Deck 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 12: The Determination of Aggregate Output, the Price Level, and the Interest Rate

1

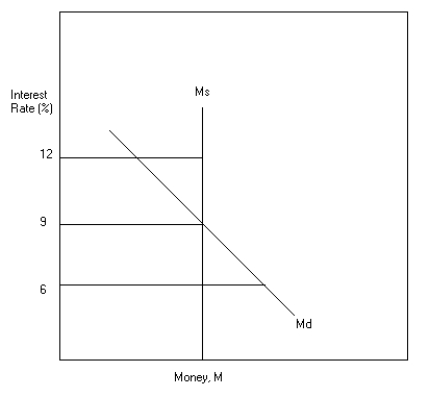

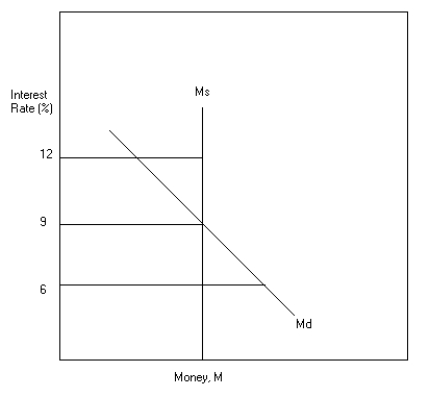

Assume the following graph for money supply and money demand. Explain the adjustment process that would take place in this money market if the interest rate is 12 percent. Make sure that your answer includes a discussion of what happens to money balances and bond prices.

If the interest rate is 12 percent then the quantity of money in circulation will exceed the amount that households will want to hold. This excess supply of money will cause the interest rate to drop as people try to shift their funds into interest bearing bonds. The increased demand for bonds will bid their price up; i.e., the interest rate will drop.

2

Related to the Economics in Practice on p. 221 [533]: What was the estimates of the study concerning a one-percentage point increase in the interest rate? Be specific.

According to their estimates, a one-percentage-point increase in the interest rate appropriate for a firm's borrowing leads to a drop in investment spending of more than one percentage point.

3

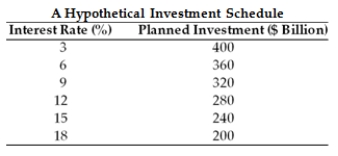

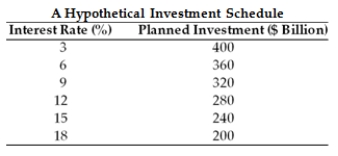

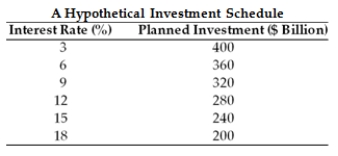

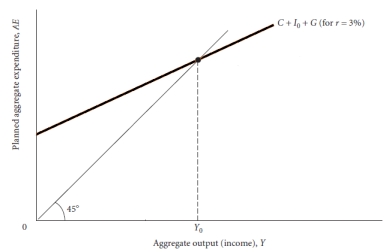

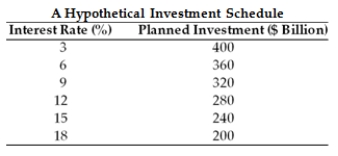

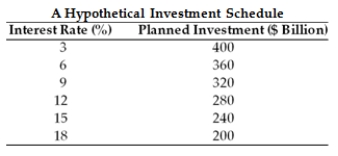

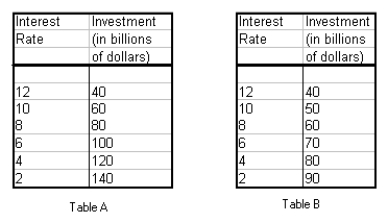

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question. What will be the change in investment spending if the interest rate falls from 9% to 6%?

Investment will increase by $40 billion ($360 - $320 billion).

4

Scenario 1

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1 calculate how high the interest rate would have to rise to drive planned investment to zero. Calculate the amount of investment that would take place at an interest rate of zero.

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1 calculate how high the interest rate would have to rise to drive planned investment to zero. Calculate the amount of investment that would take place at an interest rate of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

Scenario 1

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1, if the interest rate were 10%, calculate the level of investment.

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1, if the interest rate were 10%, calculate the level of investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

Draw a flowchart showing the impact of an increase in interest rates on planned investment, planned aggregate expenditure and equilibrium output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

Graphically illustrate the relationship between interest rate changes and the level of planned investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Suppose the investment demand function is given as the following algebraic function: I = 300 - 1000r where r is the interest rate. Calculate the amount of investment that would take place at an interest rate of ten percent. How much investment would there be if interest rates rose to fifteen percent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

Critically evaluate the assumption of autonomous investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

Why is there a negative relationship between the interest rate and the level of investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

Describe in broad terms what the money market is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

The textbook discusses the "crowding out effect". Can you think of any circumstances in which just the opposite effect could take place?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question.. Suppose the expenditure multiplier is 3. What impact on equilibrium output will there be by an increase in the interest rate from 6% to 9%, ceteris paribus?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

If the amount of money demanded by household and firms is less than the amount in circulation as determined by the Fed what will happen to the rate of interest and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

As interest rates increase what happens to planned investment and aggregate expenditure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

Scenario 1

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1, calculate the interest rate that would be necessary to bring about an investment of $200.

Assume that the investment demand function is represented by the following algebraic function: I = $300 - 2000r where $300 represents autonomous investment and "r" represents the interest rate.

Using Scenario 1, calculate the interest rate that would be necessary to bring about an investment of $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

Draw a planned investment curve as it relates to the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

Discuss the two links between the goods market and the money market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

Assume the money supply is set by the Fed at $1000 billion and the money demand function is represented by the following algebraic equation Md = 3000 - 20000r, where r = the interest rate. Calculate the interest rate which will clear this money market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Describe in broad terms what the goods market is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 4. What will be the impact on equilibrium output of a drop in the interest rate from 15% to 9%, ceteris paribus?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

Describe the chain of events that are likely to unfold when the government reduces net taxes. Explain your answer in terms of its impact on aggregate output, the demand for money, the interest rate and planned investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 5 and the initial interest rate is 12%. Where will the interest rate have to move to in order to cause equilibrium output to fall by 400 billion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Explain the chain of events that results from an expansionary monetary policy. Explain your answer in terms of its impact on money supply, aggregate output, the demand for money, the interest rate and planned investment. Be sure to include any feedback effects in your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

How does monetary policy affect the goods market?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

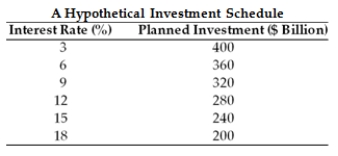

Figure 27.1

Figure 27.1Assume that money demand is perfectly elastic. What implications would this have for an expansionary monetary policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Did the anti-recession policies of 1974-1975 and 1980-1982 produce a crowding-out effect? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

Describe expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

Explain the "crowding-out effect."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

Assume the Federal Reserve contracted the money supply in the face of high deficit spending on the part of Congress. Would this lessen or aggragavate the crowding out problem? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

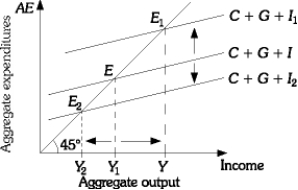

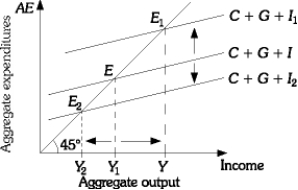

Graphically illustrate the impact of a decrease and increase in the interest rate on aggregate expenditure. On your graph, illustrate the impact of an increase and decrease in the interest rate upon aggregate expenditure. Summarize the relationship among changes in the rate of interest (r), the change in planned investment spending (I), its impact on the aggregate expenditure function (AE), and the multiple effect on income (Y).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Describe expansionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

What action could the Fed take to reduce the crowding-out effect of an expansionary fiscal policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

The size of the crowding-out effect, affecting the size of the government spending multiplier, depends on two things. Explain what those are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 5 and the initial interest rate is 12%. Where will the interest rate have to move to in order to cause equilibrium output to fall by 400 billion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Explain how the crowding out effect can be softened by the Federal Reserve accommodating an expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

What are the two primary things on which the size of the "crowding-out" effect depend?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

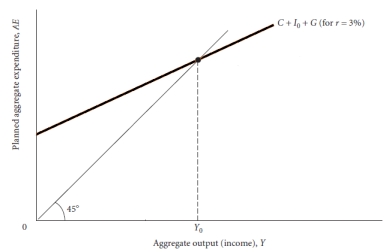

Figure 27.1

Figure 27.1Use Figure 27.1 above to answer the following question. Assume that the aggregate expenditure function depicted in the graph is based on an interest rate of 3%. Now assume that the interest rate rises to let's say 6%. Graphically illustrate the impact that this will have on the aggregate expenditure function and equilibrium output. Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

Table 27.1

Table 27.1Use the Table 27.1 to answer the following question.. Suppose the expenditure multiplier is 10 and the initial interest rate is 15%. What would be the impact on the equilibrium output if the interest rate fell to 6%?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Explain why a contractionary monetary policy would not necessarily result in interest rates rising by the full amount of what the initial contraction would produce. In other words, if there were no impact on the goods market the interest rate would rise to a higher level. Given that there is an impact explain how this works.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

Discuss the impact of an increase in the money supply upon the goods and money markets. What most importantly determines the effectiveness of monetary policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Summarize the effects of a contractionary monetary policy where the changes in the money supply (Ms) impacts the rate of interest (r), investment spending (I), output and income (Y), and the demand for money (Md).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

Using short-hand symbols, explain the effects of a contractionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Describe the sequence of events that occurs in response to an expansionary monetary policy. Explain in terms of the impact on aggregate output, money demand, interest rates and planned investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

What will be the impact on money demand, the interest rate and the level of planned investment if the government increases spending?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

In addition to the rate of interest, what other conditions affect the level of planned investment? Explain how these factors affect planned investment spending.

(a) Expectations regarding business and overall economic conditions

(b) Capital utilization rates

(c) Relative labor and capital costs

(a) Expectations regarding business and overall economic conditions

(b) Capital utilization rates

(c) Relative labor and capital costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

Explain what is meant by a contractionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Using short-hand symbols, explain the effects of a contractionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Draw an investment demand curve that would render monetary policy completely ineffectual. Make sure to explain why it looks the way it does.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

How much crowding out would be expected from an expansionary fiscal policy if investment was completely insensitive to the interest rate: that is independent of the interest rate? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume investment demand is independent of the interest rate. Explain why an expansionary monetary policy designed to drive the interest rate to zero may not be enough to stimulate the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

Explain the impact upon the crowding-out effect if the Federal Reserve changes the money supply when government spending increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

Explain what is meant by a contractionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

Describe the sequence of events that occurs in response to a contractionary fiscal policy. Explain in terms of the impact on aggregate output, money demand, interest rates and planned investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

Summarize the effects of a contractionary fiscal policy where the changes in government spending (G) and/or taxes (T) are changes upon output and income (Y), the demand for money (Md), the rate of interest (r), and investment spending (I).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

Using the short-hand symbols Ms, r, I, Y, and Md, demonstrate the effects of an expansionary monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Explain the only circumstance in which expansionary monetary policy is likely to be effective. Hint: Use the linkage between the interest rate and investment spending to explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

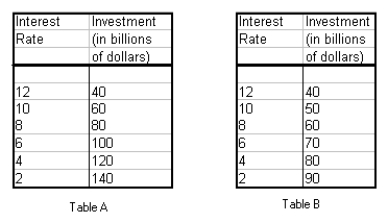

According to the two investment demand schedules above which will allow an expansionary monetary policy to have its greater impact? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

Using the short-hand symbols G, Y, Md, r and I, demonstrate the effects of an expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

Explain how the sensitivity of investment to the interest rate can have a bearing on the amount of crowding out that results from an expansionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Suppose investment becomes less responsive to (i.e., sensitive to) changes in the interest rate. What effect will this have on the effectiveness of fiscal policy? Specifically, what will happen to the output effects of a given change in government spending?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

What would be the policy mix that would cause the interest rate to increase, and investment to decrease but have an indeterminate effect on aggregate output?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

Discuss the effects of a policy mix of an expansionary fiscal policy and an expansionary monetary policy on output and interest rates. Is there any ambiguity with regard to the effect on interest rates and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

Explain when fiscal policy is more effective in changing equilibrium output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Graphically illustrate and explain the effects of a reduction in the money supply on the equilibrium interest rate, investment, and equilibrium output. Clearly label all curves and the initial and final equilibria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

Discuss what is meant by the crowding-out effects of fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

Explain the two key links between the goods market and the money market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Indicate the effect of each of the following policies on the variables: Y, C, S, r, I, Ms, and Md.

(a) The government reduces the personal income tax rates.

(b) Firms become more pessimistic about future sales.

(a) The government reduces the personal income tax rates.

(b) Firms become more pessimistic about future sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

Suppose the Federal Reserve pursues expansionary monetary policy at the same time a reduction in taxes occurs (i.e., a fiscal expansion). Explain what effects this combination of monetary and fiscal policy will have on the macroeconomy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose investment becomes more responsive to (i.e., sensitive to) changes in the interest rate. What effect will this have on the effectiveness of monetary policy? Specifically, what will happen to the output effects of a given change in the money supply?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

How can monetary policy be used to reduce the impact of the crowding-out effect?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Define the crowding-out effect. What factors can influence the extent to which crowding-out occurs when the government implements an expansionary fiscal policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

What is determined in the goods market? What is determined in the money market? Explain the two links between the goods market and the money market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

What is a policy mix?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

Summarize the effects of an expansionary fiscal policy in the aggregate expenditure model. That is graphically illustrate the effects of an expansionary fiscal policy on the equilibrium level of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Explain what is meant by the "mix of macroeconomic policy" and explain how it can affect the level and composition of output (i.e., GDP).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

Between the spring of 1990 and the spring of 1991, interest rates in the United States dropped nearly two full percentage points, but this did not have much of an effect on investment spending plans. Explain how this could happen. Draw a graph of the investment demand schedule that would represent this situation. During this time period would an expansionary monetary policy have been an effective way to stimulate the economy? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Explain why the effectiveness of an expansionary monetary policy in increasing aggregate output is partially dependent on the interest sensitivity of the demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Graphically illustrate and explain the effects of a reduction in government spending on the equilibrium interest rate, investment, and equilibrium output. Clearly label all curves and the initial and final equilibria. Does any crowding-out take place when government spending falls? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Briefly explain what type of policy mix existed in the United States in 1980-82. What effect did this policy mix have on the interest rate and investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck