Deck 15: Exchange Rates II: the Asset Approach in the Short Run

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/159

العب

ملء الشاشة (f)

Deck 15: Exchange Rates II: the Asset Approach in the Short Run

1

Which of the following is NOT an assumption of the behavior of exchange rates in the short run?

A) The adjustment period involves weeks rather than years.

B) Market forces are irrelevant and "do not matter."

C) Prices of goods adjust slowly and are therefore "sticky."

D) Economic actors behave in their own self-interest.

A) The adjustment period involves weeks rather than years.

B) Market forces are irrelevant and "do not matter."

C) Prices of goods adjust slowly and are therefore "sticky."

D) Economic actors behave in their own self-interest.

B

2

Using the UIP equation to determine the spot exchange rate, assume that the expected spot rate (after one year) for euros (in terms of dollars) equals $1.50, the current interest rate on euro deposits is 4.5%, and the current interest rate on dollar deposits is 5.5%. Which of the following current spot rates would satisfy the equation?

A) $1.65

B) $1.50

C) $1.485

D) $1.25

A) $1.65

B) $1.50

C) $1.485

D) $1.25

C

3

Using the UIP equation to determine the spot exchange rate requires a knowledge of: I. expected future exchange rates.

II) observed rates of interest.

III) expected returns on foreign deposits.

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

II) observed rates of interest.

III) expected returns on foreign deposits.

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

D

4

If UIP holds, the foreign interest rate is 6%, and the home currency is expected to appreciate by 2%, then the home interest rate is:

A) 10%.

B) 8%.

C) 4%.

D) 3%.

A) 10%.

B) 8%.

C) 4%.

D) 3%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

5

When currencies are viewed as assets, the price of a currency is its:

A) interest rate.

B) exchange rate.

C) inflation rate.

D) growth rate.

A) interest rate.

B) exchange rate.

C) inflation rate.

D) growth rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

6

If UIP holds and if the home currency is expected to depreciate, then:

A) the home interest rate must be greater than the foreign interest rate.

B) interest rates cannot be changing.

C) the home interest rate must be less than the foreign interest rate.

D) Not enough information is provided to answer the question.

A) the home interest rate must be greater than the foreign interest rate.

B) interest rates cannot be changing.

C) the home interest rate must be less than the foreign interest rate.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

7

When PPP does not hold in the short run, economists have developed an alternative short-run explanatory theory based on the idea that:

A) currency values are different from other prices, since currencies are not considered assets.

B) currency values are influenced in the short run because they serve as short-term assets.

C) currency values will eventually result in PPP over time, so no short-run theory is needed.

D) currency values are set by government entities and the IMF so the value often does not result in PPP.

A) currency values are different from other prices, since currencies are not considered assets.

B) currency values are influenced in the short run because they serve as short-term assets.

C) currency values will eventually result in PPP over time, so no short-run theory is needed.

D) currency values are set by government entities and the IMF so the value often does not result in PPP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

8

A key component of the asset approach to exchange rates is being able to accurately gauge:

A) the price level.

B) the rate of inflation.

C) expected future exchange rates.

D) the GDP gap.

A) the price level.

B) the rate of inflation.

C) expected future exchange rates.

D) the GDP gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the domestic dollar return (home nominal interest rate) is 5%, and the foreign nominal interest rate is 3%, and there is no expected change in future exchange rates, then as the spot exchange rate depreciates:

A) the foreign return rises.

B) the foreign return falls.

C) the domestic return rises.

D) the domestic return falls.

A) the foreign return rises.

B) the foreign return falls.

C) the domestic return rises.

D) the domestic return falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

10

If UIP holds, the foreign interest rate is 10%, and the home currency is expected to depreciate by 4%, then the home interest rate is:

A) 4%.

B) 6%.

C) 10%.

D) 14%.

A) 4%.

B) 6%.

C) 10%.

D) 14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

11

If UIP holds, the interest rate at home is 4%, and the exchange rate is expected to depreciate by 3%, then the foreign interest rate is:

A) 1%.

B) 3%.

C) 7%.

D) 12%.

A) 1%.

B) 3%.

C) 7%.

D) 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

12

If UIP holds and the home currency is expected to appreciate by 4%, then the home interest rate is:

A) 6%.

B) 5%.

C) 4%.

D) Not enough information is provided to answer the question.

A) 6%.

B) 5%.

C) 4%.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to UIP, when interest rates are equal, the exchange rate of the country's home currency is expected to:

A) fall.

B) remain constant.

C) rise.

D) Not enough information is provided to answer the question.

A) fall.

B) remain constant.

C) rise.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

14

Assume that the U.S. interest rate is 5%, the European interest rate is 2%, and the future expected exchange rate in one year is $1.224. If the spot rate is $1.16, then the expected dollar return on euro deposits is:

A) 7.52%

B) 5%

C) 3.2%

D) 2%

A) 7.52%

B) 5%

C) 3.2%

D) 2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

15

When the expected dollar-euro exchange rate rises, the domestic dollar return curve shifts:

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the U.S. interest rate is 5% and the interest rate in Germany is 2%, and the euro is expected to appreciate by 2% over the next year, then investors would:

A) sell dollars in the spot market.

B) buy euros.

C) seek to invest in the United States.

D) seek to invest in Germany.

A) sell dollars in the spot market.

B) buy euros.

C) seek to invest in the United States.

D) seek to invest in Germany.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume that the U.S. interest rate is 5%, the European interest rate is 2%, and the future expected exchange rate in one year is $1.224. At approximately what exchange rate will the returns between the United States and Europe be equalized?

A) $1.20

B) $1.224

C) $1.188

D) $1.98

A) $1.20

B) $1.224

C) $1.188

D) $1.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the spot rate for euros depreciates, and all other variables and expected values remain constant, U.S. investors contemplating European investments would:

A) get larger returns in terms of dollars.

B) get smaller returns in terms of dollars.

C) get very similar returns because of arbitrage.

D) lose the principal of the investment.

A) get larger returns in terms of dollars.

B) get smaller returns in terms of dollars.

C) get very similar returns because of arbitrage.

D) lose the principal of the investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

19

Explaining exchange rate behavior in the long run assumes that changes in price levels and real interest rates affect nominal exchange rates so that interest parity and PPP hold. Short-run deviations from PPP may be explained by an alternative theory called the:

A) relative PPP approach.

B) asset approach to exchange rate determination.

C) long-run equilibrium approach.

D) law of one price.

A) relative PPP approach.

B) asset approach to exchange rate determination.

C) long-run equilibrium approach.

D) law of one price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

20

Assume that the U.S. interest rate is 5%, the European interest rate is 2%, and the future expected exchange rate in one year is $1.224. If the spot rate is $1.24, then the expected dollar return on euro deposits is:

A) 4%.

B) 7.1%.

C) 0.71%.

D) 0.129%.

A) 4%.

B) 7.1%.

C) 0.71%.

D) 0.129%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

21

Equilibrium, in the short run, is achieved when:

A) differences in rates of return cause investors to purchase and sell currency and thereby change the spot rate of exchange.

B) the government recognizes a problem and takes action to correct it.

C) traders adjust their expectations to match reality.

D) inflation falls to zero.

A) differences in rates of return cause investors to purchase and sell currency and thereby change the spot rate of exchange.

B) the government recognizes a problem and takes action to correct it.

C) traders adjust their expectations to match reality.

D) inflation falls to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

22

When exchange rates are not in alignment, traders see opportunities for _____, which move the rates _____ equilibrium.

A) speculation; away from

B) arbitrage; toward

C) investments; away from

D) liquidation; toward

A) speculation; away from

B) arbitrage; toward

C) investments; away from

D) liquidation; toward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

23

When expected dollar-euro exchange rates rise, the foreign expected dollar return curve shifts:

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

24

The money market (short-run) equilibrium equation states that the demand for real balances, (L(i)Y) is always equal to the supply of real balances (M/P) because ____ adjust(s) to ensure that people are willing to hold the entire stock.

A) nominal interest rates

B) real interest rates

C) the price level

D) nominal GDP

A) nominal interest rates

B) real interest rates

C) the price level

D) nominal GDP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the spot exchange rate is undervalued, the foreign rate of return is:

A) equal to the domestic rate of return.

B) greater than the domestic rate of return.

C) less than the domestic rate of return.

D) diverging from the domestic rate of return.

A) equal to the domestic rate of return.

B) greater than the domestic rate of return.

C) less than the domestic rate of return.

D) diverging from the domestic rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the U.S. interest rate is 9% and the Eurozone interest rate is 5%, then in the short run we would expect:

A) the dollar to appreciate.

B) the dollar to depreciate.

C) the euro to appreciate.

D) There is no change in the exchange rate.

A) the dollar to appreciate.

B) the dollar to depreciate.

C) the euro to appreciate.

D) There is no change in the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

27

We assume flexible prices in the long run, but whenever it is costly to change prices (menu costs) or when there are long-term contracts for labor or capital:

A) short-run prices tend to be flexible.

B) short-run prices tend to be sticky.

C) long-run prices tend to be sticky.

D) firms have to pay higher costs and therefore have to raise prices.

A) short-run prices tend to be flexible.

B) short-run prices tend to be sticky.

C) long-run prices tend to be sticky.

D) firms have to pay higher costs and therefore have to raise prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

28

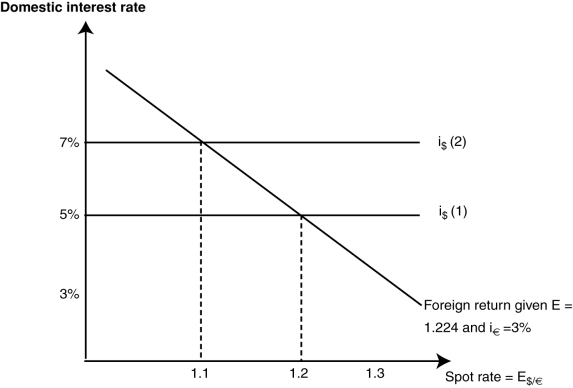

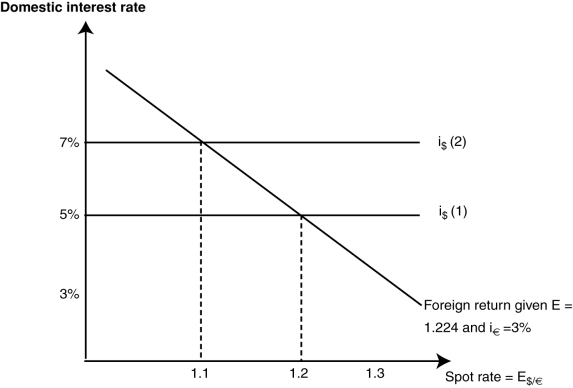

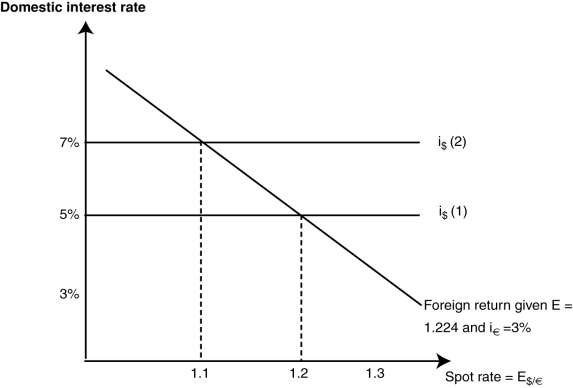

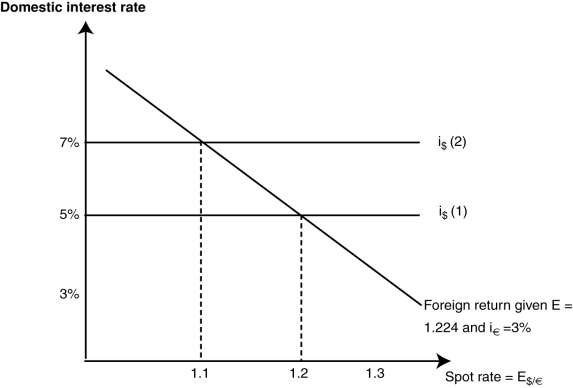

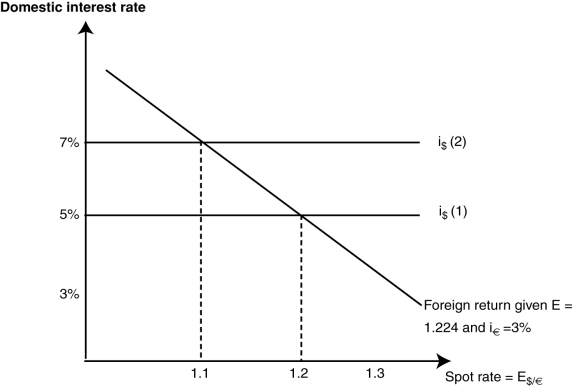

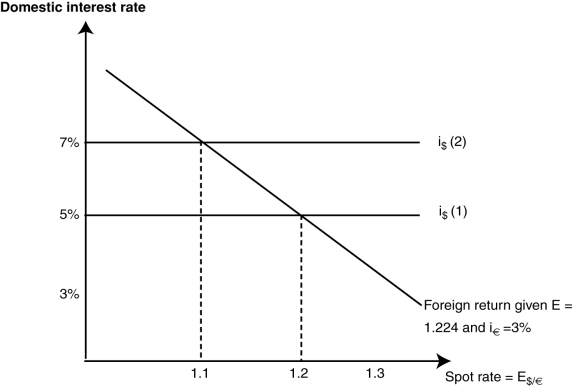

(Figure: The Domestic Interest Rate) Using the graph, if the expected future exchange rate falls from $1.224 to $1.15:

A) the dollar interest rate line shifts up and the spot rate rises.

B) the dollar interest rate line shifts down and the spot rate rises.

C) the foreign return line shifts up and to the right and the spot rate rises.

D) the foreign return line shifts down and to the left and the spot rate falls.

A) the dollar interest rate line shifts up and the spot rate rises.

B) the dollar interest rate line shifts down and the spot rate rises.

C) the foreign return line shifts up and to the right and the spot rate rises.

D) the foreign return line shifts down and to the left and the spot rate falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

29

Using the UIP equation, what would happen to the spot rate for euros if the interest rate on U.S. dollar deposits rises, ceteris paribus?

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would be unchanged.

D) The U.S. Federal Reserve would have to raise U.S. short-term interest rates.

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would be unchanged.

D) The U.S. Federal Reserve would have to raise U.S. short-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

30

Using the UIP equation, equilibrium in the short run occurs when:

A) arbitrage is possible.

B) the spot rate is such that foreign and domestic investment returns are equalized.

C) the spot rate is less than the forward rate.

D) foreign interest rates are higher than domestic rates of interest.

A) arbitrage is possible.

B) the spot rate is such that foreign and domestic investment returns are equalized.

C) the spot rate is less than the forward rate.

D) foreign interest rates are higher than domestic rates of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

31

(Figure: The Domestic Interest Rate) Using the graph, if i€ falls, the result is:

A) the dollar interest rate line shifts up and the spot rate rises.

B) the dollar interest rate line shifts down and the spot rate rises.

C) the foreign return line shifts up and to the right and the spot rate rises.

D) the foreign return line shifts down and to the left and the spot rate falls.

A) the dollar interest rate line shifts up and the spot rate rises.

B) the dollar interest rate line shifts down and the spot rate rises.

C) the foreign return line shifts up and to the right and the spot rate rises.

D) the foreign return line shifts down and to the left and the spot rate falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

32

The asset approach to short-run exchange rate determination relies on which three variables?

A) prices, interest rates, and inflation

B) the reserve ratio, aggregate wealth, and interest rates

C) nominal domestic rates, foreign interest rates, and expectations of exchange rate changes

D) prices, aggregate wealth, and inflation

A) prices, interest rates, and inflation

B) the reserve ratio, aggregate wealth, and interest rates

C) nominal domestic rates, foreign interest rates, and expectations of exchange rate changes

D) prices, aggregate wealth, and inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

33

Using the UIP equation, what would happen to the spot rate for euros if the interest rate on euro deposits rises, ceteris paribus?

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would be unchanged.

D) The U.S. Federal Reserve would have to raise U.S. short-term interest rates.

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would be unchanged.

D) The U.S. Federal Reserve would have to raise U.S. short-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the UIP equation, what would happen to the spot rate for euros if the dollar-euro exchange rate is expected to appreciate in the future?

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would remain unchanged.

D) The spot rate to purchase euros would remain unchanged today, but rise in the future (dollar depreciation).

A) The spot rate to purchase euros would rise (dollar depreciation).

B) The spot rate to purchase euros would fall (dollar appreciation).

C) The spot rate to purchase euros would remain unchanged.

D) The spot rate to purchase euros would remain unchanged today, but rise in the future (dollar depreciation).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

35

Given expectations of future exchange rates, when foreign returns are greater than domestic returns, investors will ____ domestic assets, _____ domestic currency, ____ foreign currency, and _____ foreign assets.

A) sell; sell; buy; buy

B) sell; buy; sell; buy

C) buy; sell; buy; sell

D) buy; buy; sell; sell

A) sell; sell; buy; buy

B) sell; buy; sell; buy

C) buy; sell; buy; sell

D) buy; buy; sell; sell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

36

(Figure: The Domestic Interest Rate) Using the graph, if the dollar rate of interest increases from 5% to 7%, what result will occur in the short run?

A) Expectations of future exchange rates will change.

B) U.S. real GDP will fall and the dollar will also fall.

C) The spot rate for dollars will appreciate to $1.10.

D) The nominal interest rate on the euro will decrease.

A) Expectations of future exchange rates will change.

B) U.S. real GDP will fall and the dollar will also fall.

C) The spot rate for dollars will appreciate to $1.10.

D) The nominal interest rate on the euro will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

37

What assumptions are made to create a model to determine short-run changes in exchange rates using the asset approach?

A) Prices are completely flexible.

B) In the long run, money is neutral.

C) Prices are sticky, yet nominal interest rates are flexible.

D) Prices and nominal interest rates are sticky.

A) Prices are completely flexible.

B) In the long run, money is neutral.

C) Prices are sticky, yet nominal interest rates are flexible.

D) Prices and nominal interest rates are sticky.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

38

When the European interest rate falls, the foreign expected dollar return curve shifts:

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

39

When the U.S. interest rate falls, the foreign expected dollar return curve shifts:

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

A) in.

B) out.

C) not at all.

D) Not enough information is provided to answer the question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

40

If domestic returns are greater than foreign returns, then:

A) the spot rate is too high.

B) the spot rate is too low.

C) expectations of future exchange rates will change in the long run.

D) There is no opportunity for arbitrage.

A) the spot rate is too high.

B) the spot rate is too low.

C) expectations of future exchange rates will change in the long run.

D) There is no opportunity for arbitrage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

41

In the short run, when the central bank increases the quantity of money, what happens to real balances?

A) They do not change, since prices will rise by the same proportion.

B) They will fall, since prices will rise by a greater proportion.

C) They will rise, since prices overall will fall.

D) They will rise, since prices will not change in the short run.

A) They do not change, since prices will rise by the same proportion.

B) They will fall, since prices will rise by a greater proportion.

C) They will rise, since prices overall will fall.

D) They will rise, since prices will not change in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

42

Menu costs are the:

A) cost of changing interest rates.

B) cost of converting currencies.

C) cost of changing prices.

D) cost of changing exchange rates.

A) cost of changing interest rates.

B) cost of converting currencies.

C) cost of changing prices.

D) cost of changing exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

43

An increase in nominal GDP (with inflexible prices) results in:

A) an increase in the nominal rate of interest.

B) an increase in the U.S. dollar exchange rate.

C) a decrease in the nominal rate of interest.

D) increased price and wage flexibility.

A) an increase in the nominal rate of interest.

B) an increase in the U.S. dollar exchange rate.

C) a decrease in the nominal rate of interest.

D) increased price and wage flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

44

Normally, whenever the central bank lowers the rate it charges banks for overnight loans, market rates of interest:

A) are not affected.

B) fall at the same rate.

C) increase.

D) are unstable.

A) are not affected.

B) fall at the same rate.

C) increase.

D) are unstable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

45

During the financial crisis of 2007-08, the U.S. central bank lowered its policy rate from 5.25% to 0%. What was the effect on market rates of interest?

A) Market rates increased by 5%.

B) Market rates fell by 5%.

C) Market rates fell below zero.

D) Market rates barely moved at all.

A) Market rates increased by 5%.

B) Market rates fell by 5%.

C) Market rates fell below zero.

D) Market rates barely moved at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

46

Nominal rigidity is another term for:

A) sticky prices.

B) fixed exchange rates.

C) menu prices.

D) the trilemma.

A) sticky prices.

B) fixed exchange rates.

C) menu prices.

D) the trilemma.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

47

To move quickly to turn around the crisis during 2007-08, the U.S. Federal Reserve relied on:

A) lowering taxes.

B) removing restrictions on collateral, adding more categories of securities purchased by the Federal Reserve, and expanding its operations with nonbank dealers.

C) tightening up credit rules and keeping banks out of trouble.

D) admonishing the administration for its excessive debt situation.

A) lowering taxes.

B) removing restrictions on collateral, adding more categories of securities purchased by the Federal Reserve, and expanding its operations with nonbank dealers.

C) tightening up credit rules and keeping banks out of trouble.

D) admonishing the administration for its excessive debt situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following are explanations for sticky prices?

A) long-term labor contracts

B) fixed exchange rates

C) flexible exchange rates

D) fixed money supply

A) long-term labor contracts

B) fixed exchange rates

C) flexible exchange rates

D) fixed money supply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

49

With sticky prices increasing, the supply of money results in:

A) an increase in the nominal rate of interest.

B) an increase in the U.S. dollar exchange rate.

C) a decrease in the nominal rate of interest.

D) increased price and wage flexibility.

A) an increase in the nominal rate of interest.

B) an increase in the U.S. dollar exchange rate.

C) a decrease in the nominal rate of interest.

D) increased price and wage flexibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

50

Nominal interest rates are considered to be _____ in the short-run model.

A) flexible

B) rigid

C) zero

D) set by the central bank

A) flexible

B) rigid

C) zero

D) set by the central bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

51

Whenever there is excess demand for real balances, short-run adjustment occurs because:

A) savers and investors buy bonds and drive up their prices (drive down nominal rates of interest).

B) investors and borrowers sell bonds (convert to cash) and drive down their prices (drive up nominal rates of interest).

C) the price level falls to restore real balances.

D) aggregate demand is decreased to restore equilibrium.

A) savers and investors buy bonds and drive up their prices (drive down nominal rates of interest).

B) investors and borrowers sell bonds (convert to cash) and drive down their prices (drive up nominal rates of interest).

C) the price level falls to restore real balances.

D) aggregate demand is decreased to restore equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

52

The demand for real money balances is a function of:

A) the supply of real money balances.

B) the nominal GDP.

C) the nominal rate of interest on alternative assets and the level of real GDP.

D) policy decisions by the central bank.

A) the supply of real money balances.

B) the nominal GDP.

C) the nominal rate of interest on alternative assets and the level of real GDP.

D) policy decisions by the central bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the money market, equilibrium is achieved:

A) in the long run by the adjustment of interest rates.

B) in the short run by the adjustment of prices.

C) in the long run by the adjustment of prices.

D) in the short run by changes in the money supply.

A) in the long run by the adjustment of interest rates.

B) in the short run by the adjustment of prices.

C) in the long run by the adjustment of prices.

D) in the short run by changes in the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

54

What are options for monetary easing using interest rate policy instruments when the rate has hit the zero lower bound?

A) At that point, interest rate policy cannot be used.

B) Monetary easing can still occur whenever interest rates are greater than zero at the retail level.

C) The central bank can increase the money supply, and interest rates can be less than zero.

D) Borrowing can be stimulated in ways other than lower rates of interest.

A) At that point, interest rate policy cannot be used.

B) Monetary easing can still occur whenever interest rates are greater than zero at the retail level.

C) The central bank can increase the money supply, and interest rates can be less than zero.

D) Borrowing can be stimulated in ways other than lower rates of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

55

The money market clears as people with excess real balances:

A) buy bonds and drive down nominal rates of interest until the demand for real balances equals supply.

B) sell bonds and drive up nominal rates of interest until the demand for real balances equals supply.

C) increase spending, driving up nominal GDP and raising nominal rates of interest.

D) sell financial assets such as stocks to increase the total supply of real balances.

A) buy bonds and drive down nominal rates of interest until the demand for real balances equals supply.

B) sell bonds and drive up nominal rates of interest until the demand for real balances equals supply.

C) increase spending, driving up nominal GDP and raising nominal rates of interest.

D) sell financial assets such as stocks to increase the total supply of real balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

56

A rise in real income will have which of the following effects on money demand?

A) The money demand curve will shift out.

B) The money demand curve will not shift at all.

C) The money demand curve will shift in.

D) Real income has no effect on money demand.

A) The money demand curve will shift out.

B) The money demand curve will not shift at all.

C) The money demand curve will shift in.

D) Real income has no effect on money demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

57

At higher nominal rates of interest, the demand for real balances is:

A) higher because savers can earn higher returns.

B) lower because the opportunity cost of holding those funds is higher.

C) invariant with respect to the nominal interest rate.

D) inversely related to the price level.

A) higher because savers can earn higher returns.

B) lower because the opportunity cost of holding those funds is higher.

C) invariant with respect to the nominal interest rate.

D) inversely related to the price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

58

Aggressive policy measures taken by the monetary authority during the 2007-08 financial crisis in the United States resulted in:

A) avoidance of a recession caused by a tight credit market.

B) almost no transmission of the monetary stimulus to market rates of interest, increased lending, and expansion of GDP.

C) lower rates of interest and increased investment activity.

D) an increase of real GDP and a fall in the core unemployment rate.

A) avoidance of a recession caused by a tight credit market.

B) almost no transmission of the monetary stimulus to market rates of interest, increased lending, and expansion of GDP.

C) lower rates of interest and increased investment activity.

D) an increase of real GDP and a fall in the core unemployment rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

59

Assuming short-run sticky prices, the same monetary policy result may be achieved by targeting the money supply or the nominal rate of interest whenever:

A) the demand for money is stable.

B) interest income is not taxable.

C) changes in the supply of money are small and predictable.

D) real income is constant.

A) the demand for money is stable.

B) interest income is not taxable.

C) changes in the supply of money are small and predictable.

D) real income is constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

60

What happened to the measure of money, M0, which includes only cash, bank reserves, and deposits at the Federal Reserve during the crisis?

A) It shrank measurably.

B) It expanded slightly.

C) It more than doubled.

D) There was no change in M0.

A) It shrank measurably.

B) It expanded slightly.

C) It more than doubled.

D) There was no change in M0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

61

A short-run appreciation of the British pound would be consistent with:

A) a temporary fall in the British money supply.

B) a temporary fall in the European money supply.

C) a permanent rise in the European money supply.

D) either a temporary fall in the British money supply or a temporary rise in the European money supply.

A) a temporary fall in the British money supply.

B) a temporary fall in the European money supply.

C) a permanent rise in the European money supply.

D) either a temporary fall in the British money supply or a temporary rise in the European money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

62

A perceived permanent rise in the rate of money growth will cause what long-run effects in the economy?

A) a rise in the nominal rate of interest and a rise in inflation by the same percentage

B) a rise in the nominal rate of interest and a rise in real GDP by the same percentage

C) a fall in the nominal rate of interest and a rise in inflation by the same percentage

D) a fall in the nominal rate of interest and a fall in real GDP by the same percentage

A) a rise in the nominal rate of interest and a rise in inflation by the same percentage

B) a rise in the nominal rate of interest and a rise in real GDP by the same percentage

C) a fall in the nominal rate of interest and a rise in inflation by the same percentage

D) a fall in the nominal rate of interest and a fall in real GDP by the same percentage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

63

Assuming sticky prices and given expectations of future exchange rates, what is the short-run effect on the exchange rate of the U.S. dollar (purchasing euros) and on domestic and foreign rates of return if there is a temporary increase in the quantity of euros?

A) Rates of return on domestic and foreign assets diverge, as the dollar appreciates.

B) Domestic and foreign rates of return both fall, as the dollar depreciates.

C) Domestic and foreign rates of return converge, as depreciation of the euro raises returns for U.S. investors who purchase euro-based assets.

D) Rates of return on dollar assets fall, causing investors to switch into euro assets and, therefore, the U.S. dollar depreciates against the euro.

A) Rates of return on domestic and foreign assets diverge, as the dollar appreciates.

B) Domestic and foreign rates of return both fall, as the dollar depreciates.

C) Domestic and foreign rates of return converge, as depreciation of the euro raises returns for U.S. investors who purchase euro-based assets.

D) Rates of return on dollar assets fall, causing investors to switch into euro assets and, therefore, the U.S. dollar depreciates against the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

64

A short-run depreciation of the British pound would be consistent with:

A) a temporary fall in the British money supply.

B) a temporary fall in the European money supply.

C) a temporary rise in the European money supply.

D) either a temporary fall in the British money supply or a temporary rise in the European money supply.

A) a temporary fall in the British money supply.

B) a temporary fall in the European money supply.

C) a temporary rise in the European money supply.

D) either a temporary fall in the British money supply or a temporary rise in the European money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

65

Using the asset model of short-run exchange rate determination, once the domestic rate of return is determined by MS and MD, the short-run equilibrium _____ can be determined if prices are inflexible and expectations are given.

A) interest rate

B) exchange rate

C) price level

D) income level

A) interest rate

B) exchange rate

C) price level

D) income level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

66

An increase in real income _____ the demand for real money balances and thereby causes a ____ in the nominal rate of interest.

A) lowers; rise

B) lowers; fall

C) raises; rise

D) raises; fall

A) lowers; rise

B) lowers; fall

C) raises; rise

D) raises; fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

67

In the short run/long run, a strong currency goes with:

A) a low interest rate/a high interest rate.

B) a high interest rate/a high interest rate.

C) a high interest rate/a low interest rate.

D) a low interest rate/a low interest rate.

A) a low interest rate/a high interest rate.

B) a high interest rate/a high interest rate.

C) a high interest rate/a low interest rate.

D) a low interest rate/a low interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

68

When the public perceives that a monetary expansion will be temporary, what happens to nominal interest rates in the short run?

A) They will rise.

B) They will overshoot their target.

C) They will fall.

D) They will be unchanged.

A) They will rise.

B) They will overshoot their target.

C) They will fall.

D) They will be unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

69

When policy changes are temporary, then:

A) exchange rates do not change.

B) expectations do not change.

C) interest rates do not change.

D) expectations can change based on results.

A) exchange rates do not change.

B) expectations do not change.

C) interest rates do not change.

D) expectations can change based on results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

70

The dependent variable (vertical axis) in standard graphical treatments of the money market is:

A) the exchange rate.

B) the real rate of interest.

C) real GDP.

D) the nominal rate of interest.

A) the exchange rate.

B) the real rate of interest.

C) real GDP.

D) the nominal rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

71

Assume sticky prices and given expectations of future exchange rates, what is the immediate effect on the exchange rate of the U.S. dollar if there is a temporary increase in the quantity of U.S. dollars?

A) U.S. nominal and real returns rates decline while euro rates hold steady, and the U.S. dollar depreciates against the euro.

B) U.S. nominal returns rise, U.S. real returns fall, euro rates rise, and the U.S. dollar appreciates against the euro.

C) U.S. nominal returns fall, U.S. real returns rise, euro rates fall, and the U.S. dollar appreciates against the euro.

D) U.S. dollar returns and euro returns both rise, leaving the exchange rate unchanged.

A) U.S. nominal and real returns rates decline while euro rates hold steady, and the U.S. dollar depreciates against the euro.

B) U.S. nominal returns rise, U.S. real returns fall, euro rates rise, and the U.S. dollar appreciates against the euro.

C) U.S. nominal returns fall, U.S. real returns rise, euro rates fall, and the U.S. dollar appreciates against the euro.

D) U.S. dollar returns and euro returns both rise, leaving the exchange rate unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

72

When a country's central bank temporarily switches from an expansionary to a more conservative monetary policy, one would expect the exchange rate to:

A) depreciate in the short run, then return to its initial value.

B) appreciate in the short run, then return to its initial value.

C) depreciate in the short run and then stay higher.

D) appreciate in the short run and then stay lower.

A) depreciate in the short run, then return to its initial value.

B) appreciate in the short run, then return to its initial value.

C) depreciate in the short run and then stay higher.

D) appreciate in the short run and then stay lower.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

73

During the period 2001-04, the U.S. Federal Reserve lowered nominal interest rates on the dollar by more than the European Central Bank (ECB) did on the euro, a move that most market participants viewed as temporary. What was the effect on the dollar-euro exchange rate?

A) The dollar depreciated against the euro.

B) The dollar appreciated against the euro.

C) There was no change in the dollar-euro rate because expectations adjusted.

D) There was no change in the dollar-euro rate because real interest rates were unchanged.

A) The dollar depreciated against the euro.

B) The dollar appreciated against the euro.

C) There was no change in the dollar-euro rate because expectations adjusted.

D) There was no change in the dollar-euro rate because real interest rates were unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

74

A key assumption to ensure that domestic returns and foreign returns are in equilibrium is:

A) there are perfectly flexible prices.

B) the quantity of money is fixed.

C) there are no capital controls preventing the movement of capital.

D) trade is not subject to any restrictions.

A) there are perfectly flexible prices.

B) the quantity of money is fixed.

C) there are no capital controls preventing the movement of capital.

D) trade is not subject to any restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assuming sticky prices and given expectations of future exchange rates, what is the short-run effect on the exchange rate of the U.S. dollar (purchasing euros) and on domestic and foreign rates of return if there is a temporary increase in the quantity of U.S. dollars?

A) Rates of return on domestic and foreign assets diverge, as the dollar appreciates.

B) Domestic and foreign rates of return both fall, as the dollar depreciates.

C) Domestic and foreign rates of return converge, as the dollar depreciation lowers returns for U.S. investors who purchase euro-based assets.

D) Rates of return on euro assets fall, causing investors to switch into U.S. assets and, therefore, the U.S. dollar appreciates against the euro.

A) Rates of return on domestic and foreign assets diverge, as the dollar appreciates.

B) Domestic and foreign rates of return both fall, as the dollar depreciates.

C) Domestic and foreign rates of return converge, as the dollar depreciation lowers returns for U.S. investors who purchase euro-based assets.

D) Rates of return on euro assets fall, causing investors to switch into U.S. assets and, therefore, the U.S. dollar appreciates against the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

76

If there is a temporary increase in the money supply in the Eurozone, ceteris paribus, what is the result for the United States?

A) The money supply in the United States must decrease by the same proportion.

B) The U.S. dollar nominal interest rate will increase, as the euro rate is unchanged.

C) Long-run expectations shift to expect a stronger euro.

D) The dollar appreciates against the euro.

A) The money supply in the United States must decrease by the same proportion.

B) The U.S. dollar nominal interest rate will increase, as the euro rate is unchanged.

C) Long-run expectations shift to expect a stronger euro.

D) The dollar appreciates against the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

77

Combining the home money market and the uncovered interest parity relationship, we can see how changes in variables determine:

A) real GDP.

B) the exchange rate.

C) the price level.

D) the quantity of money.

A) real GDP.

B) the exchange rate.

C) the price level.

D) the quantity of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

78

An increase in the money supply in the short run changes ____, whereas in the long run, ____ change.

A) exchange rates; nominal interest rates

B) price levels; interest rates

C) interest rates; interest rates

D) interest rates; inflation rates

A) exchange rates; nominal interest rates

B) price levels; interest rates

C) interest rates; interest rates

D) interest rates; inflation rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

79

The returns from the home country and foreign country capital markets are equalized if:

A) the home country interest rates are higher.

B) the foreign country interest rates are higher.

C) the foreign country has a higher price level.

D) both countries have no capital controls.

A) the home country interest rates are higher.

B) the foreign country interest rates are higher.

C) the foreign country has a higher price level.

D) both countries have no capital controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

80

In the short run, ceteris paribus, an expanded money supply leads to:

A) a higher nominal interest rate.

B) no change in the nominal interest rate.

C) a lower nominal interest rate.

D) an increase in the exchange rate.

A) a higher nominal interest rate.

B) no change in the nominal interest rate.

C) a lower nominal interest rate.

D) an increase in the exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck