Deck 17: Operational Decision-Making Tools: Decision Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/38

العب

ملء الشاشة (f)

Deck 17: Operational Decision-Making Tools: Decision Analysis

1

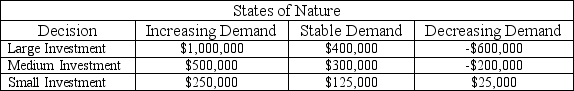

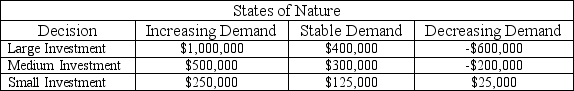

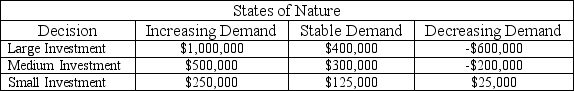

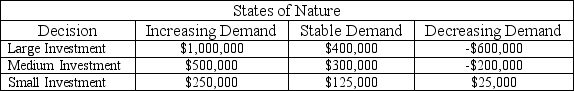

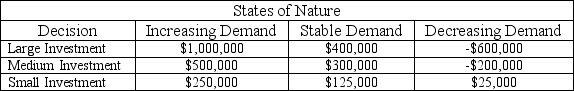

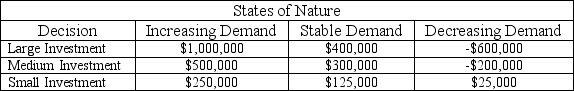

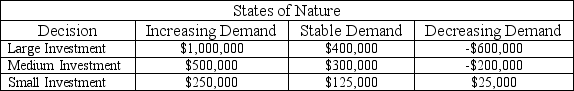

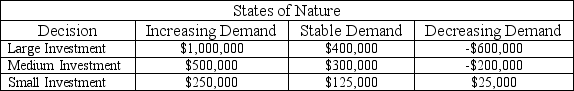

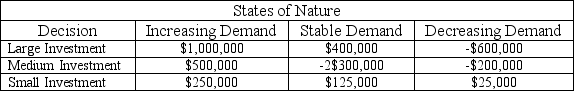

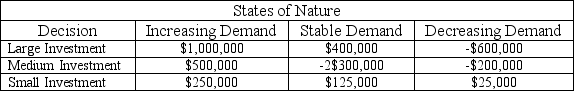

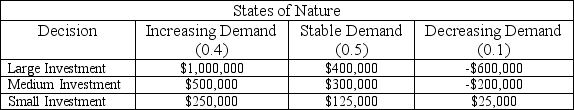

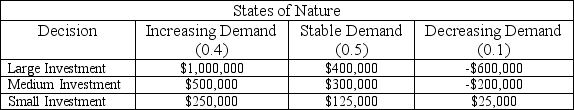

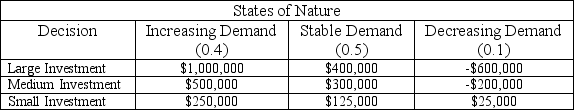

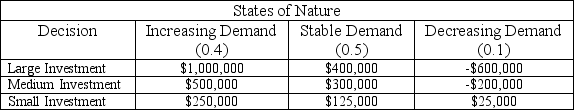

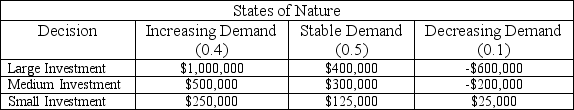

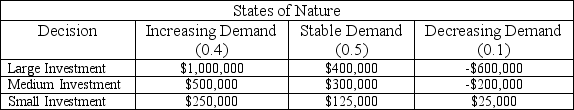

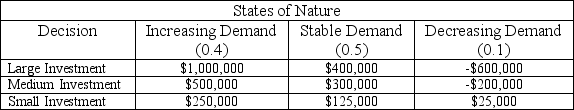

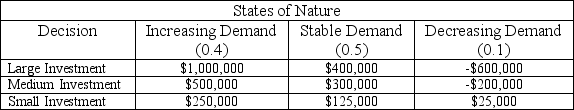

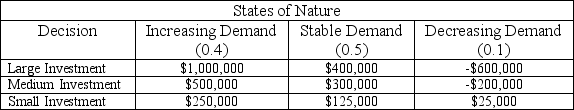

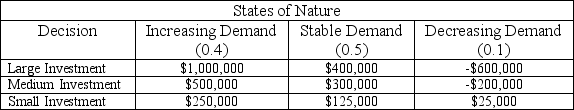

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation.  The best decision for Fairco using the maximin criterion would be to

The best decision for Fairco using the maximin criterion would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose stable demand.

The best decision for Fairco using the maximin criterion would be to

The best decision for Fairco using the maximin criterion would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose stable demand.

C

2

Quantitative methods are tools available to operations managers to help make a decision or recommendation.

True

3

Which of the following techniques is the most widely used decision-making criterion under risk?

A) maximax criterion

B) minimax regret criterion

C) expected value criterion

D) Hurwicz criterion

A) maximax criterion

B) minimax regret criterion

C) expected value criterion

D) Hurwicz criterion

C

4

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation.  The best decision for Fairco using the Hurwicz criterion with a coefficient of optimism equal to 0.80 would be to

The best decision for Fairco using the Hurwicz criterion with a coefficient of optimism equal to 0.80 would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose stable demand.

The best decision for Fairco using the Hurwicz criterion with a coefficient of optimism equal to 0.80 would be to

The best decision for Fairco using the Hurwicz criterion with a coefficient of optimism equal to 0.80 would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose stable demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

5

The most widely used decision-making criterion for situations with risk is expected value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

6

A sequential decision tree is a graphical method for analyzing decision situations that require a sequence of decisions over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

7

Decision analysis is a quantitative technique supporting decision-making with uncertainty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

8

A payoff table is a quantitative technique supporting decision-making under uncertainty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

9

Quantitative methods are tools available to operations managers to help make a decision but not a recommendation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

10

The outcome of a decision is referred to as a payoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

11

When probabilities are assigned to states of nature the situation is referred to as decision-making under uncertainty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

12

The maximum value of perfect information to the decision maker is known as

A) the expected value of perfect information.

B) the expected value of imperfect information.

C) the minimum of the minimax regret.

D) None of these answers is correct.

A) the expected value of perfect information.

B) the expected value of imperfect information.

C) the minimum of the minimax regret.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

13

A decision criterion in which the decision payoffs are weighted by a coefficient of optimism is known as the Hurwicz criterion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

14

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation.  The best decision for Fairco using the equal likelihood criterion would be to

The best decision for Fairco using the equal likelihood criterion would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose increasing demand.

The best decision for Fairco using the equal likelihood criterion would be to

The best decision for Fairco using the equal likelihood criterion would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose increasing demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

15

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation.  The best decision for Fairco using the maximax criterion would be to

The best decision for Fairco using the maximax criterion would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose increasing demand.

The best decision for Fairco using the maximax criterion would be to

The best decision for Fairco using the maximax criterion would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose increasing demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

16

A decision criterion that results in the maximum of the minimum payoffs is called a maximin criterion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

17

When probabilities can be assigned to the occurrence of states of nature in the future, the situation is referred to as

A) decision-making under risk.

B) decision-making under certainty.

C) decision-making under uncertainty.

D) None of these answers is correct.

A) decision-making under risk.

B) decision-making under certainty.

C) decision-making under uncertainty.

D) None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

18

In a decision-making situation, the events that may occur in the future are known as states of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

19

The LaPlace criterion is a decision criterion in which each state of nature is weighted equally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

20

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The following payoff table describes the decision situation.  The best decision for Fairco using the minimax regret decision criterion would be to

The best decision for Fairco using the minimax regret decision criterion would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose decreasing demand.

The best decision for Fairco using the minimax regret decision criterion would be to

The best decision for Fairco using the minimax regret decision criterion would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose decreasing demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

21

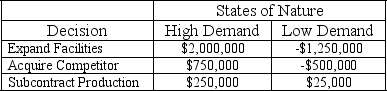

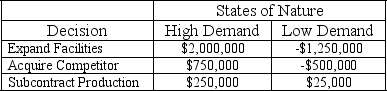

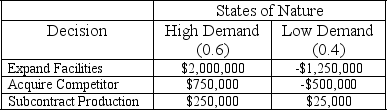

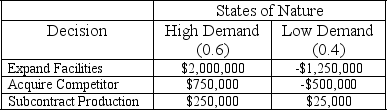

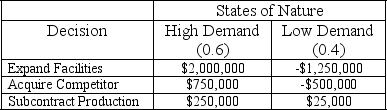

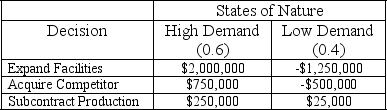

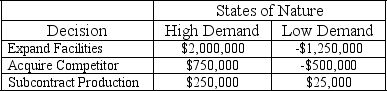

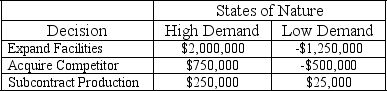

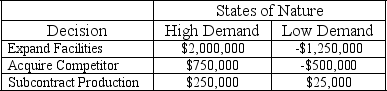

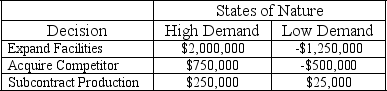

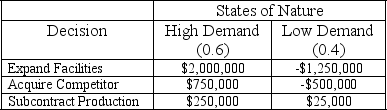

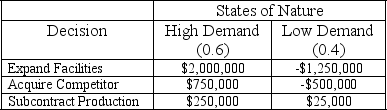

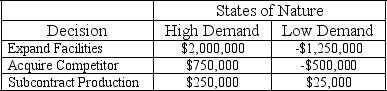

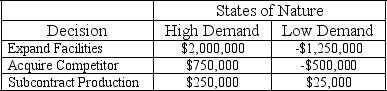

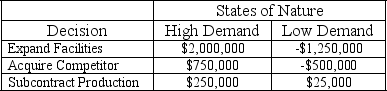

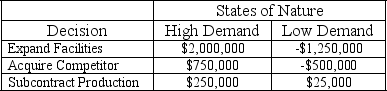

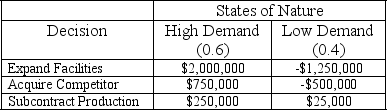

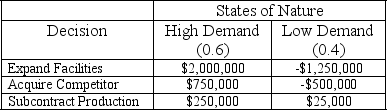

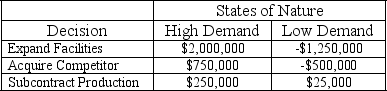

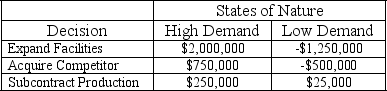

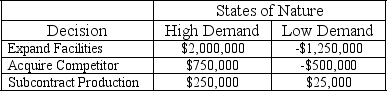

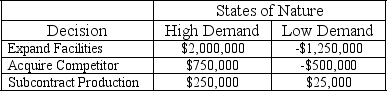

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The best decision for Kallie Inc. using the maximax decision criterion is to

The best decision for Kallie Inc. using the maximax decision criterion is to

A) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

The best decision for Kallie Inc. using the maximax decision criterion is to

The best decision for Kallie Inc. using the maximax decision criterion is toA) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is decision analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

23

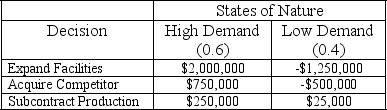

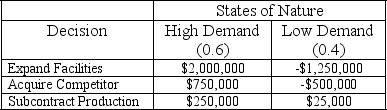

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand, with probabilities of 0.6 and 0.4, respectively. The following payoff table describes the company's decision situation.  The expected value for the acquire competitor decision is

The expected value for the acquire competitor decision is

A) $250,000.

B) $160,000.

C) $700,000.

D) $1,200,000.

The expected value for the acquire competitor decision is

The expected value for the acquire competitor decision isA) $250,000.

B) $160,000.

C) $700,000.

D) $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

24

Kallie Inc., a, small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand, with probabilities of 0.6 and 0.4, respectively. The following payoff table describes the company's decision situation.  The expected value for the expand facilities decision is

The expected value for the expand facilities decision is

A) $250,000.

B) $160,000.

C) $700,000.

D) $1,200,000.

The expected value for the expand facilities decision is

The expected value for the expand facilities decision isA) $250,000.

B) $160,000.

C) $700,000.

D) $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

25

Kallie Inc., a, small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The best decision for Kallie Inc., using the Hurwicz decision criterion with a coefficient of optimism equal to 0.3 is to

The best decision for Kallie Inc., using the Hurwicz decision criterion with a coefficient of optimism equal to 0.3 is to

A) expand facilities.

B) acquire competitor.

C) subcontract production.

D) make no decision.

The best decision for Kallie Inc., using the Hurwicz decision criterion with a coefficient of optimism equal to 0.3 is to

The best decision for Kallie Inc., using the Hurwicz decision criterion with a coefficient of optimism equal to 0.3 is toA) expand facilities.

B) acquire competitor.

C) subcontract production.

D) make no decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

26

The expected value for

Small Investment $100,000+62,500+$2,500=$165,000

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation. The expected value for the medium investment decision is

The expected value for the medium investment decision is

A) $600,000.

B) $540,000.

C) $330,000.

D) $165,000.

Small Investment $100,000+62,500+$2,500=$165,000

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation.

The expected value for the medium investment decision is

The expected value for the medium investment decision isA) $600,000.

B) $540,000.

C) $330,000.

D) $165,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

27

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The regret that is associated with the decision to acquire competitor when demand is low is

The regret that is associated with the decision to acquire competitor when demand is low is

A) $0.

B) $525,000.

C) $1,250,000.

D) $1,275,000.

The regret that is associated with the decision to acquire competitor when demand is low is

The regret that is associated with the decision to acquire competitor when demand is low isA) $0.

B) $525,000.

C) $1,250,000.

D) $1,275,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

28

Fairco, a family business is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation.  The expected value of perfect information for Fairco is

The expected value of perfect information for Fairco is

A) $602,500.

B) $540,000.

C) $62,500.

D) $25,000.

The expected value of perfect information for Fairco is

The expected value of perfect information for Fairco isA) $602,500.

B) $540,000.

C) $62,500.

D) $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

29

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation.  The expected value for the large investment decision is

The expected value for the large investment decision is

A) $700,000.

B) $540,000.

C) $330,000.

D) $165,000.

The expected value for the large investment decision is

The expected value for the large investment decision isA) $700,000.

B) $540,000.

C) $330,000.

D) $165,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

30

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand, with probabilities of 0.6 and 0.4, respectively. The following payoff table describes the company's decision situation.  The expected value for the subcontract production decision is

The expected value for the subcontract production decision is

A) $250,000

B) $160,000

C) $700,000

D) $1,200,000

The expected value for the subcontract production decision is

The expected value for the subcontract production decision isA) $250,000

B) $160,000

C) $700,000

D) $1,200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

31

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The best decision for Kallie Inc. using the equal likelihood criterion is to

The best decision for Kallie Inc. using the equal likelihood criterion is to

A) expand facilities.acquire competitor.

B) subcontract production.

C) select high demand.

The best decision for Kallie Inc. using the equal likelihood criterion is to

The best decision for Kallie Inc. using the equal likelihood criterion is toA) expand facilities.acquire competitor.

B) subcontract production.

C) select high demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

32

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The best decision for Kallie Inc. using the minimax regret decision criterion is to

The best decision for Kallie Inc. using the minimax regret decision criterion is to

A) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

The best decision for Kallie Inc. using the minimax regret decision criterion is to

The best decision for Kallie Inc. using the minimax regret decision criterion is toA) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

33

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand, with probabilities of 0.6 and 0.4, respectively. The following payoff table describes the company's decision situation.  The expected value of perfect information for Kallie Inc.is

The expected value of perfect information for Kallie Inc.is

A) $1,210,000.

B) $700,000.

C) $510,000..

D) $312,500

The expected value of perfect information for Kallie Inc.is

The expected value of perfect information for Kallie Inc.isA) $1,210,000.

B) $700,000.

C) $510,000..

D) $312,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation.  If the expected value criterion is used, then the best decision would be to

If the expected value criterion is used, then the best decision would be to

A) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose the stable demand.

If the expected value criterion is used, then the best decision would be to

If the expected value criterion is used, then the best decision would be toA) make the large investment.

B) make the medium investment.

C) make the small investment.

D) choose the stable demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

35

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The best decision for Kallie Inc. using the maximin decision criterion is to

The best decision for Kallie Inc. using the maximin decision criterion is to

A) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

The best decision for Kallie Inc. using the maximin decision criterion is to

The best decision for Kallie Inc. using the maximin decision criterion is toA) expand facilities.

B) acquire competitor.

C) subcontract production.

D) select high demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

36

A small parts manufacturer has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand, with probabilities of 0.6 and 0.4, respectively. The following payoff table describes the company's decision situation.  The best decision according to the expected value criterion is

The best decision according to the expected value criterion is

A) Acquire Competitor.

B) Expand Facilities.

C) Subcontract Production.

D) High Demand

The best decision according to the expected value criterion is

The best decision according to the expected value criterion isA) Acquire Competitor.

B) Expand Facilities.

C) Subcontract Production.

D) High Demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

37

Kallie Inc., a small parts manufacturer, has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience high market demand or low market demand. The following payoff table describes the company's decision situation.  The value of the Hurwicz decision criterion for subcontract production when the coefficient of optimism is 0.30 is

The value of the Hurwicz decision criterion for subcontract production when the coefficient of optimism is 0.30 is

A) $92,500.

B) $182,500.

C) $250,000.

D) $275,000.

The value of the Hurwicz decision criterion for subcontract production when the coefficient of optimism is 0.30 is

The value of the Hurwicz decision criterion for subcontract production when the coefficient of optimism is 0.30 isA) $92,500.

B) $182,500.

C) $250,000.

D) $275,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck

38

Fairco, a family business, is considering making an investment in its manufacturing operation. Three decisions are under consideration: (1) a large investment; (2) a medium investment; and (3) a small investment. The business believes that there are three possible future outcomes for its product: (1) increasing demand; (2) stable demand; and (3) decreasing demand. The business believes that the probability for increasing, stable and decreasing product demand are 0.4, 0.5, and 0.1, respectively. The following payoff table describes the decision situation.  The expected value for the small investment decision is

The expected value for the small investment decision is

A) $540,000.

B) $400,000.

C) $330,000.

D) $165,000.

The expected value for the small investment decision is

The expected value for the small investment decision isA) $540,000.

B) $400,000.

C) $330,000.

D) $165,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 38 في هذه المجموعة.

فتح الحزمة

k this deck