Deck 17: Accounting and Reporting for the Federal Government

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 17: Accounting and Reporting for the Federal Government

1

Fund balances of a federal agency's various funds are reported in the fund equity section of the agency's balance sheet.

False

2

Federal government agencies prepare a management's discussion and analysis (MD&A) to be included in their general purpose federal financial report.

True

3

Under SFFAC No. 2, all federal agencies are defined as separate reporting entities for financial statement preparation and reporting purposes.

False

4

The financial statements of the U.S. government are prepared using generally accepted accounting principles promulgated by the Governmental Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

The purpose of revolving funds of the federal government is similar to that of proprietary funds of state and local governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

Social Security is an example of a trust fund administered by the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

The federal budgetary term "commitment" is synonymous with "appropriations" as used in state and local government terminology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

The objectives of federal financial reporting are to assist report users in evaluating budgetary integrity, operating performance, stewardship, and adequacy of systems and controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

An expended appropriation occurs when cash has been disbursed to pay for a good or service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Responsibility for setting accounting and reporting standards for federal agencies rests primarily with the Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

An example of a federal government general property, plant, and equipment asset would be Yellowstone National Park.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

At the present time, the conceptual framework for the federal government and its agencies does not provide definitions of the basic elements of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to FASAB, entity assets are defined as those assets arising from transactions between federal entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

Heritage assets are defined as beneficial investments of the federal government in items such as nonfederal physical property, human capital, and research and development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cumulative results of operations is the component of net position in a federal agency balance sheet that represents the amount of appropriations still available for obligation, or which has been obligated but not yet expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Unexpended appropriations is the component of net position in a federal agency balance sheet that represents the amount of appropriations still available for obligation, or which has been obligated but not yet expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

Objectives that are identified by SFFAC No. 1 for federal financial reporting include budgetary integrity, operating performance, transparency, and stewardship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

Federal departments and agencies should utilize the U.S. Government Standard General Ledger as the account structure for their accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

By law, federal agencies must incorporate the accounting standards (GAAP) established for the federal government into their financial management systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Similar to state and local governments, the federal government uses funds to demonstrate funds are being used for their intended purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Stewardship assets are reported as a classification within the property, plant, and equipment section of the federal balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

The fund balances of a federal reporting entity should be separated into unexpended appropriations, restricted appropriations, and cumulative fund balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Comptroller General of the United States is the head of the:

A) Office of the Management and Budget.

B) Government Accountability Office.

C) Congressional Budget Office.

D) Federal Accounting Standards Advisory Board.

A) Office of the Management and Budget.

B) Government Accountability Office.

C) Congressional Budget Office.

D) Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following officials has shared responsibility under federal law for establishing and maintaining a sound financial structure for the federal government?

A) Chief Financial Officer of the Congressional Budget Office.

B) Chair of the Governmental Accounting Standards Board.

C) Secretary of the Treasury.

D) Chair of the Federal Accounting Standards Advisory Board.

A) Chief Financial Officer of the Congressional Budget Office.

B) Chair of the Governmental Accounting Standards Board.

C) Secretary of the Treasury.

D) Chair of the Federal Accounting Standards Advisory Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

A certain federal agency placed an order for office supplies at an estimated cost of $14,400. Later in the same fiscal year these supplies were received at an actual cost of $14,800. Assume commitment accounting is not used by this agency. At the time the order is received, what is the net effect on the budgetary and proprietary track accounts?

A) Budgetary Accounts: $14,400; Proprietary Accounts: $14,400.

B) Budgetary Accounts: $14,400; Proprietary Accounts: $14,800.

C) Budgetary Accounts: $400; Proprietary Accounts: $14,800.

D) Budgetary Accounts: $0; Proprietary Accounts: $14,800.

A) Budgetary Accounts: $14,400; Proprietary Accounts: $14,400.

B) Budgetary Accounts: $14,400; Proprietary Accounts: $14,800.

C) Budgetary Accounts: $400; Proprietary Accounts: $14,800.

D) Budgetary Accounts: $0; Proprietary Accounts: $14,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

As described in Statement of Federal Financial Accounting Concepts (SFFAC) No. 2 "Entity and Display," which of the following is an accurate list of the three perspectives from which the federal government can be viewed?

A) Function, department, and program.

B) Organization, budget, and program.

C) Budget, program, and line-item.

D) Fund, activity, and account.

A) Function, department, and program.

B) Organization, budget, and program.

C) Budget, program, and line-item.

D) Fund, activity, and account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not a part of the FASAB due process for establishing a federal financial accounting standard?

A) Public comment on a discussion memorandum.

B) Issuing an exposure draft.

C) Unanimous approval by the FASAB.

D) Support (or lack of opposition) of the standard by the three principals (Comptroller General, Secretary of the Treasury, and Director of the Office of Management and Budget).

A) Public comment on a discussion memorandum.

B) Issuing an exposure draft.

C) Unanimous approval by the FASAB.

D) Support (or lack of opposition) of the standard by the three principals (Comptroller General, Secretary of the Treasury, and Director of the Office of Management and Budget).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

A certain federal agency placed an order for office supplies at an estimated cost of $14,400. Later in the same fiscal year these supplies were received at an actual cost of $14,800. Assume commitment accounting is not used by this agency. At the time the order is placed, what is the net effect on the budgetary and proprietary track accounts?

A) Budgetary accounts: $14,400; Proprietary accounts: $14,400.

B) Budgetary accounts: $14,400; Proprietary accounts: $0.

C) Budgetary accounts: $14,400; Proprietary accounts: $14,800.

D) Budgetary accounts: $0; Proprietary accounts: $0.

A) Budgetary accounts: $14,400; Proprietary accounts: $14,400.

B) Budgetary accounts: $14,400; Proprietary accounts: $0.

C) Budgetary accounts: $14,400; Proprietary accounts: $14,800.

D) Budgetary accounts: $0; Proprietary accounts: $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is not an objective identified in FASAB Statement of Accounting and Reporting Concepts No. 1 ?

A) To assist report users in evaluating budgetary integrity.

B) To assist report users in evaluating the extent to which tax burdens have changed.

C) To assist report users in evaluating stewardship.

D) To assist report users in evaluating operating performance.

A) To assist report users in evaluating budgetary integrity.

B) To assist report users in evaluating the extent to which tax burdens have changed.

C) To assist report users in evaluating stewardship.

D) To assist report users in evaluating operating performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not a fund group used by the federal government?

A) General Fund.

B) Permanent Fund.

C) Special Fund.

D) Trust Fund.

A) General Fund.

B) Permanent Fund.

C) Special Fund.

D) Trust Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements most accurately describes the dual-track accounting system used in federal agency accounting?

A) Recording internal budgetary transactions and proprietary transactions with external parties on a modified accrual basis of accounting.

B) Use of double-entry accounting.

C) Maintaining self-balancing sets of proprietary and budgetary accounts and recording the effects of transactions on both available budgetary resources and proprietary accounts.

D) Keeping separate books, one on a tax basis and the other on a GAAP basis.

A) Recording internal budgetary transactions and proprietary transactions with external parties on a modified accrual basis of accounting.

B) Use of double-entry accounting.

C) Maintaining self-balancing sets of proprietary and budgetary accounts and recording the effects of transactions on both available budgetary resources and proprietary accounts.

D) Keeping separate books, one on a tax basis and the other on a GAAP basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

When an appropriation is passed a federal agency would record entries in both the budgetary and the proprietary track accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

A federal agency does not record depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

One of the purposes of the Federal Financial Management Improvement Act of 1996 was to:

A) Establish a requirement that the financial statements of the federal government as a whole be audited.

B) Improve the effectiveness of programs receiving federal funds.

C) Establish generally accepted federal accounting principles.

D) Rebuild the credibility and restore public confidence in the federal government.

A) Establish a requirement that the financial statements of the federal government as a whole be audited.

B) Improve the effectiveness of programs receiving federal funds.

C) Establish generally accepted federal accounting principles.

D) Rebuild the credibility and restore public confidence in the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following financial statements is not required by OMB Circular A-136?

A) Statement of budgetary resources.

B) Statement of cash flows.

C) Balance sheet.

D) Statement of changes in net position.

A) Statement of budgetary resources.

B) Statement of cash flows.

C) Balance sheet.

D) Statement of changes in net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

36

A federal agency only records entries in the proprietary track accounts for supplies inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Where would federal agencies report information concerning their performance goals and performance results, along with their future challenges?

A) Other accompanying information.

B) Required supplemental information.

C) Management discussion and analysis.

D) Notes to the financial statements.

A) Other accompanying information.

B) Required supplemental information.

C) Management discussion and analysis.

D) Notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

The "net position" of a federal agency may include all of the following components, except:

A) Unexpended appropriations.

B) Cumulative results of operations.

C) Appropriations represented by undelivered orders and unobligated balances.

D) Fund balance with U.S. Treasury.

A) Unexpended appropriations.

B) Cumulative results of operations.

C) Appropriations represented by undelivered orders and unobligated balances.

D) Fund balance with U.S. Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

As identified by FASAB, which of the following are major user groups of federal financial reports?

A) Congress, executives, program managers, and citizens.

B) Congress, executives, citizens, and municipal rating agencies.

C) Congress, program managers, foreign governments, and citizens.

D) Congress, program managers, bond rating agencies, and political parties.

A) Congress, executives, program managers, and citizens.

B) Congress, executives, citizens, and municipal rating agencies.

C) Congress, program managers, foreign governments, and citizens.

D) Congress, program managers, bond rating agencies, and political parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under federal government accounting, recording the estimated amount of equipment prior to actually placing an order or entering into a contract is called a(an):

A) Obligation.

B) Apportionment.

C) Commitment.

D) Allotment.

A) Obligation.

B) Apportionment.

C) Commitment.

D) Allotment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

The management's discussion and analysis (MD&A) required in general purpose federal financial reporting is different than that required by GASB of state and local governments in that:

A) It includes information about the agency's performance goals and results in addition to financial activities.

B) It is outside the general purpose federal financial report and is optional, not required.

C) It is a part of the basic financial statements and, as a result, it is audited along with the financial statements.

D) There are no significant differences.

A) It includes information about the agency's performance goals and results in addition to financial activities.

B) It is outside the general purpose federal financial report and is optional, not required.

C) It is a part of the basic financial statements and, as a result, it is audited along with the financial statements.

D) There are no significant differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is an example of a stewardship asset?

A) The Treasury Building.

B) The Lincoln Memorial.

C) The George Washington Bridge.

D) A stealth fighter jet.

A) The Treasury Building.

B) The Lincoln Memorial.

C) The George Washington Bridge.

D) A stealth fighter jet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following federal government fund groups is most similar to a state and local government custodial fund?

A) Deposit Fund.

B) General Fund.

C) Special Fund.

D) Trust Fund.

A) Deposit Fund.

B) General Fund.

C) Special Fund.

D) Trust Fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

"Each federal government agency should maintain a General Fund and as many other funds defined by the GASB as are appropriate." Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following describes the usual flow of budgetary authority through the budgetary accounts of a federal agency?

A) Apportionment, allotment, appropriation, commitment, obligation, expended appropriation.

B) Allotment, commitment, obligation, expended appropriation, apportionment.

C) Appropriation, apportionment, allotment, commitment, obligation, expended appropriation.

D) Commitment, obligation, appropriation, apportionment, allotment, expended appropriation.

A) Apportionment, allotment, appropriation, commitment, obligation, expended appropriation.

B) Allotment, commitment, obligation, expended appropriation, apportionment.

C) Appropriation, apportionment, allotment, commitment, obligation, expended appropriation.

D) Commitment, obligation, appropriation, apportionment, allotment, expended appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

Explain the GAAP hierarchy used by federal government agencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

A federal agency recorded the receipt of supplies at an actual cost of $57,000. At the time the purchase orders were issued it was estimated the supplies would cost $56,000. How would this transaction be recorded in the budgetary track accounts?

A) It would not be recorded in the budgetary track; it would only be recorded in the proprietary track.

B) Debit Undelivered Orders $57,000 and credit Expended Authority $57,000.

C) Debit Undelivered Orders $56,000, debit Allotments $1,000, and credit Expended Authority $57,000.

D) Debit Undelivered Orders $57,000, credit Allotments $1,000, and credit Expended Authority $56,000.

A) It would not be recorded in the budgetary track; it would only be recorded in the proprietary track.

B) Debit Undelivered Orders $57,000 and credit Expended Authority $57,000.

C) Debit Undelivered Orders $56,000, debit Allotments $1,000, and credit Expended Authority $57,000.

D) Debit Undelivered Orders $57,000, credit Allotments $1,000, and credit Expended Authority $56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Desert Conservation Agency was authorized by the United States Congress to commence operations on October 1, 2020. Record the following transactions in general journal form, as they should appear in the budgetary and proprietary accounts of the agency. For each entry indicate whether it affects the budgetary accounts or the proprietary accounts. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

1. The agency received official notice that its one-year appropriation passed by the Congress and signed by the President amounted to $350 million for operating expenses for the fiscal year and $100 million for acquisition of capital assets during the year.

2. The Office of Management and Budget notified the agency that the entire appropriation had been apportioned.

3. The head of the agency allotted $75 million for the first quarter's operating expenses, and $25 million for equipment to be ordered during the first quarter.

4. Purchase orders and contracts for services recorded for the first quarter totaled $90 million (the agency does not record commitments prior to placing orders or entering into contracts).

5. Total expenditures for the first quarter amounted to $70 million for operating expenses and $18 million for equipment, for which an obligation in the amount of $84 million had been previously recorded (see item 4 above). The expenditures were all paid from fund balance with U.S. Treasury.

1. The agency received official notice that its one-year appropriation passed by the Congress and signed by the President amounted to $350 million for operating expenses for the fiscal year and $100 million for acquisition of capital assets during the year.

2. The Office of Management and Budget notified the agency that the entire appropriation had been apportioned.

3. The head of the agency allotted $75 million for the first quarter's operating expenses, and $25 million for equipment to be ordered during the first quarter.

4. Purchase orders and contracts for services recorded for the first quarter totaled $90 million (the agency does not record commitments prior to placing orders or entering into contracts).

5. Total expenditures for the first quarter amounted to $70 million for operating expenses and $18 million for equipment, for which an obligation in the amount of $84 million had been previously recorded (see item 4 above). The expenditures were all paid from fund balance with U.S. Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

Describe the budgetary accounts used in federal agency accounting and the flow of budgetary authority through those accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

A federal agency issued $1,000 in purchase orders for goods and services. How would this transaction be recorded?

A) In the budgetary track debit Commitments $1,000, and credit Undelivered Orders $1,000.

B) In the proprietary track debit Operating Materials and Supplies $1,000, and credit Undelivered Orders $1,000.

C) In the budgetary track debit Unapportioned Authority $1,000, and credit Undelivered Orders $1,000.

D) In the budgetary track debit Commitments $1,000, and credit Undelivered Orders $1,000; in the proprietary track debit Estimated Operating Materials and Supplies $1,000, and credit Undelivered Orders $1,000.

A) In the budgetary track debit Commitments $1,000, and credit Undelivered Orders $1,000.

B) In the proprietary track debit Operating Materials and Supplies $1,000, and credit Undelivered Orders $1,000.

C) In the budgetary track debit Unapportioned Authority $1,000, and credit Undelivered Orders $1,000.

D) In the budgetary track debit Commitments $1,000, and credit Undelivered Orders $1,000; in the proprietary track debit Estimated Operating Materials and Supplies $1,000, and credit Undelivered Orders $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

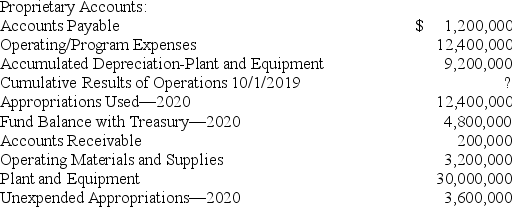

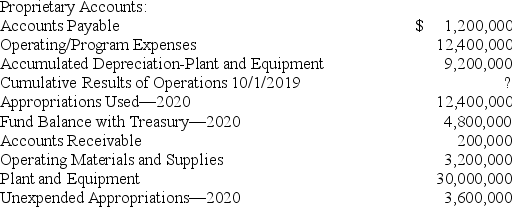

Compute the missing amount in the following list of proprietary accounts of a federal government agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following federal financial statements relies primarily on the use of actuarial assumptions and long-range projections for the information reported on the statement?

A) Balance sheet.

B) Statement of social insurance.

C) Statement of custodial activity.

D) Statement of fiduciary net assets.

A) Balance sheet.

B) Statement of social insurance.

C) Statement of custodial activity.

D) Statement of fiduciary net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is not True about the United States government-wide financial report?

A) Since 1997, the financial statements of the U.S. government as a whole have been audited by the GAO.

B) The majority of the 24 major federal agencies required to be audited have received unmodified audit opinions by the GAO.

C) The Comptroller General of the United States has rendered a disclaimer of opinion on the U.S. Government's consolidated financial statements for as long as that office has audited these statements.

D) The federal government received an unmodified opinion from the GAO on the most recent financial statements of the U.S. government as a whole.

A) Since 1997, the financial statements of the U.S. government as a whole have been audited by the GAO.

B) The majority of the 24 major federal agencies required to be audited have received unmodified audit opinions by the GAO.

C) The Comptroller General of the United States has rendered a disclaimer of opinion on the U.S. Government's consolidated financial statements for as long as that office has audited these statements.

D) The federal government received an unmodified opinion from the GAO on the most recent financial statements of the U.S. government as a whole.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

For each of the following definitions, indicate the key term from the list that best matches by placing the appropriate definition.

A. Apportionment

B. Budgetary resources

C. Expended appropriation

D. Governmental assets

E. Heritage assets

F. Intragovernmental assets

G. Stewardship investments

H. Stewardship land

________1. Federal capital assets that possess educational, cultural, or natural characteristics

________2. Claims by or against a reporting entity that arise from transactions between the entity and other reporting entities

________3. Assets that arise from transactions of the federal government or an entity of the federal government with nonfederal entities

________4. Dividing a federal appropriation into amounts that are available during specific periods

________5. Federal land other than that included in general property, plant, and equipment

________6. New budgetary authority for the period plus unobligated budgetary authority carried over from the prior period and offsetting collections, if any, plus or minus any budgetary adjustments

________7. An account used when the goods or services have been received

A. Apportionment

B. Budgetary resources

C. Expended appropriation

D. Governmental assets

E. Heritage assets

F. Intragovernmental assets

G. Stewardship investments

H. Stewardship land

________1. Federal capital assets that possess educational, cultural, or natural characteristics

________2. Claims by or against a reporting entity that arise from transactions between the entity and other reporting entities

________3. Assets that arise from transactions of the federal government or an entity of the federal government with nonfederal entities

________4. Dividing a federal appropriation into amounts that are available during specific periods

________5. Federal land other than that included in general property, plant, and equipment

________6. New budgetary authority for the period plus unobligated budgetary authority carried over from the prior period and offsetting collections, if any, plus or minus any budgetary adjustments

________7. An account used when the goods or services have been received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

Explain the components of net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

The Federal Monuments Commission began operations on October 1, 2020. Prepare journal form all entries that should be made in budgetary and proprietary accounts of the agency. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

1. The Congress passed, and the President signed, a one-year appropriation for fiscal year 2021 for the Monuments Commission in the amount of $30,000,000.

2. The OMB notified the agency of the following apportionments of the 2021 appropriation: first quarter, $8,000,000; second quarter, $8,000,000; third quarter, $7,000,000; and fourth quarter, $7,000,000.

3. The Commission Director allotted $1,500,000 for the operations of October 2020.

4. Commitments for goods and services not yet ordered or received were recorded in the amount of $1,300,000.

5. Purchase orders and contracts for services were recorded for the month of October 2020 in the amount of $1,250,000.

1. The Congress passed, and the President signed, a one-year appropriation for fiscal year 2021 for the Monuments Commission in the amount of $30,000,000.

2. The OMB notified the agency of the following apportionments of the 2021 appropriation: first quarter, $8,000,000; second quarter, $8,000,000; third quarter, $7,000,000; and fourth quarter, $7,000,000.

3. The Commission Director allotted $1,500,000 for the operations of October 2020.

4. Commitments for goods and services not yet ordered or received were recorded in the amount of $1,300,000.

5. Purchase orders and contracts for services were recorded for the month of October 2020 in the amount of $1,250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is required by OMB Circular A-136 in the basic financial statements?

A) Statement of changes in net position.

B) Statement of net assets.

C) Statement of revenues, expenditures, and changes in fund balances.

D) Statement of financing.

A) Statement of changes in net position.

B) Statement of net assets.

C) Statement of revenues, expenditures, and changes in fund balances.

D) Statement of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Explain the "dual-track" accounting system used by federal agencies and why it is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

A federal agency recorded the receipt of supplies at an actual cost of $57,000. At the time the purchase orders were issued it was estimated the supplies would cost $56,000. How would this transaction be recorded in the proprietary track accounts?

A) It would not be recorded in the proprietary track; it would only be recorded in the budgetary track.

B) Debit Operating Materials and Supplies $57,000 and credit Accounts Payable $57,000.

C) Debit Unexpended Appropriations $57,000 and credit Appropriations Used $57,000.

D) Debit Operating Materials and Supplies $57,000 and Unexpended Appropriations $57,000; credit Accounts Payable $57,000 and Appropriations Used $57,000.

A) It would not be recorded in the proprietary track; it would only be recorded in the budgetary track.

B) Debit Operating Materials and Supplies $57,000 and credit Accounts Payable $57,000.

C) Debit Unexpended Appropriations $57,000 and credit Appropriations Used $57,000.

D) Debit Operating Materials and Supplies $57,000 and Unexpended Appropriations $57,000; credit Accounts Payable $57,000 and Appropriations Used $57,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

A federal agency received $900,000 as its annual appropriation from Congress. How would the appropriation be recorded by the agency?

A) In the budgetary track debit Fund Balance with Treasury $900,000, and credit Unapportioned Authority $900,000; in the proprietary track debit Other Appropriations Realized $900,000, and credit Unexpended Appropriations $900,000.

B) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unexpended Appropriations; in the proprietary track debit Fund Balance with Treasury $900,000, and credit Unapportioned Authority $900.000.

C) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unapportioned Authority $900,000. In the proprietary track no entry is recorded since the transaction involves the budget.

D) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unapportioned Authority $900,000; in the proprietary track debit Fund Balance with Treasury, and credit Unexpended Appropriations.

A) In the budgetary track debit Fund Balance with Treasury $900,000, and credit Unapportioned Authority $900,000; in the proprietary track debit Other Appropriations Realized $900,000, and credit Unexpended Appropriations $900,000.

B) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unexpended Appropriations; in the proprietary track debit Fund Balance with Treasury $900,000, and credit Unapportioned Authority $900.000.

C) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unapportioned Authority $900,000. In the proprietary track no entry is recorded since the transaction involves the budget.

D) In the budgetary track debit Other Appropriations Realized $900,000, and credit Unapportioned Authority $900,000; in the proprietary track debit Fund Balance with Treasury, and credit Unexpended Appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is a Performance and Accountability Report (PAR)? Describe its purpose and contents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

Describe accounting for federal social insurance programs. Comment on the adequacy of current accounting standards in this area.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Identify the office, officer, or department of the United States federal government that is responsible for each of the following:

A. Appropriations.

B. Apportionments.

C. Allotments.

D. Obligations.

A. Appropriations.

B. Apportionments.

C. Allotments.

D. Obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Describe the purpose of a management's discussion and analysis (MD&A) in the general purpose federal financial report of a federal agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the difference between entity assets and nonentity assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Explain the process of financial reporting of the U.S. Government as a whole. Does the federal government receive an unmodified audit opinion on its financial report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck