Deck 8: Provisions, Contingent Liabilities and Contingent Assets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 8: Provisions, Contingent Liabilities and Contingent Assets

1

Which of the following is an example of a provision falling within the scope of AASB 137?

A) Accruals.

B) Onerous contracts.

C) Employee benefits.

D) Future operating losses.

A) Accruals.

B) Onerous contracts.

C) Employee benefits.

D) Future operating losses.

B

2

In respect to a contingent liability, AASB 137 Provisions, Contingent Liabilities and Contingent Assets, requires disclosure of:

A) any increase in the contingent liability during the period.

B) an estimate of its financial effect.

C) the carrying amount at the beginning and end of the period.

D) an indication of the uncertainties about the amount and timing of expected outflows.

A) any increase in the contingent liability during the period.

B) an estimate of its financial effect.

C) the carrying amount at the beginning and end of the period.

D) an indication of the uncertainties about the amount and timing of expected outflows.

B

3

Provisions shall be recognised when:

I - an entity has a present obligation.

II - it is possible that an outflow of resources will be required to settle the obligation.

III - the amount of the obligation can be reliably estimated.

IV - there has been a past event.

A) I, II and III.

B) II, III and IV.

C) I, III and IV.

D) I, II and IV.

I - an entity has a present obligation.

II - it is possible that an outflow of resources will be required to settle the obligation.

III - the amount of the obligation can be reliably estimated.

IV - there has been a past event.

A) I, II and III.

B) II, III and IV.

C) I, III and IV.

D) I, II and IV.

C

4

At balance sheet date, Raschella Limited was awaiting the final details of a court case for damages awarded in its favour. The amount and possible receipt of damages is unknown and will not be decided until the court sits again in several months' time. How is this event dealt with in the preparation of the financial statements?

A) Do not recognise or disclose in the financial statements as the possibility of receiving damages is remote.

B) Recognise as an asset in the financial statements as the receipt of damages is probable.

C) Disclose in the notes to the financial statements as it is possible that the entity will receive the damages and the court decision is out of its control.

D) Recognise as a deferred asset in the statement of financial position and re-classify as a non-current asset when the court decision is known.

A) Do not recognise or disclose in the financial statements as the possibility of receiving damages is remote.

B) Recognise as an asset in the financial statements as the receipt of damages is probable.

C) Disclose in the notes to the financial statements as it is possible that the entity will receive the damages and the court decision is out of its control.

D) Recognise as a deferred asset in the statement of financial position and re-classify as a non-current asset when the court decision is known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Entity A has provided a bank guarantee to a bank in relation to a loan provided to entity B. Entity B is solvent and shows no signs of defaulting on the loan. The treatment of the bank guarantee in the records of entity A is to:

A) recognise a liability.

B) recognise a provision.

C) recognise a contingent liability.

D) do nothing.

A) recognise a liability.

B) recognise a provision.

C) recognise a contingent liability.

D) do nothing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

JayJay Limited estimated that the future cash outflows relating to settlement of warranty obligations would be as follows:

In 1 year - $40 000.

In 2 years - $50 000.

In 3 years - $60 000.

A government rate for bonds with similar terms is 6%. What is the present value of the total expected future cash outflow?

A) $132 612.

B) $140 510.

C) $150 000.

D) $159 000.

In 1 year - $40 000.

In 2 years - $50 000.

In 3 years - $60 000.

A government rate for bonds with similar terms is 6%. What is the present value of the total expected future cash outflow?

A) $132 612.

B) $140 510.

C) $150 000.

D) $159 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

The June 2005 exposure draft issued in relation to proposed changes to AASB 137:

A) will be issued as a standard applicable for reporting periods ending on or after 1 June 2014.

B) has been withdrawn by the AASB.

C) is still under consideration by the AASB.

D) is already applicable.

A) will be issued as a standard applicable for reporting periods ending on or after 1 June 2014.

B) has been withdrawn by the AASB.

C) is still under consideration by the AASB.

D) is already applicable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

Liabilities which fail the recognition criteria and where the possibility of an outflow is remote should:

A) be recognised as an accrual.

B) be recognised as a provision.

C) be recognised as a contingent liability.

D) not be recognised in the financial statement at all.

A) be recognised as an accrual.

B) be recognised as a provision.

C) be recognised as a contingent liability.

D) not be recognised in the financial statement at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Purcell Limited is a manufacturer of swimming pools and provides its customers with warranties at the time of sale. The warranty applies for three years from the date of sale. Past experience shows that there will be some claims under the warranties. The appropriate treatment of this item under AASB 137 Provisions, Contingent Liabilities and Contingent Assets is to:

A) disclose in the notes, but do not recognise in the financial statements.

B) recognise the best estimate of costs as a provision.

C) charge the costs directly to profit or loss in the period in which the economic outflows occur.

D) transfer the expected amount of the warranty from retained earnings to a special reserve account in equity.

A) disclose in the notes, but do not recognise in the financial statements.

B) recognise the best estimate of costs as a provision.

C) charge the costs directly to profit or loss in the period in which the economic outflows occur.

D) transfer the expected amount of the warranty from retained earnings to a special reserve account in equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

The following is statement made in AASB 137 Provisions, Contingent Liabilities and Contingent Assets:

'a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it'.

This statement provides a definition of:

A) an onerous contract.

B) a deferred liability.

C) a future operating loss.

D) a present obligation.

'a contract in which the unavoidable costs of meeting the obligations under the contract exceed the economic benefits expected to be received under it'.

This statement provides a definition of:

A) an onerous contract.

B) a deferred liability.

C) a future operating loss.

D) a present obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

An event that gives rise to a present obligation, but which cannot be measured with sufficient reliability is an example of a:

A) liability.

B) accrual.

C) provision.

D) contingent liability.

A) liability.

B) accrual.

C) provision.

D) contingent liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

McCann Limited announced its plans for a major restructuring of its operations. Under AASB 137 Provisions, Contingent Liabilities and Contingent Assets, the entity is able to:

A) capitalise all direct and indirect restructuring costs.

B) set up a provision for the best estimate of all restructuring costs.

C) provide only for restructuring costs that are directly and necessarily caused by the restructuring.

D) provide for restructuring costs that are associated with the ongoing activities of the entity.

A) capitalise all direct and indirect restructuring costs.

B) set up a provision for the best estimate of all restructuring costs.

C) provide only for restructuring costs that are directly and necessarily caused by the restructuring.

D) provide for restructuring costs that are associated with the ongoing activities of the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under AASB 137 Provisions, Contingent Liabilities and Contingent Assets, the appropriate accounting treatment for future operating losses is to:

A) determine a reasonable estimate of the cost and provide for the future liability.

B) determine the cost and charge it directly against retained earnings.

C) not recognise such items in the financial statements.

D) measure on the basis of estimated future cash flows.

A) determine a reasonable estimate of the cost and provide for the future liability.

B) determine the cost and charge it directly against retained earnings.

C) not recognise such items in the financial statements.

D) measure on the basis of estimated future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

For each class of provision, an entity is required under AASB 137 Provisions, Contingent Liabilities and Contingent Assets, to disclose the following information:

I - The carrying amount at the beginning and end of the period.

II - Amounts incurred and charged against the provision during the period.

III - Comparative information.

IV - Unused amounts reversed during the period.

V - Additional provisions made during the period.

A) I, II, IV and V only.

B) I, II, and III only.

C) II, III and IV only.

D) I, III, IV and V only.

I - The carrying amount at the beginning and end of the period.

II - Amounts incurred and charged against the provision during the period.

III - Comparative information.

IV - Unused amounts reversed during the period.

V - Additional provisions made during the period.

A) I, II, IV and V only.

B) I, II, and III only.

C) II, III and IV only.

D) I, III, IV and V only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

According to AASB 137 Provisions, Contingent Liabilities and Contingent Assets, the appropriate treatment for a contingent asset in the financial statements of an entity is:

A) disclosure of information in the notes, but do not recognise in the financial statements.

B) recognition in the financial statements, and note disclosure.

C) recognition in the financial statements, but no further disclosure in the notes.

D) do not recognise in the financial statements, and do not disclose in the notes.

A) disclosure of information in the notes, but do not recognise in the financial statements.

B) recognition in the financial statements, and note disclosure.

C) recognition in the financial statements, but no further disclosure in the notes.

D) do not recognise in the financial statements, and do not disclose in the notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

The following statement, contained in AASB 137 Provisions, Contingent Liabilities and Contingent Assets, defines:

'a possible asset that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity'

A) a deferred liability.

B) a contingent liability.

C) a deferred asset.

D) a contingent asset.

'a possible asset that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity'

A) a deferred liability.

B) a contingent liability.

C) a deferred asset.

D) a contingent asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

A railway company is required, under law, to overhaul its rail-tracks every three years as a safety measure. The appropriate treatment of this event for the purposes of preparing financial statements is:

A) recognise as a provision for future maintenance costs.

B) estimate the future maintenance costs and charge as depreciation over the next three years.

C) disclose in the notes as a contingent liability, but do not recognise.

D) estimate the future cash outflows and discount to determine the amount to be recognised as a deferred liability.

A) recognise as a provision for future maintenance costs.

B) estimate the future maintenance costs and charge as depreciation over the next three years.

C) disclose in the notes as a contingent liability, but do not recognise.

D) estimate the future cash outflows and discount to determine the amount to be recognised as a deferred liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

An example of where an entity has a present obligation is:

A) a public announcement made by an entity's management to undertake restructuring.

B) a recommendation from the HR manager to the Board as to the level of bonuses to be paid at year end.

C) a historical pattern of performing a major overhaul of machinery every two years.

D) the declaration of a dividend by directors which is required to be ratified at a meeting of shareholders.

A) a public announcement made by an entity's management to undertake restructuring.

B) a recommendation from the HR manager to the Board as to the level of bonuses to be paid at year end.

C) a historical pattern of performing a major overhaul of machinery every two years.

D) the declaration of a dividend by directors which is required to be ratified at a meeting of shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

The uncertainty that exists in relation to provisions is one of:

A) timing.

B) amount.

C) timing and amount.

D) timing or amount.

A) timing.

B) amount.

C) timing and amount.

D) timing or amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

According to AASB 137 Provisions, Contingent Liabilities and Contingent Assets, when providing for the future, a future event such as the clean-up of a contaminated site, gains and other cash inflows that are expected to arise on the sale of asset related to the clean-up, must be treated as follows:

A) set-off against the provision for the clean-up.

B) measured separately of the provision.

C) recognised directly in equity in the period in which the cash inflows arose.

D) recognised as a deferred asset.

A) set-off against the provision for the clean-up.

B) measured separately of the provision.

C) recognised directly in equity in the period in which the cash inflows arose.

D) recognised as a deferred asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

Entities are not required to disclose which of the following in relation to provisions?

A) Carrying amounts of provisions at the beginning of the period.

B) Amounts used during the period.

C) The effect of any change in the discount rate used.

D) Comparatives.

A) Carrying amounts of provisions at the beginning of the period.

B) Amounts used during the period.

C) The effect of any change in the discount rate used.

D) Comparatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is correct?

A) A present obligation is an example of a legal obligation.

B) A legal obligation is an example of a constructive obligation.

C) A constructive obligation is an example of an equitable obligation.

D) An equitable obligation is an example of a present obligation.

A) A present obligation is an example of a legal obligation.

B) A legal obligation is an example of a constructive obligation.

C) A constructive obligation is an example of an equitable obligation.

D) An equitable obligation is an example of a present obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

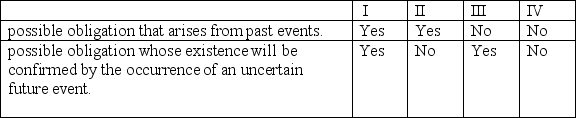

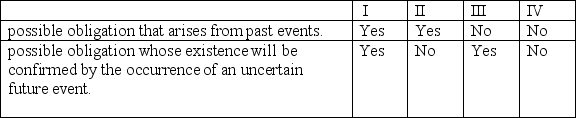

A contingent liability is defined as a:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is correct?

A) A provision is a class of liabilities.

B) A contingent liability is a class of liabilities.

C) A provision is a class of contingent liabilities.

D) Contingent liabilities and provisions are classes of liabilities.

A) A provision is a class of liabilities.

B) A contingent liability is a class of liabilities.

C) A provision is a class of contingent liabilities.

D) Contingent liabilities and provisions are classes of liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

The costs under an onerous contract are measured using which valuation method?

A) The lower of cost or net market value.

B) The lower of the cost of fulfilling the contract and the penalties arising from failure to fulfil the contract.

C) The present value method using a risk-free discount rate.

D) The unavoidable costs of meeting the obligations discounted by reference to market yields at reporting date.

A) The lower of cost or net market value.

B) The lower of the cost of fulfilling the contract and the penalties arising from failure to fulfil the contract.

C) The present value method using a risk-free discount rate.

D) The unavoidable costs of meeting the obligations discounted by reference to market yields at reporting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

An entity sells goods under warranty and past experience shows that minor defects account for 10% of sales and major defects account for 2% of sales. If all minor defects were repaired the warranty cost would be $300 000, and if all major defects were repaired the warranty cost would be $800 000. The expected value of the warranty cost is:

A) $0.

B) $22 000.

C) $46 000.

D) $86 000.

A) $0.

B) $22 000.

C) $46 000.

D) $86 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

Contingent liabilities are:

A) recognised in the financial statements unless the possibility of an outflow in settlement is remote.

B) recognised in the notes to the financial statements unless the possibility of an outflow in settlement is remote.

C) recognised in the notes to the financial statements because the possibility of an outflow in settlement is remote.

D) not recognised in the notes to the financial statements because the possibility of an outflow in settlement is remote.

A) recognised in the financial statements unless the possibility of an outflow in settlement is remote.

B) recognised in the notes to the financial statements unless the possibility of an outflow in settlement is remote.

C) recognised in the notes to the financial statements because the possibility of an outflow in settlement is remote.

D) not recognised in the notes to the financial statements because the possibility of an outflow in settlement is remote.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck