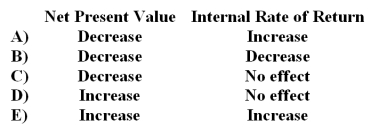

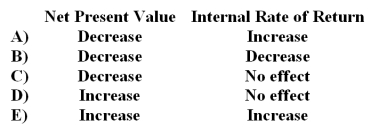

In capital budgeting,what will be the effect on the following if there is an increase in the discount rate?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

21

(Ignore income taxes in this problem. ) Arthur operates a part-time auto repair service.He estimates that a new diagnostic computer system will result in increased cash inflows of $2,100 in Year 1,$3,200 in Year 2,and $4,000 in Year 3.If Arthur's discount rate is 10%,then the most he would be willing to pay for the new computer system would be:

A)$6,652

B)$6,984

C)$7,747

D)$7,556

A)$6,652

B)$6,984

C)$7,747

D)$7,556

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

22

(Ignore income taxes in this problem. ) Highpoint,Inc. ,is considering investing in automated equipment with a ten-year useful life.Managers at Highpoint have estimated the cash flows associated with the tangible costs and benefits of automation,but have been unable to estimate the cash flows associated with the intangible benefits.Using the company's 10% discount rate,the net present value of the cash flows associated with just the tangible costs and benefits is a negative $184,350.How large would the annual net cash inflows from the intangible benefits have to be to make this a financially acceptable investment?

A)$18,435

B)$30,000

C)$35,000

D)$37,236

A)$18,435

B)$30,000

C)$35,000

D)$37,236

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

23

(Ignore income taxes in this problem. ) Kumanu,Inc.is considering investing in new FMS equipment for its factory.This equipment will cost $80,000,is expected to last 6 years,and is expected to have a $10,000 salvage value at the end of 6 years.The new equipment is expected to generate cost savings of $20,000 per year in each of the 6 years.Kumanu's discount rate is 16%.What is the net present value of this equipment?

A)$(2,200)

B)$3,700

C)$20,500

D)$(34,950)

A)$(2,200)

B)$3,700

C)$20,500

D)$(34,950)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

24

(Ignore income taxes in this problem) The management of Boie Corporation is considering the purchase of a machine that would cost $330,980 and would have a useful life of 6 years.The machine would have no salvage value.The machine would reduce labor and other operating costs by $76,000 per year.The internal rate of return on the investment in the new machine is closest to:

A)11%

B)10%

C)12%

D)7%

A)11%

B)10%

C)12%

D)7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

25

(Ignore income taxes in this problem. ) The Whitton Company uses a discount rate of 16%.The company has an opportunity to buy a machine now for $18,000 that will yield cash inflows of $10,000 per year for each of the next three years.The machine would have no salvage value.The net present value of this machine to the nearest whole dollar is:

A)$22,460

B)$4,460

C)$(9,980)

D)$12,000

A)$22,460

B)$4,460

C)$(9,980)

D)$12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

26

(Ignore income taxes in this problem. ) Pare Long-Haul,Inc.is considering the purchase of a tractor-trailer that would cost $104,520,would have a useful life of 6 years,and would have no salvage value.The tractor-trailer would be used in the company's hauling business,resulting in additional net cash inflows of $24,000 per year.The internal rate of return on the investment in the tractor-trailer is closest to:

A)10%

B)8%

C)13%

D)11%

A)10%

B)8%

C)13%

D)11%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

27

(Ignore income taxes in this problem. ) Stratford Company purchased a machine with an estimated useful life of seven years.The machine will generate cash inflows of $90,000 each year over the next seven years.If the machine has no salvage value at the end of seven years,and assuming the company's discount rate is 10%,what is the purchase price of the machine if the net present value of the investment is $170,000?

A)$221,950

B)$170,000

C)$268,120

D)$438,120

A)$221,950

B)$170,000

C)$268,120

D)$438,120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

28

The capital budgeting method that divides a project's annual incremental net operating income by the initial investment is the:

A)internal rate of return method.

B)the simple rate of return method.

C)the payback method.

D)the net present value method.

A)internal rate of return method.

B)the simple rate of return method.

C)the payback method.

D)the net present value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

29

(Ignore income taxes in this problem) The management of Rousseau Corporation is considering the purchase of a machine that would cost $340,000,would last for 8 years,and would have no salvage value.The machine would reduce labor and other costs by $67,000 per year.The company requires a minimum pretax return of 15% on all investment projects.The net present value of the proposed project is closest to:

A)$196,000

B)-$120,437

C)-$39,371

D)$64,073

A)$196,000

B)-$120,437

C)-$39,371

D)$64,073

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

30

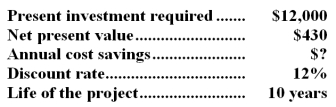

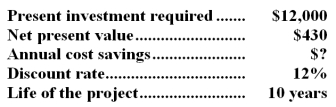

(Ignore income taxes in this problem. ) Sue Falls is the president of Sports,Inc.She is considering buying a new machine that would cost $14,125.Sue has determined that the new machine promises an internal rate of return of 12%,but Sue has misplaced the paper which tells the annual cost savings promised by the new machine.She does remember that the machine has a projected life of 10 years.Based on these data,the annual cost savings are:

A)It is impossible to determine from the data given.

B)$1,412.50

C)$2,500.00

D)$1,695.00

A)It is impossible to determine from the data given.

B)$1,412.50

C)$2,500.00

D)$1,695.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

31

(Ignore income taxes in this problem. ) Valdivieso Roofing is considering the purchase of a crane that would cost $137,885,would have a useful life of 9 years,and would have no salvage value.The use of the crane would result in labor savings of $23,000 per year.The internal rate of return on the investment in the crane is closest to:

A)6%

B)8%

C)11%

D)9%

A)6%

B)8%

C)11%

D)9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

32

(Ignore income taxes in this problem. ) Banderas Corporation is considering the purchase of a machine that would cost $330,000 and would last for 9 years.At the end of 9 years,the machine would have a salvage value of $79,000.By reducing labor and other operating costs,the machine would provide annual cost savings of $59,000.The company requires a minimum pretax return of 12% on all investment projects.The net present value of the proposed project is closest to:

A)$12,871

B)$63,352

C)-$15,648

D)$35,692

A)$12,871

B)$63,352

C)-$15,648

D)$35,692

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

33

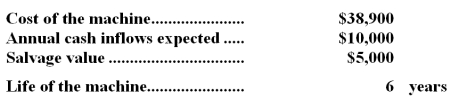

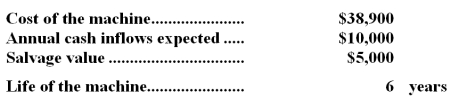

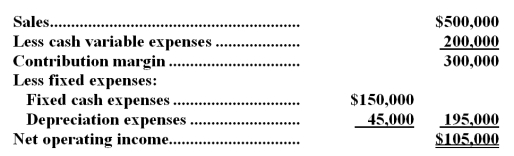

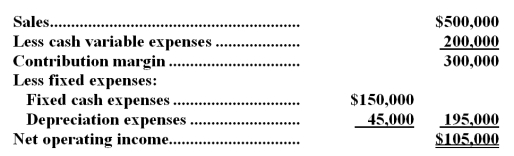

(Ignore income taxes in this problem. ) Boston Company is contemplating the purchase of a new machine on which the following information has been gathered:  The company's discount rate is 16%,and the machine will be depreciated using the straight-line method.Given these data,the machine has a net present value of:

The company's discount rate is 16%,and the machine will be depreciated using the straight-line method.Given these data,the machine has a net present value of:

A)-$26,100

B)-$23,900

C)$0

D)+$26,100

The company's discount rate is 16%,and the machine will be depreciated using the straight-line method.Given these data,the machine has a net present value of:

The company's discount rate is 16%,and the machine will be depreciated using the straight-line method.Given these data,the machine has a net present value of:A)-$26,100

B)-$23,900

C)$0

D)+$26,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

34

(Ignore income taxes in this problem. ) Joe Flubup is the president of Flubup,Inc.He is considering buying a new machine that would cost $25,470.Joe has determined that the new machine promises an internal rate of return of 14%,but Joe has misplaced the paper which tells the annual cost savings promised by the new machine.He does remember that the machine has a projected life of 12 years.Based on these data,the annual cost savings are:

A)It is impossible to determine from the given data.

B)$2,122.50

C)$4,500.00

D)$4,650.00

A)It is impossible to determine from the given data.

B)$2,122.50

C)$4,500.00

D)$4,650.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

35

(Ignore income taxes in this problem. ) Parks Company is considering an investment proposal in which a working capital investment of $10,000 would be required.The investment would provide cash inflows of $2,000 per year for six years.The working capital would be released for use elsewhere when the project is completed.If the company's discount rate is 10%,the investment's net present value is:

A)$1,290

B)$(1,290)

C)$2,000

D)$4,350

A)$1,290

B)$(1,290)

C)$2,000

D)$4,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

36

(Ignore income taxes in this problem. ) Dokes,Inc.is considering the purchase of a machine that would cost $440,000 and would last for 9 years.At the end of 9 years,the machine would have a salvage value of $62,000.The machine would reduce labor and other costs by $81,000 per year.Additional working capital of $8,000 would be needed immediately.All of this working capital would be recovered at the end of the life of the machine.The company requires a minimum pretax return of 13% on all investment projects.The net present value of the proposed project is closest to:

A)-$24,308

B)-$8,998

C)-$27,030

D)-$3,662

A)-$24,308

B)-$8,998

C)-$27,030

D)-$3,662

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

37

(Ignore income taxes in this problem. ) The following information concerns a proposed investment:  The internal rate of return is (do not interpolate):

The internal rate of return is (do not interpolate):

A)14%

B)12%

C)10%

D)5%

The internal rate of return is (do not interpolate):

The internal rate of return is (do not interpolate):A)14%

B)12%

C)10%

D)5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

38

(Ignore income taxes in this problem. ) The following data pertain to an investment:  The net present value of the proposed investment is:

The net present value of the proposed investment is:

A)$3,355

B)$(3,430)

C)$0

D)$621

The net present value of the proposed investment is:

The net present value of the proposed investment is:A)$3,355

B)$(3,430)

C)$0

D)$621

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

39

(Ignore income taxes in this problem. ) Given the following data:  Based on the data given,the annual cost savings would be:

Based on the data given,the annual cost savings would be:

A)$1,630.00

B)$2,200.00

C)$2,123.89

D)$2,553.89

Based on the data given,the annual cost savings would be:

Based on the data given,the annual cost savings would be:A)$1,630.00

B)$2,200.00

C)$2,123.89

D)$2,553.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

40

(Ignore income taxes in this problem. ) Cuarto Corporation just invested in a project that has an internal rate of return of 24%.This project is expected to generate $44,000 of net cash inflows each year of its 6 year life.The project has no salvage value.What was the initial investment required for this project?

A)$63,360

B)$72,600

C)$132,880

D)$160,000

A)$63,360

B)$72,600

C)$132,880

D)$160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

41

(Ignore income taxes in this problem. ) Picado,Inc.is investigating an investment in equipment that would have a useful life of 8 years.The company uses a discount rate of 9% in its capital budgeting.The net present value of the investment,excluding the salvage value,is -$389,000.To the nearest whole dollar how large would the salvage value of the equipment have to be to make the investment in the equipment financially attractive?

A)$774,900

B)$35,010

C)$389,000

D)$4,322,222

A)$774,900

B)$35,010

C)$389,000

D)$4,322,222

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

42

(Ignore income taxes in this problem. ) Burwinkel Corporation is considering a project that would require an investment of $252,000 and would last for 7 years.The incremental annual revenues and expenses generated by the project during those 7 years would be as follows:  The scrap value of the project's assets at the end of the project would be $28,000.The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $28,000.The payback period of the project is closest to:

A)1.1 years

B)1.3 years

C)1.4 years

D)1.5 years

The scrap value of the project's assets at the end of the project would be $28,000.The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $28,000.The payback period of the project is closest to:A)1.1 years

B)1.3 years

C)1.4 years

D)1.5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

43

(Ignore income taxes in this problem) Digrande Corporation is investigating buying a small used aircraft for the use of its executives.The aircraft would have a useful life of 6 years.The company uses a discount rate of 12% in its capital budgeting.The net present value of the investment,excluding the salvage value of the aircraft,is -$250,113.Management is having difficulty estimating the salvage value of the aircraft.To the nearest whole dollar how large would the salvage value of the aircraft have to be to make the investment in the aircraft financially attractive?

A)$30,014

B)$2,084,275

C)$250,113

D)$493,320

A)$30,014

B)$2,084,275

C)$250,113

D)$493,320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

44

(Ignore income taxes in this problem) The management of Malit Corporation is investigating an investment in equipment that would have a useful life of 9 years.The company uses a discount rate of 17% in its capital budgeting.The net present value of the investment,excluding the annual cash inflow,is -$367,742.To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive?

A)$62,516

B)$82,620

C)$40,860

D)$367,742

A)$62,516

B)$82,620

C)$40,860

D)$367,742

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

45

A project requires an initial investment of $70,000 and has a project profitability index of 0.141.The present value of the future cash inflows from this investment is:

A)$61,350

B)$68,920

C)$75,210

D)$79,870

A)$61,350

B)$68,920

C)$75,210

D)$79,870

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

46

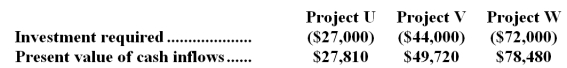

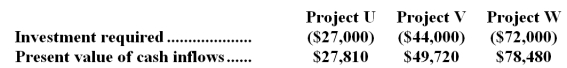

(Ignore income taxes in this problem. ) The management of Eversman Corporation is considering the following three investment projects:  Rank the projects according to the profitability index,from most profitable to least profitable.

Rank the projects according to the profitability index,from most profitable to least profitable.

A)V,U,W

B)U,W,V

C)W,V,U

D)V,W,U

Rank the projects according to the profitability index,from most profitable to least profitable.

Rank the projects according to the profitability index,from most profitable to least profitable.A)V,U,W

B)U,W,V

C)W,V,U

D)V,W,U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

47

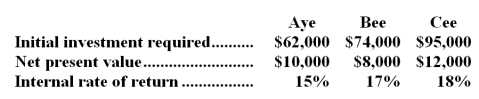

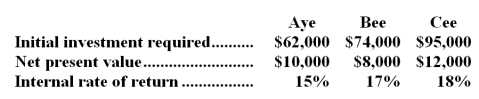

Fonics Corporation is considering the following three competing investment proposals:  Using the project profitability index,how would the above investments be ranked (highest to lowest)?

Using the project profitability index,how would the above investments be ranked (highest to lowest)?

A)Aye,Bee,Cee

B)Aye,Cee,Bee

C)Cee,Bee,Aye

D)Bee,Cee,Aye

Using the project profitability index,how would the above investments be ranked (highest to lowest)?

Using the project profitability index,how would the above investments be ranked (highest to lowest)?A)Aye,Bee,Cee

B)Aye,Cee,Bee

C)Cee,Bee,Aye

D)Bee,Cee,Aye

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

48

(Ignore income taxes in this problem. ) Glassett Corporation is considering a project that would require an investment of $62,000.No other cash outflows would be involved.The present value of the cash inflows would be $70,060.The profitability index of the project is closest to:

A)0.13

B)1.13

C)0.87

D)0.12

A)0.13

B)1.13

C)0.87

D)0.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

49

(Ignore income taxes in this problem. ) The management of Morrissette Corporation is considering a project that would require an investment of $284,000 and would last for 7 years.The annual net operating income from the project would be $135,000,which includes depreciation of $37,000.The scrap value of the project's assets at the end of the project would be $25,000.The payback period of the project is closest to:

A)2.1 years

B)1.5 years

C)1.9 years

D)1.7 years

A)2.1 years

B)1.5 years

C)1.9 years

D)1.7 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

50

(Ignore income taxes in this problem. ) The management of Wiersema Corporation is investigating purchasing equipment that would increase sales revenues by $257,000 per year and cash operating expenses by $103,000 per year.The equipment would cost $430,000 and have a 5 year life with no salvage value.The simple rate of return on the investment is closest to:

A)15.8%

B)20.0%

C)26.5%

D)35.8%

A)15.8%

B)20.0%

C)26.5%

D)35.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

51

(Ignore income taxes in this problem) The management of Nagata Corporation is investigating buying a small used aircraft to use in making airborne inspections of its above-ground pipelines.The aircraft would have a useful life of 6 years.The company uses a discount rate of 13% in its capital budgeting.The net present value of the investment,excluding the intangible benefits,is -$326,237.To the nearest whole dollar how large would the annual intangible benefit have to be to make the investment in the aircraft financially attractive?

A)$326,237

B)$54,373

C)$81,600

D)$42,411

A)$326,237

B)$54,373

C)$81,600

D)$42,411

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

52

(Ignore income taxes in this problem. ) An expansion at Huebschman,Inc. ,would increase sales revenues by $76,000 per year and cash operating expenses by $33,000 per year.The initial investment would be for equipment that would cost $196,000 and have a 7 year life with no salvage value.The annual depreciation on the equipment would be $28,000.The simple rate of return on the investment is closest to:

A)7.7%

B)14.3%

C)21.9%

D)19.7%

A)7.7%

B)14.3%

C)21.9%

D)19.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

53

(Ignore income taxes in this problem. ) Tighe Corporation is contemplating purchasing equipment that would increase sales revenues by $420,000 per year and cash operating expenses by $231,000 per year.The equipment would cost $747,000 and have a 9 year life with no salvage value.The annual depreciation would be $83,000.The simple rate of return on the investment is closest to:

A)25.3%

B)14.2%

C)11.1%

D)25.2%

A)25.3%

B)14.2%

C)11.1%

D)25.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

54

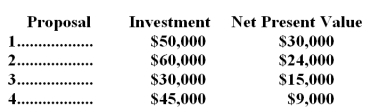

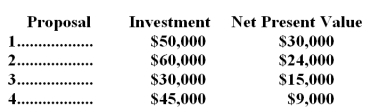

Information on four investment proposals is given below:  Rank the proposals in terms of preference according to the project profitability index:

Rank the proposals in terms of preference according to the project profitability index:

A)3,4,1,2

B)1,2,3,4

C)1,3,2,4

D)2,1,4,3

Rank the proposals in terms of preference according to the project profitability index:

Rank the proposals in terms of preference according to the project profitability index:A)3,4,1,2

B)1,2,3,4

C)1,3,2,4

D)2,1,4,3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

55

(Ignore income taxes in this problem. ) A company with $800,000 in operating assets is considering the purchase of a machine that costs $75,000 and which is expected to reduce operating costs by $20,000 each year.The payback period for this machine in years is closest to:

A)0.27 years

B)10.7 years

C)3.75 years

D)40 years

A)0.27 years

B)10.7 years

C)3.75 years

D)40 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

56

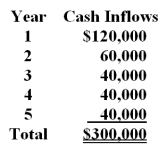

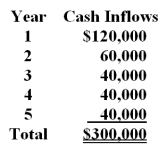

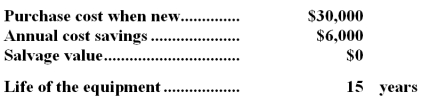

(Ignore income taxes in this problem. ) The Keego Company is planning a $200,000 equipment investment which has an estimated five-year life with no estimated salvage value.The company has projected the following annual cash flows for the investment.  Assuming that the cash inflows occur evenly over the year,the payback period for the investment is:

Assuming that the cash inflows occur evenly over the year,the payback period for the investment is:

A)0.75 years

B)1.67 years

C)4.91 years

D)2.50 years

Assuming that the cash inflows occur evenly over the year,the payback period for the investment is:

Assuming that the cash inflows occur evenly over the year,the payback period for the investment is:A)0.75 years

B)1.67 years

C)4.91 years

D)2.50 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

57

(Ignore income taxes in this problem. ) The management of Crail Corporation is considering a project that would require an initial investment of $51,000.No other cash outflows would be required.The present value of the cash inflows would be $60,180.The profitability index of the project is closest to:

A)0.18

B)0.82

C)1.18

D)0.15

A)0.18

B)0.82

C)1.18

D)0.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

58

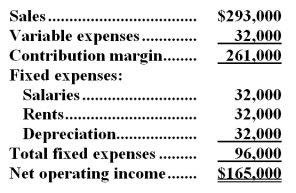

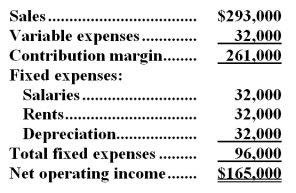

(Ignore income taxes in this problem. ) Jarvey Company is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value.The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 12%.What is the payback period for this project?

The company's required rate of return is 12%.What is the payback period for this project?

A)3 years

B)2 years

C)4.28 years

D)9 years

The company's required rate of return is 12%.What is the payback period for this project?

The company's required rate of return is 12%.What is the payback period for this project?A)3 years

B)2 years

C)4.28 years

D)9 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

59

(Ignore income taxes in this problem. ) Tanna Corporation is considering three investment projects: O,P,and Q.Project O would require an investment of $38,000,Project P of $49,000,and Project Q of $91,000.No other cash outflows would be involved.The present value of the cash inflows would be $42,180 for Project O,$53,900 for Project P,and $91,910 for Project Q.Rank the projects according to the profitability index,from most profitable to least profitable.

A)P,O,Q

B)O,Q,P

C)Q,O,P

D)O,P,Q

A)P,O,Q

B)O,Q,P

C)Q,O,P

D)O,P,Q

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

60

(Ignore income taxes in this problem. ) Denny Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine.The new machine would cost $450,000 and would have a ten-year useful life.Unfortunately,the new machine would have no salvage value.The new machine would cost $20,000 per year to operate and maintain,but would save $100,000 per year in labor and other costs.The old machine can be sold now for scrap for $50,000.The simple rate of return on the new machine is closest to:

A)8.75%

B)20.00%

C)7.78%

D)22.22%

A)8.75%

B)20.00%

C)7.78%

D)22.22%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

61

(Ignore income taxes in this problem. ) The management of Kissinger Corporation is investigating automating a process.Old equipment,with a current salvage value of $23,000,would be replaced by a new machine.The new machine would be purchased for $330,000 and would have a 6 year useful life and no salvage value.By automating the process,the company would save $108,000 per year in cash operating costs.The simple rate of return on the investment is closest to:

A)17.3%

B)16.7%

C)16.1%

D)32.7%

A)17.3%

B)16.7%

C)16.1%

D)32.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

62

(Ignore income taxes in this problem. ) Isomer Industrial Training Corporation is considering the purchase of new presentation equipment at a cost of $150,000.The equipment has an estimated useful life of 10 years with an expected salvage value of zero.The equipment is expected to generate net cash inflows of $35,000 per year in each of the 10 years.Isomer's discount rate is 16%.Isomer uses the straight-line method of depreciation for its assets.

What is the payback period of the presentation equipment?

A)2.3 years

B)3.0 years

C)4.3 years

D)5.8 years

What is the payback period of the presentation equipment?

A)2.3 years

B)3.0 years

C)4.3 years

D)5.8 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

63

(Ignore income taxes in this problem. ) Treads Corporation is considering the replacement of an old machine that is currently being used.The old machine is fully depreciated but can be used by the corporation for five more years.If Treads decides to replace the old machine,Picco Company has offered to purchase the old machine for $60,000.The old machine would have no salvage value in five years.

The new machine would be acquired from Hillcrest Industries for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine,estimated annual cash savings of $300,000 would be generated.

Treads Corporation uses a discount rate of 12%.

The internal rate of return of the project is closest to:

A)14%

B)16%

C)18%

D)20%

The new machine would be acquired from Hillcrest Industries for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine,estimated annual cash savings of $300,000 would be generated.

Treads Corporation uses a discount rate of 12%.

The internal rate of return of the project is closest to:

A)14%

B)16%

C)18%

D)20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

64

(Ignore income taxes in this problem. ) Treads Corporation is considering the replacement of an old machine that is currently being used.The old machine is fully depreciated but can be used by the corporation for five more years.If Treads decides to replace the old machine,Picco Company has offered to purchase the old machine for $60,000.The old machine would have no salvage value in five years.

The new machine would be acquired from Hillcrest Industries for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine,estimated annual cash savings of $300,000 would be generated.

Treads Corporation uses a discount rate of 12%.

The net present value of the project is closest to:

A)$171,000

B)$136,400

C)$141,500

D)$560,000

The new machine would be acquired from Hillcrest Industries for $1,000,000 in cash.The new machine has an expected useful life of five years with no salvage value.Due to the increased efficiency of the new machine,estimated annual cash savings of $300,000 would be generated.

Treads Corporation uses a discount rate of 12%.

The net present value of the project is closest to:

A)$171,000

B)$136,400

C)$141,500

D)$560,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

65

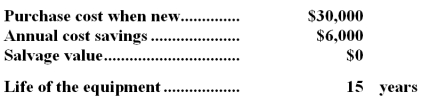

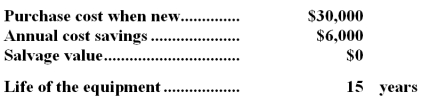

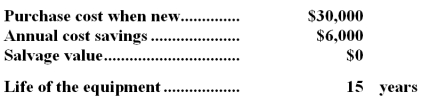

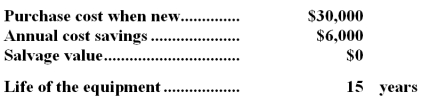

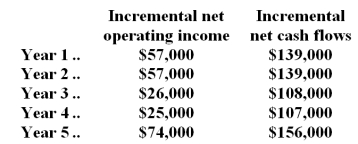

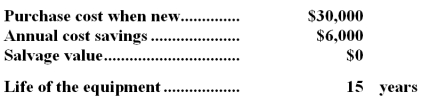

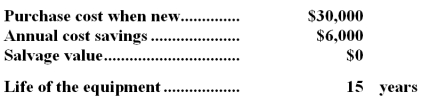

(Ignore income taxes in this problem. ) Jones and Company has just purchased a new piece of equipment,the cost characteristics of which are given below:  The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The internal rate of return of the investment is closest to:

A)16%

B)18%

C)20%

D)22%

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.The internal rate of return of the investment is closest to:

A)16%

B)18%

C)20%

D)22%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

66

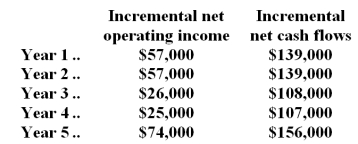

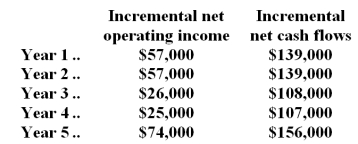

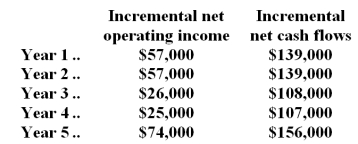

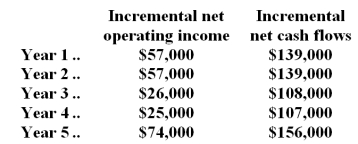

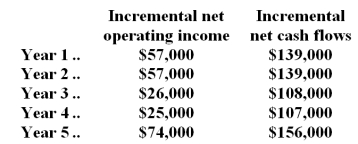

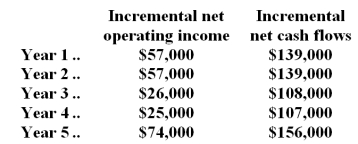

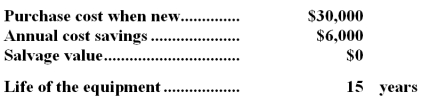

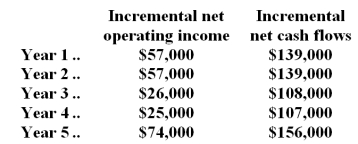

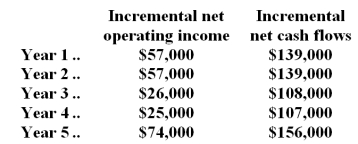

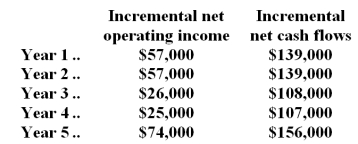

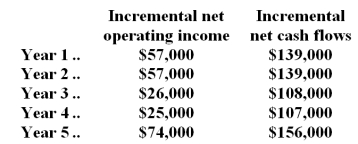

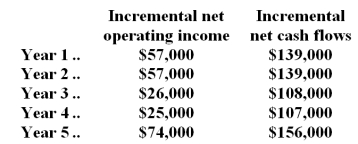

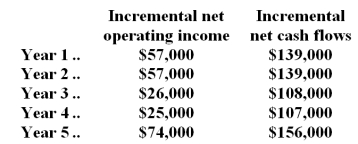

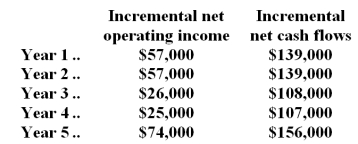

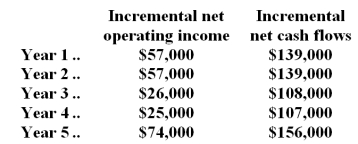

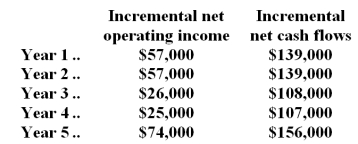

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

The present value of the stream of annual net cash inflows from operations is:

A)$228,720

B)$420,000

C)$209,880

D)$150,640

The present value of the stream of annual net cash inflows from operations is:

A)$228,720

B)$420,000

C)$209,880

D)$150,640

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

67

(Ignore income taxes in this problem. ) Isomer Industrial Training Corporation is considering the purchase of new presentation equipment at a cost of $150,000.The equipment has an estimated useful life of 10 years with an expected salvage value of zero.The equipment is expected to generate net cash inflows of $35,000 per year in each of the 10 years.Isomer's discount rate is 16%.Isomer uses the straight-line method of depreciation for its assets.

What is the net present value of the presentation equipment?

A)$950

B)$19,155

C)$(36,500)

D)$(53,340)

What is the net present value of the presentation equipment?

A)$950

B)$19,155

C)$(36,500)

D)$(53,340)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

68

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

The payback period of this investment is closest to:

A)2.9 years

B)3.2 years

C)4.8 years

D)5.0 years

The payback period of this investment is closest to:

A)2.9 years

B)3.2 years

C)4.8 years

D)5.0 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

69

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

If the discount rate is 14%,the net present value of the investment is closest to:

A)$410,000

B)$239,000

C)$446,002

D)$36,141

If the discount rate is 14%,the net present value of the investment is closest to:

A)$410,000

B)$239,000

C)$446,002

D)$36,141

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

70

(Ignore income taxes in this problem. ) Jones and Company has just purchased a new piece of equipment,the cost characteristics of which are given below:  The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The net present value of the investment is:

A)$15,636

B)$24,000

C)$45,636

D)$60,000

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.The net present value of the investment is:

A)$15,636

B)$24,000

C)$45,636

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

71

(Ignore income taxes in this problem. ) Jones and Company has just purchased a new piece of equipment,the cost characteristics of which are given below:  The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The simple rate of return for the investment (rounded to the nearest tenth of a percent) is:

A)20.0%

B)13.3%

C)18.0%

D)10.0%

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.The simple rate of return for the investment (rounded to the nearest tenth of a percent) is:

A)20.0%

B)13.3%

C)18.0%

D)10.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

72

(Ignore income taxes in this problem. ) Isomer Industrial Training Corporation is considering the purchase of new presentation equipment at a cost of $150,000.The equipment has an estimated useful life of 10 years with an expected salvage value of zero.The equipment is expected to generate net cash inflows of $35,000 per year in each of the 10 years.Isomer's discount rate is 16%.Isomer uses the straight-line method of depreciation for its assets.

What is the simple rate of return of the presentation equipment?

A)13.3%

B)22.7%

C)23.3%

D)26.0%

What is the simple rate of return of the presentation equipment?

A)13.3%

B)22.7%

C)23.3%

D)26.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

73

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

Consider only the cash flows for the seventh year.The present value of the net cash flow (cash inflows less cash outflows) for this year only is:

A)$6,280

B)$25,120

C)$37,680

D)$56,520

Consider only the cash flows for the seventh year.The present value of the net cash flow (cash inflows less cash outflows) for this year only is:

A)$6,280

B)$25,120

C)$37,680

D)$56,520

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

74

(Ignore income taxes in this problem. ) Finlay Corporation is investigating automating a process by purchasing a machine for $225,000 that would have a 9 year useful life and no salvage value.By automating the process,the company would save $54,000 per year in cash operating costs.The new machine would replace some old equipment that would be sold for scrap now,yielding $24,000.The annual depreciation on the new machine would be $25,000.The simple rate of return on the investment is closest to:

A)24.0%

B)12.9%

C)11.1%

D)14.5%

A)24.0%

B)12.9%

C)11.1%

D)14.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

75

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

If the discount rate is 18%,the net present value of the investment is closest to:

A)$24,418

B)$177,000

C)$224,418

D)$65,566

If the discount rate is 18%,the net present value of the investment is closest to:

A)$24,418

B)$177,000

C)$224,418

D)$65,566

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

76

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

The present value of the salvage value to be received in seven years is:

A)$14,800

B)$12,560

C)$14,160

D)$152,480

The present value of the salvage value to be received in seven years is:

A)$14,800

B)$12,560

C)$14,160

D)$152,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

77

(Ignore income taxes in this problem. ) Isomer Industrial Training Corporation is considering the purchase of new presentation equipment at a cost of $150,000.The equipment has an estimated useful life of 10 years with an expected salvage value of zero.The equipment is expected to generate net cash inflows of $35,000 per year in each of the 10 years.Isomer's discount rate is 16%.Isomer uses the straight-line method of depreciation for its assets.

Between what two percents does the internal rate of return of the presentation equipment fall?

A)5% and 6%

B)8% and 10%

C)14% and 16%

D)18% and 20%

Between what two percents does the internal rate of return of the presentation equipment fall?

A)5% and 6%

B)8% and 10%

C)14% and 16%

D)18% and 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

78

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

Consider only the cash flows for the third year.The present value of the net cash flows (cash inflows less cash outflows) for this year only is:

A)$6,090

B)$36,540

C)$8,720

D)$30,450

Consider only the cash flows for the third year.The present value of the net cash flows (cash inflows less cash outflows) for this year only is:

A)$6,090

B)$36,540

C)$8,720

D)$30,450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

79

(Ignore income taxes in this problem. ) Jones and Company has just purchased a new piece of equipment,the cost characteristics of which are given below:  The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The payback period for the investment is:

A)5 years

B)15 years

C)2 years

D)7.143 years

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.

The company uses a required rate of return of 10% and depreciates equipment using the straight-line method.The payback period for the investment is:

A)5 years

B)15 years

C)2 years

D)7.143 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

80

(Ignore income taxes in this problem. ) Steinmann Inc.is considering the acquisition of a new machine that costs $410,000 and has a useful life of 5 years with no salvage value.The incremental net operating income and incremental net cash flows that would be produced by the machine are:

The payback period of this investment is closest to:

A)2.8 years

B)2.6 years

C)3.1 years

D)5.0 years

The payback period of this investment is closest to:

A)2.8 years

B)2.6 years

C)3.1 years

D)5.0 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck