Deck 19: aauction Design and Information Economics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 19: aauction Design and Information Economics

1

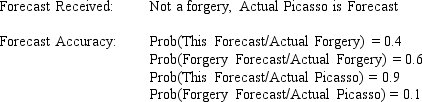

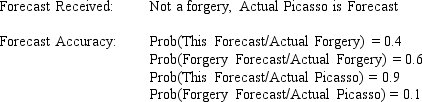

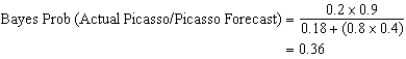

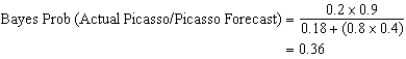

If two art dealers bidding for a Picasso receive the following forecast information about the chance of a forgery which with previously unknown Picasso paintings is present 8 times in 10 historically,what is the amount by which strategic underbidding could be reduced if ten bidders were attracted to the auction?

With two bidders the optimal amount of strategic underbidding is 1/n-th (50%)if the bidders have private values based on different distribution channels or different complementary resources or different tastes of a private client.With ten bidders the proportion of underbidding would fall to 10%.Hence,40% of the winning bidder's private value would be lost to the seller who conducts a two-bidder auction.

The Bayesian probability information should be seen as a further basis for reduction of all bids. Therefore,the winning bidder would pay only 0.36 of his willingness to pay (up from 0.2 before receiving the forecast)and this amount would be further reduced by 10% (to 0.324 of X)with ten bidders and by 50% (to 0.18 of X)with two bidders.Hence the seller's expected revenue from attracting ten bidders rather than two increases by 0.324X - 0.18X = 0.144X,by fourteen percent.

Therefore,the winning bidder would pay only 0.36 of his willingness to pay (up from 0.2 before receiving the forecast)and this amount would be further reduced by 10% (to 0.324 of X)with ten bidders and by 50% (to 0.18 of X)with two bidders.Hence the seller's expected revenue from attracting ten bidders rather than two increases by 0.324X - 0.18X = 0.144X,by fourteen percent.

The Bayesian probability information should be seen as a further basis for reduction of all bids.

Therefore,the winning bidder would pay only 0.36 of his willingness to pay (up from 0.2 before receiving the forecast)and this amount would be further reduced by 10% (to 0.324 of X)with ten bidders and by 50% (to 0.18 of X)with two bidders.Hence the seller's expected revenue from attracting ten bidders rather than two increases by 0.324X - 0.18X = 0.144X,by fourteen percent.

Therefore,the winning bidder would pay only 0.36 of his willingness to pay (up from 0.2 before receiving the forecast)and this amount would be further reduced by 10% (to 0.324 of X)with ten bidders and by 50% (to 0.18 of X)with two bidders.Hence the seller's expected revenue from attracting ten bidders rather than two increases by 0.324X - 0.18X = 0.144X,by fourteen percent. 2

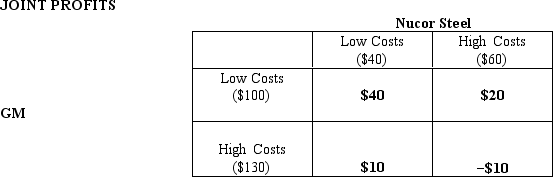

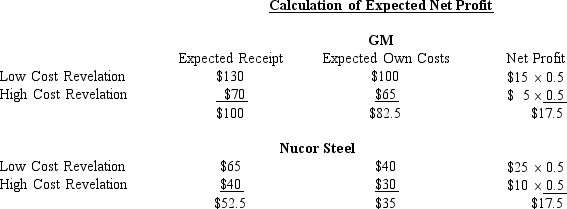

Exhibit 15A-1

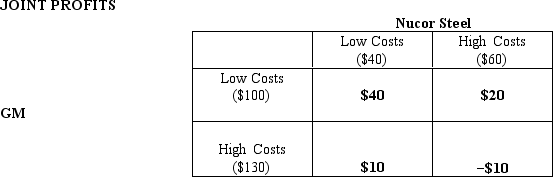

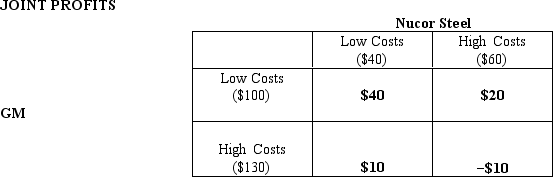

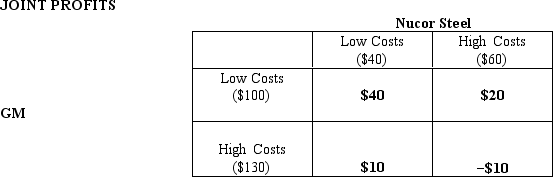

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the expected net profit under the simple profit sharing contract,and why would the partners adopt an incentive-compatible revelation mechanism (i.e. ,an optimal incentives contract)?

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the expected net profit under the simple profit sharing contract,and why would the partners adopt an incentive-compatible revelation mechanism (i.e. ,an optimal incentives contract)?

Here,GM must assume that mixed cost projects will be cancelled,since Nucor Steel must be predicted to overstate its costs.This will result in a cancellation of all projects for which GM experiences high cost--i.e. ,those with mutually high cost and those with mixed cost.Therefore,from GM's point of view,only one-half of the probability space can result in non-cancelled projects.Similarly,anytime Nucor experiences high cost it will predict cancellation as well.Therefore,only 0.5 0.5 $40 = $10 payoffs will be realized from the simple profit-sharing contract,and this expected $10 million would then be split between the partners.

Compare $5 million to $17.5 million.The simple profit-sharing contract results in too many cancellations in the presence of asymmetric information.This is most easily seen by thinking about all the possible outcomes for many trials of a one-shot game.In contrast,in repeated plays of this partnership,the parties may develop other ways to circumvent the cost overstatement problem (including reputation effects,reciprocity in sequential play in other partnership efforts--tit for tat,etc. )

Compare $5 million to $17.5 million.The simple profit-sharing contract results in too many cancellations in the presence of asymmetric information.This is most easily seen by thinking about all the possible outcomes for many trials of a one-shot game.In contrast,in repeated plays of this partnership,the parties may develop other ways to circumvent the cost overstatement problem (including reputation effects,reciprocity in sequential play in other partnership efforts--tit for tat,etc. )

3

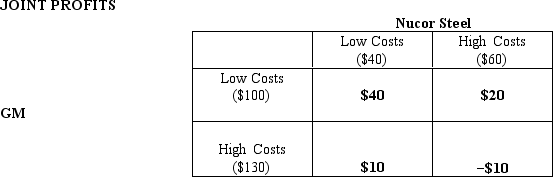

Exhibit 15A-1

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What are the expected net profits to each partner under the incentives contract?

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What are the expected net profits to each partner under the incentives contract?

4

Sealed bids can be used in multiple rounds.How is this done?

A)The winner of the first round automatically wins all future rounds.

B)The winner's price in the first round is the reservation price in the next round.If higher prices come in the next round,the highest price is the new reservation price for round three,and so forth.

C)The second best price in the first round is the winner.

D)Bidding continues in more and more rounds until someone yells "uncle."

A)The winner of the first round automatically wins all future rounds.

B)The winner's price in the first round is the reservation price in the next round.If higher prices come in the next round,the highest price is the new reservation price for round three,and so forth.

C)The second best price in the first round is the winner.

D)Bidding continues in more and more rounds until someone yells "uncle."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

In comparing rules for serving a queue,last-come first-served has all of the following effects except

A)reduces the waiting time

B)causes few customers to arrive and depart more than once

C)increases the side payments among those yet to be served

D)hastens the adoption of a lottery system for deciding who should get the tickets

A)reduces the waiting time

B)causes few customers to arrive and depart more than once

C)increases the side payments among those yet to be served

D)hastens the adoption of a lottery system for deciding who should get the tickets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

Auctions are used in place of markets when the items traded are unique (e.g. ,a Ming vase or a right to drill for oil).Which of the following examples are typically sold using Vickrey auction methods?

A)For-sale-by-owner houses

B)Household furnishings

C)Items sold in Filene's Basement,with the price discounted after a certain date

D)Vintage postage stamps

A)For-sale-by-owner houses

B)Household furnishings

C)Items sold in Filene's Basement,with the price discounted after a certain date

D)Vintage postage stamps

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

An optimal incentives contract can induce the revelation of true costs in a partnership by

A)imposing penalties when costs are overstated

B)offering bonus payments when costs are verified

C)renewing the reliance relationship

D)linking revealed cost to the partner's foregone expected profits

E)enlisting third-party enforcement

A)imposing penalties when costs are overstated

B)offering bonus payments when costs are verified

C)renewing the reliance relationship

D)linking revealed cost to the partner's foregone expected profits

E)enlisting third-party enforcement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

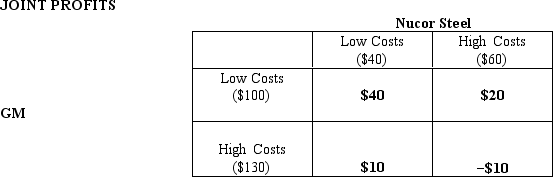

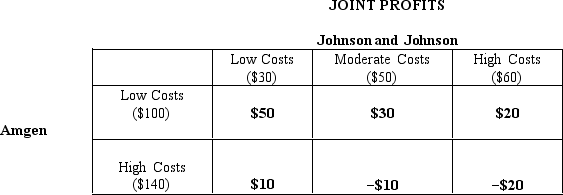

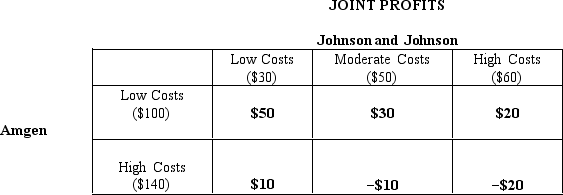

Exhibit 15A-1

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

What are the expected net profits to Johnson & Johnson in a pharmaceutical R&D joint venture with Amgen given the following joint profit payoffs.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.Assume that the three columns are equally likely to occur,each row is equally likely to occur.Both Johnson and Johnson and Amgen can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.What are the expected net profits to Johnson & Johnson in a pharmaceutical R&D joint venture with Amgen given the following joint profit payoffs.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.Assume that the three columns are equally likely to occur,each row is equally likely to occur.Both Johnson and Johnson and Amgen can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

The figures in parentheses represent costs associated with the Low,Moderate and High cost realizations,and all figures are in millions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose that a private firm wants to go public to give the owners a chance to retire.It follows the lead of the Google IPO by using a modified Vickrey (or uniform price)auction.The owners of the firm plans to sell 1 million shares and hope to raise at least $10 million from the auction.The following bids were submitted. Bob 250,000 shares at $12

Sam 350,000 shares at $13

Mary 300,000 shares at $9

Sue 100,000 shares at $10

Ravi 450,000 shares at $11

A)The market clearing price is $13,and the sellers of the firm get $13 million.

B)The market clearing price is $12,and the sellers of the firm get $13 million.

C)The market clearing price is $11,and the sellers of the firm get $11 million.

D)The market clearing price is $10,and the sellers of the firm get $10 million.

E)The market clearing price is $9,and the sellers of the firm get$9 million

Sam 350,000 shares at $13

Mary 300,000 shares at $9

Sue 100,000 shares at $10

Ravi 450,000 shares at $11

A)The market clearing price is $13,and the sellers of the firm get $13 million.

B)The market clearing price is $12,and the sellers of the firm get $13 million.

C)The market clearing price is $11,and the sellers of the firm get $11 million.

D)The market clearing price is $10,and the sellers of the firm get $10 million.

E)The market clearing price is $9,and the sellers of the firm get$9 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

An incentive-compatible revelation mechanism is

A)self-enforcing

B)always multi-period

C)too complicated to influence decisions

D)prevalent in vertically integrated businesses

E)not adopted by franchise businesses

A)self-enforcing

B)always multi-period

C)too complicated to influence decisions

D)prevalent in vertically integrated businesses

E)not adopted by franchise businesses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

Common value auctions with open bidding necessarily entail

A)asymmetric information

B)ascending prices

C)more than two bidders

D)amendment of bids

E)sealed final offers.

A)asymmetric information

B)ascending prices

C)more than two bidders

D)amendment of bids

E)sealed final offers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Incentive-compatible revelation mechanisms attempt to

A)induce an employee to reject the next best alternative employment opportunity

B)elicit privately-held information

C)secure enforcement primarily by third parties

D)reject voluntary contracting with third parties

E)impose similar risk premiums on all employees

A)induce an employee to reject the next best alternative employment opportunity

B)elicit privately-held information

C)secure enforcement primarily by third parties

D)reject voluntary contracting with third parties

E)impose similar risk premiums on all employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

An incentive-compatible mechanism for revealing true willingness to pay in a private value auction is

A)impossible

B)a Dutch auction

C)a second-highest sealed bid auction

D)a sequential auction with open bidding

E)a discriminatory price all-or-nothing auction.

A)impossible

B)a Dutch auction

C)a second-highest sealed bid auction

D)a sequential auction with open bidding

E)a discriminatory price all-or-nothing auction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

The principal advantage of an open bidding system for allocating telecommunications spectrum licenses was

A)the pooling of asymmetric information by the bidders

B)the reconfiguring of cell phone license areas

C)the substitute value of adjacent service areas

D)reduced cost

A)the pooling of asymmetric information by the bidders

B)the reconfiguring of cell phone license areas

C)the substitute value of adjacent service areas

D)reduced cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

Revenue equivalence theorem refers to equal seller revenue in which of the following pairs:

A)sealed bid auctions and English auctions

B)second highest wins and pays auctions and Dutch auctions

C)English highest wins and pays auctions and sealed bid Dutch auctions

D)highest wins and pays auctions and second highest wins and pay auctions

A)sealed bid auctions and English auctions

B)second highest wins and pays auctions and Dutch auctions

C)English highest wins and pays auctions and sealed bid Dutch auctions

D)highest wins and pays auctions and second highest wins and pay auctions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

Each partner in a simple profit-sharing contract that splits the independently verifiable sales revenue minus unobservable cost has an incentive

A)to reject an automatic renewal of the contract

B)to understate fixed cost

C)to overstate avoidable cost

D)to understate customer loyalty for repeat purchases

E)to renew the partnership contract

A)to reject an automatic renewal of the contract

B)to understate fixed cost

C)to overstate avoidable cost

D)to understate customer loyalty for repeat purchases

E)to renew the partnership contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

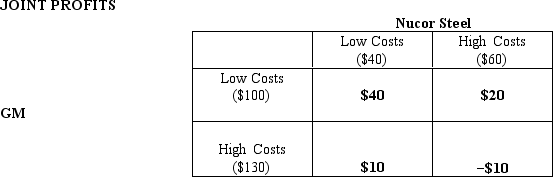

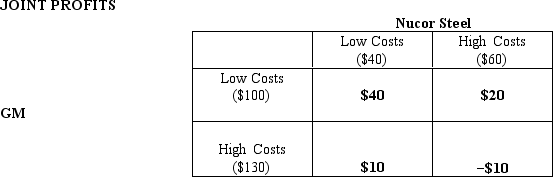

Exhibit 15A-1

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the incentive-compatible revelation mechanism that will induce true revelation of the asymmetric cost information and maximize the value of the partnership?

Suppose GM and Nucor Steel seek to develop jointly a new sheet metal and auto body stamping machine,and each party knows the payoffs in the following table of equi-probable outcomes but cannot independently verify one another's costs.Both GM and Nucor can cancel the project and both will then earn $0 if the cost revelations give early warning of losses.

Note: The figures in parentheses represent costs associated with the Low and High cost realizations,and all figures are in millions.The joint profit payoffs are the difference between $180 and the sum of the cost realizations.

-Refer to Exhibit 15A-1.

What is the incentive-compatible revelation mechanism that will induce true revelation of the asymmetric cost information and maximize the value of the partnership?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

Research suggests that an auction for a private value item will yield the HIGHEST payout if:

A)we use a Dutch auction

B)we use an English auction

C)we use only cash,and not allow credit cards

D)use a fixed price

A)we use a Dutch auction

B)we use an English auction

C)we use only cash,and not allow credit cards

D)use a fixed price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

A Dutch auction implies all of the following except

A)more than one unit sale available

B)higher prices later in the auction

C)identical expected seller revenue for common value items

D)greater expected seller revenue in estate sales with risk-averse bidders

A)more than one unit sale available

B)higher prices later in the auction

C)identical expected seller revenue for common value items

D)greater expected seller revenue in estate sales with risk-averse bidders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

In Dutch auctions,the bidding

A)starts low and rises until the highest bidder wins.

B)is done in secret "sealed bids" which are opened at a specified time.

C)begins with a very high price,and is reduced until the first person takes it.

D)is accomplished by giving the price of the second highest bid to the highest bidder.

A)starts low and rises until the highest bidder wins.

B)is done in secret "sealed bids" which are opened at a specified time.

C)begins with a very high price,and is reduced until the first person takes it.

D)is accomplished by giving the price of the second highest bid to the highest bidder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck