Deck 29: Consolidation: Non-Controlling Interest

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/51

العب

ملء الشاشة (f)

Deck 29: Consolidation: Non-Controlling Interest

1

Ownership interests in a subsidiary entity that do not belong to the parent entity are known as:

A) unowned interests.

B) non-controlling interests.

C) proprietary interests.

D) private interests.

A) unowned interests.

B) non-controlling interests.

C) proprietary interests.

D) private interests.

B

2

Which statements are incorrect with regards to a consolidation worksheet in the presence of the non-controlling interest:

A) there is no NCI share extracted from the assets and liabilities section of the worksheet.

B) two extra columns are added to the worksheet to divide the consolidated equity into the NCI and parent share.

C) one extra column is added that includes the NCI share of the individual equity accounts.

D) one extra column is added that includes the parent share of the individual equity accounts.

A) there is no NCI share extracted from the assets and liabilities section of the worksheet.

B) two extra columns are added to the worksheet to divide the consolidated equity into the NCI and parent share.

C) one extra column is added that includes the NCI share of the individual equity accounts.

D) one extra column is added that includes the parent share of the individual equity accounts.

C

3

Under the full goodwill method, the NCI is measured based on:

A) the fair value of the shares that NCI owns in the subsidiary.

B) the fair value of the shares that parent owns in the subsidiary.

C) the proportionate share of the carrying amount of the acquiree's identifiable assets and liabilities.

D) the proportionate share of the fair value of the acquiree's identifiable assets and liabilities..

A) the fair value of the shares that NCI owns in the subsidiary.

B) the fair value of the shares that parent owns in the subsidiary.

C) the proportionate share of the carrying amount of the acquiree's identifiable assets and liabilities.

D) the proportionate share of the fair value of the acquiree's identifiable assets and liabilities..

C

4

Disclosure of NCI's share of consolidated equity is required in the following financial statements:

A) consolidated statement of financial position.

B) consolidated statement of comprehensive income.

C) consolidated statement of changes in equity.

D) all the options are correct.

A) consolidated statement of financial position.

B) consolidated statement of comprehensive income.

C) consolidated statement of changes in equity.

D) all the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the full goodwill method, a control premium is recognised when:

A) the parent paid more than the fair value for the shares they acquired.

B) the parent paid less than the fair value for the shares they acquired.

C) the consideration transferred by the parent is more than the fair value of the identifiable net assets acquired.

D) the consideration transferred by the parent is less than the fair value of the identifiable net assets acquired.

A) the parent paid more than the fair value for the shares they acquired.

B) the parent paid less than the fair value for the shares they acquired.

C) the consideration transferred by the parent is more than the fair value of the identifiable net assets acquired.

D) the consideration transferred by the parent is less than the fair value of the identifiable net assets acquired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

6

The following information does not need to be disclosed for NCI:

A) the NCI share of consolidated profit before tax.

B) the NCI share of consolidated profit after tax.

C) the NCI share of consolidated comprehensive income.

D) the NCI share of consolidated equity.

A) the NCI share of consolidated profit before tax.

B) the NCI share of consolidated profit after tax.

C) the NCI share of consolidated comprehensive income.

D) the NCI share of consolidated equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

7

Non-controlling interest is classified, according to AASB 10 Consolidated Financial Statements, as:

A) part of the equity of the parent entity.

B) part of the equity of the group.

C) a liability of the parent entity.

D) a liability of the group.

A) part of the equity of the parent entity.

B) part of the equity of the group.

C) a liability of the parent entity.

D) a liability of the group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

8

In Sunrise Group's consolidation worksheet, the opening balance of retained earnings under 'Group' column shows a balance of $90 000. If there is a debit entry of $22 000 in the NCI column, the opening balance of retained earnings under 'Parent' column would be:

A) $112 000.

B) $100 000.

C) $68 000.

D) $56 000.

A) $112 000.

B) $100 000.

C) $68 000.

D) $56 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is not a reason for an entity's preference to have less than 100% ownership interest in some subsidiaries:

A) to decrease the cash necessary to acquire the control over the subsidiaries.

B) to incentivise the subsidiary's executives by allowing them to hold a non-controlling interest.

C) to comply with regulatory requirements.

D) to receive the whole gain on acquisition.

A) to decrease the cash necessary to acquire the control over the subsidiaries.

B) to incentivise the subsidiary's executives by allowing them to hold a non-controlling interest.

C) to comply with regulatory requirements.

D) to receive the whole gain on acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

10

Xana Limited paid $110 000 for 60% of the shares in Yama Limited. At the date of acquisition Yama Limited had share capital of $100 000 and retained earnings of $36 000 and all of Yama Limited's assets and liabilities were recorded at fair value, except for land that was recorded at an amount less than the fair value by $20 000. The company tax rate was 30%. The fair value of identifiable net assets acquired by Xana Limited amounted to:

A) $60 000.

B) $90 000.

C) $110 000.

D) $150 000.

A) $60 000.

B) $90 000.

C) $110 000.

D) $150 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

11

When preparing a set of consolidated financial statements, the pre-acquisition entry relates to:

A) both the parent and the non-controlling interest in the subsidiary.

B) only the investment by the parent in the subsidiary.

C) only the investment by the non-controlling interest in the subsidiary.

D) the total investment by the parent in the subsidiary plus the after tax effect of the investment by the non-controlling interest.

A) both the parent and the non-controlling interest in the subsidiary.

B) only the investment by the parent in the subsidiary.

C) only the investment by the non-controlling interest in the subsidiary.

D) the total investment by the parent in the subsidiary plus the after tax effect of the investment by the non-controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is incorrect with regards to control premium:

A) it is recognised under the full goodwill method.

B) it is recognised only in the pre-acquisition entry.

C) it is recognised in the business combination valuation entries.

D) it is not recognised under the partial goodwill method.

A) it is recognised under the full goodwill method.

B) it is recognised only in the pre-acquisition entry.

C) it is recognised in the business combination valuation entries.

D) it is not recognised under the partial goodwill method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

13

Xin Limited paid $12 000 for 75% of the shares in Yan Limited. At the date of acquisition Yan Limited had equity as follows:

Share capital $10 000

Retained earnings $5 000

Other reserves $3 000

All of Yan Limited's assets and liabilities were recorded at fair value. The fair value of identifiable net assets acquired by Xin Limited amounted to:

A) $9 750.

B) $12 000.

C) $13 500.

D) $18 000.

Share capital $10 000

Retained earnings $5 000

Other reserves $3 000

All of Yan Limited's assets and liabilities were recorded at fair value. The fair value of identifiable net assets acquired by Xin Limited amounted to:

A) $9 750.

B) $12 000.

C) $13 500.

D) $18 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the followings is not the reason of why entities do not use the full goodwill method?

A) Users of financial statements do not see any value in the reported NCI.

B) It is more costly to measure NCI at fair value.

C) It results in less reliable NCI information due to difficulties in measuring NCI at fair value.

D) There is not sufficient evidence to assess the marginal benefits of reporting the acquisition-date fair value of the NCI.

A) Users of financial statements do not see any value in the reported NCI.

B) It is more costly to measure NCI at fair value.

C) It results in less reliable NCI information due to difficulties in measuring NCI at fair value.

D) There is not sufficient evidence to assess the marginal benefits of reporting the acquisition-date fair value of the NCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

15

The non-controlling interest columns on a consolidation worksheet are used to:

A) adjust the amounts that have been recorded for intragroup sales.

B) adjust the amounts that have been recorded for intragroup services.

C) eliminate the recorded amounts of the non-controlling investment in the subsidiary.

D) compile the amounts of non-controlling interest and parent share of particular line items.

A) adjust the amounts that have been recorded for intragroup sales.

B) adjust the amounts that have been recorded for intragroup services.

C) eliminate the recorded amounts of the non-controlling investment in the subsidiary.

D) compile the amounts of non-controlling interest and parent share of particular line items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

16

When presenting a consolidated statement of financial position the non-controlling interest is:

A) presented separately within the non-current liability section.

B) presented as a separate component of total assets and total liabilities.

C) presented separately within the equity section.

D) shown as a separate portion of net assets.

A) presented separately within the non-current liability section.

B) presented as a separate component of total assets and total liabilities.

C) presented separately within the equity section.

D) shown as a separate portion of net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the full goodwill method:

A) the NCI does not get a share of any equity relating to goodwill.

B) only goodwill acquired by parent entity will be recognised.

C) the NCI is measured at the NCI's proportionate share of the acquiree's identifiable assets and liabilities.

D) acquired goodwill consists of both goodwill of the subsidiary and the premium paid by the parent to acquire control over the subsidiary.

A) the NCI does not get a share of any equity relating to goodwill.

B) only goodwill acquired by parent entity will be recognised.

C) the NCI is measured at the NCI's proportionate share of the acquiree's identifiable assets and liabilities.

D) acquired goodwill consists of both goodwill of the subsidiary and the premium paid by the parent to acquire control over the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

18

A non-controlling interest is a contributor of:

A) equity to a consolidated group.

B) liabilities to a consolidated group.

C) assets to a consolidated group.

D) profit to a consolidated group.

A) equity to a consolidated group.

B) liabilities to a consolidated group.

C) assets to a consolidated group.

D) profit to a consolidated group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

19

According to AASB 10 Consolidated Financial Statements, the term 'non-controlling interest' means:

A) the total equity of the combined group.

B) the equity in the parent entity other than the portion owned by the subsidiary entity.

C) the equity in the economic entity other than that which can be attributed to the subsidiary entity.

D) equity in a subsidiary not attributable, directly or indirectly, to a parent.

A) the total equity of the combined group.

B) the equity in the parent entity other than the portion owned by the subsidiary entity.

C) the equity in the economic entity other than that which can be attributed to the subsidiary entity.

D) equity in a subsidiary not attributable, directly or indirectly, to a parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

20

Non-controlling interest is entitled to as:

A) a part of the equity of the parent entity.

B) a part of the equity of the subsidiary entity.

C) a part of the equity of the parent entity as reflected in the consolidated equity.

D) a part of the equity of the subsidiary entity as reflected in the consolidated equity.

A) a part of the equity of the parent entity.

B) a part of the equity of the subsidiary entity.

C) a part of the equity of the parent entity as reflected in the consolidated equity.

D) a part of the equity of the subsidiary entity as reflected in the consolidated equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

21

During the current year, a partly-owned subsidiary has made a transfer from retained earnings to a general reserve. Which of the following lines would appear in the NCI journal relating to the current year transfer?

A) Dr NCI.

B) Dr Retained earnings.

C) Cr General reserve.

D) Cr Transfer to general reserve.

A) Dr NCI.

B) Dr Retained earnings.

C) Cr General reserve.

D) Cr Transfer to general reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

22

Jiminez Limited acquired 80% of the shares in Mustang Limited for $180 000. At acquisition date, share capital in Mustang was $100 000 and reserves amounted to $50 000. All assets and liabilities of Mustang were recorded at fair value at acquisition date except buildings which was recorded at $10 000 below fair value. The fair value of the NCI at the date of Jiminez's acquisition was $35 000 and the full goodwill method is adopted by the group. If the company tax rate was 30%, the goodwill recorded in relation to this business combination amounts to:

A) $3 600.

B) $23 000.

C) $54 400.

D) $58 000.

A) $3 600.

B) $23 000.

C) $54 400.

D) $58 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

23

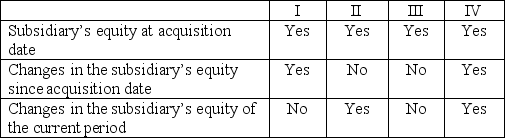

A non-controlling interest in a subsidiary entity is entitled to a share of the following items:

A) I.

B) II.

C) III.

D) IV.

A) I.

B) II.

C) III.

D) IV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

24

Lu Nan Limited acquired 70% of the share capital and reserves of Hui Limited for $36 000. Share capital was $18 000 and reserves amounted to $10 800. All assets and liabilities were recorded at fair value except plant which was recorded at $2 500 below fair value. The company tax rate was 30%. The partial goodwill method is adopted by the group. The amount of goodwill acquired by Lu Nan Limited in this business combination was:

A) $8 640.

B) $9 165.

C) $10 800.

D) $14 615.

A) $8 640.

B) $9 165.

C) $10 800.

D) $14 615.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

25

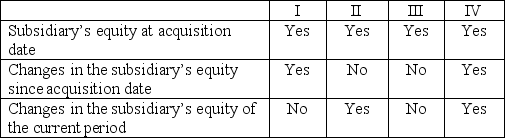

A non-controlling interest is entitled to a share of which of the following items?

I Equity of the group entity at acquisition date.

II Current period profit or loss of the subsidiary entity.

III Changes in equity of the subsidiary since acquisition date and the beginning of the financial period.

IV Equity of the subsidiary at acquisition date.

A) I, II and III.

B) I and II only.

C) II, III and IV only.

D) III only.

I Equity of the group entity at acquisition date.

II Current period profit or loss of the subsidiary entity.

III Changes in equity of the subsidiary since acquisition date and the beginning of the financial period.

IV Equity of the subsidiary at acquisition date.

A) I, II and III.

B) I and II only.

C) II, III and IV only.

D) III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

26

For an intragroup transaction to require an adjustment to the calculation of the non-controlling interest share of equity it must have which of the following characteristics:

I The transaction must result in the subsidiary recording a profit or a loss.

II After the transaction the other party (not the party holding the non-controlling interest) must have on hand an asset on which unrealised profit is accrued.

III The initial consolidation adjustment must affect both the statement of financial position and statement of comprehensive income.

A) I and II only.

B) I, II and III.

C) II and III only.

D) None of the above.

I The transaction must result in the subsidiary recording a profit or a loss.

II After the transaction the other party (not the party holding the non-controlling interest) must have on hand an asset on which unrealised profit is accrued.

III The initial consolidation adjustment must affect both the statement of financial position and statement of comprehensive income.

A) I and II only.

B) I, II and III.

C) II and III only.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

27

Petros Limited is a subsidiary of Butros Limited. When Butros acquired its 60% interest in Petros, the retained earnings of Petros were $20 000. At the beginning of the current period Petros Limited's retained earnings were $50 000. Petros earned profit after tax of $10 000 during the current period. The share of the non-controlling interest in the equity of Petros Limited at the end of the current period is:

A) $8 000.

B) $16 000.

C) $24 000.

D) $32 000.

A) $8 000.

B) $16 000.

C) $24 000.

D) $32 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

28

Company A Limited owns 90% of the share capital of Company B Limited. Company B Limited paid a dividend of $20 000 during the financial period. The NCI adjustment entries in the consolidation worksheet for the dividend include:

A) Dr Dividend revenue $2 000.

B) Cr Dividend revenue $2 000.

C) Dr Dividend payable $2 000.

D) Dr NCI $2 000.

A) Dr Dividend revenue $2 000.

B) Cr Dividend revenue $2 000.

C) Dr Dividend payable $2 000.

D) Dr NCI $2 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

29

A non-controlling interest in the net assets of a subsidiary consists of the amount of those non-controlling interests at the date of the business combination:

A) less 100% of any post-acquisition dividends paid.

B) less the parent's share of any post-acquisition dividends paid or declared.

C) plus the non-controlling proportionate share of the changes in the subsidiary's equity since the business combination.

D) less the non-controlling proportionate share of increases in the subsidiary's equity since the business combination.

A) less 100% of any post-acquisition dividends paid.

B) less the parent's share of any post-acquisition dividends paid or declared.

C) plus the non-controlling proportionate share of the changes in the subsidiary's equity since the business combination.

D) less the non-controlling proportionate share of increases in the subsidiary's equity since the business combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

30

Jiminez Limited acquired 80% of the shares in Mustang Limited for $180 000. At acquisition date, share capital in Mustang was $100 000 and reserves amounted to $50 000. All assets and liabilities of Mustang were recorded at fair value at acquisition date except buildings which was recorded at $10 000 below fair value. If the company tax rate was 30%, and the partial goodwill method was adopted, the NCI share of equity at the date of acquisition was:

A) $30 000.

B) $31 400.

C) $32 000.

D) $54 400.

A) $30 000.

B) $31 400.

C) $32 000.

D) $54 400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

31

A Ltd holds a 60% interest in B Ltd. B Ltd sells inventories to A Ltd during the year for $10 000. The inventories originally cost $7 000. At the end of the year 50% of the inventories are still on hand. The tax rate is 30%. The NCI adjustment required in relation to this transaction is a debit to NCI of:

A) Nil.

B) $420.

C) $630.

D) $1 050.

A) Nil.

B) $420.

C) $630.

D) $1 050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

32

A Ltd holds a 60% interest in B Ltd. A Ltd sells inventory to B Ltd during the year for $10 000. The inventories originally cost $7 000 when purchased from an external party. At the end of the year 50% of the inventories are still on hand. The tax rate is 30%. The NCI adjustment required in relation to this intragroup transaction is a debit to NCI of:

A) Nil.

B) $420.

C) $630.

D) $1 050.

A) Nil.

B) $420.

C) $630.

D) $1 050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

33

Under the partial goodwill method:

A) the NCI is measured at fair value of the shares they own.

B) only goodwill acquired by NCI will be recognised.

C) the NCI is measured at the NCI's proportionate share of the fair value of acquiree's identifiable assets and liabilities.

D) the goodwill will be recognised in the business combination valuation entries.

A) the NCI is measured at fair value of the shares they own.

B) only goodwill acquired by NCI will be recognised.

C) the NCI is measured at the NCI's proportionate share of the fair value of acquiree's identifiable assets and liabilities.

D) the goodwill will be recognised in the business combination valuation entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

34

A Ltd holds a 60% interest in B Ltd. B Ltd sells inventory to A Ltd during the year for $10 000. The inventories originally cost $7 000 when purchased from an external party. At the end of the year all inventories are still on hand. The tax rate is 30%. The NCI adjustment to this intragroup transaction is a debit to NCI of:

A) Nil.

B) $840.

C) $2 100.

D) $3 000.

A) Nil.

B) $840.

C) $2 100.

D) $3 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

35

Changes in equity in the previous periods up to the beginning of the current period that must be identified for the step 2 NCI entry do not include:

A) changes in retained earnings, adjusted for the impact of BCVR entries on the opening balance of retained earnings.

B) transfers to/from reserves.

C) changes in share capital.

D) dividends paid/declared.

A) changes in retained earnings, adjusted for the impact of BCVR entries on the opening balance of retained earnings.

B) transfers to/from reserves.

C) changes in share capital.

D) dividends paid/declared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

36

Company A Limited owns 70% of the share capital of Company B Limited. Company B Limited paid a dividend of $10 000 during the financial period. The adjustment entries in the consolidation worksheet for the dividend include:

A) Dr Dividend revenue $7 000.

B) Dr Dividend revenue $10 000.

C) Dr Dividend payable $7 000.

D) Dr Dividend payable $10 000.

A) Dr Dividend revenue $7 000.

B) Dr Dividend revenue $10 000.

C) Dr Dividend payable $7 000.

D) Dr Dividend payable $10 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

37

During the previous year, a partly-owned subsidiary has made a transfer from retained earnings to a general reserve. Which of the following lines would appear in the NCI journal relating to the current year transfer?

A) Cr NCI.

B) Dr Retained earnings.

C) Cr General reserve.

D) Cr Transfer to general reserve.

A) Cr NCI.

B) Dr Retained earnings.

C) Cr General reserve.

D) Cr Transfer to general reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

38

What is not an effect of choosing the partial goodwill method over the full goodwill method:

A) there will be differences in the reported amounts at acquisition date in the consolidated statements.

B) the impairment test on goodwill after acquisition will be more complex under the partial goodwill method.

C) where the parent acquires some or all of NCI after obtaining control, there will be a higher impact on equity attributable to the parent shareholders.

D) many users or financial statements will so no value in the reported NCI.

A) there will be differences in the reported amounts at acquisition date in the consolidated statements.

B) the impairment test on goodwill after acquisition will be more complex under the partial goodwill method.

C) where the parent acquires some or all of NCI after obtaining control, there will be a higher impact on equity attributable to the parent shareholders.

D) many users or financial statements will so no value in the reported NCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

39

Changes in equity in the current period that must be identified for the step 3 NCI entry include:

A) profit/(loss) earned, adjusted for the impact of BCVR entries on the current profit.

B) transfers to/from reserves.

C) dividends paid/declared.

D) all the options are correct.

A) profit/(loss) earned, adjusted for the impact of BCVR entries on the current profit.

B) transfers to/from reserves.

C) dividends paid/declared.

D) all the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

40

The step 1 NCI entry to reflect the NCI share of equity at acquisition date:

A) never changes, so it does not need to be repeated every period.

B) changes every period as a result of changes in the subsidiary's pre-acquisition equity.

C) changes every period as a result of changes in the subsidiary's post-acquisition equity.

D) changes every period as a result of changes in NCI.

A) never changes, so it does not need to be repeated every period.

B) changes every period as a result of changes in the subsidiary's pre-acquisition equity.

C) changes every period as a result of changes in the subsidiary's post-acquisition equity.

D) changes every period as a result of changes in NCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

41

A Ltd holds a 60% interest in B Ltd. B Ltd sells inventory to A Ltd during the year for $10 000. The inventories originally cost $7 000 when purchased from an external party. At the end of the year all inventories are still on hand, but were sold by the end of the next period. The tax rate is 30%. The NCI adjustment required in relation to this intragroup transaction at the end of the next period is a credit to Retained earnings (opening balance) of:

A) Nil.

B) $840.

C) $2 100.

D) $3 000.

A) Nil.

B) $840.

C) $2 100.

D) $3 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

42

A Ltd holds a 60% interest in B Ltd. On 1 July 2017 B Ltd transferred a depreciable non-current asset to A Ltd at a profit of $5 000. The remaining useful life of the asset at the date of transfer was 4 years and the tax rate is 30%. The impact of the above transaction on the NCI for the year ended 30 June 2019 is:

A) an increase of $700.

B) a decrease of $700.

C) an increase of $1 750.

D) a decrease of $1 750.

A) an increase of $700.

B) a decrease of $700.

C) an increase of $1 750.

D) a decrease of $1 750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

43

The intragroup transactions considered for NCI are normally those involving:

A) the subsidiary selling inventories items or non-current assets to the parent for a profit or loss.

B) the parent selling inventories items or non-current assets to the subsidiary for a profit or loss.

C) the NCI selling inventories items or non-current assets to the parent for a profit or loss.

D) all of the options are correct.

A) the subsidiary selling inventories items or non-current assets to the parent for a profit or loss.

B) the parent selling inventories items or non-current assets to the subsidiary for a profit or loss.

C) the NCI selling inventories items or non-current assets to the parent for a profit or loss.

D) all of the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

44

In respect to the intragroup services provided by a partly-owned subsidiary to the parent, the NCI adjustment required is a debit to NCI of:

A) Nil.

B) the service fees.

C) the service fees multiplied by the NCI ownership interest.

D) the service fees multiplied by the parent's ownership interest.

A) Nil.

B) the service fees.

C) the service fees multiplied by the NCI ownership interest.

D) the service fees multiplied by the parent's ownership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

45

Jiminez Limited acquired 80% of the shares in Mustang Limited for $150 000. At acquisition date, share capital in Mustang was $150 000 and reserves amounted to $50 000. All assets and liabilities of Mustang were recorded at fair value at acquisition date. The partial goodwill method is adopted by the group. If the company tax rate was 30%, the NCI will recognise a gain on bargain purchase of:

A) Nil.

B) $10 000.

C) $40 000.

D) $50 000.

A) Nil.

B) $10 000.

C) $40 000.

D) $50 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

46

A Ltd holds a 60% interest in B Ltd. On 1 July 2017 B Ltd transferred a depreciable non-current asset to A Ltd at a profit of $5 000. The remaining useful life of the asset at the date of transfer was 4 years and the tax rate is 30%. The impact of the above transaction on the NCI share of profit for the year ended 30 June 2018 is:

A) an increase of $2 625.

B) a decrease of $2 625.

C) an increase of $1 050.

D) a decrease of $1 050.

A) an increase of $2 625.

B) a decrease of $2 625.

C) an increase of $1 050.

D) a decrease of $1 050.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following information relating to the NCI is not required to be disclosed in accordance with the AASB 12 Disclosure of Interests in Other Entities?

A) The proportion of ownership interests held by NCI.

B) The profit or loss allocated to NCI of the subsidiary during the reporting period.

C) The total number of shares owned by the NCI.

D) The name of the subsidiary.

A) The proportion of ownership interests held by NCI.

B) The profit or loss allocated to NCI of the subsidiary during the reporting period.

C) The total number of shares owned by the NCI.

D) The name of the subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is correct?

A) The NCI is not entitled to share the group's profit.

B) Transactions that do not affect profit will not give rise to an adjustment to the NCI.

C) All intragroup transactions have an impact on the NCI share of equity.

D) When the parent entity sells inventories to its subsidiary, a consolidation adjustment needs to be recorded to reduce the NCI.

A) The NCI is not entitled to share the group's profit.

B) Transactions that do not affect profit will not give rise to an adjustment to the NCI.

C) All intragroup transactions have an impact on the NCI share of equity.

D) When the parent entity sells inventories to its subsidiary, a consolidation adjustment needs to be recorded to reduce the NCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

49

A Ltd holds a 60% interest in B Ltd. On 30 June 2016 B Ltd transferred a depreciable non-current asset to A Ltd at a profit of $5 000. The remaining useful life of the asset at the date of transfer was 4 years and the tax rate is 30%. The impact of the above transaction on the NCI share of profit at 30 June 2016 is:

A) an increase of $1 400.

B) a decrease of $1 400.

C) an increase of $3 500.

D) a decrease of $3 500.

A) an increase of $1 400.

B) a decrease of $1 400.

C) an increase of $3 500.

D) a decrease of $3 500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

50

In respect to the intragroup services, any profit or loss is regarded as:

A) insignificant and so not adjusted on consolidation.

B) extraordinary and so ignored for consolidation reporting purposes.

C) immediately realised.

D) unrealised.

A) insignificant and so not adjusted on consolidation.

B) extraordinary and so ignored for consolidation reporting purposes.

C) immediately realised.

D) unrealised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck

51

If a gain on bargain purchase arises on a business combination, the non-controlling interest:

A) is allocated 100% of the gain.

B) has no involvement with the gain.

C) is entitled to a proportionate share of the gain based on its level of share ownership.

D) receives a proportionate share of the gain after adjustments for tax effects have been made.

A) is allocated 100% of the gain.

B) has no involvement with the gain.

C) is entitled to a proportionate share of the gain based on its level of share ownership.

D) receives a proportionate share of the gain after adjustments for tax effects have been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 51 في هذه المجموعة.

فتح الحزمة

k this deck