Deck 3: Cost Behavior: Analysis and Use

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

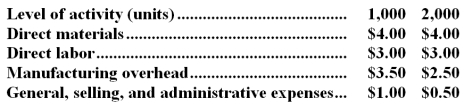

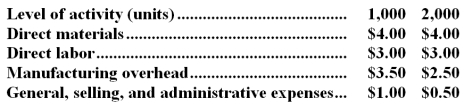

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 3: Cost Behavior: Analysis and Use

1

Economists correctly point out that many costs that the accountant classifies as variable are actually curvilinear.

True

2

The high-low method is generally less accurate than the least-squares regression method for analyzing the behavior of mixed costs.

True

3

The contribution approach to the income statement classifies costs by behavior rather than by function.

True

4

The linear equation Y = a + bX is often used to express cost formulas.In this equation:

A)the b term represents variable cost per unit of activity.

B)the a term represents variable cost in total.

C)the X term represents total cost.

D)the Y term represents total fixed cost.

A)the b term represents variable cost per unit of activity.

B)the a term represents variable cost in total.

C)the X term represents total cost.

D)the Y term represents total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

An example of a discretionary fixed cost is:

A)insurance.

B)taxes on real estate.

C)management training.

D)depreciation of buildings and equipment.

A)insurance.

B)taxes on real estate.

C)management training.

D)depreciation of buildings and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

An example of a cost that is variable with respect to the number of units produced and sold is:

A)insurance on the headquarters building.

B)power to run production equipment.

C)supervisory salaries.

D)depreciation of factory facilities.

A)insurance on the headquarters building.

B)power to run production equipment.

C)supervisory salaries.

D)depreciation of factory facilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

A cost that is obtained in large chunks and that increases or decreases only in response to fairly wide changes in the activity level is known as a step-variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

Within the relevant range,the variable cost per unit:

A)remains constant as activity changes.

B)increases as activity increases.

C)decreases as activity increases.

D)can increase or decrease as the activity changes.

A)remains constant as activity changes.

B)increases as activity increases.

C)decreases as activity increases.

D)can increase or decrease as the activity changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

An increase in the activity level within the relevant range results in:

A)an increase in fixed cost per unit.

B)a proportionate increase in total fixed costs.

C)an unchanged fixed cost per unit.

D)a decrease in fixed cost per unit.

A)an increase in fixed cost per unit.

B)a proportionate increase in total fixed costs.

C)an unchanged fixed cost per unit.

D)a decrease in fixed cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

The planning horizons for committed fixed costs and discretionary fixed costs are generally the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

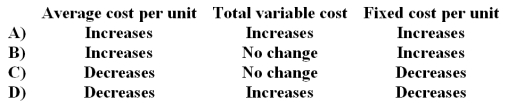

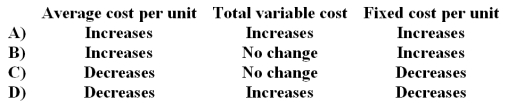

When the level of activity increases within the relevant range,how does each of the following change?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which costs will change with a decrease in activity within the relevant range?

A)Total fixed costs and total variable cost.

B)Unit fixed costs and total variable cost.

C)Unit variable cost and unit fixed cost.

D)Unit fixed cost and total fixed cost.

A)Total fixed costs and total variable cost.

B)Unit fixed costs and total variable cost.

C)Unit variable cost and unit fixed cost.

D)Unit fixed cost and total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

Expense A is a fixed cost;expense B is a variable cost.During the current year the activity level has increased,but is still within the relevant range.In terms of cost per unit of activity,we would expect that:

A)expense A has remained unchanged.

B)expense B has decreased.

C)expense A has decreased.

D)expense B has increased.

A)expense A has remained unchanged.

B)expense B has decreased.

C)expense A has decreased.

D)expense B has increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

Discretionary fixed costs:

A)vary directly and proportionately with the level of activity.

B)have a long-term planning horizon,generally encompassing many years.

C)are made up of plant,equipment,and basic organizational costs.

D)none of the above.

A)vary directly and proportionately with the level of activity.

B)have a long-term planning horizon,generally encompassing many years.

C)are made up of plant,equipment,and basic organizational costs.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

With automation,fixed costs increase relative to variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

On an income statement prepared by the traditional approach,costs are organized and presented according to function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

A cost formula may not be valid outside the relevant range of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

Fixed cost per unit increases as activity decreases and decreases as activity increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

The relevant range concept is not applicable to mixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

The fact that the high-low method uses only two data points is a major defect of the method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

Contribution margin is the excess of revenues over:

A)cost of goods sold.

B)manufacturing cost.

C)all direct costs.

D)all variable costs.

A)cost of goods sold.

B)manufacturing cost.

C)all direct costs.

D)all variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

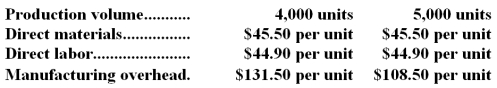

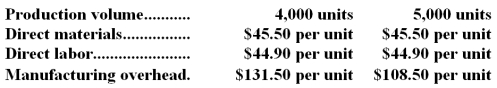

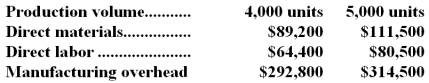

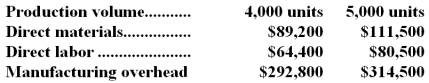

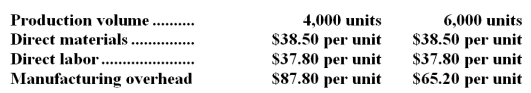

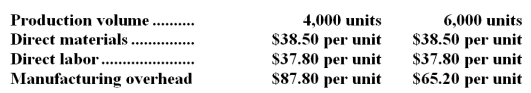

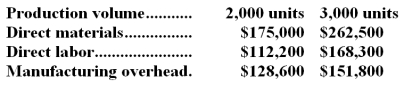

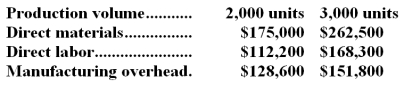

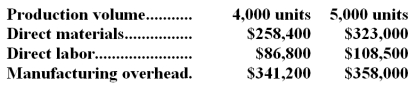

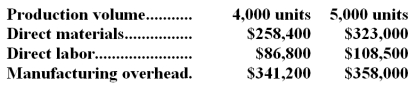

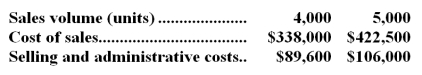

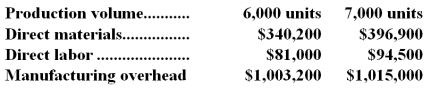

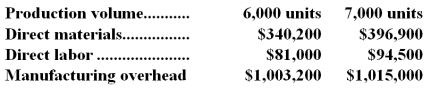

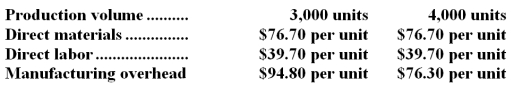

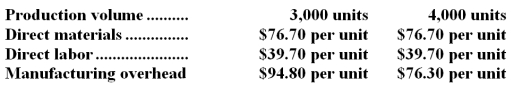

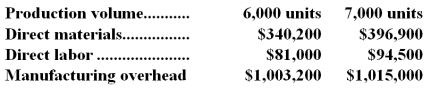

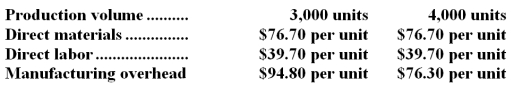

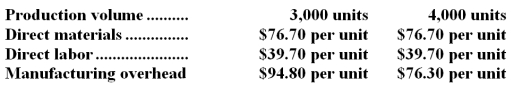

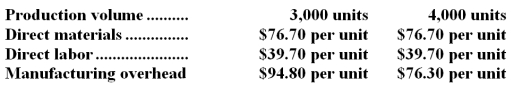

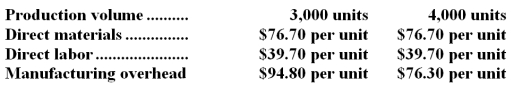

Bakken Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

A)$16.50

B)$90.40

C)$45.50

D)$106.90

The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:A)$16.50

B)$90.40

C)$45.50

D)$106.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

A cost driver is:

A)the largest single category of cost in a company.

B)a fixed cost that cannot be avoided.

C)a factor that causes variations in a cost.

D)an indirect cost that is essential to the business.

A)the largest single category of cost in a company.

B)a fixed cost that cannot be avoided.

C)a factor that causes variations in a cost.

D)an indirect cost that is essential to the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

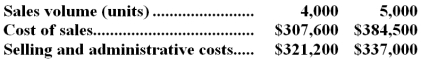

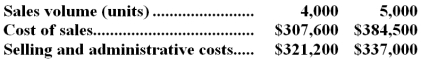

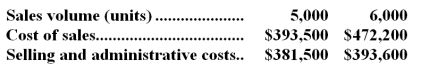

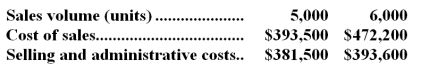

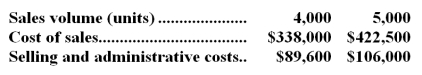

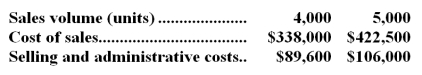

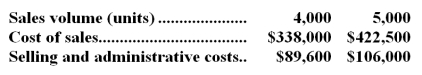

Iacopi Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $172.50 per unit.  The best estimate of the total contribution margin when 4,300 units are sold is:

The best estimate of the total contribution margin when 4,300 units are sold is:

A)$343,140

B)$65,790

C)$121,260

D)$411,080

The best estimate of the total contribution margin when 4,300 units are sold is:

The best estimate of the total contribution margin when 4,300 units are sold is:A)$343,140

B)$65,790

C)$121,260

D)$411,080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

Eddins Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:

A)$60.10

B)$38.40

C)$21.70

D)$22.30

The best estimate of the total variable manufacturing cost per unit is:

The best estimate of the total variable manufacturing cost per unit is:A)$60.10

B)$38.40

C)$21.70

D)$22.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

An analysis of past maintenance costs indicates that maintenance cost is an average of $0.20 per machine-hour at an activity level of 10,000 machine-hours and $0.25 per machine-hour at an activity level of 8,000 machine-hours.Assuming that this activity is within the relevant range,what is the total expected maintenance cost if the activity level is 8,700 machine-hours?

A)$2,000

B)$400

C)$2,250

D)$1,740

A)$2,000

B)$400

C)$2,250

D)$1,740

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

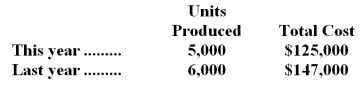

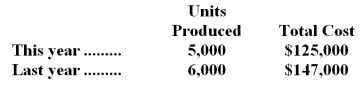

A company that produces and sells a single product has provided the following volume and average cost data for two accounting periods:  The best estimates of the total fixed cost and variable cost per unit are closest to:

The best estimates of the total fixed cost and variable cost per unit are closest to:

A)$2,000 fixed;$1.50 variable

B)$2,000 fixed;$7.00 variable

C)$3,000 fixed;$7.00 variable

D)$3,000 fixed;$8.50 variable

The best estimates of the total fixed cost and variable cost per unit are closest to:

The best estimates of the total fixed cost and variable cost per unit are closest to:A)$2,000 fixed;$1.50 variable

B)$2,000 fixed;$7.00 variable

C)$3,000 fixed;$7.00 variable

D)$3,000 fixed;$8.50 variable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

Anderton Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A)$391,200

B)$271,200

C)$656,400

D)$351,200

The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:A)$391,200

B)$271,200

C)$656,400

D)$351,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

The _______________ approach to the income statement organizes costs by function.

A)contribution

B)traditional

C)comparable

D)None of the above is true.

A)contribution

B)traditional

C)comparable

D)None of the above is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

Shipping expense is $9,000 for 8,000 pounds shipped and $11,250 for 11,000 pounds shipped.Assuming that this activity is within the relevant range,if the company ships 9,000 pounds,its expected shipping expense is closest to:

A)$10,125

B)$8,583

C)$9,972

D)$9,750

A)$10,125

B)$8,583

C)$9,972

D)$9,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

A disadvantage of the high-low method of cost analysis is that:

A)it cannot be used when there are a very large number of observations.

B)it is too time consuming to apply.

C)it uses two extreme data points,which may not be representative of normal conditions.

D)it relies totally on the judgment of the person performing the cost analysis.

A)it cannot be used when there are a very large number of observations.

B)it is too time consuming to apply.

C)it uses two extreme data points,which may not be representative of normal conditions.

D)it relies totally on the judgment of the person performing the cost analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

The cost of goods sold in a merchandising company typically would be classified as a:

A)fixed cost.

B)variable cost.

C)step-variable cost.

D)mixed cost.

A)fixed cost.

B)variable cost.

C)step-variable cost.

D)mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

The contribution approach to the income statement:

A)organizes costs on a functional basis.

B)is useful to managers in planning and decision making.

C)shows a contribution margin rather than a net operating income figure at the bottom of the statement.

D)can be used only by manufacturing companies.

A)organizes costs on a functional basis.

B)is useful to managers in planning and decision making.

C)shows a contribution margin rather than a net operating income figure at the bottom of the statement.

D)can be used only by manufacturing companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

_________________ is a method of separating a mixed cost into its fixed and variable elements by fitting a regression line that minimizes the sum of the squared errors.

A)Quick and dirty method

B)Scattergraph method

C)High-low method

D)Least-square regression method

A)Quick and dirty method

B)Scattergraph method

C)High-low method

D)Least-square regression method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

Gamba Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $170.00 per unit.  The best estimate of the total monthly fixed cost is:

The best estimate of the total monthly fixed cost is:

A)$865,800

B)$321,000

C)$820,400

D)$775,000

The best estimate of the total monthly fixed cost is:

The best estimate of the total monthly fixed cost is:A)$865,800

B)$321,000

C)$820,400

D)$775,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

Faram Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total cost to manufacture 2,300 units is closest to:

The best estimate of the total cost to manufacture 2,300 units is closest to:

A)$446,660

B)$465,840

C)$462,415

D)$478,170

The best estimate of the total cost to manufacture 2,300 units is closest to:

The best estimate of the total cost to manufacture 2,300 units is closest to:A)$446,660

B)$465,840

C)$462,415

D)$478,170

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

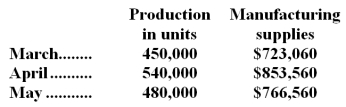

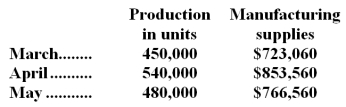

The controller of JoyCo has requested a quick estimate of the manufacturing supplies needed for the month of July when production is expected to be 470,000 units.Below are actual data from the prior three months of operations.  Using these data and the high-low method,what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range. )

Using these data and the high-low method,what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range. )

A)$805,284

B)$1,188,756

C)$755,196

D)$752,060

Using these data and the high-low method,what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range. )

Using these data and the high-low method,what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range. )A)$805,284

B)$1,188,756

C)$755,196

D)$752,060

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

Haram Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $182.10 per unit.  The best estimate of the total variable cost per unit is:

The best estimate of the total variable cost per unit is:

A)$120.40

B)$158.40

C)$167.90

D)$96.30

The best estimate of the total variable cost per unit is:

The best estimate of the total variable cost per unit is:A)$120.40

B)$158.40

C)$167.90

D)$96.30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

Dabbs Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A)$737,950

B)$686,400

C)$274,000

D)$789,500

The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:A)$737,950

B)$686,400

C)$274,000

D)$789,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

Carbert Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total cost to manufacture 4,300 units is closest to:

The best estimate of the total cost to manufacture 4,300 units is closest to:

A)$899,345

B)$951,160

C)$847,530

D)$915,010

The best estimate of the total cost to manufacture 4,300 units is closest to:

The best estimate of the total cost to manufacture 4,300 units is closest to:A)$899,345

B)$951,160

C)$847,530

D)$915,010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

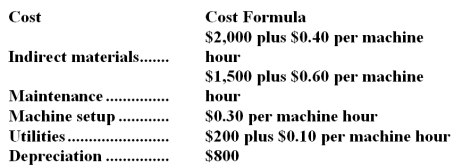

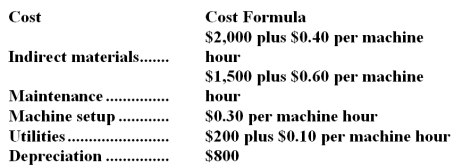

Reddy Company has the following cost formulas for overhead:  Based on these cost formulas,the total overhead cost at 600 machine hours is expected to be:

Based on these cost formulas,the total overhead cost at 600 machine hours is expected to be:

A)$4,500

B)$5,200

C)$5,620

D)$5,340

Based on these cost formulas,the total overhead cost at 600 machine hours is expected to be:

Based on these cost formulas,the total overhead cost at 600 machine hours is expected to be:A)$4,500

B)$5,200

C)$5,620

D)$5,340

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

Krouse Corporation reports that at an activity level of 8,100 units,its total variable cost is $509,652 and its total fixed cost is $197,316.What would be the total cost,both fixed and variable,at an activity level of 8,400 units? Assume that this level of activity is within the relevant range.

A)$725,844

B)$706,968

C)$720,060

D)$733,152

A)$725,844

B)$706,968

C)$720,060

D)$733,152

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

At an activity level of 10,000 units,variable costs totaled $35,000 and fixed costs totaled $20,800.If 16,000 units are produced and this activity is within the relevant range,then:

A)total cost would equal $89,280.

B)total unit cost would equal $4.80.

C)fixed cost per unit would equal $5.58.

D)total costs would equal $55,800.

A)total cost would equal $89,280.

B)total unit cost would equal $4.80.

C)fixed cost per unit would equal $5.58.

D)total costs would equal $55,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

Given the cost formula Y = $17,500 + $4X,at what level of activity will total cost be $42,500?

A)10,625 units

B)4,375 units

C)6,250 units

D)5,250 units

A)10,625 units

B)4,375 units

C)6,250 units

D)5,250 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

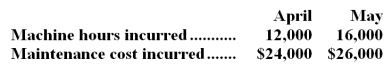

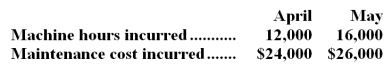

Bell Company has provided the following data for maintenance costs:  Using the high-low method,the cost formula for maintenance cost would be:

Using the high-low method,the cost formula for maintenance cost would be:

A)$2.00 per machine hour

B)$1.625 per machine hour

C)$18,000 plus $0.50 per machine hour

D)$24,000 plus $0.50 per machine hour

Using the high-low method,the cost formula for maintenance cost would be:

Using the high-low method,the cost formula for maintenance cost would be:A)$2.00 per machine hour

B)$1.625 per machine hour

C)$18,000 plus $0.50 per machine hour

D)$24,000 plus $0.50 per machine hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

The cost of goods sold in a retail store totaled $325,000.Fixed selling and administrative expenses totaled $115,000 and variable selling and administrative expenses were $210,000.If the store's contribution margin totaled $590,000,then sales must have been:

A)$1,125,000

B)$1,030,000

C)$915,000

D)$650,000

A)$1,125,000

B)$1,030,000

C)$915,000

D)$650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

At an activity level of 4,500 machine-hours in a month,Novosel Corporation's total variable maintenance and repair cost is $394,830 and its total fixed maintenance and repair cost is $105,570.What would be the total maintenance and repair cost,both fixed and variable,at an activity level of 4,600 units in a month? Assume that this level of activity is within the relevant range.

A)$511,520

B)$505,960

C)$509,174

D)$500,400

A)$511,520

B)$505,960

C)$509,174

D)$500,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information was collected for one of the costs at Demetra Manufacturing Corporation over the past two years:  Assuming that there has been no change in the cost structure over the last two years and this activity is within the relevant range,this cost at Demetra would best be described as a:

Assuming that there has been no change in the cost structure over the last two years and this activity is within the relevant range,this cost at Demetra would best be described as a:

A)fixed cost

B)mixed cost

C)step-variable cost

D)true variable cost

Assuming that there has been no change in the cost structure over the last two years and this activity is within the relevant range,this cost at Demetra would best be described as a:

Assuming that there has been no change in the cost structure over the last two years and this activity is within the relevant range,this cost at Demetra would best be described as a:A)fixed cost

B)mixed cost

C)step-variable cost

D)true variable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

Tempcon,Inc.sells and installs furnaces for $3,000 per furnace.The following cost formula relates to last year's operations at Tempcon: Y = $125,000 + $1,800X

If Tempcon sold and installed 500 furnaces last year,what was its total contribution margin last year?

A)$475,000

B)$900,000

C)$1,025,000

D)$600,000

If Tempcon sold and installed 500 furnaces last year,what was its total contribution margin last year?

A)$475,000

B)$900,000

C)$1,025,000

D)$600,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

At an activity level of 9,600 machine-hours in a month,Montgomery Corporation's total variable production engineering cost is $402,336 and its total fixed production engineering cost is $570,240.What would be the total production engineering cost,both fixed and variable,at an activity level of 9,900 machine-hours in a month? Assume that this level of activity is within the relevant range.

A)$101.31

B)$99.51

C)$98.24

D)$99.78

A)$101.31

B)$99.51

C)$98.24

D)$99.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

Given the cost formula Y = $12,000 + $6X,total cost at an activity level of 8,000 units would be:

A)$20,000

B)$60,000

C)$12,000

D)$48,000

A)$20,000

B)$60,000

C)$12,000

D)$48,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

You are applying the scattergraph method and find that the regression line you have drawn passes through a data point with the following coordinates: 1,000 units and $9,600.The regression line passes through the Y axis at the $600 point.Which of the following is the cost formula that represents the slope of this line?

A)Y = $600 + $9.00X

B)Y = $600 + $9.60X

C)Y = $9,600 + $.06X

D)None of the above is true.

A)Y = $600 + $9.00X

B)Y = $600 + $9.60X

C)Y = $9,600 + $.06X

D)None of the above is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

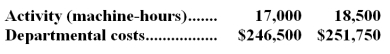

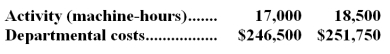

The following data for a production department relate to two accounting periods:  The best estimate of the fixed departmental cost is closest to:

The best estimate of the fixed departmental cost is closest to:

A)$5,250

B)$59,500

C)$187,000

D)$246,500

The best estimate of the fixed departmental cost is closest to:

The best estimate of the fixed departmental cost is closest to:A)$5,250

B)$59,500

C)$187,000

D)$246,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

A clothing manufacturer incurred the following factory maintenance costs: 2,100 units produced with maintenance cost of $61,500,and 750 units produced with maintenance cost of $41,250.How much of the maintenance cost is made up of fixed cost? (Use the high-low method. )

A)$11,181

B)$20,125

C)$30,000

D)$50,319

A)$11,181

B)$20,125

C)$30,000

D)$50,319

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

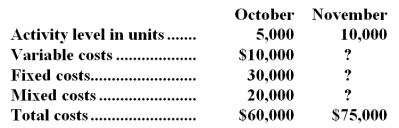

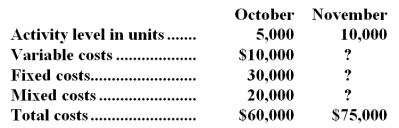

The following data pertain to activity and costs for two recent months:  Assuming that these activity levels are within the relevant range,the mixed costs for November were:

Assuming that these activity levels are within the relevant range,the mixed costs for November were:

A)$40,000

B)$35,000

C)$25,000

D)$20,000

Assuming that these activity levels are within the relevant range,the mixed costs for November were:

Assuming that these activity levels are within the relevant range,the mixed costs for November were:A)$40,000

B)$35,000

C)$25,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

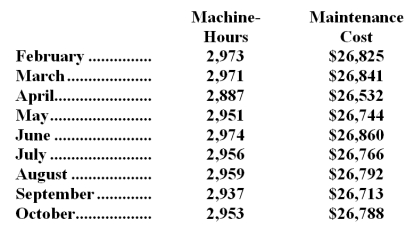

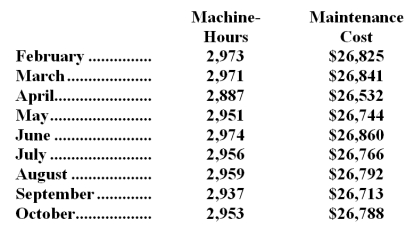

56

Maintenance costs at a Neller Corporation factory are listed below:  Management believes that maintenance cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

Management believes that maintenance cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

A)$1.85 per machine-hour;$21,325 per month

B)$3.77 per machine-hour;$15,648 per month

C)$9.07 per machine-hour;$26,762 per month

D)$0.27 per machine-hour;$26,071 per month

Management believes that maintenance cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

Management believes that maintenance cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:A)$1.85 per machine-hour;$21,325 per month

B)$3.77 per machine-hour;$15,648 per month

C)$9.07 per machine-hour;$26,762 per month

D)$0.27 per machine-hour;$26,071 per month

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

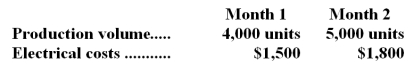

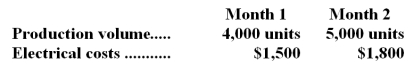

The following data pertains to activity and utility costs for two recent years:  Using the high-low method,the cost formula for utilities is:

Using the high-low method,the cost formula for utilities is:

A)$1.50 per unit

B)$8,000 plus $0.50 per unit

C)$1.25 per unit

D)$6,000 plus $0.75 per unit

Using the high-low method,the cost formula for utilities is:

Using the high-low method,the cost formula for utilities is:A)$1.50 per unit

B)$8,000 plus $0.50 per unit

C)$1.25 per unit

D)$6,000 plus $0.75 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

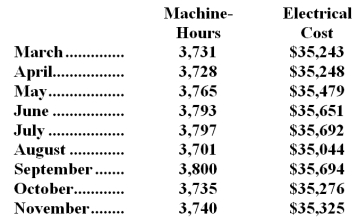

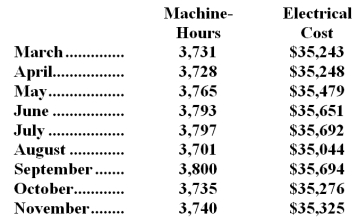

58

Electrical costs at one of Gotch Corporation's factories are listed below:  Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

A)$0.15 per machine-hour;$35,115 per month

B)$9.11 per machine-hour;$1,249 per month

C)$9.43 per machine-hour;$35,406 per month

D)$6.57 per machine-hour;$10,728 per month

Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:

Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method to estimate the variable and fixed components of this cost,these estimates would be closest to:A)$0.15 per machine-hour;$35,115 per month

B)$9.11 per machine-hour;$1,249 per month

C)$9.43 per machine-hour;$35,406 per month

D)$6.57 per machine-hour;$10,728 per month

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

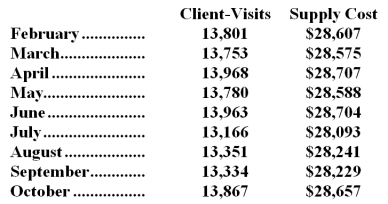

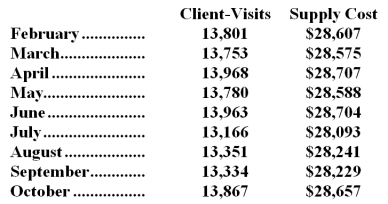

59

Supply costs at Rupard Corporation's chain of gyms are listed below:  Management believes that supply cost is a mixed cost that depends on client-visits.Using the high-low method to estimate the variable and fixed components of this cost,those estimates would be closest to:

Management believes that supply cost is a mixed cost that depends on client-visits.Using the high-low method to estimate the variable and fixed components of this cost,those estimates would be closest to:

A)$0.76 per client-visit;$18,152 per month

B)$1.31 per client-visit;$10,462 per month

C)$2.08 per client-visit;$28,489 per month

D)$0.77 per client-visit;$17,952 per month

Management believes that supply cost is a mixed cost that depends on client-visits.Using the high-low method to estimate the variable and fixed components of this cost,those estimates would be closest to:

Management believes that supply cost is a mixed cost that depends on client-visits.Using the high-low method to estimate the variable and fixed components of this cost,those estimates would be closest to:A)$0.76 per client-visit;$18,152 per month

B)$1.31 per client-visit;$10,462 per month

C)$2.08 per client-visit;$28,489 per month

D)$0.77 per client-visit;$17,952 per month

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

At an activity level of 6,000 units the cost for maintenance is $7,200 and at 10,000 units the cost for maintenance is $11,600.Using the high-low method,the cost formula for maintenance is:

A)$1.20 per unit

B)$1.16 per unit

C)$1,200 plus $1.10 per unit

D)$600 plus $1.10 per unit

A)$1.20 per unit

B)$1.16 per unit

C)$1,200 plus $1.10 per unit

D)$600 plus $1.10 per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

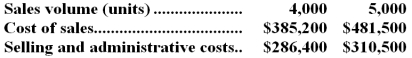

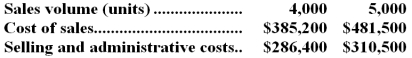

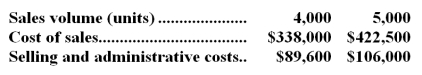

Callaham Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $115.80 per unit.

The best estimate of the total contribution margin when 4,300 units are sold is:

A)$134,590

B)$43,430

C)$64,070

D)$38,270

The best estimate of the total contribution margin when 4,300 units are sold is:

A)$134,590

B)$43,430

C)$64,070

D)$38,270

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

Callaham Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $115.80 per unit.

The best estimate of the total monthly fixed cost is:

A)$24,000

B)$478,050

C)$427,600

D)$528,500

The best estimate of the total monthly fixed cost is:

A)$24,000

B)$478,050

C)$427,600

D)$528,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

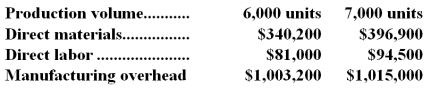

Baaca Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.

The best estimate of the total variable manufacturing cost per unit is:

A)$82.00

B)$70.20

C)$56.70

D)$11.80

The best estimate of the total variable manufacturing cost per unit is:

A)$82.00

B)$70.20

C)$56.70

D)$11.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

Maxwell Company has a total expense per unit of $2.00 per unit at the 16,000 level of activity and total expense per unit of $1.95 at the 21,000 unit level of activity.

The best estimate of the total expected costs at the 19,000 level of activity for Maxwell Company is:

A)$37,050

B)$38,000

C)$37,370

D)$39,830

The best estimate of the total expected costs at the 19,000 level of activity for Maxwell Company is:

A)$37,050

B)$38,000

C)$37,370

D)$39,830

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

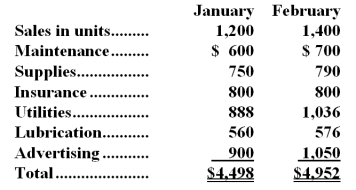

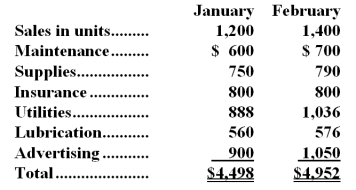

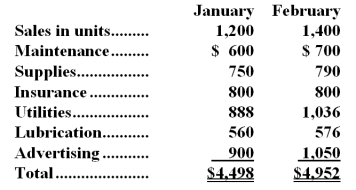

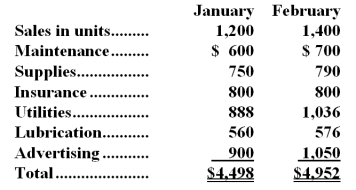

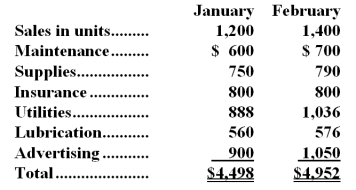

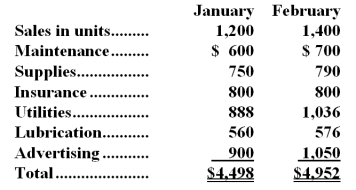

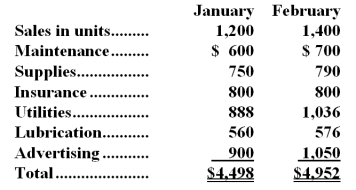

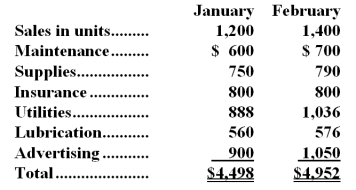

Stewart Company is attempting to classify costs according to their cost behavior.Data concerning activity and costs are listed below:

The cost(s) that Stewart Company would classify as fixed would be:

A)insurance.

B)insurance and lubrication.

C)supplies and lubrication.

D)insurance and advertising.

The cost(s) that Stewart Company would classify as fixed would be:

A)insurance.

B)insurance and lubrication.

C)supplies and lubrication.

D)insurance and advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

Stewart Company is attempting to classify costs according to their cost behavior.Data concerning activity and costs are listed below:

If Stewart Company sells 1,150 units in March and this activity is within the relevant range,the expected total cost would most likely be closest to:

A)$2,610.50

B)$1,774.00

C)$4,343.92

D)$4,384.50

If Stewart Company sells 1,150 units in March and this activity is within the relevant range,the expected total cost would most likely be closest to:

A)$2,610.50

B)$1,774.00

C)$4,343.92

D)$4,384.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

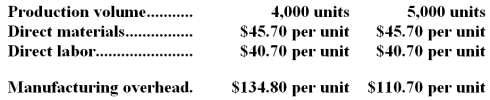

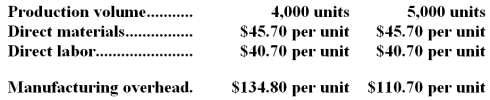

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

The best estimate of the total cost to manufacture 3,200 units is closest to:

A)$675,840

B)$616,640

C)$661,040

D)$646,240

The best estimate of the total cost to manufacture 3,200 units is closest to:

A)$675,840

B)$616,640

C)$661,040

D)$646,240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

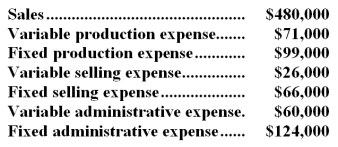

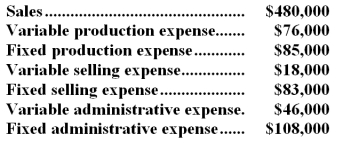

The management of Degenhart Corporation,a manufacturing company,has provided the following data for February:  The contribution margin for February was:

The contribution margin for February was:

A)$34,000

B)$323,000

C)$191,000

D)$310,000

The contribution margin for February was:

The contribution margin for February was:A)$34,000

B)$323,000

C)$191,000

D)$310,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

Baaca Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.

The best estimate of the total monthly fixed manufacturing cost is:

A)$1,424,400

B)$1,506,400

C)$932,400

D)$1,465,400

The best estimate of the total monthly fixed manufacturing cost is:

A)$1,424,400

B)$1,506,400

C)$932,400

D)$1,465,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

The best estimate of the total variable manufacturing cost per unit is:

A)$116.40

B)$137.20

C)$20.80

D)$76.70

The best estimate of the total variable manufacturing cost per unit is:

A)$116.40

B)$137.20

C)$20.80

D)$76.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

Maxwell Company has a total expense per unit of $2.00 per unit at the 16,000 level of activity and total expense per unit of $1.95 at the 21,000 unit level of activity.

The best estimate of the variable cost per unit for Maxwell Company is:

A)$0.56

B)$1.79

C)$2.00

D)$1.95

The best estimate of the variable cost per unit for Maxwell Company is:

A)$0.56

B)$1.79

C)$2.00

D)$1.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

Stewart Company is attempting to classify costs according to their cost behavior.Data concerning activity and costs are listed below:

The costs that Stewart Company would classify as variable would be:

A)maintenance and supplies.

B)maintenance,supplies,utilities,lubrication and advertising.

C)supplies and advertising.

D)maintenance,utilities and advertising.

The costs that Stewart Company would classify as variable would be:

A)maintenance and supplies.

B)maintenance,supplies,utilities,lubrication and advertising.

C)supplies and advertising.

D)maintenance,utilities and advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

The best estimate of the total monthly fixed manufacturing cost is:

A)$222,000

B)$284,400

C)$305,200

D)$633,600

The best estimate of the total monthly fixed manufacturing cost is:

A)$222,000

B)$284,400

C)$305,200

D)$633,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

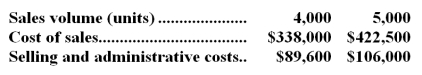

Callaham Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $115.80 per unit.

The best estimate of the total variable cost per unit is:

A)$84.50

B)$100.90

C)$106.90

D)$105.70

The best estimate of the total variable cost per unit is:

A)$84.50

B)$100.90

C)$106.90

D)$105.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

At a sales level of $300,000,James Company's gross margin is $15,000 less than its contribution margin,its net operating income is $50,000,and its selling and administrative expenses total $120,000.At this sales level,its contribution margin would be:

A)$250,000

B)$155,000

C)$170,000

D)$185,000

A)$250,000

B)$155,000

C)$170,000

D)$185,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

Stewart Company is attempting to classify costs according to their cost behavior.Data concerning activity and costs are listed below:

The costs that Stewart Company would classify as mixed would be:

A)lubrication and advertising.

B)maintenance and insurance.

C)supplies and lubrication.

D)supplies and utilities.

The costs that Stewart Company would classify as mixed would be:

A)lubrication and advertising.

B)maintenance and insurance.

C)supplies and lubrication.

D)supplies and utilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

The following data pertains to activity and the cost of electricity for two recent months:  The best estimate of the total monthly fixed electrical cost is:

The best estimate of the total monthly fixed electrical cost is:

A)$300

B)$1,200

C)$1,500

D)$1,050

The best estimate of the total monthly fixed electrical cost is:

The best estimate of the total monthly fixed electrical cost is:A)$300

B)$1,200

C)$1,500

D)$1,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

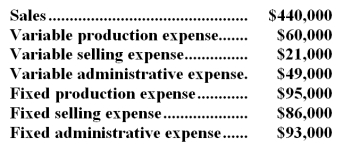

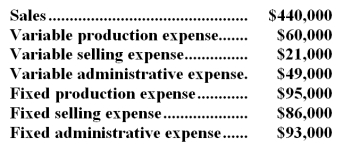

The management of Harper Corporation,a manufacturing company,has provided the following financial data for December:  The contribution margin for December was:

The contribution margin for December was:

A)$204,000

B)$64,000

C)$340,000

D)$319,000

The contribution margin for December was:

The contribution margin for December was:A)$204,000

B)$64,000

C)$340,000

D)$319,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

Maxwell Company has a total expense per unit of $2.00 per unit at the 16,000 level of activity and total expense per unit of $1.95 at the 21,000 unit level of activity.

The best estimate of the total fixed cost per period for Maxwell Company is:

A)$40,950

B)$32,000

C)$3,360

D)$29,190

The best estimate of the total fixed cost per period for Maxwell Company is:

A)$40,950

B)$32,000

C)$3,360

D)$29,190

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

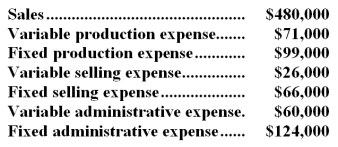

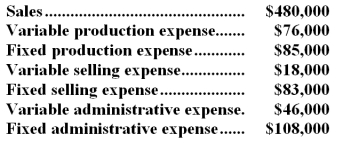

Kalbach Corporation,a manufacturing company,has provided the following financial data for November:  The company had no beginning or ending inventories.The contribution margin for November was:

The company had no beginning or ending inventories.The contribution margin for November was:

A)$285,000

B)$166,000

C)$310,000

D)$36,000

The company had no beginning or ending inventories.The contribution margin for November was:

The company had no beginning or ending inventories.The contribution margin for November was:A)$285,000

B)$166,000

C)$310,000

D)$36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck