Deck 21: International Cash Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/49

العب

ملء الشاشة (f)

Deck 21: International Cash Management

1

Assume the U.S. one-year interest rate is 11% and the French one-year interest rate is 18%. The break-even level of depreciation in the euro at which the U.S. and French investments would exhibit the same return to a U.S. investor is:

A) about 5.1%.

B) about 6.8%.

C) about 6.3%.

D) about 5.9%.

A) about 5.1%.

B) about 6.8%.

C) about 6.3%.

D) about 5.9%.

D

2

A common purpose of inter-subsidiary leading or lagging strategies is to:

A) allow subsidiaries with excess funds to provide financing to subsidiaries with deficient funds.

B) assure that the inventory levels at subsidiaries are maintained within tolerable ranges.

C) change the prices a high-tax rate subsidiary charges a low-tax rate subsidiary.

D) measure the performance of subsidiaries according to how quickly subsidiaries remit dividend payments to the parent.

A) allow subsidiaries with excess funds to provide financing to subsidiaries with deficient funds.

B) assure that the inventory levels at subsidiaries are maintained within tolerable ranges.

C) change the prices a high-tax rate subsidiary charges a low-tax rate subsidiary.

D) measure the performance of subsidiaries according to how quickly subsidiaries remit dividend payments to the parent.

A

3

The international Fisher effect suggests that:

A) the effective yield on short-term foreign securities should, on average, equal the yield on short-term domestic securities.

B) the effective yield on short-term securities of high inflation countries is greater than the yield on short-term domestic securities.

C) if domestic income grows faster than foreign income, the effective yield on short-term foreign securities is higher than short-term domestic securities.

D) if foreign tax rates equal domestic tax rates, the exchange rates of different currencies will change by the same degree.

A) the effective yield on short-term foreign securities should, on average, equal the yield on short-term domestic securities.

B) the effective yield on short-term securities of high inflation countries is greater than the yield on short-term domestic securities.

C) if domestic income grows faster than foreign income, the effective yield on short-term foreign securities is higher than short-term domestic securities.

D) if foreign tax rates equal domestic tax rates, the exchange rates of different currencies will change by the same degree.

A

4

The most useful measure of an MNC's liquidity is its:

A) cash balance.

B) amount of securities held as investments.

C) political risk rating.

D) potential access to funds.

A) cash balance.

B) amount of securities held as investments.

C) political risk rating.

D) potential access to funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

5

In what is known as dynamic hedging, banks always hedge open positions in any foreign currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assume that a U.S. firm considers investing in British one-year Treasury securities. The interest rate on these securities is 12%, while the interest rate on the same securities in the U.S. is 10%. The firm believes that today's spot rate is an appropriate forecast for the spot rate of the pound in one year. Based on this information, the effective yield on British securities from the U.S. firm's perspective is:

A) equal to the U.S. interest rate.

B) equal to the British interest rate.

C) lower than the U.S. interest rate.

D) higher than the British interest rate.

E) lower than the British interest rate, but higher than the U.S. interest rate.

A) equal to the U.S. interest rate.

B) equal to the British interest rate.

C) lower than the U.S. interest rate.

D) higher than the British interest rate.

E) lower than the British interest rate, but higher than the U.S. interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume that Subsidiaries X and Y often trade with each other. Assume that Subsidiary X has excess cash while Subsidiary Y is short on cash. How can Subsidiary X help out Subsidiary Y?

A) X should lag its payments sent to Y to pay for imports from Y.

B) X should request that Y lead its payments to be sent for goods that Y sent to X.

C) A and B

D) None of the above

A) X should lag its payments sent to Y to pay for imports from Y.

B) X should request that Y lead its payments to be sent for goods that Y sent to X.

C) A and B

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the international Fisher effect (IFE) exists, then a U.S. firm that has access to banks offering high interest rates in deposits denominated in foreign currencies should:

A) invest in the foreign deposits since they will, on average, generate higher effective yields than a U.S. deposit.

B) invest in the U.S. deposits since they will, on average, generate higher effective yields than a foreign deposit.

C) invest in the U.S. deposits since they will, on average, generate similar effective yields as a foreign deposit.

D) invest in the foreign deposits since they will, on average, generate similar effective yields as a U.S. deposit.

A) invest in the foreign deposits since they will, on average, generate higher effective yields than a U.S. deposit.

B) invest in the U.S. deposits since they will, on average, generate higher effective yields than a foreign deposit.

C) invest in the U.S. deposits since they will, on average, generate similar effective yields as a foreign deposit.

D) invest in the foreign deposits since they will, on average, generate similar effective yields as a U.S. deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assume that a U.S. investor invests in a British CD offering a six-month interest rate of 5%. Over this six-month period, the pound depreciates by 9%. The effective yield on the British CD for the U.S. investor is:

A) 14.45%.

B) -4.45%.

C) 14.00%.

D) -4.00%.

A) 14.45%.

B) -4.45%.

C) 14.00%.

D) -4.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

10

Generally, if interest rate parity holds and the forward rate is an unbiased predictor of the future spot rate, then the international Fisher effect will also hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

11

In a bilateral netting system, transactions between the parent and a subsidiary or between two subsidiaries are consolidated over a specific period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Mexican one-year interest rate is 27 percent, while the U.S. one-year interest rate is 9 percent. If a U.S. firm creates a one-year deposit in Mexico, the Mexican peso would have to ____ against the U.S. dollar by ____ in order to make that investment have an effective yield that is achievable in the U.S.

A) appreciate; 18%

B) depreciate; 36%

C) depreciate; 14%

D) appreciate; 14%

E) depreciate; 8.5%

A) appreciate; 18%

B) depreciate; 36%

C) depreciate; 14%

D) appreciate; 14%

E) depreciate; 8.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to the international Fisher effect:

A) exchange rates adjust to compensate for income differentials between countries.

B) interest rates adjust to compensate for income differentials between countries.

C) exchange rates adjust to compensate for interest rate differentials between countries.

D) exchange rates adjust to compensate for risk differentials between countries.

A) exchange rates adjust to compensate for income differentials between countries.

B) interest rates adjust to compensate for income differentials between countries.

C) exchange rates adjust to compensate for interest rate differentials between countries.

D) exchange rates adjust to compensate for risk differentials between countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

14

Netting can achieve all but one of the following:

A) Cross border transactions between subsidiaries are reduced.

B) Transactions costs are reduced.

C) Currency conversion costs are reduced.

D) Transaction exposure is eliminated.

A) Cross border transactions between subsidiaries are reduced.

B) Transactions costs are reduced.

C) Currency conversion costs are reduced.

D) Transaction exposure is eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

15

Assume that there are several foreign currencies that exhibit a higher interest rate than the U.S. interest rate. The U.S. firm has a higher probability of generating a higher effective yield on a portfolio of currencies (relative to the domestic yield) if:

A) the foreign currency movements against the U.S. dollar are highly correlated.

B) the foreign currency movements against the U.S. dollar are perfectly positively correlated.

C) the foreign currency movements against the U.S. dollar exhibit low correlations.

D) none of the answers above would have any impact on the probability of a foreign cash investment generating a higher effective yield than a U.S. investment.

A) the foreign currency movements against the U.S. dollar are highly correlated.

B) the foreign currency movements against the U.S. dollar are perfectly positively correlated.

C) the foreign currency movements against the U.S. dollar exhibit low correlations.

D) none of the answers above would have any impact on the probability of a foreign cash investment generating a higher effective yield than a U.S. investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is true?

A) Some countries may prohibit netting.

B) Some countries may prohibit forms of leading and lagging.

C) A and B

D) None of the above

A) Some countries may prohibit netting.

B) Some countries may prohibit forms of leading and lagging.

C) A and B

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

17

According to ____, the effective yield earned by U.S. investors will be the same as the effective yield earned by non-U.S. investors in any given period.

A) interest rate parity (IRP)

B) the international Fisher effect (IFE)

C) purchasing power parity (PPP)

D) none of the above

A) interest rate parity (IRP)

B) the international Fisher effect (IFE)

C) purchasing power parity (PPP)

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to the text:

A) banks in the U.S. are prohibited from facilitating cash transfers for MNCs.

B) banks in most non-U.S. countries are more advanced than the U.S. in facilitating cash transfers for MNCs.

C) an MNC with subsidiaries in several different countries has no problems in coordinating its cash transfers since a uniform global banking system exists.

D) none of the above

A) banks in the U.S. are prohibited from facilitating cash transfers for MNCs.

B) banks in most non-U.S. countries are more advanced than the U.S. in facilitating cash transfers for MNCs.

C) an MNC with subsidiaries in several different countries has no problems in coordinating its cash transfers since a uniform global banking system exists.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a foreign currency consistently depreciated against the dollar over several periods and had lower interest rates at the beginning of those periods than the U.S. interest rates, then:

A) U.S. firms could have achieved a higher effective yield on foreign deposits than on U.S. deposits during those periods.

B) the international Fisher effect is supported by the results.

C) A and B

D) none of the above

A) U.S. firms could have achieved a higher effective yield on foreign deposits than on U.S. deposits during those periods.

B) the international Fisher effect is supported by the results.

C) A and B

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

20

Assume that in recent months, most currencies of industrialized countries depreciated substantially against the dollar. Assume that their interest rates were similar to the U.S. interest rate. If non-U.S. firms invested in U.S. Treasury securities during this period, their effective yield would have been:

A) negative.

B) zero.

C) positive, but less than the interest rate of their respective countries.

D) more than the interest rate of their respective countries.

A) negative.

B) zero.

C) positive, but less than the interest rate of their respective countries.

D) more than the interest rate of their respective countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

21

Since each subsidiary may be more concerned with its own operations than with the overall operations of the MNC, a centralized management group may need to monitor the parent-subsidiary and intersubsidiary cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume that interest rate parity holds. The U.S. one-year interest rate is 10% and the Australian one-year interest rate is 8%. What will the approximate effective yield be for an Australian citizen of a one-year deposit denominated in U.S. dollars? Assume the deposit is covered by a forward sale of dollars.

A) 10%.

B) 8%.

C) 2%.

D) cannot answer without more information

A) 10%.

B) 8%.

C) 2%.

D) cannot answer without more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

23

____ may complicate cash flow optimization.

A) The use of a zero-balance account

B) Government restrictions

C) Leading and lagging

D) None of the above

A) The use of a zero-balance account

B) Government restrictions

C) Leading and lagging

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

24

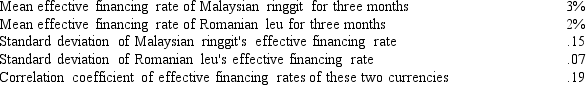

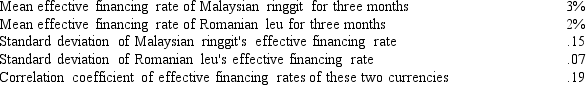

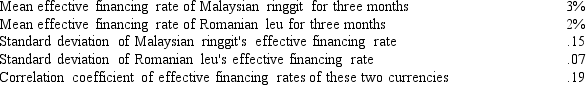

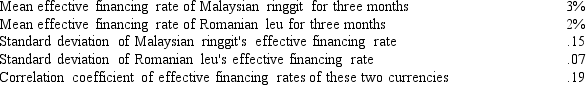

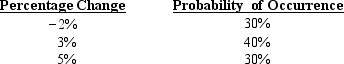

Exhibit 21-2

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

Refer to Exhibit 21-2. What is the standard deviation of the portfolio contemplated by Moore Corporation?

A) .624%.

B) 7.950%.

C) 1.040%.

D) 10.200%.

E) none of the above

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

Refer to Exhibit 21-2. What is the standard deviation of the portfolio contemplated by Moore Corporation?

A) .624%.

B) 7.950%.

C) 1.040%.

D) 10.200%.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

25

Leading refers to the payment of supplies earlier than necessary; lagging refers to the payment of supplies later than allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

26

Since exchange rate forecasts are not always accurate, a probability distribution of possible exchange rates may be preferable to a single point estimate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

27

Exhibit 21-2

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

Refer to Exhibit 21-2. What is the expected effective yield of the portfolio contemplated by Moore Corporation?

A) 2.50%.

B) 2.60%.

C) 2.40%.

D) none of the above

Moore Corporation would like to simultaneously invest in Malaysian ringgit (MYR) and Romanian leu (ROL) for a three-month period. Moore would like to determine the expected yield and the variance of a portfolio consisting of 40% ringgit and 60% leu. Moore has identified the following information:

Refer to Exhibit 21-2. What is the expected effective yield of the portfolio contemplated by Moore Corporation?

A) 2.50%.

B) 2.60%.

C) 2.40%.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bullock Corporation invests 1,500,000 South African rand at a nominal interest rate of 10%. At the time the investment is made, the spot rate of the rand is $.205. If the spot rate of the rand at maturity of the investment is $.203, what is the effective yield of investing in rand?

A) 11.08%.

B) 8.92%.

C) 10.00%.

D) none of the above

A) 11.08%.

B) 8.92%.

C) 10.00%.

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

29

Although netting typically increases the need for foreign exchange conversion, it generally reduces the number of cross border transactions between subsidiaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

30

Centralized cash management is more complicated when the MNC uses multiple currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assume Costner Corporation, a U.S.-based MNC, invests 2,500,000 Zambian kwacha (ZMK) for a one-year period at a nominal interest rate of 9%. At the time the loan is extended, the spot rate of the kwacha is $.00060. If the spot rate of the kwacha in one year is $.00056, the dollar amount initially invested in Zambia is $____, and $____ are paid out after one year.

A) 1,500; 1,526

B) 1,526; 1,500

C) 1,500; 1,400

D) 1,400; 1,500

A) 1,500; 1,526

B) 1,526; 1,500

C) 1,500; 1,400

D) 1,400; 1,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

32

Lockboxes are post office box numbers assigned to employees for picking up their paychecks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

33

MNCs often use ____ to invest excess cash while retaining liquidity.

A) international bond markets

B) international equity markets

C) international money markets

D) the market for acquisitions

A) international bond markets

B) international equity markets

C) international money markets

D) the market for acquisitions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

34

To ____, MNCs can use preauthorized payments.

A) accelerate cash inflows

B) minimize currency conversion costs

C) manage blocked funds

D) manage intersubsidiary cash transfers

A) accelerate cash inflows

B) minimize currency conversion costs

C) manage blocked funds

D) manage intersubsidiary cash transfers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

35

In general, exchange rate fluctuations cause cash flows to be more volatile and uncertain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

36

Preauthorized payment is an arrangement that allows a corporation to charge a customer's bank account up to some limit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

37

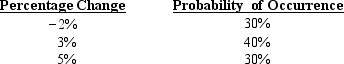

Assume that you forecast the value of the euro as follows for the next year:  If the interest rate on the euro is 12%, the expected effective yield from a euro-denominated deposit is:

If the interest rate on the euro is 12%, the expected effective yield from a euro-denominated deposit is:

A) 15.36%.

B) 15.70%.

C) 12.00%.

D) 14.35%.

E) none of the above

If the interest rate on the euro is 12%, the expected effective yield from a euro-denominated deposit is:

If the interest rate on the euro is 12%, the expected effective yield from a euro-denominated deposit is:A) 15.36%.

B) 15.70%.

C) 12.00%.

D) 14.35%.

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

38

When investing in a portfolio of foreign currencies, the currencies represented within the portfolio are ideally highly positively correlated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

39

A subsidiary will normally have a more difficult time forecasting future outflow payments if its purchases are international rather than domestic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

40

A currency portfolio's variability depends on the standard deviations and paired correlations of effective yields of the individual currencies within the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

41

An MNC has determined that the degree of appreciation for the Singapore dollar that equates the foreign and domestic yield is 2%. If the Singapore dollar appreciates by less than 2%, the investment in Singapore will be more attractive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

42

When investing in a portfolio of foreign currencies, the currencies represented within the portfolio are ideally highly positively correlated if the goal is to reduce exchange rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements is false?

A) If interest rate parity exists, covered interest arbitrage is not worthwhile.

B) If interest rate parity holds and the forward rate is an accurate forecast of the future spot rate, an uncovered investment in a foreign security is not worthwhile.

C) If interest rate parity exists and the forward rate is an unbiased forecast of the future spot rate, an uncovered investment in a foreign security will on average earn an effective yield similar to an investment in a domestic security.

D) If interest rate parity exists and the forward rate is expected to underestimate the future spot rate, an uncovered investment in a foreign security is expected to earn a lower effective yield than an investment in a domestic security.

A) If interest rate parity exists, covered interest arbitrage is not worthwhile.

B) If interest rate parity holds and the forward rate is an accurate forecast of the future spot rate, an uncovered investment in a foreign security is not worthwhile.

C) If interest rate parity exists and the forward rate is an unbiased forecast of the future spot rate, an uncovered investment in a foreign security will on average earn an effective yield similar to an investment in a domestic security.

D) If interest rate parity exists and the forward rate is expected to underestimate the future spot rate, an uncovered investment in a foreign security is expected to earn a lower effective yield than an investment in a domestic security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a technique to optimize cash flows?

A) Accelerate cash inflows

B) Minimize currency conversion costs

C) Manage blocked funds

D) All of the above are techniques to optimize cash flows

A) Accelerate cash inflows

B) Minimize currency conversion costs

C) Manage blocked funds

D) All of the above are techniques to optimize cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

45

A ____ allows customers to send payments to a post office box number.

A) bilateral netting system

B) multilateral netting system

C) lockbox

D) preauthorized payment

A) bilateral netting system

B) multilateral netting system

C) lockbox

D) preauthorized payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

46

Assume the U.S. one-year interest rate is 15%, while the South African one-year interest rate is 13%. If the South African rand ____ by ____%, a U.S.-based MNC is indifferent between investing in dollars and investing in rand.

A) depreciates; 1.77

B) appreciates; 1.74

C) appreciates; 1.77

D) depreciates; 1.74

A) depreciates; 1.77

B) appreciates; 1.74

C) appreciates; 1.77

D) depreciates; 1.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

47

Zanada Corporation invests 1,500,000 South African rand (ZAR) at a nominal interest rate of 10%. At the time the investment is made, the spot rate of the rand is $0.205. If the spot rate of the rand at maturity of the investment is $0.203, what is the effective yield of investing in rand?

A) 11.08%

B) 8.93%

C) 10.00%

D) None of the above

A) 11.08%

B) 8.93%

C) 10.00%

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

48

If interest rate parity does not hold, and the forward ____ is greater than the interest rate differential, then covered interest arbitrage is feasible for investors residing in the ____ country.

A) premium; home

B) discount; home

C) premium; foreign

D) B and C

A) premium; home

B) discount; home

C) premium; foreign

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

49

The effective yield of investing in a foreign currency depends on both the ____ and the ____ of the foreign currency.

A) inflation rate; exchange rate movements

B) income level; interest rates

C) interest rates; exchange rate movements

D) interest rates; amount invested

A) inflation rate; exchange rate movements

B) income level; interest rates

C) interest rates; exchange rate movements

D) interest rates; amount invested

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck