Deck 6: Bonds and Bond Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 6: Bonds and Bond Valuation

1

The appropriate rate to use to discount the cash flows of a bond in order to determine the current price is the ________.

A)yield to maturity

B)coupon rate

C)par rate

D)current yield

A)yield to maturity

B)coupon rate

C)par rate

D)current yield

A

2

Ten years ago Bacon Signs Inc.issued twenty-five-year 8% annual coupon bonds with a $1,000 face value each.Since then,interest rates in general have fallen and the yield to maturity on the Bacon bonds is now 7%.Given this information,what is the price today for a Bacon Signs bond?

A)$1,000

B)$1,116.54

C)$1,091.08

D)$914.41

A)$1,000

B)$1,116.54

C)$1,091.08

D)$914.41

C

3

The ________ is the face value of the bond.

A)coupon rate

B)maturity date

C)par value

D)coupon

A)coupon rate

B)maturity date

C)par value

D)coupon

C

4

A bond is a ________ instrument by which a borrower of funds agrees to pay back the funds with interest on specific dates in the future.

A)long-term equity

B)long-term debt

C)short-term debt

D)short-term equity

A)long-term equity

B)long-term debt

C)short-term debt

D)short-term equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

Blackburn Inc.has issued 30-year $1,000 face value,10% annual coupon bonds,with a yield to maturity of 9.0%.The annual interest payment for the bond is ________.

A)$100

B)$90

C)$50

D)$45

A)$100

B)$90

C)$50

D)$45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

Twenty years ago JeffCo Inc.issued thirty-year 9% annual coupon bonds with a $1,000 face value each.Since then,interest rates in general have risen and the yield to maturity on the firm's bonds is now 11%.Given this information,what is the price today for a bond from this issue?

A)$1,000

B)$1,116.54

C)$882.22

D)$914.41

A)$1,000

B)$1,116.54

C)$882.22

D)$914.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

The ________ is the regular interest payment of the bond.

A)dividend

B)par

C)coupon rate

D)coupon

A)dividend

B)par

C)coupon rate

D)coupon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bonds are sometimes called ________ securities because they pay set amounts on specific future dates.

A)variable-income

B)fixed-income

C)bully

D)real

A)variable-income

B)fixed-income

C)bully

D)real

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

Johnson Construction Inc.has issued 20-year $1,000 face value,8% annual coupon bonds,with a yield to maturity of 10%.The current price of the bond is ________.

A)$1,000.00

B)$1,196.36

C)$829.73

D)There is not enough information to answer this question.

A)$1,000.00

B)$1,196.36

C)$829.73

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Ten years ago Bacon Signs Inc.issued twenty-five-year 8% annual coupon bonds with a $1,000 face value each.Since then,interest rates in general have risen and the yield to maturity on the Bacon bonds is now 9%.Given this information,what is the price today for a Bacon Signs bond?

A)$1,000

B)$919.39

C)$901.77

D)$1.085.59

A)$1,000

B)$919.39

C)$901.77

D)$1.085.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fifteen years ago TravelEasy Inc.issued twenty-five-year 10% annual coupon bonds with a $1,000 face value each.Since then,interest rates in general have fallen and the yield to maturity on the firm's bonds is now 6%.Given this information,what is the price today for a TravelEasy bond?

A)$1,000

B)$1,294.40

C)$1,091.08

D)$914.41

A)$1,000

B)$1,294.40

C)$1,091.08

D)$914.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

The ________ is the yield an individual would receive if the individual purchased the bond today and held the bond to the end of its life.

A)current yield

B)yield to maturity

C)prime rate

D)coupon rate

A)current yield

B)yield to maturity

C)prime rate

D)coupon rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

The ________ is the annual coupon payment divided by the current price of the bond,and is not always an accurate indicator.

A)current yield

B)yield to maturity

C)bond discount rate

D)coupon rate

A)current yield

B)yield to maturity

C)bond discount rate

D)coupon rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

Five years ago,Thompson Tarps Inc.issued twenty-five-year 10% annual coupon bonds with a $1,000 face value each.Since then,interest rates in general have risen and the yield to maturity on the Thompson bonds is now 12%.Given this information,what is the price today for a Thompson Tarps bond?

A)$843.14

B)$850.61

C)$1,181.54

D)$1,170.27

A)$843.14

B)$850.61

C)$1,181.54

D)$1,170.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

A bond may be issued by ________.

A)companies

B)state governments

C)the federal government

D)All of the above

A)companies

B)state governments

C)the federal government

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

The ________ is the expiration date of the bond.

A)future value

B)yield to maturity

C)maturity date

D)coupon

A)future value

B)yield to maturity

C)maturity date

D)coupon

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

Petty Productions Inc.recently issued 30-year $1,000 face value,12% annual coupon bonds.The market discount rate for this bond is only 7%.What is the current price of this bond?

A)$387.59

B)$597.24

C)$1,000.00

D)$1,620.45

A)$387.59

B)$597.24

C)$1,000.00

D)$1,620.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

The four steps to determining the price of a bond are:

A)determine the amount and timing of the present cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and add the PVs of the principal and coupons.

B)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the future value of the lump-sum principal and the annuity stream of coupons,and add the FVs of the principal and coupons.

C)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and multiply the PVs of the principal and coupons.

D)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and add the PVs of the principal and coupons.

A)determine the amount and timing of the present cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and add the PVs of the principal and coupons.

B)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the future value of the lump-sum principal and the annuity stream of coupons,and add the FVs of the principal and coupons.

C)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and multiply the PVs of the principal and coupons.

D)determine the amount and timing of the future cash flows,determine the appropriate discount rate,find the present value of the lump-sum principal and the annuity stream of coupons,and add the PVs of the principal and coupons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

The ________ is the return the bondholder receives on the bond if held to maturity.

A)coupon

B)coupon rate

C)yield to maturity

D)par rate

A)coupon

B)coupon rate

C)yield to maturity

D)par rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

The coupon payment for an annual-coupon corporate bond is equal to the yield to maturity multiplied by the par value of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

Hampton Construction Inc.has issued 20-year semiannual coupon bonds with a face value of $1,000.If the annual coupon rate is 12% and the current yield to maturity is 10%,what is the firm's current price per bond?

A)$934.20

B)$1,000.00

C)$1,171.59

D)$1,362.74

A)$934.20

B)$1,000.00

C)$1,171.59

D)$1,362.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

When pricing a zero-coupon bond,the convention is to use the semiannual pricing formula rather than the annual pricing formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume that today's date is August 15,2015 and that the Kroger Bond is an annual-coupon bond.Describe what each of the following terms mean and how each value was determined if appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Cougar Corporation has issued 20-year semiannual coupon bonds with a face value of $1,000.If the annual coupon rate is 10% and the current yield to maturity is 12%,what is the firm's current price per bond?

A)$850.61

B)$849.54

C)$1,170.27

D)$1,171.59

A)$850.61

B)$849.54

C)$1,170.27

D)$1,171.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

RC Inc.just issued zero-coupon bonds with a par value of $1,000.If the bond has a maturity of 15 years and a yield to maturity of 10%,what is the current price of the bond if it is priced in the conventional manner?

A)$1,000

B)$239.39

C)$231.38

D)This question cannot be answered because the coupon payment information is missing.

A)$1,000

B)$239.39

C)$231.38

D)This question cannot be answered because the coupon payment information is missing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between the price and the par value of a zero-coupon bond represents ________.

A)taxes payable by the bond buyer

B)the accumulated principal over the life of the bond

C)the bond premium

D)the accumulated interest over the life of the bond

A)taxes payable by the bond buyer

B)the accumulated principal over the life of the bond

C)the bond premium

D)the accumulated interest over the life of the bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

The coupon payment for an annual-coupon corporate bond is equal to the coupon rate multiplied by the current price of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

Johnson Products issued $1,000 face value 20-year bonds five years ago.These bonds are currently selling for $1,218.47.From this information we can conclude that the Johnson Products bonds have a yield-to-maturity greater than the coupon rate on these bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

Plymouth Fountains Inc.has issued 30-year semiannual coupon bonds with a face value of $1,000.If the annual coupon rate is 6% and the current yield to maturity is 7%,what is the firm's current price per bond?

A)$875.28

B)$1,000.00

C)$934.34

D)$466.79

A)$875.28

B)$1,000.00

C)$934.34

D)$466.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

Zero-coupon bonds are priced at deep discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

Endicott Enterprises Inc.has issued 30-year semiannual coupon bonds with a face value of $1,000.If the annual coupon rate is 14% and the current yield to maturity is 8%,what is the firm's current price per bond?

A)$578.82

B)$579.84

C)$1,675.47

D)$1,678.70

A)$578.82

B)$579.84

C)$1,675.47

D)$1,678.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

Endicott Enterprises Inc.has issued 30-year semiannual coupon bonds with a face value of $1,000.If the annual coupon rate is 14% and the current yield to maturity is 15%,what is the firm's current price per bond?

A)$934.20

B)$1,000.00

C)$934.34

D)$466.79

A)$934.20

B)$1,000.00

C)$934.34

D)$466.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following types of bonds,as characterized by a feature,by definition has two coupon payments per year?

A)Consol

B)Semiannual

C)Zero-coupon

D)Putable

A)Consol

B)Semiannual

C)Zero-coupon

D)Putable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

Vitmix Industries Inc.is issuing a zero-coupon bond that will have a maturity of fifty years.The bond's par value is $1,000,and the current yield on similar bonds is 7.5%.What is the expected price of this bond,using the semiannual convention?

A)$25.19

B)$250.19

C)$750.00

D)$1,000.00

A)$25.19

B)$250.19

C)$750.00

D)$1,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

The coupon rate for a bond is the interest rate for the coupons,stated in annual terms,and printed on the bond.It normally remains the same throughout the life of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

Most U.S.corporate and government bonds choose to make ________ coupon payments.

A)annual

B)semiannual

C)quarterly

D)monthly

A)annual

B)semiannual

C)quarterly

D)monthly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

Progressive Plastics Inc.issued 30-year 7% annual coupon bonds five years ago.Currently,the yield to maturity is 9.65% on these $1,000 par value bonds.What is the current price per bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

Zero-coupon U.S.Government bonds are known as ________.

A)STRIPS

B)muni-bonds

C)Uncle Sam's Empty Pockets

D)BLANKS

A)STRIPS

B)muni-bonds

C)Uncle Sam's Empty Pockets

D)BLANKS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Almost all corporate and government bonds pay coupons on an annual basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

Zero-coupon bonds are more difficult and time-consuming to price because of the extensive revision of the basic bond pricing formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

Rogue Outfitters Inc.has outstanding $1,000 face value 12% coupon bonds that make semiannual payments,and have 8 years remaining to maturity.If the current price for these bonds is $1,274.35,what is the annualized yield to maturity?

A)7.81%

B)7.40%

C)6.12%

D)6.00%

A)7.81%

B)7.40%

C)6.12%

D)6.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

Rogue Outfitters Inc.has outstanding $1,000 face value 8% coupon bonds that make semiannual payments,and have 14 years remaining to maturity.If the current price for these bonds is $1,118.74,what is the annualized yield to maturity?

A)6.68%

B)6.67%

C)6.12%

D)6.00%

A)6.68%

B)6.67%

C)6.12%

D)6.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

MicroMedia Inc.$1,000 par value bonds are selling for $832.Which of the following statements is TRUE?

A)The bonds must have more than six years to maturity.

B)The bonds are selling at a premium to the par value.

C)The coupon rate is greater than the yield to maturity.

D)None of the above is true.

A)The bonds must have more than six years to maturity.

B)The bonds are selling at a premium to the par value.

C)The coupon rate is greater than the yield to maturity.

D)None of the above is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

If the par value of a bond is equal to the bond price,then we know the yield to maturity is equal to the coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

MacroMedia Inc.$1,000 par value bonds are selling for $1,265.Which of the following statements is TRUE?

A)The bond market currently requires a rate (yield)less than the coupon rate.

B)The bonds are selling at a premium to the par value.

C)The coupon rate is greater than the yield to maturity.

D)All of the above are true.

A)The bond market currently requires a rate (yield)less than the coupon rate.

B)The bonds are selling at a premium to the par value.

C)The coupon rate is greater than the yield to maturity.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

Rogue Outfitters Inc.has outstanding $1,000 face value 4% coupon bonds that make semiannual payments,and have 10 years remaining to maturity.If the current price for these bonds is $938.57,what is the annualized yield to maturity?

A)4.78%

B)4.96%

C)5.02%

D)5.13%

A)4.78%

B)4.96%

C)5.02%

D)5.13%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

When the ________ is less than the yield to maturity,the bond sells at a/the ________ the par value.

A)coupon rate;premium over

B)coupon rate;discount to

C)time to maturity;discount to

D)time to maturity;same price as

A)coupon rate;premium over

B)coupon rate;discount to

C)time to maturity;discount to

D)time to maturity;same price as

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

The ________ is the interest rate printed on the bond.

A)coupon rate

B)semiannual coupon rate

C)yield to maturity

D)compound rate

A)coupon rate

B)semiannual coupon rate

C)yield to maturity

D)compound rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Douglas Dynamics Corporation $1,000 par value,15% annual coupon bonds,have 6 years remaining to maturity and are currently selling for $938.45.What is the firm's yield to maturity for these bonds?

A)15.00%

B)16.70%

C)16.66%

D)15.47%

A)15.00%

B)16.70%

C)16.66%

D)15.47%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Franklin Framing Inc.has twenty years remaining on $1,000 par value semiannual coupon bonds paying semiannual coupons of $40.If the yield to maturity on these bonds is 6% per year,what is the current price?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

Rogue Outfitters Inc.has outstanding $1,000 face value 8% coupon bonds that make semiannual payments,and have 14 years remaining to maturity.If the current price for these bonds is $987.24,what is the annualized yield to maturity?

A)8.00%

B)8.38%

C)8.15%

D)8.64%

A)8.00%

B)8.38%

C)8.15%

D)8.64%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

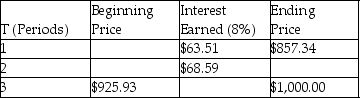

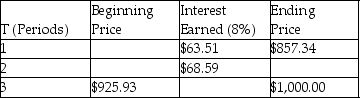

Complete the following zero-coupon amortization schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements about the relationship between yield to maturity and bond prices is FALSE?

A)When the yield to maturity and coupon rate are the same,the bond is called a par value bond.

B)A bond selling at a premium means that the coupon rate is greater than the yield to maturity.

C)When interest rates go up,bond prices go up.

D)A bond selling at a discount means that the coupon rate is less than the yield to maturity.

A)When the yield to maturity and coupon rate are the same,the bond is called a par value bond.

B)A bond selling at a premium means that the coupon rate is greater than the yield to maturity.

C)When interest rates go up,bond prices go up.

D)A bond selling at a discount means that the coupon rate is less than the yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

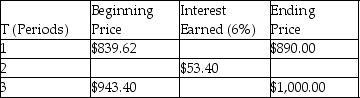

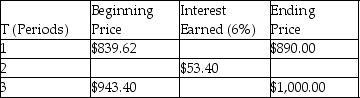

Complete the following zero-coupon amortization schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

Zero-coupon bonds are priced at steep premiums.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

When the coupon rate is less than the yield to maturity,the bond sells for a premium over the par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

Mountain Treks Inc.has issued ten-year zero-coupon bonds with a $1,000 face value.If the bonds are currently selling for $514.87,what is the yield to maturity?

A)6.75%

B)6.86%

C)10.45%

D)This question cannot be answered because there is no coupon payment provided.

A)6.75%

B)6.86%

C)10.45%

D)This question cannot be answered because there is no coupon payment provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

The ________ is a market derived interest rate used to discount the future cash flows of the bond.

A)coupon rate

B)semiannual coupon rate

C)yield to maturity

D)compound rate

A)coupon rate

B)semiannual coupon rate

C)yield to maturity

D)compound rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Bonsai Nursery Corporation has $1,000 par value bonds with a coupon rate of 8% per year making semiannual coupon payments.If there are twelve years remaining prior to maturity and these bonds are selling for $876.40,what is the yield to maturity for these bonds?

A)9.80%

B)8.00%

C)9.77%

D)8.33%

A)9.80%

B)8.00%

C)9.77%

D)8.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

Ringtones Inc.wishes to issue new bonds but is uncertain how the market would set the yield to maturity.The bonds would be 20-year,7% annual coupon bonds with a $1,000 par value.The firm has determined that these bonds would sell for $1,050 each.What is the yield to maturity for these bonds?

A)7.00%

B)6.55%

C)7.35%

D)6.54%

A)7.00%

B)6.55%

C)7.35%

D)6.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

Moody's has developed a corporate bond default-risk rating system using capital and lower case letters and numbers.Below are several examples of Moody's ratings.Which answer choice lists a collection of ratings for "high credit investment grade" bonds?

A)Baa1,A1,A3

B)Ba1,Baa2,Baa3

C)Aa2,Aa3,A1

D)Caa,Ca,C

A)Baa1,A1,A3

B)Ba1,Baa2,Baa3

C)Aa2,Aa3,A1

D)Caa,Ca,C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

The ________ is the written contract between the bond issuer and the bondholder.

A)debenture

B)sinking fund

C)indenture

D)corpus

A)debenture

B)sinking fund

C)indenture

D)corpus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

From 1980 to 2013,the default risk premium differential between Aaa-rated bonds and Aa-rated bonds has averaged between ________.

A)5 to 10 basis points

B)11 to 23 basis points

C)24 to 35 basis points

D)36 to 50 basis points

A)5 to 10 basis points

B)11 to 23 basis points

C)24 to 35 basis points

D)36 to 50 basis points

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

Describe the relationship between the yield to maturity and the coupon rate of a bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

"Junk" bonds are a street name for ________ grade bonds.

A)investment

B)speculative

C)extremely speculative

D)speculative and investment

A)investment

B)speculative

C)extremely speculative

D)speculative and investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

When real property is used as collateral for a bond,it is termed a/an ________.

A)debenture

B)mortgaged security

C)indenture

D)senior bond

A)debenture

B)mortgaged security

C)indenture

D)senior bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is NOT a category for rating classifications of bonds?

A)Investment grade bonds

B)American grade bonds

C)Extremely speculative grade bonds

D)Speculative grade bonds

A)Investment grade bonds

B)American grade bonds

C)Extremely speculative grade bonds

D)Speculative grade bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

When a company is in financial difficulty and cannot fully pay all of its creditors,the first lenders to be paid are the ________.

A)stockholders

B)sinking fund holders

C)junior debtholders

D)senior debtholders

A)stockholders

B)sinking fund holders

C)junior debtholders

D)senior debtholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

From 1980 to 2013,the default risk premium differential between Aaa-rated bonds and Baa-rated bonds has averaged between ________.

A)5 to 15 basis points

B)20 to 50 basis points

C)100 to 200 basis points

D)250 to 350 basis points

A)5 to 15 basis points

B)20 to 50 basis points

C)100 to 200 basis points

D)250 to 350 basis points

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

According to bond rating agencies,a bond rated "AAA" has a higher probability of default than a bond with a "BBB" rating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

Espresso Petroleum Inc.has a contractual option to buy back,prior to maturity,bonds the firm issued five years ago.This is an example of what type of bond?

A)Putable bond

B)Callable bond

C)Convertible bond

D)Junior bond

A)Putable bond

B)Callable bond

C)Convertible bond

D)Junior bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

If a bond is selling at a premium above the par value that means that the yield to maturity is greater than the coupon rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

________ are always unsecured bonds.

A)Mortgage bonds

B)Debentures

C)Callable bonds

D)Junior debt bonds

A)Mortgage bonds

B)Debentures

C)Callable bonds

D)Junior debt bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

Southern Transit Corporation has $1,000 par value,twenty-year,6% annual coupon bonds,outstanding currently selling for $696.25.What is the yield to maturity on these bonds? Use a calculator for your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

With a bearer bond,whoever held it was entitled to the ________ and the ________.

A)interest payments;principal

B)dividend payments;principal

C)interest payments;dividend payments

D)interest payments;voting rights

A)interest payments;principal

B)dividend payments;principal

C)interest payments;dividend payments

D)interest payments;voting rights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

A basis point is ________.

A)one-thousandth of a percentage point

B)one percentage point

C)one-tenth of a percentage point

D)one-hundredth of a percentage point

A)one-thousandth of a percentage point

B)one percentage point

C)one-tenth of a percentage point

D)one-hundredth of a percentage point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is NOT an example of a bond that contains an option feature?

A)Callable bond

B)Putable bond

C)Convertible bond

D)These are all examples of bonds with option features.

A)Callable bond

B)Putable bond

C)Convertible bond

D)These are all examples of bonds with option features.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

A higher bond rating usually means a lower yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

What type of risk is being rated when bond agencies assign ratings to outstanding debt? What are the two main reasons for having bond agencies rate bonds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

As the rating of a bond increases (for example,from A,to AA,to AAA),it generally means that

A)the credit rating increases,the default risk increases,and the required rate of return decreases.

B)the credit rating increases,the default risk decreases,and the required rate of return increases.

C)the credit rating increases,the default risk decreases,and the required rate of return decreases.

D)the credit rating decreases,the default risk decreases,and the required rate of return decreases.

A)the credit rating increases,the default risk increases,and the required rate of return decreases.

B)the credit rating increases,the default risk decreases,and the required rate of return increases.

C)the credit rating increases,the default risk decreases,and the required rate of return decreases.

D)the credit rating decreases,the default risk decreases,and the required rate of return decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck