Deck 30: Consolidation: Other Issues

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 30: Consolidation: Other Issues

1

When calculating the direct non-controlling interest share of equity, consolidation adjustments are needed to:

A) remove unrealised profits or losses from intragroup transactions.

B) recognise profits made on intragroup services.

C) eliminate intragroup advances.

D) partially eliminate profits on intragroup services.

A) remove unrealised profits or losses from intragroup transactions.

B) recognise profits made on intragroup services.

C) eliminate intragroup advances.

D) partially eliminate profits on intragroup services.

A

2

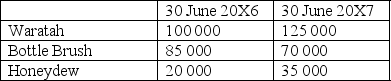

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 20X5.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

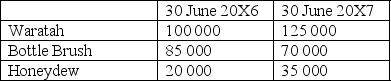

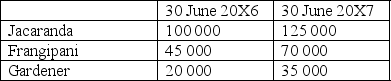

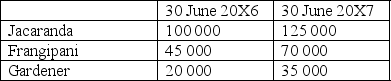

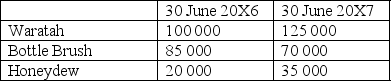

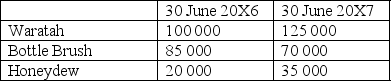

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in Honeydew for the year ended 30 June 20X7 is:

A) $9800.

B) $10 500.

C) $20 300.

D) $22 330.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in Honeydew for the year ended 30 June 20X7 is:

A) $9800.

B) $10 500.

C) $20 300.

D) $22 330.

$20 300.

3

The pre-acquisition entry for the Baxter group in order to consolidate a 60% interest in a subsidiary contained the following debits. Retained earnings $6000, share capital $12 000, general reserve $2400, BCVR $1200. The direct non-controlling interest's share of the subsidiary's equity at the date of acquisition is:

A) $8640.

B) $14 400.

C) $12 960.

D) $21 600.

A) $8640.

B) $14 400.

C) $12 960.

D) $21 600.

B

4

An indirect non-controlling interest arises:

A) only when a wholly owned subsidiary owns shares in another subsidiary.

B) when a partly owned subsidiary owns shares in the parent entity.

C) when a wholly owned subsidiary owns shares in the parent entity.

D) only when a partly owned subsidiary holds shares in another subsidiary.

A) only when a wholly owned subsidiary owns shares in another subsidiary.

B) when a partly owned subsidiary owns shares in the parent entity.

C) when a wholly owned subsidiary owns shares in the parent entity.

D) only when a partly owned subsidiary holds shares in another subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

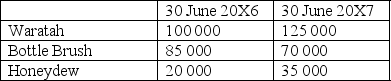

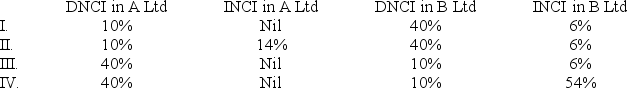

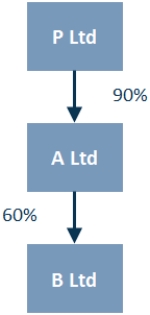

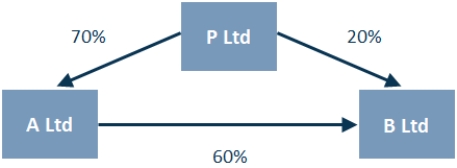

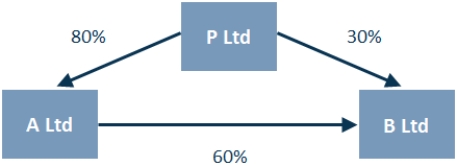

Consider the following economic entity structure:

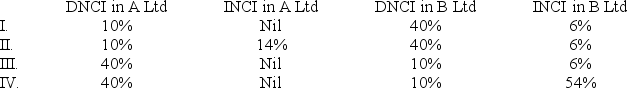

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 20X5.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The effect of the interest paid by Bottle Brush to Waratah on the NCI of Bottle Brush for the year ended 30 June 20X7 is:

A) nil.

B) an increase in MI of $1120.

C) an increase in MI of $1600.

D) an increase in MI of $2800.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The effect of the interest paid by Bottle Brush to Waratah on the NCI of Bottle Brush for the year ended 30 June 20X7 is:

A) nil.

B) an increase in MI of $1120.

C) an increase in MI of $1600.

D) an increase in MI of $2800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

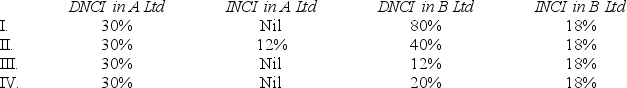

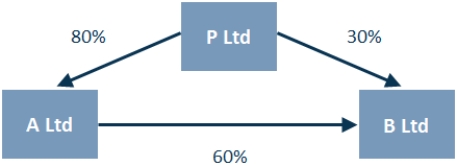

Consider the following economic entity structure.

The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

Caloundra Limited has an ownership interest of 60% in a subsidiary Aroona Limited. Aroona owns 70% of Bribie Limited. Since acquisition date the retained earnings of Bribie Limited have increased from $100 000 to $150 000. The direct non-controlling interest in the retained earnings of Bribie is:

A) $0.

B) $105 000.

C) $60 000.

D) $45 000.

A) $0.

B) $105 000.

C) $60 000.

D) $45 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 20X5. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7:

On 1 July 20X5 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 20X5, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 20X5.

Jacaranda lent $500 000 to Gardener on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $20 000 and for the year ended 30 June 20X7 was $40 000.

On 31 May 20X6 Frangipani sold inventories to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventories to external parties on 1 August 20X6.

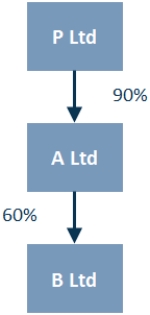

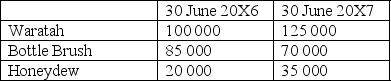

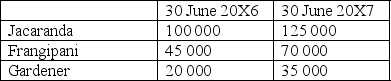

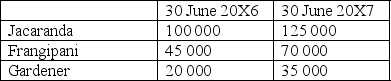

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in the Frangipani group for the year ended 30 June 20X6 is:

A) $14 812.50.

B) $15 487.50.

C) $17 175.00.

D) $21 987.50.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7:

On 1 July 20X5 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 20X5, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 20X5.

Jacaranda lent $500 000 to Gardener on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $20 000 and for the year ended 30 June 20X7 was $40 000.

On 31 May 20X6 Frangipani sold inventories to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in the Frangipani group for the year ended 30 June 20X6 is:

A) $14 812.50.

B) $15 487.50.

C) $17 175.00.

D) $21 987.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a group that has a multiple subsidiary structure, the indirect non-controlling interest is entitled to:

A) a proportionate share of post-acquisition equity only.

B) a proportionate share of pre-acquisition equity only.

C) no share of post acquisition equity.

D) no share of either pre acquisition or post acquisition equity.

A) a proportionate share of post-acquisition equity only.

B) a proportionate share of pre-acquisition equity only.

C) no share of post acquisition equity.

D) no share of either pre acquisition or post acquisition equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a situation where a parent acquires shares in a subsidiary, and the subsidiary later acquires a controlling interest in another entity, the ownership structure is:

A) sequential.

B) non-sequential.

C) ordered.

D) random.

A) sequential.

B) non-sequential.

C) ordered.

D) random.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

Nambour Limited has a direct ownership interest of 70% in Noosa Limited. Liao Limited has a direct ownership interest of 60% in Mudjimba Limited. The indirect non-controlling interest in Mudjimba Limited is:

A) 28%.

B) 40%.

C) 30%.

D) 18%.

A) 28%.

B) 40%.

C) 30%.

D) 18%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

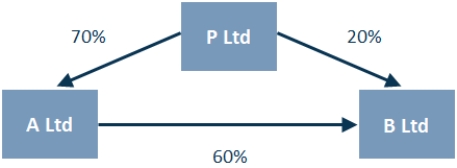

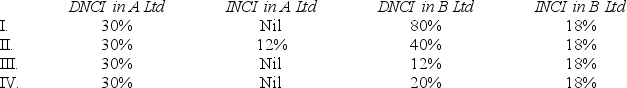

Consider the following economic entity structure.

The indirect NCI in B Ltd is the same group of shareholders as the:

A) direct NCI in B Ltd.

B) indirect NCI in A Ltd.

C) direct NCI in A Ltd.

D) shareholders in P Ltd.

The indirect NCI in B Ltd is the same group of shareholders as the:

A) direct NCI in B Ltd.

B) indirect NCI in A Ltd.

C) direct NCI in A Ltd.

D) shareholders in P Ltd.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a group that has a multiple subsidiary structure, the direct non-controlling interest is entitled to:

A) a proportionate share of post-acquisition equity only.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of both pre-acquisition and post-acquisition equity.

D) no share of post-acquisition equity.

A) a proportionate share of post-acquisition equity only.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of both pre-acquisition and post-acquisition equity.

D) no share of post-acquisition equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

An ownership structure in which Orange Limited acquires shares in Pear Limited before Pear Limited acquires shares in Quince Limited is known as:

A) an aggregate acquisition.

B) a sequential acquisition.

C) a multiple acquisition.

D) a consequential acquisition.

A) an aggregate acquisition.

B) a sequential acquisition.

C) a multiple acquisition.

D) a consequential acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

Jacaranda Limited acquired a 75% ownership interest in Frangipani Limited on 30 June 20X5. On the same day, Frangipani Limited acquired a 60% ownership interest in Gardener Limited.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7:

On 1 July 20X5 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 20X5, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 20X5.

Jacaranda lent $500 000 to Gardener on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $20 000 and for the year ended 30 June 20X7 was $40 000.

On 31 May 20X6 Frangipani sold inventories to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The effect of the dividend paid by Gardener to Frangipani on the NCI of Gardener for the year ended 30 June 20X6 is:

A) nil.

B) $15 000.

C) $40 000.

D) $55 000.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7:

On 1 July 20X5 Gardener sold an item of plant to Jacaranda for a profit of $25 000. The remaining useful life of the plant at the date of transfer was 2 years.

On 1 September 20X5, Gardener paid a dividend of $100 000 from profits earned prior to 30 June 20X5.

Jacaranda lent $500 000 to Gardener on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $20 000 and for the year ended 30 June 20X7 was $40 000.

On 31 May 20X6 Frangipani sold inventories to Gardener for $15 000. Profit earned on the sale was $1500. Gardener sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The effect of the dividend paid by Gardener to Frangipani on the NCI of Gardener for the year ended 30 June 20X6 is:

A) nil.

B) $15 000.

C) $40 000.

D) $55 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

17

Waratah Ltd acquired a 60% ownership interest in Bottle Brush Ltd on 30 June 20X5.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in Bottle Brush for the year ended 30 June 20X6 is:

A) $11 600.

B) $13 000.

C) $13 800.

D) $29 800.

On the same day, Bottle Brush Ltd acquired a 70% ownership interest in Honeydew Ltd.

The following interentity transactions have taken place between the entities in the group during the years ended 30 June 20X6 and 30 June 20X7.

On 1 July 20X5 Bottle Brush sold an item of plant to Honeydew for a profit of $20 000. The remaining useful life of the plant at the date of transfer was 4 years.

-On 1 September 20X5, Honeydew paid a dividend of $70 000 from profits earned since 30 June 20X5.

-Waratah lent $50 000 to Bottle Brush on 1 January 20X6. Interest charged on the loan for the year ended 30 June 20X6 was $2000 and for the year ended 30 June 20X7 was $4000.

On 31 May 20X6 Waratah sold inventories to Honeydew for $15 000. Profit earned on the sale was $5000. Honeydew sold the inventories to external parties on 1 August 20X6.

Details of profits earned by entities within the group for the years ended 30 June 20X6 and 30 June 20X7 are:

The tax rate is 30%.

The NCI share of profit in Bottle Brush for the year ended 30 June 20X6 is:

A) $11 600.

B) $13 000.

C) $13 800.

D) $29 800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

When calculating the direct non-controlling interest share of equity, consolidation adjustments are needed to:

A) eliminate any realised profits or losses from inventory transfers.

B) recognise any unrealised profits or losses from intragroup service transfers.

C) fully eliminate any unrealised profits or losses from intragroup transactions.

D) partially eliminate any unrealised profits from inventory transfers.

A) eliminate any realised profits or losses from inventory transfers.

B) recognise any unrealised profits or losses from intragroup service transfers.

C) fully eliminate any unrealised profits or losses from intragroup transactions.

D) partially eliminate any unrealised profits from inventory transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

Kerri Limited has a 60% ownership interest in Emily Limited. Emily Limited has an 80% ownership interest in Georgia Limited. As a result of these ownership interests, there is an indirect NCI in Georgia Limited of:

A) 48%.

B) 12%.

C) 8%.

D) 32%.

A) 48%.

B) 12%.

C) 8%.

D) 32%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

Caloundra Limited has an 85% ownership interest in Minchinton Limited. Minchinton Limited has a 55% ownership interest in Moreton Limited. As a result of these ownership interests, there is a direct ownership interest in Moreton Limited amounting to:

A) 15%.

B) 8%.

C) 45%.

D) 85%.

A) 15%.

B) 8%.

C) 45%.

D) 85%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a multiple subsidiary structure, the indirect non-controlling interest is entitled to a proportionate share of:

A) pre-acquisition equity.

B) post-acquisition equity only.

C) both pre- and post-acquisition equity.

D) neither pre- nor post-acquisition equity.

A) pre-acquisition equity.

B) post-acquisition equity only.

C) both pre- and post-acquisition equity.

D) neither pre- nor post-acquisition equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a multiple subsidiary structure, the direct non-controlling interest is entitled to a proportionate share of:

A) pre-acquisition equity only.

B) pre- and post-acquisition amounts of equity.

C) post-acquisition amounts of equity only.

D) post-acquisition balance of retained earnings only.

A) pre-acquisition equity only.

B) pre- and post-acquisition amounts of equity.

C) post-acquisition amounts of equity only.

D) post-acquisition balance of retained earnings only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

Alpha Limited acquired shares in Bravo Limited. At the time of this acquisition Bravo Limited already held shares in Charlie Limited. This form of acquisition of an indirect ownership interest, by Alpha Limited in Charlie Limited, is known as a/an:

A) inconsequential acquisition.

B) indirect acquisition.

C) non-sequential acquisition.

D) unorthodox acquisition.

A) inconsequential acquisition.

B) indirect acquisition.

C) non-sequential acquisition.

D) unorthodox acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

Where a change in ownership interest results in the loss of control of a subsidiary:

A) the gain or loss in the parent's records will equal the consolidated gain or loss.

B) the remaining investment will be recorded at fair value in accordance with AASB 9 Financial Instruments.

C) the remaining investment will be accounted for in accordance with AASB 127 Separate Financial Statements.

D) the gain or loss will be recorded in other comprehensive income.

A) the gain or loss in the parent's records will equal the consolidated gain or loss.

B) the remaining investment will be recorded at fair value in accordance with AASB 9 Financial Instruments.

C) the remaining investment will be accounted for in accordance with AASB 127 Separate Financial Statements.

D) the gain or loss will be recorded in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following can result in a loss of control by a parent over a subsidiary?

A) The parent sells some of the shares in the subsidiary.

B) There is a change in the dispersion in the holding of shares by entities comprising the NCI.

C) There may be a change in a contractual arrangement.

D) All of the above.

A) The parent sells some of the shares in the subsidiary.

B) There is a change in the dispersion in the holding of shares by entities comprising the NCI.

C) There may be a change in a contractual arrangement.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

When preparing consolidation adjustment entries to effect a consolidation of a multiple subsidiary structure, intragroup transactions:

A) are not eliminated.

B) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction.

C) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction.

D) are eliminated in full.

A) are not eliminated.

B) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction.

C) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction.

D) are eliminated in full.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

Realty Group had the following debits in the pre-acquisition entry used to consolidate a 60% direct ownership interest in a subsidiary: Retained earnings $60 000, Share capital $120 000, General Reserve $24 000, BCVR $12 000. The amount attributable to the direct non-controlling interest is:

A) $129 600.

B) $144 000.

C) $86 400.

D) $216 000.

A) $129 600.

B) $144 000.

C) $86 400.

D) $216 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

Peter Limited has an ownership interest of 80% in a subsidiary John Limited. John Limited owns 60% of Joseph Limited. At acquisition date the retained earnings of Joseph Limited were $200 000. At consolidation date, the retained earnings of Joseph Limited were $440 000. The indirect non-controlling interest in the retained earnings of Joseph Limited is calculated as:

A) $0.

B) $24 000.

C) $28 800.

D) $52 800.

A) $0.

B) $24 000.

C) $28 800.

D) $52 800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck