Deck 9: Asset Pricing Principles

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 9: Asset Pricing Principles

1

The expected return on the market for next period is 11 percent. The risk free rate of return is 4 percent, and Alpha Company has a beta of 1.1. The market risk premium is

A) 7.7 percent.

B) 7 percent.

C) 11 percent.

D) 12.1 percent.

Solution: Market risk premium = 11 - 4

= 7 percent

A) 7.7 percent.

B) 7 percent.

C) 11 percent.

D) 12.1 percent.

Solution: Market risk premium = 11 - 4

= 7 percent

B

2

The Capital Asset Pricing Model:

A) has serious flaws because of its complexity.

B) measures relevant risk of a security and shows the relationship between risk and expected return.

C) was developed by Markowitz in the 1930s.

D) discounts almost all of the Markowitz portfolio theory.

A) has serious flaws because of its complexity.

B) measures relevant risk of a security and shows the relationship between risk and expected return.

C) was developed by Markowitz in the 1930s.

D) discounts almost all of the Markowitz portfolio theory.

B

3

The separation theorem states that:

A) systematic risk is separate from unsystematic risk.

B) individual security risk is separate from portfolio risk.

C) the investment decision is separate from the financing decision.

D) borrowing portfolio is separate from the lending portfolio.

A) systematic risk is separate from unsystematic risk.

B) individual security risk is separate from portfolio risk.

C) the investment decision is separate from the financing decision.

D) borrowing portfolio is separate from the lending portfolio.

A

4

Select the correct statement regarding the market portfolio. It:

A) is readily and precisely observable.

B) is a risky portfolio.

C) is the lowest point of tangency between the risk-free rate and the efficient frontier.

D) should be composed of stocks or bonds.

A) is readily and precisely observable.

B) is a risky portfolio.

C) is the lowest point of tangency between the risk-free rate and the efficient frontier.

D) should be composed of stocks or bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the CMT, the relevant risk to consider with any security is:

A) its correlation with other securities in the portfolio.

B) its covariance with the market portfolio.

C) its deviation from the portfolio required rate of return.

D) its variance from the risk-free rate of return.

A) its correlation with other securities in the portfolio.

B) its covariance with the market portfolio.

C) its deviation from the portfolio required rate of return.

D) its variance from the risk-free rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

Select the INCORRECT statement regarding the CML.

A) The CML is an equilibrium relationship for efficient portfolios and individual securities.

B) The CML represents the risk-return tradeoff in equilibrium for efficient portfolios.

C) The intercept of the CML is the reward per unit of time available to investors for deferring consumption.

D) Standard deviation is the measure of risk which determines a portfolio's equilibrium return.

A) The CML is an equilibrium relationship for efficient portfolios and individual securities.

B) The CML represents the risk-return tradeoff in equilibrium for efficient portfolios.

C) The intercept of the CML is the reward per unit of time available to investors for deferring consumption.

D) Standard deviation is the measure of risk which determines a portfolio's equilibrium return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

When markets are in equilibrium, the CML will be upward sloping

A) because it shows the optimum combination of risky securities.

B) because the price of risk must always be positive.

C) because it contains all securities weighted by their market values.

D) because the CML indicates the required return for each portfolio risk level.

A) because it shows the optimum combination of risky securities.

B) because the price of risk must always be positive.

C) because it contains all securities weighted by their market values.

D) because the CML indicates the required return for each portfolio risk level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is an assumption of the CMT?

A) Single investors can affect the market by their buying and selling decisions.

B) There is no inflation.

C) Investors prefer capital gains over dividends.

D) Different investors have different probability distributions..

A) Single investors can affect the market by their buying and selling decisions.

B) There is no inflation.

C) Investors prefer capital gains over dividends.

D) Different investors have different probability distributions..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is the correct calculation for the required rate of return under the CAPM?

A) beta (market risk premium)

B) beta + market risk premium

C) risk-free rate + risk premium

D) risk-free rate(market risk premium)

A) beta (market risk premium)

B) beta + market risk premium

C) risk-free rate + risk premium

D) risk-free rate(market risk premium)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

The slope of the CML is the:

A) standard deviation for efficient portfolios.:::::

B) market price of risk for efficient portfolios.

C) risk-free rate.

D) risk premium for the market portfolio.

A) standard deviation for efficient portfolios.:::::

B) market price of risk for efficient portfolios.

C) risk-free rate.

D) risk premium for the market portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements about the difference between the SML and the CML is TRUE?

A) The intercept of the CML is the origin while the intercept of the SML is RF.

B) CML consists of efficient portfolios, while the SML is concerned with all portfolios or securities.

C) CML could be downward sloping while that is impossible for the SML.

D) CML and the SML are essentially the same except in terms of the securities represented.

A) The intercept of the CML is the origin while the intercept of the SML is RF.

B) CML consists of efficient portfolios, while the SML is concerned with all portfolios or securities.

C) CML could be downward sloping while that is impossible for the SML.

D) CML and the SML are essentially the same except in terms of the securities represented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not one of the assumptions of the CMT?

A) All investors have the same one-period time horizon.

B) There are no personal income taxes.

C) There is no interest rate charged on borrowing.

D) There are no transaction costs.

A) All investors have the same one-period time horizon.

B) There are no personal income taxes.

C) There is no interest rate charged on borrowing.

D) There are no transaction costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is generally used as a proxy for the risk-free rate of return?

A) savings account

B) certificate of deposit

C) Treasury bill

D) Treasury bond

A) savings account

B) certificate of deposit

C) Treasury bill

D) Treasury bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following regarding investors and the CMT is true?

A) Investors recognize that all the assumptions of the CMT are unrealistic.

B) Investors recognize that all of the CMT assumptions are not unrealistic.

C) Investors are not aware of the assumptions of the CMT model.

D) Investors recognize the CMT is useless for individual investors.

A) Investors recognize that all the assumptions of the CMT are unrealistic.

B) Investors recognize that all of the CMT assumptions are not unrealistic.

C) Investors are not aware of the assumptions of the CMT model.

D) Investors recognize the CMT is useless for individual investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

The expected market return is 16 percent. The risk-free rate of return is 7 percent, and BC Co. has a beta of 1.1. Their required rate of return is

A) 17.6 percent.

B) 16.0 percent.

C) 16.9 percent.

D) 23.0 percent.

Solution: required return = 7 + 1.1(16 - 7)

= 16.9 percent

A) 17.6 percent.

B) 16.0 percent.

C) 16.9 percent.

D) 23.0 percent.

Solution: required return = 7 + 1.1(16 - 7)

= 16.9 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

__________, the CML can be downward sloping.

A) Ex post

B) When investors are risk-lovers

C) When the SML is upward sloping

D) When the risk premium for the market is very high

A) Ex post

B) When investors are risk-lovers

C) When the SML is upward sloping

D) When the risk premium for the market is very high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

The _________ is a plot of __________.

A) CML . . . individual stocks and efficient portfolios

B) CML . . . both efficient and inefficient portfolios, only

C) SML . . . individual securities and efficient portfolios

D) SML . . . individual securities, inefficient portfolios, and efficient portfolios.

A) CML . . . individual stocks and efficient portfolios

B) CML . . . both efficient and inefficient portfolios, only

C) SML . . . individual securities and efficient portfolios

D) SML . . . individual securities, inefficient portfolios, and efficient portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under the separation theorem, all investors should:

A) hold the same portfolio of risky assets and therefore have the same risk/return combination.

B) have different optimal portfolios.

C) have the same portfolio of risky assets and achieve their own risk-return combination through borrowing and lending.

D) hold the same portfolio of risky assets and the same expected return but at different levels of risk

A) hold the same portfolio of risky assets and therefore have the same risk/return combination.

B) have different optimal portfolios.

C) have the same portfolio of risky assets and achieve their own risk-return combination through borrowing and lending.

D) hold the same portfolio of risky assets and the same expected return but at different levels of risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

What does it mean when the CAPM is called "robust?"

A) The CAPM requires no assumptions.

B) Even if most of the assumptions of the CAPM are relaxed, most of the conclusions will still hold.

C) The CAPM is based on realistic assumptions.

D) No other model can represent stock returns better than the CAPM.

A) The CAPM requires no assumptions.

B) Even if most of the assumptions of the CAPM are relaxed, most of the conclusions will still hold.

C) The CAPM is based on realistic assumptions.

D) No other model can represent stock returns better than the CAPM.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

Securities with betas greater than l should have:

A) expected returns higher than the market.:::::

B) required returns higher than the market return.

C) required returns lower than the market return.

D) no systematic risk.

A) expected returns higher than the market.:::::

B) required returns higher than the market return.

C) required returns lower than the market return.

D) no systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

The CML indicates the required return for each portfolio risk level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

If markets are truly efficient and in equilibrium

A) all securities would lie on the SML.

B) any security that plots below the SML would be considered undervalued.

C) any security that lies above the SML would be considered overvalued.

D) no security would lie on the SML..

A) all securities would lie on the SML.

B) any security that plots below the SML would be considered undervalued.

C) any security that lies above the SML would be considered overvalued.

D) no security would lie on the SML..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

If a certain stock has a beta greater than 1.0, it means that

A) the stock's return is more volatile than that of the market portfolio.

B) an investor can eliminate the risk by combining it with another stock that has a negative beta.

C) an investor will earn a higher return on his stock than that on the market portfolio.

D) the stock is less risky than the market portfolio.

A) the stock's return is more volatile than that of the market portfolio.

B) an investor can eliminate the risk by combining it with another stock that has a negative beta.

C) an investor will earn a higher return on his stock than that on the market portfolio.

D) the stock is less risky than the market portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

The APT is based on the:

A) law of averages.

B) law of attraction.

C) law of accelerating return.

D) law of one price.

A) law of averages.

B) law of attraction.

C) law of accelerating return.

D) law of one price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

Risk factors in the APT must possess all of the following the characteristics except:

A) Factors must be readily observable in risk/return space.

B) Each factor must have a pervasive influence on stock returns

C) The factors must influence expected return.

D) Factors must be unpredictable.

A) Factors must be readily observable in risk/return space.

B) Each factor must have a pervasive influence on stock returns

C) The factors must influence expected return.

D) Factors must be unpredictable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is not one of the reasonable conclusions of the CAPM reached by a consensus of the empirical results?

A) The intercept term is generally higher than the RF.

B) The SML appears to be non-linear.

C) The slope of the CAPM is generally less steep than suggested by the theory.

D) CAPM is an imperfect model for the explanation of the cross section of security returns.

A) The intercept term is generally higher than the RF.

B) The SML appears to be non-linear.

C) The slope of the CAPM is generally less steep than suggested by the theory.

D) CAPM is an imperfect model for the explanation of the cross section of security returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

A security that plots above the SML would be a good security to sell short.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

The CML states that all investors should invest in the same portfolio of risky assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

The most volatile stocks have beta's near zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

Testing of the CAPM suggests the trade-off between expected return and risk is an upward-sloping straight line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

Beta is a measure of systematic risk and relates one security's return to another security's return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

The expected market return is 9 percent. The risk-free rate of return is 1 percent, and XYZ Co. has a beta of 1.4. The risk premium is

A) 8 percent.

B) 11.2 percent.

C) 12.2 percent.

D) 10.3 percent

Solution: risk premium = 1.4(9 - 1)

= 11.2 percent

A) 8 percent.

B) 11.2 percent.

C) 12.2 percent.

D) 10.3 percent

Solution: risk premium = 1.4(9 - 1)

= 11.2 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

The arbitrage pricing theory (APT)

A) considers only one factor and is a narrower model than the CAPM.

B) considers more factors than the CAPM and is a broader model.

C) is useful only for well-diversified portfolios of common stock.

D) is to practice because the factors are readily observable.

A) considers only one factor and is a narrower model than the CAPM.

B) considers more factors than the CAPM and is a broader model.

C) is useful only for well-diversified portfolios of common stock.

D) is to practice because the factors are readily observable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the separation theorem, it is necessary to match each investor's indifference curves with a particular efficient portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

Under the Market Model, the regression line that results when the return of a security is plotted against the market index return is the:

A) SML.

B) CML.

C) characteristic line.

D) slope.

A) SML.

B) CML.

C) characteristic line.

D) slope.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following might be used as a factor in an APT factor model?

A) The risk-free rate

B) Expected inflation

C) Unanticipated deviations from expected inflation

D) Loss by fire at a company's manufacturing plant

A) The risk-free rate

B) Expected inflation

C) Unanticipated deviations from expected inflation

D) Loss by fire at a company's manufacturing plant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

A less restrictive form of the Single Index Model is the:

A) Risk-free Model.

B) CAPM.

C) CML.

D) Market Model.

A) Risk-free Model.

B) CAPM.

C) CML.

D) Market Model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

Positive theory refers to a theory that

A) explains how economic participants should act

B) describes how economic participants act

C) is optimistic

D) has been shown to have high explanatory power as a result of empirical testing

A) explains how economic participants should act

B) describes how economic participants act

C) is optimistic

D) has been shown to have high explanatory power as a result of empirical testing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

The arbitrage pricing theory (APT) and the CAPM both assume all except the following?

A) Investors have homogeneous beliefs.

B) Investors are risk-averse utility maximizers.

C) Borrowing and lending can be done at the rate RF.

D) Markets are perfect.

A) Investors have homogeneous beliefs.

B) Investors are risk-averse utility maximizers.

C) Borrowing and lending can be done at the rate RF.

D) Markets are perfect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

Most professional investors use the S&P 500 as a general gauge of total market performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

Suppose the SML has a risk-free rate of 5 percent and an expected market return of 15 percent. Now suppose that the SML shifts, changing slope, so that kRF is still 5 percent but kM is now 16 percent. What does this shift suggest about investors' risk aversion? If the slope were to change downward, what would that suggest?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

In a declining market, a portfolio manager should attempt to increase the overall beta of the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

43

Like CAPM, APT does not assume a single period investment horizon, no taxes, borrowing and lending at the RF rate, and investors selecting portfolios based on expected return and variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

The APT is based on the law of one price, which states two identical assets cannot sell at different prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

With the APT, risk is defined in terms of a stock's sensitivity to basic economic factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

With the introduction of risk-free borrowing and lending changes the nature of the original Markowitz efficient frontier by turning the efficient frontier into a straight line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

At a given point in time the SML dictates that a security with a beta of 1.10 should require a return of 18 percent. Analysts determine that a particular stock with an observed beta of 1.10 has an expected return of 20 percent. Outline the scenario that will bring the security's return into equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

The characteristic line is the regression fitting total returns for a stock against total

returns for the market, and is sometimes calculated using excess returns.

returns for the market, and is sometimes calculated using excess returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

What are the assumptions in the CAPM? Can these be relaxed without destroying the conclusions of the model?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

Two points define a straight line. What two points could be most readily identified to estimate the SML?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

Compare the capital market line and the security market line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

52

None of the asset-pricing models assume that the market is perfect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

How are securities chosen and in what proportions are they represented in the market portfolio M?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the formula for the slope of the CML? What does it represent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

Like the CAPM, the APT assumes a single-period investment horizon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

Betas of individual securities are unstable over time. What are some characteristics that could cause a company's beta to change over time?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why is market risk sometimes said to be the "relevant" risk for a portfolio manager? What is the measure of market risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Unlike the CAPM, the APT does not assume borrowing and lending at the risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

An analyst determined that for the past two quarters the risk-free rate has exceeded the return on the market portfolio. Does this information disprove the CML?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

Some securities are considered to be "defensive" in that they tend to hold their value or increase in value when the majority of securities are losing value, such as during a recession. What could one conclude about the betas of defensive securities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

If the risk free lending rate is lower than the borrowing rate, what would the shape

of the CML and efficient frontier look like?

of the CML and efficient frontier look like?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

The market has an expected return of 13 percent and the risk-free rate is 5.5 percent. If Merrill Lynch has a beta of 1.85, what is the required return for Merrill Lynch?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compare the security market line model and the arbitrage pricing theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

The expected return for the market is 12 percent, with a standard deviation of 20 percent. The expected risk-free rate is 8 percent. Information is available for three mutual funds, all assumed to be efficient, as follows:

(a) Based on the CML, calculate the market price of risk.

(a) Based on the CML, calculate the market price of risk.

(b) Calculate the expected return on each of these portfolios.

(a) Based on the CML, calculate the market price of risk.

(a) Based on the CML, calculate the market price of risk.(b) Calculate the expected return on each of these portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

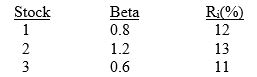

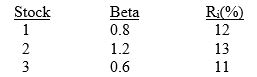

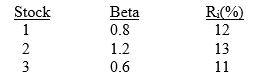

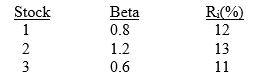

Given an expected return for the market of 12 percent, with a standard deviation of 20 percent, and a risk-free rate of 8 percent, consider the following data:

(a) Calculate the required return for each stock using the SML.

(a) Calculate the required return for each stock using the SML.

(b) Assume that an analyst, using fundamental analysis, develops the estimates labeled Ri for these stocks. Which stock would be recommended for purchase?

(a) Calculate the required return for each stock using the SML.

(a) Calculate the required return for each stock using the SML.(b) Assume that an analyst, using fundamental analysis, develops the estimates labeled Ri for these stocks. Which stock would be recommended for purchase?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck