Deck 4: Key Differences Between IFRS and US-part 2

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/24

العب

ملء الشاشة (f)

Deck 4: Key Differences Between IFRS and US-part 2

1

Which of the following is a correct treatment of impaired equity securities?

A)Under IFRS,equity security is impaired if the decline in value is significant and prolonged

B)Under U.S.GAAP,equity security is impaired if the decline in value is significant or prolonged.

C)All of the above

D)None of the above

A)Under IFRS,equity security is impaired if the decline in value is significant and prolonged

B)Under U.S.GAAP,equity security is impaired if the decline in value is significant or prolonged.

C)All of the above

D)None of the above

D

2

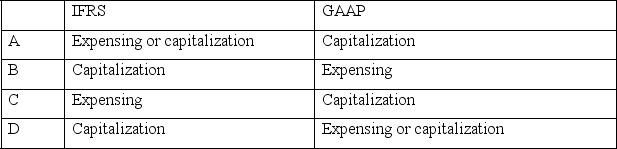

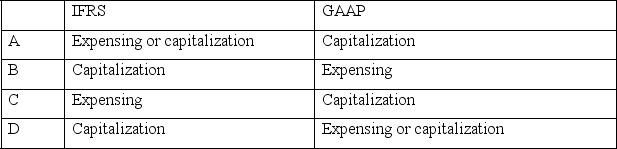

How do IFRS and U.S.GAAP deal with interest cost on assets during contraction respectively?

A

3

Significant differences can occur in required funding of pension funds due to different discount rates required under IFRS and U.S.GAAP,which of the following is true?

A)The discount rates under IFRS are determined by reference to market yields at the balance sheet date on high quality corporate bonds.

B)The discount rate under U.S.GAAP should reflect the rates at which pension benefits could be effectively settled.

C)All of the above

D)None of the above

A)The discount rates under IFRS are determined by reference to market yields at the balance sheet date on high quality corporate bonds.

B)The discount rate under U.S.GAAP should reflect the rates at which pension benefits could be effectively settled.

C)All of the above

D)None of the above

C

4

Which statement regarding commitments and contingencies is false?

A)U.S.GAAP record commitments since they have a legal basis

B)Under IFRS,the purchase agreements are recognized when an entity has a demonstrable commitment for a future payment or transfer of assets

C)Under U.S.GAAP,contingent assets and liabilities are recognized if they are probable and can be estimated.

D)Under IFRS,there must be a present obligation that arises from past events and fair value must be determinable

A)U.S.GAAP record commitments since they have a legal basis

B)Under IFRS,the purchase agreements are recognized when an entity has a demonstrable commitment for a future payment or transfer of assets

C)Under U.S.GAAP,contingent assets and liabilities are recognized if they are probable and can be estimated.

D)Under IFRS,there must be a present obligation that arises from past events and fair value must be determinable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statement is correct regarding impairment of goodwill?

A)Impairment of goodwill is tested at least annually under IFRS but not U.S.GAAP by comparing the carrying amount to recoverable value.

B)Under IFRS,Goodwill is allocated to cash generating units and can be larger than an operating segment.

C)Under U.S.GAAP,Goodwill is allocated to reporting unit level which may contain multiple cash generating units.

D)None of the above.

A)Impairment of goodwill is tested at least annually under IFRS but not U.S.GAAP by comparing the carrying amount to recoverable value.

B)Under IFRS,Goodwill is allocated to cash generating units and can be larger than an operating segment.

C)Under U.S.GAAP,Goodwill is allocated to reporting unit level which may contain multiple cash generating units.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is not a similar requirement of financial instruments under both IFRS and U.S.GAAP?

A)Financial assets held for trading at fair value with changes in profit but not loss on the income statement

B)Held to maturity investments at amortized cost to the income statement

C)Available for sale investments at fair value with changes in other comprehensive income

D)Receivables and loans at amortized cost to the income statement

A)Financial assets held for trading at fair value with changes in profit but not loss on the income statement

B)Held to maturity investments at amortized cost to the income statement

C)Available for sale investments at fair value with changes in other comprehensive income

D)Receivables and loans at amortized cost to the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

7

The impairment of debt investments are treated as follows except:

A)under IFRS,impairment losses are recognized in profit and loss on the income statement

B)under U.S.GAAP,in the intent is to sell the debt investment,impairment losses are recognized entirely on the income statement.

C)under U.S.GAAP,other debt investments are recognized as other comprehensive income.

D)reverse of impairment write-downs are allowed under U.S.GAAP

A)under IFRS,impairment losses are recognized in profit and loss on the income statement

B)under U.S.GAAP,in the intent is to sell the debt investment,impairment losses are recognized entirely on the income statement.

C)under U.S.GAAP,other debt investments are recognized as other comprehensive income.

D)reverse of impairment write-downs are allowed under U.S.GAAP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

8

The required current amount of the pension fund depends primarily on which of the following?

A)The discount rate used to discount future payments

B)The length of time that retirees are expected to received payments

C)A and B

D)None of the above

A)The discount rate used to discount future payments

B)The length of time that retirees are expected to received payments

C)A and B

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

9

Recoverable amount is the higher of the following:

A)fair value and value in use

B)fair value and carrying value

C)fair value less costs to sell and value in use

D)value in use and carrying value

A)fair value and value in use

B)fair value and carrying value

C)fair value less costs to sell and value in use

D)value in use and carrying value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which following is not a new requirement of IFRS 9?

A)Equity investments are measured at fair value and changes in fair value appear in other comprehensive income and are recycled to profit and loss

B)Amortized cost may be used only if the asset gives rise on specified date to cash flows that are solely payments of principal and interest on the outstanding principal and the entity's business model calls for holding the asset to collect the cash flows.

C)All other financial assets must be accounted for at fair value.

D)Most financial liabilities are measured at fair value.

A)Equity investments are measured at fair value and changes in fair value appear in other comprehensive income and are recycled to profit and loss

B)Amortized cost may be used only if the asset gives rise on specified date to cash flows that are solely payments of principal and interest on the outstanding principal and the entity's business model calls for holding the asset to collect the cash flows.

C)All other financial assets must be accounted for at fair value.

D)Most financial liabilities are measured at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is not the major difference in accounting for intangible assets under IFRS and U.S.GAAP?

A)Under IFRS,intangible assets previously written down may be revalued upward if the annual impairment test indicates an increase in fair value.

B)Under U.S.GAAP,once written down due to lower impairment,intangible assets can be written up again.

C)All of the above

D)None of the above

A)Under IFRS,intangible assets previously written down may be revalued upward if the annual impairment test indicates an increase in fair value.

B)Under U.S.GAAP,once written down due to lower impairment,intangible assets can be written up again.

C)All of the above

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

12

In which ways)are intangible assets under IFRS treated similarly to U.S.GAAP?

A)Indefinite-lived intangible assets are amortized over useful life but are tested for impairment annually.

B)Goodwill is recognized in acquisition accounting.

C)Definite-lived intangible assets are carried at cost with annually test for impairment

D)Initial recording of acquired intangible assets is at cost

E)B and D

A)Indefinite-lived intangible assets are amortized over useful life but are tested for impairment annually.

B)Goodwill is recognized in acquisition accounting.

C)Definite-lived intangible assets are carried at cost with annually test for impairment

D)Initial recording of acquired intangible assets is at cost

E)B and D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following standards would exist for cancellable leases?

A)Can be canceled by the lessee and lessor with minimal termination payments

B)Include renewal options that the lessor and lessee must agree to

C)All of the above

D)None of the above

A)Can be canceled by the lessee and lessor with minimal termination payments

B)Include renewal options that the lessor and lessee must agree to

C)All of the above

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

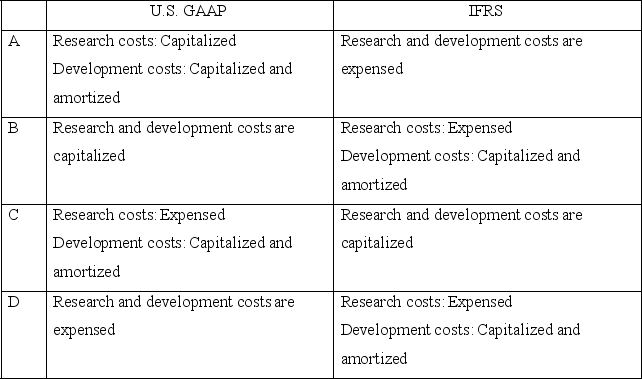

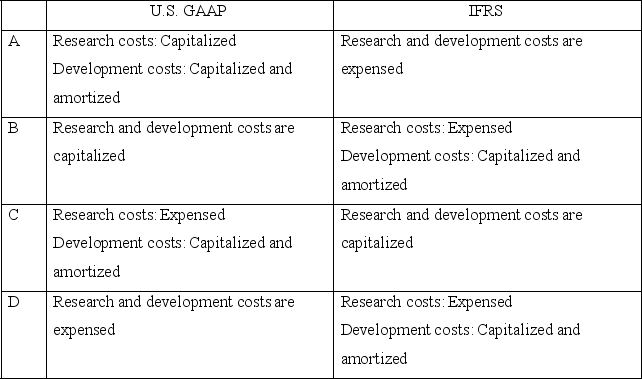

14

Which differences between U.S.GAAP and IFRS exists with regard to accounting for research and development costs is true?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following regarding operating lease and financing lease is true?

A)Under operating leases,the lease is usually longer term,approximating the life of the asset being leased

B)Under financing leases,the lease is short-term.

C)Under operating leases,the risk of ownership lie with the lessor

D)Under financing leases,the risks of ownership lie more with the lessor

A)Under operating leases,the lease is usually longer term,approximating the life of the asset being leased

B)Under financing leases,the lease is short-term.

C)Under operating leases,the risk of ownership lie with the lessor

D)Under financing leases,the risks of ownership lie more with the lessor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which following statement regarding investment property is true?

A)Investment property is property held to earn rentals from outside parties or held for capital appreciation.

B)Investment property includes property that is owner occupied and used or leased for use in the business.

C)Investment property includes property held as inventory such as a homebuilder.

D)U.S.GAAP and IFRS both specifically address this type of property in the standards.

A)Investment property is property held to earn rentals from outside parties or held for capital appreciation.

B)Investment property includes property that is owner occupied and used or leased for use in the business.

C)Investment property includes property held as inventory such as a homebuilder.

D)U.S.GAAP and IFRS both specifically address this type of property in the standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following regarding financing leases and operating leases under lessors and lessees is not true?

A)The lessor model requires that most leases be recognized as financing leases

B)The lessor model requires a relatively long-term leases-usually those more than one year in duration- would be recorded as an operating lease.

C)The lessee model uses a "right to use" concept deal with financing leases

D)The lessee model records operating lease payments as an expense when paid.

A)The lessor model requires that most leases be recognized as financing leases

B)The lessor model requires a relatively long-term leases-usually those more than one year in duration- would be recorded as an operating lease.

C)The lessee model uses a "right to use" concept deal with financing leases

D)The lessee model records operating lease payments as an expense when paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

18

Consider a situation where accumulated depreciation is eliminated against the asset's gross carrying amount and the net amount is restated to the revalued amount of the asset,which term applies to the revaluation of depreciation?

A)Proportional method

B)Reset method

C)Book cost method

D)Elimination method

A)Proportional method

B)Reset method

C)Book cost method

D)Elimination method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which are two major differences between U.S.GAAP and IFRS in accounting for property,plant,and equipment PPE)?

A)Re-evaluation,impairment requirements

B)Component depreciation,re-evaluation

C)Interest cost during construction,impairment requirements

D)Depreciation method,interest cost during construction

A)Re-evaluation,impairment requirements

B)Component depreciation,re-evaluation

C)Interest cost during construction,impairment requirements

D)Depreciation method,interest cost during construction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

20

When the revaluation results in an increase,a debit is made to the asset account,which account does the revaluation ?surplus go?

A)Equity

B)Liability

C)Asset

D)Contra-Asset

A)Equity

B)Liability

C)Asset

D)Contra-Asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the major difference between how U.S GAAP and IFRS handle share-based payments?

A)U.S.GAAP rules measure SBP at fair value on the grant date; IFRS records the future option of the SBP right after the announcement

B)U.S.GAAP rules only recognize market shares as payments; IFRS also includes goods or services paid in shares or SBP

C)U.S.GAAP rules apply only to employee SBP; IFRS apply to all SBP,including non-employee SBP

D)U.S.GAAP rules true up for failure to meet service,non-market vesting conditions; IFRS true up for failure to meet market conditions

A)U.S.GAAP rules measure SBP at fair value on the grant date; IFRS records the future option of the SBP right after the announcement

B)U.S.GAAP rules only recognize market shares as payments; IFRS also includes goods or services paid in shares or SBP

C)U.S.GAAP rules apply only to employee SBP; IFRS apply to all SBP,including non-employee SBP

D)U.S.GAAP rules true up for failure to meet service,non-market vesting conditions; IFRS true up for failure to meet market conditions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

22

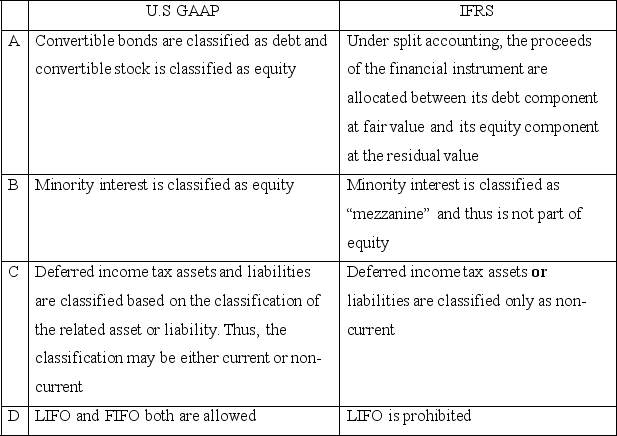

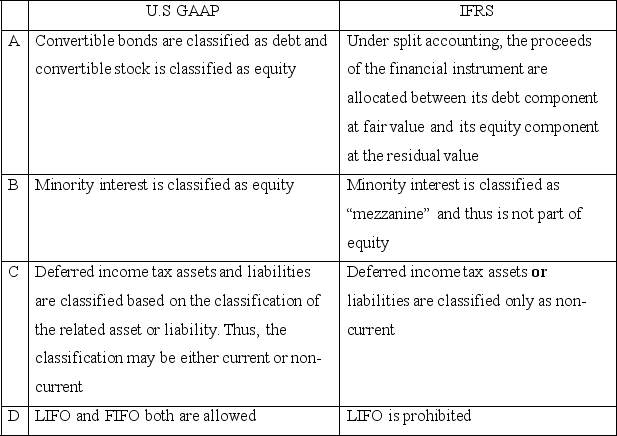

Which of the following comparison statements is not correct?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is an indicator of power to influence financial and operating policy of an investee?

A)Representation on the board of directors

B)Participation in the policy making process

C)Material transactions between investor and investee

D)Interchange of managerial personnel

E)All of the above

A)Representation on the board of directors

B)Participation in the policy making process

C)Material transactions between investor and investee

D)Interchange of managerial personnel

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements regarding consolidation is false?

A)U.S.GAAP,with few exceptions,require a greater than 50 percent ownership before financial statements of related companies are consolidated into a single set of financial statements.

B)Under IFRS,consolidation is based on the power of the investor over the investees company.

C)Under U.S.GAAP,consolidation may occur more often in cases when a company has less than 50 percent ownership than under IFRS

D)None of the above

A)U.S.GAAP,with few exceptions,require a greater than 50 percent ownership before financial statements of related companies are consolidated into a single set of financial statements.

B)Under IFRS,consolidation is based on the power of the investor over the investees company.

C)Under U.S.GAAP,consolidation may occur more often in cases when a company has less than 50 percent ownership than under IFRS

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck