Deck 20: Operating Segments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 20: Operating Segments

1

For financial reporting periods commencing prior to 1 January 2009, the accounting standard relating to segment reporting was:

A) AASB 8 Operating Segments.

B) AASB 114 Segment Reporting.

C) AASB 114 Operating Segments.

D) AASB 8 Segment Reporting.

A) AASB 8 Operating Segments.

B) AASB 114 Segment Reporting.

C) AASB 114 Operating Segments.

D) AASB 8 Segment Reporting.

B

2

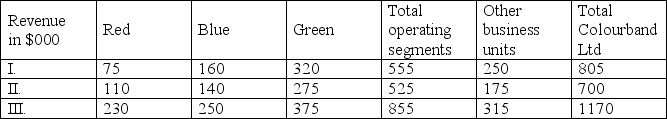

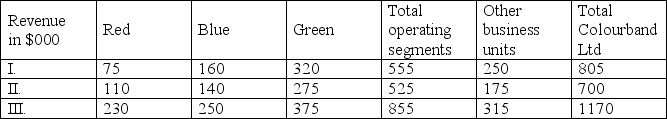

Assuming the three business units below are operating segments and all revenue earned are from external customers, in which of the following scenarios does Colourband Ltd need to identify another reportable segment to be disclosed?

A) I only.

B) I and II.

C) I and III.

D) II and III.

A) I only.

B) I and II.

C) I and III.

D) II and III.

C

3

Which of the following information is not required to be disclosed by entities complying with AASB 8/IFRS 8?

A) The identity of external customers from which the entity earns at least 10% of its revenue.

B) A reconciliation of the total of the reportable segments' liabilities to the entity's liabilities.

C) The nature and effect of the changes in measurement of segment profit or loss.

D) Revenues from external customers located in foreign countries.

A) The identity of external customers from which the entity earns at least 10% of its revenue.

B) A reconciliation of the total of the reportable segments' liabilities to the entity's liabilities.

C) The nature and effect of the changes in measurement of segment profit or loss.

D) Revenues from external customers located in foreign countries.

A

4

Segment disclosures are designed to:

A) combine components of consolidated financial data to provide a higher level of summarisation.

B) condense particular items of consolidated financial data into one financial statement.

C) disaggregate selected consolidated financial data.

D) aggregate revenues and expenses so that only net profit is shown for each important segment.

A) combine components of consolidated financial data to provide a higher level of summarisation.

B) condense particular items of consolidated financial data into one financial statement.

C) disaggregate selected consolidated financial data.

D) aggregate revenues and expenses so that only net profit is shown for each important segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

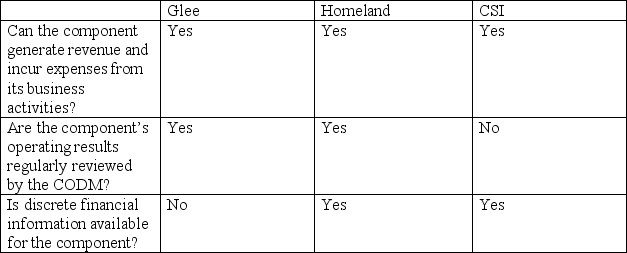

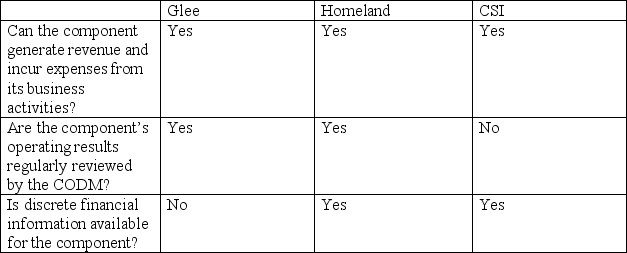

Based on the information provided below, which business unit(s) should be identified as TeeVee Ltd's operating segment(s)?

A) Glee only.

B) Homeland only.

C) CSI only.

D) Glee and CSI.

A) Glee only.

B) Homeland only.

C) CSI only.

D) Glee and CSI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

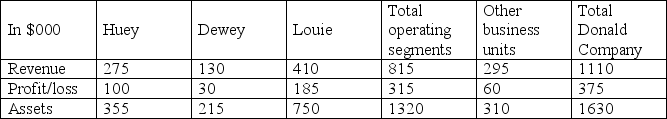

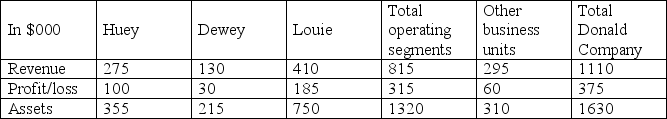

Huey, Dewey and Louie are the three operating segments of Donald Company. Which of the following statements is correct based on the information provided below?

A) Huey, Dewey and Louie are reportable segments of Donald Company.

B) Only Dewey and Louie should be disclosed as reportable segments.

C) Dewey is not a reportable segment as it does not satisfy the profit/loss quantitative threshold.

D) Donald Company needs to identify another reportable segment from 'other business units' component.

A) Huey, Dewey and Louie are reportable segments of Donald Company.

B) Only Dewey and Louie should be disclosed as reportable segments.

C) Dewey is not a reportable segment as it does not satisfy the profit/loss quantitative threshold.

D) Donald Company needs to identify another reportable segment from 'other business units' component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

AASB 8/IFRS 8 Operating Segments applies to:

I - public companies.

II - listed entities.

III - entities in the process of listing.

IV - any entity who voluntarily chooses to apply it.

A) I, II and III only.

B) II, III and IV only.

C) I, II and IV only.

D) I, III and IV only.

I - public companies.

II - listed entities.

III - entities in the process of listing.

IV - any entity who voluntarily chooses to apply it.

A) I, II and III only.

B) II, III and IV only.

C) I, II and IV only.

D) I, III and IV only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

A key objective of providing financial reporting information by segment is:

A) to allow detailed analysis to be undertaken by users such as segment profit margin analysis.

B) to allow the user to better understand the entity's future performance.

C) to highlight poorly performing areas of an entity's business to users.

D) to allow users to better assess the entity's risks and returns.

A) to allow detailed analysis to be undertaken by users such as segment profit margin analysis.

B) to allow the user to better understand the entity's future performance.

C) to highlight poorly performing areas of an entity's business to users.

D) to allow users to better assess the entity's risks and returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements is incorrect? AASB 8/IFRS 8 requires external revenue by product to be disclosed on an entity wide basis by all entities to which AASB 8/IFRS 8 applies:

A) unless the information has already been provided as part of the reportable segment information.

B) unless the information is not available and the cost to develop it would be excessive.

C) and must be calculated based on the financial information used to produce the entity's financial statements.

D) unless providing such information would be considered to damage the entity's competitive advantage.

A) unless the information has already been provided as part of the reportable segment information.

B) unless the information is not available and the cost to develop it would be excessive.

C) and must be calculated based on the financial information used to produce the entity's financial statements.

D) unless providing such information would be considered to damage the entity's competitive advantage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

Segments that do not satisfy the requirements of a reportable segment must:

A) not be disclosed at all in the financial report.

B) be reported in the notes to the financial statements.

C) be combined and disclosed as 'all other segements'.

D) be combined with the smallest reportable segment.

A) not be disclosed at all in the financial report.

B) be reported in the notes to the financial statements.

C) be combined and disclosed as 'all other segements'.

D) be combined with the smallest reportable segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

The following criteria are the key decision points in identifying an entity's component as an operating segment, except for:

A) the component's manager is part of the CODM.

B) discrete financial information are available for the component.

C) the component is able to generate revenue and incur expenses from its business activities.

D) the component's operating results are regularly reviewed by the CODM.

A) the component's manager is part of the CODM.

B) discrete financial information are available for the component.

C) the component is able to generate revenue and incur expenses from its business activities.

D) the component's operating results are regularly reviewed by the CODM.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Bloomsville Ltd has a board of directors that consist of a Managing Director (MD) and non-executive directors. The MD has a regular monthly meeting with the Chief Operating Officer (COO) and the managers of Bloomsville's three business units. During the meeting, each manager would present an update of their unit's financial performance. The financial information is then reviewed by the MD and the COO to assess the performance of each business unit and to make decisions related to resource allocation. In this case, who is the CODM of Bloomsville?

A) The board of directors.

B) The MD and the COO.

C) The MD, the COO, and the three managers.

D) The MD only.

A) The board of directors.

B) The MD and the COO.

C) The MD, the COO, and the three managers.

D) The MD only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under AASB 8/IFRS 8, entities are required to provide reconciliations on the following, except for:

A) the total of the reportable segment's measures of profit and loss to the entity's profit or loss.

B) the total of the reportable segment's equity to the entity's equity.

C) the total of the reportable segment's revenue to the entity's revenue.

D) the total of the reportable segment's liabilities to the entity's liabilities.

A) the total of the reportable segment's measures of profit and loss to the entity's profit or loss.

B) the total of the reportable segment's equity to the entity's equity.

C) the total of the reportable segment's revenue to the entity's revenue.

D) the total of the reportable segment's liabilities to the entity's liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements is correct about the controversial issues surrounding AASB 8/IFRS 8?

A) The management approach adopted in AASB 8/IFRS 8 was argued to put preparers' needs ahead of users' needs.

B) Despite the objections from different parties, all IASB board members at the time unanimously agreed that AASB 8/IFRS 8 should replace AASB 114.

C) The European Parliament was not able to endorse AASB 8/IFRS 8 due to strong oppositions from European countries.

D) The proponents of AASB 114 argued that AASB 8/IFRS 8 contains too many mandatory disclosure requirements compared to AASB 114.

A) The management approach adopted in AASB 8/IFRS 8 was argued to put preparers' needs ahead of users' needs.

B) Despite the objections from different parties, all IASB board members at the time unanimously agreed that AASB 8/IFRS 8 should replace AASB 114.

C) The European Parliament was not able to endorse AASB 8/IFRS 8 due to strong oppositions from European countries.

D) The proponents of AASB 114 argued that AASB 8/IFRS 8 contains too many mandatory disclosure requirements compared to AASB 114.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

If an entity presents both consolidated financial statements and parent entity financial statements in the same financial report, it must present:

A) segment data only on the basis of the parent entity financial statements.

B) segment data only on the basis of the consolidated financial statements.

C) condensed segment data that includes revenue information only.

D) segment information on the basis of both the consolidated and the parent financial information.

A) segment data only on the basis of the parent entity financial statements.

B) segment data only on the basis of the consolidated financial statements.

C) condensed segment data that includes revenue information only.

D) segment information on the basis of both the consolidated and the parent financial information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

AASB 8/IFRS 8 requires disclosure in relation to which of the following?

A) The basis of accounting for all segments.

B) The nature of any difference between the measurement of the reportable segments' revenue and the entity's revenue.

C) The nature of any difference between the measurement of the reportable segments' assets and liabilities and the entity's assets and liabilities.

D) The nature and effect of all symmetrical allocations to reportable segments.

A) The basis of accounting for all segments.

B) The nature of any difference between the measurement of the reportable segments' revenue and the entity's revenue.

C) The nature of any difference between the measurement of the reportable segments' assets and liabilities and the entity's assets and liabilities.

D) The nature and effect of all symmetrical allocations to reportable segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

Complete the following sentence:

AASB 8/IFRS 8 Operating Segments is applicable for financial reporting periods _____ on or after 1 January 2009. Early adoption is _______.

A) ending, not permitted

B) ending, permitted

C) beginning, not permitted

D) beginning, permitted

AASB 8/IFRS 8 Operating Segments is applicable for financial reporting periods _____ on or after 1 January 2009. Early adoption is _______.

A) ending, not permitted

B) ending, permitted

C) beginning, not permitted

D) beginning, permitted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

AASB 8/IFRS 8 Operating Segments is primarily a:

A) disclosure standard.

B) measurement standard.

C) definition standard.

D) conceptual standard.

A) disclosure standard.

B) measurement standard.

C) definition standard.

D) conceptual standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

Compared to AASB 114 Segment Reporting, AASB 8/IFRS 8 Operating Segments can be described as being:

A) more closely aligned to other accounting standards.

B) preferred in the European Union to its predecessor.

C) less prescriptive.

D) less onerous in terms of disclosure.

A) more closely aligned to other accounting standards.

B) preferred in the European Union to its predecessor.

C) less prescriptive.

D) less onerous in terms of disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under AASB 8/IFRS 8 all entities to which the standard applies are required to disclose:

A) a reconciliation of total segment expenses to total consolidated expenses.

B) factors used to identify all segments.

C) the basis of accounting for any transactions between reportable segments.

D) a measure of segment liabilities.

A) a reconciliation of total segment expenses to total consolidated expenses.

B) factors used to identify all segments.

C) the basis of accounting for any transactions between reportable segments.

D) a measure of segment liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck