Deck 4: Product Costing Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/88

العب

ملء الشاشة (f)

Deck 4: Product Costing Systems

1

The debit side of the manufacturing overhead account is used to accumulate:

A) actual manufacturing overhead costs as they are incurred throughout the accounting period.

B) overhead applied, to work in process inventory.

C) predetermined overhead.

D) overapplied overhead.

A) actual manufacturing overhead costs as they are incurred throughout the accounting period.

B) overhead applied, to work in process inventory.

C) predetermined overhead.

D) overapplied overhead.

A

2

Under Australian accounting standards, manufactured products are generally:

A) valued at market value and expensed in the period made.

B) valued at market value and expensed in the period sold.

C) valued at cost and expensed in the period made.

D) valued at cost and expensed in the period sold.

A) valued at market value and expensed in the period made.

B) valued at market value and expensed in the period sold.

C) valued at cost and expensed in the period made.

D) valued at cost and expensed in the period sold.

D

3

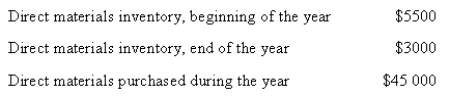

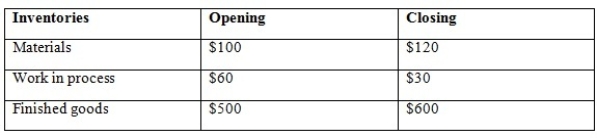

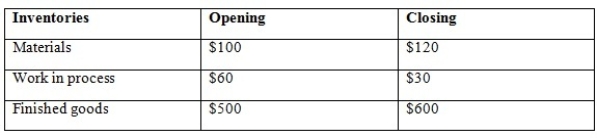

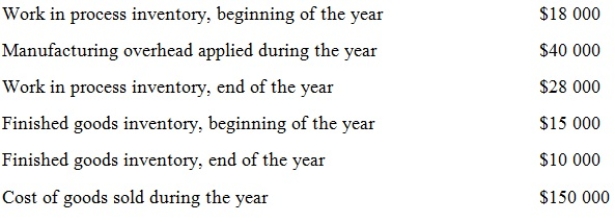

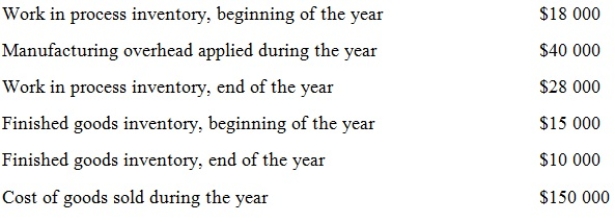

The following data apply to Stratford Ltd

Calculate the amount of direct materials used during the year.

A) $36 500

B) $42 500

C) $47 500

D) $53 500

Calculate the amount of direct materials used during the year.

A) $36 500

B) $42 500

C) $47 500

D) $53 500

C

4

A predetermined overhead rate is calculated as follows:

A) budgeted manufacturing overhead/budgeted amount of cost driver.

B) budgeted amount of cost driver/budgeted manufacturing overhead.

C) budgeted manufacturing overhead/budgeted amount of non-manufacturing overhead.

D) budgeted manufacturing overhead/ budgeted total expenses.

A) budgeted manufacturing overhead/budgeted amount of cost driver.

B) budgeted amount of cost driver/budgeted manufacturing overhead.

C) budgeted manufacturing overhead/budgeted amount of non-manufacturing overhead.

D) budgeted manufacturing overhead/ budgeted total expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

5

To transfer work in process inventory to finished goods inventory:

A) debit finished goods and credit work in process.

B) debit work in process and credit finished goods.

C) add direct labour to the work in process inventory.

D) add direct labour and direct materials to the finished goods inventory.

A) debit finished goods and credit work in process.

B) debit work in process and credit finished goods.

C) add direct labour to the work in process inventory.

D) add direct labour and direct materials to the finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is not correct regarding work in process?

A) Work in process is partially completed inventory.

B) Work in process consists of direct labour, direct material and allocated manufacturing overhead.

C) Work in process is debited as product costs are incurred.

D) Work in process is credited when goods are sold.

A) Work in process is partially completed inventory.

B) Work in process consists of direct labour, direct material and allocated manufacturing overhead.

C) Work in process is debited as product costs are incurred.

D) Work in process is credited when goods are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

7

If a manufacturer underestimated the manufacturing overhead budget and overestimates the activity base for the year, what is the result?

A) Overapplied factory overhead

B) Underapplied factory overhead

C) Overstated finished goods inventory

D) Understated work in process inventory

A) Overapplied factory overhead

B) Underapplied factory overhead

C) Overstated finished goods inventory

D) Understated work in process inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

8

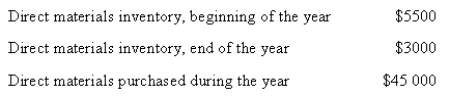

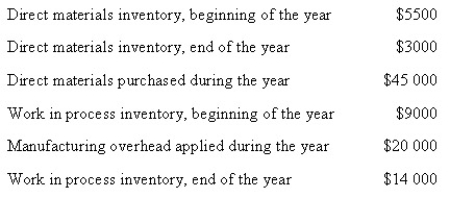

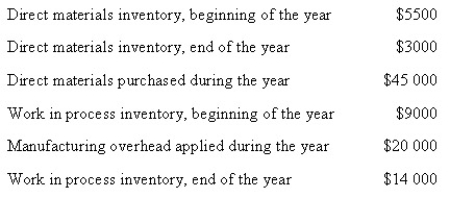

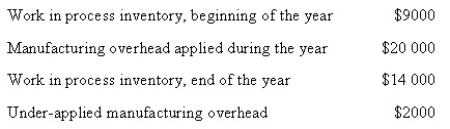

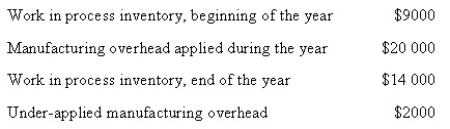

The following data apply to Stratford Ltd

Predetermined overhead rate-200 per cent of direct labour cost

Calculate the amount of direct labour cost incurred during the year.

A) $20 000

B) $18 000

C) $10 000

D) None of the given answers

Predetermined overhead rate-200 per cent of direct labour cost

Calculate the amount of direct labour cost incurred during the year.

A) $20 000

B) $18 000

C) $10 000

D) None of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

9

Manufacturing costs consist of:

A) direct materials.

B) conversion costs.

C) downstream costs.

D) direct materials and conversion costs, but not downstream costs.

A) direct materials.

B) conversion costs.

C) downstream costs.

D) direct materials and conversion costs, but not downstream costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

10

As production takes place, all manufacturing costs are debited to the:

A) work in process inventory account.

B) manufacturing overhead account.

C) cost of goods sold account.

D) finished goods account.

A) work in process inventory account.

B) manufacturing overhead account.

C) cost of goods sold account.

D) finished goods account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

11

Cost of goods sold is closed into the income summary account:

A) at the end of the production cycle.

B) when the product is sold.

C) at the end of the accounting period, along with other expenses and revenues of the period.

D) at no time.

A) at the end of the production cycle.

B) when the product is sold.

C) at the end of the accounting period, along with other expenses and revenues of the period.

D) at no time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

12

The following data apply to Stratford Ltd

What was the actual manufacturing overhead incurred during the year?

A) $22 000

B) $20 000

C) $18 000

D) $16 000

What was the actual manufacturing overhead incurred during the year?

A) $22 000

B) $20 000

C) $18 000

D) $16 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

13

When products are completed, their product costs are transferred from work in process inventory to the:

A) manufacturing overhead accounts.

B) finished goods account.

C) cost of goods sold account.

D) indirect labour account.

A) manufacturing overhead accounts.

B) finished goods account.

C) cost of goods sold account.

D) indirect labour account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

14

Consider the following statements regarding product cost information.

I) Product cost information is necessary for planning, cost control and providing information for making decisions.

Ii) Product cost information is not necessary to justify rate increases that are subject to the approval of government authorities.

Iii) Product cost information is necessary to value inventory on the balance sheet.

Which of the statement/s is/are correct?

A) i, ii and iii

B) i and ii

C) i and iii

D) iii

I) Product cost information is necessary for planning, cost control and providing information for making decisions.

Ii) Product cost information is not necessary to justify rate increases that are subject to the approval of government authorities.

Iii) Product cost information is necessary to value inventory on the balance sheet.

Which of the statement/s is/are correct?

A) i, ii and iii

B) i and ii

C) i and iii

D) iii

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

15

Process costing is normally used when:

A) large numbers of different products are manufactured.

B) large numbers of nearly identical products are manufactured.

C) small numbers of nearly identical products are manufactured.

D) the fixed costs of manufacturing exceed the variable cost of manufacturing.

A) large numbers of different products are manufactured.

B) large numbers of nearly identical products are manufactured.

C) small numbers of nearly identical products are manufactured.

D) the fixed costs of manufacturing exceed the variable cost of manufacturing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

16

Product costing is the process of:

A) accumulating the costs of a production process.

B) assigning costs to a firm's products.

C) placing a value on fixed assets owned by a producer.

D) accumulating the costs of a production process AND assigning costs to a firm's products.

A) accumulating the costs of a production process.

B) assigning costs to a firm's products.

C) placing a value on fixed assets owned by a producer.

D) accumulating the costs of a production process AND assigning costs to a firm's products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

17

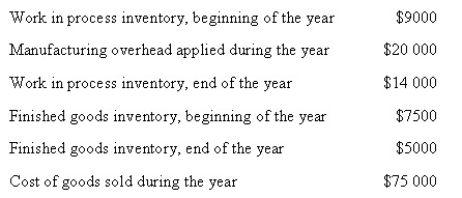

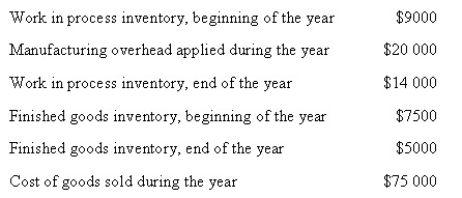

The following data apply to Stratford Ltd

Calculate the cost of goods manufactured during the year.

A) $62 500

B) $67 500

C) $70 500

D) $72 500

Calculate the cost of goods manufactured during the year.

A) $62 500

B) $67 500

C) $70 500

D) $72 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

18

Manufacturing overhead:

A) consists of direct material and direct labour costs.

B) is easily traced to jobs.

C) should not be assigned to individual jobs because it bears no obvious relationship to them.

D) is a heterogeneous pool of indirect production costs that can include gas and electricity costs and depreciation.

A) consists of direct material and direct labour costs.

B) is easily traced to jobs.

C) should not be assigned to individual jobs because it bears no obvious relationship to them.

D) is a heterogeneous pool of indirect production costs that can include gas and electricity costs and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

19

Gratis Company Ltd applies overhead based on direct labour hours in their printing department. At the beginning of the year, the company estimated that manufacturing overhead would be $550 000, direct labour hours would be 100 000 and direct labour cost would be $1 100 000 in the printing department. What is the printing department's predetermined overhead rate for the year?

A) $0.18 per direct labour hour

B) $0.50 per direct labour hour

C) $2.00 per direct labour hour

D) $5.50 per direct labour hour

A) $0.18 per direct labour hour

B) $0.50 per direct labour hour

C) $2.00 per direct labour hour

D) $5.50 per direct labour hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

20

Brainpower Pty Ltd is an advertising agency that uses a job costing system. Brainpower applies overhead to jobs based on direct professional labour hours. At the beginning of the year, overhead was estimated to be $75 000, direct professional labour hours were estimated to be 15 000, and direct professional labour cost was projected to be $225 000. During the year, Brainpower incurred actual overhead of $80 000, actual direct labour hours of 14 500 and actual direct labour cost of $222 000. What was Brainpower's overapplied or underapplied overhead during the year?

A) $5000 underapplied

B) $5000 overapplied

C) $7500 underapplied

D) $7500 overapplied

A) $5000 underapplied

B) $5000 overapplied

C) $7500 underapplied

D) $7500 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

21

When underapplied or overapplied overhead is allocated among the three accounts work in process, finished goods and cost of goods sold, this process is called:

A) proration.

B) just-in-time costing.

C) zero-based costing.

D) overhead application.

A) proration.

B) just-in-time costing.

C) zero-based costing.

D) overhead application.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

22

In which of the following industries could process costing be used?

A) Petroleum refining

B) Food processing

C) Paper mills

D) All of the given answers

A) Petroleum refining

B) Food processing

C) Paper mills

D) All of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

23

If manufacturing overhead is overapplied for the period, a method to bring the balance of the manufacturing overhead account to zero would be:

A) debit cost of goods sold, credit manufacturing overhead.

B) debit work in process inventory, credit manufacturing overhead.

C) debit manufacturing overhead, credit raw materials inventory.

D) debit manufacturing overhead, credit cost of goods sold.

A) debit cost of goods sold, credit manufacturing overhead.

B) debit work in process inventory, credit manufacturing overhead.

C) debit manufacturing overhead, credit raw materials inventory.

D) debit manufacturing overhead, credit cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

24

To accumulate costs under job costing

A) the cost of direct labour is assigned to each production job.

B) the cost of direct material is assigned to each production job.

C) the cost of manufacturing overhead is allocated to each production job.

D) All of the given answers

A) the cost of direct labour is assigned to each production job.

B) the cost of direct material is assigned to each production job.

C) the cost of manufacturing overhead is allocated to each production job.

D) All of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is true regarding job costing?

A) It is a type of product costing system used for small numbers of products produced in distinct batches.

B) It is used exclusively in manufacturing environments.

C) It is used for continuous mass production of products.

D) It is used exclusively for products of a similar nature.

A) It is a type of product costing system used for small numbers of products produced in distinct batches.

B) It is used exclusively in manufacturing environments.

C) It is used for continuous mass production of products.

D) It is used exclusively for products of a similar nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

26

If the manufacturing overhead account has a credit balance, then

A) manufacturing overhead is overapplied.

B) manufacturing overhead is underapplied.

C) cost of goods sold is understated.

D) manufacturing overhead is underapplied AND cost of goods sold is understated.

A) manufacturing overhead is overapplied.

B) manufacturing overhead is underapplied.

C) cost of goods sold is understated.

D) manufacturing overhead is underapplied AND cost of goods sold is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

27

Managers using costing data for making decisions will usually use the following data in product cost information.

A) Manufacturing costs

B) Manufacturing and upstream costs

C) Manufacturing and downstream costs

D) Manufacturing, upstream and downstream costs

A) Manufacturing costs

B) Manufacturing and upstream costs

C) Manufacturing and downstream costs

D) Manufacturing, upstream and downstream costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

28

Leisure Life manufactures a variety of sporting equipment. The firm's predetermined overhead application rate was 150 per cent of direct labour cost. Job 104 included direct material of $20 000 and total costs were $25 000. The manufacturing overhead applied to Job 104 to date is

A) $5000.

B) $2000.

C) $3000.

D) $2500.

A) $5000.

B) $2000.

C) $3000.

D) $2500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements is false?

A) In job costing, costs are accumulated by job order.

B) In process costing, the cost per unit is found by averaging the costs incurred over the units produced.

C) In process costing, the production costs are assigned to each unit produced.

D) In job costing, the cost of each unit of a particular job is found by dividing the total cost of the job by the number of units in the job.

A) In job costing, costs are accumulated by job order.

B) In process costing, the cost per unit is found by averaging the costs incurred over the units produced.

C) In process costing, the production costs are assigned to each unit produced.

D) In job costing, the cost of each unit of a particular job is found by dividing the total cost of the job by the number of units in the job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

30

Total manufacturing cost includes

A) direct material and direct labour in a job costing system.

B) direct labour and manufacturing overhead in a process costing system.

C) direct material, direct labour and manufacturing overhead in both job costing and process costing.

D) direct labour and manufacturing overhead in both a job costing and a process costing system.

A) direct material and direct labour in a job costing system.

B) direct labour and manufacturing overhead in a process costing system.

C) direct material, direct labour and manufacturing overhead in both job costing and process costing.

D) direct labour and manufacturing overhead in both a job costing and a process costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

31

In the valuation of inventory at the end of an accounting period, the following costs are included:

A) manufacturing costs.

B) manufacturing and upstream costs.

C) manufacturing and downstream costs.

D) manufacturing, upstream and downstream costs.

A) manufacturing costs.

B) manufacturing and upstream costs.

C) manufacturing and downstream costs.

D) manufacturing, upstream and downstream costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

32

The assignment of direct labour costs to individual jobs is based on

A) actual total payroll costs divided equally among all the jobs in process.

B) estimated total payroll costs divided equally among all the jobs in process.

C) the actual time spent on each job multiplied by the wage rate.

D) the estimated time spent on each job multiplied by the wage rate.

A) actual total payroll costs divided equally among all the jobs in process.

B) estimated total payroll costs divided equally among all the jobs in process.

C) the actual time spent on each job multiplied by the wage rate.

D) the estimated time spent on each job multiplied by the wage rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

33

When underapplied or overapplied manufacturing overhead is prorated, to which of the following accounts can amounts be assigned?

A) Direct materials, manufacturing overhead and direct labour

B) Cost of goods sold, work in process and finished goods

C) Direct materials, finished goods and cost of goods sold

D) Direct materials, work in process inventory and finished goods inventory

A) Direct materials, manufacturing overhead and direct labour

B) Cost of goods sold, work in process and finished goods

C) Direct materials, finished goods and cost of goods sold

D) Direct materials, work in process inventory and finished goods inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

34

On completion of products under a job cost system, costs are transferred as follows:

A) Debit finished goods inventory, credit work in process

B) Debit work in process, credit finished goods inventory

C) Debit cost of goods sold, credit work in process inventory

D) Debit work in process inventory, credit cost of goods sold

A) Debit finished goods inventory, credit work in process

B) Debit work in process, credit finished goods inventory

C) Debit cost of goods sold, credit work in process inventory

D) Debit work in process inventory, credit cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a manufacturing firm ends the year with underapplied overhead, one method of treatment is

A) debit manufacturing overhead, credit cost of goods sold.

B) debit cost of goods sold, credit manufacturing overhead.

C) debit work in process, credit manufacturing overhead.

D) debit finished goods inventory, credit manufacturing overhead.

A) debit manufacturing overhead, credit cost of goods sold.

B) debit cost of goods sold, credit manufacturing overhead.

C) debit work in process, credit manufacturing overhead.

D) debit finished goods inventory, credit manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

36

Leisure Life manufactures a variety of sporting equipment. The firm's predetermined overhead application rate was 150 per cent of direct labour cost. Job 101 included direct materials of $15 000 and direct labour of $6000.

The manufacturing overhead applied to Job 101 during the year was

A) $4000.

B) $6000.

C) $8000.

D) $9000.

The manufacturing overhead applied to Job 101 during the year was

A) $4000.

B) $6000.

C) $8000.

D) $9000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

37

The estimates used to calculate the predetermined overhead rate:

A) will generally prove to be incorrect to some degree.

B) will usually result in a non-zero balance left in the manufacturing overhead account at the end of the year.

C) are likely to result in either overapplied or underapplied overhead.

D) All of the given answers.

A) will generally prove to be incorrect to some degree.

B) will usually result in a non-zero balance left in the manufacturing overhead account at the end of the year.

C) are likely to result in either overapplied or underapplied overhead.

D) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is most complete and correct?

A) Job costing traces costs to departments and process costing traces costs to products.

B) Job costing develops the cost of products and process costing develops the costs of processes.

C) Both job and process costing develop the cost of products.

D) Both job and process costing are concerned with the cost of departments.

A) Job costing traces costs to departments and process costing traces costs to products.

B) Job costing develops the cost of products and process costing develops the costs of processes.

C) Both job and process costing develop the cost of products.

D) Both job and process costing are concerned with the cost of departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements is false?

I) Job costing accumulates costs by jobs or batches.

Ii) Process costing accumulates costs by departments or processes.

Iii) Process costing accumulates costs for specific time periods.

Iv) Job costing accumulates costs by departments.

A) i and ii

B) ii

C) iv

D) iii and iv

I) Job costing accumulates costs by jobs or batches.

Ii) Process costing accumulates costs by departments or processes.

Iii) Process costing accumulates costs for specific time periods.

Iv) Job costing accumulates costs by departments.

A) i and ii

B) ii

C) iv

D) iii and iv

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

40

In which of the following industries could job costing be used?

A) Machine shop and specialty manufacturing

B) Bread making

C) Cement production

D) Food processing

A) Machine shop and specialty manufacturing

B) Bread making

C) Cement production

D) Food processing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

41

Bambie Ltd. applies overheads based on direct labour hours. The company has budgeted 50 000 direct labour hours at a cost of $10 per hour, and manufacturing overhead of $750 000 in the assembly division for the year. The actual direct labour hours used for the year turns out to be 47 000 hours. What is the applied overhead for the year?

A) $705 000

B) $70 500

C) $750 000

D) 500 000

A) $705 000

B) $70 500

C) $750 000

D) 500 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

42

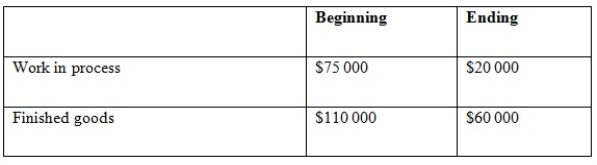

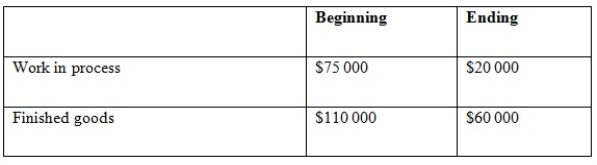

A firm's total overhead incurred for the year was $40 000, and at year-end the overhead component of WIP, FG and COGS were as follows:

If underapplied or overapplied overhead is to be prorated, what is the amount (to the nearest dollar) that will be transferred to WIP because of the proration?

A) Credit WIP with $945

B) Debit WIP with $945

C) Credit WIP with $974

D) Debit WIP with $974

If underapplied or overapplied overhead is to be prorated, what is the amount (to the nearest dollar) that will be transferred to WIP because of the proration?

A) Credit WIP with $945

B) Debit WIP with $945

C) Credit WIP with $974

D) Debit WIP with $974

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the work in process inventory has increased during the period, which of the following statements is definitely true?

A) Cost of goods sold will be greater than cost of goods manufactured.

B) Cost of goods manufactured will be greater than cost of goods sold.

C) Total manufacturing costs for the period will be greater than cost of goods manufactured.

D) Total manufacturing costs for the period will be less than cost of goods manufactured.

A) Cost of goods sold will be greater than cost of goods manufactured.

B) Cost of goods manufactured will be greater than cost of goods sold.

C) Total manufacturing costs for the period will be greater than cost of goods manufactured.

D) Total manufacturing costs for the period will be less than cost of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would appear on the debit side of the overhead account?

A) Actual overhead cost incurred in the period

B) Overhead applied (charged) to production

C) Overapplied overhead for the period

D) Actual overhead cost incurred in the period AND overapplied overhead for the period

A) Actual overhead cost incurred in the period

B) Overhead applied (charged) to production

C) Overapplied overhead for the period

D) Actual overhead cost incurred in the period AND overapplied overhead for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements about product costing is false?

A) Product costs may differ depending on the decision context.

B) Organisations should aim to have only one product costing system.

C) In designing a product costing system, managers need to make a careful assessment of costs and benefits associated with each element of the product cost.

D) Both current costs and future costs are relevant for managerial decisions.

A) Product costs may differ depending on the decision context.

B) Organisations should aim to have only one product costing system.

C) In designing a product costing system, managers need to make a careful assessment of costs and benefits associated with each element of the product cost.

D) Both current costs and future costs are relevant for managerial decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

46

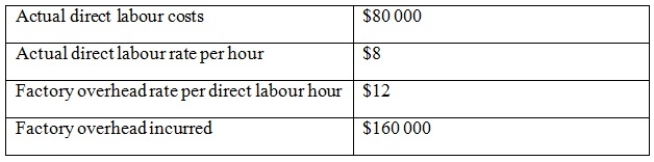

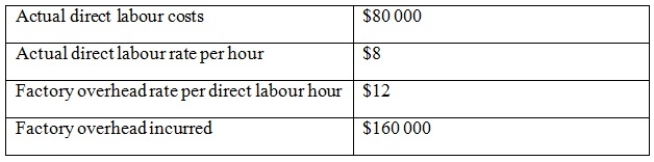

The following information relates to Wells Fargo for July 2008:

Assuming underapplied or overapplied overhead is transferred to cost of goods sold at the end of the period, which of the following would be the entry to the cost of goods sold account?

A) $80 000 debit

B) $80 000 credit

C) $40 000 credit

D) $40 000 debit

Assuming underapplied or overapplied overhead is transferred to cost of goods sold at the end of the period, which of the following would be the entry to the cost of goods sold account?

A) $80 000 debit

B) $80 000 credit

C) $40 000 credit

D) $40 000 debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements correctly completes this sentence? 'For a manufacturing firm, when goods are completed and ready for sale .....'

A) the firm's total assets are increased.

B) the firm's total assets are decreased.

C) there is no change in the value of the firm's assets.

D) the firm's work in process inventory is increased.

A) the firm's total assets are increased.

B) the firm's total assets are decreased.

C) there is no change in the value of the firm's assets.

D) the firm's work in process inventory is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

48

In calculating its predetermined overhead rate, a firm incorrectly called some items of indirect labour 'direct labour'. Since the firm uses direct labour costs as the basis for application of overhead costs, the effect of this error is to

A) underestimate the overhead rate.

B) overestimate the overhead rate.

C) underestimate direct labour costs.

D) underestimate the denominator used for allocating overhead.

A) underestimate the overhead rate.

B) overestimate the overhead rate.

C) underestimate direct labour costs.

D) underestimate the denominator used for allocating overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

49

For a particular period, Petersen's opening and closing work in process balances were $20 000 and $14 000 respectively. Direct materials used was $200 000 and overhead applied was $130 000. Cost of goods manufactured was $490 000. What was the amount of direct labour cost incurred for the period?

A) $148 000

B) $154 000

C) $160 000

D) $504 000

A) $148 000

B) $154 000

C) $160 000

D) $504 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

50

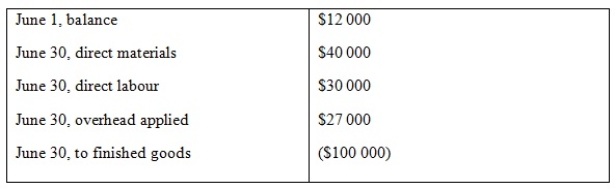

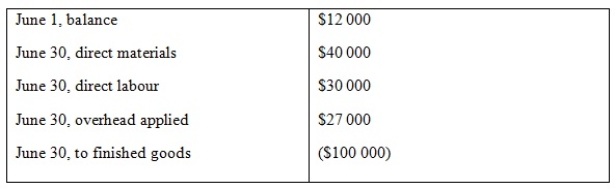

Howard Corporation has a job order costing system. The following debits (credits) appear in the firm's work in process account for the month of June:

Overhead is applied at 90 per cent of direct labour cost. There is only one job still in process at the end of June, and this job has been charged with $2250 factory overhead. What was the amount of direct materials charged to that job?

A) $2250

B) $2500

C) $4250

D) $9000

Overhead is applied at 90 per cent of direct labour cost. There is only one job still in process at the end of June, and this job has been charged with $2250 factory overhead. What was the amount of direct materials charged to that job?

A) $2250

B) $2500

C) $4250

D) $9000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

51

Product costs may be used for which of the following purposes?

I) Valuation of inventories

Ii) Management decision making

Iii) Pricing decisions

Iv) Cost control

A) i and ii

B) ii, iii and iv

C) i, ii and iii

D) All of the given answers

I) Valuation of inventories

Ii) Management decision making

Iii) Pricing decisions

Iv) Cost control

A) i and ii

B) ii, iii and iv

C) i, ii and iii

D) All of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following industries are likely to be using process costing?

I) Petroleum

Ii) Computer manufacture

Iii) Sugar refining

Iv) Furniture manufacture

A) i and ii

B) ii and iii

C) i and iii

D) ii and iv

I) Petroleum

Ii) Computer manufacture

Iii) Sugar refining

Iv) Furniture manufacture

A) i and ii

B) ii and iii

C) i and iii

D) ii and iv

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

53

The amount of overhead applied to jobs using a predetermined (budgeted) rate is rarely equal to the actual cost of overhead incurred for a period. Which of the following is not a valid explanation for this?

A) Actual spending for overhead is not equal to budgeted spending for overhead.

B) Actual use of the overhead allocation base is not equal to the budgeted use of the allocation base.

C) Budget estimates of overhead were unrealistically low.

D) Direct costs were unexpectedly high.

A) Actual spending for overhead is not equal to budgeted spending for overhead.

B) Actual use of the overhead allocation base is not equal to the budgeted use of the allocation base.

C) Budget estimates of overhead were unrealistically low.

D) Direct costs were unexpectedly high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following would appear on the credit side of the overhead account?

A) Actual overhead cost incurred in the period

B) Overhead applied (charged) to production

C) Underapplied overhead for the period

D) Overhead applied (charged) to production AND underapplied overhead for the period

A) Actual overhead cost incurred in the period

B) Overhead applied (charged) to production

C) Underapplied overhead for the period

D) Overhead applied (charged) to production AND underapplied overhead for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following costs should be considered when managers are making short term profitability analysis decisions?

A) Marketing costs

B) Design costs

C) Research and development costs

D) None of the above

A) Marketing costs

B) Design costs

C) Research and development costs

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following about using proration to dispose of underapplied or overapplied overhead is correct?

A) Proration is a less accurate method than closing the account to COGS, because it arbitrarily allocates overhead between the COGS account, WIP account, and finished goods account.

B) Proration is a less accurate method than closing the account to COGS, because the process affects three accounts rather than just one account.

C) Proration is a more accurate method than closing the account to COGS, because it recognises that over/under estimation of overhead rate affects more than just the COGS account.

D) Proration is a more accurate method than closing the account to COGS, because the potential distortion is spread out over three accounts.

A) Proration is a less accurate method than closing the account to COGS, because it arbitrarily allocates overhead between the COGS account, WIP account, and finished goods account.

B) Proration is a less accurate method than closing the account to COGS, because the process affects three accounts rather than just one account.

C) Proration is a more accurate method than closing the account to COGS, because it recognises that over/under estimation of overhead rate affects more than just the COGS account.

D) Proration is a more accurate method than closing the account to COGS, because the potential distortion is spread out over three accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following costs should managers focus on when making long term strategic pricing decisions?

A) Marketing costs

B) Design costs

C) Research and development costs

D) All of the above

A) Marketing costs

B) Design costs

C) Research and development costs

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

58

Select the relevant information from the following, and calculate the cost of goods available for sale:

Total manufacturing costs were $5390.

Cost of goods available for sale is:

A) $5300

B) $5320

C) $5920

D) None of the given answers

Total manufacturing costs were $5390.

Cost of goods available for sale is:

A) $5300

B) $5320

C) $5920

D) None of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

59

Snoozo Moozo manufactures bed frames and mattresses that are custom-made to a person's height and weight. It is a publicly listed company and therefore must comply with any applicable Australian accounting standards. Which of the following statements is most correct?

A) Snoozo Moozo should use job costing as it is more applicable to their production process.

B) Snoozo Moozo should use process costing as it is more applicable to their production process.

C) Snoozo Moozo should use process costing as it is more applicable to their production process and it is required under applicable accounting standards.

D) Snoozo Moozo may use either job costing or processing cost, as both are acceptable under applicable accounting standards and both methods can result in accurate production costs.

A) Snoozo Moozo should use job costing as it is more applicable to their production process.

B) Snoozo Moozo should use process costing as it is more applicable to their production process.

C) Snoozo Moozo should use process costing as it is more applicable to their production process and it is required under applicable accounting standards.

D) Snoozo Moozo may use either job costing or processing cost, as both are acceptable under applicable accounting standards and both methods can result in accurate production costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

60

Richardson & Sons purchased direct material worth $15 000 during the most recent period. At the end of the period the direct material account balance was $6000 larger than the beginning balance. Cost of goods sold was $150 000. Overhead is applied at 50 per cent of direct labour cost. Other account balances are:

What is the amount of prime cost added to production for the period?

A) $9000

B) $29 000

C) $33 000

D) $36 000

What is the amount of prime cost added to production for the period?

A) $9000

B) $29 000

C) $33 000

D) $36 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

61

Job costing and process costing

Differentiate between the types of manufacturing environments that would be suited to:

i. job costing and

ii. process costing

Include two examples of manufacturers that would fit each of these two environments.

Differentiate between the types of manufacturing environments that would be suited to:

i. job costing and

ii. process costing

Include two examples of manufacturers that would fit each of these two environments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

62

A list of all materials required for a particular job is most commonly referred to as

A) a source document.

B) a bill of materials.

C) a purchase order.

D) a schedule of goods manufactured.

A) a source document.

B) a bill of materials.

C) a purchase order.

D) a schedule of goods manufactured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

63

Applied overhead

Discuss the reasons for using applied overhead rather than actual overhead to determine the cost of production jobs.

Discuss the reasons for using applied overhead rather than actual overhead to determine the cost of production jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

64

In comparison to job-order costing, process costing is by far the most accurate costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

65

In a company where products undergo a number of separate processes, the process costing system

A) is not appropriate and job costing system should be used instead.

B) aggregates the costs of different processes and averages them out when calculating product costs.

C) requires the costs of undergoing different production processes to be determined simultaneously.

D) requires the costs of products that have completed processing in the earlier department to be transferred to the subsequent department.

A) is not appropriate and job costing system should be used instead.

B) aggregates the costs of different processes and averages them out when calculating product costs.

C) requires the costs of undergoing different production processes to be determined simultaneously.

D) requires the costs of products that have completed processing in the earlier department to be transferred to the subsequent department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

66

Management can hold department managers responsible for costs incurred in their area by

A) tracking production costs to production departments.

B) dividing total production costs by the number of production areas.

C) keeping work in process to a minimum in each area.

D) employing experienced production managers.

A) tracking production costs to production departments.

B) dividing total production costs by the number of production areas.

C) keeping work in process to a minimum in each area.

D) employing experienced production managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

67

Underapplied overhead

i. Describe how overhead may be underapplied.

ii. Assume that underapplied overhead is treated as an adjustment to cost of goods sold. Explain why an under application of overhead increases cost of goods sold.

i. Describe how overhead may be underapplied.

ii. Assume that underapplied overhead is treated as an adjustment to cost of goods sold. Explain why an under application of overhead increases cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

68

Explain the difference between direct labour costs and indirect labour costs. How would this information be captured on a timesheet by an employee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

69

In the general ledger, the production costs are transferred through the work in process inventory accounts to

A) production costs account.

B) costs of goods sold account.

C) finished goods inventory account.

D) work in process account.

A) production costs account.

B) costs of goods sold account.

C) finished goods inventory account.

D) work in process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

70

Valuing inventories using net realisable value method requires managers to:

A) estimate sales value of the components of the merchandise, less any anticipated conversion costs.

B) estimate costs of the merchandise based on the most recent job cost sheets.

C) estimate sales value of the merchandise less any anticipated costs of completing and selling the products.

D) estimate sales value of the merchandise, disregarding any anticipated costs of completing and selling the products.

A) estimate sales value of the components of the merchandise, less any anticipated conversion costs.

B) estimate costs of the merchandise based on the most recent job cost sheets.

C) estimate sales value of the merchandise less any anticipated costs of completing and selling the products.

D) estimate sales value of the merchandise, disregarding any anticipated costs of completing and selling the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

71

The flow of manufacturing overheads is:

Raw materials WIP Finished Goods COGS

Raw materials WIP Finished Goods COGS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

72

To calculate a predetermined overhead rate, budgeted overheads are divided by the actual cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

73

Snoozo Moozo manufactures bed frames and mattresses that are custom-made to a person's height and weight. Last week, Stevie Oslow, a bed frame specialist, reported spending 35 hours working on a number of bed frames, including 5 hours overtime. Barry is paid $20 per hour ordinarily, and $30 per hour when working overtime. Which of the following journal entries are most appropriate in accounting for Barry's wages for the 35 hours?

A) Credit Wage Payable $750, Debit WIP $750

B) Credit Wage Payable $750, Debit WIP $700, Debit Manufacturing overhead $50

C) Credit Wage Payable $750, Debit WIP $600, Debit Manufacturing overhead $150

D) Credit Wage Payable $600, Credit other expenses $150, Debit WIP $750

A) Credit Wage Payable $750, Debit WIP $750

B) Credit Wage Payable $750, Debit WIP $700, Debit Manufacturing overhead $50

C) Credit Wage Payable $750, Debit WIP $600, Debit Manufacturing overhead $150

D) Credit Wage Payable $600, Credit other expenses $150, Debit WIP $750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

74

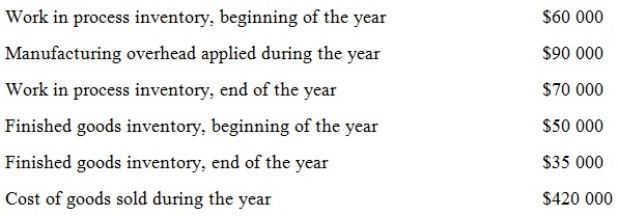

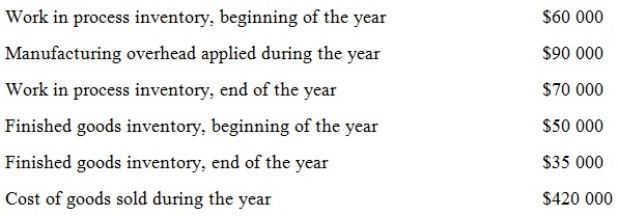

The following data apply to Brewers Ltd

Calculate the cost of goods manufactured during the year.

A) $122 000

B) $135 000

C) $145 000

D) $150 000

Calculate the cost of goods manufactured during the year.

A) $122 000

B) $135 000

C) $145 000

D) $150 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

75

With job costing, a job cost sheet is used to record the manufacturing overheads allocated, when finishing a specific job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

76

Under AASB102 Inventories the cost of inventory must include

A) administration and selling costs.

B) transportation and handling costs.

C) storage costs.

D) abnormal wastage costs.

A) administration and selling costs.

B) transportation and handling costs.

C) storage costs.

D) abnormal wastage costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

77

When overheads are over-allocated, the actual overheads incurred are greater than those allocated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

78

The following data apply to Easy Chairs Ltd

Calculate the cost of goods manufactured during the year.

A) $420 000

B) $405 000

C) $385 000

D) $370 000

Calculate the cost of goods manufactured during the year.

A) $420 000

B) $405 000

C) $385 000

D) $370 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

79

Flow of costs

Describe the flow of goods through the manufacturing accounts in order to calculate cost of goods sold.

Describe the flow of goods through the manufacturing accounts in order to calculate cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following factors influences management's approach to process costing?

A) The degree to which products are identical in their consumption of direct materials

B) The existence of work in process inventory at the end of the accounting period

C) The degree to which products are identical in their specific production processes

D) All of the given answers

A) The degree to which products are identical in their consumption of direct materials

B) The existence of work in process inventory at the end of the accounting period

C) The degree to which products are identical in their specific production processes

D) All of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck