Deck 23: Analysis of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 23: Analysis of Financial Statements

1

How are trade receivables used in the calculation of each of the following? Current Ratio Inventory Turnover

A) Not used Numerator

B) Numerator Numerator

C) Numerator Not used

D) Denominator Numerator

A) Not used Numerator

B) Numerator Numerator

C) Numerator Not used

D) Denominator Numerator

C

2

Which of the following statements best describes the use of financial statement analysis?

A) Financial statement analysis techniques are merely guides to interpretation of financial data.

B) Financial statement analysis can eliminate the risk in investment decisions.

C) Measurements for a specific company should be compared only with data from past periods.

D) All of these are correct.

A) Financial statement analysis techniques are merely guides to interpretation of financial data.

B) Financial statement analysis can eliminate the risk in investment decisions.

C) Measurements for a specific company should be compared only with data from past periods.

D) All of these are correct.

A

3

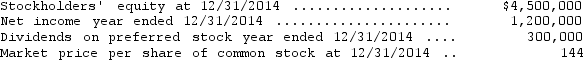

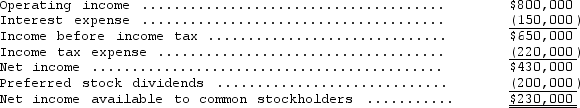

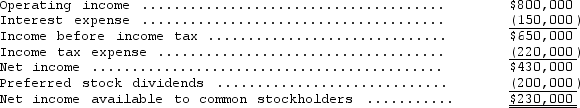

On December 31,2013 and 2014,Tomlin Corporation had 100,000 shares of common stock and 50,000 shares of noncumulative and nonconvertible preferred stock issued and outstanding.Additional information:  The price-earnings ratio on common stock at December 31,2014,was

The price-earnings ratio on common stock at December 31,2014,was

A) 10 to 1.

B) 12 to 1.

C) 14 to 1.

D) 16 to 1.

The price-earnings ratio on common stock at December 31,2014,was

The price-earnings ratio on common stock at December 31,2014,wasA) 10 to 1.

B) 12 to 1.

C) 14 to 1.

D) 16 to 1.

B

4

Ringer Corporation had a current ratio of 3.1 at the end of 2013.Current assets and current liabilities increased by equal amounts during 2014.The effects on net working capital and on the current ratio,respectively,were

A) no effect;increase.

B) no effect;decrease.

C) increase;increase.

D) decrease;decrease.

A) no effect;increase.

B) no effect;decrease.

C) increase;increase.

D) decrease;decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

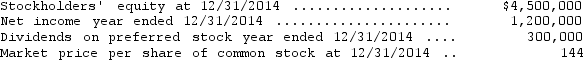

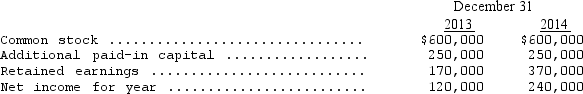

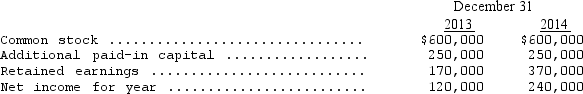

Selected information for Henriot Company is as follows:  Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 is

Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 is

A) 20 percent.

B) 21 percent.

C) 28 percent.

D) 40 percent.

Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 is

Henriot's return on common stockholder's equity,rounded to the nearest percentage point,for 2014 isA) 20 percent.

B) 21 percent.

C) 28 percent.

D) 40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

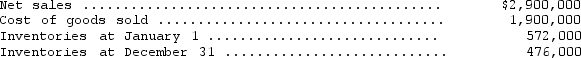

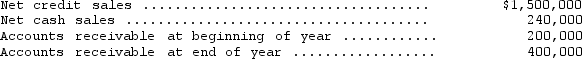

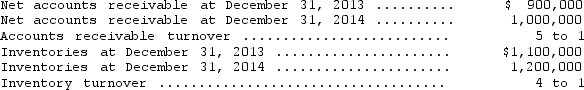

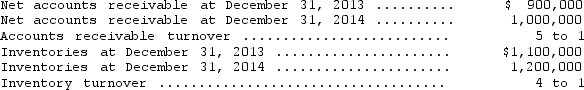

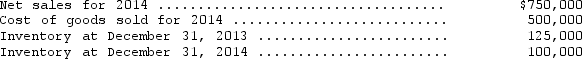

Selected information from the accounting records of Carbine Manufacturing follows:  What is the number of days' sales in average inventories for the year?

What is the number of days' sales in average inventories for the year?

A) 132

B) 109

C) 101

D) 66

What is the number of days' sales in average inventories for the year?

What is the number of days' sales in average inventories for the year?A) 132

B) 109

C) 101

D) 66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is included in the calculation of the acid-test (quick)ratio? Accounts Receivable Inventories

A) No No

B) No Yes

C) Yes No

D) Yes Yes

A) No No

B) No Yes

C) Yes No

D) Yes Yes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

A useful tool in financial statement analysis is the common-size financial statement.What does this tool enable the financial analyst to do?

A) Evaluate financial statements of companies within a given industry of approximately the same value.

B) Determine which companies in the same industry are at approximately the same stage of development.

C) Ascertain the relative potential of companies of similar size in different industries.

D) Compare the mix of assets,liabilities,capital,revenue,and expenses within a company over time or between companies within a given industry without respect to relative size.

A) Evaluate financial statements of companies within a given industry of approximately the same value.

B) Determine which companies in the same industry are at approximately the same stage of development.

C) Ascertain the relative potential of companies of similar size in different industries.

D) Compare the mix of assets,liabilities,capital,revenue,and expenses within a company over time or between companies within a given industry without respect to relative size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

When using common-size statements,

A) data may be selected for the same business as of different dates,or for two or more businesses as of the same date.

B) relationships should be stated in terms of ratios.

C) dollar changes are reported over a period of at least three years.

D) All of these are correct.

A) data may be selected for the same business as of different dates,or for two or more businesses as of the same date.

B) relationships should be stated in terms of ratios.

C) dollar changes are reported over a period of at least three years.

D) All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

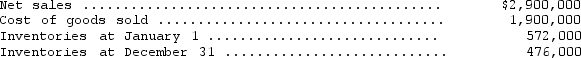

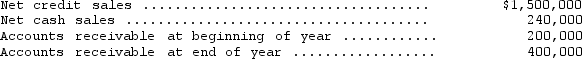

Brookville Corporation's books disclosed the following information for the year ended December 31,2014:  Brookville's accounts receivable turnover is

Brookville's accounts receivable turnover is

A) 3.75 times.

B) 4.35 times.

C) 5.00 times.

D) 5.80 times.

Brookville's accounts receivable turnover is

Brookville's accounts receivable turnover isA) 3.75 times.

B) 4.35 times.

C) 5.00 times.

D) 5.80 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

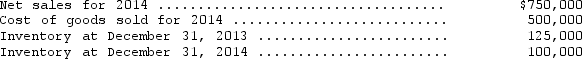

Selected financial data of Nicholas Corporation for the year ended December 31,2014,is presented below:  Common stock dividends were $120,000.The times-interest-earned ratio is

Common stock dividends were $120,000.The times-interest-earned ratio is

A) 2.9 to 1.

B) 3.6 to 1.

C) 4.3 to 1.

D) 5.3 to 1.

Common stock dividends were $120,000.The times-interest-earned ratio is

Common stock dividends were $120,000.The times-interest-earned ratio isA) 2.9 to 1.

B) 3.6 to 1.

C) 4.3 to 1.

D) 5.3 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

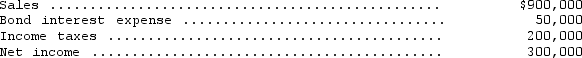

Selected information from the accounting records of the Clemens Company is as follows:  What was Clemens' gross margin for 2014?

What was Clemens' gross margin for 2014?

A) $150,000

B) $200,000

C) $400,000

D) $500,000

What was Clemens' gross margin for 2014?

What was Clemens' gross margin for 2014?A) $150,000

B) $200,000

C) $400,000

D) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

Selected information from the accounting records of Thackary Company is as follows:  Thackary's inventory turnover for 2014 is

Thackary's inventory turnover for 2014 is

A) 7.50 times.

B) 6.665 times.

C) 4.44times.

D) 2.22 times.

Thackary's inventory turnover for 2014 is

Thackary's inventory turnover for 2014 isA) 7.50 times.

B) 6.665 times.

C) 4.44times.

D) 2.22 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following transactions would increase a firm's current ratio?

A) Purchase of inventory on account

B) Payment of accounts payable

C) Collection of accounts receivable

D) Purchase of temporary investments for cash

A) Purchase of inventory on account

B) Payment of accounts payable

C) Collection of accounts receivable

D) Purchase of temporary investments for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

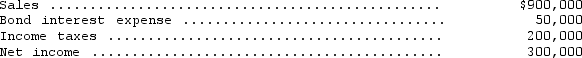

The following data were abstracted from the records of Ballistic Corporation for the year:  How many times was bond interest earned?

How many times was bond interest earned?

A) 18.0

B) 15.0

C) 11.0

D) 10.0

How many times was bond interest earned?

How many times was bond interest earned?A) 18.0

B) 15.0

C) 11.0

D) 10.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

In comparing the current ratios of two companies,why is it invalid to assume that the company with the higher current ratio is the better company?

A) The two companies may be different sizes.

B) A high current ratio may indicate inadequate inventory on hand.

C) The two companies may define working capital in different terms.

D) A high current ratio may indicate inefficient use of various assets and liabilities.

A) The two companies may be different sizes.

B) A high current ratio may indicate inadequate inventory on hand.

C) The two companies may define working capital in different terms.

D) A high current ratio may indicate inefficient use of various assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

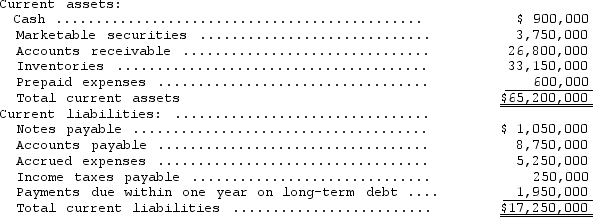

Information from Caine Company's balance sheet is as follows:  What is Caine's current ratio?

What is Caine's current ratio?

A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.78 to 1

What is Caine's current ratio?

What is Caine's current ratio?A) 0.26 to 1

B) 0.30 to 1

C) 1.80 to 1

D) 3.78 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following ratios measures short-term solvency?

A) Current ratio

B) Creditors' equity to total assets

C) Return on investment

D) Total asset turnover

A) Current ratio

B) Creditors' equity to total assets

C) Return on investment

D) Total asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

Harvest Corporation's capital stock at December 31 consisted of the following: (a)Common stock,$2 par value;100,000 shares authorized,issued,and outstanding.(b)10% noncumulative,nonconvertible preferred stock,$100 par value;1,000 shares authorized,issued,and outstanding. Harvest's common stock,which is listed on a major stock exchange,was quoted at $4 per share on December 31.Harvest's net income for the year ended December 31 was $50,000.The yearly preferred dividend was declared.No capital stock transactions occurred.What was the price- earnings ratio on Harvest's common stock at December 31?

A) 6 to 1

B) 8 to 1

C) 10 to 1

D) 16 to 1

A) 6 to 1

B) 8 to 1

C) 10 to 1

D) 16 to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

If a firm changes its inventory method from FIFO to LIFO just prior to a period of rising prices,the effect in the next period will be Current Ratio Inventory Turnover

A) No effect Increase

B) No effect Decrease

C) Increase Decrease

D) Decrease Increase

A) No effect Increase

B) No effect Decrease

C) Increase Decrease

D) Decrease Increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

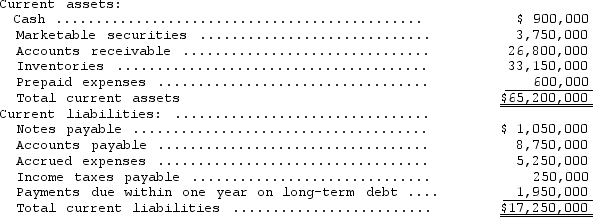

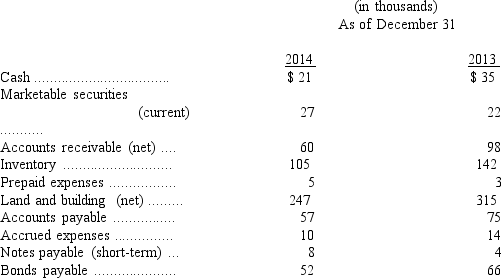

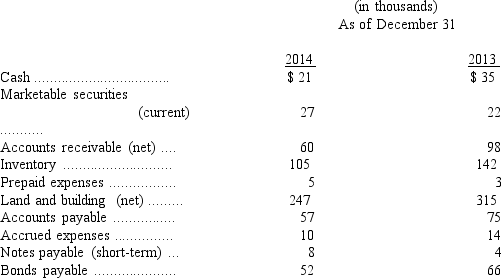

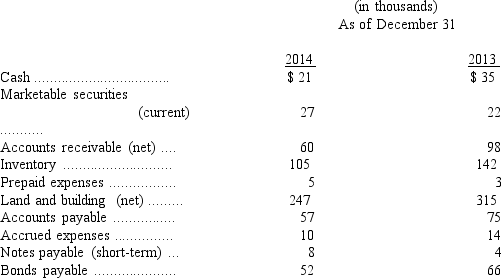

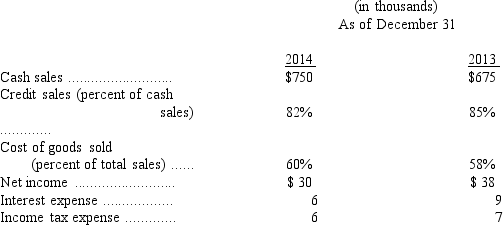

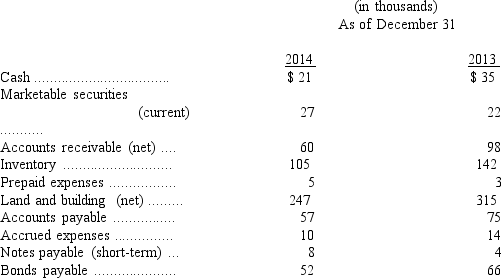

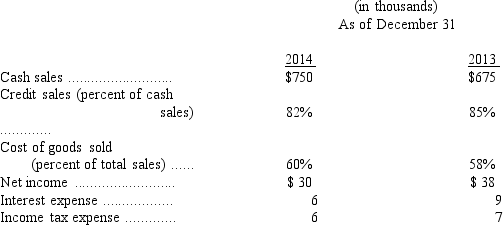

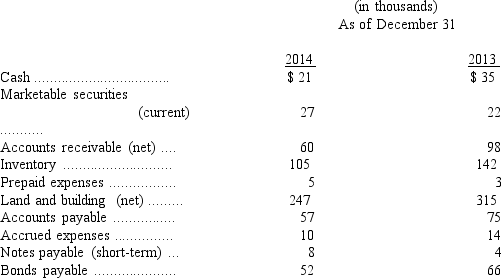

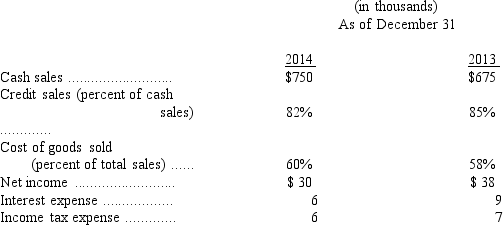

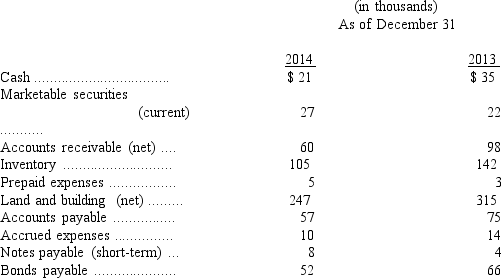

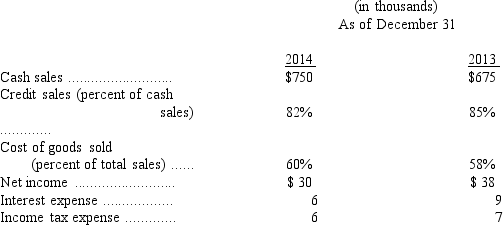

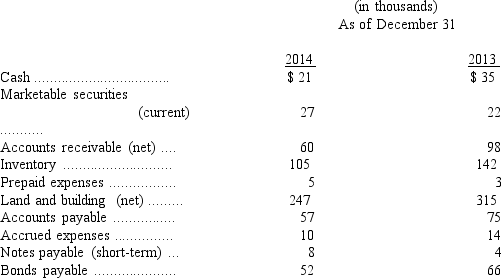

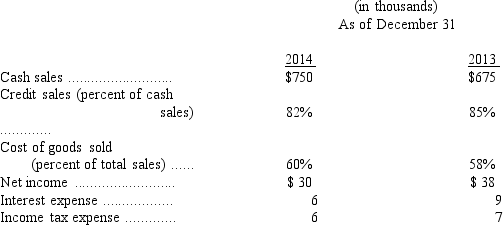

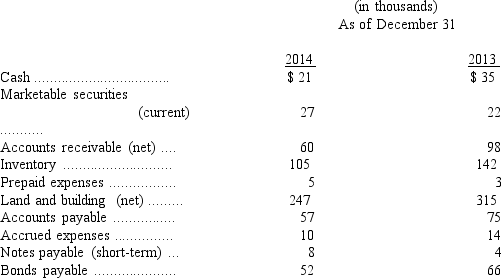

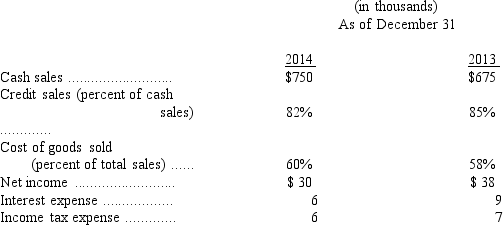

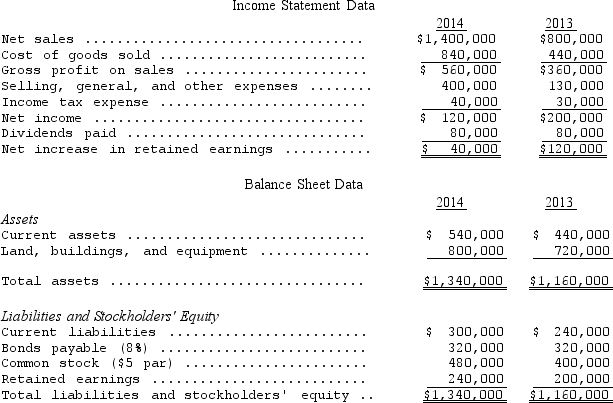

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

Refer to the Sculley Corporation information above.Sculley's current ratio as of December 31,2014,is

A) 2.84 to 1.

B) 3.37 to 1.

C) 2.91 to 1.

D) 3.33 to 1.

Refer to the Sculley Corporation information above.Sculley's current ratio as of December 31,2014,is

A) 2.84 to 1.

B) 3.37 to 1.

C) 2.91 to 1.

D) 3.33 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

A measure of profitability analysis is

A) times interest earned.

B) cash flow per share.

C) quick ratio.

D) dividend payout ratio.

A) times interest earned.

B) cash flow per share.

C) quick ratio.

D) dividend payout ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

From the standpoint of the stockholders of a company,the ratio that measures the overall performance of a company would be calculated using which of the following?

A) Average total assets and net income

B) Average stockholders' equity and net sales

C) Average stockholders' equity and net income

D) Net sales and average total assets

A) Average total assets and net income

B) Average stockholders' equity and net sales

C) Average stockholders' equity and net income

D) Net sales and average total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

An entity changed from the FIFO to the LIFO cost flow assumption for inventories.Assuming that inventory and sales remain constant over time,and that prices are rising,how would the current ratio be changed as a result of converting from FIFO to LIFO?

A) The current ratio did not change.

B) The current ratio increased.

C) The current ratio decreased.

D) The effect on the current ratio cannot be determined from the information given.

A) The current ratio did not change.

B) The current ratio increased.

C) The current ratio decreased.

D) The effect on the current ratio cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

How would the quick ratio be affected by a prepayment of $30,000 for fire and liability insurance?

A) The quick ratio would decrease.

B) The quick ratio would increase.

C) The quick ratio would not change.

D) The effect cannot be determined from the information given.

A) The quick ratio would decrease.

B) The quick ratio would increase.

C) The quick ratio would not change.

D) The effect cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

During the year,The Core Company purchased $1,700,000 of inventory.The cost of goods sold for the year was $1,600,000 and the ending inventory at December 31 was $330,000.What was the inventory turnover for the year?

A) 2.9

B) 3.3

C) 5.7

D) 6.1

A) 2.9

B) 3.3

C) 5.7

D) 6.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

Hermine Company wrote off an $700 uncollectible account receivable against the allowance for doubtful accounts with a balance of $2,000.The current ratio after the write-off of the uncollectible account

A) would be less than before the write-off of the account.

B) would be greater than before the write-off of the account.

C) would be the same as before the write-off of the account.

D) cannot be determined with the information given.

A) would be less than before the write-off of the account.

B) would be greater than before the write-off of the account.

C) would be the same as before the write-off of the account.

D) cannot be determined with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following ratios does NOT measure liquidity?

A) Net cash flow to current liabilities

B) Working capital to total assets

C) Current ratio

D) Quick ratio

A) Net cash flow to current liabilities

B) Working capital to total assets

C) Current ratio

D) Quick ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

Refer to the Sculley Corporation information above.Sculley's account receivable turnover for 2014 is

A) 13.85.

B) 10.00.

C) 9.49.

D) 7.78.

Refer to the Sculley Corporation information above.Sculley's account receivable turnover for 2014 is

A) 13.85.

B) 10.00.

C) 9.49.

D) 7.78.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

The calculation of the return on total assets ratio would use all of the following except

A) average stockholders' equity.

B) total assets.

C) average total assets.

D) net sales.

A) average stockholders' equity.

B) total assets.

C) average total assets.

D) net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

The book value per share of common stock measures

A) liquidity.

B) profitability.

C) equity position and coverage.

D) efficiency.

A) liquidity.

B) profitability.

C) equity position and coverage.

D) efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

Refer to the Sculley Corporation information above.Sculley's quick (acid test)ratio as December 31,2014,is

A) 1.44 to 1.

B) 1.50 to 1.

C) 1.67 to 1.

D) 1.66 to 1.

Refer to the Sculley Corporation information above.Sculley's quick (acid test)ratio as December 31,2014,is

A) 1.44 to 1.

B) 1.50 to 1.

C) 1.67 to 1.

D) 1.66 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

An entity sells an equal dollar amount of convertible preferred stock and long-term notes payable.Prior to these transactions,total debt was less than total equity.How did the sale of the convertible preferred stock and the long-term notes payable affect the company's debt to total assets ratio?

A) The debt to total assets ratio would decrease.

B) The debt to total assets ratio would increase.

C) The debt to total assets ratio would remain the same.

D) The effect on the debt to total assets ratio cannot be determined from the information given.

A) The debt to total assets ratio would decrease.

B) The debt to total assets ratio would increase.

C) The debt to total assets ratio would remain the same.

D) The effect on the debt to total assets ratio cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following ratios does NOT measure efficiency or activity of an entity?

A) Accounts receivable turnover

B) Age of accounts receivable

C) Net cash flow to current liabilities

D) Times interest earned

A) Accounts receivable turnover

B) Age of accounts receivable

C) Net cash flow to current liabilities

D) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following ratios does NOT measure liquidity?

A) Current ratio

B) Quick ratio

C) Working capital to total assets

D) Debt to equity

A) Current ratio

B) Quick ratio

C) Working capital to total assets

D) Debt to equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the effect of the collection of accounts receivable on the current ratio and net working capital,respectively? Current Ratio Net Working Capital

A) No effect No effect

B) Increase Increase

C) Increase No effect

D) No effect Increase

A) No effect No effect

B) Increase Increase

C) Increase No effect

D) No effect Increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is an appropriate computation for return on investment?

A) Sales divided by total assets

B) Net income divided by total assets

C) Net income divided by sales

D) Sales divided by stockholders' equity

A) Sales divided by total assets

B) Net income divided by total assets

C) Net income divided by sales

D) Sales divided by stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is true regarding the debt to equity ratio?

A) The debt to equity ratio is a stringent measure of liquidity.

B) The debt to equity ratio measures the productivity and desirability of the equity investment.

C) The debt to equity ratio measures management's ability to productively employ all its resources.

D) The debt to equity ratio measures the capital structure of the entity.

A) The debt to equity ratio is a stringent measure of liquidity.

B) The debt to equity ratio measures the productivity and desirability of the equity investment.

C) The debt to equity ratio measures management's ability to productively employ all its resources.

D) The debt to equity ratio measures the capital structure of the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

Refer to the Sculley Corporation information above.Sculley's merchandise inventory turnover for 2014 is

A) 3.43.

B) 5.68.

C) 6.63.

D) 6.79.

Refer to the Sculley Corporation information above.Sculley's merchandise inventory turnover for 2014 is

A) 3.43.

B) 5.68.

C) 6.63.

D) 6.79.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

Selected information from the 2014 and 2013 financial statements of Sculley Corporation is presented below:

Refer to the Sculley Corporation information above.Sculley's turnover of assets and number of times interest earned for 2014 are respectively Asset Turnover Times Interest Earned

A) 2.97 5.0

B) 2.94 5.0

C) 2.53 6.0

D) 2.94 7.0

Refer to the Sculley Corporation information above.Sculley's turnover of assets and number of times interest earned for 2014 are respectively Asset Turnover Times Interest Earned

A) 2.97 5.0

B) 2.94 5.0

C) 2.53 6.0

D) 2.94 7.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following ratios would not be affected by the choice of depreciation methods?

A) Working capital turnover

B) Earnings per share of common stock

C) Debt to equity

D) Price-earnings ratio

A) Working capital turnover

B) Earnings per share of common stock

C) Debt to equity

D) Price-earnings ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

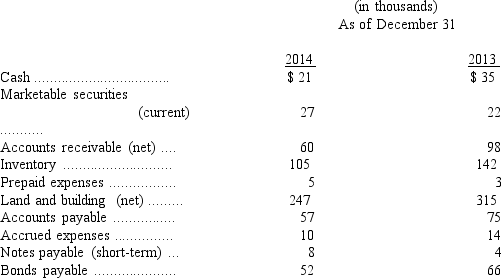

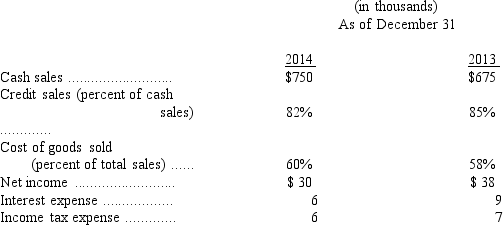

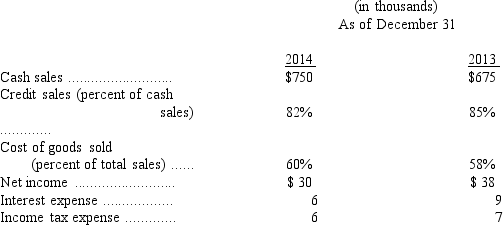

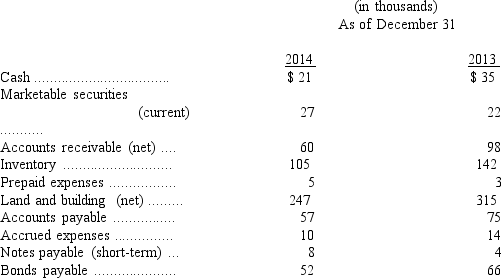

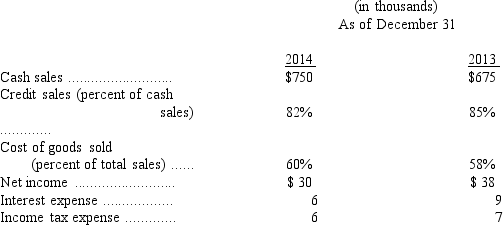

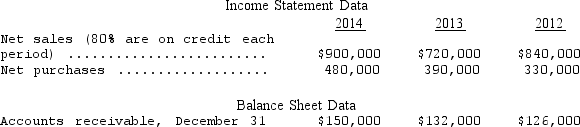

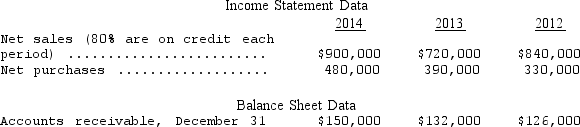

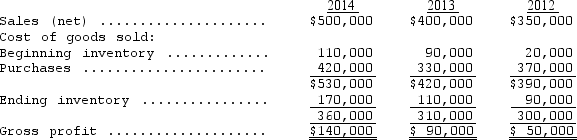

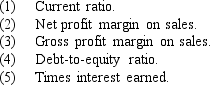

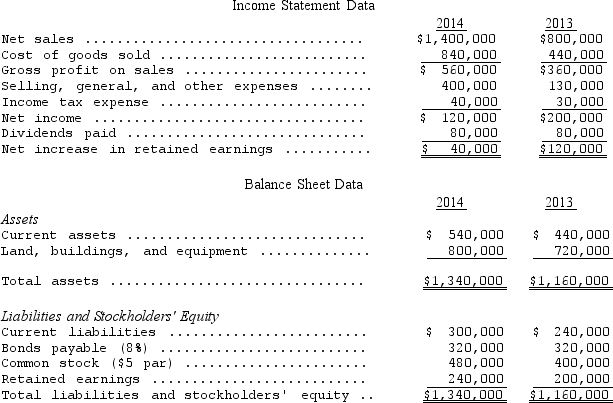

The following are comparative data for Jobs Company for the three-year period 2012-2014:

Compute the following measurements for 2014 and 2013:

Compute the following measurements for 2014 and 2013:

Compute the following measurements for 2014 and 2013:

Compute the following measurements for 2014 and 2013:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

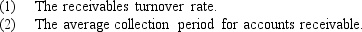

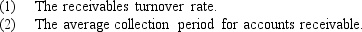

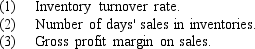

Income statements for Maroon Co.show the following:

From the data presented,calculate the following ratios for 2014 and 2013:

From the data presented,calculate the following ratios for 2014 and 2013:

From the data presented,calculate the following ratios for 2014 and 2013:

From the data presented,calculate the following ratios for 2014 and 2013:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a component of the DuPont Framework?

A) Return on sales

B) Asset turnover

C) Assets to debt

D) Assets to equity

A) Return on sales

B) Asset turnover

C) Assets to debt

D) Assets to equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

All other things held constant,which of the following ratios would not be improved if a company structures a leasing transaction as an operating lease rather than a capital lease?

A) Debt to equity ratio

B) Quick ratio

C) Price-earnings ratio

D) Return on investment

A) Debt to equity ratio

B) Quick ratio

C) Price-earnings ratio

D) Return on investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following ratios would NOT be positively affected by a change from LIFO to FIFO,assuming that prices are rising?

A) Current ratio

B) Debt to equity ratio

C) Times interest earned

D) Quick ratio

A) Current ratio

B) Debt to equity ratio

C) Times interest earned

D) Quick ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

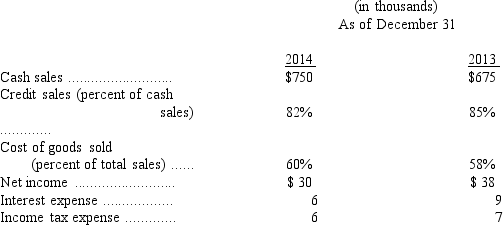

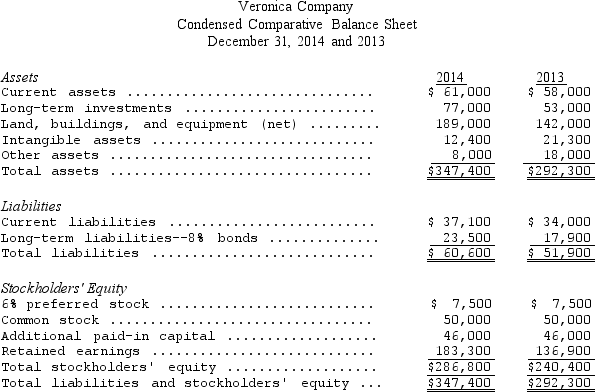

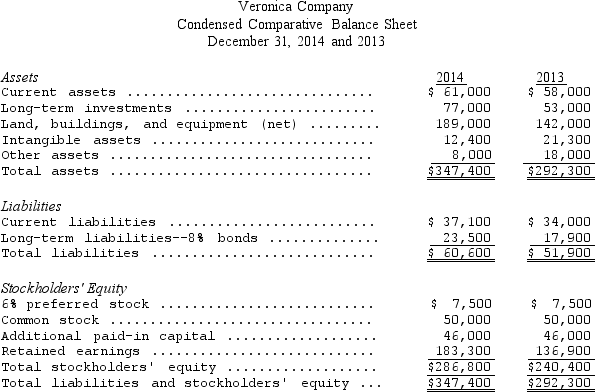

Comparative balance sheet data for the Veronica Co.at the end of 2013 and 2014 follows:

Prepare a common-size balance sheet comparing financial structure percentages for the two-year period.Use total assets to standardize.

Prepare a common-size balance sheet comparing financial structure percentages for the two-year period.Use total assets to standardize.

Prepare a common-size balance sheet comparing financial structure percentages for the two-year period.Use total assets to standardize.

Prepare a common-size balance sheet comparing financial structure percentages for the two-year period.Use total assets to standardize.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

The inventory turnover ratio

A) measures management's ability to productively employ all of its resources.

B) measures the efficient use of assets held for resale.

C) is a stringent measure of liquidity.

D) provides a measure of the strength of the sales mix the company currently employs.

A) measures management's ability to productively employ all of its resources.

B) measures the efficient use of assets held for resale.

C) is a stringent measure of liquidity.

D) provides a measure of the strength of the sales mix the company currently employs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

Comparative data for Agnew Inc.for the two-year period 2013-2014 are given as follows:

From the given data,compute the following for 2014 and 2013:

From the given data,compute the following for 2014 and 2013:

From the given data,compute the following for 2014 and 2013:

From the given data,compute the following for 2014 and 2013:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is NOT correct regarding the rate of return on assets?

A) The rate of return on assets measures management's ability to productively employ all its resources.

B) The rate of return on assets measures the return on all assets used regardless of how the assets are financed.

C) The rate of return on assets is a measure of profitability.

D) The rate of return on assets measures the return on the investment made by the owners of the entity.

A) The rate of return on assets measures management's ability to productively employ all its resources.

B) The rate of return on assets measures the return on all assets used regardless of how the assets are financed.

C) The rate of return on assets is a measure of profitability.

D) The rate of return on assets measures the return on the investment made by the owners of the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck