Deck 9: The Government and Fiscal Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 9: The Government and Fiscal Policy

1

Assume the following behavioral equations for a macroeconomy:

C = 100 + .9Yd , I = 50, T = 100 and G = 40

Calculate the equilibrium level of output.

C = 100 + .9Yd , I = 50, T = 100 and G = 40

Calculate the equilibrium level of output.

In equilibrium AE = Y . Since AE = C + I + G we can write C + I + G = Y . Rewriting the consumption function yields: 100 + .9 ( Y - 100) since Y = Y - T . This reduces to 10 + .9 Y . When added to I and G yields 10 + .9 Y + 50 + 40. Combining terms this equals 100 + .9 Y . Since this is AE we must then set it equal to Y and solve for Y . We then get 100 + .9 Y = Y . Rearranging and solving for Y yields 1000.

2

Define the budget deficit.

The budget deficit is the difference between what the government spends and what it collects in taxes.

3

Assume that the economy is in equilibrium at $9 trillion and the government increases spending by $100 billion. What would happen to unplanned inventories and why?

Unplanned inventories would fall. The reason is that the economy is currently in equilibrium with aggregate expenditures at $9 trillion. If government increases spending by $100 billion then spending will be greater than the level of output causing a drawing down of inventories.

4

If the government wants to reduce unemployment what are some ways it should change spending and taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

Given that Yd C + S, prove that Y C + S + T. Explain the importance of this relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose the economy is slipping into a recession and the budget deficit begins to grow. In response Congress cuts government spending to reduce the deficit. What might the macroeconomic consequences of Congress' action?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the media, the deficit is often defined as total outlays (spending plus transfers) minus total tax revenue. Economists, however, like to define the deficit as "G - T," where "G" includes only government purchases of goods and services, and "T" is net taxes. Prove that these two definitions are actually equivalent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

What are the two types of macroeconomic policy channels that are available to the government and describe how they work?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose the economy is slipping into a recession and the budget deficit begins to grow. In response Congress raises taxes to reduce the deficit. What might the macroeconomic consequences of Congress' action?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

Explain why it might not be necessary for the government to cut spending to reduce the deficit when the economy is expanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

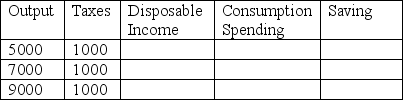

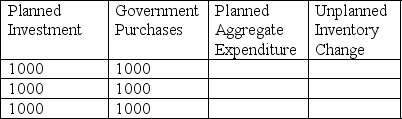

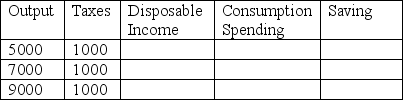

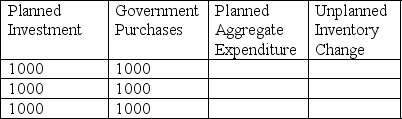

Assume that the consumption function for the above economy is C = 1000 + .75Yd fill in the empty cells. (All Figures are in Billions of Dollars)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

Assume that an economy is operating at full employment and furthermore there is a government budget surplus. What might be the macroeconomic impact if Congress decides to take the budget surplus and return it to taxpayers as a rebate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

Write out the modified algebraic representation of the consumption function when taxes are included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

Define net taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

Why is it more important to be concerned with net tax revenue than gross tax revenue when judging the fiscal state of the government's budget?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

How can government affect investment behavior?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

How would a weak economy affect the size of the budget deficit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

What is discretionary fiscal policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

How would a strong economy affect the size of the budget deficit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

Write the equation for disposable income and identify each component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

Determine the impact of an increase in government spending of $5 billion when the MPC is .8. Determine the impact of a decrease in government spending of $2.5 billion when the MPS is 1/3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

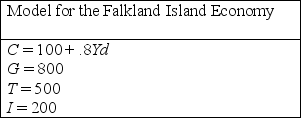

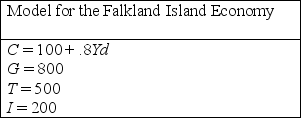

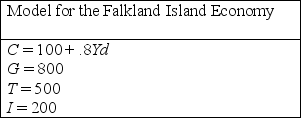

Given the above model for the Falkland Island economy calculate the level of savings when the economy is in equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

How do the values of the tax multiplier and the government spending multiplier change as the MPC increases? Explain why the multipliers change. If the MPC were 0, what would the government spending and tax multipliers equal? If the MPC were 1, what would the government spending and tax multipliers equal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

The MPC in Montavada is .75.

(a) If taxes were reduced by $1,000 in Montavada, by how much would equilibrium output change?

(b) If government spending were increased by $1,000 in Montavada, by how much would equilibrium output change?

(c) Explain why a tax cut of $1,000 would have less effect on the economy of Montavada than an increase in government spending of $1,000.

(a) If taxes were reduced by $1,000 in Montavada, by how much would equilibrium output change?

(b) If government spending were increased by $1,000 in Montavada, by how much would equilibrium output change?

(c) Explain why a tax cut of $1,000 would have less effect on the economy of Montavada than an increase in government spending of $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assume that you know that the tax multiplier for the economy is -4. From this information calculate the value of the MPC and MPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the aggregate consumption function is C = 100 +.8Yd what is the level of consumption if income is $2000 and net taxes are $200. Show all work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

Identify the broad contrasting views regarding the role of government within the macroeconomy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

Explain what would be the impact of a decrease in lump-sum taxes on the slope of the consumption function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

Explain the case where unplanned inventories increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

Determine the net impact upon the nation's economy that results from equal increases in spending and taxes of $10 billion when the MPC is .8.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

Determine the net impact upon the nation's economy that results from equal decreases in spending and taxes of $5 billion when the MPC is .75.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

Determine the impact of an increase in government spending of $10 billion when the MPC is .8. Determine the impact of a decrease in government spending of $5 billion when the MPS is .25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

Explain why saving plus taxes must equal investment plus government spending in equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

Explain why the government spending multiplier is different from the tax multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume that you know that the government multiplier for the economy is 3. From this information calculate the tax multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

Determine the impact of an increase in taxes of $20 billion when the MPS is .25. Determine the impact of a decrease in taxes of $10 billion when the MPS is .2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

For the economy to be in equilibrium what must be the relationship between government spending, investment, savings, and tax revenue. (Hint: write out an equation)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose policymakers decide to increase government spending by 100 and simultaneously increase taxes by 100. Explain what effect this simultaneous increase in G and increase in T will have on the economy and on the budget deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

Discuss an important difference between the spending and tax multipliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the aggregate consumption function is C = 100 +.9Yd what is the level of consumption if income is $3000 and net taxes are $100. Show all work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

Write out the formula for the tax multiplier and explain why a higher MPC would generate a more negative tax multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose planned investment drops by 200.

(a) First, graphically illustrate the effects of this reduction in planned investment using the AE - Y graph. Explain what effect it will have on the economy.

(b) Now suppose policymakers wish to prevent this drop in I from having any effect on output. How much would government spending have to increase in order to prevent any change in Y? Explain.

(c) Rather than use a change in spending, suppose policymakers wish to use a change in taxes to prevent Y from changing. Explain what must happen to taxes to achieve this.

(d) Briefly compare and explain any differences in the size of the change in G and change in T in parts (b) and (c).

(a) First, graphically illustrate the effects of this reduction in planned investment using the AE - Y graph. Explain what effect it will have on the economy.

(b) Now suppose policymakers wish to prevent this drop in I from having any effect on output. How much would government spending have to increase in order to prevent any change in Y? Explain.

(c) Rather than use a change in spending, suppose policymakers wish to use a change in taxes to prevent Y from changing. Explain what must happen to taxes to achieve this.

(d) Briefly compare and explain any differences in the size of the change in G and change in T in parts (b) and (c).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

Calculate how much output would expand by if the government increased spending by $500 billion and financed this spending by increasing lump-sum taxes by the same amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

Explain the government spending multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

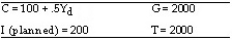

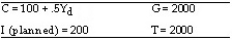

Assume an economy is represented by the following:

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?

(b) Calculate the equilibrium level of output.

(c) Based on your analysis in Part (b), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(d) Now suppose that G decreases by 100 and T simultaneously decreases by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the balanced budget multiplier?

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?

(a) Suppose actual output is 3000. What is the level of planned expenditures at this level of output? What is the level of unplanned changes in inventories?(b) Calculate the equilibrium level of output.

(c) Based on your analysis in Part (b), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(d) Now suppose that G decreases by 100 and T simultaneously decreases by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the balanced budget multiplier?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

If the tax multiplier is -2 what must be the value of the MPC. Show all work.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Calculate the value of the tax multiplier if the MPS = .1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

The intuition behind the balanced budget multiplier is fairly straightforward. When the government taxes the public and spends the money, it is taking funds from people who would not have spent it all, and giving it to people (government agencies) who will spend it all. Can you think of any flaw in this logic?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

Suppose that the government's budget deficit is $200 billion and the equilibrium level of output is at $8 trillion. If the output level necessary for full employment is $8.1 trillion, by how much must the government increase spending and taxes to stimulate the economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

Explain the balanced budget multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume that the government spending multiplier is equal to 4. Calculate the tax multiplier from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Draw a graph of an economy's aggregate expenditure function. Using this graph, explain how equilibrium income is determined. Show graphically the effect on the equilibrium level of output if government spending and taxes are increased by the same amount. Explain why the balanced-budget multiplier equals 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

Suppose that the MPS = .2 and the government is interested in raising the level of output in the economy by $100 billion. Calculate how much the government would have to spend to achieve this objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume the economy was originally at an output level of $800 billion. The government then cut taxes by $20 billion. If the economy expands by $60 billion, what is the value of the tax multiplier?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume an economy is represented by the following:

(a) Calculate the equilibrium level of output.

(b) Based on your analysis in Part (a), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(c) Now suppose planned investment rises by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the multiplier?

(d) What is the size of the tax multiplier for this economy?

(a) Calculate the equilibrium level of output.

(b) Based on your analysis in Part (a), calculate the levels of consumption and saving that occur when the economy is in equilibrium.

(c) Now suppose planned investment rises by 100. Calculate the new equilibrium level of income. Given your answer, what is the size of the multiplier?

(d) What is the size of the tax multiplier for this economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Prove that the balanced budget multiplier is equal to one by using the government and tax multipliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why does the tax multiplier differ from the spending multiplier?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

Assume lump-sum taxes are reduced by $500 billion and income rises by $1 trillion. Calculate the value of the tax multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

What effect does an introduction of an income tax rate have on the size of the spending multiplier? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Define the tax multiplier and give the algebraic expression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

Explain how some government tax revenue and spending can depend on the state of the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume government reforms the unemployment compensation program such that the amount of benefits that are distributed in any given fiscal year are fixed. In periods where there are more claims the amount of the benefits per person would simply decline and vice versa. Would this tend to soften or to weaken macroeconomic stability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

The the primary purpose of the shock absorber in an automobile is to control spring and suspension movement. This is accomplished by turning the kinetic energy of suspension movement into thermal energy to be dissipated through the hydraulic fluid. How is this similar to the automatic stabilizers of the economy. Why does neither of these necessarily imply a "smooth ride"?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

Why do you suppose that state governments cannot rely on automatic stabilizers but the federal government can?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

Compare and contrast the following two proposals to deal with a federal budget surplus in an economy that is operating at full employment. Proposal #1 would require that significant portions of the surplus be returned to the public in the form of tax cuts. Proposal #2 would require that an equal portion instead be impounded to augment the Social Security Trust Fund. Make sure to point out the effect that each may have on inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

What do economists mean by the concept of a full-employment budget? Explain your answer in relation to the structural and cyclical deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain what is meant by fiscal drag.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

What would be the effect of a cut in taxes of $100 billion on the economy if the marginal propensity to consume were .9? Explain why this policy is much different from simply having the government initiate a $100 billion spending program. Support your answer with specific calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

How is is possible for the budget deficit to change even when Congress doesn't change spending or taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

Define automatic stabilizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

Why might a balanced budget requirement be potentially destabilizing for the economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck