Deck 19: International Monetary Systems: an Historical Overview

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/171

العب

ملء الشاشة (f)

Deck 19: International Monetary Systems: an Historical Overview

1

Which one of the following statements is TRUE?

A) Countries with strong investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

B) Countries with weak investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

C) Countries with weak investment opportunities should invest more at home.

D) Countries with weak investment opportunities should invest little abroad.

E) Countries with weak investment opportunities should invest little abroad and channel their savings into more productive investment activity domestically.

A) Countries with strong investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

B) Countries with weak investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

C) Countries with weak investment opportunities should invest more at home.

D) Countries with weak investment opportunities should invest little abroad.

E) Countries with weak investment opportunities should invest little abroad and channel their savings into more productive investment activity domestically.

B

2

A current account surplus

A) poses a problem if domestic savings are being invested more profitably abroad than they would be at home.

B) may pose no problem if domestic savings are being invested more profitably abroad than they would be at home.

C) may pose no problem if domestic savings are being invested less profitably abroad than they would be at home.

D) there is no relation between current account surplus and between savings and investment.

E) poses a problem if domestic savings are being invested less profitably abroad than they would be at home.

A) poses a problem if domestic savings are being invested more profitably abroad than they would be at home.

B) may pose no problem if domestic savings are being invested more profitably abroad than they would be at home.

C) may pose no problem if domestic savings are being invested less profitably abroad than they would be at home.

D) there is no relation between current account surplus and between savings and investment.

E) poses a problem if domestic savings are being invested less profitably abroad than they would be at home.

B

3

Countries where investment is

A) relatively unproductive should have current account deficits.

B) relatively productive should have current account surpluses.

C) relatively productive should have current account deficits.

D) relatively productive should have balanced current accounts.

E) relatively unproductive should have balanced current accounts.

A) relatively unproductive should have current account deficits.

B) relatively productive should have current account surpluses.

C) relatively productive should have current account deficits.

D) relatively productive should have balanced current accounts.

E) relatively unproductive should have balanced current accounts.

C

4

Countries where investment is relatively

A) productive should be net exporters of currently available output.

B) unproductive should be net importers of currently available output.

C) unproductive should be net exporters of currently available output.

D) unproductive should be net exporters of future available output.

E) unproductive should focus on their internal balance.

A) productive should be net exporters of currently available output.

B) unproductive should be net importers of currently available output.

C) unproductive should be net exporters of currently available output.

D) unproductive should be net exporters of future available output.

E) unproductive should focus on their internal balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

5

By internal balance, most economists mean

A) full employment.

B) price stability.

C) full employment and price stability.

D) full employment and moderate increase in prices.

E) full employment and high disposable income.

A) full employment.

B) price stability.

C) full employment and price stability.

D) full employment and moderate increase in prices.

E) full employment and high disposable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

6

Governments prefer to avoid excessive current account surpluses because

A) the returns to domestic savings are more difficult to tax than those on assets abroad.

B) an addition to the home capital stock may increase domestic unemployment and therefore lead to higher national income.

C) foreign investment in one firm may have beneficial technological spillover effects on other foreign producers that the investing firm does not capture.

D) an addition to the home capital stock may reduce domestic unemployment and therefore lead to higher national income.

E) domestic savings increase with more investment abroad.

A) the returns to domestic savings are more difficult to tax than those on assets abroad.

B) an addition to the home capital stock may increase domestic unemployment and therefore lead to higher national income.

C) foreign investment in one firm may have beneficial technological spillover effects on other foreign producers that the investing firm does not capture.

D) an addition to the home capital stock may reduce domestic unemployment and therefore lead to higher national income.

E) domestic savings increase with more investment abroad.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

7

"The line distinguishing external from internal goals can be fuzzy." Discuss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

8

Countries with

A) strong investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

B) strong investment opportunities should invest more at home and less abroad.

C) weak investment opportunities should invest more at home.

D) weak investment opportunities should invest little abroad.

E) countries with productive investment should invest exclusively at home.

A) strong investment opportunities should invest little at home and channel their savings into more productive investment activity abroad.

B) strong investment opportunities should invest more at home and less abroad.

C) weak investment opportunities should invest more at home.

D) weak investment opportunities should invest little abroad.

E) countries with productive investment should invest exclusively at home.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

9

Why do governments prefer to avoid current account deficits that are too large?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which one of the following statements is TRUE?

A) Inflation but not deflation can occur even under conditions of full employment.

B) Deflation but not inflation can occur even under conditions of full employment.

C) Inflation or deflation can occur even under conditions of full employment.

D) Inflation can occur even under conditions of full employment only in the long run.

E) Inflation does not coincide with periods of high unemployment levels.

A) Inflation but not deflation can occur even under conditions of full employment.

B) Deflation but not inflation can occur even under conditions of full employment.

C) Inflation or deflation can occur even under conditions of full employment.

D) Inflation can occur even under conditions of full employment only in the long run.

E) Inflation does not coincide with periods of high unemployment levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

11

A sudden increase in the U.S. price level

A) makes creditors in dollars better off.

B) makes creditors in dollars worse off.

C) do not affect creditors in dollars.

D) makes creditors in DM worse off.

E) makes lenders worse off.

A) makes creditors in dollars better off.

B) makes creditors in dollars worse off.

C) do not affect creditors in dollars.

D) makes creditors in DM worse off.

E) makes lenders worse off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

12

A sudden decrease in the U.S. price level

A) makes creditors in dollars better off.

B) makes creditors in dollars worse off.

C) do not affect creditors in dollars.

D) makes creditors in DM better off.

E) makes those with dollar debts better off.

A) makes creditors in dollars better off.

B) makes creditors in dollars worse off.

C) do not affect creditors in dollars.

D) makes creditors in DM better off.

E) makes those with dollar debts better off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

13

A sudden increase in the U.S. price level

A) makes those with dollar debts worse off.

B) makes those with dollar debts better off.

C) does not affect those with dollar debts.

D) makes those with foreign debts better off.

E) increases all dollar debts.

A) makes those with dollar debts worse off.

B) makes those with dollar debts better off.

C) does not affect those with dollar debts.

D) makes those with foreign debts better off.

E) increases all dollar debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

14

By external balance, most economists mean

A) avoiding excessive imbalances in international payments.

B) balance between exports and imports.

C) balance between the trade and service accounts.

D) what amounts to fixed exchange rates.

E) imbalance in internal transactions.

A) avoiding excessive imbalances in international payments.

B) balance between exports and imports.

C) balance between the trade and service accounts.

D) what amounts to fixed exchange rates.

E) imbalance in internal transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

15

A sudden decrease in the U.S. price level

A) makes those with dollar debts worse off.

B) makes those with dollar debts better off.

C) do not affect those with dollar debts.

D) makes those with DM worse off.

E) makes creditors worse off.

A) makes those with dollar debts worse off.

B) makes those with dollar debts better off.

C) do not affect those with dollar debts.

D) makes those with DM worse off.

E) makes creditors worse off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

16

A current account deficit

A) will not pose a problem, especially if it is accompanied by an expansionary fiscal policy.

B) may pose no problem if the borrowed funds are channeled into productive domestic investment projects that pay for themselves with the revenue they generate in the future.

C) may still pose a problem, even if the borrowed funds are channeled into productive domestic investment projects.

D) There is no relation between current account surplus and between savings and investment.

E) will pose a problem because the country is borrowing funds from the rest of the world that it won't be able to pay back later.

A) will not pose a problem, especially if it is accompanied by an expansionary fiscal policy.

B) may pose no problem if the borrowed funds are channeled into productive domestic investment projects that pay for themselves with the revenue they generate in the future.

C) may still pose a problem, even if the borrowed funds are channeled into productive domestic investment projects.

D) There is no relation between current account surplus and between savings and investment.

E) will pose a problem because the country is borrowing funds from the rest of the world that it won't be able to pay back later.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which one of the following statements is TRUE?

A) Countries where investment is relatively productive should be net importers of current output.

B) Countries where investment is relatively unproductive should be net importers of current output.

C) Countries where investment is relatively productive should be net exporters of current output.

D) Countries where investment is relatively productive should not export or import current output.

E) Countries where investment is relatively unproductive should invest at home.

A) Countries where investment is relatively productive should be net importers of current output.

B) Countries where investment is relatively unproductive should be net importers of current output.

C) Countries where investment is relatively productive should be net exporters of current output.

D) Countries where investment is relatively productive should not export or import current output.

E) Countries where investment is relatively unproductive should invest at home.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

18

A country seeking to maintain internal balance would be concerned

A) only with attaining low levels of unemployment.

B) primarily with ensuring that saving is weighted more towards domestic investment than the current account.

C) with large fluctuations in output or prices.

D) with maintaining an adequate stock of gold reserves.

E) with stabilizing employment levels globally.

A) only with attaining low levels of unemployment.

B) primarily with ensuring that saving is weighted more towards domestic investment than the current account.

C) with large fluctuations in output or prices.

D) with maintaining an adequate stock of gold reserves.

E) with stabilizing employment levels globally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

19

Countries where investment is relatively

A) productive should have current account deficits.

B) productive should have current account surpluses.

C) unproductive should have current account surpluses.

D) productive should balanced current account surpluses.

E) productive should have low outputs.

A) productive should have current account deficits.

B) productive should have current account surpluses.

C) unproductive should have current account surpluses.

D) productive should balanced current account surpluses.

E) productive should have low outputs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

20

Inflation can occur under conditions of full employment

A) only if the central bank continues to inject money into the economy and the agents' expectations of inflation are supported by the bank's activities.

B) only if the central bank continues to inject money into the economy.

C) only if the central bank continues to withdraw money from the economy.

D) only if the central bank continues to inject money into the economy and all agents expect that inflation will not occur.

E) only if the central bank fails to inject money into the economy.

A) only if the central bank continues to inject money into the economy and the agents' expectations of inflation are supported by the bank's activities.

B) only if the central bank continues to inject money into the economy.

C) only if the central bank continues to withdraw money from the economy.

D) only if the central bank continues to inject money into the economy and all agents expect that inflation will not occur.

E) only if the central bank fails to inject money into the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

21

The main policy goal for a country according to the mercantilists is

A) to create a one-time deficit in the balance of payments.

B) to create a continuing deficit in the balance of payments.

C) to create a one-time surplus in the balance of payments.

D) to create a continuing surplus in the balance of payments.

E) to create specie overflows.

A) to create a one-time deficit in the balance of payments.

B) to create a continuing deficit in the balance of payments.

C) to create a one-time surplus in the balance of payments.

D) to create a continuing surplus in the balance of payments.

E) to create specie overflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

22

The case of New Zealand, described in the text, is concerned with the country's

A) prospects for long term growth.

B) ability to sustain current account deficits.

C) unproductive industrial sector and its prospects for long run growth.

D) labor productivity.

E) exchange rate volatility relative to other currencies.

A) prospects for long term growth.

B) ability to sustain current account deficits.

C) unproductive industrial sector and its prospects for long run growth.

D) labor productivity.

E) exchange rate volatility relative to other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

23

Using an equation, explain why governments prefer to avoid excessive current account surpluses?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

24

Why do governments prefer to avoid excessive current account surpluses? Or, why are growing domestic claims to foreign wealth ever a problem?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the price-specie-flow mechanism, what happens when, say, Germany's current account surplus is greater than its non-reserve capital account deficits?

A) German loans will finance all foreign net imports.

B) Automatic drop in German domestic prices and rise in foreign prices.

C) Gold reserves will flow into Germany.

D) Gold reserves will flow out of Germany.

E) Germany will experience a deficit.

A) German loans will finance all foreign net imports.

B) Automatic drop in German domestic prices and rise in foreign prices.

C) Gold reserves will flow into Germany.

D) Gold reserves will flow out of Germany.

E) Germany will experience a deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

26

The case of New Zealand, described in the text, draws what technical conclusion regarding the country's international debt position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

27

L. Frank Baum's classic 1900 children's book, The Wonderful Wizard of Oz, is

A) an allegorical rendition of the U.S. political struggle over silver.

B) an allegorical rendition of the U.S. political struggle over copper.

C) an allegorical rendition of the U.S. political struggle over both silver and gold.

D) an allegorical rendition of the U.S. political struggle over indebted farmers.

E) an allegorical rendition of the U.S. political struggle over gold.

A) an allegorical rendition of the U.S. political struggle over silver.

B) an allegorical rendition of the U.S. political struggle over copper.

C) an allegorical rendition of the U.S. political struggle over both silver and gold.

D) an allegorical rendition of the U.S. political struggle over indebted farmers.

E) an allegorical rendition of the U.S. political struggle over gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

28

The view of mercantilists can be summarized as follows

A) to sell less to strangers yearly than we consume of theirs in value.

B) to sell more to strangers yearly than we consume of theirs in value.

C) to consume more of theirs in value than we sell to strangers.

D) to consume the same amount as theirs in value as we sell to strangers.

E) to sell gold and silver to strangers in exchange for services.

A) to sell less to strangers yearly than we consume of theirs in value.

B) to sell more to strangers yearly than we consume of theirs in value.

C) to consume more of theirs in value than we sell to strangers.

D) to consume the same amount as theirs in value as we sell to strangers.

E) to sell gold and silver to strangers in exchange for services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

29

Until the United States Civil War, The Unites States had a

A) gold-based monetary standard.

B) silver-based monetary standard.

C) bimetallic monetary standard consisting of silver and gold.

D) bimetallic monetary standard consisting of copper and silver.

E) bimetallic monetary standard consisting of copper and gold.

A) gold-based monetary standard.

B) silver-based monetary standard.

C) bimetallic monetary standard consisting of silver and gold.

D) bimetallic monetary standard consisting of copper and silver.

E) bimetallic monetary standard consisting of copper and gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

30

The case of New Zealand, as described in the text, draws what simple conclusion regarding the country's international debt position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is one component of the "trilemma" that is faced by policy makers in choosing monetary arrangements?

A) exchange rate stability

B) restrictions on international capital movements

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

A) exchange rate stability

B) restrictions on international capital movements

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

32

Mercantilism held that

A) silver alone was the mainstay of national wealth.

B) gold alone was the mainstay of national wealth.

C) silver and gold were the mainstays of national wealth.

D) silver and gold are not important for national wealth of a country.

E) labor forces were the mainstay of national wealth.

A) silver alone was the mainstay of national wealth.

B) gold alone was the mainstay of national wealth.

C) silver and gold were the mainstays of national wealth.

D) silver and gold are not important for national wealth of a country.

E) labor forces were the mainstay of national wealth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

33

The "rules of the game" under the gold standard can best be described as which of the following:

A) selling domestic assets in a deficit and buying assets in a surplus.

B) slowing down the automatic adjustments processes inherent in the gold standard.

C) selling domestic assets in order to accumulate gold.

D) selling foreign assets in a deficit and buying foreign assets in a surplus.

E) selling domestic assets in a surplus.

A) selling domestic assets in a deficit and buying assets in a surplus.

B) slowing down the automatic adjustments processes inherent in the gold standard.

C) selling domestic assets in order to accumulate gold.

D) selling foreign assets in a deficit and buying foreign assets in a surplus.

E) selling domestic assets in a surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

34

The case of New Zealand, described in the text, concludes that a country's current account deficits are not sustainable if a country's

A) prospects for long term economic growth are above its global deficit growth.

B) ability to sustain current account deficits is questionable.

C) unproductive industrial sectors and its prospects for long run growth.

D) labor productivity is below that of most other countries.

E) exchange rate has fallen relative to other currencies.

A) prospects for long term economic growth are above its global deficit growth.

B) ability to sustain current account deficits is questionable.

C) unproductive industrial sectors and its prospects for long run growth.

D) labor productivity is below that of most other countries.

E) exchange rate has fallen relative to other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the nature of the trilemma that is encountered when choosing monetary arrangements?

A) Only two of the three aspects of internal and external balance can be accommodated simultaneously.

B) Only three of the four aspects of internal and external balance can be accommodated simultaneously.

C) Only one of the three aspects of internal and external balance can be accommodated simultaneously.

D) Only two of the four aspects of internal and external balance can be accommodated simultaneously.

E) Only one of the four aspects of internal and external balance can be accommodated simultaneously.

A) Only two of the three aspects of internal and external balance can be accommodated simultaneously.

B) Only three of the four aspects of internal and external balance can be accommodated simultaneously.

C) Only one of the three aspects of internal and external balance can be accommodated simultaneously.

D) Only two of the four aspects of internal and external balance can be accommodated simultaneously.

E) Only one of the four aspects of internal and external balance can be accommodated simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is one component of the "trilemma" that is faced by policy makers in choosing monetary arrangements?

A) freedom of international capital movements

B) exchange rate instability

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

A) freedom of international capital movements

B) exchange rate instability

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

37

The case of New Zealand, described in the text, asks what question about the country's international debt position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is one component of the "trilemma" that is faced by policy makers in choosing monetary arrangements?

A) monetary policy oriented towards domestic goals

B) exchange rate instability

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

A) monetary policy oriented towards domestic goals

B) exchange rate instability

C) tariffs and subsidies

D) restrictions on the migration of labor

E) global inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

39

The case of New Zealand, described in the text, draws what technical conclusion regarding the country's international debt position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

40

What are the components of the trilemma that is encountered when a country chooses its monetary policy and what is the meaning of the term?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

41

Under the gold standard era of 1870-1914

A) central banks tried to have sharp fluctuations in the balance of payments.

B) central banks tried to avoid sharp fluctuations in the current account of the balance of payments.

C) central banks tried to avoid sharp fluctuations in the trade account of the balance of payments.

D) central banks tried to avoid sharp fluctuations in the capital account of the balance of payments.

E) central banks tried to avoid sharp fluctuations in the balance of payments.

A) central banks tried to have sharp fluctuations in the balance of payments.

B) central banks tried to avoid sharp fluctuations in the current account of the balance of payments.

C) central banks tried to avoid sharp fluctuations in the trade account of the balance of payments.

D) central banks tried to avoid sharp fluctuations in the capital account of the balance of payments.

E) central banks tried to avoid sharp fluctuations in the balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

42

How did the international monetary system influenced macroeconomic policy-making and performance during the gold standard era (1870-1914)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

43

Under the gold standard

A) a perpetual surplus is possible.

B) a perpetual deficit is possible.

C) a perpetual surplus is impossible, but a perpetual deficit is possible.

D) a perpetual deficit is impossible, but a perpetual surplus is possible.

E) a perpetual surplus is impossible.

A) a perpetual surplus is possible.

B) a perpetual deficit is possible.

C) a perpetual surplus is impossible, but a perpetual deficit is possible.

D) a perpetual deficit is impossible, but a perpetual surplus is possible.

E) a perpetual surplus is impossible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

44

Describe the effects of the Smoot-Hawley tariff imposed by the United States in 1930.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

45

How did the international monetary system influence macroeconomic policy-making and performance during the interwar period (1918-1939)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

46

Explain why under the gold standard a perpetual surplus or a perpetual deficit is impossible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

47

Once the United States Civil War broke out, the United States moved to a

A) gold standard.

B) silver standard.

C) bimetallic monetary standard consisting of silver and gold.

D) bimetallic monetary standard consisting of copper and gold.

E) paper currency, called the "greenback."

A) gold standard.

B) silver standard.

C) bimetallic monetary standard consisting of silver and gold.

D) bimetallic monetary standard consisting of copper and gold.

E) paper currency, called the "greenback."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

48

Countries with the

A) biggest deflations and output contractions are countries which were never on the gold standard until 1936.

B) biggest inflations and output contractions are countries which were on the gold standard until 1936.

C) lowest deflations and output contractions are countries which were on the gold standard until 1936.

D) biggest deflations and output increases are countries which were on the gold standard until 1936.

E) biggest deflations and output contractions are countries which stayed on the gold standard until 1936.

A) biggest deflations and output contractions are countries which were never on the gold standard until 1936.

B) biggest inflations and output contractions are countries which were on the gold standard until 1936.

C) lowest deflations and output contractions are countries which were on the gold standard until 1936.

D) biggest deflations and output increases are countries which were on the gold standard until 1936.

E) biggest deflations and output contractions are countries which stayed on the gold standard until 1936.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

49

The gold standard period was

A) up until the first world war.

B) between the first and second world wars.

C) following the second world war until 1970.

D) between 1954 and 1970.

E) between 1814 and 1865.

A) up until the first world war.

B) between the first and second world wars.

C) following the second world war until 1970.

D) between 1954 and 1970.

E) between 1814 and 1865.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

50

Under the gold standard

A) a shortage of currency leads to low domestic prices and a foreign payments surplus.

B) a shortage of currency leads to high domestic prices and a foreign payments surplus.

C) a shortage of currency leads to low domestic prices and a foreign payments deficit.

D) a shortage of currency leads to low domestic prices but leaves the foreign balance of payments at equilibrium.

E) a shortage of currency leads to a perpetual surplus.

A) a shortage of currency leads to low domestic prices and a foreign payments surplus.

B) a shortage of currency leads to high domestic prices and a foreign payments surplus.

C) a shortage of currency leads to low domestic prices and a foreign payments deficit.

D) a shortage of currency leads to low domestic prices but leaves the foreign balance of payments at equilibrium.

E) a shortage of currency leads to a perpetual surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Great Depression that started in 1929 was

A) confined only to the United States.

B) confined only to the United States and Britain.

C) confined only to the United States and Europe.

D) a global phenomenon.

E) confined only to the Americas.

A) confined only to the United States.

B) confined only to the United States and Britain.

C) confined only to the United States and Europe.

D) a global phenomenon.

E) confined only to the Americas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

52

It is claimed that L. Frank Baum's classic 1900 children's book, The Wonderful Wizard of Oz, is an allegorical rendition of the U.S. political struggle over gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

53

Under the gold standard era of 1870-1914

A) Tokyo was the center of the international monetary system.

B) Paris was the center of the international monetary system.

C) Berlin the center of the international monetary system.

D) New York was the center of the international monetary system.

E) London was the center of the international monetary system.

A) Tokyo was the center of the international monetary system.

B) Paris was the center of the international monetary system.

C) Berlin the center of the international monetary system.

D) New York was the center of the international monetary system.

E) London was the center of the international monetary system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under the Gold standard, a country is said to be in balance of payments equilibrium when the current account balance is

A) financed entirely by international lending without reserve movements.

B) financed by international lending and with reserve movements.

C) equal to zero.

D) financed entirely by international lending and past gold reserves.

E) financed entirely by gold reserves.

A) financed entirely by international lending without reserve movements.

B) financed by international lending and with reserve movements.

C) equal to zero.

D) financed entirely by international lending and past gold reserves.

E) financed entirely by gold reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which one of the following statements is the MOST accurate? By the year 1932, the United States

A) and Canada alone held more than 70 percent of the world's monetary gold.

B) and Germany alone held more than 70 percent of the world's monetary gold.

C) and Britain alone held more than 70 percent of the world's monetary gold.

D) Britain, and France alone held more than 70 percent of the world's monetary gold.

E) and France alone held more than 70 percent of the world's monetary gold.

A) and Canada alone held more than 70 percent of the world's monetary gold.

B) and Germany alone held more than 70 percent of the world's monetary gold.

C) and Britain alone held more than 70 percent of the world's monetary gold.

D) Britain, and France alone held more than 70 percent of the world's monetary gold.

E) and France alone held more than 70 percent of the world's monetary gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

56

The price-specie-flow mechanism

A) is an automatic mechanism for assuring external balance under floating exchange rates.

B) is an automatic mechanism for assuring external balance under the gold standard.

C) is an automatic mechanism for assuring internal balance under floating exchange rates.

D) is an automatic mechanism for assuring internal balance under the gold standard.

E) is an automatic mechanism for assuring internal balance under mercantilism.

A) is an automatic mechanism for assuring external balance under floating exchange rates.

B) is an automatic mechanism for assuring external balance under the gold standard.

C) is an automatic mechanism for assuring internal balance under floating exchange rates.

D) is an automatic mechanism for assuring internal balance under the gold standard.

E) is an automatic mechanism for assuring internal balance under mercantilism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

57

A policy of "beggar-thy-neighbor" is a policy that

A) often benefits the home country in the long run.

B) often benefits the foreign country in the long run.

C) often benefits foreign country in the short run.

D) does not often benefits any country in the long run.

E) benefits the home country's neighbors in the long run.

A) often benefits the home country in the long run.

B) often benefits the foreign country in the long run.

C) often benefits foreign country in the short run.

D) does not often benefits any country in the long run.

E) benefits the home country's neighbors in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

58

Refute the claim by mercantilists who claimed that without severe restrictions on international trade and payments, a country might find itself impoverished and without an adequate supply of circulating monetary gold as a result of balance of payments deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

59

A country is said to be in balance of payments equilibrium, when the sum of its current and its

A) non-reserved capital accounts equals zero.

B) reserved capital accounts equals zero.

C) non-reserved capital accounts equals to the surplus in the capital account.

D) non-reserved capital accounts equals to the deficit in the capital account.

E) non-reserved capital accounts is higher than the total capital account balance.

A) non-reserved capital accounts equals zero.

B) reserved capital accounts equals zero.

C) non-reserved capital accounts equals to the surplus in the capital account.

D) non-reserved capital accounts equals to the deficit in the capital account.

E) non-reserved capital accounts is higher than the total capital account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

60

In L. Frank Baum's classic 1900 children's book, The Wonderful Wizard of Oz, the name "oz" is a reference to

A) an ounce (oz.) of gold.

B) an ounce (oz.) of silver.

C) an ounce (oz.) of copper.

D) an ounce (oz.) of gold or silver.

E) an ounce (oz.) of wheat.

A) an ounce (oz.) of gold.

B) an ounce (oz.) of silver.

C) an ounce (oz.) of copper.

D) an ounce (oz.) of gold or silver.

E) an ounce (oz.) of wheat.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

61

The costs of inflation have been most apparent in the post-war period in countries like

A) Brazil.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

A) Brazil.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain how a country with a current account deficit is a ripe candidate for currency devaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

63

What explains the nearly universal scope of the Great Depression?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

64

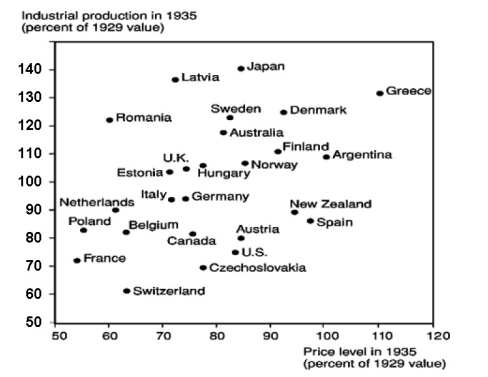

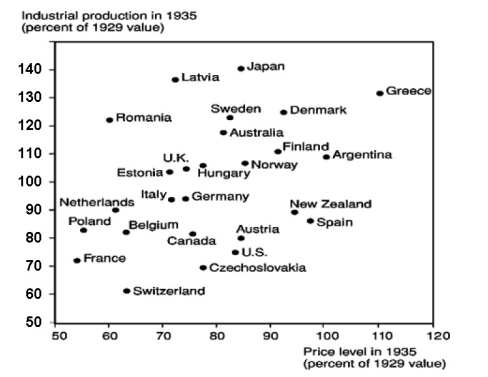

The following figure introduces the relationship between industrial production and wholesale price index changes between the years 1929-1935. What is the purpose of the following figure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the two features of the IMF Articles of Agreement helped promote flexibility in external adjustment?

A) IMF members helped countries maintain full employment.

B) IMF allowed countries to attain internal balance.

C) New countries would enter the agreement if they fixed their exchange rate.

D) IMF members contributed their currency to form a pool of resources that IMF could lend to countries in need and parities in the exchange rate against the dollar could be adjusted with agreement of IMF.

E) IMF members argued against the use of floating exchange rates.

A) IMF members helped countries maintain full employment.

B) IMF allowed countries to attain internal balance.

C) New countries would enter the agreement if they fixed their exchange rate.

D) IMF members contributed their currency to form a pool of resources that IMF could lend to countries in need and parities in the exchange rate against the dollar could be adjusted with agreement of IMF.

E) IMF members argued against the use of floating exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

66

The costs of inflation have been most apparent in the post-war period in countries like

A) Argentina.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

A) Argentina.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

67

Discuss the impact of the restoration of convertibility in 1958.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is a convertible currency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

69

The dollar of the United States became the postwar world's key currency because of all EXCEPT

A) the early convertibility of the U.S. dollar in 1945.

B) the special position of the dollar under the Bretton Woods system.

C) the strength of the American economy relative to the devastated economies of Europe and Japan.

D) central banks naturally found it advantageous to hold their international reserves in the form of interest-bearing dollar assets.

E) the ease of transporting U.S. dollars compared with other currencies.

A) the early convertibility of the U.S. dollar in 1945.

B) the special position of the dollar under the Bretton Woods system.

C) the strength of the American economy relative to the devastated economies of Europe and Japan.

D) central banks naturally found it advantageous to hold their international reserves in the form of interest-bearing dollar assets.

E) the ease of transporting U.S. dollars compared with other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

70

Countries with large current account surpluses might be viewed by the market as candidates for

A) devaluation.

B) revaluation.

C) bankruptcy.

D) depreciation.

E) investment.

A) devaluation.

B) revaluation.

C) bankruptcy.

D) depreciation.

E) investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

71

How did the international monetary system influence macroeconomic policy-making and performance during the post-World War II years during which exchange rates were fixed under the Bretton Woods agreement (1946-1973)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

72

Explain why the United States dollar became the postwar world's key currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

73

A convertible currency is a currency that may be freely exchanged for

A) domestic assets.

B) only silver.

C) only copper.

D) national currency.

E) foreign currencies.

A) domestic assets.

B) only silver.

C) only copper.

D) national currency.

E) foreign currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain how a country with a current account surplus is a ripe candidate for currency revaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

75

The current account surplus is

A) an increasing function of disposable income and an increasing function of the real exchange rate.

B) a decreasing function of disposable income and a decreasing function of the real exchange rate.

C) a decreasing function of disposable income and an increasing function of the real exchange rate.

D) only a decreasing function of disposable income.

E) only an increasing function of the real exchange rate.

A) an increasing function of disposable income and an increasing function of the real exchange rate.

B) a decreasing function of disposable income and a decreasing function of the real exchange rate.

C) a decreasing function of disposable income and an increasing function of the real exchange rate.

D) only a decreasing function of disposable income.

E) only an increasing function of the real exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

76

A person holding dollar deposits during the devaluation of the dollar would

A) enjoy a monetary gain.

B) see the foreign currency value of dollar assets increase by the amount of the exchange rate change.

C) shift their wealth into domestic investments.

D) suffer a monetary loss and see the foreign currency value of dollar assets decrease by the amount of the exchange rate change.

E) see no change in their investments.

A) enjoy a monetary gain.

B) see the foreign currency value of dollar assets increase by the amount of the exchange rate change.

C) shift their wealth into domestic investments.

D) suffer a monetary loss and see the foreign currency value of dollar assets decrease by the amount of the exchange rate change.

E) see no change in their investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

77

How did the international monetary system created at Bretton Woods in 1944 allow its members to reconcile their external commitments with their internal goals of full employment and price stability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

78

The costs of inflation have been most apparent in the post-war period in countries like

A) Serbia.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

A) Serbia.

B) Belgium.

C) the United States.

D) Canada.

E) Japan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

79

When the exchange rate, E, and the foreign price level, P*, is fixed, domestic inflation depends primarily on

A) amount of aggregate demand.

B) home price level set by IMF.

C) current account balance.

D) government tax policy.

E) foreign interest rates.

A) amount of aggregate demand.

B) home price level set by IMF.

C) current account balance.

D) government tax policy.

E) foreign interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck

80

The IMF agreement forced the U.S. to exchange gold for dollars at what price?

A) $25/ ounce

B) $35/ ounce

C) $45/ ounce

D) $55/ ounce

E) $20/ ounce

A) $25/ ounce

B) $35/ ounce

C) $45/ ounce

D) $55/ ounce

E) $20/ ounce

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 171 في هذه المجموعة.

فتح الحزمة

k this deck