Deck 9: Decision Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

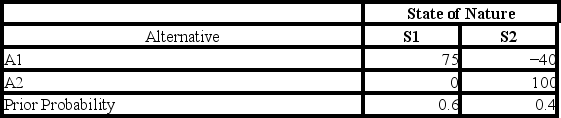

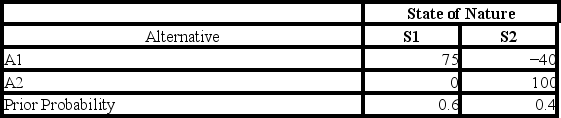

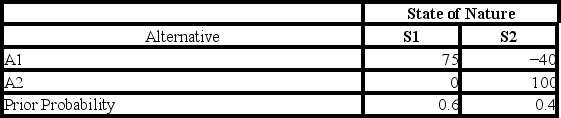

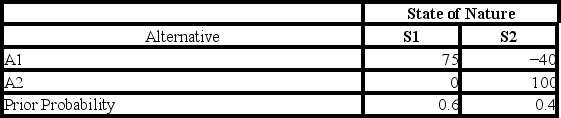

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 9: Decision Analysis

1

The maximax approach is an optimistic strategy.

True

2

Payoffs always represent profits in decision analysis problems.

False

3

States of nature are alternatives available to a decision maker.

False

4

The maximum likelihood criterion ignores the payoffs for states of nature other than the most likely one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

A event node in a decision tree indicates that a decision needs to be made at that point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

Graphical analysis can only be used in sensitivity analysis for those problems that have two decision alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

In decision analysis, states of nature refer to possible future conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

The maximin criterion is an optimistic criterion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

The maximin approach involves choosing the alternative that has the "best worst" payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

The maximin approach involves choosing the alternative with the highest payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

Payoff tables may include only non-negative numbers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

The equally likely criterion assigns a probability of 0.5 to each state of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

An advantage of payoff tables compared to decision trees is that they permit us to analyze situations involving sequential decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

Prior probabilities refer to the relative likelihood of possible states of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

Bayes' decision rule says to choose the alternative with the largest expected payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

A decision tree branches out all of the possible decisions and all of the possible events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

The maximum likelihood criterion says to focus on the largest payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

Using Bayes' decision rule will always lead to larger payoffs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

Sensitivity analysis may be useful in decision analysis since prior probabilities may be inaccurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

An example of maximax decision making is a person buying lottery tickets in hopes of a very big payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

Testing how a problem solution reacts to changes in one or more of the model parameters is called:

A) analysis of tradeoffs.

B) sensitivity analysis.

C) priority recognition.

D) analysis of variance.

E) decision analysis.

A) analysis of tradeoffs.

B) sensitivity analysis.

C) priority recognition.

D) analysis of variance.

E) decision analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

The maximin criterion refers to:

A) minimizing the maximum return.

B) maximizing the minimum return.

C) choosing the alternative with the highest payoff.

D) choosing the alternative with the minimum payoff.

E) None of the answer choices is correct.

A) minimizing the maximum return.

B) maximizing the minimum return.

C) choosing the alternative with the highest payoff.

D) choosing the alternative with the minimum payoff.

E) None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

A utility function for money can be constructed by applying a lottery procedure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

Determining the worst payoff for each alternative and choosing the alternative with the "best worst" is the criterion called:

A) minimin.

B) maximin.

C) maximax.

D) maximum likelihood.

E) Bayes decision rule.

A) minimin.

B) maximin.

C) maximax.

D) maximum likelihood.

E) Bayes decision rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

Based on the following payoff table, answer the following:

The Bayes' decision rule strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

The Bayes' decision rule strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

A posterior probability is a revised probability of a state of nature after doing a test or survey to refine the prior probability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Bayes' theorem is a formula for determining prior probabilities of a state of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

Based on the following payoff table, answer the following:

The maximin strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

The maximin strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

Utilities can be useful when monetary values do not accurately reflect the true values of an outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

Two people who face the same problem and use the same decision-making methodology must always arrive at the same decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

Based on the following payoff table, answer the following:

The expected value of perfect information is:

A) 12.

B) 55.

C) 57.

D) 69.

E) 90.

The expected value of perfect information is:

A) 12.

B) 55.

C) 57.

D) 69.

E) 90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

Based on the following payoff table, answer the following:

The maximax strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

The maximax strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

The exponential utility function assumes a constant aversion to risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

Most people occupy a middle ground and are classified as risk neutral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which one of the following statements is not correct when making decisions?

A) The sum of the state of nature probabilities must be 1.

B) Every probability must be greater than or equal to 0.

C) All probabilities are assumed to be equal.

D) Probabilities are used to compute expected values.

E) Perfect information assumes that the state of nature that will actually occur is known.

A) The sum of the state of nature probabilities must be 1.

B) Every probability must be greater than or equal to 0.

C) All probabilities are assumed to be equal.

D) Probabilities are used to compute expected values.

E) Perfect information assumes that the state of nature that will actually occur is known.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

The EVPI indicates an upper limit in the amount a decision-maker should be willing to spend to obtain information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

Based on the following payoff table, answer the following:

The maximum likelihood strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

The maximum likelihood strategy is:

A) Buy.

B) Rent.

C) Lease.

D) High.

E) Low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Based on the following payoff table, answer the following:

The maximax strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

The maximax strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a criterion for decision making?

A) EVPI.

B) Maximin

C) Maximax

D) Bayes' decision rule

E) Maximum likelihood

A) EVPI.

B) Maximin

C) Maximax

D) Bayes' decision rule

E) Maximum likelihood

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

A risk seeker has a decreasing marginal utility for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

Based on the following payoff table, answer the following:

The maximum likelihood strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

The maximum likelihood strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. She feels that script #1 has a 70% chance of earning $100 million over the long run, but a 30% chance of losing $20 million. If this movie is successful, then a sequel could also be produced, with an 80% chance of earning $50 million, but a 20% chance of losing $10 million. On the other hand, she feels that script #2 has a 60 % chance of earning $120 million, but a 40% chance of losing $30 million. If successful, its sequel would have a 50% chance of earning $80 million and a 50% chance of losing $40 million. As with the first script, if the original movie is a "flop," then no sequel would be produced.

What is the probability that script #1 will be a success, but its sequel will not?

A) 0.8

B) 0.7

C) 0.56

D) 0.2

E) 0.14

What is the probability that script #1 will be a success, but its sequel will not?

A) 0.8

B) 0.7

C) 0.56

D) 0.2

E) 0.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

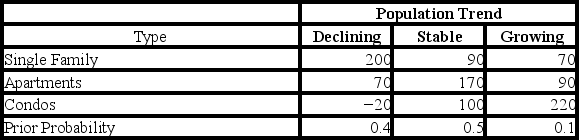

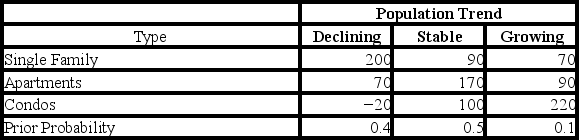

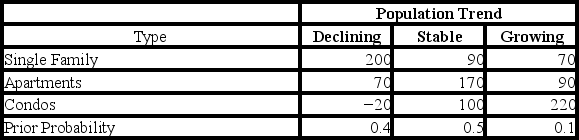

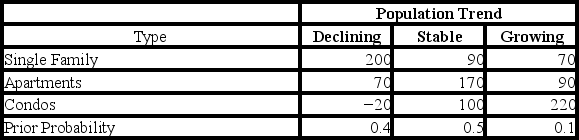

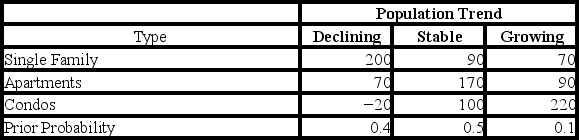

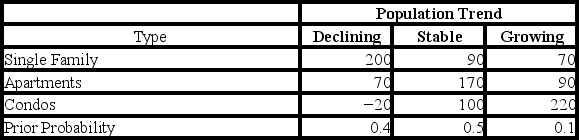

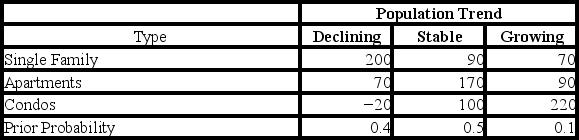

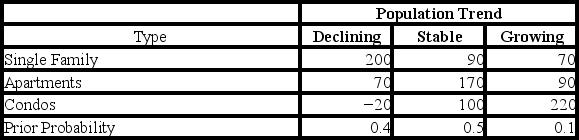

The construction manager for ABC Construction must decide whether to build single family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:

If he uses Bayes' decision rule, which kind of dwellings will he decide to build?

A) Single family

B) Apartments

C) Condos

D) Either single family or apartments

E) Either apartments or condos

If he uses Bayes' decision rule, which kind of dwellings will he decide to build?

A) Single family

B) Apartments

C) Condos

D) Either single family or apartments

E) Either apartments or condos

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

Based on the following payoff table, answer the following:

The maximax strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

The maximax strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

Based on the following payoff table, answer the following:

The maximin strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

The maximin strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

The construction manager for ABC Construction must decide whether to build single family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:

What is the expected annual profit for the dwellings that he will decide to build using Bayes' decision rule?

A) $187,000

B) $132,000

C) $123,000

D) $65,000

E) $55,000

What is the expected annual profit for the dwellings that he will decide to build using Bayes' decision rule?

A) $187,000

B) $132,000

C) $123,000

D) $65,000

E) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

Based on the following payoff table, answer the following:

The Bayes' decision rule strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

The Bayes' decision rule strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. She feels that script #1 has a 70% chance of earning $100 million over the long run, but a 30% chance of losing $20 million. If this movie is successful, then a sequel could also be produced, with an 80% chance of earning $50 million, but a 20% chance of losing $10 million. On the other hand, she feels that script #2 has a 60 % chance of earning $120 million, but a 40% chance of losing $30 million. If successful, its sequel would have a 50% chance of earning $80 million and a 50% chance of losing $40 million. As with the first script, if the original movie is a "flop," then no sequel would be produced.

What is the expected payoff from selecting script #1?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

What is the expected payoff from selecting script #1?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

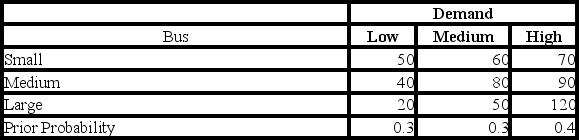

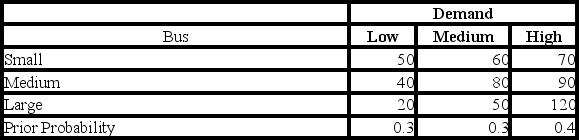

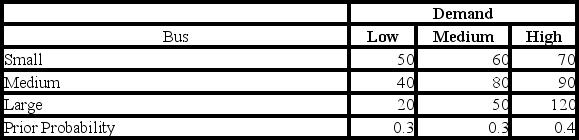

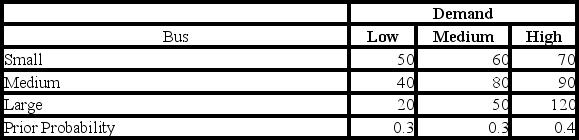

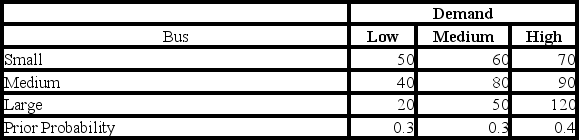

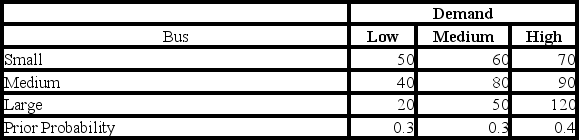

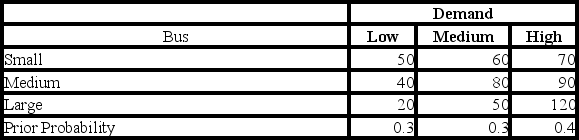

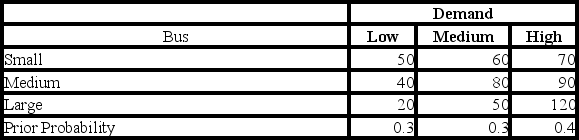

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, moderate, or high, as follows.

What is the expected annual profit for the bus that he will decide to purchase using Bayes' decision rule?

A) $15,000

B) $61,000

C) $69,000

D) $72,000

E) $87,000

What is the expected annual profit for the bus that he will decide to purchase using Bayes' decision rule?

A) $15,000

B) $61,000

C) $69,000

D) $72,000

E) $87,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

Based on the following payoff table, answer the following:

The maximum likelihood strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

The maximum likelihood strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, moderate, or high, as follows.

What is his expected value of perfect information?

A) $15,000

B) $61,000

C) $69,000

D) $72,000

E) $87,000

What is his expected value of perfect information?

A) $15,000

B) $61,000

C) $69,000

D) $72,000

E) $87,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

Based on the following payoff table, answer the following:

The maximin strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

The maximin strategy is:

A) A.

B) B.

C) C.

D) D.

E) E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, moderate, or high, as follows.

If he uses Bayes' decision rule, which size bus will he decide to purchase?

A) Small

B) Medium

C) Large

D) Either small or medium

E) Either medium or large

If he uses Bayes' decision rule, which size bus will he decide to purchase?

A) Small

B) Medium

C) Large

D) Either small or medium

E) Either medium or large

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. She feels that script #1 has a 70% chance of earning $100 million over the long run, but a 30% chance of losing $20 million. If this movie is successful, then a sequel could also be produced, with an 80% chance of earning $50 million, but a 20% chance of losing $10 million. On the other hand, she feels that script #2 has a 60 % chance of earning $120 million, but a 40% chance of losing $30 million. If successful, its sequel would have a 50% chance of earning $80 million and a 50% chance of losing $40 million. As with the first script, if the original movie is a "flop," then no sequel would be produced.

What would be the total payoff is script #1 were a success, but its sequel were not?

A) $150 million

B) $100 million

C) $90 million

D) $50 million

E) $−10 million

What would be the total payoff is script #1 were a success, but its sequel were not?

A) $150 million

B) $100 million

C) $90 million

D) $50 million

E) $−10 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

Based on the following payoff table, answer the following:

The Bayes' decision rule strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

The Bayes' decision rule strategy is:

A) small.

B) medium.

C) medium large.

D) large.

E) extra large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

Based on the following payoff table, answer the following:

The expected value of perfect information is:

A) ?28.

B) 0.

C) 10.5.

D) 19.

E) 23.

The expected value of perfect information is:

A) ?28.

B) 0.

C) 10.5.

D) 19.

E) 23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

The construction manager for ABC Construction must decide whether to build single family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:

What is his expected value of perfect information?

A) $187,000

B) $132,000

C) $123,000

D) $65,000

E) $55,000

What is his expected value of perfect information?

A) $187,000

B) $132,000

C) $123,000

D) $65,000

E) $55,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

The operations manager for a local bus company wants to decide whether he should purchase a small, medium, or large new bus for his company. He estimates that the annual profits (in $000) will vary depending upon whether passenger demand is low, moderate, or high, as follows.

If he uses the maximum likelihood criterion, which size bus will he decide to purchase?

A) Small

B) Medium

C) Large

D) Either small or medium

E) Either medium or large

If he uses the maximum likelihood criterion, which size bus will he decide to purchase?

A) Small

B) Medium

C) Large

D) Either small or medium

E) Either medium or large

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

The construction manager for ABC Construction must decide whether to build single family homes, apartments, or condominiums. He estimates annual profits (in $000) will vary with the population trend as follows:

If he uses the maximum likelihood criterion, which kind of dwellings will he decide to build?

A) Single family

B) Apartments

C) Condos

D) Either single family or apartments

E) Either apartments or condos

If he uses the maximum likelihood criterion, which kind of dwellings will he decide to build?

A) Single family

B) Apartments

C) Condos

D) Either single family or apartments

E) Either apartments or condos

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

Based on the following payoff table, answer the following:

The expected value of perfect information is:

A) 4.5.

B) 9.

C) 40.5.

D) 49.5.

E) 60.

The expected value of perfect information is:

A) 4.5.

B) 9.

C) 40.5.

D) 49.5.

E) 60.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

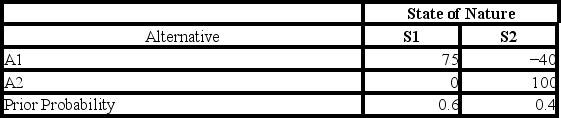

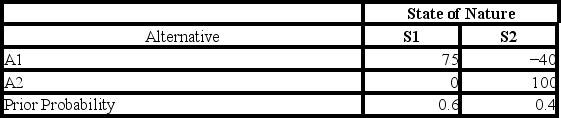

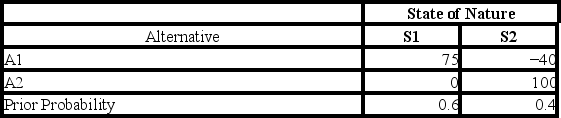

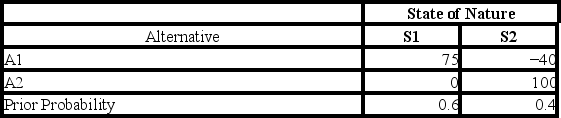

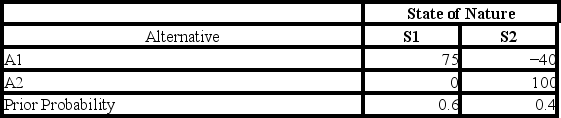

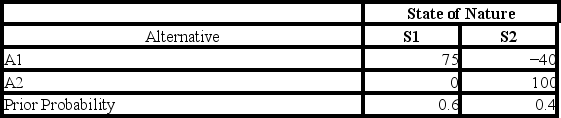

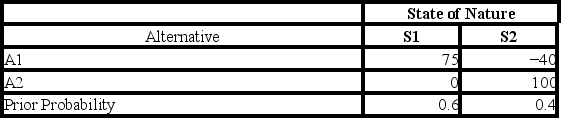

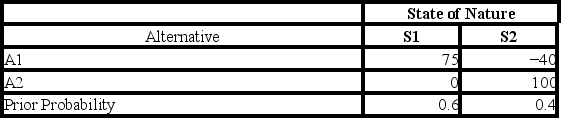

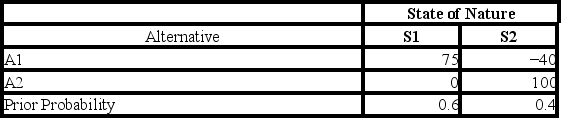

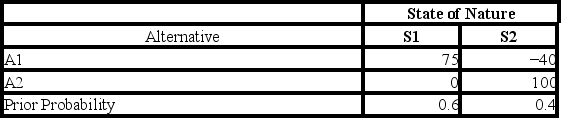

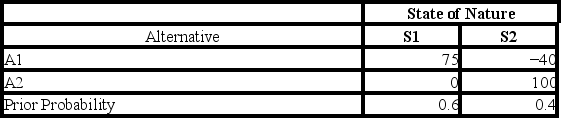

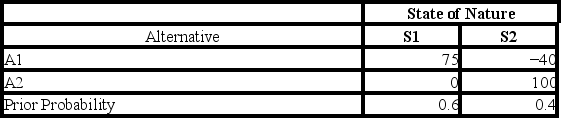

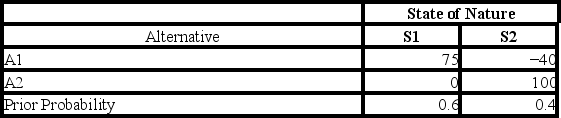

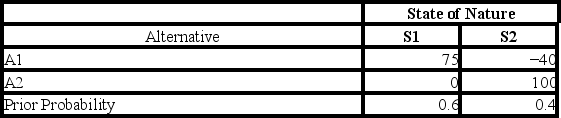

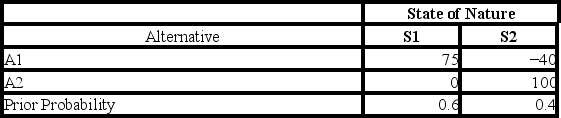

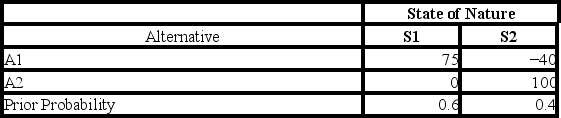

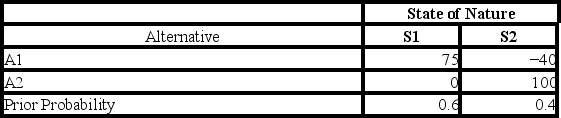

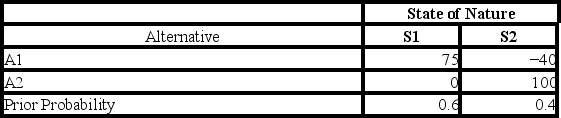

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the posterior probability of S2 given that the research predicts S2?

A) 0.18

B) 0.44

C) 0.57

D) 0.65

E) 0.82

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the posterior probability of S2 given that the research predicts S2?

A) 0.18

B) 0.44

C) 0.57

D) 0.65

E) 0.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S2 and the research predicts S1?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S2 and the research predicts S1?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the posterior probability of S1 given that the research predicts S1?

A) 0.18

B) 0.44

C) 0.57

D) 0.65

E) 0.82

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the posterior probability of S1 given that the research predicts S1?

A) 0.18

B) 0.44

C) 0.57

D) 0.65

E) 0.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies.

What is the probability that the economics book would wind up being placed with a smaller publisher?

A) 0.8

B) 0.5

C) 0.4

D) 0.2

E) 0.1

What is the probability that the economics book would wind up being placed with a smaller publisher?

A) 0.8

B) 0.5

C) 0.4

D) 0.2

E) 0.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S1 and the research predicts S1?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S1 and the research predicts S1?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies.

What is the expected payoff for the optimum decision alternative?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

What is the expected payoff for the optimum decision alternative?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. She feels that script #1 has a 70% chance of earning $100 million over the long run, but a 30% chance of losing $20 million. If this movie is successful, then a sequel could also be produced, with an 80% chance of earning $50 million, but a 20% chance of losing $10 million. On the other hand, she feels that script #2 has a 60 % chance of earning $120 million, but a 40% chance of losing $30 million. If successful, its sequel would have a 50% chance of earning $80 million and a 50% chance of losing $40 million. As with the first script, if the original movie is a "flop," then no sequel would be produced.

What is the expected payoff from selecting script #2?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

What is the expected payoff from selecting script #2?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

68

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is not done, what is the expected payoff using Bayes' decision rule?

A) 0

B) 29

C) 40

D) 75

E) 100

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is not done, what is the expected payoff using Bayes' decision rule?

A) 0

B) 29

C) 40

D) 75

E) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

69

The head of operations for a movie studio wants to determine which of two new scripts they should select for their next major production. She feels that script #1 has a 70% chance of earning $100 million over the long run, but a 30% chance of losing $20 million. If this movie is successful, then a sequel could also be produced, with an 80% chance of earning $50 million, but a 20% chance of losing $10 million. On the other hand, she feels that script #2 has a 60 % chance of earning $120 million, but a 40% chance of losing $30 million. If successful, its sequel would have a 50% chance of earning $80 million and a 50% chance of losing $40 million. As with the first script, if the original movie is a "flop," then no sequel would be produced.

What is the expected payoff for the optimum decision alternative?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

What is the expected payoff for the optimum decision alternative?

A) $150 million

B) $90.6 million

C) $84 million

D) $72 million

E) $60 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

70

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the expected value of perfect information?

A) 40

B) 45

C) 75

D) 85

E) 100

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the expected value of perfect information?

A) 40

B) 45

C) 75

D) 85

E) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the unconditional probability that the research predicts S2?

A) 0.32

B) 0.4

C) 0.44

D) 0.56

E) 0.6

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the unconditional probability that the research predicts S2?

A) 0.32

B) 0.4

C) 0.44

D) 0.56

E) 0.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

72

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S1 and the research predicts S2?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S1 and the research predicts S2?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

73

Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies.

What is the expected payoff for the decision to write the economics book?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

What is the expected payoff for the decision to write the economics book?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

74

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the unconditional probability that the research predicts S1?

A) 0.32

B) 0.4

C) 0.44

D) 0.56

E) 0.6

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

What is the unconditional probability that the research predicts S1?

A) 0.32

B) 0.4

C) 0.44

D) 0.56

E) 0.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

75

Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies.

What is the probability that the statistics book would wind up being placed with a smaller publisher?

A) 0.6

B) 0.5

C) 0.4

D) 0.3

E) 0

What is the probability that the statistics book would wind up being placed with a smaller publisher?

A) 0.6

B) 0.5

C) 0.4

D) 0.3

E) 0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

76

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the expected payoff using Bayes' decision rule?

A) −82

B) −44

C) 0

D) 29

E) 40

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the expected payoff using Bayes' decision rule?

A) −82

B) −44

C) 0

D) 29

E) 40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

77

Refer to the following payoff table:

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S2 and the research predicts S2?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

There is an option of paying $100 to have research done to better predict which state of nature will occur. When the true state of nature is S1, the research will accurately predict S1 60% of the time. When the true state of nature is S2, the research will accurately predict S2 80% of the time.

Given that the research is done, what is the joint probability that the state of nature is S2 and the research predicts S2?

A) 0.08

B) 0.16

C) 0.24

D) 0.32

E) 0.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

78

Two professors at a nearby university want to co-author a new textbook in either economics or statistics. They feel that if they write an economics book they have a 50% chance of placing it with a major publisher where it should ultimately sell about 40,000 copies. If they can't get a major publisher to take it, then they feel they have an 80% chance of placing it with a smaller publisher, with sales of 30,000 copies. On the other hand if they write a statistics book, they feel they have a 40% chance of placing it with a major publisher, and it should result in ultimate sales of about 50,000 copies. If they can't get a major publisher to take it, they feel they have a 50% chance of placing it with a smaller publisher, with ultimate sales of 35,000 copies.

What is the expected payoff for the decision to write the statistics book?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

What is the expected payoff for the decision to write the statistics book?

A) 50,000 copies

B) 40,000 copies

C) 32,000 copies

D) 30,500 copies

E) 10,500 copies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the role of the group facilitator in decision conferencing?

A) Lead the group to the desired outcome.

B) Structure and focus discussions.

C) Provide mathematical support for decision analysis.

D) Determine the states of nature.

E) Determine the payoffs for each alternative.

A) Lead the group to the desired outcome.

B) Structure and focus discussions.

C) Provide mathematical support for decision analysis.

D) Determine the states of nature.

E) Determine the payoffs for each alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

80

A risk-averse decision maker is trying to decide which alternative to choose. The payoff table for the alternatives, given two possible states of nature, is shown below. Assuming that the decision makers risk tolerance (R) is 5, which decision should she choose based on the utility of each outcome? Assume the exponential utility function is applicable.

A) Alternative A

B) Alternative B

C) Alternative C

D) Alternative D

E) Alternative E

A) Alternative A

B) Alternative B

C) Alternative C

D) Alternative D

E) Alternative E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck