Deck 12: Debt Financing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/99

العب

ملء الشاشة (f)

Deck 12: Debt Financing

1

When bonds are retired prior to maturity with proceeds from a new bond issue,gain or loss from the early extinguishment of debt,if material,should be

A) amortized over the remaining original life of the retired bond issue.

B) recognized in income from continuing operations in the period of extinguishment.

C) recognized as an extraordinary item in the period of extinguishment.

D) amortized over the life of the new bond issue.

A) amortized over the remaining original life of the retired bond issue.

B) recognized in income from continuing operations in the period of extinguishment.

C) recognized as an extraordinary item in the period of extinguishment.

D) amortized over the life of the new bond issue.

B

2

Unamortized debt premium should be reported on the balance sheet of the issuer as a

A) direct addition to the face amount of the debt.

B) direct addition to the present value of the debt.

C) deferred credit.

D) deduction from the issue costs.

A) direct addition to the face amount of the debt.

B) direct addition to the present value of the debt.

C) deferred credit.

D) deduction from the issue costs.

A

3

When the interest payment dates of a bond are May 1 and November 1,and the bond is issued on June 1,the amount of interest expense at December 31 of the year of issuance would be for

A) two months.

B) six months.

C) seven months.

D) eight months.

A) two months.

B) six months.

C) seven months.

D) eight months.

C

4

Any gains or losses from the early extinguishment of debt should be

A) recognized in income of the period of extinguishment.

B) treated as an increase or decrease in Paid-In Capital.

C) allocated between a portion that is an increase (decrease)in Paid-In Capital and a portion that is recognized in current income.

D) amortized over the remaining original life of the extinguished debt.

A) recognized in income of the period of extinguishment.

B) treated as an increase or decrease in Paid-In Capital.

C) allocated between a portion that is an increase (decrease)in Paid-In Capital and a portion that is recognized in current income.

D) amortized over the remaining original life of the extinguished debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

5

In theory (disregarding any other marketplace variables),the proceeds from the sale of a bond will be equal to the

A) face amount of the bond.

B) present value of the bond maturity value plus the present value of the interest payments to be made during the life of the bond.

C) face amount of the bond plus the present value of the interest payments made during the life of the bond.

D) sum of the face amount of the bond and the periodic interest payments.

A) face amount of the bond.

B) present value of the bond maturity value plus the present value of the interest payments to be made during the life of the bond.

C) face amount of the bond plus the present value of the interest payments made during the life of the bond.

D) sum of the face amount of the bond and the periodic interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following does NOT meet the FASB's definition of a liability?

A) The signing of a three-year employment contract at a fixed annual salary

B) An obligation to provide goods or services in the future

C) A note payable with no specified maturity date

D) An obligation that is estimated in amount

A) The signing of a three-year employment contract at a fixed annual salary

B) An obligation to provide goods or services in the future

C) A note payable with no specified maturity date

D) An obligation that is estimated in amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following is true when the effective-interest method of amortizing bond discount is used?

A) Interest expense as a percentage of the bonds' book value varies from period to period.

B) Interest expense remains constant for each period.

C) Interest expense increases each period.

D) The interest rate decreases each period.

A) Interest expense as a percentage of the bonds' book value varies from period to period.

B) Interest expense remains constant for each period.

C) Interest expense increases each period.

D) The interest rate decreases each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

8

At December 31,2014,Ambrose Sales & Service has a $100,000,120-day note payable outstanding.The company has followed the policy of replacing the note rather than repaying it over the last three years.The company's treasurer says that this policy is expected to continue indefinitely,and the arrangement is acceptable to the bank to which the note was issued.The proper classification of the note on the December 31,2014,balance sheet is

A) dependent on the intention of management.

B) dependent on the actual ability to refinance.

C) current liability,unless specific refinancing criteria are met.

D) noncurrent liability.

A) dependent on the intention of management.

B) dependent on the actual ability to refinance.

C) current liability,unless specific refinancing criteria are met.

D) noncurrent liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

9

Torlin Inc.neglected to amortize the discount on outstanding ten-year bonds payable.What is the effect of the failure to record discount amortization on interest expense and bond carrying value,respectively?

A) Understate;understate

B) Understate;overstate

C) Overstate;overstate

D) Overstate;understate

A) Understate;understate

B) Understate;overstate

C) Overstate;overstate

D) Overstate;understate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

10

The most conceptually appropriate method of valuing a liability under the historical cost basis is to

A) discount the amount of expected cash outflows that are necessary to liquidate the liability using the market rate of interest at the date the liability was initially incurred.

B) discount the amount of expected cash outflows that are necessary to liquidate the liability using the market rate of interest at the date financial statements are prepared subsequent to issuance.

C) record as a liability the amount of cash or cash-equivalent value that the company would be required to pay to eliminate the liability in the ordinary course of business on the date of the financial statements.

D) record as a liability the amount of cash or cash-equivalent proceeds actually received when a liability was incurred.

A) discount the amount of expected cash outflows that are necessary to liquidate the liability using the market rate of interest at the date the liability was initially incurred.

B) discount the amount of expected cash outflows that are necessary to liquidate the liability using the market rate of interest at the date financial statements are prepared subsequent to issuance.

C) record as a liability the amount of cash or cash-equivalent value that the company would be required to pay to eliminate the liability in the ordinary course of business on the date of the financial statements.

D) record as a liability the amount of cash or cash-equivalent proceeds actually received when a liability was incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

11

When bonds are redeemed by the issuer prior to their maturity date,any gain or loss on the redemption,if material,is

A) amortized over the period remaining to maturity and reported as an extraordinary item in the income statement.

B) amortized over the period remaining to maturity and reported as part of income from continuing operations in the income statement.

C) reported in the income statement as an extraordinary item in the period of redemption.

D) reported in the income statement as part of income from continuing operations in the period of redemption.

A) amortized over the period remaining to maturity and reported as an extraordinary item in the income statement.

B) amortized over the period remaining to maturity and reported as part of income from continuing operations in the income statement.

C) reported in the income statement as an extraordinary item in the period of redemption.

D) reported in the income statement as part of income from continuing operations in the period of redemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

12

Brawn Co.has a $20,000,two-year note payable to Gassaway City Bank that matures June 30,2014.Brawn's management intends to refinance the note for an additional three years and is negotiating a financing agreement with Gassaway City.In order to exclude this note from current liabilities on its December 31,2013,balance sheet,Brawn Co.must

A) pay off the note and complete the refinancing before the 2013

Financial statements are issued.

B) complete the refinancing before the note's maturity date.

C) complete the refinancing before the balance sheet date.

D) demonstrate an ability to refinance the obligation before the 2013

Financial statements are issued.

A) pay off the note and complete the refinancing before the 2013

Financial statements are issued.

B) complete the refinancing before the note's maturity date.

C) complete the refinancing before the balance sheet date.

D) demonstrate an ability to refinance the obligation before the 2013

Financial statements are issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

13

The market price of a bond issued at a discount is the present value of its principal amount at the market (effective)rate of interest

A) plus the present value of all future interest payments at the market (effective)rate of interest.

B) plus the present value of all future interest payments at the rate of interest stated on the bond.

C) minus the present value of all future interest payments at the market (effective)rate of interest.

D) minus the present value of all future interest payments at the rate of interest stated on the bond.

A) plus the present value of all future interest payments at the market (effective)rate of interest.

B) plus the present value of all future interest payments at the rate of interest stated on the bond.

C) minus the present value of all future interest payments at the market (effective)rate of interest.

D) minus the present value of all future interest payments at the rate of interest stated on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following represents a liability?

A) The obligation to pay for goods that a company expects to order from suppliers next year.

B) The obligation to provide goods that customers have ordered and paid for during the current year.

C) The obligation to pay interest on a five-year note payable that was issued the last day of the current year.

D) The obligation to distribute shares of a company's own common stock next year as a result of a stock dividend declared near the end of the current year.

A) The obligation to pay for goods that a company expects to order from suppliers next year.

B) The obligation to provide goods that customers have ordered and paid for during the current year.

C) The obligation to pay interest on a five-year note payable that was issued the last day of the current year.

D) The obligation to distribute shares of a company's own common stock next year as a result of a stock dividend declared near the end of the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

15

Bond discount should be presented in the financial statements of the issuer as a(n)

A) adjunct liability.

B) contra liability.

C) deferred charge.

D) contra asset.

A) adjunct liability.

B) contra liability.

C) deferred charge.

D) contra asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

16

For a bond issue that sells for more than its face value,the market rate of interest is

A) less than the rate stated on the bond.

B) equal to the rate stated on the bond.

C) dependent on the rate stated on the bond.

D) higher than the rate stated on the bond.

A) less than the rate stated on the bond.

B) equal to the rate stated on the bond.

C) dependent on the rate stated on the bond.

D) higher than the rate stated on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

17

A short-term note payable with no stated rate of interest should be

A) recorded at maturity value.

B) recorded at the face amount.

C) discounted to its present value.

D) reported separately from other short-term notes payable.

A) recorded at maturity value.

B) recorded at the face amount.

C) discounted to its present value.

D) reported separately from other short-term notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

18

For a liability to exist,

A) the identity of the party owed must be known.

B) the exact amount must be known.

C) a past transaction or event must have occurred.

D) an obligation to pay cash in the future must exist.

A) the identity of the party owed must be known.

B) the exact amount must be known.

C) a past transaction or event must have occurred.

D) an obligation to pay cash in the future must exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

19

Marantz Co.neglected to amortize the premium on outstanding ten-year bonds payable.What is the effect of the failure to record premium amortization on interest expense and bond carrying value,respectively?

A) Understate;understate

B) Understate;overstate

C) Overstate;overstate

D) Overstate;understate

A) Understate;understate

B) Understate;overstate

C) Overstate;overstate

D) Overstate;understate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

20

How would the carrying value of a bond payable be affected by amortization of each of the following? Discount Premium

A) No effect No effect

B) Increase No effect

C) Increase Decrease

D) Decrease Increase

A) No effect No effect

B) Increase No effect

C) Increase Decrease

D) Decrease Increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

21

For the issuer of ten-year bonds,the amount of amortization using the effective-interest method would increase each year if the bonds were sold at a Discount Premium

A) No No

B) Yes Yes

C) No Yes

D) Yes No

A) No No

B) Yes Yes

C) No Yes

D) Yes No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

22

When bonds are sold between interest dates,any accrued interest is credited to

A) Interest Payable.

B) Interest Revenue.

C) Interest Receivable.

D) Bonds Payable.

A) Interest Payable.

B) Interest Revenue.

C) Interest Receivable.

D) Bonds Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

23

The issuance price of a bond does not depend on the

A) face value of the bond.

B) riskiness of the bond.

C) method used to amortize the bond discount or premium.

D) effective interest rate.

A) face value of the bond.

B) riskiness of the bond.

C) method used to amortize the bond discount or premium.

D) effective interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

24

To compute the price to pay for a bond,you use

A) only the present value of $1 concept.

B) only the present value of an annuity of $1 concept.

C) both of these.

D) neither of these.

A) only the present value of $1 concept.

B) only the present value of an annuity of $1 concept.

C) both of these.

D) neither of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

25

The effective-interest method of amortizing bond premiums

A) is too complicated for practical use.

B) uses a constant rate of interest.

C) is another name for the straight-line method.

D) is needed to determine the amount of cash to be paid to bondholders at each interest date.

A) is too complicated for practical use.

B) uses a constant rate of interest.

C) is another name for the straight-line method.

D) is needed to determine the amount of cash to be paid to bondholders at each interest date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

26

The effective interest rate on bonds is higher than the stated rate when bonds sell

A) at face value.

B) above face value.

C) below face value.

D) at maturity value.

A) at face value.

B) above face value.

C) below face value.

D) at maturity value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a company issues bonds,how are unamortized bond discounts and premiums classified on the balance sheet?

A) Bond discounts are classified as assets,and bond premiums are classified as contra-asset accounts.

B) Bond discounts are classified as expenses,and bond premiums are classified as revenues.

C) Bond premiums are classified as additions to,and bond discounts are classified as deductions from,the face value of bonds.

D) None of these are correct.

A) Bond discounts are classified as assets,and bond premiums are classified as contra-asset accounts.

B) Bond discounts are classified as expenses,and bond premiums are classified as revenues.

C) Bond premiums are classified as additions to,and bond discounts are classified as deductions from,the face value of bonds.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

28

The net amount of a bond liability that appears on the balance sheet is the

A) call price of the bond plus bond discount or minus bond premium.

B) face value of the bond plus related premium or minus related discount.

C) face value of the bond plus related discount or minus related premium.

D) maturity value of the bond plus related discount or minus related premium.

A) call price of the bond plus bond discount or minus bond premium.

B) face value of the bond plus related premium or minus related discount.

C) face value of the bond plus related discount or minus related premium.

D) maturity value of the bond plus related discount or minus related premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is true of accrued interest on bonds that are sold between interest dates?

A) It is computed at the effective market rate.

B) It will be paid to the seller when the bonds mature.

C) It is extra income to the buyer.

D) None of these is true.

A) It is computed at the effective market rate.

B) It will be paid to the seller when the bonds mature.

C) It is extra income to the buyer.

D) None of these is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

30

The net amount required to retire a bond before maturity (assuming no call premium and constant interest rates)is the

A) face value of the bond plus any unamortized premium or minus any unamortized discount.

B) issuance price of the bond plus any unamortized discount or minus any unamortized premium.

C) face value of the bond plus any unamortized discount or minus any unamortized premium.

D) maturity value of the bond plus any unamortized discount or minus any unamortized premium.

A) face value of the bond plus any unamortized premium or minus any unamortized discount.

B) issuance price of the bond plus any unamortized discount or minus any unamortized premium.

C) face value of the bond plus any unamortized discount or minus any unamortized premium.

D) maturity value of the bond plus any unamortized discount or minus any unamortized premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

31

Debentures are

A) unsecured bonds.

B) secured bonds.

C) ordinary bonds.

D) serial bonds.

A) unsecured bonds.

B) secured bonds.

C) ordinary bonds.

D) serial bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

32

Callable bonds

A) can be redeemed by the issuer at some time at a pre-specified price.

B) can be converted to stock.

C) mature in a series of payments.

D) None of these is correct.

A) can be redeemed by the issuer at some time at a pre-specified price.

B) can be converted to stock.

C) mature in a series of payments.

D) None of these is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

33

When interest expense is calculated using the effective-interest amortization method,interest expense (assuming that interest is paid annually)always equals the

A) actual amount of interest paid.

B) book value of the bonds multiplied by the stated interest rate.

C) book value of the bonds multiplied by the effective interest rate.

D) maturity value of the bonds multiplied by the effective interest rate.

A) actual amount of interest paid.

B) book value of the bonds multiplied by the stated interest rate.

C) book value of the bonds multiplied by the effective interest rate.

D) maturity value of the bonds multiplied by the effective interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

34

Rowan Corporation,a calendar-year firm,is authorized to issue $200,000 of 10 percent,20-year bonds dated January 1,2014,with interest payable on January 1 and July 1 of each year.If the bonds were issued to yield 12 percent,the entry to account for the discount amortization and accrual of interest on December 31,2014,would include a

A) debit to Discount on Bonds Payable.

B) credit to Cash.

C) credit to Interest Payable.

D) debit to Bonds Payable.

A) debit to Discount on Bonds Payable.

B) credit to Cash.

C) credit to Interest Payable.

D) debit to Bonds Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

35

The effective interest rate on bonds is lower than the stated rate when bonds sell

A) above face value.

B) at maturity value.

C) below face value.

D) at face value.

A) above face value.

B) at maturity value.

C) below face value.

D) at face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is true of a premium on bonds payable?

A) It is a contra-stockholders' equity account.

B) It is an account that appears only on the books of the investor.

C) It increases when amortization entries are made until it reaches its maturity value.

D) It decreases when amortization entries are made until its balance reaches zero at the maturity date.

A) It is a contra-stockholders' equity account.

B) It is an account that appears only on the books of the investor.

C) It increases when amortization entries are made until it reaches its maturity value.

D) It decreases when amortization entries are made until its balance reaches zero at the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

37

Bonds usually sell at a premium

A) when the market rate of interest is greater than the stated rate of interest on the bonds.

B) when the stated rate of interest on the bonds is greater than the market rate of interest.

C) when the price of the bonds is greater than their maturity value.

D) in none of these cases.

A) when the market rate of interest is greater than the stated rate of interest on the bonds.

B) when the stated rate of interest on the bonds is greater than the market rate of interest.

C) when the price of the bonds is greater than their maturity value.

D) in none of these cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

38

Outstanding bonds payable are converted into common stock.Under either the book value or market value method,the same amount would be debited to Bonds Premium on

Payable Bonds Payable

A) No No

B) No Yes

C) Yes No

D) Yes Yes

Payable Bonds Payable

A) No No

B) No Yes

C) Yes No

D) Yes Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

39

Bonds usually sell at a discount when

A) investors are willing to invest in the bonds only at rates that are higher than the stated interest rate.

B) investors are willing to invest in the bonds at rates that are lower than the stated interest rate.

C) investors are willing to invest in the bonds at the stated interest rate.

D) a capital gain is expected.

A) investors are willing to invest in the bonds only at rates that are higher than the stated interest rate.

B) investors are willing to invest in the bonds at rates that are lower than the stated interest rate.

C) investors are willing to invest in the bonds at the stated interest rate.

D) a capital gain is expected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

40

Accrued interest on bonds that are sold between interest dates

A) is ignored by both the seller and the buyer.

B) increases the amount a buyer must pay to acquire the bonds.

C) is recorded as a loss on the sale of the bonds.

D) decreases the amount a buyer must pay to acquire the bonds.

A) is ignored by both the seller and the buyer.

B) increases the amount a buyer must pay to acquire the bonds.

C) is recorded as a loss on the sale of the bonds.

D) decreases the amount a buyer must pay to acquire the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

41

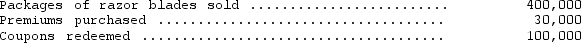

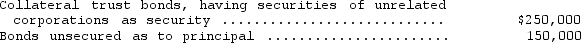

In an effort to increase sales,Sharpy Razor Blade Company inaugurated a sales promotion campaign on June 30,2014,whereby Sharpy placed a coupon in each package of razor blades sold,the coupons being redeemable for a premium.Each premium costs Sharpy $0.75,and five coupons must be presented by a customer to receive a premium.Sharpy estimated that only 60 percent of the coupons issued will be redeemed.For the six months ended December 31,2014,the following information is available:  What is the estimated liability for premium claims outstanding at December 31,2014?

What is the estimated liability for premium claims outstanding at December 31,2014?

A) $15,000

B) $20,000

C) $21,000

D) $22,500

What is the estimated liability for premium claims outstanding at December 31,2014?

What is the estimated liability for premium claims outstanding at December 31,2014?A) $15,000

B) $20,000

C) $21,000

D) $22,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

42

On January 1,SOMA issued ten-year bonds with a face amount of $1,000,000 and a stated interest rate of 8 percent payable annually each January 1.The bonds were priced to yield 10 percent.The total issue price (rounded)of the bonds was

A) $1,000,000.

B) $980,000.

C) $920,000.

D) $880,000.

A) $1,000,000.

B) $980,000.

C) $920,000.

D) $880,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

43

On January 1,2014,Madrid Corp.issued 2,000 of its 9 percent,$1,000 bonds at 95.Interest is payable semiannually on July 1 and January 1.The bonds mature on January 1,2024.Madrid paid bond issue costs of $80,000,which are appropriately recorded as a deferred charge.Madrid uses the straight-line method of amortizing bond discount and bond issue costs.On Madrid's December 31,2014,balance sheet,how much would be shown as the carrying amount of the bonds payable?

A) $2,110,000

B) $2,090,000

C) $1,982,000

D) $1,910,000

A) $2,110,000

B) $2,090,000

C) $1,982,000

D) $1,910,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

44

On July 1,2014,Martinez Manufacturing Co.issued a five-year note payable with a face amount of $250,000 and an interest rate of 10 percent.The terms of the note require Martinez to make five annual payments of $50,000 plus accrued interest,with the first payment due June 30,2015.With respect to the note,the current liabilities section of Martinez' December 31,2014,balance sheet should include

A) $12,500.

B) $50,000.

C) $62,500.

D) $75,000.

A) $12,500.

B) $50,000.

C) $62,500.

D) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

45

Conrad,Inc.has $2,000,000 of notes payable due June 15,2015.At the financial statement date of December 31,2014,Conrad signed an agreement to borrow up to $2,000,000 to refinance the notes payable on a long-term basis.The financing agreement called for borrowings not to exceed 80 percent of the value of the collateral Conrad was providing.At the date of issue of the December 31,2014,financial statements,the value of the collateral was $2,400,000 and was not expected to fall below this amount during 2015.In its December 31,2014,balance sheet,Conrad should classify notes payable as Short-Term Long-Term

Obligations Obligations

A) $2,000,000 $0

B) $400,000 $1,600,000

C) $80,000 $1,920,000

D) $0 $2,000,000

Obligations Obligations

A) $2,000,000 $0

B) $400,000 $1,600,000

C) $80,000 $1,920,000

D) $0 $2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

46

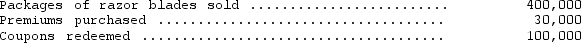

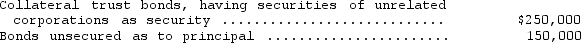

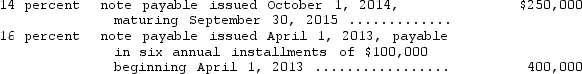

Tarpon Corp.had the following long-term debt at December 31:  The debenture bonds amounted to

The debenture bonds amounted to

A) $0.

B) $150,000.

C) $250,000.

D) $400,000.

The debenture bonds amounted to

The debenture bonds amounted toA) $0.

B) $150,000.

C) $250,000.

D) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

47

On July 1,2014,Saunter issued 2,000 of its 8 percent,$1,000 bonds for $1,752,000.The bonds were issued to yield 10 percent.The bonds are dated July 1,2014,and mature on July 1,2024.Interest is payable semiannually on January 1 and July 1.Using the effective-interest method,how much of the bond discount should be amortized for the six months ended December 31,2014?

A) $15,200

B) $12,400

C) $9,920

D) $7,600

A) $15,200

B) $12,400

C) $9,920

D) $7,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bridge Corporation had two issues of securities outstanding-- common stock and a 5 percent convertible bond issue in the face amount of $10,000,000.Interest payment dates of the bond issue are June 30 and December 31.The conversion clause in the bond indenture entitles the bondholders to receive 40 shares of $20 par value common stock in exchange for each $1,000 bond.On June 30,2014,the holders of $1,800,000 face value bonds exercised the conversion privilege.The market price of the bonds on that date was $1,100 per bond and the market price of the common stock was $35.The total unamortized bond discount at the date of conversion was $500,000.What amount should Bridge credit to the account "Paid-In Capital in Excess of Par" as a result of this conversion assuming Bridge does not want to recognize any gain (or loss)on the conversion?

A) $0

B) $270,000

C) $360,000

D) $920,000

A) $0

B) $270,000

C) $360,000

D) $920,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

49

On October 1,2014,Southpark Inc.issued,at 101 plus accrued interest,800 of its 10 percent,$1,000 bonds.The bonds are dated July 1,2014,and mature on July 1,2021.Interest is payable semiannually on January 1 and July 1.At the time of issuance,Southpark would receive cash of

A) $800,000.

B) $808,000.

C) $820,000.

D) $828,000.

A) $800,000.

B) $808,000.

C) $820,000.

D) $828,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

50

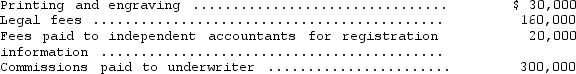

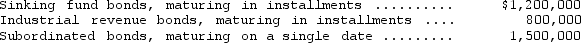

During the year,Franklin Corporation incurred the following costs in connection with the issuance of bonds:  The amount recorded as a deferred charge to be amortized over the term of the bonds is

The amount recorded as a deferred charge to be amortized over the term of the bonds is

A) $0.

B) $30,000.

C) $300,000.

D) $510,000.

The amount recorded as a deferred charge to be amortized over the term of the bonds is

The amount recorded as a deferred charge to be amortized over the term of the bonds isA) $0.

B) $30,000.

C) $300,000.

D) $510,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

51

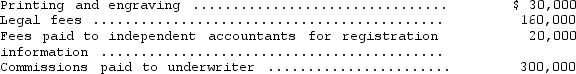

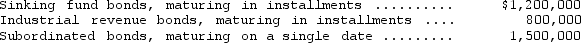

Arthur Enterprises had the following long-term debt:  The total of the serial bonds amounted to

The total of the serial bonds amounted to

A) $900,000.

B) $1,500,000.

C) $2,000,000.

D) $2,400,000.

The total of the serial bonds amounted to

The total of the serial bonds amounted toA) $900,000.

B) $1,500,000.

C) $2,000,000.

D) $2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

52

At December 31,2014,Strom Corp.owed notes payable of $1,000,000 with a maturity date of April 30,2015.These notes did not arise from transactions in the normal course of business.On February 1,2015,Strom issued $3,000,000 of ten-year bonds with the intention of using part of the bond proceeds to liquidate the $1,000,000 of notes payable.Strom's December 31,2014,financial statements were issued on March 29,2015.How much of the $1,000,000 notes payable should be classified as current in Strom's balance sheet at December 31,2014?

A) $0

B) $100,000

C) $900,000

D) $1,000,000

A) $0

B) $100,000

C) $900,000

D) $1,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

53

Gunther Inc.purchased $400,000 of Malone Corp.ten-year bonds with a stated interest rate of 8 percent payable quarterly.At the time the bonds were purchased,the market interest rate was 12 percent.Determine the amount of premium or discount on the purchase of the bonds.

A) $92,442 premium

B) $92,442 discount

C) $81,143 premium

D) $81,143 discount

A) $92,442 premium

B) $92,442 discount

C) $81,143 premium

D) $81,143 discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

54

On July 1,2014,Chelsea Company purchased as a long-term investment Soho Company's ten-year,9 percent bonds,with a face value of $100,000 for $95,200.Interest is payable semiannually on January 1 and July 1.The bonds mature on July 1,2018.Chelsea uses the straight-line method of amortization.What is the amount of interest revenue that Chelsea should report in its income statement for the year ended December 31,2014?

A) $3,900

B) $4,500

C) $5,100

D) $5,700

A) $3,900

B) $4,500

C) $5,100

D) $5,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

55

On June 30,2014,Island Inc.had outstanding 10 percent,$1,000,000 face amount,15-year bonds maturing on June 30,2019.Interest is paid on June 30 and December 31,and bond discount and bond issue costs are amortized on these dates.The unamortized balances on June 30,2014,of bond discount and bond issue costs were $55,000 and $20,000,respectively.Island reacquired all of these bonds at 96 on June 30,2014,and retired them.Ignoring income taxes,how much gain or loss should Island record on the bond retirement?

A) Loss of $15,000

B) Loss of $35,000

C) Gain of $5,000

D) Gain of $40,000

A) Loss of $15,000

B) Loss of $35,000

C) Gain of $5,000

D) Gain of $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

56

Freddy,Inc.had outstanding 10 percent,$1,000,000 face value,convertible bonds maturing on December 31,2017.Interest is paid December 31 and June 30.After amortization through June 30,2014,the unamortized balance in the bond premium account was $30,000.On that date,bonds with a face amount of $500,000 were converted into 20,000 shares of $20 par common stock.Recording the conversion by using the carrying value of the bonds,Freddy should credit Additional Paid-In Capital for

A) $0.

B) $85,000.

C) $100,000.

D) $115,000.

A) $0.

B) $85,000.

C) $100,000.

D) $115,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

57

On February 1,2015,Gaslight Corp.issued 12 percent,$2,000,000 face value,ten-year bonds for $2,234,000 plus accrued interest.The bonds are dated November 1,2014,and interest is payable on May 1 and November 1.Gaslight reacquired all of these bonds at 102 on May 1,2018,and retired them.Unamortized bond premium on that date was $156,000.Ignoring the income tax effect,what was Gaslight's gain on the bond retirement?

A) $116,000

B) $194,000

C) $234,000

D) $236,000

A) $116,000

B) $194,000

C) $234,000

D) $236,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

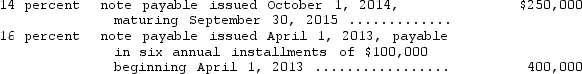

58

Included in Zollar Corporation's liability account balances at December 31,2014,were the following:  Zollar's December 31,2014,financial statements were issued on March 31,2015.On January 15,2015,the entire $400,000 balance of the 16 percent note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition,on March 10,2015,Zollar consummated a noncancelable agreement with the lender to refinance the 14 percent,$250,000 note on a long-term basis,on readily determinable terms that have not yet been implemented.Both parties are financially capable of honoring the agreement,and there have been no violations of the agreement's provisions.On the December 31,2014,balance sheet,the amount of the notes payable that Zollar should classify as noncurrent obligations is

Zollar's December 31,2014,financial statements were issued on March 31,2015.On January 15,2015,the entire $400,000 balance of the 16 percent note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition,on March 10,2015,Zollar consummated a noncancelable agreement with the lender to refinance the 14 percent,$250,000 note on a long-term basis,on readily determinable terms that have not yet been implemented.Both parties are financially capable of honoring the agreement,and there have been no violations of the agreement's provisions.On the December 31,2014,balance sheet,the amount of the notes payable that Zollar should classify as noncurrent obligations is

A) $100,000.

B) $250,000.

C) $350,000.

D) $650,000.

Zollar's December 31,2014,financial statements were issued on March 31,2015.On January 15,2015,the entire $400,000 balance of the 16 percent note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition,on March 10,2015,Zollar consummated a noncancelable agreement with the lender to refinance the 14 percent,$250,000 note on a long-term basis,on readily determinable terms that have not yet been implemented.Both parties are financially capable of honoring the agreement,and there have been no violations of the agreement's provisions.On the December 31,2014,balance sheet,the amount of the notes payable that Zollar should classify as noncurrent obligations is

Zollar's December 31,2014,financial statements were issued on March 31,2015.On January 15,2015,the entire $400,000 balance of the 16 percent note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition,on March 10,2015,Zollar consummated a noncancelable agreement with the lender to refinance the 14 percent,$250,000 note on a long-term basis,on readily determinable terms that have not yet been implemented.Both parties are financially capable of honoring the agreement,and there have been no violations of the agreement's provisions.On the December 31,2014,balance sheet,the amount of the notes payable that Zollar should classify as noncurrent obligations isA) $100,000.

B) $250,000.

C) $350,000.

D) $650,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

59

On January 1,2014,Roger Inc.issued its 10 percent bonds in the face amount of $1,500,000.They mature on January 1,2024.The bonds were issued for $1,329,000 to yield 12 percent,resulting in bond discount of $171,000.Roger uses the effective-interest method of amortizing bond discount.Interest is payable July 1 and January 1.For the six months ended June 30,2014,Roger should report bond interest expense of

A) $75,000.

B) $79,740.

C) $83,550.

D) $85,260.

A) $75,000.

B) $79,740.

C) $83,550.

D) $85,260.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

60

On July 1,2008 Magda Corporation issued for $960,000 one thousand of its 9 percent,$1,000 callable bonds.The bonds are dated July 1,2008,and mature on July 1,2018.Interest is payable semiannually on January 1 and July 1.Magda uses the straight-line method of amortizing bond discount.The bonds can be called by the issuer at 101 at any time after June 30,2013.On July 1,2014,Magda called in all of the bonds and retired them.Ignoring income taxes,how much loss should Magda report on this early extinguishment of debt for the year ended December 31,2014?

A) $50,000

B) $34,000

C) $26,000

D) $10,000

A) $50,000

B) $34,000

C) $26,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

61

A $50,000 bond with a carrying value of $52,000 was called at 103 and retired.In recording the retirement,the issuing company should record

A) a $500 gain.

B) a $1,500 loss.

C) a $2,000 gain.

D) no gain or loss.

A) a $500 gain.

B) a $1,500 loss.

C) a $2,000 gain.

D) no gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

62

The total interest expense on a $300,000,10 percent,10-year bond issued at 95 would be

A) $290,000.

B) $295,000.

C) $300,000.

D) $315,000.

A) $290,000.

B) $295,000.

C) $300,000.

D) $315,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

63

Assuming the straight-line method of amortization is used,the average yearly interest expense on a $250,000,11 percent,20-year bond issued at 94 would be

A) $26,750.

B) $27,500.

C) $28,250.

D) $29,500.

A) $26,750.

B) $27,500.

C) $28,250.

D) $29,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

64

Eli Corporation issued $200,000 of 10-year bonds on January 1.The bonds pay interest on January 1 and July 1 and have a stated rate of 10 percent.If the market rate of interest at the time the bonds are sold is 8 percent,what will be the issuance price of the bonds?

A) $175,078

B) $211,283

C) $215,902

D) $227,183

A) $175,078

B) $211,283

C) $215,902

D) $227,183

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

65

Romer Corporation,a calendar-year firm,is authorized to issue $200,000 of 10 percent,20-year bonds dated January 1,2014,with interest payable on January 1 and July 1 of each year.

If the bonds were issued at 97 on April 1,2014,plus accrued interest,the amount of cash received by Romer Corporation would be

A) $200,000.

B) $194,000.

C) $199,000.

D) none of these.

If the bonds were issued at 97 on April 1,2014,plus accrued interest,the amount of cash received by Romer Corporation would be

A) $200,000.

B) $194,000.

C) $199,000.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

66

Moreland Corporation issued $200,000 of 10-year bonds on January 1.The bonds pay interest on January 1 and July 1 and have a stated rate of 10 percent.If the market rate of interest at the time the bonds are sold is 12 percent,what will be the issuance price of the bonds?

A) $114,699

B) $177,059

C) $190,079

D) $224,926

A) $114,699

B) $177,059

C) $190,079

D) $224,926

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

67

Craig Corporation issued a $100,000,10-year,10 percent bond on January 1,2013,for $112,000.Craig uses the straight-line method of amortization.On April 1,2016,Craig reacquired the bonds for retirement when they were selling at 102 on the open market.How much gain or loss should Craig recognize on the retirement of the bonds?

A) $2,000 loss

B) $3,900 gain

C) $6,100 gain

D) $8,200 loss

A) $2,000 loss

B) $3,900 gain

C) $6,100 gain

D) $8,200 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

68

On January 1,2014,$50,000 of 20-year,6 percent debentures were issued for $56,275.20.Interest payment dates on the bonds are January 1 and July 1.The amount of premium to be amortized on July 1,2014,when using the straight-line method is

A) $313.76.

B) $156.88.

C) $776.50.

D) $93.11.

A) $313.76.

B) $156.88.

C) $776.50.

D) $93.11.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

69

If a $1,000,9 percent,10-year bond was issued at 96 plus accrued interest one month after the authorization date,how much cash was received by the issuer?

A) $967.50

B) $960.00

C) $1,007.50

D) $992.50

A) $967.50

B) $960.00

C) $1,007.50

D) $992.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

70

The annual interest expense on a $50,000,15-year,10 percent bond issued for $45,650 plus accrued interest 6 months after authorization,assuming straight-line amortization,would be

A) $5,300

B) $5,025

C) $5,000

D) $4,975

A) $5,300

B) $5,025

C) $5,000

D) $4,975

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

71

If a $1,000,9 percent,10-year bond was issued at 103 plus accrued interest one month after the authorization date,how much cash did the issuer receive?

A) $1,037.50

B) $1,030.00

C) $1,007.50

D) $992.50

A) $1,037.50

B) $1,030.00

C) $1,007.50

D) $992.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1,2014,Gustavo Hospital issued a $250,000,10 percent,5-year bond for $231,601.Interest is payable on June 30 and December 31.Gustavo uses the effective-interest method to amortize all premiums and discounts.Assuming an effective interest rate of 12 percent,how much interest expense should be recorded on June 30,2014?

A) $11,935.14

B) $12,500.00

C) $13,896.06

D) $14,729.82

A) $11,935.14

B) $12,500.00

C) $13,896.06

D) $14,729.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

73

Romer Corporation,a calendar-year firm,is authorized to issue $200,000 of 10 percent,20-year bonds dated January 1,2014,with interest payable on January 1 and July 1 of each year.

If a $6,000,10 percent,10-year bond was issued at 104 plus accrued interest two months after the authorization date,how much cash was received by the issuer?

A) $6,000

B) $6,240

C) $6,340

D) $6,600

If a $6,000,10 percent,10-year bond was issued at 104 plus accrued interest two months after the authorization date,how much cash was received by the issuer?

A) $6,000

B) $6,240

C) $6,340

D) $6,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gunnison County issued a $500,000,10 percent,10-year bond on January 1,2014,for 113.6 when the effective interest rate was 8 percent.Interest is payable on June 30 and December 31.Gunnison uses the effective-interest method to amortize all premiums and discounts.

How much premium or discount should be amortized on June 30,2014?

A) $2,790

B) $2,280

C) $2,000

D) $1,970

How much premium or discount should be amortized on June 30,2014?

A) $2,790

B) $2,280

C) $2,000

D) $1,970

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bonds that were authorized on January 1,2014,and that pay interest on January 1 and July 1 of each year were issued on October 1,2014.If the issuer's accounting year ends on December 31,how many months would any discount or premium be amortized in 2014?

A) 12 months

B) 9 months

C) 6 months

D) 3 months

A) 12 months

B) 9 months

C) 6 months

D) 3 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

76

Romer Corporation,a calendar-year firm,is authorized to issue $200,000 of 10 percent,20-year bonds dated January 1,2014,with interest payable on January 1 and July 1 of each year.

If the bonds were issued at 97 on April 1,2014,the amount of the discount amortized on July 1 (using the straight-line method)would be approximately

A) $25.

B) $76.

C) $67.

D) $152.

If the bonds were issued at 97 on April 1,2014,the amount of the discount amortized on July 1 (using the straight-line method)would be approximately

A) $25.

B) $76.

C) $67.

D) $152.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

77

On January 1,2014,Marco Hospital issued a $250,000,10 percent,5-year bond for $231,601.Interest is payable on June 30 and December 31.Marco uses the effective-interest method to amortize all premiums and discounts.Assuming an effective interest rate of 12 percent,approximately how much discount will be amortized on December 31,2014?

A) $2,230

B) $1,480

C) $1,396

D) $987

A) $2,230

B) $1,480

C) $1,396

D) $987

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

78

Romer Corporation,a calendar-year firm,is authorized to issue $200,000 of 10 percent,20-year bonds dated January 1,2014,with interest payable on January 1 and July 1 of each year.

If the bonds were issued on April 1,2014,the amount of accrued interest on the date of sale is

A) $20,000.

B) $10,000.

C) $2,500.

D) $5,000.

If the bonds were issued on April 1,2014,the amount of accrued interest on the date of sale is

A) $20,000.

B) $10,000.

C) $2,500.

D) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

79

Gunnison County issued a $500,000,10 percent,10-year bond on January 1,2014,for 113.6 when the effective interest rate was 8 percent.Interest is payable on June 30 and December 31.Gunnison uses the effective-interest method to amortize all premiums and discounts.

How much interest expense should Gunnison record on December 31,2014?

A) $25,000.00

B) $23,810.15

C) $19,920.10

D) $22,628.80

How much interest expense should Gunnison record on December 31,2014?

A) $25,000.00

B) $23,810.15

C) $19,920.10

D) $22,628.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck

80

On January 1,2014,Yearly Corporation issued $500,000 of 10 percent,10-year bonds at 88.5.Interest is payable on December 31.If the market rate of interest was 12 percent at the time the bonds were issued,how much cash was paid for interest in 2014?

A) $44,250

B) $50,000

C) $53,100

D) $60,000

A) $44,250

B) $50,000

C) $53,100

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 99 في هذه المجموعة.

فتح الحزمة

k this deck