Deck 4: Inventories

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/30

العب

ملء الشاشة (f)

Deck 4: Inventories

1

The weighted average inventories costing method is particularly suitable to inventories where:

A) dissimilar products are stored in separate locations.

B) the entity carries stocks of raw materials, work-in-progress and finished goods.

C) goods have distinct use-by dates and the goods produced first must be sold earliest.

D) homogeneous products are mixed together.

A) dissimilar products are stored in separate locations.

B) the entity carries stocks of raw materials, work-in-progress and finished goods.

C) goods have distinct use-by dates and the goods produced first must be sold earliest.

D) homogeneous products are mixed together.

D

2

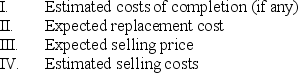

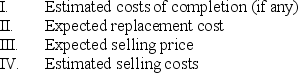

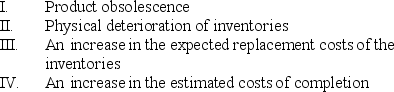

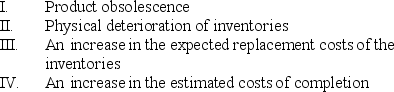

When determining the net realisable value of inventories, estimates must be made of which of the following:

A) I, II, III and IV

B) I, II and III only

C) II and IV only

D) I, III and IV only

A) I, II, III and IV

B) I, II and III only

C) II and IV only

D) I, III and IV only

D

3

AASB 102 Inventories requires that when inventories are written down to net realisable value, they are written-down:

A) on a class-by-class basis.

B) on the basis of industry segment.

C) on an item-by-item basis.

D) according to geographical segment within the entity.

A) on a class-by-class basis.

B) on the basis of industry segment.

C) on an item-by-item basis.

D) according to geographical segment within the entity.

C

4

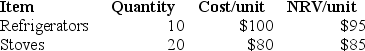

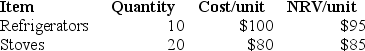

Ming Limited had the following items of inventories at reporting date.

What is the adjustment necessary at reporting date?

A) DR Inventories $50

B) DR Inventories $100

C) CR Inventories $50

D) CR Inventories $0

What is the adjustment necessary at reporting date?

A) DR Inventories $50

B) DR Inventories $100

C) CR Inventories $50

D) CR Inventories $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under AASB 102 Inventories, items of inventories that are used by business enterprise as components in a self-constructed property asset are required to be:

A) aggregated into the 'cost of goods sold' expense in the period in which the items are used.

B) expensed directly into equity in the period in which the items are used.

C) capitalised and depreciated.

D) added to a 'property construction' provision account.

A) aggregated into the 'cost of goods sold' expense in the period in which the items are used.

B) expensed directly into equity in the period in which the items are used.

C) capitalised and depreciated.

D) added to a 'property construction' provision account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

6

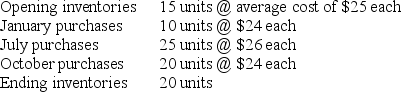

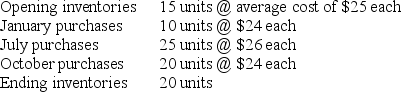

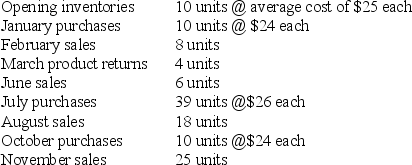

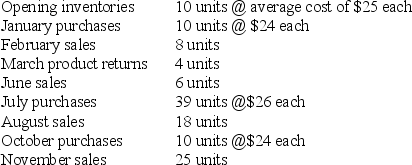

Duo Ltd uses a periodic inventories system and rounds the average unit cost to the nearest dollar. The following data relates to Duo Ltd for the year ended 30 June 2013.

The cost of ending inventories using the weighted average cost method (rounded to the nearest dollar) is:

A) $459.

B) $465.

C) $499.

D) $483.

The cost of ending inventories using the weighted average cost method (rounded to the nearest dollar) is:

A) $459.

B) $465.

C) $499.

D) $483.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

7

When an inventories costing formula is changed, the change is required to be applied:

A) prospectively and the adjustment taken through the current profit or loss.

B) retrospectively and the adjustment taken through the opening balance of retained earnings.

C) prospectively and the current period adjustment recognised directly in equity.

D) retrospectively and the adjustment recognised as an extraordinary gain or loss.

A) prospectively and the adjustment taken through the current profit or loss.

B) retrospectively and the adjustment taken through the opening balance of retained earnings.

C) prospectively and the current period adjustment recognised directly in equity.

D) retrospectively and the adjustment recognised as an extraordinary gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

8

Net realisable value of inventories may fall below cost for a number of reasons including which of the following:

A) I, II and IV only

B) I, III and IV only

C) II, III and IV only

D) I and II only

A) I, II and IV only

B) I, III and IV only

C) II, III and IV only

D) I and II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the selling price of inventories that has been written down to net realisable value in a prior period, subsequently recovers, the:

A) previous amount of the write-down can be reversed.

B) carrying amount of the inventories cannot be adjusted.

C) value adjustment can be recognised immediately in equity.

D) adjustment must be recognised in a 'provision for future inventories write-downs' account.

A) previous amount of the write-down can be reversed.

B) carrying amount of the inventories cannot be adjusted.

C) value adjustment can be recognised immediately in equity.

D) adjustment must be recognised in a 'provision for future inventories write-downs' account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

10

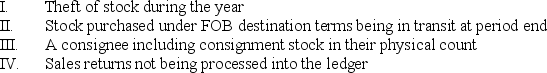

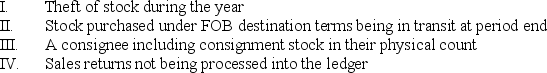

Stock take discrepancies between a count sheet and recorded quantities in the ledger may arise due to which of the following:

A) I, II and III

B) II, III and IV

C) I, III and IV

D) I, II and IV

A) I, II and III

B) II, III and IV

C) I, III and IV

D) I, II and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

11

The measurement rule for inventories, mandated by AASB 102 Inventories, is:

A) lower of fair value and selling price.

B) lower of cost and net realisable value.

C) higher of initial cost and realisable value.

D) higher of completion costs and replacement costs.

A) lower of fair value and selling price.

B) lower of cost and net realisable value.

C) higher of initial cost and realisable value.

D) higher of completion costs and replacement costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

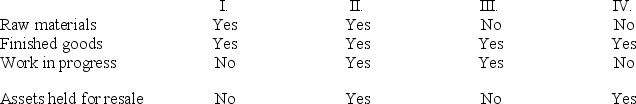

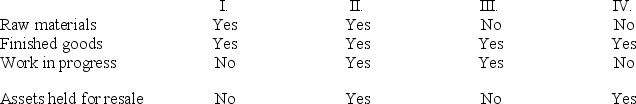

12

Which of the following are common classifications for the disclosure of inventories in a set of financial statements:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

13

AASB 102 prohibits which of the following from being included in the cost of inventories:

A) Trade discounts received

B) Freight (where the terms of sale are FOB destination)

C) Production overheads

D) Import duties

A) Trade discounts received

B) Freight (where the terms of sale are FOB destination)

C) Production overheads

D) Import duties

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

14

'Net realisable value' of inventories is defined as the net amount that an enterprise expects to realise from the sale of the inventories:

A) in the ordinary course of operations less estimated costs of completion and costs necessary to make the sale.

B) plus the estimated costs of completion plus the estimated costs necessary to make the sale.

C) in a forced sale.

D) plus the estimated costs of completion.

A) in the ordinary course of operations less estimated costs of completion and costs necessary to make the sale.

B) plus the estimated costs of completion plus the estimated costs necessary to make the sale.

C) in a forced sale.

D) plus the estimated costs of completion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

15

Where the net realisable value of inventories falls below cost, AASB 102 Inventories requires that:

A) inventories continue to be carried in the statement of financial position at cost.

B) inventories be written down to net realisable value.

C) no adjustment be made, but the difference between net realisable value and cost be disclosed in the notes to the financial statements.

D) the difference be added to the carrying amount of the inventories.

A) inventories continue to be carried in the statement of financial position at cost.

B) inventories be written down to net realisable value.

C) no adjustment be made, but the difference between net realisable value and cost be disclosed in the notes to the financial statements.

D) the difference be added to the carrying amount of the inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

16

Uno Ltd uses a periodic inventories system and rounds the average unit cost to the nearest dollar. The following data relates to Uno Ltd for the year ended 30 June 2014.

The cost of goods sold for the year using the weighted average method is:

A) $1528.

B) $1734.

C) $1425.

D) $1984.

The cost of goods sold for the year using the weighted average method is:

A) $1528.

B) $1734.

C) $1425.

D) $1984.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is correct:

A) The periodic method of accounting for inventories will always result in a higher closing inventories balance than the perpetual method.

B) The periodic method of accounting for inventories will always result in a lower closing inventories balance than the perpetual method.

C) Closing inventories will always be the same under the periodic and perpetual methods.

D) The relationship between the closing inventories balance under the periodic and perpetual methods will depend on whether the FIFO or weighted average method is used to value inventories.

A) The periodic method of accounting for inventories will always result in a higher closing inventories balance than the perpetual method.

B) The periodic method of accounting for inventories will always result in a lower closing inventories balance than the perpetual method.

C) Closing inventories will always be the same under the periodic and perpetual methods.

D) The relationship between the closing inventories balance under the periodic and perpetual methods will depend on whether the FIFO or weighted average method is used to value inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

18

AASB 102 requires separate disclosure of:

A) where there has been abnormal wastage which has been expensed.

B) details of inventories pledged as security for loans.

C) interest costs which have been capitalised into the cost of inventories.

D) details of key terms of purchase.

A) where there has been abnormal wastage which has been expensed.

B) details of inventories pledged as security for loans.

C) interest costs which have been capitalised into the cost of inventories.

D) details of key terms of purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

19

AASB 102 allows which of the following to be capitalised into the cost of inventories:

A) Storage costs for finished goods

B) Selling costs

C) Normal wastage costs

D) Administrative overheads

A) Storage costs for finished goods

B) Selling costs

C) Normal wastage costs

D) Administrative overheads

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

20

Commodity broker traders are able to measure their inventories at:

A) replacement cost.

B) nominal cost.

C) fair value less costs of disposal.

D) current cost.

A) replacement cost.

B) nominal cost.

C) fair value less costs of disposal.

D) current cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not recognised as an expense in accordance with AASB 102:

A) Cost of goods sold

B) Write-downs of inventories to net realisable value

C) Reversal of write downs to net realisable value

D) Inventories items used by an entity as components in self-constructed property, plant or equipment

A) Cost of goods sold

B) Write-downs of inventories to net realisable value

C) Reversal of write downs to net realisable value

D) Inventories items used by an entity as components in self-constructed property, plant or equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

22

Where inventories in an industry are measured by reference to historical cost, which of the following measurement rules applies subsequent to initial measurement:

A) Historical cost

B) Discounted cash flow

C) Lower of cost and net realisable value

D) Replacement cost

A) Historical cost

B) Discounted cash flow

C) Lower of cost and net realisable value

D) Replacement cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

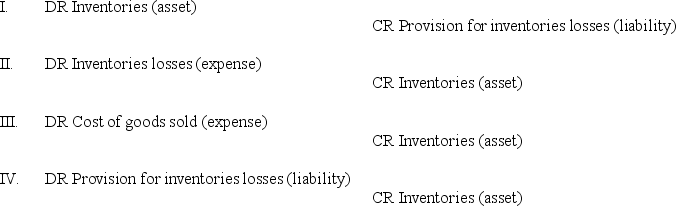

23

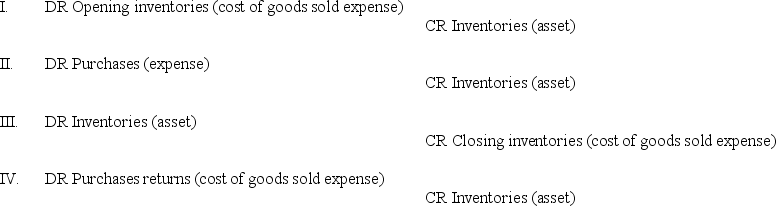

Which of the following is an appropriate journal entry to recognise inventories items that have been lost:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

24

When an entity's operating cycle is not clearly identifiable it is assumed to be:

A) three months.

B) six months.

C) nine months.

D) 12 months.

A) three months.

B) six months.

C) nine months.

D) 12 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

25

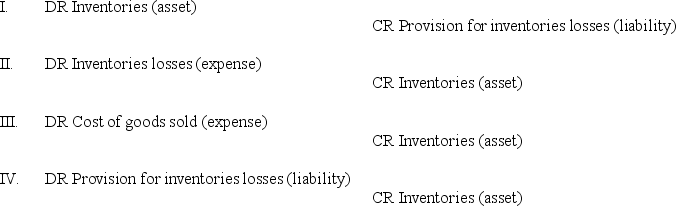

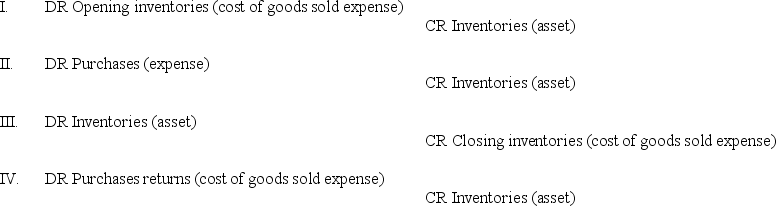

Under the periodic inventories approach, which of the following is an appropriate journal entry to measure closing inventories:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

26

AASB 102 Inventories applies to the accounting for:

A) work in progress under construction contracts.

B) financial instruments.

C) biological assets.

D) materials consumed in the manufacture of knitting machines for sale.

A) work in progress under construction contracts.

B) financial instruments.

C) biological assets.

D) materials consumed in the manufacture of knitting machines for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under the periodic inventories approach, how is the cost of goods sold during a period determined?

A) Beginning inventories + net purchases - ending inventories

B) Beginning inventories - net purchases - ending inventories

C) Opening inventories + net purchases + closing inventories

D) Opening inventories - net purchases + closing inventories

A) Beginning inventories + net purchases - ending inventories

B) Beginning inventories - net purchases - ending inventories

C) Opening inventories + net purchases + closing inventories

D) Opening inventories - net purchases + closing inventories

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

28

The terms '2/7' appearing on an invoice for the sale/purchase of inventories means that the buyer:

A) will receive a 2% discount if paid within 7 days of the invoice date.

B) will receive a 7% discount if paid within 2 days of the invoice date.

C) has 7 days from the invoice date to pay or will be charged a 2% surcharge.

D) has 2 days from the invoice date to pay or will be charged a 7% surcharge.

A) will receive a 2% discount if paid within 7 days of the invoice date.

B) will receive a 7% discount if paid within 2 days of the invoice date.

C) has 7 days from the invoice date to pay or will be charged a 2% surcharge.

D) has 2 days from the invoice date to pay or will be charged a 7% surcharge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

29

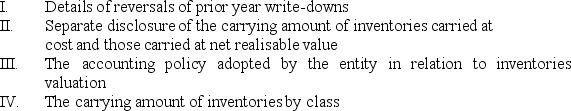

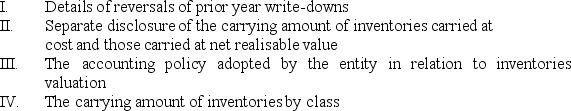

AASB 102 requires disclosure of which of the following:

A) II and III only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

A) II and III only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck

30

Taxes may be included in the cost of inventories unless they are:

A) levied on the entity by a foreign government.

B) in respect to the raw materials component of manufactured inventories.

C) recoverable by the entity from the taxing authority.

D) in the nature of import duties.

A) levied on the entity by a foreign government.

B) in respect to the raw materials component of manufactured inventories.

C) recoverable by the entity from the taxing authority.

D) in the nature of import duties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 30 في هذه المجموعة.

فتح الحزمة

k this deck